Medical Exam Gloves Market Synopsis

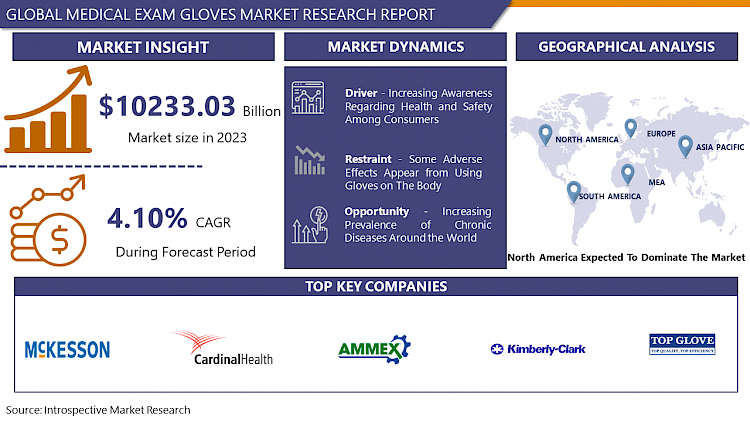

The Global Medical Exam Gloves Market size was valued at USD 10233.03 Million in 2023 and is projected to reach USD 14691.32 Million by 2032, growing at a CAGR of 4.10% from 2024 to 2032.

Exam gloves are the standard whenever there is a procedure that requires sterility and cleanliness. Exam gloves protect the wearer from biohazards, chemicals, and other potentially dangerous substances, regardless of whether the user is in a healthcare facility or in any situation where there is a risk of contamination.

- Examination gloves are also designed to protect the patient from any cross-contamination during examinations or medical procedures. Medical exam gloves from the Vitality Medical range in various sizes, thicknesses, and materials. There are three types of medical exam gloves Latex Gloves, Vinyl Gloves, and Nitrile Gloves. Latex Gloves are used for handling hazardous substances and have the maximum stretchability. The benefits of latex gloves such as it avoids cross-contamination during examination is drive the demand for Medical Exam Gloves.

- Vinyl Gloves are used for handling biohazardous materials as an alternative to latex in case of allergic reactions and for a low-cost, economy exam glove. Nitrile Gloves are used as an alternative to latex in case of an allergic reaction, puncture resistance, maximum strength, a more breathable exam glove, and handling certain chemicals or medications. Medical gloves are disposable and include examination gloves and surgical gloves. The rise in the demand for examination gloves to lower the danger of virus transmission among healthcare professionals is anticipated to drive the growth of the market.

The Medical Exam Gloves Market Trend Analysis

Increasing Awareness Regarding Health and Safety Among Consumers

- The main factor for the expansion of the market is the increase in the incidence of infectious diseases, which is also accompanied by an increase in surgical procedures. The risk of the spread of bacteria and blood-borne infections is another factor expected to increase the demand for medical exam gloves in healthcare facilities. For instance, according to a 2020 article on Healthpeople.gov, one in 25 hospitalized patients in the United States has a hospital-acquired illness (HAI). As a result, the high prevalence of health hazards in the United States drives the attention of health facility management and governments to maintain facility hygiene and preventive measures, leading to profitable market expansion.

- In December 2020, the World Health Organization (WHO) declared that communicable illnesses pose a significant problem in low- and middle-income countries. The same study indicates that pneumonia was the fourth-leading cause of mortality globally in 2019. According to WHO estimates, infectious diseases like malaria, TB, and HIV/AIDS made up six of the top 10 killers in low- and middle-income countries. In such situations, the awareness among individuals is increasing which boosts market growth. Moreover, the increasing disposable income and changing lifestyle of the population increase the market growth during the forecast period.

Increasing Prevalence Of Chronic Diseases Around The World

- The prevalence of chronic diseases has increased the number of hospital visits which has positively affected the demand for products worldwide. Surgical procedures such as cesarean section, coronary artery bypass grafting (CABG), appendectomy, carotid endarterectomy, and circumcision have been observed to be increasingly performed in the United States, requiring extensive use of medical gloves. Therefore, they are expected to strengthen industrial demand.

- As increasing the geriatric population there increases the risk of chronic diseases which increases the demand for medical exam gloves. For instance, according to Statista, the percentage of seniors in developed countries with a select number of chronic health conditions as of 2021, by country. According to the statistic, among the elderly in Canada, 30 percent had 3 or more chronic health conditions and 15 percent had no chronic health conditions.

- Additionally, the recent development in technology, mergers, partnership, and acquisition within the companies involved in the designing of medical exam gloves are anticipated to create growth opportunities during the forecast period. For instance, Honeywell and Premier Inc. a leading technology-driven healthcare improvement company announced a new commercial relationship dedicated to expanding the domestic production of nitrile exam gloves. This new collaboration is expected to produce at least 750 million domestically made-nitrile exam gloves. Such factors create growth opportunities for the medical exam gloves market.

Segmentation Analysis of The Medical Exam Gloves Market

Medical Exam Gloves market segments cover the Type and Application. By Application, the Hospital segment is Anticipated to Dominate the Market Over the Forecast period.

- The rapidly increasing geriatric population especially in developed countries drives market growth. With an increase in the geriatric population around the world, various geriatric disorders also increase, which is excepted a driving factor of the market expansion. For instance, according to the World Health Organization, it is estimated at 2030 there will be 34 nations with over 20% population above 65 years. The high use of medical exam gloves in different medical procedures, treatments, and surgeries boosts market growth.

- Moreover, the increasing prevalence of hospital-acquired and other infections, such as AIDS and hepatitis is boosting the segment growth. The increasing prevalence of Hospital-Acquired Infections (HAIs), such as ventilator-associated pneumonia, bloodstream infection, and surgical site infection, is likely to boost product demand in the hospital end-use segment.

Regional Analysis of The Medical Exam Gloves Market

North America is Expected to Dominate the Medical Exam Gloves Market Over the Forecast Period.

- Over the forecast period, North America is expected to dominate the market for disposable medical gloves. Regional market expansion is anticipated to be driven by elements including a robust healthcare sector, strict government restrictions, and rising consumer awareness. Additionally, it is anticipated that increasing health issues brought on by unhealthy lifestyles would increase demand for healthcare services, which will help the industry expand.

- Due to ongoing developments in the field of surgery, including those in medical technology and High-reliability Organising (HRO), which are anticipated to increase the demand for these products as well as increase hospital sector growth in the North American region. Industrial demand is excepted to be driven by strict government laws governing the safety of clients, physicians, and other staff in hospitals and other facilities, as well as by harsh fines for noncompliance.

- Due to the rising number of diseases each year, the United States is one of the top buyers of preventative personal protective equipment packages. For instance, according to the United States National Vital Statistics System, there were 17.7% more deaths in the country in 2020 than there were in 2019. Henceforth, the demand for medical exam gloves is increasing in this region.

Covid-19 Impact Analysis on Medical Exam Gloves Market

- The Covid-19 pandemic affects every industry including the healthcare industry. The COVID-19 pandemic has had a negative impact on the global economy and healthcare system. The global shutdown affected supply chains for drugs, medical devices, and biotech products. On the other hand, investments were made in research and development.

- All government agencies and health stakeholders support the development of diagnostic and treatment options for COVID-19. Because hospital-acquired infections have been a common feature of novel coronavirus epidemics and can be transmitted through medical gloves, the prevention of nosocomial infections is an important part of the clinical management of COVID-19.

- The coronavirus pandemic has harmed the network for sourcing, shipping, and distribution of raw materials, and travel restrictions have been put in place, which hinders the flow of goods. However, the positive thing that comes out during the pandemic situation is to stop the spread of disease, there has been an increase in demand for safety equipment and emergency assistance. The public's understanding of the value of PPE has also increased significantly as a result of the covid-19 outbreak.

Top Key Players Covered in The Medical Exam Gloves Market

- Ammex Corporation (US)

- McKesson(US)

- Diamond Gloves (US)

- Top Glove (Malaysia)

- Kimberly Clark (US)

- Lohmann & Rauscher (Germany)

- Cypress (US)

- Semperit (Australia)

- Intco Medical (China)

- Halyard Health (US)

- Ansell (Australia)

- Cardinal Health (US)

- V12 Health (US)

- Zhonghong Pulin (China)

- Unigloves (England)

- Hospeco (US)

- Medline Industries (US), and Other Major Players

Key Industry Developments in the Medical Exam Gloves Market

In February 2023, McKesson introduced the "Biodegradable Nitrile Exam Glove," the first commercially available nitrile glove certified for industrial composting. This address growing concerns about plastic waste in healthcare.

In April 2023, Ansell Healthcare launched the "HyFlex+ Touch NT Nitrile Exam Glove," featuring enhanced tactile sensitivity and dexterity for improved medical procedures.

In June2023, Supermax Corporation unveiled the "AmbiSure Biodegradable Powder-Free Nitrile Exam Glove," offering both biodegradability and a comfortable, powder-free experience.

In September 2023, Cardinal Health introduced the "SensiShield Ultra Nitrile Exam Glove," boasting superior puncture resistance and tear strength for added safety and durability.

|

Global Medical Exam Gloves Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10233.03 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.10% |

Market Size in 2030: |

USD 14691.32 Mn. |

|

|

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Medical Exam Gloves Market by Type

5.1 Medical Exam Gloves Market Overview Snapshot and Growth Engine

5.2 Medical Exam Gloves Market Overview

5.3 Latex Gloves

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Latex Gloves: Geographic Segmentation

5.4 Vinyl Gloves

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Vinyl Gloves: Geographic Segmentation

5.5 Nitrile Gloves

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Nitrile Gloves: Geographic Segmentation

Chapter 6: Medical Exam Gloves Market by Application

6.1 Medical Exam Gloves Market Overview Snapshot and Growth Engine

6.2 Medical Exam Gloves Market Overview

6.3 Hospital

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospital: Geographic Segmentation

6.4 Clinic

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Clinic: Geographic Segmentation

6.5 Others

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Others: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Medical Exam Gloves Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Medical Exam Gloves Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Medical Exam Gloves Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 AMMEX CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 MCKESSON

7.4 DIAMOND GLOVES

7.5 TOP GLOVE

7.6 KIMBERLY CLARK

7.7 LOHMANN & RAUSCHER

7.8 CYPRESS

7.9 SEMPERIT

7.10 INTCO MEDICAL

7.11 HALYARD HEALTH

7.12 ANSELL

7.13 CARDINAL HEALTH

7.14 V12 HEALTH

7.15 ZHONGHONG PULIN

7.16 UNIGLOVES

7.17 HOSPECO

7.18 MEDLINE INDUSTRIES

7.19 OTHER MAJOR PLAYERS

Chapter 8: Global Medical Exam Gloves Market Analysis, Insights and Forecast, 2017-2032

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Latex Gloves

8.2.2 Vinyl Gloves

8.2.3 Nitrile Gloves

8.3 Historic and Forecasted Market Size By Application

8.3.1 Hospital

8.3.2 Clinic

8.3.3 Others

Chapter 9: North America Medical Exam Gloves Market Analysis, Insights and Forecast, 2017-2032

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Latex Gloves

9.4.2 Vinyl Gloves

9.4.3 Nitrile Gloves

9.5 Historic and Forecasted Market Size By Application

9.5.1 Hospital

9.5.2 Clinic

9.5.3 Others

9.6 Historic and Forecast Market Size by Country

9.6.1 US

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Eastern Europe Medical Exam Gloves Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Latex Gloves

10.4.2 Vinyl Gloves

10.4.3 Nitrile Gloves

10.5 Historic and Forecasted Market Size By Application

10.5.1 Hospital

10.5.2 Clinic

10.5.3 Others

10.6 Historic and Forecast Market Size by Country

10.6.1 Bulgaria

10.6.2 The Czech Republic

10.6.3 Hungary

10.6.4 Poland

10.6.5 Romania

10.6.6 Rest of Eastern Europe

Chapter 11: Western Europe Medical Exam Gloves Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Latex Gloves

11.4.2 Vinyl Gloves

11.4.3 Nitrile Gloves

11.5 Historic and Forecasted Market Size By Application

11.5.1 Hospital

11.5.2 Clinic

11.5.3 Others

11.6 Historic and Forecast Market Size by Country

11.6.1 Germany

11.6.2 UK

11.6.3 France

11.6.4 Netherlands

11.6.5 Italy

11.6.6 Russia

11.6.7 Spain

11.6.8 Rest of Western Europe

Chapter 12: Asia Pacific Medical Exam Gloves Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Latex Gloves

12.4.2 Vinyl Gloves

12.4.3 Nitrile Gloves

12.5 Historic and Forecasted Market Size By Application

12.5.1 Hospital

12.5.2 Clinic

12.5.3 Others

12.6 Historic and Forecast Market Size by Country

12.6.1 China

12.6.2 India

12.6.3 Japan

12.6.4 South Korea

12.6.5 Malaysia

12.6.6 Thailand

12.6.7 Vietnam

12.6.8 The Philippines

12.6.9 Australia

12.6.10 New Zealand

12.6.11 Rest of APAC

Chapter 13: Middle East & Africa Medical Exam Gloves Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Latex Gloves

13.4.2 Vinyl Gloves

13.4.3 Nitrile Gloves

13.5 Historic and Forecasted Market Size By Application

13.5.1 Hospital

13.5.2 Clinic

13.5.3 Others

13.6 Historic and Forecast Market Size by Country

13.6.1 Turkey

13.6.2 Bahrain

13.6.3 Kuwait

13.6.4 Saudi Arabia

13.6.5 Qatar

13.6.6 UAE

13.6.7 Israel

13.6.8 South Africa

Chapter 14: South America Medical Exam Gloves Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Latex Gloves

14.4.2 Vinyl Gloves

14.4.3 Nitrile Gloves

14.5 Historic and Forecasted Market Size By Application

14.5.1 Hospital

14.5.2 Clinic

14.5.3 Others

14.6 Historic and Forecast Market Size by Country

14.6.1 Brazil

14.6.2 Argentina

14.6.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Medical Exam Gloves Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10233.03 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.10% |

Market Size in 2030: |

USD 14691.32 Mn. |

|

|

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MEDICAL EXAM GLOVES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MEDICAL EXAM GLOVES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MEDICAL EXAM GLOVES MARKET COMPETITIVE RIVALRY

TABLE 005. MEDICAL EXAM GLOVES MARKET THREAT OF NEW ENTRANTS

TABLE 006. MEDICAL EXAM GLOVES MARKET THREAT OF SUBSTITUTES

TABLE 007. MEDICAL EXAM GLOVES MARKET BY TYPE

TABLE 008. LATEX GLOVES MARKET OVERVIEW (2016-2030)

TABLE 009. VINYL GLOVES MARKET OVERVIEW (2016-2030)

TABLE 010. NITRILE GLOVES MARKET OVERVIEW (2016-2030)

TABLE 011. MEDICAL EXAM GLOVES MARKET BY APPLICATION

TABLE 012. HOSPITAL MARKET OVERVIEW (2016-2030)

TABLE 013. CLINIC MARKET OVERVIEW (2016-2030)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 015. NORTH AMERICA MEDICAL EXAM GLOVES MARKET, BY TYPE (2016-2030)

TABLE 016. NORTH AMERICA MEDICAL EXAM GLOVES MARKET, BY APPLICATION (2016-2030)

TABLE 017. N MEDICAL EXAM GLOVES MARKET, BY COUNTRY (2016-2030)

TABLE 018. EASTERN EUROPE MEDICAL EXAM GLOVES MARKET, BY TYPE (2016-2030)

TABLE 019. EASTERN EUROPE MEDICAL EXAM GLOVES MARKET, BY APPLICATION (2016-2030)

TABLE 020. MEDICAL EXAM GLOVES MARKET, BY COUNTRY (2016-2030)

TABLE 021. WESTERN EUROPE MEDICAL EXAM GLOVES MARKET, BY TYPE (2016-2030)

TABLE 022. WESTERN EUROPE MEDICAL EXAM GLOVES MARKET, BY APPLICATION (2016-2030)

TABLE 023. MEDICAL EXAM GLOVES MARKET, BY COUNTRY (2016-2030)

TABLE 024. ASIA PACIFIC MEDICAL EXAM GLOVES MARKET, BY TYPE (2016-2030)

TABLE 025. ASIA PACIFIC MEDICAL EXAM GLOVES MARKET, BY APPLICATION (2016-2030)

TABLE 026. MEDICAL EXAM GLOVES MARKET, BY COUNTRY (2016-2030)

TABLE 027. MIDDLE EAST & AFRICA MEDICAL EXAM GLOVES MARKET, BY TYPE (2016-2030)

TABLE 028. MIDDLE EAST & AFRICA MEDICAL EXAM GLOVES MARKET, BY APPLICATION (2016-2030)

TABLE 029. MEDICAL EXAM GLOVES MARKET, BY COUNTRY (2016-2030)

TABLE 030. SOUTH AMERICA MEDICAL EXAM GLOVES MARKET, BY TYPE (2016-2030)

TABLE 031. SOUTH AMERICA MEDICAL EXAM GLOVES MARKET, BY APPLICATION (2016-2030)

TABLE 032. MEDICAL EXAM GLOVES MARKET, BY COUNTRY (2016-2030)

TABLE 033. AMMEX CORPORATION: SNAPSHOT

TABLE 034. AMMEX CORPORATION: BUSINESS PERFORMANCE

TABLE 035. AMMEX CORPORATION: PRODUCT PORTFOLIO

TABLE 036. AMMEX CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. MCKESSON: SNAPSHOT

TABLE 037. MCKESSON: BUSINESS PERFORMANCE

TABLE 038. MCKESSON: PRODUCT PORTFOLIO

TABLE 039. MCKESSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. DIAMOND GLOVES: SNAPSHOT

TABLE 040. DIAMOND GLOVES: BUSINESS PERFORMANCE

TABLE 041. DIAMOND GLOVES: PRODUCT PORTFOLIO

TABLE 042. DIAMOND GLOVES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. TOP GLOVE: SNAPSHOT

TABLE 043. TOP GLOVE: BUSINESS PERFORMANCE

TABLE 044. TOP GLOVE: PRODUCT PORTFOLIO

TABLE 045. TOP GLOVE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. KIMBERLY CLARK: SNAPSHOT

TABLE 046. KIMBERLY CLARK: BUSINESS PERFORMANCE

TABLE 047. KIMBERLY CLARK: PRODUCT PORTFOLIO

TABLE 048. KIMBERLY CLARK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. LOHMANN & RAUSCHER: SNAPSHOT

TABLE 049. LOHMANN & RAUSCHER: BUSINESS PERFORMANCE

TABLE 050. LOHMANN & RAUSCHER: PRODUCT PORTFOLIO

TABLE 051. LOHMANN & RAUSCHER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. CYPRESS: SNAPSHOT

TABLE 052. CYPRESS: BUSINESS PERFORMANCE

TABLE 053. CYPRESS: PRODUCT PORTFOLIO

TABLE 054. CYPRESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. SEMPERIT: SNAPSHOT

TABLE 055. SEMPERIT: BUSINESS PERFORMANCE

TABLE 056. SEMPERIT: PRODUCT PORTFOLIO

TABLE 057. SEMPERIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. INTCO MEDICAL: SNAPSHOT

TABLE 058. INTCO MEDICAL: BUSINESS PERFORMANCE

TABLE 059. INTCO MEDICAL: PRODUCT PORTFOLIO

TABLE 060. INTCO MEDICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. HALYARD HEALTH: SNAPSHOT

TABLE 061. HALYARD HEALTH: BUSINESS PERFORMANCE

TABLE 062. HALYARD HEALTH: PRODUCT PORTFOLIO

TABLE 063. HALYARD HEALTH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ANSELL: SNAPSHOT

TABLE 064. ANSELL: BUSINESS PERFORMANCE

TABLE 065. ANSELL: PRODUCT PORTFOLIO

TABLE 066. ANSELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. CARDINAL HEALTH: SNAPSHOT

TABLE 067. CARDINAL HEALTH: BUSINESS PERFORMANCE

TABLE 068. CARDINAL HEALTH: PRODUCT PORTFOLIO

TABLE 069. CARDINAL HEALTH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. V12 HEALTH: SNAPSHOT

TABLE 070. V12 HEALTH: BUSINESS PERFORMANCE

TABLE 071. V12 HEALTH: PRODUCT PORTFOLIO

TABLE 072. V12 HEALTH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. ZHONGHONG PULIN: SNAPSHOT

TABLE 073. ZHONGHONG PULIN: BUSINESS PERFORMANCE

TABLE 074. ZHONGHONG PULIN: PRODUCT PORTFOLIO

TABLE 075. ZHONGHONG PULIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. UNIGLOVES: SNAPSHOT

TABLE 076. UNIGLOVES: BUSINESS PERFORMANCE

TABLE 077. UNIGLOVES: PRODUCT PORTFOLIO

TABLE 078. UNIGLOVES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. HOSPECO: SNAPSHOT

TABLE 079. HOSPECO: BUSINESS PERFORMANCE

TABLE 080. HOSPECO: PRODUCT PORTFOLIO

TABLE 081. HOSPECO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. MEDLINE INDUSTRIES: SNAPSHOT

TABLE 082. MEDLINE INDUSTRIES: BUSINESS PERFORMANCE

TABLE 083. MEDLINE INDUSTRIES: PRODUCT PORTFOLIO

TABLE 084. MEDLINE INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 085. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 086. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 087. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MEDICAL EXAM GLOVES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MEDICAL EXAM GLOVES MARKET OVERVIEW BY TYPE

FIGURE 012. LATEX GLOVES MARKET OVERVIEW (2016-2030)

FIGURE 013. VINYL GLOVES MARKET OVERVIEW (2016-2030)

FIGURE 014. NITRILE GLOVES MARKET OVERVIEW (2016-2030)

FIGURE 015. MEDICAL EXAM GLOVES MARKET OVERVIEW BY APPLICATION

FIGURE 016. HOSPITAL MARKET OVERVIEW (2016-2030)

FIGURE 017. CLINIC MARKET OVERVIEW (2016-2030)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 019. NORTH AMERICA MEDICAL EXAM GLOVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 020. EASTERN EUROPE MEDICAL EXAM GLOVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 021. WESTERN EUROPE MEDICAL EXAM GLOVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 022. ASIA PACIFIC MEDICAL EXAM GLOVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. MIDDLE EAST & AFRICA MEDICAL EXAM GLOVES MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. SOUTH AMERICA MEDICAL EXAM GLOVES MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Medical Exam Gloves Market research report is 2024-2032.

Ammex Corporation (US), McKesson (US), Diamond Gloves (US), Top Glove (Malaysia), Kimberly Clark (US), Lohmann & Rauscher (Germany), Cypress (US), Semperit (Australia), Intco Medical (China), Halyard Health (US), Ansell (Australia), Cardinal Health (US), V12 Health (US), Zhonghong Pulin (China), Unigloves (England), Hospeco (US), Medline Industries (US), and Other Major Players

The Medical Exam Gloves Market is segmented into Type, Application, and regions. By Type, the market is categorized into Latex Gloves, Vinyl Gloves, and Nitrile Gloves. By Application, the market is categorized into Hospital, Clinic. By region, it is analyzed across North America (US, Canada, Mexico), Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Exam gloves are the standard whenever there is a procedure that requires sterility and cleanliness. Exam gloves protect the wearer from biohazards, chemicals, and other potentially dangerous substances, regardless of whether the user is in a healthcare facility or in any situation where there is a risk of contamination. Examination gloves are also designed to protect the patient from any cross-contamination during examinations or medical procedures. Medical exam gloves from the Vitality Medical range in various sizes, thicknesses, and materials.

The Global Medical Exam Gloves Market size was valued at USD 10233.03 Million in 2023 and is projected to reach USD 14691.32 Million by 2032, growing at a CAGR of 4.10% from 2024 to 2032.