Global Machine Vision Market Overview

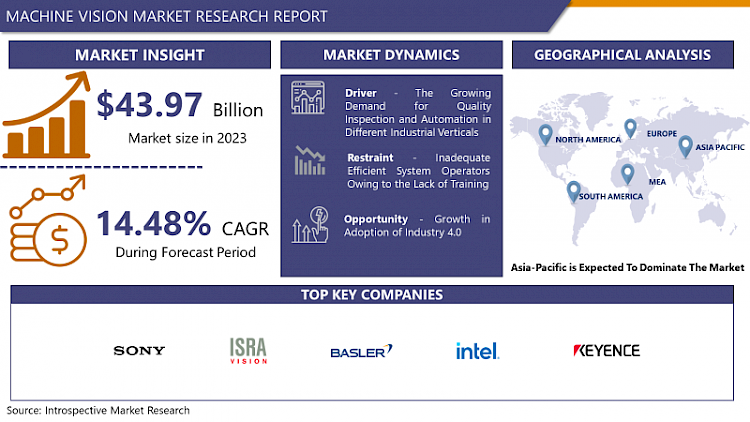

The Global Machine Vision Market size is expected to grow from USD 43.97 billion in 2023 to USD 148.5 billion by 2032, at a CAGR of 14.48% during the forecast period (2024-2032).

Machine vision is referred to as vision system or industrial vision, is a technology used for monitoring all types of machinery processes. It usually consists of different cameras which are installed over the machines depending upon the need so that the entire process can undergo proper vigilance. These cameras are fixed to perform the task of capturing and interpreting along with providing a signal as per the requirements. In addition, machine vision technology works by the precise coordination of software, hardware, and services. Machine vision is currently offering numerous benefits to organizations such as improving quality, rising productivity, decreasing floor space, declining production costs, increasing production flexibility, lowering capital equipment costs, and others. Moreover, as per the Automated Imaging Association (AIA), machine vision bounded all industrial and non-industrial applications in which a combination of hardware and software provide operational guidance to devices in the implementation of their functions based on the capture and processing of images.

Though industrial computer vision uses several of the same algorithms and approaches as academic/educational and governmental/military applications of computer vision, constraints are different. Furthermore, a machine vision system for part identification and identification reads barcodes (1-D), data matrix codes (2-D), direct part marks (DPM), and characters printed on parts, labels, and packages. An optical character recognition (OCR) system reads alphanumeric characters without earlier knowledge, whereas an optical character verification (OCV) system authenticates the presence of a character string. Additionally, machine vision systems can determine parts by locating a unique pattern or identifying items based on shape, or size color. An increase in demand for industrial applications and growth in demand for vision-guided robotics systems are the key factors that enhance the global machine vision system market growth during the forecast period.

Market Dynamics And Factors For The Machine Vision Market

Drivers:

The growing demand for quality inspection and automation in different industrial verticals is probably to turn the market for machine vision. In addition, the requirement for vision-guided robotic systems over the automotive, food and beverage, pharmaceutical and chemical, and packaging segments is anticipated to accelerate the machine vision market growth. The surge in demand for application-oriented machine vision (MV) systems is also anticipated to improve the adoption of the technology over the forecast period. MV systems involve the ability of a computer to observe, inspect, and scrutinize the work performance by utilizing one or more video cameras, digital signal processing, and analog to digital conversion. The captured data is then transferred to the computer to analyze and offer the desired output. Resolution and sensitivity are two important aspects of any MV system. Resolution is responsible for differentiating between objects whereas sensitivity is the machine's ability to detect objects or weak impulses despite dim lights or invisible wavelengths. The intensifying requirement for superior inspection and rising automation are the major impacting factors paving the way for the notable adoption of machine vision technology. Moreover, the need for increased quality control among consumers and manufacturers, coupled with the government regulations to abide by the prescribed specifications, is anticipated to propel the adoption of machine vision technology. The technology is reaching significant traction over food and packaging, automotive, pharmaceutical, and other industrial verticals due to abilities such as advanced detection of objects, improved analysis, monitoring tolerance, and accurate component measuring. All these factors are anticipated to boost the machine vision market growth over the forecast period.

Restraints:

Inadequate efficient system operators owing to the lack of training is probably to occlude the smooth growth of the machine vision market. Furthermore, aiding the risk of cyber-attacks on industrial machine robots and devices. Usernames and passwords unchanged from the factory defaults can also work as threats or glitches in the software, which can be identified through reverse engineering. The rising reliance on connectivity and IoT devices such as AI implanted devices increases vulnerability to cyberattacks.

Opportunities:

An increase in demand for AI and growth in adoption of industry 4.0 is anticipated to create lucrative machine vision system market opportunities globally in the upcoming years.

Market Segmentation

Segmentation Analysis of Machine Vision Market:

Based on the Offering, the hardware segment is anticipated to dominate the machine vision market over the forecast period. Hardware components comprise many objects such as cameras, optics/lenses, LED lightings, frame grabbers, and processors. Cameras captured the maximum share in 2020, which is attributed to the rising demand for CMOS imaging sensors. This, in turn, is expected to result in the growth of the hardware sub-segment.

Based on the Product, PC based segment is expected to capture maximum machine vision market share over the forecast period. PC-based systems dominate the market as PC-based machine vision systems have higher processing power than smart camera-based systems and can handle complex operations relatively quickly. Also, unlike smart camera-based systems, PC-based machine vision systems are highly scalable, and one can swap the components easily.

Based on the Application, the market has been classified into quality assurance and inspection, positioning and guidance, measurement, and identification. The systems are highly utilized for scanning and identifying labels, texts, and barcodes, especially in the packaging sector. This automates packaging activities, thereby saving time, avoiding human errors, and rising efficiency. The technology is frequently used in the consumer goods, pharmaceutical, and packaging sectors. The adoption of technology in these sectors has resulted in reduced counterfeit products to a large extent, eventually driving the overall machine vision market.

Based on the End-Use Industry, the automotive segment is expected to register the largest machine vision market share during the forecast period. The automotive industry is the higher adopter of machine vision systems globally and is expected to expand at a steady growth rate over the forecast period. Machine vision in the automotive industry is highly used for inspection purposes, which include presence-absence checking, error proofing, assembly verification, and final inspection.

Regional Analysis of Machine Vision Market:

The Asia Pacific region is expected to observe considerable growth over the forecasted period. This can be approved to the lucrative opportunities in pharmaceutical, automotive, packaging, and other industrial applications in the Asia Pacific region. Economies such as China, Japan, and South Korea are anticipated to be the major contributors to the market in APAC. Increased manufacturing operations contribute mainly to the economic development in China, while the growing demand to incorporate Industry 4.0 and developed production techniques for rising automation across different applications in India is contributing to the extreme growth of machine vision in APAC. Additionally, vigorous competition among consumer electronics companies in APAC is probably to improve the adoption of machine vision systems in the region.

Players Covered in Machine Vision market are :

- Cognex Corporation (US)

- Basler AG (Germany)

- Omron Corporation (Japan)

- National Instrument Corporation (US)

- Keyence Corporation (Japan)

- Teledyne Technologies (US)

- Sick AG (Germany)

- TKH Group (Netherlands)

- Sony Corporation (Japan)

- Texas Instruments Incorporated (US)

- Intel Corporation (US)

- Atlas Copco (Sweden)

- Microsoft (US)

Key Industry Developments In The Machine Vision Market

- In November 2023, Oxford Metrics acquired Industrial Vision Systems Ltd. (IVS), a developer of machine vision software and systems, for $9.9 million. IVS's noncontact vision systems, powered by AI deep learning, are used for automated production processes for high-precision quality control, inspection, guidance, identification, measurement, tracking, and counting. This acquisition will expand Oxford Metrics' smart sensing capabilities into the manufacturing industry.

- In October 2023, Smart Vision Lights launched the JWL150-DO Lightgistics Series light with Hidden Strobe technology, which delivers strobe-like lighting without the disorientation caused by traditional LED strobe lights. This technology helps high-speed machine vision systems capture clear images without affecting workers. Additionally, Lightgistics lights feature Dual OverDriveTM technology for accurate barcode reading and OCR in challenging applications.

|

Global Machine Vision Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 43.97 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.48% |

Market Size in 2032: |

USD 148.5 Bn. |

|

Segments Covered: |

By Offering |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Offering

3.2 By Product

3.3 By Application

3.4 By End-Use Industry

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Machine Vision Market by Offering

5.1 Machine Vision Market Overview Snapshot and Growth Engine

5.2 Machine Vision Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017 - 2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hardware: Grographic Segmentation

5.4 Software

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017 - 2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Software: Grographic Segmentation

5.5 Services

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017 - 2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Services: Grographic Segmentation

Chapter 6: Machine Vision Market by Product

6.1 Machine Vision Market Overview Snapshot and Growth Engine

6.2 Machine Vision Market Overview

6.3 PC Based

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017 - 2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 PC Based: Grographic Segmentation

6.4 Smart Camera Based

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017 - 2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Smart Camera Based: Grographic Segmentation

Chapter 7: Machine Vision Market by Application

7.1 Machine Vision Market Overview Snapshot and Growth Engine

7.2 Machine Vision Market Overview

7.3 Positioning & Guidance

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017 - 2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Positioning & Guidance: Grographic Segmentation

7.4 Predictive Maintenance

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017 - 2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Predictive Maintenance: Grographic Segmentation

7.5 Quality Assurance & Inspection

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017 - 2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Quality Assurance & Inspection: Grographic Segmentation

7.6 Measurement

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2017 - 2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Measurement: Grographic Segmentation

7.7 Identification

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2017 - 2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Identification: Grographic Segmentation

Chapter 8: Machine Vision Market by End-Use Industry

8.1 Machine Vision Market Overview Snapshot and Growth Engine

8.2 Machine Vision Market Overview

8.3 Automotive

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2017 - 2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Automotive: Grographic Segmentation

8.4 Food & Beverage

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2017 - 2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Food & Beverage: Grographic Segmentation

8.5 Packaging & Bottling

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2017 - 2032F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Packaging & Bottling: Grographic Segmentation

8.6 Pharmaceuticals & Chemicals

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2017 - 2032F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Pharmaceuticals & Chemicals: Grographic Segmentation

8.7 Others

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size (2017 - 2032F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Others: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Machine Vision Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Machine Vision Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Machine Vision Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 SONY CORPORATION

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 ISRA VISION

9.4 BASLER AG

9.5 INTEL CORPORATION

9.6 OMRON CORPORATION

9.7 KEYENCE

9.8 NATIONAL INSTRUMENTS

9.9 TELEDYNE TECHNOLOGIES

9.10 COGNEX CORPORATION

9.11 TEXAS INSTRUMENTS

9.12 SICK AG

9.13 FLIR SYSTEMS

9.14 OTHER MAJOR PLAYERS

Chapter 10: Global Machine Vision Market Analysis, Insights and Forecast, 2017 - 2032

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Offering

10.2.1 Hardware

10.2.2 Software

10.2.3 Services

10.3 Historic and Forecasted Market Size By Product

10.3.1 PC Based

10.3.2 Smart Camera Based

10.4 Historic and Forecasted Market Size By Application

10.4.1 Positioning & Guidance

10.4.2 Predictive Maintenance

10.4.3 Quality Assurance & Inspection

10.4.4 Measurement

10.4.5 Identification

10.5 Historic and Forecasted Market Size By End-Use Industry

10.5.1 Automotive

10.5.2 Food & Beverage

10.5.3 Packaging & Bottling

10.5.4 Pharmaceuticals & Chemicals

10.5.5 Others

Chapter 11: North America Machine Vision Market Analysis, Insights and Forecast, 2017 - 2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Offering

11.4.1 Hardware

11.4.2 Software

11.4.3 Services

11.5 Historic and Forecasted Market Size By Product

11.5.1 PC Based

11.5.2 Smart Camera Based

11.6 Historic and Forecasted Market Size By Application

11.6.1 Positioning & Guidance

11.6.2 Predictive Maintenance

11.6.3 Quality Assurance & Inspection

11.6.4 Measurement

11.6.5 Identification

11.7 Historic and Forecasted Market Size By End-Use Industry

11.7.1 Automotive

11.7.2 Food & Beverage

11.7.3 Packaging & Bottling

11.7.4 Pharmaceuticals & Chemicals

11.7.5 Others

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Machine Vision Market Analysis, Insights and Forecast, 2017 - 2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Offering

12.4.1 Hardware

12.4.2 Software

12.4.3 Services

12.5 Historic and Forecasted Market Size By Product

12.5.1 PC Based

12.5.2 Smart Camera Based

12.6 Historic and Forecasted Market Size By Application

12.6.1 Positioning & Guidance

12.6.2 Predictive Maintenance

12.6.3 Quality Assurance & Inspection

12.6.4 Measurement

12.6.5 Identification

12.7 Historic and Forecasted Market Size By End-Use Industry

12.7.1 Automotive

12.7.2 Food & Beverage

12.7.3 Packaging & Bottling

12.7.4 Pharmaceuticals & Chemicals

12.7.5 Others

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Machine Vision Market Analysis, Insights and Forecast, 2017 - 2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Offering

13.4.1 Hardware

13.4.2 Software

13.4.3 Services

13.5 Historic and Forecasted Market Size By Product

13.5.1 PC Based

13.5.2 Smart Camera Based

13.6 Historic and Forecasted Market Size By Application

13.6.1 Positioning & Guidance

13.6.2 Predictive Maintenance

13.6.3 Quality Assurance & Inspection

13.6.4 Measurement

13.6.5 Identification

13.7 Historic and Forecasted Market Size By End-Use Industry

13.7.1 Automotive

13.7.2 Food & Beverage

13.7.3 Packaging & Bottling

13.7.4 Pharmaceuticals & Chemicals

13.7.5 Others

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Machine Vision Market Analysis, Insights and Forecast, 2017 - 2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Offering

14.4.1 Hardware

14.4.2 Software

14.4.3 Services

14.5 Historic and Forecasted Market Size By Product

14.5.1 PC Based

14.5.2 Smart Camera Based

14.6 Historic and Forecasted Market Size By Application

14.6.1 Positioning & Guidance

14.6.2 Predictive Maintenance

14.6.3 Quality Assurance & Inspection

14.6.4 Measurement

14.6.5 Identification

14.7 Historic and Forecasted Market Size By End-Use Industry

14.7.1 Automotive

14.7.2 Food & Beverage

14.7.3 Packaging & Bottling

14.7.4 Pharmaceuticals & Chemicals

14.7.5 Others

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Machine Vision Market Analysis, Insights and Forecast, 2017 - 2032

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Offering

15.4.1 Hardware

15.4.2 Software

15.4.3 Services

15.5 Historic and Forecasted Market Size By Product

15.5.1 PC Based

15.5.2 Smart Camera Based

15.6 Historic and Forecasted Market Size By Application

15.6.1 Positioning & Guidance

15.6.2 Predictive Maintenance

15.6.3 Quality Assurance & Inspection

15.6.4 Measurement

15.6.5 Identification

15.7 Historic and Forecasted Market Size By End-Use Industry

15.7.1 Automotive

15.7.2 Food & Beverage

15.7.3 Packaging & Bottling

15.7.4 Pharmaceuticals & Chemicals

15.7.5 Others

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Machine Vision Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 43.97 Bn. |

|

Forecast Period 2024-32 CAGR: |

14.48% |

Market Size in 2032: |

USD 148.5 Bn. |

|

Segments Covered: |

By Offering |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. MACHINE VISION MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. MACHINE VISION MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. MACHINE VISION MARKET COMPETITIVE RIVALRY

TABLE 005. MACHINE VISION MARKET THREAT OF NEW ENTRANTS

TABLE 006. MACHINE VISION MARKET THREAT OF SUBSTITUTES

TABLE 007. MACHINE VISION MARKET BY OFFERING

TABLE 008. HARDWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 010. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 011. MACHINE VISION MARKET BY PRODUCT

TABLE 012. PC BASED MARKET OVERVIEW (2016-2028)

TABLE 013. SMART CAMERA BASED MARKET OVERVIEW (2016-2028)

TABLE 014. MACHINE VISION MARKET BY APPLICATION

TABLE 015. POSITIONING & GUIDANCE MARKET OVERVIEW (2016-2028)

TABLE 016. PREDICTIVE MAINTENANCE MARKET OVERVIEW (2016-2028)

TABLE 017. QUALITY ASSURANCE & INSPECTION MARKET OVERVIEW (2016-2028)

TABLE 018. MEASUREMENT MARKET OVERVIEW (2016-2028)

TABLE 019. IDENTIFICATION MARKET OVERVIEW (2016-2028)

TABLE 020. MACHINE VISION MARKET BY END-USE INDUSTRY

TABLE 021. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

TABLE 022. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

TABLE 023. PACKAGING & BOTTLING MARKET OVERVIEW (2016-2028)

TABLE 024. PHARMACEUTICALS & CHEMICALS MARKET OVERVIEW (2016-2028)

TABLE 025. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 026. NORTH AMERICA MACHINE VISION MARKET, BY OFFERING (2016-2028)

TABLE 027. NORTH AMERICA MACHINE VISION MARKET, BY PRODUCT (2016-2028)

TABLE 028. NORTH AMERICA MACHINE VISION MARKET, BY APPLICATION (2016-2028)

TABLE 029. NORTH AMERICA MACHINE VISION MARKET, BY END-USE INDUSTRY (2016-2028)

TABLE 030. N MACHINE VISION MARKET, BY COUNTRY (2016-2028)

TABLE 031. EUROPE MACHINE VISION MARKET, BY OFFERING (2016-2028)

TABLE 032. EUROPE MACHINE VISION MARKET, BY PRODUCT (2016-2028)

TABLE 033. EUROPE MACHINE VISION MARKET, BY APPLICATION (2016-2028)

TABLE 034. EUROPE MACHINE VISION MARKET, BY END-USE INDUSTRY (2016-2028)

TABLE 035. MACHINE VISION MARKET, BY COUNTRY (2016-2028)

TABLE 036. ASIA PACIFIC MACHINE VISION MARKET, BY OFFERING (2016-2028)

TABLE 037. ASIA PACIFIC MACHINE VISION MARKET, BY PRODUCT (2016-2028)

TABLE 038. ASIA PACIFIC MACHINE VISION MARKET, BY APPLICATION (2016-2028)

TABLE 039. ASIA PACIFIC MACHINE VISION MARKET, BY END-USE INDUSTRY (2016-2028)

TABLE 040. MACHINE VISION MARKET, BY COUNTRY (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA MACHINE VISION MARKET, BY OFFERING (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA MACHINE VISION MARKET, BY PRODUCT (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA MACHINE VISION MARKET, BY APPLICATION (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA MACHINE VISION MARKET, BY END-USE INDUSTRY (2016-2028)

TABLE 045. MACHINE VISION MARKET, BY COUNTRY (2016-2028)

TABLE 046. SOUTH AMERICA MACHINE VISION MARKET, BY OFFERING (2016-2028)

TABLE 047. SOUTH AMERICA MACHINE VISION MARKET, BY PRODUCT (2016-2028)

TABLE 048. SOUTH AMERICA MACHINE VISION MARKET, BY APPLICATION (2016-2028)

TABLE 049. SOUTH AMERICA MACHINE VISION MARKET, BY END-USE INDUSTRY (2016-2028)

TABLE 050. MACHINE VISION MARKET, BY COUNTRY (2016-2028)

TABLE 051. SONY CORPORATION: SNAPSHOT

TABLE 052. SONY CORPORATION: BUSINESS PERFORMANCE

TABLE 053. SONY CORPORATION: PRODUCT PORTFOLIO

TABLE 054. SONY CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. ISRA VISION: SNAPSHOT

TABLE 055. ISRA VISION: BUSINESS PERFORMANCE

TABLE 056. ISRA VISION: PRODUCT PORTFOLIO

TABLE 057. ISRA VISION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. BASLER AG: SNAPSHOT

TABLE 058. BASLER AG: BUSINESS PERFORMANCE

TABLE 059. BASLER AG: PRODUCT PORTFOLIO

TABLE 060. BASLER AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. INTEL CORPORATION: SNAPSHOT

TABLE 061. INTEL CORPORATION: BUSINESS PERFORMANCE

TABLE 062. INTEL CORPORATION: PRODUCT PORTFOLIO

TABLE 063. INTEL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. OMRON CORPORATION: SNAPSHOT

TABLE 064. OMRON CORPORATION: BUSINESS PERFORMANCE

TABLE 065. OMRON CORPORATION: PRODUCT PORTFOLIO

TABLE 066. OMRON CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. KEYENCE: SNAPSHOT

TABLE 067. KEYENCE: BUSINESS PERFORMANCE

TABLE 068. KEYENCE: PRODUCT PORTFOLIO

TABLE 069. KEYENCE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. NATIONAL INSTRUMENTS: SNAPSHOT

TABLE 070. NATIONAL INSTRUMENTS: BUSINESS PERFORMANCE

TABLE 071. NATIONAL INSTRUMENTS: PRODUCT PORTFOLIO

TABLE 072. NATIONAL INSTRUMENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. TELEDYNE TECHNOLOGIES: SNAPSHOT

TABLE 073. TELEDYNE TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 074. TELEDYNE TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 075. TELEDYNE TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. COGNEX CORPORATION: SNAPSHOT

TABLE 076. COGNEX CORPORATION: BUSINESS PERFORMANCE

TABLE 077. COGNEX CORPORATION: PRODUCT PORTFOLIO

TABLE 078. COGNEX CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. TEXAS INSTRUMENTS: SNAPSHOT

TABLE 079. TEXAS INSTRUMENTS: BUSINESS PERFORMANCE

TABLE 080. TEXAS INSTRUMENTS: PRODUCT PORTFOLIO

TABLE 081. TEXAS INSTRUMENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. SICK AG: SNAPSHOT

TABLE 082. SICK AG: BUSINESS PERFORMANCE

TABLE 083. SICK AG: PRODUCT PORTFOLIO

TABLE 084. SICK AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. FLIR SYSTEMS: SNAPSHOT

TABLE 085. FLIR SYSTEMS: BUSINESS PERFORMANCE

TABLE 086. FLIR SYSTEMS: PRODUCT PORTFOLIO

TABLE 087. FLIR SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 088. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 089. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 090. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. MACHINE VISION MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. MACHINE VISION MARKET OVERVIEW BY OFFERING

FIGURE 012. HARDWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 014. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 015. MACHINE VISION MARKET OVERVIEW BY PRODUCT

FIGURE 016. PC BASED MARKET OVERVIEW (2016-2028)

FIGURE 017. SMART CAMERA BASED MARKET OVERVIEW (2016-2028)

FIGURE 018. MACHINE VISION MARKET OVERVIEW BY APPLICATION

FIGURE 019. POSITIONING & GUIDANCE MARKET OVERVIEW (2016-2028)

FIGURE 020. PREDICTIVE MAINTENANCE MARKET OVERVIEW (2016-2028)

FIGURE 021. QUALITY ASSURANCE & INSPECTION MARKET OVERVIEW (2016-2028)

FIGURE 022. MEASUREMENT MARKET OVERVIEW (2016-2028)

FIGURE 023. IDENTIFICATION MARKET OVERVIEW (2016-2028)

FIGURE 024. MACHINE VISION MARKET OVERVIEW BY END-USE INDUSTRY

FIGURE 025. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

FIGURE 026. FOOD & BEVERAGE MARKET OVERVIEW (2016-2028)

FIGURE 027. PACKAGING & BOTTLING MARKET OVERVIEW (2016-2028)

FIGURE 028. PHARMACEUTICALS & CHEMICALS MARKET OVERVIEW (2016-2028)

FIGURE 029. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 030. NORTH AMERICA MACHINE VISION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. EUROPE MACHINE VISION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. ASIA PACIFIC MACHINE VISION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. MIDDLE EAST & AFRICA MACHINE VISION MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. SOUTH AMERICA MACHINE VISION MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Machine Vision Market research report is 2024-2032.

Sony Corporation (Japan), ISRA Vision (Germany), Basler AG (Germany), Intel Corporation (US), Omron Corporation (Japan), Keyence (Japan), National Instruments (US), Teledyne Technologies (US), Cognex Corporation (US), Texas Instruments (US), Sick AG (Germany), FLIR Systems (US), and other major players.

The Machine Vision Market is segmented into offering, product, application, end-use industry, and region. By Offering, the market is categorized into Hardware, Software, and Services. By Product, the market is categorized into PC Based and Smart Camera Based. By Application, the market is categorized into Positioning & Guidance, Predictive Maintenance, Quality Assurance & Inspection, Measurement, and Identification. By End-Use Industry, the market is categorized into Automotive, Food & Beverage, Packaging & Bottling, Pharmaceuticals & Chemicals, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Machine vision is referred to as vision system or industrial vision, is a technology used for monitoring all types of machinery processes. It usually consists of different cameras which are installed over the machines depending upon the need so that the entire process can undergo proper vigilance

The Global Machine Vision Market size is expected to grow from USD 43.97 billion in 2023 to USD 148.5 billion by 2032, at a CAGR of 14.48% during the forecast period (2024-2032).