Laser Processing Market Synopsis

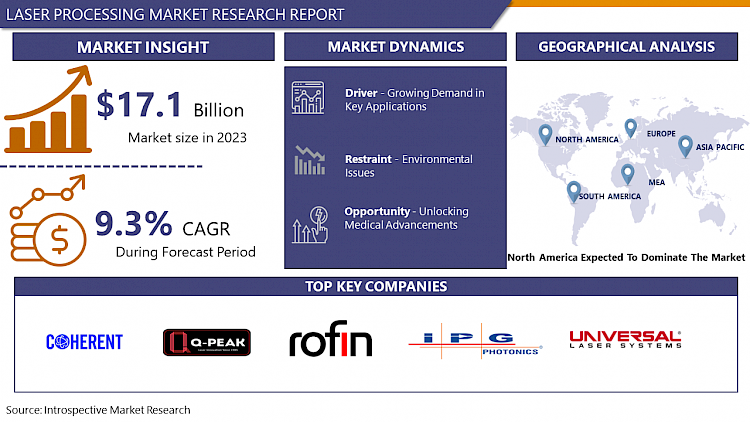

Laser Processing Market Size Was Valued at USD 17.1 Billion in 2023, and is Projected to Reach USD 31.87 Billion by 2030, Growing at a CAGR of 9.3 % From 2024-2030.

Laser processing is a versatile technique that utilizes a focused beam of light (laser) to manipulate materials. This concentrated light source packs a powerful punch, allowing for precise control over various processes. The core principle revolves around the interaction between the laser beam and the material, resulting in localized heating, melting, vaporization, or other effects depending on the power and interaction time. This enables controlled modification of the material's shape, properties, or markings.

- Across industries, laser processing finds numerous applications. In machining, it excels in cutting, drilling, and milling various materials with high precision and minimal heat distortion. It proves invaluable in welding, facilitating the joining of similar or dissimilar metals with strong, clean welds.

- Surface modification processes such as hardening, cladding, and cleaning are also achievable with laser processing, altering the properties of a material's surface. Furthermore, it is widely used for marking and engraving, creating permanent markings, logos, or other features on a material.

- Numerous advantages make laser processing an attractive choice for manufacturers. Its precision is unparalleled, thanks to the highly focused beam that enables precise cuts, welds, and modifications.

- It offers flexibility, as a wide range of materials can be processed with minimal adjustments. Additionally, the cleanliness of laser processing is noteworthy, with minimal heat input reducing distortion and environmental impact compared to traditional methods. Lastly, automation is seamless with laser systems, facilitating easy integration into high-volume production setups.

Laser Processing Market Trend Analysis

Growing Demand in Key Applications

- The market is expanding due to a increasing need for laser processing in key industries. Lasers are crucial in the automotive industry for cutting and welding car parts, especially those crafted from lightweight and high-strength materials. Maintaining quality and integrity of automotive components requires the essential precision and efficiency of laser processing to meet industry standards for safety and performance.

- In the same way, lasers are used by the aerospace sector for precise machining of complicated parts found in airplanes and spacecrafts. Laser processing allows manufacturers to meet the exact specifications needed for aerospace tasks, whether it's shaping turbine blades or creating detailed structural elements. This skill is crucial in guaranteeing the dependability and efficiency of aerospace systems in challenging conditions.

- In the field of electronics, lasers are essential for activities like accurate drilling, shaping, and soldering of small electronic parts. With the ongoing miniaturization and enhanced sophistication of electronic devices, there is a rising need for laser processing technologies. Manufacturers rely on lasers to achieve the precise microscopic level needed to create high-performance electronic devices with complex circuitry and small dimensions.

- Furthermore, laser processing is of great advantage in the medical device industry, as it is utilized for precise cutting and joining of stents, implants, and other medical tools. The precision in handling materials on a small scale is crucial for using lasers in manufacturing medical devices that demand high precision and reliability. With the increasing need for cutting-edge medical treatments and devices, the healthcare industry is also seeing a growing need for laser processing solutions.

Unlocking Medical Advancements

- Medical technology advancements are leading the healthcare industry towards less invasive procedures and microfluidic devices, with laser processing leading the way in these innovations. In this field, lasers play a crucial role in creating small fluid pathways in medical equipment and assisting in accurately cutting fragile tissues in minimally invasive procedures. Laser technology's precision in manipulating materials at a small scale is essential for modern medical procedures that prioritize accuracy and minimally invasive approaches.

- The increasing need for advanced medical technologies creates great potential for the expanded use of laser processing in the medical industry. The importance of accurate and less invasive tools is becoming more evident as healthcare providers and device manufacturers aim to improve patient outcomes and decrease recovery times. Laser processing provides a solution that is in line with these objectives, enabling the creation of medical devices and procedures that are extremely efficient and minimally intrusive to patients' daily routines.

- The flexibility of laser processing technology allows it to be utilized in various medical fields, such as cardiovascular and neurosurgery, as well as ophthalmology and dermatology. Laser technology offers unparalleled precision and control, which leads to advancements in medical technology and enhances patient care, such as creating complex microstructures for drug delivery systems or precisely shaping tissue during laser surgery.

- The combination of advancements in medical technology and the capabilities of laser processing offers significant opportunities for market expansion. As the medical sector's evolving requirements increase, there is a growing demand for innovative laser processing solutions to meet the needs of minimally invasive procedures and microfluidic devices. By utilizing the distinct features of lasers, manufacturers and healthcare providers can discover fresh opportunities to enhance patient results and advance medical science and technology.

Laser Processing Market Segment Analysis:

Laser Processing Market Segmented based on type, laser type, application, and end-users.

By Type, gas lasers currently hold the largest market share in laser processing, estimated to be around 28.15% as of 2023.

- Gas laser technology, particularly CO2 lasers, has been around for decades. This maturity translates to established manufacturing processes, readily available expertise, and a well-developed service network. This translates into lower initial equipment costs compared to some newer technologies like fiber lasers.

- CO2 lasers excel at many core laser processing applications like cutting, welding, and material ablation. They offer a good balance of power, beam quality, and wavelength that suit these tasks efficiently. For many industrial applications, particularly those involving thicker materials, CO2 lasers provide a cost-effective and reliable solution.

- Gas lasers are known for their ability to deliver high-power continuous wave (CW) beams. This makes them ideal for applications requiring significant material removal, such as cutting thick metals or plastics. While fiber lasers are catching up in terms of power output, CO2 lasers still hold an edge for certain high-power applications.

By Application, the cutting segment dominates the global laser processing market, with a market share estimated to be around 33.3% as of 2022

- Laser cutting offers a precise and clean method for cutting a wide range of materials, including metals, plastics, wood, and even textiles. This versatility makes it a valuable tool across various industries like automotive, aerospace, electronics, and construction.

- Laser cutting allows for rapid material processing with minimal heat distortion compared to traditional cutting methods. This translates to high production rates and clean-cut edges, minimizing the need for secondary finishing processes.

- Laser cutting systems are highly amenable to automation, which is crucial for high-volume manufacturing environments. Robots or CNC machines can precisely control the laser beam, enabling automated cutting of complex shapes and designs.

- The automotive and aerospace industries heavily rely on laser cutting for processing sheet metal, creating lightweight and high-strength components for vehicles and aircraft. The electronics industry utilizes laser cutting for precisely shaping intricate electronic components. This widespread adoption across key industries fuels the dominance of the cutting segment.

Laser Processing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North American manufacturers often face higher labor costs compared to some regions. The ability of lasers to automate processes and reduce reliance on manual labor can be a significant advantage, driving market growth.

- The presence of a strong ecosystem for advanced manufacturing technologies in North America creates a favorable environment for laser processing adoption. This includes readily available skilled personnel for operating and maintaining laser systems, along with established supply chains for laser equipment and components.

- North American industries are actively embracing Industry 4.0 principles, which emphasize automation, data-driven decision making, and interconnectivity. Laser processing systems, with their inherent controllability and potential for integration with sensors and data analysis tools, are well-suited for Industry 4.0 environments, further driving market growth in the region.

Active Key Players in the Laser Processing Market

- Coherent Corp. (US)

- Q-Peak Inc. (US)

- ROFIN-SINAR Technologies Inc. (US)

- IPG Photonics Corporation (US)

- Universal Laser Systems, Inc. (US)

- Xenetech Global Inc. (US)

- Epilog Laser, Inc. (US)

- Newport Corporation (MKS Instruments, Inc.) (US)

- LaserStar Technologies Corporation (US)

- Eurolaser GmbH (Germany)

- TRUMPF (Germany)

- JENOPTIK AG (Germany)

- Altec GmbH (Germany)

- Jenoptik Laser GmbH (Germany)

- FOBA (Germany)

- The Needham Group (UK)

- Alpha Nov laser (France)

- SEI Laser (Italy)

- Bystronic Laser AG (Switzerland)

- Trotec Laser GmbH (Austria)

- Han’s Laser Technology Industry Group Co., Ltd (China)

- Amada Co., Ltd. (Japan)

- Mitsubishi Electric (Japan), and Other Active Players.

Key Industry Developments in the Laser Processing Market:

- In January 2024, the debut of Coherent's OBIS 640 XT, a red laser module boasting equivalent high output power, low noise, beam quality, and compact dimensions as its blue and green counterparts. Together, these modules form a comprehensive suite powering high-performance SRM systems.

- In January 2024, Novanta Inc. finalized its acquisition of Motion Solutions, heralding the potential for the development of innovative intelligent subsystems through the synergy of our combined technological offerings.

- In November 2023, the commencement of a collaboration between IPG Photonics and Miller Electronics Mfg. LLC, aimed at fostering innovation coupled with quality and reliability in the field of handheld welding. This partnership is poised to revolutionize welding tools, providing welders with efficient, precise, and powerful solutions tailored to the demands of contemporary welding applications. The outcome promises dependable solutions for welders' critical tasks.

|

Global Laser Processing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2030 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.1 Bn. |

|

Forecast Period 2024-30 CAGR: |

9.3% |

Market Size in 2030: |

USD 31.87 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Laser Type |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- LASER PROCESSING MARKET BY TYPE (2017-2030)

- LASER PROCESSING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GAS LASERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2030F)

- Historic And Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOLID STATE LASERS

- FIBER LASERS

- OTHERS

- LASER PROCESSING MARKET BY LASER TYPE (2017-2030)

- Laser Processing MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FIXED BEAM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2030F)

- Historic And Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MOVING BEAM

- HYBRID BEAM

- LASER PROCESSING MARKET BY APPLICATION (2017-2030)

- Laser Processing MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CUTTING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2030F)

- Historic And Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MAKING

- WELDING

- DRILLING

- ENGRAVING

- ADDITIVE MANUFACTURING

- OTHERS

- LASER PROCESSING MARKET BY END-USER (2017-2030)

- Laser Processing MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMOTIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2030F)

- Historic And Forecasted Market Size in Volume (2017-2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MANUFACTURING

- SEMICONDUCTOR & ELECTRONICS

- MEDICAL & LIFE SCIENCES

- PACKAGING

- OIL & GAS

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Laser Processing Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- COHERENT CORP. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- Q-PEAK INC. (US)

- ROFIN-SINAR TECHNOLOGIES INC. (US)

- IPG PHOTONICS CORPORATION (US)

- UNIVERSAL LASER SYSTEMS, INC. (US)

- XENETECH GLOBAL INC. (US)

- EPILOG LASER, INC. (US)

- NEWPORT CORPORATION (MKS INSTRUMENTS, INC.) (US)

- LASERSTAR TECHNOLOGIES CORPORATION (US)

- EUROLASER GMBH (GERMANY)

- TRUMPF (GERMANY)

- JENOPTIK AG (GERMANY)

- ALTEC GMBH (GERMANY)

- JENOPTIK LASER GMBH (GERMANY)

- FOBA (GERMANY)

- THE NEEDHAM GROUP (UK)

- ALPHA NOV LASER (FRANCE)

- SEI LASER (ITALY)

- BYSTRONIC LASER AG (SWITZERLAND)

- TROTEC LASER GMBH (AUSTRIA)

- HAN’S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD (CHINA)

- AMADA CO., LTD. (JAPAN)

- MITSUBISHI ELECTRIC (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL Laser Processing MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Laser Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Laser Processing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2030 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.1 Bn. |

|

Forecast Period 2024-30 CAGR: |

9.3% |

Market Size in 2030: |

USD 31.87 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Laser Type |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Laser Processing Market research report is 2024-2030.

Coherent Corp. (US), Q-Peak Inc. (US), ROFIN-SINAR Technologies Inc. (US), IPG Photonics Corporation (US), Universal Laser Systems, Inc. (US), Xenetech Global Inc. (US), Epilog Laser, Inc. (US), Newport Corporation (MKS Instruments, Inc.) (US), LaserStar Technologies Corporation (US), Eurolaser GmbH (Germany), TRUMPF (Germany), JENOPTIK AG (Germany), Altec GmbH (Germany), Jenoptik Laser GmbH (Germany), FOBA (Germany), The Needham Group (UK), Alpha Nov laser (France), SEI Laser (Italy), Bystronic Laser AG (Switzerland), Trotec Laser GmbH (Austria), Han’s Laser Technology Industry Group Co., Ltd (China), Amada Co., Ltd. (Japan), Mitsubishi Electric (Japan), and Other Active Players.

The Laser Processing Market is segmented into Type, laser type, Application, End-user, and region. By Type, the market is categorized into Gas Lasers, Solid State Lasers, Fiber lasers, and Others. By Laser Type, the market is categorized into Fixed Beam, Moving Beam and Hybrid Beam. By Application, the market is categorized into Cutting, Making, Welding, Drilling, Engraving, Additive Manufacturing, and Others. By End-user, the market is categorized into Automotive, Manufacturing, Semiconductor & Electronics, Medical & life Sciences, Packaging, Oil & gas, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Laser processing is a versatile technique that utilizes a focused beam of light (laser) to manipulate materials. This concentrated light source packs a powerful punch, allowing for precise control over various processes. The core principle revolves around the interaction between the laser beam and the material, resulting in localized heating, melting, vaporization, or other effects depending on the power and interaction time. This enables controlled modification of the material's shape, properties, or markings.

Laser Processing Market Size Was Valued at USD 17.1 Billion in 2023, and is Projected to Reach USD 31.87 Billion by 2030, Growing at a CAGR of 9.3 % From 2024-2030.