Global EV Tires Market Overview

The EV Tire Market is expected to grow at a significant growth rate, and the analysis period is 2022-2028, considering base year as 2021.

The tires on electric vehicles may resemble those on fossil-fuel vehicles. They are, nonetheless, dissimilar in terms of manufacturing components. When compared to fossil fuel car tires, electric vehicle tires are 20% lighter. This is because electric vehicles utilize less rubber and other raw materials. The rolling resistance of electric vehicle tires is typically 30 percent lower. As a result, electric vehicle tires have a longer operating life than traditional tires. In comparison to traditional tires, Bridgestone states that the EV tires have deep treads and unique patterns. Electric cars are often heavier than their counterparts fuelled by fossil fuels. The batteries add a significant amount of weight to electric vehicles. As per the study, EVs would have to weigh 60% more than a conventional vehicle to achieve the same range.

The demands imposed on future electric car tires and mileage is of the utmost importance. Tires and wheels, in particular, may have a significant impact on EV range. Changing factory low-rolling-resistance tires and aerodynamic wheels with aftermarket components has been found to reduce range while improving handling in many tests. With the introduction of electric vehicles and their significantly lower propulsion noise emissions, it is now possible to assess tire-road noise through cruise-by measurements with greater accuracy, even at speeds where a combustion engine propulsion system would normally cause measurement results to be skewed. Low rolling resistance between the tire and the road surface, which results in reduced energy waste, is important for ensuring a high range with a single battery charge. The EU tire label's rolling resistance rating has been utilized as the major selection factor for possible EV tires. The tire label rating for wet grip was the second selection factor, with a lower number implying a shorter braking distance. Increased average vehicle life, more annual kilometers traveled, rising maintenance and safety concerns, technical advancements resulting in longer tire life, and other reasons are driving the EV tire market forward.

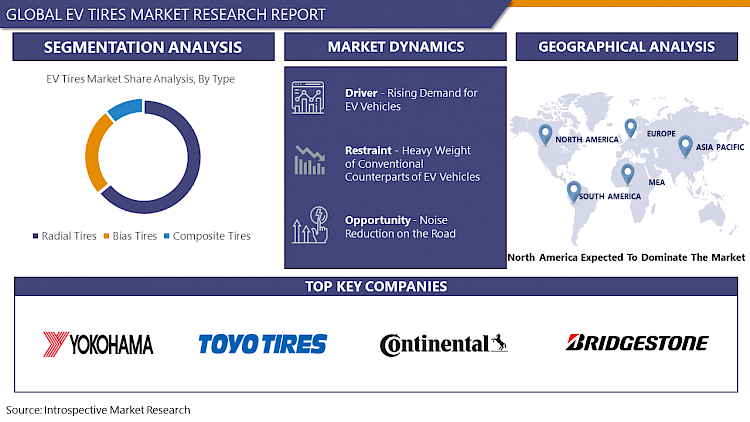

Dynamics of the EV Tires Market

Drivers

For a variety of reasons, electric vehicles require special tires. According to the business, as compared to internal combustion cars, their tires must handle greater weight and provide more power to the road while pulling away from a stop. Because of their near-silent powertrains, tire noise is far more evident in electric cars than in internal combustion vehicles, where it is somewhat covered by engine noise. The demands placed on future electric vehicle tires and mileage is critical. The influence of tires and wheels, in particular, on EV range is important. In many testing, replacing original low-rolling-resistance tires and aerodynamic wheels with aftermarket components reduced range while enhancing handling. It is now possible to assess tire-road noise more accurately through cruise measurements, even at speeds where a combustion engine propulsion system would normally cause measurement results to be skewed, thanks to the introduction of electric vehicles and their significantly lower propulsion noise emissions. Low rolling resistance between the tire and the road surface, which results in less energy waste, is critical for achieving a long-range on a single charge. The rolling resistance value on the EU tire label has been utilized as a primary selection element for potential EV tires. The second deciding element was the wet grip rating on the tire label, with a lower number signifying a shorter braking distance. Because of the weight of the batteries, an electric vehicle's overall weight is higher. The weight disparity will narrow as battery technology advances, potentially disappearing altogether, but for now, the weight differential are between 25% and 30%, depending on the car type. With more weight, a longer range, and lower emissions, low rolling resistance is even more important, so electric car tires deliver a smoother, more energy-efficient, and less-impact ride. These reasons will boost the market for electric vehicle tires ahead.

Restraints

Electric and hybrid vehicles are often heavier than their conventional counterparts, they put more torque into the road when starting, and the practically silent powertrain means other noises, such as tire noise, become more evident. All of these elements, as well as concerns like decreasing rolling resistance, confront tire makers with a slew of hurdles, according to Continental. The extra weight of any batteries and electric motor, for example, is countered by increasing the load-bearing capability of the tire carcass, as denoted by an XL sign on the sidewall of most tires. "There are present attempts within the industry to standardize tires with even larger load capabilities, which would most likely wear the XL+ mark," explains Andreas Schlenke, a Continental tire development engineer. "To keep the wear induced by high amounts of torque when moving off to a minimum, both the tread pattern design and the tread compound must be modified."

Opportunities:

Noise Reduction on the Road

Tires for electric cars must be able to support the larger weights imposed by batteries, as well as endure more torque than tires for traditional internal combustion engines. "There's also a need to reduce road noise," says Russell Shepherd, technical communications director for Michelin North America. "With EVs, there's no engine to drown out the [sound] of the tires traveling over the roadways." "In ICE automobiles, this is something most of us don't think about." However, after spending time in an EV, it becomes extremely apparent." Since the 1980s, when it experimented with adding silica to tread compounds, Michelin has been researching low resistance tire technology. Michelin has lately been the tire supplier to the Formula E series.

Market Segmentation

By product type, the radial tires segment is expected to hold the maximum market share during the forecast period. Magna radial tires include a sequence of steel cords stretching from the beads and across the tread, which are arranged at about right angles to the tread's centerline and parallel to each other, as well as belts directly beneath the tread. The tire's strength and form are provided by this network of cables. A radial tire's sidewall is more flexible than a bias tire's due to its all-steel structure, resulting in a shorter but broader footprint. This translates to lower rolling resistance, reduced fuel consumption, more grip, and improved ride comfort at higher speeds. Because there is no movement between plies in a steel radial design, there is less heat accumulation and higher resistance to heating. Additionally, the belts right beneath the tread prevents deformation, resulting in increased traction and puncture resistance.

By propulsion, the BEV segment is expected to capture the maximum EV tire market share over the forecast period. BEVs are electric-only vehicles that do not have an internal combustion engine, a gasoline tank, or an exhaust pipe. It contains one or more electric motors instead, which are driven by a bigger onboard battery. An external outlet is used to charge the battery. BEVs are already available in a variety of configurations, including automobiles, buses, motorcycles and scooters, and even boats. The Tesla Model 3 and Model Y, the SAIC-GM-Wuling Hongguang Mini, the Nissan Note, the VW ID.3, and the Renault Zoe are the best-selling BEVs worldwide.

By Distribution Channel, the OEM segment is expected to dominate the EV tire market during the forecast period. This is due to a considerable increase in electric car sales, the launch of electric buses, and OEM's growing global footprint. Globally, almost 2.1 million electric automobiles were sold in 2019, up from 1.8 million in 2018. The demand for electric vehicles is likely to continue to rise, contributing to the worldwide growth of the EV tire market over the forecast period.

Players Covered in EV Tires market are :

• The Goodyear Tire & Rubber Company

• Continental AG

• Bridgestone Corporation

• Pirelli & C. S.p.A

• Yokohama Rubber Company Ltd.

• Hankook Tire & Technology Group

• Michelin Group

• Kumho Tire Company Inc.

• Toyo Tire Corporation

• GITI Tire

• Sumitomo Rubber Industries

• Nokian Tires

• Trelleborg AB

• Falken Tire

• Apollo Tyre

• Cooper Tire & Rubber Company

• Ceat Tire

Regional Analysis for the EV Tires Market:

Countries like China, Japan, and South Korea lead the Asia Pacific EV tire market. The EV sector in the area is dominated by China, which is the world's largest EV manufacturer and customer. Their government has taken steps such as providing subsidies to EV buyers, enacting mandatory laws requiring all vehicle manufacturers to produce EVs in proportion to the number of vehicles produced, providing substantial support for the installation of EV charging stations across major cities, and enacting regulations against polluting vehicles, all of which have contributed to the growth of the EV tire market. In addition, the electric vehicle market in Japan and South Korea has been expanding. Their governments have aided the increase of EV demand by providing EV charging stations, establishing pollution standards, and establishing deadlines for switching from ICE cars to full or hybrid EVs, among other things. India is also aiming to increase its electric vehicle demand, which has boosted the EV tire market. The country's new car scrappage policy, which allows old vehicles to be scrapped in exchange for low-emission vehicles, as well as other planned rules, will help it become the region's fastest-growing EV market in the next years.

The North American region is expected to witness significant market growth for the EV tire over the forecast period. Rising sales of electric cars and the development of technologically advanced autonomous vehicles are driving up demand for automobile tires in the United States. Because of changes in taxation policy and a shift in customer demand toward safer, more comfortable, and longer-lasting tires, the country's tire industry is expanding. Because the industry in the United States is so competitive, leading firms are turning to inorganic approaches to increase revenue and market share. The inorganic approach includes strategic partnerships and mergers with automobile manufacturers.

As demand for electric cars rises, the EV tire industry in Europe is likely to expand, providing sales prospects for EV tires. Germany, Italy, France, and the United Kingdom are all industrialized countries. Large corporations have production units, as do others. Bridgestone will shift its attention to electric vehicles, to have EV tires account for 90% of all new automobile tires by 2030, as the business moves away from fierce competition from low-cost Chinese and South Korean competitors. As the Japanese manufacturer ceases production of low-cost tires for gas-powered cars in the area this year, assembly lines in Europe will be the first to be changed to accept EV tires. Similar improvements are planned in the United States and Japan, and EV tire production is also expected in South America. The bulk of the company's 50 automobile tire facilities throughout the world will most likely be converted into EV tire manufacturers in the future.

Key Industry Developments in the EV Tires Market:

- In December 2021, the new ElectricDrive GT has been released by Goodyear Tire & Rubber Company. The Goodyear ElectricDrive GT is an ultra-high performance, all-season tire that provides EV drivers and passengers with long-lasting tread wear and a peaceful ride. It is Goodyear's first replacement tire tailored for electric vehicles (EVs) in North America.

- In February 2021, Michelin created and enhanced tire technology to increase vehicle propulsion noise reduction. Due to custom-developed polyurethane foam that keeps the annoyances out of the cockpit, it reduces road noise even more with a 20% quieter composition. There are no carbon emissions from this tire technology. Michelin's e Primacy and Pilot Sport EV tires, designed for high-performance and sports electric vehicles, are designed to solve these unique challenges.

COVID-19 Impact on the EV Tires Market:

The COVID-19 epidemic has struck devastation throughout the world, with over 55 million infections and counting. Because demand for tires has nearly gone during the lockdown, tire makers' inventories have climbed to one month's worth of manufacturing, the greatest level ever, with producers looking on methods to minimize hoarding, such as production reduction. While the Pandemic has been kept under control in China and Southeast Asian nations like Singapore, several countries in Europe have been affected by the second and even third waves, resulting in lockdowns. In the United States, the world's worst-affected country, the number of infections is on the rise. The effect of the economic crisis, which is expected to last for a long time, has spread over the automobile sector, with supply chains and operations taking a significant hit. According to a study expert, the global automobile sector is anticipated to shrink by 22%. According to McKinsey, the world's top 20 automakers are expected to lose as much as $100 billion in earnings in 2020 alone. This is bad news for an industry that is already trying to adapt to shifting customer needs, and it's unclear what the long-term consequences will be. The automotive industry in China has seen volatile fortunes: many car dealerships were forced to close in the early months of the pandemic, resulting in a 60 percent drop in customer visits compared to the previous year, while the closure of Chinese auto OEM factories had a rippling effect that was eventually felt throughout the global supply chain. Any changes in the automotive scene are bound to have a significant impact on the tire sector. According to a study, the EV tire industry's top-line growth rates are predicted to decline dramatically, with a recovery starting only in 2021.

|

Global EV Tires Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD XXX Bn. |

|

Forecast Period 2022-28 CAGR: |

XXX% |

Market Size in 2028: |

USD XXX Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Propulsion |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Propulsion

3.3 By Distribution Channels

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: EV Tires Market by Type

5.1 EV Tires Market Overview Snapshot and Growth Engine

5.2 EV Tires Market Overview

5.3 Radial Tires

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Radial Tires: Grographic Segmentation

5.4 Bias Tires

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Bias Tires: Grographic Segmentation

5.5 Composite Tires

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Composite Tires: Grographic Segmentation

Chapter 6: EV Tires Market by Propulsion

6.1 EV Tires Market Overview Snapshot and Growth Engine

6.2 EV Tires Market Overview

6.3 BEV

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 BEV: Grographic Segmentation

6.4 HEV

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 HEV: Grographic Segmentation

6.5 PHEV

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 PHEV: Grographic Segmentation

Chapter 7: EV Tires Market by Distribution Channels

7.1 EV Tires Market Overview Snapshot and Growth Engine

7.2 EV Tires Market Overview

7.3 OEM

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 OEM: Grographic Segmentation

7.4 Aftermarket

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Aftermarket: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 EV Tires Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 EV Tires Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 EV Tires Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 THE GOODYEAR TIRE & RUBBER COMPANY

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 CONTINENTAL AG

8.4 BRIDGESTONE CORPORATION

8.5 PIRELLI & C. S.P.A

8.6 YOKOHAMA RUBBER COMPANY LTD.

8.7 HANKOOK TIRE & TECHNOLOGY GROUP

8.8 MICHELIN GROUP

8.9 KUMHO TIRE COMPANY INC.

8.10 TOYO TIRE CORPORATION

8.11 GITI TIRE

8.12 OTHER MAJOR PLAYERS

Chapter 9: Global EV Tires Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Radial Tires

9.2.2 Bias Tires

9.2.3 Composite Tires

9.3 Historic and Forecasted Market Size By Propulsion

9.3.1 BEV

9.3.2 HEV

9.3.3 PHEV

9.4 Historic and Forecasted Market Size By Distribution Channels

9.4.1 OEM

9.4.2 Aftermarket

Chapter 10: North America EV Tires Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Radial Tires

10.4.2 Bias Tires

10.4.3 Composite Tires

10.5 Historic and Forecasted Market Size By Propulsion

10.5.1 BEV

10.5.2 HEV

10.5.3 PHEV

10.6 Historic and Forecasted Market Size By Distribution Channels

10.6.1 OEM

10.6.2 Aftermarket

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe EV Tires Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Radial Tires

11.4.2 Bias Tires

11.4.3 Composite Tires

11.5 Historic and Forecasted Market Size By Propulsion

11.5.1 BEV

11.5.2 HEV

11.5.3 PHEV

11.6 Historic and Forecasted Market Size By Distribution Channels

11.6.1 OEM

11.6.2 Aftermarket

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific EV Tires Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Radial Tires

12.4.2 Bias Tires

12.4.3 Composite Tires

12.5 Historic and Forecasted Market Size By Propulsion

12.5.1 BEV

12.5.2 HEV

12.5.3 PHEV

12.6 Historic and Forecasted Market Size By Distribution Channels

12.6.1 OEM

12.6.2 Aftermarket

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa EV Tires Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Radial Tires

13.4.2 Bias Tires

13.4.3 Composite Tires

13.5 Historic and Forecasted Market Size By Propulsion

13.5.1 BEV

13.5.2 HEV

13.5.3 PHEV

13.6 Historic and Forecasted Market Size By Distribution Channels

13.6.1 OEM

13.6.2 Aftermarket

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America EV Tires Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Radial Tires

14.4.2 Bias Tires

14.4.3 Composite Tires

14.5 Historic and Forecasted Market Size By Propulsion

14.5.1 BEV

14.5.2 HEV

14.5.3 PHEV

14.6 Historic and Forecasted Market Size By Distribution Channels

14.6.1 OEM

14.6.2 Aftermarket

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global EV Tires Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD XXX Bn. |

|

Forecast Period 2022-28 CAGR: |

XXX% |

Market Size in 2028: |

USD XXX Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Propulsion |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. EV TIRES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. EV TIRES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. EV TIRES MARKET COMPETITIVE RIVALRY

TABLE 005. EV TIRES MARKET THREAT OF NEW ENTRANTS

TABLE 006. EV TIRES MARKET THREAT OF SUBSTITUTES

TABLE 007. EV TIRES MARKET BY TYPE

TABLE 008. RADIAL TIRES MARKET OVERVIEW (2016-2028)

TABLE 009. BIAS TIRES MARKET OVERVIEW (2016-2028)

TABLE 010. COMPOSITE TIRES MARKET OVERVIEW (2016-2028)

TABLE 011. EV TIRES MARKET BY PROPULSION

TABLE 012. BEV MARKET OVERVIEW (2016-2028)

TABLE 013. HEV MARKET OVERVIEW (2016-2028)

TABLE 014. PHEV MARKET OVERVIEW (2016-2028)

TABLE 015. EV TIRES MARKET BY DISTRIBUTION CHANNELS

TABLE 016. OEM MARKET OVERVIEW (2016-2028)

TABLE 017. AFTERMARKET MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA EV TIRES MARKET, BY TYPE (2016-2028)

TABLE 019. NORTH AMERICA EV TIRES MARKET, BY PROPULSION (2016-2028)

TABLE 020. NORTH AMERICA EV TIRES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 021. N EV TIRES MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE EV TIRES MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE EV TIRES MARKET, BY PROPULSION (2016-2028)

TABLE 024. EUROPE EV TIRES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 025. EV TIRES MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC EV TIRES MARKET, BY TYPE (2016-2028)

TABLE 027. ASIA PACIFIC EV TIRES MARKET, BY PROPULSION (2016-2028)

TABLE 028. ASIA PACIFIC EV TIRES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 029. EV TIRES MARKET, BY COUNTRY (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA EV TIRES MARKET, BY TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA EV TIRES MARKET, BY PROPULSION (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA EV TIRES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 033. EV TIRES MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOUTH AMERICA EV TIRES MARKET, BY TYPE (2016-2028)

TABLE 035. SOUTH AMERICA EV TIRES MARKET, BY PROPULSION (2016-2028)

TABLE 036. SOUTH AMERICA EV TIRES MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 037. EV TIRES MARKET, BY COUNTRY (2016-2028)

TABLE 038. THE GOODYEAR TIRE & RUBBER COMPANY: SNAPSHOT

TABLE 039. THE GOODYEAR TIRE & RUBBER COMPANY: BUSINESS PERFORMANCE

TABLE 040. THE GOODYEAR TIRE & RUBBER COMPANY: PRODUCT PORTFOLIO

TABLE 041. THE GOODYEAR TIRE & RUBBER COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. CONTINENTAL AG: SNAPSHOT

TABLE 042. CONTINENTAL AG: BUSINESS PERFORMANCE

TABLE 043. CONTINENTAL AG: PRODUCT PORTFOLIO

TABLE 044. CONTINENTAL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. BRIDGESTONE CORPORATION: SNAPSHOT

TABLE 045. BRIDGESTONE CORPORATION: BUSINESS PERFORMANCE

TABLE 046. BRIDGESTONE CORPORATION: PRODUCT PORTFOLIO

TABLE 047. BRIDGESTONE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. PIRELLI & C. S.P.A: SNAPSHOT

TABLE 048. PIRELLI & C. S.P.A: BUSINESS PERFORMANCE

TABLE 049. PIRELLI & C. S.P.A: PRODUCT PORTFOLIO

TABLE 050. PIRELLI & C. S.P.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. YOKOHAMA RUBBER COMPANY LTD.: SNAPSHOT

TABLE 051. YOKOHAMA RUBBER COMPANY LTD.: BUSINESS PERFORMANCE

TABLE 052. YOKOHAMA RUBBER COMPANY LTD.: PRODUCT PORTFOLIO

TABLE 053. YOKOHAMA RUBBER COMPANY LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. HANKOOK TIRE & TECHNOLOGY GROUP: SNAPSHOT

TABLE 054. HANKOOK TIRE & TECHNOLOGY GROUP: BUSINESS PERFORMANCE

TABLE 055. HANKOOK TIRE & TECHNOLOGY GROUP: PRODUCT PORTFOLIO

TABLE 056. HANKOOK TIRE & TECHNOLOGY GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. MICHELIN GROUP: SNAPSHOT

TABLE 057. MICHELIN GROUP: BUSINESS PERFORMANCE

TABLE 058. MICHELIN GROUP: PRODUCT PORTFOLIO

TABLE 059. MICHELIN GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. KUMHO TIRE COMPANY INC.: SNAPSHOT

TABLE 060. KUMHO TIRE COMPANY INC.: BUSINESS PERFORMANCE

TABLE 061. KUMHO TIRE COMPANY INC.: PRODUCT PORTFOLIO

TABLE 062. KUMHO TIRE COMPANY INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. TOYO TIRE CORPORATION: SNAPSHOT

TABLE 063. TOYO TIRE CORPORATION: BUSINESS PERFORMANCE

TABLE 064. TOYO TIRE CORPORATION: PRODUCT PORTFOLIO

TABLE 065. TOYO TIRE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. GITI TIRE: SNAPSHOT

TABLE 066. GITI TIRE: BUSINESS PERFORMANCE

TABLE 067. GITI TIRE: PRODUCT PORTFOLIO

TABLE 068. GITI TIRE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 069. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 070. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 071. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. EV TIRES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. EV TIRES MARKET OVERVIEW BY TYPE

FIGURE 012. RADIAL TIRES MARKET OVERVIEW (2016-2028)

FIGURE 013. BIAS TIRES MARKET OVERVIEW (2016-2028)

FIGURE 014. COMPOSITE TIRES MARKET OVERVIEW (2016-2028)

FIGURE 015. EV TIRES MARKET OVERVIEW BY PROPULSION

FIGURE 016. BEV MARKET OVERVIEW (2016-2028)

FIGURE 017. HEV MARKET OVERVIEW (2016-2028)

FIGURE 018. PHEV MARKET OVERVIEW (2016-2028)

FIGURE 019. EV TIRES MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 020. OEM MARKET OVERVIEW (2016-2028)

FIGURE 021. AFTERMARKET MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA EV TIRES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE EV TIRES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC EV TIRES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA EV TIRES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA EV TIRES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the EV Tires Market research report is 2022-2028.

The Goodyear Tire & Rubber Company, Continental AG, Bridgestone Corporation, Pirelli & C. S.p.A, Yokohama Rubber Company Ltd., Hankook Tire & Technology Group, Michelin Group, Kumho Tire Company Inc., Toyo Tire Corporation, GITI Tire, and other major players.

The EV Tires Market is segmented into Type, Propulsion, Distribution Channels, and region. By Type, the market is categorized into Radial Tires, Bias Tires, and Composite Tires. By Propulsion, the market is categorized into BEV, HEV, and PHEV. By Distribution Channels, the market is categorized into OEM, and Aftermarket. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The tires on electric vehicles may resemble those on fossil-fuel vehicles. They are, nonetheless, dissimilar in terms of manufacturing components.

The EV Tire Market is expected to grow at a significant growth rate, and the analysis period is 2022-2028, considering base year as 2021.