Global Intelligent Motor Controller Market Overview

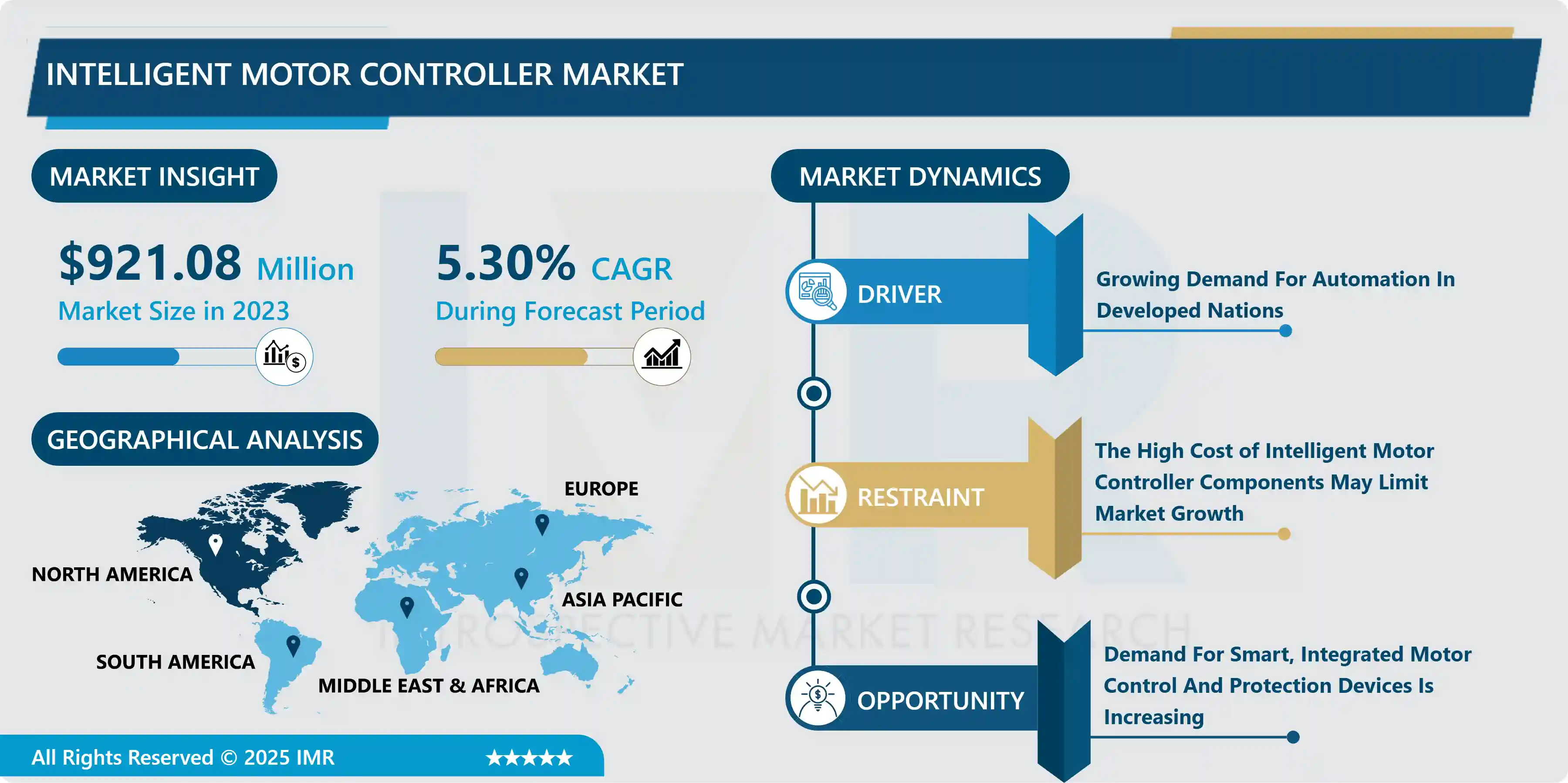

Intelligent Motor Controller Market Size Was Valued at USD 921.08 Million In 2023 And Is Projected to Reach USD 1466.06 Million By 2032, Growing at A CAGR of 5.3% From 2024-2032.

A motor control center (MCC) is a collection of one or more enclosed sections connected by a common power bus and primarily housing motor control units. MCCs, or multiple motor starters, are a factory-assembled group of motor starts. As a result of network communication challenges and technical developments, the need to combine three essential system components: hardware, communications, and software, has been revealed. Next-generation, integrated, intelligent motor control centers (IMCCs) were introduced to address these growing demands.

The global intelligent motor controller market is expected to grow due to increased industrial plant uptime, higher motor efficiency and energy savings, and rising demand for smart, versatile, and integrated motor control and protection devices. Furthermore, the growing use of industrial automation in industrialized countries presents the intelligent motor controller market with promising opportunities. Furthermore, governments around the world are emphasizing the importance of encouraging businesses and households to utilize energy-saving techniques to minimize energy consumption. Intelligent motor controllers are a good technique to save energy by increasing the efficiency of both AC and DC-powered devices. The intelligent motor controller sector will benefit from this.

Market Dynamics And Factors For Intelligent Motor Controller Market

Drivers:

Growing Demand For Automation In Developed Nations

- The majority of emerging economies have embraced urban industrialization to promote economic growth. The most successful among the middle-income countries are ones that rapidly deepened manufacturing capabilities, we're able to participate in global value chains, and steadily increased their penetration of overseas markets. Among the successful exceptions are exporters of minerals or other resource-based products and small economies that have relied on the export of services, primarily tourism. The common thread running through the strategies of all fast developers is a structural change that led to the emergence and growth of more productive, export-oriented sectors producing manufactures or resource-based products or services, or a combination of the three. Complementing this structural change was rising demand for emerging economy exports from advanced economies. Rapid growth was undoubtedly enabled by sound policies and strategic vision; however, the fast movers were also advantaged by lower factor costs, the capacity to assimilate technologies, and by investment in both productive assets and supporting infrastructures. Globalization in its several forms lent added impetus to development underpinned by trade and technology transfers. In addition, in the chemical & petrochemical industry, electric motors are used to drive compressors, pumps, fans, agitators, extruders, packing machines, and conveyor belts. Companies/industries such as chemical, plastics & rubber, industrial gases, or fine chemicals involve continuous manufacturing process operations, where motor control centers provide an efficient solution for controlling electric motors throughout the complete chemical production facility from a centralized location. Hence, the introduction of automation in various industries is likely to drive the demand for motor control centers.

Restraints:

The High Cost of Intelligent Motor Controller Components May Limit Market Growth

- The price of numerous components utilized in the production of intelligent motor controllers is extremely high. The high cost of components raises the overall price of the product. The high cost of sophisticated motor controllers drives the demand for more money. The cost of installing such technology is prohibitive for some small businesses. This could limit the industry's growth during the foreseeable term.

Opportunities:

Demand For Smart, Integrated Motor Control And Protection Devices Is Increasing

- In general, there are two types of motor control centers: conventional and intelligent motor control centers. For speed control and motor protection operations, traditional motor control centers use components such as variable speed drives, relays, and circuit breakers. These gadgets are relatively straightforward and rely on analog or electromechanical technology. Microprocessor developments, on the other hand, have improved motor control and protection functions. The demand for smart devices, such as intelligent motor control centers, has expanded as industrial automation and technology improvements have increased. Faster response time, better diagnostics, precise control, and remote control and monitoring are all features of these intelligent devices. Furthermore, because multiple tasks are combined into a single intelligent device, intelligent motor control centers reduce the number of components necessary.

Segmentation Analysis of Intelligent Motor Controller Market

- By Motor Type, the AC segment is likely to capture the maximum market growth throughout the forecast period. Because AC motors can generate more torque than DC motors and have superior torque-speed characteristics to others, there is a large demand for and installation of such motors in the market. During the forecast period, this supports growth in the AC motor category. During the projection period, the DC motor market is expected to increase significantly. DC motors are said to offer a higher beginning torque and efficiency. The need for and adoption of such motors is increasing as the end-user segment's demand grows. During the projection period, this will fuel the growth of the DC motor segment.

- By Voltage, the low voltage segment is anticipated to hold the highest intelligent motor controller market growth over the forecast period. Low voltage motor control centers are highly desired due to their extensive implementation in a variety of sectors around the world, which is expected to drive demand for them during the projected period.

- By Industry, the oil and gas segment is anticipated to capture the largest intelligent motor controller market growth during the forecast period. Because of the widespread usage of motor-operated devices in the sector, the Oil and Gas industry is the greatest end-user market for intelligent motor controllers. This raises the need for IMCs and their adoption.

Regional Analysis of Intelligent Motor Controller Market

- During the projection period, Asia Pacific is expected to be the largest market. Because of the region's expanding urbanization and industrialization, intelligent motor controllers are projected to be in high demand. In addition, the region's intelligent motor controller market is predicted to benefit from rising power generation capacity additions and rising energy demand. The electricity generating and wastewater management sectors in the region are booming, while automation in the industrial sector is fast rising. Smart device adoption is in high demand since it reduces costs and improves operational efficiency. The use of IMCs is growing as smart motors are being installed more often. As a result, the market for intelligent motor controllers in the Asia Pacific region is expected to rise throughout the forecast period.

- As end-user technology advances, the demand for and installation of smart devices is growing rapidly in this region. North America is adopting new technologies, which boosts the use of IMCs in the region's end-user sectors. As a result, it is expected to fuel growth in North America over the projection period.

- In the following years, the IMC market in Europe is predicted to grow significantly. Within the region, the adoption of new technologies is expanding at a faster rate. As automation investment grows in this region, the installation of smart devices like IMCs is rising dramatically across the water, wastewater, pharmaceuticals, food & beverage, and other industries.

- During the predicted period, Latin America is expected to increase significantly. The need for power in the region is growing rapidly, necessitating the expansion of the power generation sector and the deployment of highly efficient devices such as IMCs and others.

- During the projection period, the worldwide IMC market is expected to grow significantly in the Middle East and Africa. The popularity of smart devices is increasing as industrial automation grows. Equipment that can help boost operational efficiency is frequently deployed in the oil and gas industry. During the projection period, this boosts market growth in the Middle East and Africa region.

Players Covered in Intelligent Motor Controller Market are

- ABB (Switzerland)

- General Electric (U.S.)

- Rockwell Automation (India)

- Mitsubishi Electric (Japan)

- Siemens AG (Germany)

- Larsen & Toubro (India)

- Schneider Electric (France)

- Lsis Co. Ltd. (South Korea)

- Nanotec Electronic GmbH & Co. (Germany)

- NXP Semiconductors (Netherlands)

- Fairford Electronics (U.S.)

- Roboteq Inc. (U.S.) and other major players.

Key Industry Developments In Intelligent Motor Controller Market

- In January 2022, Qorvo®, a leading provider of innovative RF solutions that connect the world, has announced a motor control reference design that combines Qorvo's new silicon carbide (SiC) FETs with the PAC5556 intelligent motor controller to create a proof-of-concept System-on-a-Chip (SoC) that can drive applications up to 3000w. "The development of this reference design demonstrates Qorvo's capacity to rapidly integrate, innovate, and offer high-value intelligent power solutions for more power-efficient end products," said David Briggs, Qorvo senior director of Programmable Power Management. Consumer benefits include sleeker and smaller solutions, lower noise levels, longer service life, and lower power usage thanks to this design."

- In March 2022, Motor T, the next generation of motors and controllers from Sona BLW Precision Forgings Ltd (Sona Comstar), has been presented with an optimized controller family. The company says that its Motor T with optimized controller' and next-generation technology "has the highest efficiency (96 percent), power, and torque density in the 48V category in the world," according to a press statement.

- In May 2021, Schneider Electric and Allied Electronics & Automation have announced the launch of a new limited-feature set of high-quality motor control and protection devices aimed at smaller panel builders, system integrators, OEMs, and other businesses.

|

Global Intelligent Motor Controller Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 921.08 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.3 % |

Market Size in 2032: |

USD 1466.06 Mn. |

|

Segments Covered: |

By Motor Type |

|

|

|

By Application |

|

||

|

By Voltage |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Intelligent Motor Controller Market by Motor Type (2018-2032)

4.1 Intelligent Motor Controller Market Snapshot and Growth Engine

4.2 Market Overview

4.3 AC

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 DC

4.5 Others

Chapter 5: Intelligent Motor Controller Market by Application (2018-2032)

5.1 Intelligent Motor Controller Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Compressors

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pumps

5.5 Fans

5.6 Others

Chapter 6: Intelligent Motor Controller Market by Voltage (2018-2032)

6.1 Intelligent Motor Controller Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Low

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Medium

Chapter 7: Intelligent Motor Controller Market by Industry (2018-2032)

7.1 Intelligent Motor Controller Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Food & Beverage

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pharmaceuticals

7.5 Oil & Gas

7.6 Chemicals & Petrochemicals

7.7 Water & Wastewater

7.8 Power Generation

7.9 Metals & Mining

7.10 Cement & Aggregates

7.11 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Intelligent Motor Controller Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 PFIZER INC. (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MERCK & COINC. (US)

8.4 JOHNSON & JOHNSON (US)

8.5 ABBVIE (US)

8.6 NOVARTIS AG (SWITZERLAND)

8.7 BRISTOL MYERS SQUIBB (US)

8.8 ELI LILLY AND COMPANY (US)

8.9 GILEAD SCIENCES INC. (US)

8.10 AMGEN INC. (US)

8.11 SEAGEN INC. (US)

8.12 CELGENE CORPORATION (US)

8.13 BOEHRINGER INGELHEIM GMBH (GERMANY)

8.14 FRESENIUS SE & CO. KGAA (GERMANY)

8.15 ASTRAZENECA PLC (UK)

8.16 SANOFI (FRANCE)

8.17 GLAXOSMITHKLINE PLC (UK)

8.18 BAYER AG (GERMANY)

8.19 SHIONOGI & COLTD. (JAPAN)

8.20 TAKEDA PHARMACEUTICAL COMPANY LIMITED (JAPAN)

8.21 WUXI APPTEC COLTD. (CHINA)

8.22 ROCHE HOLDING AG (SWITZERLAND)

8.23 ALLERGAN PLC (IRELAND)

8.24 SHIRE PLC (IRELAND)

8.25 MEDTRONIC PLC (IRELAND)

8.26 NOVO NORDISK A/S (DENMARK)

Chapter 9: Global Intelligent Motor Controller Market By Region

9.1 Overview

9.2. North America Intelligent Motor Controller Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Motor Type

9.2.4.1 AC

9.2.4.2 DC

9.2.4.3 Others

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Compressors

9.2.5.2 Pumps

9.2.5.3 Fans

9.2.5.4 Others

9.2.6 Historic and Forecasted Market Size by Voltage

9.2.6.1 Low

9.2.6.2 Medium

9.2.7 Historic and Forecasted Market Size by Industry

9.2.7.1 Food & Beverage

9.2.7.2 Pharmaceuticals

9.2.7.3 Oil & Gas

9.2.7.4 Chemicals & Petrochemicals

9.2.7.5 Water & Wastewater

9.2.7.6 Power Generation

9.2.7.7 Metals & Mining

9.2.7.8 Cement & Aggregates

9.2.7.9 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Intelligent Motor Controller Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Motor Type

9.3.4.1 AC

9.3.4.2 DC

9.3.4.3 Others

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Compressors

9.3.5.2 Pumps

9.3.5.3 Fans

9.3.5.4 Others

9.3.6 Historic and Forecasted Market Size by Voltage

9.3.6.1 Low

9.3.6.2 Medium

9.3.7 Historic and Forecasted Market Size by Industry

9.3.7.1 Food & Beverage

9.3.7.2 Pharmaceuticals

9.3.7.3 Oil & Gas

9.3.7.4 Chemicals & Petrochemicals

9.3.7.5 Water & Wastewater

9.3.7.6 Power Generation

9.3.7.7 Metals & Mining

9.3.7.8 Cement & Aggregates

9.3.7.9 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Intelligent Motor Controller Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Motor Type

9.4.4.1 AC

9.4.4.2 DC

9.4.4.3 Others

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Compressors

9.4.5.2 Pumps

9.4.5.3 Fans

9.4.5.4 Others

9.4.6 Historic and Forecasted Market Size by Voltage

9.4.6.1 Low

9.4.6.2 Medium

9.4.7 Historic and Forecasted Market Size by Industry

9.4.7.1 Food & Beverage

9.4.7.2 Pharmaceuticals

9.4.7.3 Oil & Gas

9.4.7.4 Chemicals & Petrochemicals

9.4.7.5 Water & Wastewater

9.4.7.6 Power Generation

9.4.7.7 Metals & Mining

9.4.7.8 Cement & Aggregates

9.4.7.9 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Intelligent Motor Controller Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Motor Type

9.5.4.1 AC

9.5.4.2 DC

9.5.4.3 Others

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Compressors

9.5.5.2 Pumps

9.5.5.3 Fans

9.5.5.4 Others

9.5.6 Historic and Forecasted Market Size by Voltage

9.5.6.1 Low

9.5.6.2 Medium

9.5.7 Historic and Forecasted Market Size by Industry

9.5.7.1 Food & Beverage

9.5.7.2 Pharmaceuticals

9.5.7.3 Oil & Gas

9.5.7.4 Chemicals & Petrochemicals

9.5.7.5 Water & Wastewater

9.5.7.6 Power Generation

9.5.7.7 Metals & Mining

9.5.7.8 Cement & Aggregates

9.5.7.9 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Intelligent Motor Controller Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Motor Type

9.6.4.1 AC

9.6.4.2 DC

9.6.4.3 Others

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Compressors

9.6.5.2 Pumps

9.6.5.3 Fans

9.6.5.4 Others

9.6.6 Historic and Forecasted Market Size by Voltage

9.6.6.1 Low

9.6.6.2 Medium

9.6.7 Historic and Forecasted Market Size by Industry

9.6.7.1 Food & Beverage

9.6.7.2 Pharmaceuticals

9.6.7.3 Oil & Gas

9.6.7.4 Chemicals & Petrochemicals

9.6.7.5 Water & Wastewater

9.6.7.6 Power Generation

9.6.7.7 Metals & Mining

9.6.7.8 Cement & Aggregates

9.6.7.9 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Intelligent Motor Controller Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Motor Type

9.7.4.1 AC

9.7.4.2 DC

9.7.4.3 Others

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Compressors

9.7.5.2 Pumps

9.7.5.3 Fans

9.7.5.4 Others

9.7.6 Historic and Forecasted Market Size by Voltage

9.7.6.1 Low

9.7.6.2 Medium

9.7.7 Historic and Forecasted Market Size by Industry

9.7.7.1 Food & Beverage

9.7.7.2 Pharmaceuticals

9.7.7.3 Oil & Gas

9.7.7.4 Chemicals & Petrochemicals

9.7.7.5 Water & Wastewater

9.7.7.6 Power Generation

9.7.7.7 Metals & Mining

9.7.7.8 Cement & Aggregates

9.7.7.9 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Intelligent Motor Controller Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 921.08 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.3 % |

Market Size in 2032: |

USD 1466.06 Mn. |

|

Segments Covered: |

By Motor Type |

|

|

|

By Application |

|

||

|

By Voltage |

|

||

|

By Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||