Global IGBT Driver Market Overview

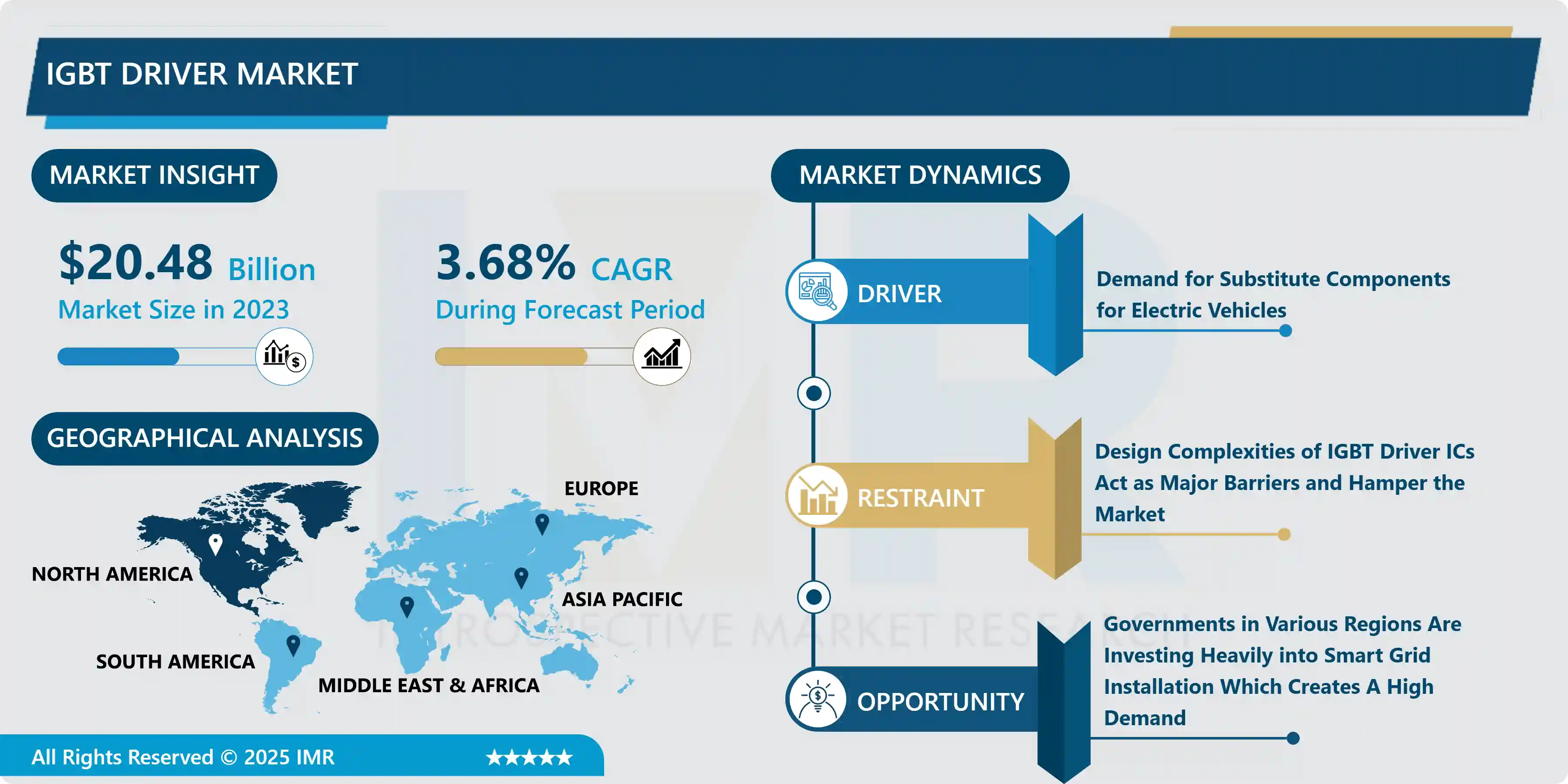

IGBT Driver market size was valued at USD 20.48 Billion in 2023 and is projected to reach USD 28.35 Billion by 2032, growing at a CAGR of 3.68% from 2024 to 2032.

IGBT is a kind of power semiconductor that's used as an associate electronic switch device. it's additionally referred to as a minority carrier device that permits a quicker switch rate and offers superior efficiency. It is an economical solution to exchange Metal Oxide Semiconductor Field-Effect Transistor (MOSFET) which is compatible with higher voltage and current. It enables power management to reinforce energy conservation in varied applications such as industrial systems, client electronics, and electrical vehicles. In addition, it is a blend of MOSFET and bipolar transistor (BJT) in monolithic form. Currently, IGBT drivers are integrated into renewable resources and electric vehicles to improve switch speed and forestall power loss. Increasing demand for electrical vehicles and aggrandized need for top voltage operational devices have pushed to higher adoption of IGBT in energy & power, automotive, client electronics, and industries. Therefore, the IGBT market is predicted to witness moderate growth during the forecasted period due to the high-speed switching rate and optimized power loss.

Market Dynamics and Factors:

Drivers

- The current growth in the electric vehicle market has seen a rise in demand for substitute components for electric vehicles. Driven by the regulation of CO2 emissions, the automotive market is moving towards electrification of the powertrain in electric and hybrid vehicles (EV / HEV), in which driving and switching losses are significantly reduced, which has a direct effect on overall efficiency. The importance of the IGBT in an electric vehicle resides in the motor's inverter as a switch. Since it is a high voltage, high current device, it is usually connected directly to the traction motor in an electric vehicle. Essentially, it draws direct current from the car battery via the inverter it converts the AC control signals into the high power required to turn the motor. Thanks to its high efficiency and fast switching times, the IGBT is a perfect component for EV motors from 35 KW to 85 KW such as IGBTs lead to less waste of energy and consequently to higher mileage.

- IGBT drivers control the inputs and output of the energy without fluctuation in the energy supply. North America and China are creating new avenues for IGBTs to support infrastructure and manufacture electric vehicles. This further strengthens the position of IGBTs in the market. For lower voltage ranges IGBTs could not penetrate the market, as they offer a clear advantage over MOSFETs. It can't handle limited freewheeling current because it lacks a body drain diode and a large current tail. IGBTs are prone to heating problems because they operate at very high frequencies and with high power. Thermal characterization helps optimize the design, structure, and assembly of IGBTs to optimize their performance. Such Drivers are pushing the growth of the IGBT Drivers market.

Restraints

- Latch-up involving gate control of IGBT driver can break easily which can cause the failure of the device. A gradual decrease in current density creates a rise in ambient temperature which can cause an increase in turn-off time. As IGBT enters the latch-up, the gates lose the control over drain current in which forced commutation of the current can be a singular way to turn of the IGBT in such a situation. If there is a delay in the termination of latch-up, excess power dissipation can destroy the IGBT driver.

Opportunities

- Smart Gird replaces the old grid network due to reliability, flexible network topology and provides better lead adjustment capacity with low and high voltage with real-time troubleshooting. IGBT drivers are installed to facilitate ease-of-control at high voltage, as it allows higher frequency with enhanced efficiency. Moreover, it is a minority-carrier device with numerous benefits such as great bipolar current-carrying capability and high input electric resistance, hence, it is used in smart grids. Governments in various regions are investing heavily into smart grid installation which creates a high demand for substitute components, semiconductors, and transistors and presents a growing opportunity for IGBT Driver Market.

Market Segmentation

- By Type, the Modular segment is dominating the IGBT Driver Market. Modular IGBT Drivers are required to convert electricity from one form to another so that the electricity can be more conveniently and safely used by all digital devices. An IGBT power module functions as an electronic switching device. the electric drive train, the power module dispenses and converts the DC from the electric vehicle battery to AC to be used in the electric motor driving the vehicle propulsion system. That makes the power module an important component in improving energy efficiency and battery range for electrical cars.

- Due to vast use in high power voltage applications, modules become hot due to the heat loss in the conversion process, and in some cases, the losses are as great as 5%. In EVs, the loss can be as high as 10-15% which in turn impacts the range and performance of the vehicle. IGBT driver reduces the loss of energy and improves efficiency which makes it a preferred choice in electric vehicle manufacturing which makes a driving factor for the growth of the IGBT Drivers market during the forecasted period.

- By Power Rating, High power voltage is dominating in the power rating segment of the IGBT Driver Market. High-power IGBT Drivers are gaining momentum as demand for high power transistors in the automotive sector as well as UAVs and industrial applications are driving the growth of the IGBT Driver Market. Aircraft carriers use IGBT-based motor drives for cargo doors and lifts. Railguns and aircraft launchers via electromagnetic propulsion need IGBTs for the high-voltage power supplies High power IGBT drivers have high current carrying capacity gate control using voltage makes it ideal for high voltage grids. Medium power IGBT drivers have substantial demand for 1700V – 2500V transistors in the industrial sector for an automation process. The medium power IGBT driver market is likely to grow at a steady pace during the forecasted period.

- By End-Use Application, EV/HEV is the dominating segment in the IGBT Driver Market. Growing concerns about emissions from fossil fuel and the reduction of non-renewable energy resources have enforced the government to explore the option in the clean energy resources and improve the infrastructure of electric vehicles like Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV) & Plug-In Hybrid Electric Vehicle (PHEV) and Electric Vehicle Supply Equipment (EVSE). IGBT drivers are installed in electric vehicles to control vehicles at high voltages and enhance efficiency and reduce energy loss. Currently, the U.S occupies the largest consumer base of electric cars, due to stringent emission rules in the region. Such volume in electric vehicles reflects on the growth of the IGBT Driver market.

Players Covered in IGBT Driver market are :

- Infineon Technologies

- Texas Instruments

- ON Semiconductor

- STMicroelectronics

- IXYS

- Powerex (Mitsubishi Electric)

- Renesas

- SEMIKRON

- Vishay

- Analog Devices

- Microchip

- ROHM Semiconductor

- Broadcom

- Toshiba

- Lite-On Technology and other major players.

Regional Analysis of IGBT Driver Market

- Asia Pacific is the dominating the IGBT Driver Market. The Asia Pacific occupied the largest manufacturer of electronics and semiconductors which is mainly in china attributing the high growth during the forecasted period. Also, China holds the majority share in electric vehicle deployment driving the market growth in the country. India and Japan are having experienced a high growth rate in the demand for IGBT drivers due to the increasing number of electric vehicle manufacturing and related substitute product which reflect the growth of the IGBT drivers’ market.

- North America is the fastest-growing region in the IGBT Driver Market. As the United States ramped up the expansion of renewable energy infrastructure, demand for transistors and semiconductor have increased and benefited local manufacturer and suppliers. Many IGBT driver manufacturers have experienced a rise in sales attributing to demand from private and government contracts. High use of power electronic and smart grid has created a boom in the IGBT Driver Market.

Key Developments of IGBT Driver Market

- In September 2024, DENSO CORPORATION and ROHM Co., Ltd. announced the initiation of discussions for a strategic partnership in the semiconductor sector. The partnership aimed to address the rising demand for semiconductors driven by the shift to electric vehicles and automated driving technologies. DENSO acquired a portion of ROHM's shares to solidify the collaboration. Both companies aimed to ensure a stable supply of high-quality semiconductors, contributing to carbon neutrality and sustainable society by leveraging their combined expertise in automotive electronics and system development.

- In July 2023, Microchip Technology Incorporated announced a multi-year initiative to invest approximately $300 million in expanding operations in India. The investments focused on improving facilities in Bangalore, Chennai, and a new R&D center in Hyderabad, enhancing engineering labs, and accelerating hiring to tap into India’s talent pool. The initiative aimed to serve technical and business support needs, sponsor technical consortia, and launch CSR programs. India's growing semiconductor market, projected to reach $64 billion by 2026, was a key factor in this strategic expansion.

|

Global IGBT Driver Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.48 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.68% |

Market Size in 2032: |

USD 28.35 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Power Rating |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: IGBT Driver Market by Type (2018-2032)

4.1 IGBT Driver Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Discrete

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Modular

Chapter 5: IGBT Driver Market by Power Rating (2018-2032)

5.1 IGBT Driver Market Snapshot and Growth Engine

5.2 Market Overview

5.3 High Power

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Medium Power

5.5 Low Power

Chapter 6: IGBT Driver Market by End User (2018-2032)

6.1 IGBT Driver Market Snapshot and Growth Engine

6.2 Market Overview

6.3 EV/HEV

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Renewables

6.5 UPS

6.6 Rail

6.7 Automotive

6.8 Industrial

6.9 Commercial

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 IGBT Driver Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BASF SE (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BOREALIS AG (AUSTRIA)

7.4 BRASKEM (BRAZIL)

7.5 DOW CHEMICAL COMPANY (USA)

7.6 EXXONMOBIL CHEMICAL (USA)

7.7 FORMOSA PLASTICS GROUP (TAIWAN)

7.8 INEOS GROUP (UK)

7.9 LG CHEM (SOUTH KOREA)

7.10 LYONDELLBASELL INDUSTRIES (NETHERLANDS)

7.11 MITSUI CHEMICALS (JAPAN)

7.12 RELIANCE INDUSTRIES LIMITED (INDIA)

7.13 SABIC (SAUDI ARABIA)

7.14 SINOPEC (CHINA)

7.15 TOTALENERGIES (FRANCE)

7.16 WESTLAKE CHEMICAL CORPORATION (USA)

7.17 OTHER KEY PLAYERS.

Chapter 8: Global IGBT Driver Market By Region

8.1 Overview

8.2. North America IGBT Driver Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Discrete

8.2.4.2 Modular

8.2.5 Historic and Forecasted Market Size by Power Rating

8.2.5.1 High Power

8.2.5.2 Medium Power

8.2.5.3 Low Power

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 EV/HEV

8.2.6.2 Renewables

8.2.6.3 UPS

8.2.6.4 Rail

8.2.6.5 Automotive

8.2.6.6 Industrial

8.2.6.7 Commercial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe IGBT Driver Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Discrete

8.3.4.2 Modular

8.3.5 Historic and Forecasted Market Size by Power Rating

8.3.5.1 High Power

8.3.5.2 Medium Power

8.3.5.3 Low Power

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 EV/HEV

8.3.6.2 Renewables

8.3.6.3 UPS

8.3.6.4 Rail

8.3.6.5 Automotive

8.3.6.6 Industrial

8.3.6.7 Commercial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe IGBT Driver Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Discrete

8.4.4.2 Modular

8.4.5 Historic and Forecasted Market Size by Power Rating

8.4.5.1 High Power

8.4.5.2 Medium Power

8.4.5.3 Low Power

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 EV/HEV

8.4.6.2 Renewables

8.4.6.3 UPS

8.4.6.4 Rail

8.4.6.5 Automotive

8.4.6.6 Industrial

8.4.6.7 Commercial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific IGBT Driver Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Discrete

8.5.4.2 Modular

8.5.5 Historic and Forecasted Market Size by Power Rating

8.5.5.1 High Power

8.5.5.2 Medium Power

8.5.5.3 Low Power

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 EV/HEV

8.5.6.2 Renewables

8.5.6.3 UPS

8.5.6.4 Rail

8.5.6.5 Automotive

8.5.6.6 Industrial

8.5.6.7 Commercial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa IGBT Driver Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Discrete

8.6.4.2 Modular

8.6.5 Historic and Forecasted Market Size by Power Rating

8.6.5.1 High Power

8.6.5.2 Medium Power

8.6.5.3 Low Power

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 EV/HEV

8.6.6.2 Renewables

8.6.6.3 UPS

8.6.6.4 Rail

8.6.6.5 Automotive

8.6.6.6 Industrial

8.6.6.7 Commercial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America IGBT Driver Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Discrete

8.7.4.2 Modular

8.7.5 Historic and Forecasted Market Size by Power Rating

8.7.5.1 High Power

8.7.5.2 Medium Power

8.7.5.3 Low Power

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 EV/HEV

8.7.6.2 Renewables

8.7.6.3 UPS

8.7.6.4 Rail

8.7.6.5 Automotive

8.7.6.6 Industrial

8.7.6.7 Commercial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global IGBT Driver Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 20.48 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.68% |

Market Size in 2032: |

USD 28.35 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Power Rating |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||