IT Operations and Service Management (ITOSM) Market Synopsis

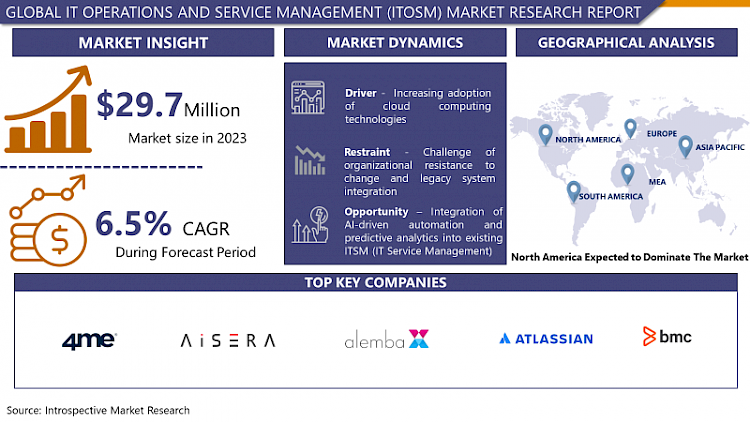

IT Operations and Service Management (ITOSM) Market Size Was Valued at USD 29.7 Billion in 2023, and is Projected to Reach USD 52.4 Billion by 2032, Growing at a CAGR of 6.5% From 2024-2032.

IT Operations and Service Management (ITOSM) is a term that is used to obtain the combined capacity to manage and optimize an organization’s IT facilities and operating services by aligning them with business purposes and responding to the end users’ needs as well.

These activities cover a range from IT systems management, crowdsourced monitoring, incidents management and problem-solving, as well as new technology deployment and, lastly, continuous improvement of service delivery processes. ITOSM will enable improvement of operational efficiency, lessen downtime, and unleash maximum value of IT to the organization among others in the long run which equally contribute to the prosperity of the business.

- The entire Information Technology Operations and Service Management (ITOSM) market, which operates as a complex environment and includes numerous tools, services and procedures meant to streamline IT infrastructure and make sure that service delivery is flawless, is quite a dynamic area. As the IT architecture of organizations becomes more complex and enterprises rely on digital technology a lot, the number of investments in IT Operations Management (ITOSM) is rising to keep the business processes smooth, raise productivity and stop downtime.

- Main products/services of the ITOSM market include IT service desk software, network monitoring tools, asset management systems, and ITIL (Information Technology Infrastructure Library) the best practice. Along with the necessity for the high level of availability and performance of the individual service, the IT Technology Operation Service Management market starts to develop with the innovative solutions as AI-automated software, predictive analytics, and cloud-based services.

- Meanwhile, the ITOSM market will experience significant changes as well for factors including availability of remote working, the proliferation of cloud computing services, and the growing demand for cybersecurity. Within this wake, organizations are now hard pressed to rethink their IT infrastructure and the way they deliver services, thereby prompting the demand of ITOSM solutions whose capabilities cover scalability, flexibility, strong security, and other core elements.

IT Operations and Service Management (ITOSM) Market Trend Analysis

Increasing adoption of AIOps (Artificial Intelligence for IT Operations) solutions

- Leveraging machine learning and analytics, AIOps is an advanced IT operations tool that enables automation and great tricks in a variety of tasks including monitoring, troubleshooting, and incident management. Through the examination of petabytes of data from billions of sources including logs, metrics and events; AIOps platforms are able to pinpoint operational patterns, predict future occurrences and provide practical solutions to IT Operations.

- This movement is orchestrated by the rising level of IT design complication, growing diversity in information resources and the requirement to act quicker and more proactive. In the attempt of organizations to progress by the introduction of the latest technology into the IT market, AIOps becomes the foundation of the reference and sets the pace for IT-related services management transformation.

Integration of AI-driven automation and predictive analytics into existing ITSM (IT Service Management) frameworks

- Through utilizing AI and ML models orchestration, companies can reduce time-consuming manual tasks, monitor operation conditions, and organize workflow adjustment, which will result in the increase of efficiency and cost savings.

- Besides these, this skill graphs into many aspects of IT operations, including incident management, problem resolution, change management and capacity planning. As a matter of illustration, AI-powered chatbots can have a huge impact on the number of inquiries and service requests that can be answered by bridging the gap between IT personnel and users. Artificial intelligence (AI) algorithms are able to analyse previous records (historic data) in order to forecast future disruptions and, in this way, the system is able to take corrective actions before a downtime occurs; as a result, service efficiency is improved.

- In addition to this, combining AI with predictive analytics even helps IT organizations to move from reactive to proactive methodologies, as they are able to foresee and address identified problems before they actually affect the end-users’ comfort level. In detail, this shift from reactive to predictive IT operations not only makes service quality better but also contributes to the robustness of the overall IT architecture.

IT Operations and Service Management (ITOSM) Market Segment Analysis:

IT Operations and Service Management (ITOSM) Market is Segmented on the basis of type, ITOM Type, Industry verticals and end-users.

By Type, ITSM segment is expected to dominate the market during the forecast period

- Looking at the utilities and services management (ITOSM) segment in the market landscape, the IT service management (ITSM) segment stands out as a preferential choice that is likely to dominate the market during the forecast period as well. ITSM can be spread across the whole range of tools and practices aimed at improving the processes of support and delivery of IT-based services. ITSM, however, plays an extremely important role in many companies' digital operations nowadays. With effective planning and constant client feedback, a new service desk can improve problem solving and overall customer satisfaction.

- Core parts of ITSM such as incident management, change management, and service desk operations that function as an essential process of guaranteeing flawless operations and no interruptions of service delivery. Also, the development of cutting-edge technologies, like system technologies aided by AI, or automation powered by technology, and predictive analysis, uplifts the ITSM solutions so that they can be more useful and relevant to the organizations. It helps to anticipate challenges and to make possible performance improvements.

- It is the ITSM segment that holds the key to the greatly growing ITOSM market and its sets out to ensure that IT management practices and indeed, the collaboration between departments are both efficient and cost effective as it future proofs organizations for the digital era.

By ITOM Type, Configuration Automation and Discovery segment held the largest share in 2023

- While all industry participants have a role in Information and Technology Operations and Service Management (ITOSM) market, Configuration Automation and Discovery has the lion's share in the ITOM (Information and Technology Operations Management) segment. This prevalent segment demonstrates an implication of the two areas of automation and the quick discovery of assets as the backbone of current IT organizations.

- Heuristic software packages are emerging to ease up the creation, management, and expansion of information technology infrastructures, so that organizations can enjoy envisaged consistence, security, and quick scalability in the data they maintain. Intelligence discovery also gives us some strong vision of the entire infrastructure being used in the organization, and based on that it provides comprehensive details like the all devices, apps and dependencies.

- T has these advantages that these business gain, they embrace Configuration Automation and Discovery Solutions.

- Thanks to the use of such tools, IT teams can carry out autonomously the usual repeatable processes, i.e. provisioning and configuration management, which result in both time and error reduction. At the same time, broad discovery possibilities of different companies allow one to map out their entire IT ecosystem which propels better decision-making, risk management, and optimization of resources.

IT Operations and Service Management (ITOSM) Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In the ITO/SMO for North America, it is North American countries that are in the driver's seat and will be setting the trend and direction by 2018 An exemplary technological infrastructure, a high-developed IT ecosystem, and a culturally inclined early application of the latest innovation technologies make the region be a leader in developing IT service management solutions cutting-edge developments. North America contains a wide range of industries-from the financial sector to the health care, manufacturing and technology firms that emphasize on the operational efficiency, service availability, and client satisfaction, making them utilizing internet of things solutions worthily.

- Together with this, it is worth mentioning that the North American market especially enjoys benefits from the advancement of the local IT services industry where a lot of major vendors, innovative startups, and active service providers have been operating over the last decades and offering the broad range of the IT security management products and services. Initiatives taken by this region with respect to accommodating the new technologies, for example: artificial intelligence, cloud computing and data mining, place it a frontier innovation and researching area for IT operations and service management.

- In addition, there is a growing need for communication technologies, device security, and network complications which supports the prominent face of ITOSM solutions in North America. Given that in North America the ITOSM market simultaneously is on the rise and faces the challenges of a competitive environment and digital changes, it is probably going to remain the dominant player for a long time and new technologies and IT services management practices are likely to emerge in this market.

Active Key Players in the IT Operations and Service Management (ITOSM) Market

- 4me (US)

- Aisera (US)

- Alemba (UK)

- Atlassian (Australia)

- BMC Software (US)

- Broadcom (US)

- EasyVista (US)

- Efecte (Finland)

- Freshworks (US)

- GoTo (US)

- HalolTSM (US)

- Hornbill (UK)

- IBM (US)

- IFS (Sweden)

- InvGate (US

- ITarain (US)

- Ivanti (US)

- ManageEngine (India)

- Microsoft (US)

- NinjaOne (US)

- OpenText (Canada)

- ServiceNow (US)

- SolarWinds (US)

- SymphonyAl Summit (US)

- SysAid (Israel)

- TeamDynamix (US)

- TOPdesk (Netherlands)

- Zendesk (US)

- Other key Players

|

Global IT Operations and Service Management (ITOSM) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 29.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.5 % |

Market Size in 2032: |

USD 52.4 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By ITOM Type |

|

||

|

By Industry Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- SEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET BY TYPE (2017-2032)

- IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ITSM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ITOM

- IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET BY ITOM TYPE (2017-2032)

- IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONFIGURATION AUTOMATION AND DISCOVERY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- EVENT MANAGEMENT

- CLOUD PROVISIONING

- WORKLOAD AND IT AUTOMATION

- IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET BY INDUSTRY VERTICALS (2017-2032)

- IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BFSI

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TELECOM AND IT

- HEALTHCARE/MEDICAL/PHARMACEUTICAL

- AEROSPACE/ DEFENCE

- RETAIL/WHOLESALE/DISTRIBUTION

- MANUFACTURING

- EDUCATION

- HOSPITALITY/ ENTERTAINMENT/RECREATION/TRAVEL

- ENERGY UTILITIES

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- IT Operations And Service Management (ITOSM) Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- 4ME (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AISERA (US)

- ALEMBA (UK)

- ATLASSIAN (AUSTRALIA)

- BMC SOFTWARE (US)

- BROADCOM (US)

- EASYVISTA (US)

- EFECTE (FINLAND)

- FRESHWORKS (US)

- GOTO (US)

- HALOLTSM (US)

- HORNBILL (UK)

- IBM (US)

- IFS (SWEDEN)

- INVGATE (US

- ITARAIN (US)

- IVANTI (US)

- MANAGEENGINE (INDIA)

- MICROSOFT (US)

- NINJAONE (US)

- OPENTEXT (CANADA)

- SERVICENOW (US)

- SOLARWINDS (US)

- SYMPHONYAL SUMMIT (US)

- SYSAID (ISRAEL)

- TEAMDYNAMIX (US)

- TOPDESK (NETHERLANDS)

- ZENDESK (US)

- COMPETITIVE LANDSCAPE

- GLOBAL IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Itom Type

- Historic And Forecasted Market Size By Industry Verticals

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global IT Operations and Service Management (ITOSM) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 29.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.5 % |

Market Size in 2032: |

USD 52.4 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By ITOM Type |

|

||

|

By Industry Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET COMPETITIVE RIVALRY

TABLE 005. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET THREAT OF NEW ENTRANTS

TABLE 006. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET THREAT OF SUBSTITUTES

TABLE 007. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET BY TYPE

TABLE 008. ITSM MARKET OVERVIEW (2016-2028)

TABLE 009. ITOM {CONFIGURATION MARKET OVERVIEW (2016-2028)

TABLE 010. AUTOMATION & DISCOVERY MARKET OVERVIEW (2016-2028)

TABLE 011. EVENT MANAGEMENT MARKET OVERVIEW (2016-2028)

TABLE 012. CLOUD PROVISIONING MARKET OVERVIEW (2016-2028)

TABLE 013. WORKLOAD & IT AUTOMATION} MARKET OVERVIEW (2016-2028)

TABLE 014. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET BY END-USER INDUSTRY

TABLE 015. BFSI MARKET OVERVIEW (2016-2028)

TABLE 016. TELECOM & IT MARKET OVERVIEW (2016-2028)

TABLE 017. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 018. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 019. MEDICAL MARKET OVERVIEW (2016-2028)

TABLE 020. DEFENSE MARKET OVERVIEW (2016-2028)

TABLE 021. RETAIL & WHOLESALE DISTRIBUTION MARKET OVERVIEW (2016-2028)

TABLE 022. EDUCATION MARKET OVERVIEW (2016-2028)

TABLE 023. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY END-USER INDUSTRY (2016-2028)

TABLE 026. N IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY TYPE (2016-2028)

TABLE 028. EUROPE IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY END-USER INDUSTRY (2016-2028)

TABLE 029. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY TYPE (2016-2028)

TABLE 031. ASIA PACIFIC IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY END-USER INDUSTRY (2016-2028)

TABLE 032. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY COUNTRY (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY TYPE (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY END-USER INDUSTRY (2016-2028)

TABLE 035. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY TYPE (2016-2028)

TABLE 037. SOUTH AMERICA IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY END-USER INDUSTRY (2016-2028)

TABLE 038. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET, BY COUNTRY (2016-2028)

TABLE 039. MICROSOFT CORPORATION: SNAPSHOT

TABLE 040. MICROSOFT CORPORATION: BUSINESS PERFORMANCE

TABLE 041. MICROSOFT CORPORATION: PRODUCT PORTFOLIO

TABLE 042. MICROSOFT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. BMC SOFTWARE INC.: SNAPSHOT

TABLE 043. BMC SOFTWARE INC.: BUSINESS PERFORMANCE

TABLE 044. BMC SOFTWARE INC.: PRODUCT PORTFOLIO

TABLE 045. BMC SOFTWARE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. ORACLE CORP: SNAPSHOT

TABLE 046. ORACLE CORP: BUSINESS PERFORMANCE

TABLE 047. ORACLE CORP: PRODUCT PORTFOLIO

TABLE 048. ORACLE CORP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. IBM CORPORATION: SNAPSHOT

TABLE 049. IBM CORPORATION: BUSINESS PERFORMANCE

TABLE 050. IBM CORPORATION: PRODUCT PORTFOLIO

TABLE 051. IBM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. CA TECHNOLOGY INC: SNAPSHOT

TABLE 052. CA TECHNOLOGY INC: BUSINESS PERFORMANCE

TABLE 053. CA TECHNOLOGY INC: PRODUCT PORTFOLIO

TABLE 054. CA TECHNOLOGY INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. DELL INC: SNAPSHOT

TABLE 055. DELL INC: BUSINESS PERFORMANCE

TABLE 056. DELL INC: PRODUCT PORTFOLIO

TABLE 057. DELL INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. TOSHIBA CORPORATION: SNAPSHOT

TABLE 058. TOSHIBA CORPORATION: BUSINESS PERFORMANCE

TABLE 059. TOSHIBA CORPORATION: PRODUCT PORTFOLIO

TABLE 060. TOSHIBA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. HEWLETT PACKARD ENTERPRISE COMPANY: SNAPSHOT

TABLE 061. HEWLETT PACKARD ENTERPRISE COMPANY: BUSINESS PERFORMANCE

TABLE 062. HEWLETT PACKARD ENTERPRISE COMPANY: PRODUCT PORTFOLIO

TABLE 063. HEWLETT PACKARD ENTERPRISE COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. SAP: SNAPSHOT

TABLE 064. SAP: BUSINESS PERFORMANCE

TABLE 065. SAP: PRODUCT PORTFOLIO

TABLE 066. SAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. MICRO FOCUS: SNAPSHOT

TABLE 067. MICRO FOCUS: BUSINESS PERFORMANCE

TABLE 068. MICRO FOCUS: PRODUCT PORTFOLIO

TABLE 069. MICRO FOCUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. SPLUNK: SNAPSHOT

TABLE 070. SPLUNK: BUSINESS PERFORMANCE

TABLE 071. SPLUNK: PRODUCT PORTFOLIO

TABLE 072. SPLUNK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. HITACHI: SNAPSHOT

TABLE 073. HITACHI: BUSINESS PERFORMANCE

TABLE 074. HITACHI: PRODUCT PORTFOLIO

TABLE 075. HITACHI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. SISCO: SNAPSHOT

TABLE 076. SISCO: BUSINESS PERFORMANCE

TABLE 077. SISCO: PRODUCT PORTFOLIO

TABLE 078. SISCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. SOLAR WINDS: SNAPSHOT

TABLE 079. SOLAR WINDS: BUSINESS PERFORMANCE

TABLE 080. SOLAR WINDS: PRODUCT PORTFOLIO

TABLE 081. SOLAR WINDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 082. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 083. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 084. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET OVERVIEW BY TYPE

FIGURE 012. ITSM MARKET OVERVIEW (2016-2028)

FIGURE 013. ITOM {CONFIGURATION MARKET OVERVIEW (2016-2028)

FIGURE 014. AUTOMATION & DISCOVERY MARKET OVERVIEW (2016-2028)

FIGURE 015. EVENT MANAGEMENT MARKET OVERVIEW (2016-2028)

FIGURE 016. CLOUD PROVISIONING MARKET OVERVIEW (2016-2028)

FIGURE 017. WORKLOAD & IT AUTOMATION} MARKET OVERVIEW (2016-2028)

FIGURE 018. IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET OVERVIEW BY END-USER INDUSTRY

FIGURE 019. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 020. TELECOM & IT MARKET OVERVIEW (2016-2028)

FIGURE 021. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 022. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 023. MEDICAL MARKET OVERVIEW (2016-2028)

FIGURE 024. DEFENSE MARKET OVERVIEW (2016-2028)

FIGURE 025. RETAIL & WHOLESALE DISTRIBUTION MARKET OVERVIEW (2016-2028)

FIGURE 026. EDUCATION MARKET OVERVIEW (2016-2028)

FIGURE 027. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA IT OPERATIONS AND SERVICE MANAGEMENT (ITOSM) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the IT Operations and Service Management (ITOSM) Market research report is 2024-2032.

ServiceNow (US), BMC Software (US), Broadcom (US), Ivanti (US), Efecte (Finland), SymphonyAl Summit (US) and Other Major Players.

The IT Operations and Service Management (ITOSM) Market is segmented into Type, ITOM Type, Industry Verticals, and region. By Type, the market is categorized into ITSM and ITOM. By ITOM Type, the market is categorized into Configuration Automation and Discovery, Event Management, Cloud Provisioning and Workload, and IT Automation. By Industry Verticals, the market is categorized into BFSI, Telecom and IT, Government, Healthcare/Medical/Pharmaceutical, Aerospace/ Defense, Retail/Wholesale/Distribution, Manufacturing, Education, Hospitality/ Entertainment/Recreation/Travel, Energy Utilities and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

IT Operations and Service Management (ITOSM) refers to the holistic approach of overseeing and optimizing an organization's IT infrastructure and services to ensure they align with business objectives and meet user needs effectively. This encompasses a range of activities, including monitoring and maintaining IT systems, managing incidents and problems, deploying new technologies, and continuously improving service delivery processes. ITOSM aims to enhance operational efficiency, minimize downtime, and maximize the value IT brings to the organization, ultimately contributing to overall business success.

IT Operations and Service Management (ITOSM) Market Size Was Valued at USD 29.7 Billion in 2023, and is Projected to Reach USD 52.4 Billion by 2032, Growing at a CAGR of 6.5% From 2024-2032.