Injectable Drug Delivery Devices Market Synopsis

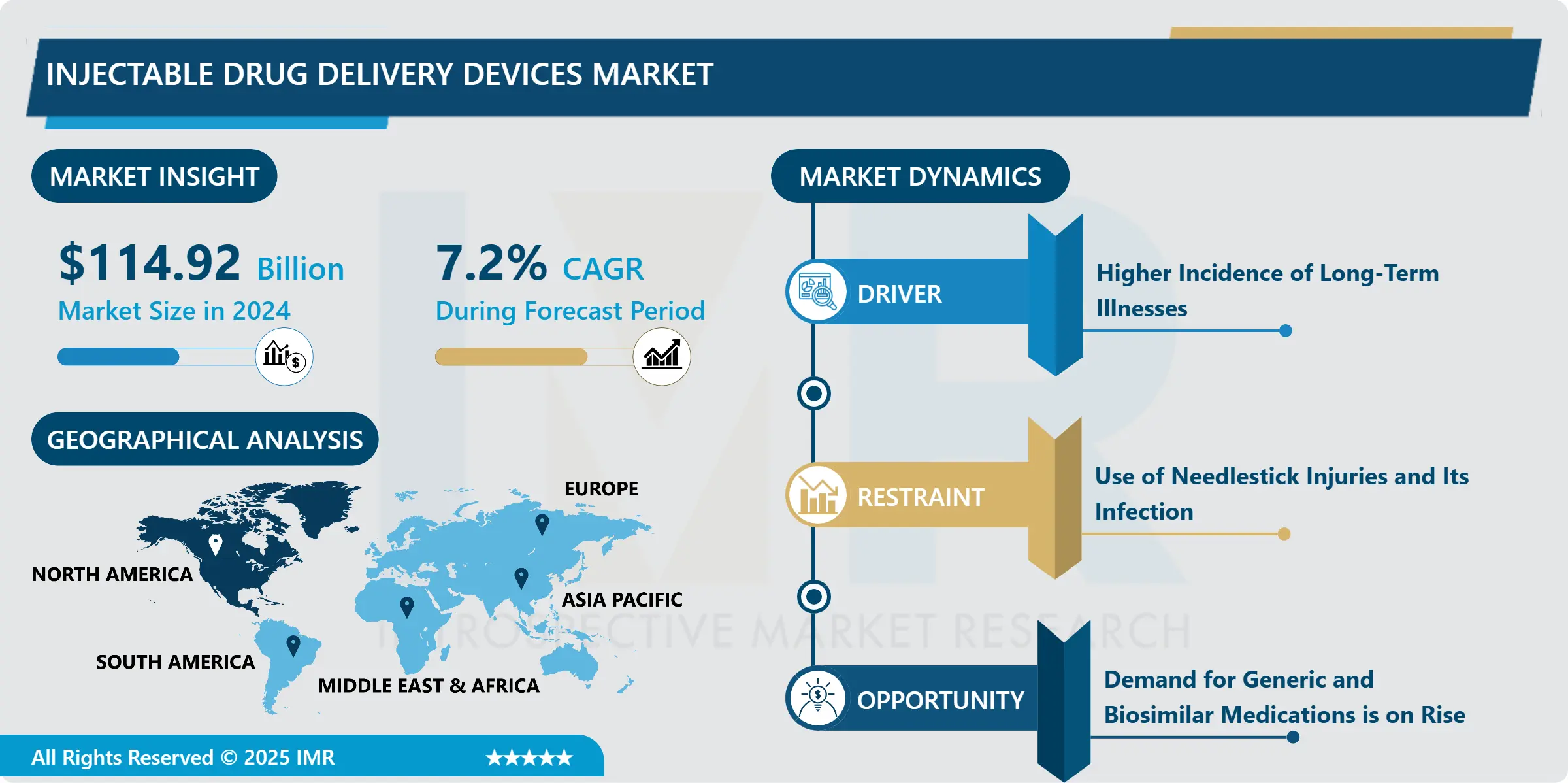

Injectable Drug Delivery Devices Market Size Was Valued at USD 114.92 Billion in 2024, and is Projected to Reach USD 246.91 Billion by 2035, Growing at a CAGR of 7.2% From 2025-2035.

The rise in the Injectable drug delivery sector is primarily attributed to advancements in technology, a rise in chronic illnesses, and an increase in government support. The increasing number of elderly people worldwide is driving an increase in the need for healthcare services and medications. Elderly individuals often have complex healthcare needs and may need injectable medications for chronic conditions, leading to the growth of the injectable drug delivery sector.

Developing countries are experiencing fast urbanization, better healthcare facilities, and increased healthcare budgets, leading to increased availability of injectable drugs. Consequently, pharmaceutical companies are prioritizing expanding their footprint in these markets to boost market expansion. Needles, syringes, or specialized devices are used in the technology of injectable drug delivery to directly administer medication into the body, bypassing the digestive system. This technology plays a vital role in the treatment of autoimmune diseases, diabetes, and cancer. Improvements in injectable drug delivery systems have resulted in the development of needle-free injectors, auto-injectors, and wearable devices.

The benefits, need, and expansion of injectable drug delivery technology are key factors in its rising popularity and market growth. The advantages of using it are accurate dosing, quick response, and enhanced drug efficacy, making it the preferred approach for administering medication. By administering drugs straight into the bloodstream, it avoids the digestive system, guaranteeing drug potency and effectiveness.

The demand for injectable drug delivery technology is growing due to the increasing prevalence of chronic diseases like diabetes, cancer, and autoimmune disorders. This demand is also fuelled by user-friendly devices like auto-injectors and wearable injectors, which improve patient adherence. Furthermore, market growth is promoted by the development of specialized delivery systems needed for advancements in biologics and targeted therapies. Ongoing research and development activities to improve drug delivery devices, increase patient convenience, and meet emerging therapeutic needs also contribute to market expansion. Additionally, elements like increasing.

Injectable Drug Delivery Devices Market Trend Analysis

Higher Incidence of Long-Term Illnesses

- The rise of chronic illnesses such as diabetes, cancer, and autoimmune conditions is not only boosting the market for injectable drug delivery devices but also creating a mutually beneficial relationship. Chronic illnesses frequently need complicated treatment plans that can include several medicines, some with distinct administration instructions. For example, certain biologics utilized in treating autoimmune conditions break down in the stomach, making oral intake ineffective. Injectable drug delivery devices, like pre-filled syringes and auto-injectors, guarantee that these medications avoid the digestive system and go straight to their intended locations.

- Long-term medication use is often necessary for chronic conditions. Conventional methods of injecting can be scary and bothersome, resulting in lack of compliance. Injectable drug delivery tools such as pens and pumps provide convenient features and pre-set amounts, simplifying self-administration in the comfort of one's own home. This allows patients to manage their treatment, enhancing adherence and potentially resulting in improved clinical results.

- The emergence of personalized medicine is influencing the use of injectable drug delivery devices. Smart pens and pumps link with mobile applications to monitor medication consumption, track vital signs, and offer instant feedback to patients and healthcare professionals. Minor changes in medication can have a big impact on chronic illnesses. These devices enable customized dosing changes and improved monitoring of how well medications work, resulting in better results for patients.

- Major obstacles to medication adherence are fear of needles and pain from injections. Injectable drug delivery devices advancements focus on enhancing patient comfort. Needle-thinning innovations reduce injection discomfort, while additions such as automatic injection systems and built-in heating elements (for injectable pain medications) enhance the comfort of treatment. Moreover, needle guards on auto-injectors reduce the likelihood of needle-stick injuries for patients and healthcare workers, enhancing safety during the administration process. The market for injectable drug delivery is always changing. Scientists are investigating novel methods such as microneedle patches and implantable pumps for painless medication administration and regulated drug release.

Restraints

Use of Needlestick Injuries and Its Infection

- The market for injectable drug delivery devices, which revolutionizes chronic disease treatment, is navigating a delicate balance between innovation and the ongoing risk of needle-stick injuries (NSIs). Although these devices provide unmatched convenience and accuracy in delivering medication, the potential danger of accidental needle punctures from contaminated needles is a significant concern. Non-Sharp Injuries (NSIs) are not only associated with traditional syringes. The same characteristics that make these devices easy to use can also bring about additional complications. Auto-injectors simplify medication administration by including pre-filled cartridges and automatic injection mechanisms. Nevertheless, adequate training is required for these characteristics. If healthcare professionals and patients do not have a complete understanding of how to activate and dispose of procedures, they may be at a higher risk for accidental injuries.

- Another issue arises when devices need to be recapped with a needle after being used. This procedure, known for its high risk of NSIs, can be worrisome for healthcare facilities and individuals who self-administer at home, particularly when not done carefully. Patients who utilize pens or pumps for their chronic medications may accidentally harm themselves while handling or disposing of them. Fortunately, the market is not remaining inactive. Numerous tactics are currently being employed to reduce the risk of NSIs. Manufacturers are incorporating advanced safety features, such as automatic needle guards, into their devices. These clever devices automatically cover the needle once it has been used, effectively removing the possibility of accidental exposure.

- Thorough training programs are being introduced for healthcare providers and patients alike. These programs explore safe handling and disposal methods for each device, enabling users to reduce the chances of self-inflicted or accidental NSIs. Standardized training procedures guarantee uniform best practices in healthcare environments. Research and innovation are expanding the limits of injection technology. Jet injectors and microneedle patches are progressing quickly as needle-free delivery systems. These new techniques provide a preview of a future in which the advantages of injectable medications are administered without the use of needles.

Opportunity

Demand for Generic and Biosimilar Medications is on Rise

- The market for injectable drug delivery devices is growing rapidly due to a strong collaborative ecosystem and increasing demand for biosimilar and generic injectable drugs. Let's further explore this complex dance, where each part influences the others. Biosimilars are close biological copies of intricate medications, frequently employed for critical therapies in fields such as oncology and rheumatology. Generics are almost exact replicas of branded drugs, containing identical active components. Both biosimilars and generics provide great benefits: Biosimilars and generics offer considerable cost reductions when compared to brand-name drugs. This results in improved availability for patients who may face difficulties in paying for these important injectable medications.

- Healthcare systems can also experience advantages from these savings, enabling them to allocate resources towards a broader array of treatments. The increased presence of biosimilars and generics expands the range of treatments available. Healthcare professionals can now select medications based on the specific requirements, financial considerations, and the effectiveness of treatments for each patient. This individualized method enables more efficient and budget-friendly treatment strategies.

- The need for trained personnel for preparing and administering vials and syringes restricts patient autonomy and results in greater dependence on healthcare facilities for injections. This may cause inconvenience and disturb regular schedules, possibly resulting in non-compliance. Many patients experience genuine concerns about needle phobia and injection anxiety. Conventional injection techniques may worsen fear, discouraging patients from following important treatment plans, and potentially affecting treatment results.

- Using syringes for manual preparation increases the likelihood of dosage mistakes. Injectable drug delivery devices help address the problem of dosage errors, which can result in either reduced treatment effectiveness or an increased risk of side effects. They play a crucial role in meeting the growing need for biosimilars and generics while overcoming the limitations of traditional methods. Devices such as pens, and auto-injectors come pre-filled and are designed to be easy for users to use.

Challenges

Inclination Towards Alternative Drug Delivery Methods

- Despite its groundbreaking effect on managing chronic diseases, the injectable drug delivery device market is hindered by the preference for other drug delivery methods. Patients and healthcare providers may choose varying methods of administering treatment for various reasons. Now, let's further explore these rivalling techniques and grasp the difficulties they present for injectable devices. Oral medications reign supreme in terms of convenience. They are usually simple to take and give to oneself, which makes them a common option, particularly for patients who have a fear of needles or do not like getting injections. Oral drugs typically have decreased manufacturing and delivery expenses in contrast to injectable medications. This means that healthcare systems could save money by choosing oral options, which would be more appealing on a financial basis.

- Injectable delivery methods are significantly disadvantaged in cases where there are already successful oral medications available. Patients may focus on the convenience and cost efficiency of oral medications, which can limit the adoption of injectable devices in certain areas of therapy. Producers of injectable devices should concentrate on creating devices that provide notable benefits compared to oral medications, like enhanced bioavailability or precise delivery, to remain competitive.

- Topical creams and ointments provide targeted therapy, perfect for skin issues or managing localized pain. Compared to injections, they are frequently less invasive and more comfortable for patients. Topical medications reduce the likelihood of systemic side effects by mainly targeting the area of application, decreasing the chance of adverse effects in other areas of the body. Topical medications provide a non-surgical and focused option for skin conditions or localized pain, which may reduce the demand for injectable devices in these specific areas. Manufacturers of injectable devices should think about creating combination therapies or injectable formulations that provide extra advantages like quicker onset of action or better penetration into deeper tissues to rival topical treatments. Extended period by delivering the medication through the skin.

Injectable Drug Delivery Devices Market Segment Analysis:

Injectable Drug Delivery Devices market is segmented on the basis of Administration, Technology, Application, End users.

By Administration, Subcutaneous Segment Is Expected to Dominate the Market During the Forecast Period

- Administering medication subcutaneously is not only a convenient method, but also a precise coordination of technology and the body. A closer examination reveals that the subcutaneous layer, which is the focus of SubQ injections, is situated directly below the skin. This region contains numerous blood vessels and lymphatic channels, making it an ideal area for medication absorption. The SubQ delivery method allows for a gradual and consistent release of medication, which is made possible by the complex system of vessels in this layer. SubQ injections commonly involve the use of smaller needles in comparison to intramuscular injections. This diminishes discomfort and possible tissue harm. Moreover, progress in needle technology has resulted in the creation of bevelled needles that reduce pain and improve medication delivery.

- After being injected, the medication creates a small reservoir, known as a depot, in the subcutaneous tissue. This facility serves as a controlled-release mechanism, gradually releasing the medicine into the bloodstream over a period. Factors such as the properties of the medication and the type of formulation used determine the exact rate of release. The lymphatic system, which is responsible for draining fluids and supporting immune function, also has an impact. Certain medications can be partly taken in by the lymphatic system, impacting their general spread and possible immune reaction. Scientists are currently researching this interaction to improve SubQ delivery for different drugs.

- The SubQ delivery environment is always changing. Prefilled syringes and autoinjectors have transformed how patients self-administer medication, improving ease of use and precision. Moreover, scientists are investigating new methods of delivery such as microneedles, which are less invasive and may improve patient comfort and adherence. Understanding this complex interaction between technology and the body allows us to recognize the effectiveness and possibilities of Subcutaneous administration. It demonstrates scientific creativity by utilizing the body's own mechanisms to deliver drugs in an effective and regulated manner.

By Technology, Conventional Syringes Segment Held the Largest Share In 2023

- The conventional syringes segment held the biggest market share in the Injectable Drug Delivery Devices Market by technology. Conventional syringes, recognized for their ease of use and versatility, have been a popular choice for administering medications for a long time. Several factors are responsible for their high prevalence.

- Conventional syringes provide a simple and affordable way to give medications in different healthcare environments. Their convenience makes them appropriate for healthcare professionals and patients alike, resulting in broad acceptance. conventional syringes guarantee exact dosage delivery, making it easier to administer medication accurately, especially for drugs with specific dosing needs. Moreover, the market dominance of conventional syringes is influenced by the familiarity and established infrastructure linked to them. Healthcare professionals are skilled at using it, with healthcare facilities often having the required equipment on hand, which helps boost their widespread use.

- These constraints are fuelling creativity in the field of injectable drug delivery technology. The future is dependent on finding solutions to these weaknesses. Safety syringes equipped with needle guards are starting to become popular, reducing the chance of needle stick accidents. Autoinjectors provide a more convenient and possibly less painful option for patients, enhancing their willingness to stick to treatment regimens. Moreover, research is being conducted on improving needle design and materials to reduce discomfort. Although conventional syringes will still be used in certain cases, they are paving the path for new drug delivery technologies that focus on safety, patient comfort, and environmental sustainability. The future of delivering injectable drugs depends on not only effectively delivering medication but also on ensuring a safe and convenient user experience.

Injectable Drug Delivery Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is dealing with a substantial challenge of chronic illnesses such as diabetes, cancer, and heart disease. Typically, these situations necessitate the ongoing use of injectable medications for an extended period. The constant need for efficient and convenient delivery devices is a result of the high prevalence. Picture a significant market for devices that help administer injectable medications due to a sizable population constantly requiring them. North America has a strong pharmaceutical research and development (R&D) system. This results in a continuous flow of newly created injectable drugs. However, innovation does not end at that point. In addition, the area supports the creation of advanced delivery tools alongside fresh medications. The ongoing development of fresh treatment choices and their corresponding delivery mechanisms drives market expansion.

- Governments in North America frequently take an active role in healthcare. They could put in place measures to promote the use of new medical technologies, such as injectable drug delivery devices. This may include providing financial support for studies, simplifying the process of approvals, or giving rewards to medical professionals who utilize these products. Government assistance provides a conducive atmosphere for the market to thrive. North American nations typically allocate more funds towards healthcare in comparison to other areas. This results in more money for patients and healthcare providers to spend on advanced, possibly pricier, delivery devices. With increased funding in the healthcare sector, there is a higher potential to implement these cutting-edge technologies.

- North America is currently the leader, with a dynamic future ahead in this market. Consider these factors: Emerging Markets are on the rise with regions such as Asia Pacific experiencing fast economic expansion and an increasingly older population.

Players Covered in Injectable Drug Delivery Devices Market are

- Pfizer Inc. (US)

- Merck & Co.

- Johnson & Johnson (US)

- AbbVie (US)

- Novartis AG (Switzerland)

- Bristol Myers Squibb (US)

- Eli Lilly and Company (US)

- Gilead Sciences

- Amgen Inc. (US)

- Seagen Inc. (US)

- Celgene Corporation (US)

- Boehringer Ingelheim GmbH (Germany)

- Fresenius SE & Co. KGaA (Germany)

- AstraZeneca PLC (UK)

- Sanofi (France)

- GlaxoSmithKline plc (UK)

- Bayer AG (Germany)

- Shionogi & Co. Ltd. (Japan)

- Takeda Pharmaceutical Company Limited (Japan)

- WuXi AppTec Co.Ltd. (China)

- Roche Holding AG (Switzerland)

- Allergan plc (Ireland)

- Shire plc (Ireland)

- Medtronic plc (Ireland)

- Novo Nordisk A/S (Denmark) and Other Active Players.

|

Global Injectable Drug Delivery Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 114.92 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.2% |

Market Size in 2035: |

USD 246.91 Bn. |

|

Segments Covered: |

By Administration |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Pfizer Inc. (US), Merck & Co., Inc. (US), Johnson & Johnson (US), AbbVie (US), Novartis AG (Switzerland), Bristol Myers Squibb (US) and Other Active Players |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Injectable Drug Delivery Devices Market by Administration (2018-2035)

4.1 Injectable Drug Delivery Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Subcutaneous

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Intramuscular

4.5 Intravenous

4.6 Intranasal

Chapter 5: Injectable Drug Delivery Devices Market by Technology (2018-2035)

5.1 Injectable Drug Delivery Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Conventional syringes

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Needle-free injectors

5.5 Pre-filled syringes

5.6 Implantable drug delivery systems

5.7 Microneedle patches

Chapter 6: Injectable Drug Delivery Devices Market by Application (2018-2035)

6.1 Injectable Drug Delivery Devices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Diabetes

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pain management

6.5 Oncology

6.6 Autoimmune diseases

6.7 Infectious diseases

Chapter 7: Injectable Drug Delivery Devices Market by End users (2018-2035)

7.1 Injectable Drug Delivery Devices Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Clinics

7.5 Homecare settings

7.6 Ambulatory surgical centres

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Injectable Drug Delivery Devices Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AMAZON (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MICROSFT (US)

8.4 GOOGLE (US)

8.5 IBM (US)

8.6 ORACLE (US)

8.7 CISCO (US)

8.8 APPLE (US)

8.9 META (US)

8.10 EQUINIX (US)

8.11 DIGITAL REALTY (US)

8.12 NTT GLOBAL DATA CENTERS (US)

8.13 CYRUSONE (US)

8.14 CYXTERA (US)

8.15 QTS DATA CENTERS (US)

8.16 SWITCH INC. (US)

8.17 CLOUDHQ (US)

8.18 VANTAGE DATA CENTERS (US)

8.19 STACK INFRASTRUCTURE (US)

8.20 DATABANK (US)

8.21 COLT DATA CENTER (UK)

8.22 OVHCLOUD (FRANCE)

8.23 ALICLOUD (CHINA)

8.24 TENCENT (CHINA)

8.25 ALIBABA (CHINA)

8.26 GDS HOLDINGS (CHINA)

8.27

Chapter 9: Global Injectable Drug Delivery Devices Market By Region

9.1 Overview

9.2. North America Injectable Drug Delivery Devices Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Administration

9.2.4.1 Subcutaneous

9.2.4.2 Intramuscular

9.2.4.3 Intravenous

9.2.4.4 Intranasal

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 Conventional syringes

9.2.5.2 Needle-free injectors

9.2.5.3 Pre-filled syringes

9.2.5.4 Implantable drug delivery systems

9.2.5.5 Microneedle patches

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Diabetes

9.2.6.2 Pain management

9.2.6.3 Oncology

9.2.6.4 Autoimmune diseases

9.2.6.5 Infectious diseases

9.2.7 Historic and Forecasted Market Size by End users

9.2.7.1 Hospitals

9.2.7.2 Clinics

9.2.7.3 Homecare settings

9.2.7.4 Ambulatory surgical centres

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Injectable Drug Delivery Devices Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Administration

9.3.4.1 Subcutaneous

9.3.4.2 Intramuscular

9.3.4.3 Intravenous

9.3.4.4 Intranasal

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 Conventional syringes

9.3.5.2 Needle-free injectors

9.3.5.3 Pre-filled syringes

9.3.5.4 Implantable drug delivery systems

9.3.5.5 Microneedle patches

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Diabetes

9.3.6.2 Pain management

9.3.6.3 Oncology

9.3.6.4 Autoimmune diseases

9.3.6.5 Infectious diseases

9.3.7 Historic and Forecasted Market Size by End users

9.3.7.1 Hospitals

9.3.7.2 Clinics

9.3.7.3 Homecare settings

9.3.7.4 Ambulatory surgical centres

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Injectable Drug Delivery Devices Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Administration

9.4.4.1 Subcutaneous

9.4.4.2 Intramuscular

9.4.4.3 Intravenous

9.4.4.4 Intranasal

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 Conventional syringes

9.4.5.2 Needle-free injectors

9.4.5.3 Pre-filled syringes

9.4.5.4 Implantable drug delivery systems

9.4.5.5 Microneedle patches

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Diabetes

9.4.6.2 Pain management

9.4.6.3 Oncology

9.4.6.4 Autoimmune diseases

9.4.6.5 Infectious diseases

9.4.7 Historic and Forecasted Market Size by End users

9.4.7.1 Hospitals

9.4.7.2 Clinics

9.4.7.3 Homecare settings

9.4.7.4 Ambulatory surgical centres

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Injectable Drug Delivery Devices Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Administration

9.5.4.1 Subcutaneous

9.5.4.2 Intramuscular

9.5.4.3 Intravenous

9.5.4.4 Intranasal

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 Conventional syringes

9.5.5.2 Needle-free injectors

9.5.5.3 Pre-filled syringes

9.5.5.4 Implantable drug delivery systems

9.5.5.5 Microneedle patches

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Diabetes

9.5.6.2 Pain management

9.5.6.3 Oncology

9.5.6.4 Autoimmune diseases

9.5.6.5 Infectious diseases

9.5.7 Historic and Forecasted Market Size by End users

9.5.7.1 Hospitals

9.5.7.2 Clinics

9.5.7.3 Homecare settings

9.5.7.4 Ambulatory surgical centres

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Injectable Drug Delivery Devices Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Administration

9.6.4.1 Subcutaneous

9.6.4.2 Intramuscular

9.6.4.3 Intravenous

9.6.4.4 Intranasal

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 Conventional syringes

9.6.5.2 Needle-free injectors

9.6.5.3 Pre-filled syringes

9.6.5.4 Implantable drug delivery systems

9.6.5.5 Microneedle patches

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Diabetes

9.6.6.2 Pain management

9.6.6.3 Oncology

9.6.6.4 Autoimmune diseases

9.6.6.5 Infectious diseases

9.6.7 Historic and Forecasted Market Size by End users

9.6.7.1 Hospitals

9.6.7.2 Clinics

9.6.7.3 Homecare settings

9.6.7.4 Ambulatory surgical centres

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Injectable Drug Delivery Devices Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Administration

9.7.4.1 Subcutaneous

9.7.4.2 Intramuscular

9.7.4.3 Intravenous

9.7.4.4 Intranasal

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 Conventional syringes

9.7.5.2 Needle-free injectors

9.7.5.3 Pre-filled syringes

9.7.5.4 Implantable drug delivery systems

9.7.5.5 Microneedle patches

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Diabetes

9.7.6.2 Pain management

9.7.6.3 Oncology

9.7.6.4 Autoimmune diseases

9.7.6.5 Infectious diseases

9.7.7 Historic and Forecasted Market Size by End users

9.7.7.1 Hospitals

9.7.7.2 Clinics

9.7.7.3 Homecare settings

9.7.7.4 Ambulatory surgical centres

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Injectable Drug Delivery Devices Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 114.92 Bn. |

|

Forecast Period 2025-35 CAGR: |

7.2% |

Market Size in 2035: |

USD 246.91 Bn. |

|

Segments Covered: |

By Administration |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Pfizer Inc. (US), Merck & Co., Inc. (US), Johnson & Johnson (US), AbbVie (US), Novartis AG (Switzerland), Bristol Myers Squibb (US) and Other Active Players |

||