Global Meat Speciation Testing Market Overview

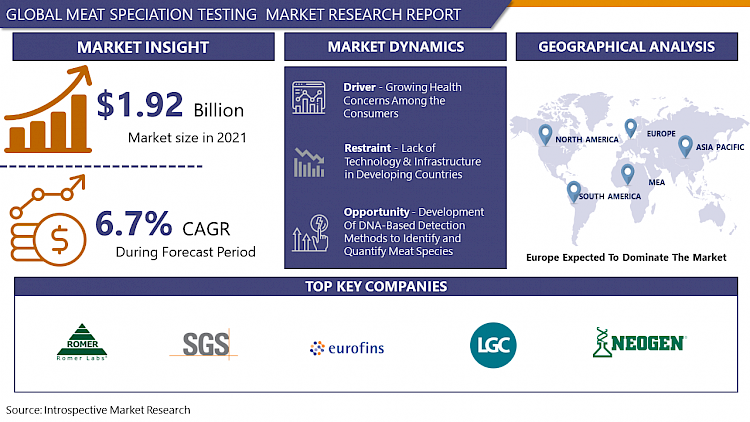

The Global Meat Speciation Testing market was valued at USD 1.92 billion in 2021 and is expected to reach USD 3.02 billion by the year 2028, at a CAGR of 6.7%.

Meat speciation testing is the identification of animal species and is carried out for a variety of reasons safety, economic, and ethnic. Meat speciation is performed for both cooked and raw meat products. Claims that are produced by-product labels are confirmed by the meat speciation testing systems so that the reliability of meat and meat products is checked, hence ensuring the safety of the consumers. The growing amount of meat consumers over the world coupled with the contemporary scandals occurring from the mislabeling of meat products has raised the demand for meat speciation testing. Meat is one of the highly utilized foodstuffs worldwide. Furthermore, the launching of the latest and innovative products within the meat food category, ensuring the food is of the highest quality has become of extreme importance.

Meat speciation testing is a process to quantify relative levels of animal DNA in the total meat using diagnostic techniques such as PCR, ELISA, and others. Owing to the extensive scrutiny in the food production industry, there is raised pressure for technological developments in the speciation testing market, to offer quality products with less production cost. As a result, maximum demand for Meat Speciation Testing Market as well. Moreover, adulteration and authenticity of meat products have been making the headlines with horse and pig meat created in the UK and Irish beef products and now in several other countries. The EU Commission initiated an EU-wide program of control measures incorporating random control of processed beef products for foreign DNA as well as analysis of residues of the veterinary drug phenylbutazone. Horses that have been treated with the drug phenylbutazone are forbidden to enter the food chain.

COVID-19 Impact on Meat Speciation Testing Market

The meat speciation testing market is rapidly gaining its pre-COVID levels and a healthy growth rate is anticipated over the forecast period, driven by the economic revival in most of the developing nations. Nevertheless, unprecedented situations owing to the anticipated third and further waves are producing a disconsolate outlook. This study endeavors to evaluate different scenarios of COVID-19's impact on the future of the Meat Speciation Testing market over the forecast period. The COVID-19 pandemic impacted the supply chain, meat production, and meat prices that causing a severe socio-economic pandemic globally. Initially, meat and meat products' prices increased owing to the lower manufacturing and increased demand because of panic buying. Apart from this, later on, both meat production and demand were significantly declined due to lockdown limitations and lower purchasing power of the consumers that results in a decrease in meat prices. Moreover, meat producers and processors faced difficulty in harvesting and shipment of the products owing to lockdown situations, declining in the labor force, limitations in movement of animals within and over the country, and changes in the constitution of the local and international export market. These conditions poorly influenced the meat speciation testing industry owing to a decrease in meat production, processing and distribution facilities.

Market Dynamics For The Meat Speciation Testing Market

Drivers:

Government Leads and Food Governing Bodies

The growth of the Meat Speciation Testing market is turned by its rising in several food duplicity cases and growing infection among consumers, compliance with labeling laws, religious beliefs and stringent rules & regulations, and buyer demand for certified foodstuffs. Global food examining and food testing bodies such as the Food and Drug Administration (FDA) and the Food Standard Agency (FSA) are putting efforts to seize the adulteration activities in meat products. These agencies rely on the previously mentioned meat speciation tests to separate the meat composition. These government bodies are generally supported with heavy investment and investments to tackle the issue of adulteration in food and evidently, a massive share of this capital is allotted for meat speciation testing thereby, improving the meat speciation market growth.

Associations of Massive Brand Names

The lion's share of the frozen meat products is sold in retail supermarkets such as Walmart and Safeway. These supermarkets tend to promise opposed to and authorized products owing to selling counterfeit products in these retail stores can affect the brand value of the supermarket chain. Therefore, these big retail chains are now more careful than ever in selling meat products and meat speciation testing has become an important part of the supply chain here. Hence, the distribution channel of a retail store is also one of the key growth drivers in the meat speciation testing market along with the rising demands for meat globally.

Restraints:

Inadequate technology & infrastructure, scarcity of food control systems, and resources in emerging countries are the major hampering for the Meat Speciation Testing is market are influencing the profit margins of Meat Speciation Testing market.

Opportunities:

The trend determined in the global meat speciation testing market is collaborations and acquisitions between processed meat producers and contract research organizations. The company manufacturing meat speciation testing products has a lucrative opportunity in regions such as North America, Europe, and the Asia Pacific, attributed to rising health concerns among a large number of individuals.

Adulteration of meat and meat products owing species alternatives is also of key importance in the case of traditional products and/or game meat since both types of products are frequently more expensive and recognized by consumers as being of superior quality. In the case of game meat, its utilization has been rising in recent years, mainly owing to its particular taste and flavor but also because it may be considered healthier and less-fat meat, obtained from animals free of hormones and drugs such as antibiotics.

Market Segmentation

Segmentation Analysis of Meat Speciation Testing Market:

Based on Species, the swine (Sus Scrofa) segment is anticipated to hold maximum Meat Speciation Testing market share during the forecast period among all the segments among species in the meat speciation market as the growth in several adulterations of swine meat with chicken meat and horse meat has managed to an inclination for increased quality control for meat products. The identification of species in swine (pig) meat products is required to defend the consumers from fraud and to respect the consumer's religious beliefs & cultural aspects.

Based on Technology, Polymerase Chain Reaction (PCR) is anticipated to record the highest Meat Speciation Testing market share during the forecast period. Maximum expansion in adoption of this technology for meat speciation testing can be assigned to drawbacks of the ELISA (enzyme-linked immunosorbent assay) technology; accordingly, DNA analysis is conducted by the technology for authentic determination of meat species in products even at 0.1% levels of detection. Another significance of PCR technology is the automated approach to testing, which provides rapid results, and aids the decision-making process for product recalls further distribution of meat products and other related strategies of related stakeholders.

Based on Form, the raw segment is expected to reach the highest Meat Speciation Testing market share across the projected period. This is attributable to the fact that the domestic utilization of meat as well as the meat trade in raw form is very high, owing to which the testing of meat in raw form is also the largest as well as the fastest-increasing.

Regional Analysis of Meat Speciation Testing Market:

Europe is presently the dominates in the global meat speciation testing market, as the growth in strict food laws, consumer consciousness, and an upsurge in meat trade are turning the meat speciation testing market in the region. The increasing consumer demand for certified products, which are perceived to be authentic and compliant with the Islamic and Jewish laws of halal and kosher, is another factor for the growing interest in meat speciation testing in Europe. The companies are emerging the latest technologies to test the authenticity of meat and to serve the requirements of the consumers. For example, in June 2015, Eurofins introduced an innovative analytical method, based on DNA chip technology, which allows simultaneous detection and identification of up to 21 animal species in feed and food products.

The Asia Pacific and Latin America are expected to witness significant growth in the meat speciation testing market due to rising urbanization, rising disposable incomes, changing preferences of the consumers regarding food habits, and the growth in the animal husbandry sector. The emerging nation China dominates this regional segment owing to the adoption of Western food habits. The meat speciation testing market in the Asia-Pacific region is driven by various rules and regulations implemented by different countries in the region. Food security standards are getting strict year on year to ensure a safer supply of food to individuals in local and foreign countries. Furthermore, the US holds a major share in terms of meat utilization in the North American region.

Players Covered in Meat Speciation Testing Market are:

- Romer Labs Division Holding GmbH (Austria)

- VWR International LLC (U.S.)

- SGS SA (Switzerland)

- Eurofins Scientific SE (Luxemburg)

- Intertek Group PLC (UK)

- ALS Limited (Australia)

- Bio-Check Ltd (UK)

- LGC Ltd. (UK)

- Neogen Corporation (U.S.)

- LGC Science Group Ltd. (U.K.)

- Scientific Analysis Laboratories (U.K.)

- Genetic ID NA Inc. (U.S.)

- International Laboratory Services Ltd. (U.K.)

- AB Sciex LLC (U.S.)

- SYNLAB (Germany)

- Genius Laboratories Ltd. (U.K.) and Other Major Players.

Key Industry Developments In Meat Speciation Testing Market

- In December 2020, Neogen Corporation has designed the quickest and easiest tests available to indicate meat speciation in raw meat and environmental samples. Neogen's latest Reveal® tests for sheep, horse, beef, and poultry offer authentic results in just 5 minutes after simple water extraction. The latest tests can determine as little as 0.5% of the target species in raw meat or raw processed samples, and have also been confirmed for usage with environmental swabs and rinse water samples. The new tests join Neogen's existing Reveal for Pork in the company's simple and quick meat speciation test range.

- Bio-Check (UK) has designed rapid, on-site FlowThrough™ tests and laboratory Species-Check™ ELISAs for raw meat adulteration, using its wide experience in this specialist field. Its products are utilized by labs and meat processors across the UK and overseas. The tests are effective and efficient, developed to help you observe both UK and international food regulations.

|

Global Meat Speciation Testing Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.92 Bn. |

|

Forecast Period 2022-28 CAGR: |

6.7% |

Market Size in 2028: |

USD 3.02 Bn. |

|

Segments Covered: |

By Species |

|

|

|

By Technology |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Species

3.2 By Technology

3.3 By Form

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Meat Speciation Testing Market by Species

5.1 Meat Speciation Testing Market Overview Snapshot and Growth Engine

5.2 Meat Speciation Testing Market Overview

5.3 Cow {Bos Taurus}

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Cow {Bos Taurus}: Grographic Segmentation

5.4 Swine {Sus Scrofa}

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Swine {Sus Scrofa}: Grographic Segmentation

5.5 Chicken {Gallus Gallus}

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Chicken {Gallus Gallus}: Grographic Segmentation

5.6 Horse {Equus Caballus}

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Horse {Equus Caballus}: Grographic Segmentation

5.7 Sheep {Ovis Aries}

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Sheep {Ovis Aries}: Grographic Segmentation

5.8 Others

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size (2016-2028F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Others: Grographic Segmentation

Chapter 6: Meat Speciation Testing Market by Technology

6.1 Meat Speciation Testing Market Overview Snapshot and Growth Engine

6.2 Meat Speciation Testing Market Overview

6.3 Polymerase Chain Reaction (PCR)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Polymerase Chain Reaction (PCR): Grographic Segmentation

6.4 Enzyme-Linked Immunosorbent Assay (ELISA)

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Enzyme-Linked Immunosorbent Assay (ELISA): Grographic Segmentation

6.5 Molecular-Diagnostic Tests (LC-MS/MS)

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Molecular-Diagnostic Tests (LC-MS/MS): Grographic Segmentation

Chapter 7: Meat Speciation Testing Market by Form

7.1 Meat Speciation Testing Market Overview Snapshot and Growth Engine

7.2 Meat Speciation Testing Market Overview

7.3 Raw

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Raw: Grographic Segmentation

7.4 Cooked

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Cooked: Grographic Segmentation

7.5 Processed

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Processed: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Meat Speciation Testing Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Meat Speciation Testing Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Meat Speciation Testing Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 ROMER LABS DIVISION HOLDING GMBH

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 VWR INTERNATIONAL LLC

8.4 SGS SA

8.5 EUROFINS SCIENTIFIC SE

8.6 INTERTEK GROUP PLC

8.7 ALS LIMITED

8.8 BIO-CHECK LTD

8.9 LGC LTD.

8.10 NEOGEN CORPORATION

8.11 LGC SCIENCE GROUP LTD.

8.12 SCIENTIFIC ANALYSIS LABORATORIES

8.13 GENETIC ID NA INC.

8.14 INTERNATIONAL LABORATORY SERVICES LTD.

8.15 AB SCIEX LLC

8.16 SYNLAB

8.17 GENIUS LABORATORIES LTD.

8.18 OTHER MAJOR PLAYERS

Chapter 9: Global Meat Speciation Testing Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Species

9.2.1 Cow {Bos Taurus}

9.2.2 Swine {Sus Scrofa}

9.2.3 Chicken {Gallus Gallus}

9.2.4 Horse {Equus Caballus}

9.2.5 Sheep {Ovis Aries}

9.2.6 Others

9.3 Historic and Forecasted Market Size By Technology

9.3.1 Polymerase Chain Reaction (PCR)

9.3.2 Enzyme-Linked Immunosorbent Assay (ELISA)

9.3.3 Molecular-Diagnostic Tests (LC-MS/MS)

9.4 Historic and Forecasted Market Size By Form

9.4.1 Raw

9.4.2 Cooked

9.4.3 Processed

Chapter 10: North America Meat Speciation Testing Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Species

10.4.1 Cow {Bos Taurus}

10.4.2 Swine {Sus Scrofa}

10.4.3 Chicken {Gallus Gallus}

10.4.4 Horse {Equus Caballus}

10.4.5 Sheep {Ovis Aries}

10.4.6 Others

10.5 Historic and Forecasted Market Size By Technology

10.5.1 Polymerase Chain Reaction (PCR)

10.5.2 Enzyme-Linked Immunosorbent Assay (ELISA)

10.5.3 Molecular-Diagnostic Tests (LC-MS/MS)

10.6 Historic and Forecasted Market Size By Form

10.6.1 Raw

10.6.2 Cooked

10.6.3 Processed

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Meat Speciation Testing Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Species

11.4.1 Cow {Bos Taurus}

11.4.2 Swine {Sus Scrofa}

11.4.3 Chicken {Gallus Gallus}

11.4.4 Horse {Equus Caballus}

11.4.5 Sheep {Ovis Aries}

11.4.6 Others

11.5 Historic and Forecasted Market Size By Technology

11.5.1 Polymerase Chain Reaction (PCR)

11.5.2 Enzyme-Linked Immunosorbent Assay (ELISA)

11.5.3 Molecular-Diagnostic Tests (LC-MS/MS)

11.6 Historic and Forecasted Market Size By Form

11.6.1 Raw

11.6.2 Cooked

11.6.3 Processed

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Meat Speciation Testing Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Species

12.4.1 Cow {Bos Taurus}

12.4.2 Swine {Sus Scrofa}

12.4.3 Chicken {Gallus Gallus}

12.4.4 Horse {Equus Caballus}

12.4.5 Sheep {Ovis Aries}

12.4.6 Others

12.5 Historic and Forecasted Market Size By Technology

12.5.1 Polymerase Chain Reaction (PCR)

12.5.2 Enzyme-Linked Immunosorbent Assay (ELISA)

12.5.3 Molecular-Diagnostic Tests (LC-MS/MS)

12.6 Historic and Forecasted Market Size By Form

12.6.1 Raw

12.6.2 Cooked

12.6.3 Processed

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Meat Speciation Testing Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Species

13.4.1 Cow {Bos Taurus}

13.4.2 Swine {Sus Scrofa}

13.4.3 Chicken {Gallus Gallus}

13.4.4 Horse {Equus Caballus}

13.4.5 Sheep {Ovis Aries}

13.4.6 Others

13.5 Historic and Forecasted Market Size By Technology

13.5.1 Polymerase Chain Reaction (PCR)

13.5.2 Enzyme-Linked Immunosorbent Assay (ELISA)

13.5.3 Molecular-Diagnostic Tests (LC-MS/MS)

13.6 Historic and Forecasted Market Size By Form

13.6.1 Raw

13.6.2 Cooked

13.6.3 Processed

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Meat Speciation Testing Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Species

14.4.1 Cow {Bos Taurus}

14.4.2 Swine {Sus Scrofa}

14.4.3 Chicken {Gallus Gallus}

14.4.4 Horse {Equus Caballus}

14.4.5 Sheep {Ovis Aries}

14.4.6 Others

14.5 Historic and Forecasted Market Size By Technology

14.5.1 Polymerase Chain Reaction (PCR)

14.5.2 Enzyme-Linked Immunosorbent Assay (ELISA)

14.5.3 Molecular-Diagnostic Tests (LC-MS/MS)

14.6 Historic and Forecasted Market Size By Form

14.6.1 Raw

14.6.2 Cooked

14.6.3 Processed

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Meat Speciation Testing Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.92 Bn. |

|

Forecast Period 2022-28 CAGR: |

6.7% |

Market Size in 2028: |

USD 3.02 Bn. |

|

Segments Covered: |

By Species |

|

|

|

By Technology |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MEAT SPECIATION TESTING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MEAT SPECIATION TESTING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MEAT SPECIATION TESTING MARKET COMPETITIVE RIVALRY

TABLE 005. MEAT SPECIATION TESTING MARKET THREAT OF NEW ENTRANTS

TABLE 006. MEAT SPECIATION TESTING MARKET THREAT OF SUBSTITUTES

TABLE 007. MEAT SPECIATION TESTING MARKET BY SPECIES

TABLE 008. COW {BOS TAURUS} MARKET OVERVIEW (2016-2028)

TABLE 009. SWINE {SUS SCROFA} MARKET OVERVIEW (2016-2028)

TABLE 010. CHICKEN {GALLUS GALLUS} MARKET OVERVIEW (2016-2028)

TABLE 011. HORSE {EQUUS CABALLUS} MARKET OVERVIEW (2016-2028)

TABLE 012. SHEEP {OVIS ARIES} MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. MEAT SPECIATION TESTING MARKET BY TECHNOLOGY

TABLE 015. POLYMERASE CHAIN REACTION (PCR) MARKET OVERVIEW (2016-2028)

TABLE 016. ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA) MARKET OVERVIEW (2016-2028)

TABLE 017. MOLECULAR-DIAGNOSTIC TESTS (LC-MS/MS) MARKET OVERVIEW (2016-2028)

TABLE 018. MEAT SPECIATION TESTING MARKET BY FORM

TABLE 019. RAW MARKET OVERVIEW (2016-2028)

TABLE 020. COOKED MARKET OVERVIEW (2016-2028)

TABLE 021. PROCESSED MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA MEAT SPECIATION TESTING MARKET, BY SPECIES (2016-2028)

TABLE 023. NORTH AMERICA MEAT SPECIATION TESTING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 024. NORTH AMERICA MEAT SPECIATION TESTING MARKET, BY FORM (2016-2028)

TABLE 025. N MEAT SPECIATION TESTING MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE MEAT SPECIATION TESTING MARKET, BY SPECIES (2016-2028)

TABLE 027. EUROPE MEAT SPECIATION TESTING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 028. EUROPE MEAT SPECIATION TESTING MARKET, BY FORM (2016-2028)

TABLE 029. MEAT SPECIATION TESTING MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC MEAT SPECIATION TESTING MARKET, BY SPECIES (2016-2028)

TABLE 031. ASIA PACIFIC MEAT SPECIATION TESTING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 032. ASIA PACIFIC MEAT SPECIATION TESTING MARKET, BY FORM (2016-2028)

TABLE 033. MEAT SPECIATION TESTING MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA MEAT SPECIATION TESTING MARKET, BY SPECIES (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA MEAT SPECIATION TESTING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA MEAT SPECIATION TESTING MARKET, BY FORM (2016-2028)

TABLE 037. MEAT SPECIATION TESTING MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA MEAT SPECIATION TESTING MARKET, BY SPECIES (2016-2028)

TABLE 039. SOUTH AMERICA MEAT SPECIATION TESTING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 040. SOUTH AMERICA MEAT SPECIATION TESTING MARKET, BY FORM (2016-2028)

TABLE 041. MEAT SPECIATION TESTING MARKET, BY COUNTRY (2016-2028)

TABLE 042. ROMER LABS DIVISION HOLDING GMBH: SNAPSHOT

TABLE 043. ROMER LABS DIVISION HOLDING GMBH: BUSINESS PERFORMANCE

TABLE 044. ROMER LABS DIVISION HOLDING GMBH: PRODUCT PORTFOLIO

TABLE 045. ROMER LABS DIVISION HOLDING GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. VWR INTERNATIONAL LLC: SNAPSHOT

TABLE 046. VWR INTERNATIONAL LLC: BUSINESS PERFORMANCE

TABLE 047. VWR INTERNATIONAL LLC: PRODUCT PORTFOLIO

TABLE 048. VWR INTERNATIONAL LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. SGS SA: SNAPSHOT

TABLE 049. SGS SA: BUSINESS PERFORMANCE

TABLE 050. SGS SA: PRODUCT PORTFOLIO

TABLE 051. SGS SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. EUROFINS SCIENTIFIC SE: SNAPSHOT

TABLE 052. EUROFINS SCIENTIFIC SE: BUSINESS PERFORMANCE

TABLE 053. EUROFINS SCIENTIFIC SE: PRODUCT PORTFOLIO

TABLE 054. EUROFINS SCIENTIFIC SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. INTERTEK GROUP PLC: SNAPSHOT

TABLE 055. INTERTEK GROUP PLC: BUSINESS PERFORMANCE

TABLE 056. INTERTEK GROUP PLC: PRODUCT PORTFOLIO

TABLE 057. INTERTEK GROUP PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ALS LIMITED: SNAPSHOT

TABLE 058. ALS LIMITED: BUSINESS PERFORMANCE

TABLE 059. ALS LIMITED: PRODUCT PORTFOLIO

TABLE 060. ALS LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. BIO-CHECK LTD: SNAPSHOT

TABLE 061. BIO-CHECK LTD: BUSINESS PERFORMANCE

TABLE 062. BIO-CHECK LTD: PRODUCT PORTFOLIO

TABLE 063. BIO-CHECK LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. LGC LTD.: SNAPSHOT

TABLE 064. LGC LTD.: BUSINESS PERFORMANCE

TABLE 065. LGC LTD.: PRODUCT PORTFOLIO

TABLE 066. LGC LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. NEOGEN CORPORATION: SNAPSHOT

TABLE 067. NEOGEN CORPORATION: BUSINESS PERFORMANCE

TABLE 068. NEOGEN CORPORATION: PRODUCT PORTFOLIO

TABLE 069. NEOGEN CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. LGC SCIENCE GROUP LTD.: SNAPSHOT

TABLE 070. LGC SCIENCE GROUP LTD.: BUSINESS PERFORMANCE

TABLE 071. LGC SCIENCE GROUP LTD.: PRODUCT PORTFOLIO

TABLE 072. LGC SCIENCE GROUP LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. SCIENTIFIC ANALYSIS LABORATORIES: SNAPSHOT

TABLE 073. SCIENTIFIC ANALYSIS LABORATORIES: BUSINESS PERFORMANCE

TABLE 074. SCIENTIFIC ANALYSIS LABORATORIES: PRODUCT PORTFOLIO

TABLE 075. SCIENTIFIC ANALYSIS LABORATORIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. GENETIC ID NA INC.: SNAPSHOT

TABLE 076. GENETIC ID NA INC.: BUSINESS PERFORMANCE

TABLE 077. GENETIC ID NA INC.: PRODUCT PORTFOLIO

TABLE 078. GENETIC ID NA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. INTERNATIONAL LABORATORY SERVICES LTD.: SNAPSHOT

TABLE 079. INTERNATIONAL LABORATORY SERVICES LTD.: BUSINESS PERFORMANCE

TABLE 080. INTERNATIONAL LABORATORY SERVICES LTD.: PRODUCT PORTFOLIO

TABLE 081. INTERNATIONAL LABORATORY SERVICES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. AB SCIEX LLC: SNAPSHOT

TABLE 082. AB SCIEX LLC: BUSINESS PERFORMANCE

TABLE 083. AB SCIEX LLC: PRODUCT PORTFOLIO

TABLE 084. AB SCIEX LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. SYNLAB: SNAPSHOT

TABLE 085. SYNLAB: BUSINESS PERFORMANCE

TABLE 086. SYNLAB: PRODUCT PORTFOLIO

TABLE 087. SYNLAB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. GENIUS LABORATORIES LTD.: SNAPSHOT

TABLE 088. GENIUS LABORATORIES LTD.: BUSINESS PERFORMANCE

TABLE 089. GENIUS LABORATORIES LTD.: PRODUCT PORTFOLIO

TABLE 090. GENIUS LABORATORIES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 091. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 092. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 093. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MEAT SPECIATION TESTING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MEAT SPECIATION TESTING MARKET OVERVIEW BY SPECIES

FIGURE 012. COW {BOS TAURUS} MARKET OVERVIEW (2016-2028)

FIGURE 013. SWINE {SUS SCROFA} MARKET OVERVIEW (2016-2028)

FIGURE 014. CHICKEN {GALLUS GALLUS} MARKET OVERVIEW (2016-2028)

FIGURE 015. HORSE {EQUUS CABALLUS} MARKET OVERVIEW (2016-2028)

FIGURE 016. SHEEP {OVIS ARIES} MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. MEAT SPECIATION TESTING MARKET OVERVIEW BY TECHNOLOGY

FIGURE 019. POLYMERASE CHAIN REACTION (PCR) MARKET OVERVIEW (2016-2028)

FIGURE 020. ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA) MARKET OVERVIEW (2016-2028)

FIGURE 021. MOLECULAR-DIAGNOSTIC TESTS (LC-MS/MS) MARKET OVERVIEW (2016-2028)

FIGURE 022. MEAT SPECIATION TESTING MARKET OVERVIEW BY FORM

FIGURE 023. RAW MARKET OVERVIEW (2016-2028)

FIGURE 024. COOKED MARKET OVERVIEW (2016-2028)

FIGURE 025. PROCESSED MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA MEAT SPECIATION TESTING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE MEAT SPECIATION TESTING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC MEAT SPECIATION TESTING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA MEAT SPECIATION TESTING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA MEAT SPECIATION TESTING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Meat Speciation Testing Market research report is 2022-2028.

Romer Labs Division Holding GmbH (Austria), VWR International LLC (U.S.), SGS SA (Switzerland), Eurofins Scientific SE (Luxemburg), Intertek Group PLC (UK), ALS Limited (Australia), Bio-Check Ltd (UK), LGC Ltd. (UK), Neogen Corporation (U.S.), LGC Science Group Ltd. (U.K.), Scientific Analysis Laboratories (U.K.), Genetic ID NA Inc. (U.S.), International Laboratory Services Ltd. (U.K.), AB Sciex LLC (U.S.), SYNLAB (Germany), Genius Laboratories Ltd. (U.K.) and other major players.

The Meat Speciation Testing Market is segmented into Species, Technology, Form, and region. By Species, the market is categorized into Cow (Bos Taurus), Swine (Sus Scrofa), Chicken (Gallus Gallus), Horse (Equus Caballus), Sheep (Ovis Aries), and Others. By Technology the market is categorized into Polymerase Chain Reaction (PCR), Enzyme-Linked Immunosorbent Assay (ELISA), and Molecular-Diagnostic Tests (LC-MS/MS). By Form, the market is categorized into Raw, Cooked, and Processed. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Meat speciation testing is the identification of animal species and is carried out for a variety of reasons safety, economic, and ethnic. Meat speciation is performed for both cooked and raw meat products. Claims that are produced by-product labels are confirmed by the meat speciation testing systems so that the reliability of meat and meat products is checked, hence ensuring the safety of the consumers.

The Global Meat Speciation Testing market was valued at USD 1.92 billion in 2021 and is expected to reach USD 3.02 billion by the year 2028, at a CAGR of 6.7%.