Global Medical Swabs Market Overview

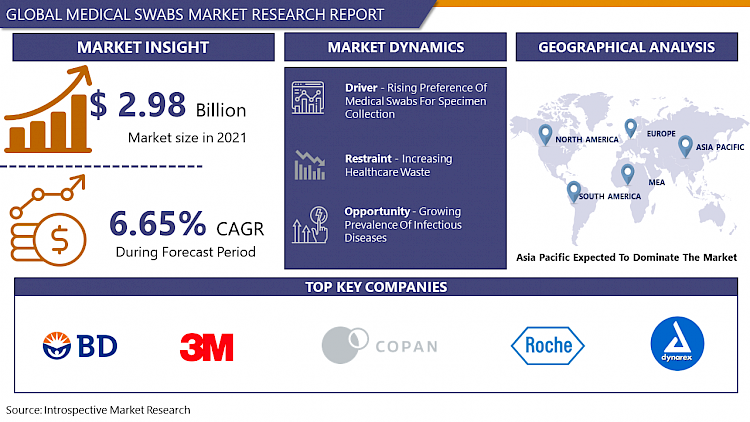

Global Medical Swabs Market Size Was Valued at USD 3.18 Billion in 2022, and is Projected to Reach USD 5.32 Billion by 2030, Growing at A CAGR of 6.65% From 2023 to 2030.

The swab is a medical device that is utilized to collect biological samples from the human body and to transport and preserve the samples. All swabs used to obtain microbiological samples are considered invasive medical devices that must adhere to the Medical Devices Directive 93/42/EEC. The tube with the medium must comply with Directive 98/79/EC on in vitro diagnostic medical devices in the case of swabs with transport medium. A medical swab is made up of two parts: a head and a shaft. Natural fibers (such as cotton) or inorganic and inert fibers (such as viscose, polyester, and flocked fibers) can be utilized to make the swab head. Depending on the intended usage, each material has distinct properties that must be evaluated by a healthcare professional. Flocked fiber-headed swabs are ideal for use with liquid transport media because they have the best sample absorption and elution capability. The swab shaft can be manufactured of a variety of materials, including wood, polystyrene, and aluminum, and is selected based on the sampling point. The shaft of flocked swabs is constructed of polystyrene, and different shafts and head shapes are available based on their intended application, such as nasopharyngeal, urethral, pediatric, and standard. The growing cases of viral disorders that require swab collections are the main factor propelling the growth of the medical swabs market.

Market Dynamics And Key Factors for Medical Swabs Market

Drivers:

The rising prevalence of COVID-19 cases is the major factor driving the development of the medical swabs market. The outbreak of COVID-19 that originated in China rapidly spread to other parts of the world. As of March 25, 2022, 478 million positive cases were reported globally. Medical swabs played an important role in specimen collection. For instance, the flocked swab was a significant advancement in microbiology since its properties make it a lot more user-friendly and efficient product, both in PCR and for seeding machine automation. Microbiological testing laboratories appreciate its numerous advantages over traditional swabs, including compatibility with new automated inoculation and sample seeding equipment, as well as the ease with which it collects, transports, and processes microbiological samples, all of which contribute to the growth of the medical swabs market.

Medical swabs with a foam tip can be utilized for disinfection. When it comes to cleaning, foam is a powerhouse. Due to its high absorbency, it's ideal for removing debris and particles. Most cleaning chemicals are suitable for this type of swab. Even acetone can be used with chemical-resistant foam swabs. Foam tip swabs' handles can be made of several materials, including firm wood and stiff-molded polypropylene, as well as a hollow or solid flexible plastic. The tip is solidly connected to survive rigorous use, including industrial cleaning or specimen collection applications, even though it is designed for single usage. Precision manufacturing, fiber optics, electronics, semiconductors, printing, aerospace, biotechnology, and pharmaceuticals are just a few of the industries where foam-tipped applicators are utilized thus, strengthening the development of the medical swabs market in the forecasted timeframe.

Restraints:

About 85% of the waste created by healthcare activities is general, non-hazardous waste. The remaining 15% is designated as hazardous waste, which may contain infectious, toxic, or radioactive materials. Infectious waste includes waste contaminated with blood and other bodily fluids (e.g., swabs, bandages, and disposable medical devices), cultures and stocks of infectious agents from laboratory work (e.g., waste from autopsies and infected animals from laboratories), and waste from patients with infections (e.g., swabs, bandages, and disposable medical devices). With the growing number of COVID-19 tests, the debris generated by swabs was also higher. Any mishandling while disposing of infectious swabs may result in medical havoc thus, hampering the growth of the medical swabs market.

Opportunities:

The growing prevalence of infectious diseases and the outbreak of COVID-19 created a profitable opportunity for the market players. RT-PCR was the major test done to conclude, whether an individual is suffering from COVID-19 or not. For PCR testing a nasal pharyngeal swab or a pharyngeal swab is taken. Moreover, medical swabs are also utilized for disinfection purposes. With the growing healthcare infrastructure, the demand for medical swabs is expected to increase. The increasing prevalence of influenza and COVID-19 cases will create a profitable opportunity for the market players.

Segmentation Analysis of Medical Swabs Market

By Type, the cotton-tipped segment is anticipated to have the highest share of the medical swabs market over the forecast period. The cotton tip of the medical cotton swab has strong water absorption. The disinfectant can wipe the skin even when it is full of disinfectant to achieve the disinfection effect. It can be used for cosmetics and makeup removal, as well as skin disinfection and surgical dressing during injections. The medical cotton swab has a smooth texture and is comprised of 100 percent natural high-quality cotton. It is clean and hygienic after high-temperature treatment. Cotton tipped medical swabs are utilized for specimen collection as these are properly sterilized thus, supporting the growth of the segment.

By Application, the specimen collection segment is expected to dominate the medical swabs market throughout the projected timeframe. The increasing prevalence of diseases and the outbreak of the COVID-19 pandemic has stimulated the growth of the segment. For instance, 782 million samples for COVID-19 were tested as of March 21, 2022. Similar tests were conducted across the European and American regions. The usage of cotton-tipped swabs for respiratory specimen collection is included in the WHO's general guidelines for respiratory specimen collection, and it has been reported to be reliable for respiratory retroviruses like influenza specifically. An increase in the number of individuals suffering from influenza and COVID-19 has stimulated the demand for medical swabs for specimen collection purposes.

By End-User, the hospitals & clinics segment is expected to have the highest share of the medical swabs market in the projected timeframe. Most of the individuals prefer hospitals and clinics for swab sampling. Hospitals have special rooms for swab collection. Additionally, they conduct safety management strategies in aspects of specimen collection environment, collectors, sampling methods, and specimen management resulting in reduced infection risk of suspected cases and nursing staff, improving the standardization of biological specimen collection and ensuring the quality of specimens thus, supporting the growth of the segment.

Regional Analysis Of Medical Swabs Market

The medical swabs market in the Asia-Pacific region is anticipated to develop at the highest CAGR throughout the projected timeframe attributed to the outbreak of COVID-19 in this region. China and India are the two major highly populated countries in this region. 782, 160, 90, 82, 65, and 53 million swab tests were conducted in India, China, Indonesia, Vietnam, Australia, and Malaysia respectively. The outbreak of viral infections has also promoted the usage of medical swabs for the accurate diagnosis of a specific disease. The usage of medical swabs for the spreading of culture on agar media has prompted manufacturers to develop lab-grade medical swabs thus, boosting the growth of the market in this region.

The North American region is anticipated to have the highest share of the medical swabs market during the forecast period. Medical swans are utilized by individuals in this region for various purposes such as specimen collection and disinfection. For instance, Foam swabs can be used dry or moistened with isopropyl alcohol or deionized water. Tips come in a range of shapes and sizes and handle come in a variety of lengths and materials. These swabs' versatility makes them perfect for a variety of cleaning tasks, especially in hard-to-reach areas. Approximately 972 million swabs in the US and 16 million swabs in Mexico were collected for specimen sampling. Thus, the increasing cases of COVID-19 and other influenza diseases are expected to boost the growth of the medical swabs market in this region.

The European region is expected to have the second-highest share of the medical swabs market in the projected timeframe. The UK, Spain, France, Italy, and Austria are the prominent countries driving the growth of the market in this region. Approximately 495, 471, 246, 195, and 170 million tests were conducted in the respective countries till March 21, 2022. The outbreak of COVID-19 is the main factor supporting the growth of the medical swabs market in this region. Moreover, the prevalence of influenza in European countries has stimulated the demand for medical swabs. Approximately 3 million individuals were tested for influenza season for 2021-2022. The rise in the number of COVID-19 and influenza cases is the major factor supporting the development of the medical swabs market.

COVID-19 Impact Analysis on Medical Swabs Market are

Medical swab sales grew as the need for fast diagnostic testing increased during the COVID-19 pandemic. The rising frequency of coronavirus infections put pressure on hospitals and diagnostic centers to undertake tests with clean medical supplies regularly. The rate of manufacture of these items was accelerated as a result of this. Puritan Medical Items, for example, said in March 2020 that it will boost manufacturing of these products to 1 million per week to preserve supply balance. Moreover, there was a shortage of medical devices required for the collection of swabs in countries like the US. The production of medical swabs was promoted globally to provide ample supplies to other countries. The demand was high during the COVID-19 pandemic and is expected to be the same in the post-pandemic period attributed to the detection of new variants. To summarize, the COVID-19 pandemic boosted the sales of the medical swabs market.

Players Covered In Medical Swabs Market are

- BD (U.S.)

- 3M (U.S.)

- Copan Diagnostics Inc. (U.S.)

- Roche Diagnostics (Switzerland)

- FL MEDICAL SRL (Italy)

- DLS Medical (U.K.)

- Dynarex (U.S.)

- Avacare Pharma (India)

- Puritan Medical Products (U.S.) and other major players.

Key Industry Developments In Medical Swabs Market

In August 2021, BD announced that the BD VeritorTM has received an Emergency Use Authorization (EUA) from the US Food and Drug Administration. The first at-home COVID-19 test will use smartphone computer vision technology to analyze and present test findings in a digital format.

In March 2021, In the United Kingdom, Roche Diagnostics released a fast antigen nasal test. The test to assist healthcare systems in diagnosing SARS-CoV-2 infection is the newest addition to Roche's COVID-19 portfolio.

|

Global Medical Swabs Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 3.18 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.65% |

Market Size in 2030: |

USD 5.32 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

3.3 By End User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Medical Swabs Market by Type

4.1 Medical Swabs Market Overview Snapshot and Growth Engine

4.2 Medical Swabs Market Overview

4.3 Cotton Tipped

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Cotton Tipped: Grographic Segmentation

4.4 Foam Tipped

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Foam Tipped: Grographic Segmentation

4.5 Non-woven

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size (2016-2028F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Non-woven: Grographic Segmentation

4.6 Others

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size (2016-2028F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Others: Grographic Segmentation

Chapter 5: Medical Swabs Market by Application

5.1 Medical Swabs Market Overview Snapshot and Growth Engine

5.2 Medical Swabs Market Overview

5.3 Specimen Collection

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Specimen Collection: Grographic Segmentation

5.4 Disinfection

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Disinfection: Grographic Segmentation

5.5 Others

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Others: Grographic Segmentation

Chapter 6: Medical Swabs Market by End User

6.1 Medical Swabs Market Overview Snapshot and Growth Engine

6.2 Medical Swabs Market Overview

6.3 Hospitals & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals & Clinics: Grographic Segmentation

6.4 Laboratories & Diagnostic Centers

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Laboratories & Diagnostic Centers: Grographic Segmentation

6.5 Research Institutes

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Research Institutes: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Medical Swabs Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Medical Swabs Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Medical Swabs Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 SARSTEDT AG & CO. KG

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 MWE

7.4 FL MEDICAL S.R.L

7.5 CLEAN CROSS CO. LTD.

7.6 NEOGEN CORPORATION

7.7 CITOTEST LABWARE MANUFACTURING CO. LTD.

7.8 UNILEVER

7.9 GPC MEDICAL

7.10 ELMEX CONTROLS PVT LTD.

7.11 COPAN DIAGNOSTICS INC.

7.12 MEDSCAPE

7.13 ADVACARE

7.14 STREMA S.R.L.

7.15 BLUE MANUFACTURING COMPANY

7.16 BD

7.17 THERMO FISHER SCIENTIFIC

7.18 MERCK KGAA.

7.19 SIRCHIE AND GROUPE LEMOINE

Chapter 8: Global Medical Swabs Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Cotton Tipped

8.2.2 Foam Tipped

8.2.3 Non-woven

8.2.4 Others

8.3 Historic and Forecasted Market Size By Application

8.3.1 Specimen Collection

8.3.2 Disinfection

8.3.3 Others

8.4 Historic and Forecasted Market Size By End User

8.4.1 Hospitals & Clinics

8.4.2 Laboratories & Diagnostic Centers

8.4.3 Research Institutes

Chapter 9: North America Medical Swabs Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Cotton Tipped

9.4.2 Foam Tipped

9.4.3 Non-woven

9.4.4 Others

9.5 Historic and Forecasted Market Size By Application

9.5.1 Specimen Collection

9.5.2 Disinfection

9.5.3 Others

9.6 Historic and Forecasted Market Size By End User

9.6.1 Hospitals & Clinics

9.6.2 Laboratories & Diagnostic Centers

9.6.3 Research Institutes

9.7 Historic and Forecast Market Size by Country

9.7.1 U.S.

9.7.2 Canada

9.7.3 Mexico

Chapter 10: Europe Medical Swabs Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Cotton Tipped

10.4.2 Foam Tipped

10.4.3 Non-woven

10.4.4 Others

10.5 Historic and Forecasted Market Size By Application

10.5.1 Specimen Collection

10.5.2 Disinfection

10.5.3 Others

10.6 Historic and Forecasted Market Size By End User

10.6.1 Hospitals & Clinics

10.6.2 Laboratories & Diagnostic Centers

10.6.3 Research Institutes

10.7 Historic and Forecast Market Size by Country

10.7.1 Germany

10.7.2 U.K.

10.7.3 France

10.7.4 Italy

10.7.5 Russia

10.7.6 Spain

Chapter 11: Asia-Pacific Medical Swabs Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Cotton Tipped

11.4.2 Foam Tipped

11.4.3 Non-woven

11.4.4 Others

11.5 Historic and Forecasted Market Size By Application

11.5.1 Specimen Collection

11.5.2 Disinfection

11.5.3 Others

11.6 Historic and Forecasted Market Size By End User

11.6.1 Hospitals & Clinics

11.6.2 Laboratories & Diagnostic Centers

11.6.3 Research Institutes

11.7 Historic and Forecast Market Size by Country

11.7.1 China

11.7.2 India

11.7.3 Japan

11.7.4 Southeast Asia

Chapter 12: South America Medical Swabs Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Cotton Tipped

12.4.2 Foam Tipped

12.4.3 Non-woven

12.4.4 Others

12.5 Historic and Forecasted Market Size By Application

12.5.1 Specimen Collection

12.5.2 Disinfection

12.5.3 Others

12.6 Historic and Forecasted Market Size By End User

12.6.1 Hospitals & Clinics

12.6.2 Laboratories & Diagnostic Centers

12.6.3 Research Institutes

12.7 Historic and Forecast Market Size by Country

12.7.1 Brazil

12.7.2 Argentina

Chapter 13: Middle East & Africa Medical Swabs Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Cotton Tipped

13.4.2 Foam Tipped

13.4.3 Non-woven

13.4.4 Others

13.5 Historic and Forecasted Market Size By Application

13.5.1 Specimen Collection

13.5.2 Disinfection

13.5.3 Others

13.6 Historic and Forecasted Market Size By End User

13.6.1 Hospitals & Clinics

13.6.2 Laboratories & Diagnostic Centers

13.6.3 Research Institutes

13.7 Historic and Forecast Market Size by Country

13.7.1 Saudi Arabia

13.7.2 South Africa

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Medical Swabs Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 3.18 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.65% |

Market Size in 2030: |

USD 5.32 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MEDICAL SWABS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MEDICAL SWABS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MEDICAL SWABS MARKET COMPETITIVE RIVALRY

TABLE 005. MEDICAL SWABS MARKET THREAT OF NEW ENTRANTS

TABLE 006. MEDICAL SWABS MARKET THREAT OF SUBSTITUTES

TABLE 007. MEDICAL SWABS MARKET BY TYPE

TABLE 008. COTTON TIPPED MARKET OVERVIEW (2016-2028)

TABLE 009. FOAM TIPPED MARKET OVERVIEW (2016-2028)

TABLE 010. NON-WOVEN MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. MEDICAL SWABS MARKET BY APPLICATION

TABLE 013. SPECIMEN COLLECTION MARKET OVERVIEW (2016-2028)

TABLE 014. DISINFECTION MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. MEDICAL SWABS MARKET BY END USER

TABLE 017. HOSPITALS & CLINICS MARKET OVERVIEW (2016-2028)

TABLE 018. LABORATORIES & DIAGNOSTIC CENTERS MARKET OVERVIEW (2016-2028)

TABLE 019. RESEARCH INSTITUTES MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA MEDICAL SWABS MARKET, BY TYPE (2016-2028)

TABLE 021. NORTH AMERICA MEDICAL SWABS MARKET, BY APPLICATION (2016-2028)

TABLE 022. NORTH AMERICA MEDICAL SWABS MARKET, BY END USER (2016-2028)

TABLE 023. N MEDICAL SWABS MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE MEDICAL SWABS MARKET, BY TYPE (2016-2028)

TABLE 025. EUROPE MEDICAL SWABS MARKET, BY APPLICATION (2016-2028)

TABLE 026. EUROPE MEDICAL SWABS MARKET, BY END USER (2016-2028)

TABLE 027. MEDICAL SWABS MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC MEDICAL SWABS MARKET, BY TYPE (2016-2028)

TABLE 029. ASIA PACIFIC MEDICAL SWABS MARKET, BY APPLICATION (2016-2028)

TABLE 030. ASIA PACIFIC MEDICAL SWABS MARKET, BY END USER (2016-2028)

TABLE 031. MEDICAL SWABS MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA MEDICAL SWABS MARKET, BY TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA MEDICAL SWABS MARKET, BY APPLICATION (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA MEDICAL SWABS MARKET, BY END USER (2016-2028)

TABLE 035. MEDICAL SWABS MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA MEDICAL SWABS MARKET, BY TYPE (2016-2028)

TABLE 037. SOUTH AMERICA MEDICAL SWABS MARKET, BY APPLICATION (2016-2028)

TABLE 038. SOUTH AMERICA MEDICAL SWABS MARKET, BY END USER (2016-2028)

TABLE 039. MEDICAL SWABS MARKET, BY COUNTRY (2016-2028)

TABLE 040. SARSTEDT AG & CO. KG: SNAPSHOT

TABLE 041. SARSTEDT AG & CO. KG: BUSINESS PERFORMANCE

TABLE 042. SARSTEDT AG & CO. KG: PRODUCT PORTFOLIO

TABLE 043. SARSTEDT AG & CO. KG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. MWE: SNAPSHOT

TABLE 044. MWE: BUSINESS PERFORMANCE

TABLE 045. MWE: PRODUCT PORTFOLIO

TABLE 046. MWE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. FL MEDICAL S.R.L: SNAPSHOT

TABLE 047. FL MEDICAL S.R.L: BUSINESS PERFORMANCE

TABLE 048. FL MEDICAL S.R.L: PRODUCT PORTFOLIO

TABLE 049. FL MEDICAL S.R.L: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. CLEAN CROSS CO. LTD.: SNAPSHOT

TABLE 050. CLEAN CROSS CO. LTD.: BUSINESS PERFORMANCE

TABLE 051. CLEAN CROSS CO. LTD.: PRODUCT PORTFOLIO

TABLE 052. CLEAN CROSS CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. NEOGEN CORPORATION: SNAPSHOT

TABLE 053. NEOGEN CORPORATION: BUSINESS PERFORMANCE

TABLE 054. NEOGEN CORPORATION: PRODUCT PORTFOLIO

TABLE 055. NEOGEN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. CITOTEST LABWARE MANUFACTURING CO. LTD.: SNAPSHOT

TABLE 056. CITOTEST LABWARE MANUFACTURING CO. LTD.: BUSINESS PERFORMANCE

TABLE 057. CITOTEST LABWARE MANUFACTURING CO. LTD.: PRODUCT PORTFOLIO

TABLE 058. CITOTEST LABWARE MANUFACTURING CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. UNILEVER: SNAPSHOT

TABLE 059. UNILEVER: BUSINESS PERFORMANCE

TABLE 060. UNILEVER: PRODUCT PORTFOLIO

TABLE 061. UNILEVER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. GPC MEDICAL: SNAPSHOT

TABLE 062. GPC MEDICAL: BUSINESS PERFORMANCE

TABLE 063. GPC MEDICAL: PRODUCT PORTFOLIO

TABLE 064. GPC MEDICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ELMEX CONTROLS PVT LTD.: SNAPSHOT

TABLE 065. ELMEX CONTROLS PVT LTD.: BUSINESS PERFORMANCE

TABLE 066. ELMEX CONTROLS PVT LTD.: PRODUCT PORTFOLIO

TABLE 067. ELMEX CONTROLS PVT LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. COPAN DIAGNOSTICS INC.: SNAPSHOT

TABLE 068. COPAN DIAGNOSTICS INC.: BUSINESS PERFORMANCE

TABLE 069. COPAN DIAGNOSTICS INC.: PRODUCT PORTFOLIO

TABLE 070. COPAN DIAGNOSTICS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. MEDSCAPE: SNAPSHOT

TABLE 071. MEDSCAPE: BUSINESS PERFORMANCE

TABLE 072. MEDSCAPE: PRODUCT PORTFOLIO

TABLE 073. MEDSCAPE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. ADVACARE: SNAPSHOT

TABLE 074. ADVACARE: BUSINESS PERFORMANCE

TABLE 075. ADVACARE: PRODUCT PORTFOLIO

TABLE 076. ADVACARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. STREMA S.R.L.: SNAPSHOT

TABLE 077. STREMA S.R.L.: BUSINESS PERFORMANCE

TABLE 078. STREMA S.R.L.: PRODUCT PORTFOLIO

TABLE 079. STREMA S.R.L.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. BLUE MANUFACTURING COMPANY: SNAPSHOT

TABLE 080. BLUE MANUFACTURING COMPANY: BUSINESS PERFORMANCE

TABLE 081. BLUE MANUFACTURING COMPANY: PRODUCT PORTFOLIO

TABLE 082. BLUE MANUFACTURING COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. BD: SNAPSHOT

TABLE 083. BD: BUSINESS PERFORMANCE

TABLE 084. BD: PRODUCT PORTFOLIO

TABLE 085. BD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. THERMO FISHER SCIENTIFIC: SNAPSHOT

TABLE 086. THERMO FISHER SCIENTIFIC: BUSINESS PERFORMANCE

TABLE 087. THERMO FISHER SCIENTIFIC: PRODUCT PORTFOLIO

TABLE 088. THERMO FISHER SCIENTIFIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. MERCK KGAA.: SNAPSHOT

TABLE 089. MERCK KGAA.: BUSINESS PERFORMANCE

TABLE 090. MERCK KGAA.: PRODUCT PORTFOLIO

TABLE 091. MERCK KGAA.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. SIRCHIE AND GROUPE LEMOINE: SNAPSHOT

TABLE 092. SIRCHIE AND GROUPE LEMOINE: BUSINESS PERFORMANCE

TABLE 093. SIRCHIE AND GROUPE LEMOINE: PRODUCT PORTFOLIO

TABLE 094. SIRCHIE AND GROUPE LEMOINE: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MEDICAL SWABS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MEDICAL SWABS MARKET OVERVIEW BY TYPE

FIGURE 012. COTTON TIPPED MARKET OVERVIEW (2016-2028)

FIGURE 013. FOAM TIPPED MARKET OVERVIEW (2016-2028)

FIGURE 014. NON-WOVEN MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. MEDICAL SWABS MARKET OVERVIEW BY APPLICATION

FIGURE 017. SPECIMEN COLLECTION MARKET OVERVIEW (2016-2028)

FIGURE 018. DISINFECTION MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. MEDICAL SWABS MARKET OVERVIEW BY END USER

FIGURE 021. HOSPITALS & CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 022. LABORATORIES & DIAGNOSTIC CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 023. RESEARCH INSTITUTES MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA MEDICAL SWABS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE MEDICAL SWABS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC MEDICAL SWABS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA MEDICAL SWABS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA MEDICAL SWABS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Medical Swabs Market research report is 2023-2030.

BD (U.S.), 3M (U.S.), Copan Diagnostics Inc. (U.S.), Roche Diagnostics (Switzerland), FL MEDICAL SRL (Italy), DLS Medical (U.K.), Dynarex (U.S.), Avacare Pharma (India), Puritan Medical Products (U.S.) and other major players.

The Medical Swabs market is segmented into Type, Application, End User, Region. By Type the market is categorized into Cotton Tipped, Foam Tipped, Non-woven, Others. By Application the market is categorized into Specimen Collection, Disinfection, Others. By End-User the market is categorized into Hospitals & Clinics, Laboratories & Diagnostic Centers, Research Institutes. By region, it is analysed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

The swab is a medical device that is utilized to collect biological samples from the human body and to transport and preserve the samples. All swabs used to obtain microbiological samples are considered invasive medical devices that must adhere to the Medical Devices Directive 93/42/EEC.

Global Medical Swabs Market Size Was Valued at USD 3.18 Billion in 2022, and is Projected to Reach USD 5.32 Billion by 2030, Growing at A CAGR of 6.65% From 2023 to 2030.