Injectable Drug Delivery Devices Market Synopsis

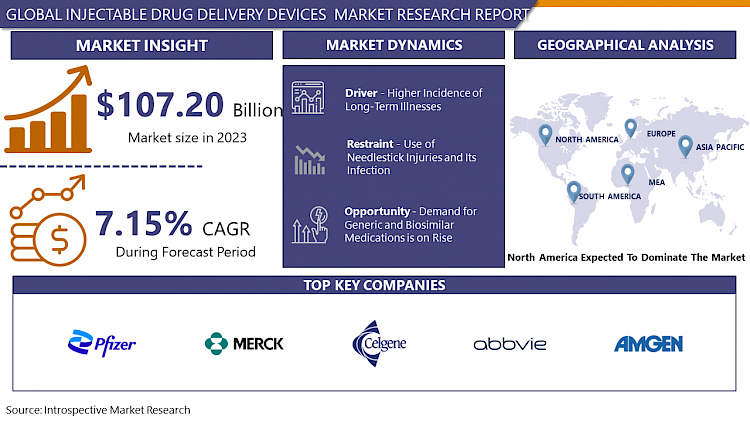

Injectable Drug Delivery Devices Market Size Was Valued at USD 107.20 Billion in 2023, and is Projected to Reach USD 199.58 Billion by 2032, Growing at a CAGR of 7.15% From 2024-2032.

The rise in the Injectable drug delivery sector is primarily attributed to advancements in technology, a rise in chronic illnesses, and an increase in government support. The increasing number of elderly people worldwide is driving an increase in the need for healthcare services and medications. Elderly individuals often have complex healthcare needs and may need injectable medications for chronic conditions, leading to the growth of the injectable drug delivery sector.

- Developing countries are experiencing fast urbanization, better healthcare facilities, and increased healthcare budgets, leading to increased availability of injectable drugs. Consequently, pharmaceutical companies are prioritizing expanding their footprint in these markets to boost market expansion. Needles, syringes, or specialized devices are used in the technology of injectable drug delivery to directly administer medication into the body, bypassing the digestive system. This technology plays a vital role in the treatment of autoimmune diseases, diabetes, and cancer. Improvements in injectable drug delivery systems have resulted in the development of needle-free injectors, auto-injectors, and wearable devices.

- The benefits, need, and expansion of injectable drug delivery technology are key factors in its rising popularity and market growth. The advantages of using it are accurate dosing, quick response, and enhanced drug efficacy, making it the preferred approach for administering medication. By administering drugs straight into the bloodstream, it avoids the digestive system, guaranteeing drug potency and effectiveness.

- The demand for injectable drug delivery technology is growing due to the increasing prevalence of chronic diseases like diabetes, cancer, and autoimmune disorders. This demand is also fuelled by user-friendly devices like auto-injectors and wearable injectors, which improve patient adherence. Furthermore, market growth is promoted by the development of specialized delivery systems needed for advancements in biologics and targeted therapies. Ongoing research and development activities to improve drug delivery devices, increase patient convenience, and meet emerging therapeutic needs also contribute to market expansion. Additionally, elements like increasing.

Injectable Drug Delivery Devices Market Trend Analysis

Higher Incidence of Long-Term Illnesses

- The rise of chronic illnesses such as diabetes, cancer, and autoimmune conditions is not only boosting the market for injectable drug delivery devices but also creating a mutually beneficial relationship. Chronic illnesses frequently need complicated treatment plans that can include several medicines, some with distinct administration instructions. For example, certain biologics utilized in treating autoimmune conditions break down in the stomach, making oral intake ineffective. Injectable drug delivery devices, like pre-filled syringes and auto-injectors, guarantee that these medications avoid the digestive system and go straight to their intended locations.

- Long-term medication use is often necessary for chronic conditions. Conventional methods of injecting can be scary and bothersome, resulting in lack of compliance. Injectable drug delivery tools such as pens and pumps provide convenient features and pre-set amounts, simplifying self-administration in the comfort of one's own home. This allows patients to manage their treatment, enhancing adherence and potentially resulting in improved clinical results.

- The emergence of personalized medicine is influencing the use of injectable drug delivery devices. Smart pens and pumps link with mobile applications to monitor medication consumption, track vital signs, and offer instant feedback to patients and healthcare professionals. Minor changes in medication can have a big impact on chronic illnesses. These devices enable customized dosing changes and improved monitoring of how well medications work, resulting in better results for patients.

- Major obstacles to medication adherence are fear of needles and pain from injections. Injectable drug delivery devices advancements focus on enhancing patient comfort. Needle-thinning innovations reduce injection discomfort, while additions such as automatic injection systems and built-in heating elements (for injectable pain medications) enhance the comfort of treatment. Moreover, needle guards on auto-injectors reduce the likelihood of needle-stick injuries for patients and healthcare workers, enhancing safety during the administration process. The market for injectable drug delivery is always changing. Scientists are investigating novel methods such as microneedle patches and implantable pumps for painless medication administration and regulated drug release.

Restraints

Use of Needlestick Injuries and Its Infection

- The market for injectable drug delivery devices, which revolutionizes chronic disease treatment, is navigating a delicate balance between innovation and the ongoing risk of needle-stick injuries (NSIs). Although these devices provide unmatched convenience and accuracy in delivering medication, the potential danger of accidental needle punctures from contaminated needles is a significant concern. Non-Sharp Injuries (NSIs) are not only associated with traditional syringes. The same characteristics that make these devices easy to use can also bring about additional complications. Auto-injectors simplify medication administration by including pre-filled cartridges and automatic injection mechanisms. Nevertheless, adequate training is required for these characteristics. If healthcare professionals and patients do not have a complete understanding of how to activate and dispose of procedures, they may be at a higher risk for accidental injuries.

- Another issue arises when devices need to be recapped with a needle after being used. This procedure, known for its high risk of NSIs, can be worrisome for healthcare facilities and individuals who self-administer at home, particularly when not done carefully. Patients who utilize pens or pumps for their chronic medications may accidentally harm themselves while handling or disposing of them. Fortunately, the market is not remaining inactive. Numerous tactics are currently being employed to reduce the risk of NSIs. Manufacturers are incorporating advanced safety features, such as automatic needle guards, into their devices. These clever devices automatically cover the needle once it has been used, effectively removing the possibility of accidental exposure.

- Thorough training programs are being introduced for healthcare providers and patients alike. These programs explore safe handling and disposal methods for each device, enabling users to reduce the chances of self-inflicted or accidental NSIs. Standardized training procedures guarantee uniform best practices in healthcare environments. Research and innovation are expanding the limits of injection technology. Jet injectors and microneedle patches are progressing quickly as needle-free delivery systems. These new techniques provide a preview of a future in which the advantages of injectable medications are administered without the use of needles.

Opportunity

Demand for Generic and Biosimilar Medications is on Rise

- The market for injectable drug delivery devices is growing rapidly due to a strong collaborative ecosystem and increasing demand for biosimilar and generic injectable drugs. Let's further explore this complex dance, where each part influences the others. Biosimilars are close biological copies of intricate medications, frequently employed for critical therapies in fields such as oncology and rheumatology. Generics are almost exact replicas of branded drugs, containing identical active components. Both biosimilars and generics provide great benefits: Biosimilars and generics offer considerable cost reductions when compared to brand-name drugs. This results in improved availability for patients who may face difficulties in paying for these important injectable medications.

- Healthcare systems can also experience advantages from these savings, enabling them to allocate resources towards a broader array of treatments. The increased presence of biosimilars and generics expands the range of treatments available. Healthcare professionals can now select medications based on the specific requirements, financial considerations, and the effectiveness of treatments for each patient. This individualized method enables more efficient and budget-friendly treatment strategies.

- The need for trained personnel for preparing and administering vials and syringes restricts patient autonomy and results in greater dependence on healthcare facilities for injections. This may cause inconvenience and disturb regular schedules, possibly resulting in non-compliance. Many patients experience genuine concerns about needle phobia and injection anxiety. Conventional injection techniques may worsen fear, discouraging patients from following important treatment plans, and potentially affecting treatment results.

- Using syringes for manual preparation increases the likelihood of dosage mistakes. Injectable drug delivery devices help address the problem of dosage errors, which can result in either reduced treatment effectiveness or an increased risk of side effects. They play a crucial role in meeting the growing need for biosimilars and generics while overcoming the limitations of traditional methods. Devices such as pens, and auto-injectors come pre-filled and are designed to be easy for users to use.

Challenges

Inclination Towards Alternative Drug Delivery Methods

- Despite its groundbreaking effect on managing chronic diseases, the injectable drug delivery device market is hindered by the preference for other drug delivery methods. Patients and healthcare providers may choose varying methods of administering treatment for various reasons. Now, let's further explore these rivalling techniques and grasp the difficulties they present for injectable devices. Oral medications reign supreme in terms of convenience. They are usually simple to take and give to oneself, which makes them a common option, particularly for patients who have a fear of needles or do not like getting injections. Oral drugs typically have decreased manufacturing and delivery expenses in contrast to injectable medications. This means that healthcare systems could save money by choosing oral options, which would be more appealing on a financial basis.

- Injectable delivery methods are significantly disadvantaged in cases where there are already successful oral medications available. Patients may focus on the convenience and cost efficiency of oral medications, which can limit the adoption of injectable devices in certain areas of therapy. Producers of injectable devices should concentrate on creating devices that provide notable benefits compared to oral medications, like enhanced bioavailability or precise delivery, to remain competitive.

- Topical creams and ointments provide targeted therapy, perfect for skin issues or managing localized pain. Compared to injections, they are frequently less invasive and more comfortable for patients. Topical medications reduce the likelihood of systemic side effects by mainly targeting the area of application, decreasing the chance of adverse effects in other areas of the body. Topical medications provide a non-surgical and focused option for skin conditions or localized pain, which may reduce the demand for injectable devices in these specific areas. Manufacturers of injectable devices should think about creating combination therapies or injectable formulations that provide extra advantages like quicker onset of action or better penetration into deeper tissues to rival topical treatments. Extended period by delivering the medication through the skin.

Injectable Drug Delivery Devices Market Segment Analysis:

Injectable Drug Delivery Devices market is segmented on the basis of Administration, Technology, Application, End users.

By Administration, Subcutaneous Segment Is Expected to Dominate the Market During the Forecast Period

- Administering medication subcutaneously is not only a convenient method, but also a precise coordination of technology and the body. A closer examination reveals that the subcutaneous layer, which is the focus of SubQ injections, is situated directly below the skin. This region contains numerous blood vessels and lymphatic channels, making it an ideal area for medication absorption. The SubQ delivery method allows for a gradual and consistent release of medication, which is made possible by the complex system of vessels in this layer. SubQ injections commonly involve the use of smaller needles in comparison to intramuscular injections. This diminishes discomfort and possible tissue harm. Moreover, progress in needle technology has resulted in the creation of bevelled needles that reduce pain and improve medication delivery.

- After being injected, the medication creates a small reservoir, known as a depot, in the subcutaneous tissue. This facility serves as a controlled-release mechanism, gradually releasing the medicine into the bloodstream over a period. Factors such as the properties of the medication and the type of formulation used determine the exact rate of release. The lymphatic system, which is responsible for draining fluids and supporting immune function, also has an impact. Certain medications can be partly taken in by the lymphatic system, impacting their general spread and possible immune reaction. Scientists are currently researching this interaction to improve SubQ delivery for different drugs.

- The SubQ delivery environment is always changing. Prefilled syringes and autoinjectors have transformed how patients self-administer medication, improving ease of use and precision. Moreover, scientists are investigating new methods of delivery such as microneedles, which are less invasive and may improve patient comfort and adherence. Understanding this complex interaction between technology and the body allows us to recognize the effectiveness and possibilities of Subcutaneous administration. It demonstrates scientific creativity by utilizing the body's own mechanisms to deliver drugs in an effective and regulated manner.

By Technology, Conventional Syringes Segment Held the Largest Share In 2023

- The conventional syringes segment held the biggest market share in the Injectable Drug Delivery Devices Market by technology. Conventional syringes, recognized for their ease of use and versatility, have been a popular choice for administering medications for a long time. Several factors are responsible for their high prevalence.

- Conventional syringes provide a simple and affordable way to give medications in different healthcare environments. Their convenience makes them appropriate for healthcare professionals and patients alike, resulting in broad acceptance. conventional syringes guarantee exact dosage delivery, making it easier to administer medication accurately, especially for drugs with specific dosing needs. Moreover, the market dominance of conventional syringes is influenced by the familiarity and established infrastructure linked to them. Healthcare professionals are skilled at using it, with healthcare facilities often having the required equipment on hand, which helps boost their widespread use.

- These constraints are fuelling creativity in the field of injectable drug delivery technology. The future is dependent on finding solutions to these weaknesses. Safety syringes equipped with needle guards are starting to become popular, reducing the chance of needle stick accidents. Autoinjectors provide a more convenient and possibly less painful option for patients, enhancing their willingness to stick to treatment regimens. Moreover, research is being conducted on improving needle design and materials to reduce discomfort. Although conventional syringes will still be used in certain cases, they are paving the path for new drug delivery technologies that focus on safety, patient comfort, and environmental sustainability. The future of delivering injectable drugs depends on not only effectively delivering medication but also on ensuring a safe and convenient user experience.

Injectable Drug Delivery Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is dealing with a substantial challenge of chronic illnesses such as diabetes, cancer, and heart disease. Typically, these situations necessitate the ongoing use of injectable medications for an extended period. The constant need for efficient and convenient delivery devices is a result of the high prevalence. Picture a significant market for devices that help administer injectable medications due to a sizable population constantly requiring them. North America has a strong pharmaceutical research and development (R&D) system. This results in a continuous flow of newly created injectable drugs. However, innovation does not end at that point. In addition, the area supports the creation of advanced delivery tools alongside fresh medications. The ongoing development of fresh treatment choices and their corresponding delivery mechanisms drives market expansion.

- Governments in North America frequently take an active role in healthcare. They could put in place measures to promote the use of new medical technologies, such as injectable drug delivery devices. This may include providing financial support for studies, simplifying the process of approvals, or giving rewards to medical professionals who utilize these products. Government assistance provides a conducive atmosphere for the market to thrive. North American nations typically allocate more funds towards healthcare in comparison to other areas. This results in more money for patients and healthcare providers to spend on advanced, possibly pricier, delivery devices. With increased funding in the healthcare sector, there is a higher potential to implement these cutting-edge technologies.

- North America is currently the leader, with a dynamic future ahead in this market. Consider these factors: Emerging Markets are on the rise with regions such as Asia Pacific experiencing fast economic expansion and an increasingly older population. This could result in a higher need for injectable medications and delivery tools, possibly posing a threat to North American control in the future. Advancements in technology and potential cost reductions may lead to increased availability of injectable drug delivery devices in different areas, influencing market share.

Injectable Drug Delivery Devices Market Active Players

- Pfizer Inc. (US)

- Merck & Co., Inc. (US)

- Johnson & Johnson (US)

- AbbVie (US)

- Novartis AG (Switzerland)

- Bristol Myers Squibb (US)

- Eli Lilly and Company (US)

- Gilead Sciences, Inc. (US)

- Amgen Inc. (US)

- Seagen Inc. (US)

- Celgene Corporation (US)

- Boehringer Ingelheim GmbH (Germany)

- Fresenius SE & Co. KGaA (Germany)

- AstraZeneca PLC (UK)

- Sanofi (France)

- GlaxoSmithKline plc (UK)

- Bayer AG (Germany)

- Shionogi & Co., Ltd. (Japan)

- Takeda Pharmaceutical Company Limited (Japan)

- WuXi AppTec Co., Ltd. (China)

- Roche Holding AG (Switzerland)

- Allergan plc (Ireland)

- Shire plc (Ireland)

- Medtronic plc (Ireland)

- Novo Nordisk A/S (Denmark) And Other Active Players

Key Industry Developments in the Injectable Drug Delivery Devices Market:

- In April 2024, Baxter International Inc. (NYSE: BAX), a global leader in injectables, anaesthesia and drug compounding, announced the continued expansion of its pharmaceutical’s portfolio with five injectable product launches in the U.S.

- In January 2024, Kindeva Drug Delivery acquired Summit Biosciences Inc., an intranasal drug-delivery CDMO, thereby adding a new drug-delivery platform and expanding Kindeva’s capabilities across a broader range of complex drug-device combination products, including pulmonary, injectable, transdermal, and nasal. Summit’s 55,000-sq.-ft. cGMP facility in Lexington, KY, augmented Kindeva’s global manufacturing footprint, which now includes nine development and manufacturing facilities across the U.S. and U.K.

|

Global Injectable Drug Delivery Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 107.20 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.15% |

Market Size in 2032: |

USD 199.58 Bn. |

|

Segments Covered: |

By Administration |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Pfizer Inc. (US), Merck & Co., Inc. (US), Johnson & Johnson (US), AbbVie (US), Novartis AG (Switzerland), Bristol Myers Squibb (US) and Other Active Players |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- INJECTABLE DRUG DELIVERY DEVICES MARKET BY ADMINISTRATION (2017-2032)

- INJECTABLE DRUG DELIVERY DEVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUBCUTANEOUS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- INTRAMUSCULAR

- INTRAVENOUS

- INTRANASAL

- INJECTABLE DRUG DELIVERY DEVICES MARKET BY TECHNOLOGY (2017-2032)

- INJECTABLE DRUG DELIVERY DEVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CONVENTIONAL SYRINGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NEEDLE-FREE INJECTORS

- PRE-FILLED SYRINGES

- IMPLANTABLE DRUG DELIVERY SYSTEMS

- MICRONEEDLE PATCHES

- INJECTABLE DRUG DELIVERY DEVICES MARKET BY APPLICATION (2017-2032)

- INJECTABLE DRUG DELIVERY DEVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- DIABETES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PAIN MANAGEMENT

- ONCOLOGY

- AUTOIMMUNE DISEASES

- INFECTIOUS DISEASES

- INJECTABLE DRUG DELIVERY DEVICES MARKET BY ENDUSERS (2017-2032)

- INJECTABLE DRUG DELIVERY DEVICES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLINICS

- HOMECARE SETTINGS

- AMBULATORY SURGICAL CENTRES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Injectable Drug Delivery Devices Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- PFIZER INC. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MERCK & CO., INC. (US)

- JOHNSON & JOHNSON (US)

- ABBVIE (US)

- NOVARTIS AG (SWITZERLAND)

- BRISTOL MYERS SQUIBB (US)

- ELI LILLY AND COMPANY (US)

- GILEAD SCIENCES, INC. (US)

- AMGEN INC. (US)

- SEAGEN INC. (US)

- CELGENE CORPORATION (US)

- BOEHRINGER INGELHEIM GMBH (GERMANY)

- FRESENIUS SE & CO. KGAA (GERMANY)

- ASTRAZENECA PLC (UK)

- SANOFI (FRANCE)

- GLAXOSMITHKLINE PLC (UK)

- BAYER AG (GERMANY)

- SHIONOGI & CO., LTD. (JAPAN)

- TAKEDA PHARMACEUTICAL COMPANY LIMITED (JAPAN)

- WUXI APPTEC CO., LTD. (CHINA)

- ROCHE HOLDING AG (SWITZERLAND)

- ALLERGAN PLC (IRELAND)

- SHIRE PLC (IRELAND)

- MEDTRONIC PLC (IRELAND)

- NOVO NORDISK A/S (DENMARK)

- COMPETITIVE LANDSCAPE

- GLOBAL INJECTABLE DRUG DELIVERY DEVICES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Administration

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Injectable Drug Delivery Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 107.20 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.15% |

Market Size in 2032: |

USD 199.58 Bn. |

|

Segments Covered: |

By Administration |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Pfizer Inc. (US), Merck & Co., Inc. (US), Johnson & Johnson (US), AbbVie (US), Novartis AG (Switzerland), Bristol Myers Squibb (US) and Other Active Players |

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. INJECTABLE DRUG DELIVERY DEVICES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. INJECTABLE DRUG DELIVERY DEVICES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. INJECTABLE DRUG DELIVERY DEVICES MARKET COMPETITIVE RIVALRY

TABLE 005. INJECTABLE DRUG DELIVERY DEVICES MARKET THREAT OF NEW ENTRANTS

TABLE 006. INJECTABLE DRUG DELIVERY DEVICES MARKET THREAT OF SUBSTITUTES

TABLE 007. INJECTABLE DRUG DELIVERY DEVICES MARKET BY DEVICE TYPE

TABLE 008. CONVENTIONAL MARKET OVERVIEW (2016-2028)

TABLE 009. SELF-INJECTABLE MARKET OVERVIEW (2016-2028)

TABLE 010. PREFILLED SYRINGES MARKET OVERVIEW (2016-2028)

TABLE 011. CONNECTED SMART DEVICES MARKET OVERVIEW (2016-2028)

TABLE 012. INJECTABLE DRUG DELIVERY DEVICES MARKET BY PARENTERAL ROUTE

TABLE 013. INTRADERMAL MARKET OVERVIEW (2016-2028)

TABLE 014. SUBCUTANEOUS MARKET OVERVIEW (2016-2028)

TABLE 015. INTRAMUSCULAR MARKET OVERVIEW (2016-2028)

TABLE 016. INTRAVENOUS MARKET OVERVIEW (2016-2028)

TABLE 017. INJECTABLE DRUG DELIVERY DEVICES MARKET BY END USERS

TABLE 018. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 019. HOMECARE SETTINGS MARKET OVERVIEW (2016-2028)

TABLE 020. CLINICS MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA INJECTABLE DRUG DELIVERY DEVICES MARKET, BY DEVICE TYPE (2016-2028)

TABLE 023. NORTH AMERICA INJECTABLE DRUG DELIVERY DEVICES MARKET, BY PARENTERAL ROUTE (2016-2028)

TABLE 024. NORTH AMERICA INJECTABLE DRUG DELIVERY DEVICES MARKET, BY END USERS (2016-2028)

TABLE 025. N INJECTABLE DRUG DELIVERY DEVICES MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE INJECTABLE DRUG DELIVERY DEVICES MARKET, BY DEVICE TYPE (2016-2028)

TABLE 027. EUROPE INJECTABLE DRUG DELIVERY DEVICES MARKET, BY PARENTERAL ROUTE (2016-2028)

TABLE 028. EUROPE INJECTABLE DRUG DELIVERY DEVICES MARKET, BY END USERS (2016-2028)

TABLE 029. INJECTABLE DRUG DELIVERY DEVICES MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC INJECTABLE DRUG DELIVERY DEVICES MARKET, BY DEVICE TYPE (2016-2028)

TABLE 031. ASIA PACIFIC INJECTABLE DRUG DELIVERY DEVICES MARKET, BY PARENTERAL ROUTE (2016-2028)

TABLE 032. ASIA PACIFIC INJECTABLE DRUG DELIVERY DEVICES MARKET, BY END USERS (2016-2028)

TABLE 033. INJECTABLE DRUG DELIVERY DEVICES MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA INJECTABLE DRUG DELIVERY DEVICES MARKET, BY DEVICE TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA INJECTABLE DRUG DELIVERY DEVICES MARKET, BY PARENTERAL ROUTE (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA INJECTABLE DRUG DELIVERY DEVICES MARKET, BY END USERS (2016-2028)

TABLE 037. INJECTABLE DRUG DELIVERY DEVICES MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA INJECTABLE DRUG DELIVERY DEVICES MARKET, BY DEVICE TYPE (2016-2028)

TABLE 039. SOUTH AMERICA INJECTABLE DRUG DELIVERY DEVICES MARKET, BY PARENTERAL ROUTE (2016-2028)

TABLE 040. SOUTH AMERICA INJECTABLE DRUG DELIVERY DEVICES MARKET, BY END USERS (2016-2028)

TABLE 041. INJECTABLE DRUG DELIVERY DEVICES MARKET, BY COUNTRY (2016-2028)

TABLE 042. BECTON: SNAPSHOT

TABLE 043. BECTON: BUSINESS PERFORMANCE

TABLE 044. BECTON: PRODUCT PORTFOLIO

TABLE 045. BECTON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. DICKINSON & COMPANY: SNAPSHOT

TABLE 046. DICKINSON & COMPANY: BUSINESS PERFORMANCE

TABLE 047. DICKINSON & COMPANY: PRODUCT PORTFOLIO

TABLE 048. DICKINSON & COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. PFIZER INC.: SNAPSHOT

TABLE 049. PFIZER INC.: BUSINESS PERFORMANCE

TABLE 050. PFIZER INC.: PRODUCT PORTFOLIO

TABLE 051. PFIZER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. TEVA PHARMACEUTICALS INDUSTRIES LTD.: SNAPSHOT

TABLE 052. TEVA PHARMACEUTICALS INDUSTRIES LTD.: BUSINESS PERFORMANCE

TABLE 053. TEVA PHARMACEUTICALS INDUSTRIES LTD.: PRODUCT PORTFOLIO

TABLE 054. TEVA PHARMACEUTICALS INDUSTRIES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. ELI LILLY & COMPANY: SNAPSHOT

TABLE 055. ELI LILLY & COMPANY: BUSINESS PERFORMANCE

TABLE 056. ELI LILLY & COMPANY: PRODUCT PORTFOLIO

TABLE 057. ELI LILLY & COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. BAXTER INTERNATIONAL INC.: SNAPSHOT

TABLE 058. BAXTER INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 059. BAXTER INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 060. BAXTER INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. SCHOTT AG: SNAPSHOT

TABLE 061. SCHOTT AG: BUSINESS PERFORMANCE

TABLE 062. SCHOTT AG: PRODUCT PORTFOLIO

TABLE 063. SCHOTT AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. GERRESHEIMER: SNAPSHOT

TABLE 064. GERRESHEIMER: BUSINESS PERFORMANCE

TABLE 065. GERRESHEIMER: PRODUCT PORTFOLIO

TABLE 066. GERRESHEIMER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. YPSOMED: SNAPSHOT

TABLE 067. YPSOMED: BUSINESS PERFORMANCE

TABLE 068. YPSOMED: PRODUCT PORTFOLIO

TABLE 069. YPSOMED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. B. BRAUN MELSUNGEN: SNAPSHOT

TABLE 070. B. BRAUN MELSUNGEN: BUSINESS PERFORMANCE

TABLE 071. B. BRAUN MELSUNGEN: PRODUCT PORTFOLIO

TABLE 072. B. BRAUN MELSUNGEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 073. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 074. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 075. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. INJECTABLE DRUG DELIVERY DEVICES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. INJECTABLE DRUG DELIVERY DEVICES MARKET OVERVIEW BY DEVICE TYPE

FIGURE 012. CONVENTIONAL MARKET OVERVIEW (2016-2028)

FIGURE 013. SELF-INJECTABLE MARKET OVERVIEW (2016-2028)

FIGURE 014. PREFILLED SYRINGES MARKET OVERVIEW (2016-2028)

FIGURE 015. CONNECTED SMART DEVICES MARKET OVERVIEW (2016-2028)

FIGURE 016. INJECTABLE DRUG DELIVERY DEVICES MARKET OVERVIEW BY PARENTERAL ROUTE

FIGURE 017. INTRADERMAL MARKET OVERVIEW (2016-2028)

FIGURE 018. SUBCUTANEOUS MARKET OVERVIEW (2016-2028)

FIGURE 019. INTRAMUSCULAR MARKET OVERVIEW (2016-2028)

FIGURE 020. INTRAVENOUS MARKET OVERVIEW (2016-2028)

FIGURE 021. INJECTABLE DRUG DELIVERY DEVICES MARKET OVERVIEW BY END USERS

FIGURE 022. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 023. HOMECARE SETTINGS MARKET OVERVIEW (2016-2028)

FIGURE 024. CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA INJECTABLE DRUG DELIVERY DEVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE INJECTABLE DRUG DELIVERY DEVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC INJECTABLE DRUG DELIVERY DEVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA INJECTABLE DRUG DELIVERY DEVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA INJECTABLE DRUG DELIVERY DEVICES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Injectable Drug Delivery Devices Market research report is 2024-2032.

Pfizer Inc. (US),Merck & Co., Inc. (US),Johnson & Johnson (US),AbbVie (US),Novartis AG (Switzerland),Bristol Myers Squibb (US),Eli Lilly and Company (US),Gilead Sciences, Inc. (US),Amgen Inc. (US),Seagen Inc. (US),Celgene Corporation (US),Boehringer Ingelheim GmbH (Germany),Fresenius SE & Co. KGaA (Germany),AstraZeneca PLC (UK),Sanofi (France),GlaxoSmithKline plc (UK),Bayer AG (Germany),Shionogi & Co., Ltd. (Japan),Takeda Pharmaceutical Company Limited (Japan),WuXi AppTec Co., Ltd. (China),Roche Holding AG (Switzerland),Allergan plc (Ireland) ,Shire plc (Ireland) ,Medtronic plc (Ireland),Novo Nordisk A/S (Denmark) and Other Active Players.

The Injectable Drug Delivery Devices Market is segmented into Administration, Technology, Application, End users, and region. By Administration, the market is categorized into Subcutaneous, Intramuscular, Intravenous, Intranasal. By Technology, the market is categorized into Conventional syringes, Needle-free injectors, pre-filled syringes, Implantable drug delivery systems, Microneedle patches. By Application, the market is categorized into Diabetes, Pain management, Oncology, Autoimmune diseases, Infectious diseases. By End users, The Market Is Categorized into Hospitals, Clinics, Homecare settings, Ambulatory surgical centers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The rise in the Injectable drug delivery sector is primarily attributed to advancements in technology, a rise in chronic illnesses, and an increase in government support. The increasing number of elderly people worldwide is driving an increase in the need for healthcare services and medications. Elderly individuals often have complex healthcare needs and may need injectable medications for chronic conditions, leading to the growth of the injectable drug delivery sector.

Injectable Drug Delivery Devices Market Size Was Valued at USD 107.20 Billion in 2023, and is Projected to Reach USD 199.58 Billion by 2032, Growing at a CAGR of 7.15% From 2024-2032.