Maize Market Synopsis

Maize Market Size Was Valued at USD 143.62 Billion in 2023 and is Projected to Reach USD 204.77 Billion by 2032, Growing at a CAGR of 4.02% From 2024-2032.

Maize is an important cereal crop which is widely used for food, feed, and industrial products. It is rich in carbohydrates, vitamins, and minerals. It is also used to produce ethanol, a biofuel used as a substitute for gasoline. Maize comes in various varieties and each variety has its unique characteristics and uses.

- Maize is used in various food products such as in snacks, breakfasts, and baby foods and also as a sweetener in the form of corn syrup. It is used as an animal feed, particularly for poultry, swine, and ruminants due to carbohydrates and protein. This makes it an affordable and nutritious feed source. Maize is also used in the production of ethanol or biofuel which is used as an alternative source of fuel. This is less harmful to the environment than fossil fuels.

- In the production of paper, textiles, and adhesives, maize starch is used, and in the production of soap, paint, and varnish, maize oil is used. Due to its rich antioxidants and vitamin content, used as a raw material in the production of various pharmaceutical products such as a binding agent in the production of pills and tablets. The bioplastic made from maize starch is used in the production of disposable items such as bags, cups, and cutlery.

The following chart shows the global cultivated area, yield and production of maize in year 2021-22 and 2022-23.

|

Global Area, Yield, And Production Of Maize |

||

|

|

2021-2022 |

2022-2023 |

|

Area (Million hectares) |

206.15 |

200.45 |

|

Yield (Metric tons per hectare) |

5.90 |

5.78 |

|

Production (Million metric tons) |

1,216.13 |

1,157.74 |

Maize Market Trend Analysis

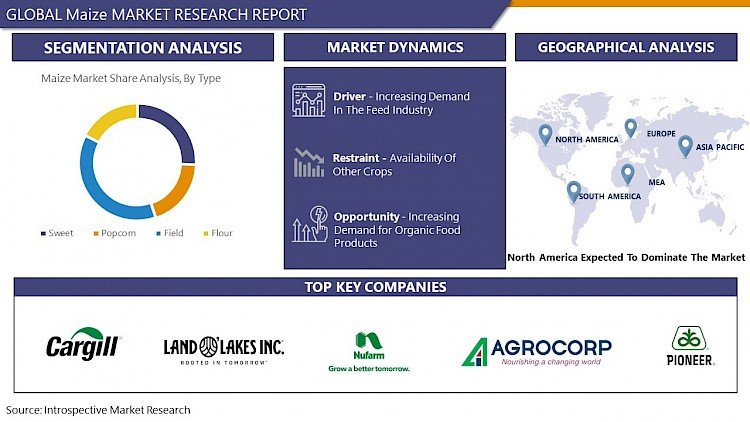

Increasing Demand In The Feed Industry

- Maize is highly valued as animal feed due to its significant nutritional content such as high content of starch, protein, and essential amino acids. This makes it an excellent energy source for livestock. The protein content in maize promotes the growth and development of animals. It is a cost-effective option compared to other feed options.

- Maize is widely cultivated globally making it easily and steadily available. Its widespread availability, large-scale production, and relatively lower production costs make it a nutritious and affordable option. It can be used as whole kernels, cracked maize, ground maize, or processed into various maize-based products. The global demand for livestock products requires a consistent and adequate supply of nutritious feed. For this, maize is a better option aligned with requirements. Maize feed has been found to improve the quality of meat products. maize residues can be utilized for animal feed or bioenergy production, reducing waste and maximizing resource utilization.

Opportunity

Increasing Demand for Organic Food Products

- With growing awareness about the potential health benefits of organic food, more consumers are actively seeking organic options. Maize is a versatile crop used in various food products such as organic corn flour, cornmeal, corn oil, and corn-based snacks. These diverse products can cater to the rising demand for organic options in different food categories. This creates an opportunity for farmers to differentiate their products and command higher prices and acquire higher profits.

- There is a high market potential for exporting organic maize and maize-based products to countries with a high demand for organic imports. any governments have implemented policies and regulations to promote organic farming and consumption helping farmers through incentives and guidance regarding organic farming.

- Organic food products often target specific markets, such as health-conscious individuals, people with dietary restrictions, and those seeking sustainable and ethical food choices. Apart from raw maize, organic maize can be processed into a variety of value-added products to fulfil the demand for convenient and healthy organic snacks.

Maize Market Segment Analysis:

Maize Market Segmented on the basis of type, application, and end-users.

By Type, Field Maize Segment Is Expected to Dominate the Market During the Forecast Period

There are four segments by type sweet, popcorn, field, and flour. Among these, the field maize segment is expected to dominate the market during the forecast period.

- Field maize is also known as dent maize or feed maize primarily used for animal feed and industrial purposes. It is a widely grown and commonly traded type of maize globally. The versatility of field maize makes it an essential crop, contributing to its higher production volume. It is also used as a raw material for the production of ethanol and other biofuels.

- The growth of the global population and an increase in demand for animal protein which overall results in a rise in demand for field maize. It can be grown in a variety of climatic conditions and soil types leading to increased production and making it profitable for farmers. It is a cost-effective crop to produce, with relatively low input costs. In some countries, the Government provides support and subsidies to farmers growing field maize to promote food security and economic development. his stability in demand makes it an attractive crop to grow, reducing the risk of fluctuations in prices.

By End-user, the Feed Segment Held the Largest Share In 2023

By end-user, there are four industries, food and beverage industry, animal feed industry, ethanol production industry, pharmaceutical and personal care industry. Among these, the feed segment held the largest share in 2023.

- The livestock industry is a major consumer of maize for animal feed. Maize is a rich source of energy, carbohydrates, vitamins, and other nutrients, making it an ideal feed option for livestock. The increasing demand for animal protein and products fuels the demand for animal feed. It offers a balanced and nutritious feed option for animals.

- The global cultivation of maize ensures a steady supply and availability of maize in the market. Its high energy content and amino acid profile make it a cost-efficient choice. Animals can efficiently convert maize-based feed into weight gain. Also, the consistent availability of maize makes it a primary ingredient in feed. The animals are more likely to eat an adequate amount of feed when maize is included in their diet which enhances animal feed intake. versatility makes maize a staple ingredient in many types of animal feed, catering to the diverse needs of different livestock sectors such as sheep, and cattle.

Maize Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is one of the largest producers of maize in the world. The region's high production capacity ensures a steady supply of maize. The climatic conditions, agricultural conditions, and advanced technologies overall contribute to the high production and cultivation of maize. Maize is a primary ingredient in animal feed formulations and there is a large demand for maize as a feed. The region has a well-established biofuel industry that demands maize as it is a key ingredient in this industry.

- The governments in North America provide support and incentives to farmers for maize production through subsidies, grants, and price support programs. This ensures a stable and profitable market for maize growers. It serves as a major exporter of maize to other regions, including Asia, Europe, and South America.

Maize Market Active Players

- Archer Daniels Midland Company (USA)

- Cargill, Incorporated (USA)

- Land O'Lakes, Inc. (USA)

- Monsanto Company (USA)

- Nufarm Limited (Australia)

- Pioneer Hi-Bred International, Inc. (USA)

- Rallis India Limited (India)

- S&W Seed Company (USA)

- Sinochem Group Co., Ltd. (China)

- Sumitomo Chemical Co., Ltd. (Japan)

- Syngenta AG (Switzerland)

- Terrena Cooperative (France)

- The Tata Chemicals Ltd. (India)

- China Foods Limited (China)

- Kaveri Seeds (India)

- Agrocorp International Pte Ltd. (Singapore)

- GoodMills Group (Austria)

- Corteva Agriscience (US)

- Louis Dreyfus Company B.V. (Netherlands)

- Agromeris LLC (USA)

- Bayer AG (Germany)

- Grain Millers, Inc. (USA)

- Kakira Sugar Works Limited (Uganda)

- DowDuPont Inc. (USA)

- China National Cereals, Oils and Foodstuffs Corporation (COFCO) (China) and Other Active Players.

Key Industry Developments in the Maize Market:

- In July 2023, Bayer Crop Science launched the herbicide-tolerant biotech corn Dekalb DK95R in Indonesia. This helps to boost overall yield by 30 %.

- In 2023, Corteva Agriscience launched 44 new exclusive corn products and 36 new soybean varieties. Vorceed Enlist corn technology is designed to enable more flexibility for farmers to manage their corn rootworm acres and provides the added benefit of controlling late-season emerged broadleaf weed pressures.

|

Global Maize Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2022: |

USD 143.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.02 % |

Market Size in 2032: |

USD 204.77 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-user |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- MAIZE MARKET BY TYPE (2017-2030)

- MAIZE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SWEET MAIZE

- Introduction and Market Overview

- Historic And Forecasted Market Size in Value (2017-2030F)

- Historic And Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POPCORN MAIZE

- FIELD MAIZE

- FLOUR MAIZE

- MAIZE MARKET BY APPLICATION (2017-2030)

- MAIZE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD AND BEVERAGE

- Introduction and Market Overview

- Historic And Forecasted Market Size in Value (2017-2030F)

- Historic And Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ANIMAL FEED

- ETHANOL PRODUCTION

- PERSONAL CARE

- MAIZE MARKET BY END-USER (2017-2030)

- MAIZE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD AND BEVERAGE INDUSTRY

- Introduction and Market Overview

- Historic And Forecasted Market Size in Value (2017-2030F)

- Historic And Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ANIMAL FEED INDUSTRY

- ETHANOL PRODUCTION INDUSTRY

- PHARMACEUTICAL AND PERSONAL CARE INDUSTRY

- MAIZE MARKET BY DISTRIBUTION CHANNEL (2017-2030)

- MAIZE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RETAIL STORES

- Introduction and Market Overview

- Historic And Forecasted Market Size in Value (2017-2030F)

- Historic And Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SUPERMARKETS

- WHOLESALE DISTRIBUTORS

- ONLINE STORES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- MAIZE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- COMPETITIVE LANDSCAPE

- ARCHER DANIELS MIDLAND COMPANY (USA)

-

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CARGILL, INCORPORATED (USA)

- LAND O'LAKES, INC. (USA)

- MONSANTO COMPANY (USA)

- NUFARM LIMITED (AUSTRALIA)

- PIONEER HI-BRED INTERNATIONAL, INC. (USA)

- RALLIS INDIA LIMITED (INDIA)

- S&W SEED COMPANY (USA)

- SINOCHEM GROUP CO., LTD. (CHINA)

- SUMITOMO CHEMICAL CO., LTD. (JAPAN)

- SYNGENTA AG (SWITZERLAND)

- TERRENA COOPERATIVE (FRANCE)

- THE TATA CHEMICALS LTD. (INDIA)

- CHINA FOODS LIMITED (CHINA)

- SINOCHEM GROUP CO., LTD. (CHINA)

- KAVERI SEEDS (INDIA)

- AGROCORP INTERNATIONAL PTE LTD. (SINGAPORE)

- GOODMILLS GROUP (AUSTRIA)

- CORTEVA AGRISCIENCE (US)

- LOUIS DREYFUS COMPANY B.V. (NETHERLAND)

- AGROMERIS LLC (USA)

- BAYER AG (GERMANY)

- GRAIN MILLERS, INC. (USA)

- KAKIRA SUGAR WORKS LIMITED (UGANDA)

- DOWDUPONT INC. (USA)

- CHINA NATIONAL CEREALS, OILS AND FOODSTUFFS CORPORATION (COFCO) (CHINA)

-

- GLOBAL MAIZE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-user

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Maize Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2022: |

USD 143.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.02 % |

Market Size in 2032: |

USD 204.77 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-user |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Maize Market research report is 2024-2032.

Archer Daniels Midland Company (USA), Cargill, Incorporated (USA), Land O'Lakes, Inc. (USA), Monsanto Company (USA), Nufarm Limited (Australia), and Other Active Players.

The Maize Market is segmented into Type, Application, End-user, Distribution Channel, and region. By Type, the market is categorized into Sweet, Popcorn, Field, and Flour. By Application, the market is categorized into Food and Beverage, Animal Feed, Ethanol Production, and Personal Care. By End-user, the market is categorized into Food and Beverage Industry, Animal Feed Industry, Ethanol Production Industry, and Pharmaceutical and Personal Care Industry. By Distribution Chanel, the market is categorized into Retail Stores, Supermarkets, Wholesale Distributors, Online Stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Maize is an important cereal crop which is widely used for food, feed, and industrial products. It is rich in carbohydrates, vitamins, and minerals. It is also used to produce ethanol, a biofuel used as a substitute for gasoline. Maize comes in various varieties and each variety has its unique characteristics and uses.

Maize Market Size Was Valued at USD 143.62 Billion in 2023 and is Projected to Reach USD 204.77 Billion by 2032, Growing at a CAGR of 4.02% From 2024-2032.