Insuretech Market Synopsis

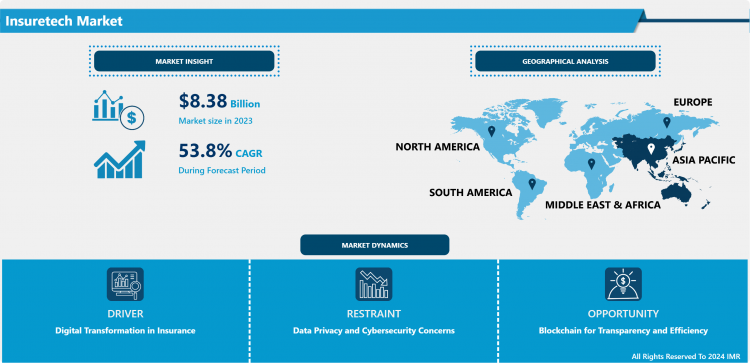

Insuretech Market Size Was Valued at USD 8.38 Billion in 2023 and is Projected to Reach USD 403.61 Billion by 2032, Growing at a CAGR of 53.80% From 2024-2032.

Insuretech also known as insurance technology is a term that indicates the use of technological solutions in streamlining insurance services to clients. They cut across all aspects of underwriting through artificial intelligence, policy management via electronic standards, smart gadgets that assist in risk evaluation, and the blockchain technology used in secure transactions and overall claims management. Insuretech has the vision of improving and enhancing all insurance processes, including cutting down costs and allowing clients to have a custom insurance that is most suitable for them, which in turn overcomes some traditional insurance market obstacles and creates a new, more efficient system.

- The insuretech market may be described as an exciting market that focuses on employing technology in innovation to disrupt insurance. This emerging segment can be underpinned by the modern digital technologies like AI, big data, IoT, and blockchain with up-and-coming players and traditional insurers testing the possibilities of extracting value from digital solutions for clients, processes, and risk management.

- This is probably one of the key factors that has seen the insuretech industry experience tremendous growth; it can solve major preexisting problems within this sector. Some of the issues that have been mentioned are, outdated procedures, the fact that banks have large and complex supporting IT structures, and they are generally seen as companies that take a long time to change with the times. Unlike traditional insurance companies, insuretech firms are still flexible and adaptable in the market while applying technology, which makes them improve internal processes and bring more effective underwriting with the personalized option to provide their clients.

- Improve customer experience is at the center of insurance innovation through insuretechnology. E-shops, web portals and mobile applications also reducing the complication of purchasing various policies, receiving quotes within minutes and also claiming in case of mishappening. This change in focus to becoming more customer friendly not only has the main benefit of better serving the needs of policyholders but also has positive secondary effects in terms of trust between insurance companies and consumers.

- Furthermore, data analytics can be said to be essential to the growth of insuretech as well. They have started relying on vast stores of data from social networks and other connected devices as well as public records, to adjust risk estimations and policy premiums more effectively. Not only does this type of examination prove useful in improving underwriting precision, but it is also helps insurers to provide products that reflect actual behavioral characteristics and preferences.

- The second revolutionary change is in the context of parametric insurance and micro-insurance, which are products of insuretech. Parametric insurance is based on clearly stipulated factors that can potentially cause losses, for example, extreme weather conditions or earthquake activities, and it pays out the claim immediately, unlike non-parametric insurance. Micro insurance, on the other hand, is an insurance product that delivers low price point insurance for a specific risks which is usually designed to reach mom and pop shop, and other potential policyholders in a developing country.

- Equally notable is the burgeoning application of blockchain in insuretech where it ensures enhanced, secure, and rapid implementation of the transactions besides minimizing fraud. Another aspect is that claim payments may be automatically processed and paid through smart contracts, reducing the timeframe of the claim to be processed as well as possible contention or need for further administrative work.

- As much as the insuretech market has been on the rise and insuring various companies and entities, the market has some of these problems. Legal and privacy regimes, the role of incumbent players and distrust between disruptors and incumbents are some of the issues which are sensitive and need to be managed well. Moreover, consumers need to have faith in the products and their potential use in their everyday lives when obtaining innovative solutions.

- As for what the future might hold for the insuretech market, it seems to be heading in a positive direction. The further development of technologies such as AI, machine learning, and other forms of predictive analytics will continue to fine-tune these risk management executions while also improving operational functions. Witnessing the ongoing evolution of insuretech, we see them diversifying their portfolio of services, pursuing even more progressive opportunities, including such ones as cyber insurance, P2P insurance, and on-demand kinds of insurance.

- Therefore, it can be said that insuretech is one of the most significant trends in the insurance market that emerges due to the desire to contribute to consumer satisfaction and positive change. Over the years, and particularly over the next decade the means we will have to work collectively, to innovate and adapt to meet the ever changing needs of consumers in a fast moving digital world.

Insuretech Market Trend Analysis

Digital Transformation and Customer Experience

- The Insuretech market is in the process of experiencing a great deal of change today due to advancements in the digital fronts that promise greater customer satisfaction. Some of the insuretech trends include applying artificial intelligence, machine learning, and data analytics to enhance new features, product and service customization, and user interactions. Here, digital transformation includes the implementation of claim processing robotics, statistical methodologies for risk evaluation, and clients’ friendly handling applications for mobile devices. These innovations do not only help insurers to enhance the efficiency of their processes but they also allow insurers to provide their clientele with better services that are more relevant to their needs. Client satisfaction is also another area of emphasis by the Insuretech firms, where the emphasis is placed on developing cohesive and easy to use interface to allow for easy purchasing of an insurance policy, filing of a claim and management of a policy.

- Furthermore, the interconnectivity of IoT devices and the adoption of real-time data means that insurers can now develop and implement usage-based insurance and risk management solutions that not only increase customer satisfaction but also loyalty. With the progressive advancement of Insuretech, the elements of digital business integration and customer oriented services are expected to contribute significantly towards the outlook of this domain and competitiveness in the insurance market.

Blockchain for Transparency and Efficiency

- The application of the blockchain is mostly perceived within the insuretech market, driven by the potential to increase transparency and streamline processes. Blockchain’s immutability allows insurers to implement this technology to manage claims and identify potential frauds in first-party insurance and underwriting. The certainty of the interaction that is provided by the blockchain provides the same trusted data to insurers, reinsurers and the customers in real-time eliminating potential for doubt and conflict between the insurance partners. The use of smart contracts that run on blockchain extends the automation and fortification of the insurance procedures so as to ensure that the operation of the insurance payout and the actual delay happening during the claims procedure is minimized.

- Moreover, it empowers the formation of parametric insurance contracts that provide payouts relating to pre-stipulated criteria based on climate information or measurements gathered by IOT sensors, which improves organizational procedures and patrons’ satisfaction. In this context, it can be stated that blockchain is the critical technology which enables insuretech to push for the next paradigm shift within the industry and offer a solid framework for transforming the existing insurance services..

Insuretech Market Segment Analysis:

Insuretech Market Segmented based on Type, Service, Technology and End-User.

By Type, Auto segment is expected to dominate the market during the forecast period

- Insuretech market can be subdivided based on the various types that target different aspects of insurance technology advancements and the clients. Auto insurance as a segment of Insuretech is studying the usage of telematics, AI technologies and solutions for promoting more accurate pricing, risk assessment and an increased level of engagement with customers via mobile apps and real-time information. The experimentation with Insuretech is seen in business insurance that has realized the use of the blockchain to support claim transparency and smart contracts as well as using artificial intelligence to support risk modeling and underwriting. Health insurance is expanding through the use of wearable devices integration and artificial intelligent diagnostics and it targets to have efficient claims processing which will in turn enhance the health of the customers. Automobile insurance is using IoT devices for tracking the real-time conditions of the car and vehicles like bikes, accident-prone zones, and preventing the occurrence of such cases by using predictive analytics to help customers and cut down premiums.

- Cyber insurance is one of the developing specialty insurance areas where AI helps in evaluating and managing digital threats; this generates suitable products for firms’ security demands. Real-time compensation for flight delays as well as digital claims within travel insurance which is in the Insuretech sector is also adopting innovations that satisfies the need of the customers. Other subcategories in Insuretech refer to other current fields such as the peer-to-peer insurance and climate risk management as Insuretech innovation adopt use of AI and big data analytics to meet the changing consumer needs and standards, and adhere to the ever changing regulations. All in all, featured with the segmentation by type, Insuretech signifies a shifting paradigm in the field of insurance sector where technology is being adapted in order to bring innovations in the operational model, services, and risk management strategies of incumbent insurance firms in the digital world.

By Technology , IOT segment held the largest share in 2023

- Insuring market especially the Insurtech is undergoing revolutionary change due to some key technologies. Through tokenization and decentralization, blockchain brings improvements to insurance business processes in terms of transparency, security, and accelerated processing of transactions and claims. As for the seventh item, cloud computing is allowing insurers enhance efficiency by relying on the usage of flexible infrastructure and storage. With the help of IoT (Internet of Things), usage-based insurance models are being employed and risks can be evaluated in real time by assessing data gathered through connected devices. Machine learning is changing underwriting and claims management through automation of risk evaluation and identification of three fraud, including various price structures based on large datasets.

- Advisory services are creating customer value and improving client interactions and satisfaction by offering tailored advice and automating investment and insurance advice. Altogether, these technologies help to transform the Insurtech landscape by encouraging innovation and enhancing effectiveness while satisfying the changing demands of digital consumers and extending product personalization. As Insurtech progresses and matures, these technologies will be increasingly important in facilitating market development and defining the future of the insurance industry.

Insuretech Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region could be poised to lead in the InsurTech market in the coming years. This projection is based on several factors such as the high growth rate in technologies, the continuous expansion in the adoption and development of the digital platforms, the growing trends of embracing digital solutions across industries including insurance and many others. The APAC region’s nations like China, India, SEA, etc. , are experiencing a tremendous upswing in the internet usage rate, mobile phone use, and an increase in the IT-literate population. These trends are creating a favorable environment in InsurTech that helps insurers integrate different technologies such as AI, machine learning, blockchain and big data to improve the customer experience, operational effectiveness and create new product offering in the insurance sector.

- Further, the legislative efforts to embrace fintech and InsurTech and growing investment from local and global venture capital players in the region are working in tandem to strengthen the InsurTech market in the region. Consequently Asia Pacific is expected to not only capture the largest share in the InsurTech market but also define future trends for the global InsurTech market growth and development in the years to come.

Active Key Players in the Insuretech Market

- Damco Group (India)

- DXC Technology Company (United States)

- Insurance Technology Services (United States)

- Majesco (United States)

- Oscar Insurance (United States)

- Quantemplate (United Kingdom)

- Shift Technology (France)

- Trōv, Inc. (United States)

- Wipro Limited (India)

- ZhongAn Insurance (China) and Other Major Players

Key Industry Developments in the Insuretech Market

- In March 2024, CNB Bank & Trust (CIBC) and Insuritas partnered to launch an embedded full-service insurance agency. Insuritas is proud to announce that it has been chosen by CIBC to install its award-winning, fully-functioning digital insurance agency solution. BUNDLE is Insuritas' award-winning, full-functioning insurance agency platform embedded in CIBC's ecosystem and engineered to provide a complete solution for CIBC's retail and commercial clients.

- In June 2023, Clover Health Investments Corp., a leading provider of physician enablement services with a mission to improve Medicare access to quality healthcare, announced that it had reached a partnership agreement in principle to settle seven derivative lawsuits that are pending in the courts of Delaware and New York, as well as in the courts of Tennessee.

|

Global Insuretech Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 8.38 Bn. |

|

Forecast Period 2024-32 CAGR: |

53.80% |

Market Size in 2032: |

USD 403.61 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Service |

|

||

|

By Technology |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Insuretech Market by Type

4.1 Insuretech Market Snapshot and Growth Engine

4.2 Insuretech Market Overview

4.3 Auto

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Auto: Geographic Segmentation Analysis

4.4 Business

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Business: Geographic Segmentation Analysis

4.5 Health

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Health: Geographic Segmentation Analysis

4.6 Home

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Home: Geographic Segmentation Analysis

4.7 Specialty

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Specialty: Geographic Segmentation Analysis

4.8 Travel

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Travel: Geographic Segmentation Analysis

4.9 Others

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Others: Geographic Segmentation Analysis

Chapter 5: Insuretech Market by Service

5.1 Insuretech Market Snapshot and Growth Engine

5.2 Insuretech Market Overview

5.3 Consulting

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Consulting: Geographic Segmentation Analysis

5.4 Support & Maintenance

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Support & Maintenance: Geographic Segmentation Analysis

5.5 Managed Services

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Managed Services: Geographic Segmentation Analysis

Chapter 6: Insuretech Market by technology

6.1 Insuretech Market Snapshot and Growth Engine

6.2 Insuretech Market Overview

6.3 Blockchain

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Blockchain: Geographic Segmentation Analysis

6.4 Cloud Computing

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Cloud Computing: Geographic Segmentation Analysis

6.5 IoT

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 IoT: Geographic Segmentation Analysis

6.6 Machine Learning

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Machine Learning: Geographic Segmentation Analysis

6.7 Robo Advisory

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Robo Advisory: Geographic Segmentation Analysis

6.8 Others

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Others: Geographic Segmentation Analysis

Chapter 7: Insuretech Market by End-use

7.1 Insuretech Market Snapshot and Growth Engine

7.2 Insuretech Market Overview

7.3 Automotive

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Automotive: Geographic Segmentation Analysis

7.4 BFSI

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 BFSI: Geographic Segmentation Analysis

7.5 Government

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Government: Geographic Segmentation Analysis

7.6 Healthcare

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Healthcare: Geographic Segmentation Analysis

7.7 Manufacturing

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Manufacturing: Geographic Segmentation Analysis

7.8 Retail

7.8.1 Introduction and Market Overview

7.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.8.3 Key Market Trends, Growth Factors and Opportunities

7.8.4 Retail: Geographic Segmentation Analysis

7.9 Transportation

7.9.1 Introduction and Market Overview

7.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.9.3 Key Market Trends, Growth Factors and Opportunities

7.9.4 Transportation: Geographic Segmentation Analysis

7.10 Others

7.10.1 Introduction and Market Overview

7.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.10.3 Key Market Trends, Growth Factors and Opportunities

7.10.4 Others: Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Insuretech Market Share by Manufacturer (2023)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 DAMCO GROUP (INDIA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DXC TECHNOLOGY COMPANY (UNITED STATES)

8.4 INSURANCE TECHNOLOGY SERVICES (UNITED STATES)

8.5 MAJESCO (UNITED STATES)

8.6 OSCAR INSURANCE (UNITED STATES)

8.7 QUANTEMPLATE (UNITED KINGDOM)

8.8 SHIFT TECHNOLOGY (FRANCE)

8.9 TRŌV INC (UNITED STATES)

8.10 WIPRO LIMITED (INDIA)

8.11 ZHONGAN INSURANCE (CHINA)

Chapter 9: Global Insuretech Market By Region

9.1 Overview

9.2. North America Insuretech Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By Type

9.2.4.1 Auto

9.2.4.2 Business

9.2.4.3 Health

9.2.4.4 Home

9.2.4.5 Specialty

9.2.4.6 Travel

9.2.4.7 Others

9.2.5 Historic and Forecasted Market Size By Service

9.2.5.1 Consulting

9.2.5.2 Support & Maintenance

9.2.5.3 Managed Services

9.2.6 Historic and Forecasted Market Size By technology

9.2.6.1 Blockchain

9.2.6.2 Cloud Computing

9.2.6.3 IoT

9.2.6.4 Machine Learning

9.2.6.5 Robo Advisory

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size By End-use

9.2.7.1 Automotive

9.2.7.2 BFSI

9.2.7.3 Government

9.2.7.4 Healthcare

9.2.7.5 Manufacturing

9.2.7.6 Retail

9.2.7.7 Transportation

9.2.7.8 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Insuretech Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By Type

9.3.4.1 Auto

9.3.4.2 Business

9.3.4.3 Health

9.3.4.4 Home

9.3.4.5 Specialty

9.3.4.6 Travel

9.3.4.7 Others

9.3.5 Historic and Forecasted Market Size By Service

9.3.5.1 Consulting

9.3.5.2 Support & Maintenance

9.3.5.3 Managed Services

9.3.6 Historic and Forecasted Market Size By technology

9.3.6.1 Blockchain

9.3.6.2 Cloud Computing

9.3.6.3 IoT

9.3.6.4 Machine Learning

9.3.6.5 Robo Advisory

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size By End-use

9.3.7.1 Automotive

9.3.7.2 BFSI

9.3.7.3 Government

9.3.7.4 Healthcare

9.3.7.5 Manufacturing

9.3.7.6 Retail

9.3.7.7 Transportation

9.3.7.8 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Bulgaria

9.3.8.2 The Czech Republic

9.3.8.3 Hungary

9.3.8.4 Poland

9.3.8.5 Romania

9.3.8.6 Rest of Eastern Europe

9.4. Western Europe Insuretech Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By Type

9.4.4.1 Auto

9.4.4.2 Business

9.4.4.3 Health

9.4.4.4 Home

9.4.4.5 Specialty

9.4.4.6 Travel

9.4.4.7 Others

9.4.5 Historic and Forecasted Market Size By Service

9.4.5.1 Consulting

9.4.5.2 Support & Maintenance

9.4.5.3 Managed Services

9.4.6 Historic and Forecasted Market Size By technology

9.4.6.1 Blockchain

9.4.6.2 Cloud Computing

9.4.6.3 IoT

9.4.6.4 Machine Learning

9.4.6.5 Robo Advisory

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size By End-use

9.4.7.1 Automotive

9.4.7.2 BFSI

9.4.7.3 Government

9.4.7.4 Healthcare

9.4.7.5 Manufacturing

9.4.7.6 Retail

9.4.7.7 Transportation

9.4.7.8 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 Netherlands

9.4.8.5 Italy

9.4.8.6 Russia

9.4.8.7 Spain

9.4.8.8 Rest of Western Europe

9.5. Asia Pacific Insuretech Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By Type

9.5.4.1 Auto

9.5.4.2 Business

9.5.4.3 Health

9.5.4.4 Home

9.5.4.5 Specialty

9.5.4.6 Travel

9.5.4.7 Others

9.5.5 Historic and Forecasted Market Size By Service

9.5.5.1 Consulting

9.5.5.2 Support & Maintenance

9.5.5.3 Managed Services

9.5.6 Historic and Forecasted Market Size By technology

9.5.6.1 Blockchain

9.5.6.2 Cloud Computing

9.5.6.3 IoT

9.5.6.4 Machine Learning

9.5.6.5 Robo Advisory

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size By End-use

9.5.7.1 Automotive

9.5.7.2 BFSI

9.5.7.3 Government

9.5.7.4 Healthcare

9.5.7.5 Manufacturing

9.5.7.6 Retail

9.5.7.7 Transportation

9.5.7.8 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Insuretech Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By Type

9.6.4.1 Auto

9.6.4.2 Business

9.6.4.3 Health

9.6.4.4 Home

9.6.4.5 Specialty

9.6.4.6 Travel

9.6.4.7 Others

9.6.5 Historic and Forecasted Market Size By Service

9.6.5.1 Consulting

9.6.5.2 Support & Maintenance

9.6.5.3 Managed Services

9.6.6 Historic and Forecasted Market Size By technology

9.6.6.1 Blockchain

9.6.6.2 Cloud Computing

9.6.6.3 IoT

9.6.6.4 Machine Learning

9.6.6.5 Robo Advisory

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size By End-use

9.6.7.1 Automotive

9.6.7.2 BFSI

9.6.7.3 Government

9.6.7.4 Healthcare

9.6.7.5 Manufacturing

9.6.7.6 Retail

9.6.7.7 Transportation

9.6.7.8 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkey

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Insuretech Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By Type

9.7.4.1 Auto

9.7.4.2 Business

9.7.4.3 Health

9.7.4.4 Home

9.7.4.5 Specialty

9.7.4.6 Travel

9.7.4.7 Others

9.7.5 Historic and Forecasted Market Size By Service

9.7.5.1 Consulting

9.7.5.2 Support & Maintenance

9.7.5.3 Managed Services

9.7.6 Historic and Forecasted Market Size By technology

9.7.6.1 Blockchain

9.7.6.2 Cloud Computing

9.7.6.3 IoT

9.7.6.4 Machine Learning

9.7.6.5 Robo Advisory

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size By End-use

9.7.7.1 Automotive

9.7.7.2 BFSI

9.7.7.3 Government

9.7.7.4 Healthcare

9.7.7.5 Manufacturing

9.7.7.6 Retail

9.7.7.7 Transportation

9.7.7.8 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Insuretech Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 8.38 Bn. |

|

Forecast Period 2024-32 CAGR: |

53.80% |

Market Size in 2032: |

USD 403.61 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Service |

|

||

|

By Technology |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Insuretech Market research report is 2024-2032.

Damco Group (India), DXC Technology Company (United States), Insurance Technology Services (United States), Majesco (United States), Oscar Insurance (United States), Quantemplate (United Kingdom), Shift Technology (France),and Other Major Players.

The Insuretech Market is segmented into Type, Service , Technology ,End Use and Region. By Type, the market is categorized into Auto, Business, Health, Home, Specialty, Travel, Others. By Service , the market is categorized into Consulting, Support & Maintenance, Managed Services. By Technology, the market is categorized into Blockchain, Cloud Computing,IoT, Machine Learning, Robo Advisory,Others. By End-use , the market is categorized into Automotive, BFSI, Government, Healthcare, Manufacturing, Retail, Transportation,Others.By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Insuretech also known as insurance technology is a term that indicates the use of technological solutions in streamlining insurance services to clients. They cut across all aspects of underwriting through artificial intelligence, policy management via electronic standards, smart gadgets that assist in risk evaluation, and the blockchain technology used in secure transactions and overall claims management. Insuretech has the vision of improving and enhancing all insurance processes, including cutting down costs and allowing clients to have a custom insurance that is most suitable for them, which in turn overcomes some traditional insurance market obstacles and creates a new, more efficient system.

Insuretech Market Size Was Valued at USD 8.38 Billion in 2023, and is Projected to Reach USD 403.61 Billion by 2032, Growing at a CAGR of 53.80% From 2024-2032.