Hr Tech Market Synopsis

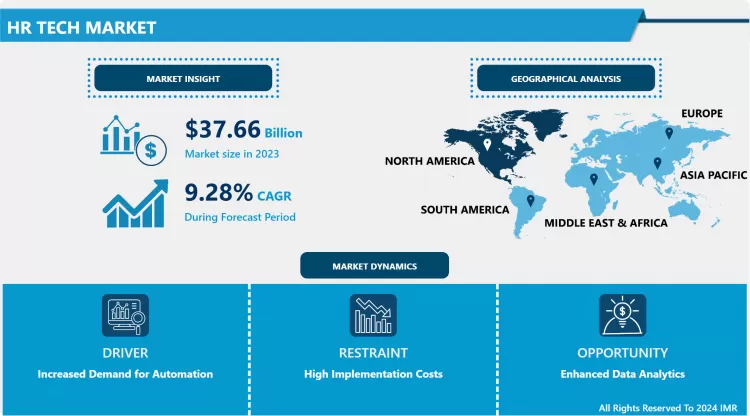

Hr Tech Market Size Was Valued at USD 37.66 Billion in 2023 and is Projected to Reach USD 83.7 Million by 2032, Growing at a CAGR of 9.28 % From 2024-2032.

- The HR Tech market encompasses technology solutions and software applications designed to streamline and enhance human resources functions and processes. This includes tools for recruitment, employee management, performance evaluation, payroll processing, and talent development. HR Tech aims to improve efficiency, reduce administrative burdens, and leverage data-driven insights to optimize human capital management, ultimately contributing to better organizational outcomes and employee experiences.

- The HR Tech market is experiencing a dynamic shift, driven by the rapid adoption of advanced digital technologies and an increasing demand for efficient workforce management solutions. This transformation is primarily fueled by the need for organizations to streamline their HR processes, enhance employee engagement, and ultimately boost productivity. As businesses globally navigate the complexities of modern workforce dynamics, the role of HR technology has become indispensable.

- One of the significant trends propelling the HR Tech market is the integration of artificial intelligence (AI), machine learning (ML), and big data analytics. These technologies are revolutionizing traditional HR functions by enabling predictive analytics for talent acquisition, employee retention, and performance management. For instance, AI-powered recruitment tools can sift through vast amounts of candidate data to identify the best fits for specific roles, reducing the time and cost associated with hiring. Similarly, ML algorithms can analyze employee performance and predict potential turnover, allowing HR managers to proactively address issues and improve retention rates.

- The shift towards remote work and hybrid work models, accelerated by the COVID-19 pandemic, has further spurred the adoption of cloud-based HR solutions. These solutions offer the flexibility and scalability needed to manage a dispersed workforce effectively. Cloud-based platforms enable seamless access to HR services, such as payroll management, benefits administration, and employee self-service portals, from any location. This flexibility is crucial in maintaining operational continuity and ensuring that employees remain connected and engaged, regardless of their physical location.

- Employee wellness and development have also become focal points in the HR Tech landscape. Organizations are increasingly recognizing the importance of fostering a supportive and growth-oriented work environment. This has led to the rise of platforms that offer personalized learning and development programs tailored to individual employee needs and career goals. These platforms leverage AI to deliver customized training content, track progress, and provide real-time feedback, enhancing the overall employee experience and driving professional growth.

- Despite the numerous advantages, the HR Tech market faces several challenges that could impede its growth. Data privacy and security concerns are paramount, given the sensitive nature of HR data. Organizations must navigate stringent data protection regulations and ensure robust cybersecurity measures to safeguard employee information. Additionally, the integration of new HR technologies with existing systems can be complex and costly, requiring significant investment in IT infrastructure and training.

- Another challenge is the need for continuous technological upgrades. The rapid pace of technological advancements means that HR Tech solutions can quickly become outdated, necessitating regular updates and innovations to stay competitive. Organizations must be prepared to invest in ongoing research and development to harness the latest advancements and maintain a cutting-edge HR technology stack

- Despite these challenges, the HR Tech market is poised for robust growth. Continuous innovations, coupled with the increasing recognition of HR technology as a strategic enabler for organizational success, are driving market expansion. Companies are progressively adopting comprehensive HR Tech solutions to enhance their competitive edge, improve employee satisfaction, and drive organizational performance. As a result, the HR Tech market is expected to witness substantial growth in the coming years, transforming the way organizations manage their most valuable asset—human capital.

Hr Tech Market Trend Analysis

Increasing Reliance on AI and Predictive Analytics in HR Tech

- One of the primary trends reshaping the HR tech market is the increasing reliance on artificial intelligence (AI) and machine learning (ML) to streamline various HR processes. AI-powered tools have revolutionized candidate screening by automating the initial stages of recruitment. These tools can sift through vast amounts of applications, identify the most suitable candidates based on predefined criteria, and even analyze social media profiles to gauge a candidate’s cultural fit. This not only accelerates the hiring process but also minimizes human biases, leading to fairer hiring practices. Moreover, AI is being leveraged for employee engagement analysis, where sentiment analysis tools can evaluate employee feedback from surveys, emails, and other communications to provide real-time insights into workforce morale. This enables HR teams to proactively address issues and improve employee satisfaction and retention.

- Additionally, the integration of predictive analytics in HR tech is proving to be a game-changer for talent management. By analyzing historical data and identifying patterns, predictive analytics can forecast workforce trends such as turnover rates, skill shortages, and employee performance trajectories. For instance, organizations can predict which employees are at risk of leaving and implement targeted retention strategies to mitigate turnover. Predictive analytics also aids in succession planning by identifying high-potential employees who can be groomed for future leadership roles. This forward-looking approach helps organizations stay ahead of workforce challenges, optimize talent utilization, and align HR strategies with business goals. As AI and predictive analytics continue to evolve, they are set to drive more informed, data-driven decision-making in the HR domain, ultimately enhancing organizational efficiency and effectiveness.

Growing Emphasis on Employee Experience

- The HR tech market is the growing emphasis on employee experience (EX), which is becoming a focal point for many organizations. Companies are increasingly investing in technology that enhances the overall employee journey, from onboarding to career development. Modern HR tech solutions are designed to provide personalized experiences that cater to individual employee needs and preferences. For example, mobile apps and self-service portals enable employees to access HR services anytime and anywhere, empowering them to manage their benefits, track their performance, and seek support without depending on HR personnel. Digital platforms that facilitate learning and development are also on the rise, offering personalized training modules and career progression paths that keep employees engaged and motivated. By focusing on EX, companies can create a more satisfied and productive workforce, which ultimately contributes to better organizational performance.

- The shift towards remote and hybrid work models has further accelerated the demand for HR tech solutions that support virtual collaboration, remote onboarding, and digital wellness programs. With the increasing prevalence of remote work, companies are seeking ways to ensure that employees remain connected and engaged despite physical distances. Virtual collaboration tools, such as video conferencing platforms and project management software, have become essential for maintaining team cohesion and productivity. Remote onboarding solutions are designed to provide new hires with a seamless and engaging introduction to the company, even when they cannot be physically present. Additionally, digital wellness programs that offer resources for mental health, fitness, and work-life balance are gaining popularity as organizations recognize the importance of employee well-being. These technologies not only enhance the employee experience but also help organizations attract and retain top talent in a competitive market.

Hr Tech Market Segment Analysis:

Hr Tech Market Segmented based on By Type, By Deployment, By Enterprise Type and By Industry.

By Type, Talent Management segment is expected to dominate the market during the forecast period

- Talent management solutions are pivotal in today’s competitive business landscape, where organizations place a high priority on acquiring, nurturing, and retaining top talent. These solutions encompass a broad range of functionalities, including recruitment, onboarding, training, and career development, all aimed at optimizing employee performance and fostering engagement. By integrating these various HR processes into a unified system, organizations can streamline their operations, ensuring that talent is effectively managed from recruitment through to career progression. This comprehensive approach not only enhances operational efficiency but also contributes to a more cohesive and motivated workforce, which is crucial for maintaining a competitive advantage in a rapidly evolving market.

- The significant investment in talent management systems by both large enterprises and small and medium-sized enterprises (SMEs) underscores their importance. Large enterprises leverage these systems to manage complex and diverse talent pools, streamline extensive HR processes, and align employee development with strategic goals. SMEs, on the other hand, are increasingly adopting these solutions to level the playing field, improve their HR capabilities, and support growth with efficient talent management practices. The widespread adoption and heavy investment in talent management solutions reflect their critical role in shaping organizational success and ensuring that companies can attract, develop, and retain the talent necessary for achieving long-term business objectives.

By Industry, BFSI segment held the largest share in 2023

- The BFSI (Banking, Financial Services, and Insurance) sector commands a substantial market share in the HR solutions industry, primarily due to its rigorous requirements for data security and regulatory compliance. This sector manages a highly diverse and extensive workforce, necessitating robust HR systems capable of handling complex payroll processes and maintaining stringent compliance with financial regulations. The intricate nature of financial operations, coupled with the need for accurate and secure management of sensitive employee information, drives the demand for advanced talent management and payroll solutions. These systems ensure that BFSI organizations adhere to regulatory standards while efficiently managing employee compensation, benefits, and performance.

- Moreover, the BFSI sector's emphasis on operational efficiency and risk management further amplifies the need for sophisticated HR solutions. Talent management systems play a critical role in this context, enabling financial institutions to attract, develop, and retain skilled professionals while ensuring alignment with strategic goals. Effective payroll management systems are equally essential, as they mitigate the risk of errors and compliance issues associated with employee compensation. The combination of these advanced solutions helps BFSI organizations streamline their HR operations, enhance productivity, and maintain a high level of operational integrity, solidifying their significant market share in the HR solutions landscape.

Hr Tech Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America holds a prominent position in the HR Tech market, primarily due to the early adoption of advanced technologies and the presence of significant market players. The United States, in particular, drives this growth, with companies across various industries recognizing the value of automated and efficient HR solutions. The demand for sophisticated HR technologies is propelled by the need to streamline recruitment, onboarding, payroll, and performance management processes. Major tech hubs like Silicon Valley foster innovation and the development of cutting-edge HR solutions, contributing to the market's dynamic growth. Furthermore, the region's focus on enhancing employee experience and engagement, alongside a robust IT infrastructure, creates a conducive environment for the proliferation of HR Tech

- The shift towards remote work, accelerated by the COVID-19 pandemic, has further underscored the importance of virtual HR management tools. As organizations adapt to hybrid work models, the need for tools that facilitate remote recruitment, virtual onboarding, and digital employee engagement has surged. This trend has led to increased investment in cloud-based HR platforms that offer flexibility and scalability. Additionally, North American companies are increasingly prioritizing data-driven decision-making in HR, leveraging analytics and AI to improve talent acquisition and retention strategies. This focus on innovation and the continuous evolution of HR practices ensure that North America remains a leading market for HR Tech, with sustained growth anticipated in the coming years.

Active Key Players in the Hr Tech Market

- SAP SE (Germany)

- Oracle Corporation (U.S.)

- Automatic Data Processing (ADP), Inc. (U.S.)

- Cornerstone OnDemand, Inc. (U.S.)

- Ceridian HCM Holding Inc. (U.S.)

- Workday, Inc. (U.S.)

- Infor, Inc. (U.S.)

- Cegid Group (France)

- Hi Bob Inc. (U.K.)

- The Access Group (U.K.),Other Key Players.

Key Industry Developments in the Hr Tech Market:

- October 2023: Workday expanded its partnership with ADP to provide global compliance, payroll, and HR experiences for joint customers. The partnership aimed to enable the customer to view data across their HCM environments, including tax, compliance, and payroll.

- September 2023: HiBob collaborated with Papaya Global, a payroll platform provider, to help multinational employers meet the need for compliant HR-integrated payroll solutions. Through the collaboration, HiBob integrated its HR data into Papaya’s platform, allowing employers to integrate PTO, HR, and compensation information with real-time data synchronization and optimize payroll processes.

- September 2023: The Access Group acquired Diversely, a Singapore-based inclusive recruitment solution company, offering a comprehensive suite, Access Volcanic, to its customers. The website allows organizations to track, measure, and improve diversity, providing recruitment solutions to bring new business, stay compliant, and attract a wider candidate group.

- August 2023: ADP acquired Honu HR, Inc. DBA Sora (Sora), a data integration and workflow automation tool platform company, to simplify complex HR processes through automation. This acquisition aimed to provide HR solutions by integrating Sora's easy-to-use platform with ADP's HCM solutions for employees, business owners, and HR professionals.

- June 2023: Oracle introduced Oracle Fusion Cloud Human Capital Management (HCM) with generative AI-powered capabilities to boost HR functions and productivity. These capabilities are embedded in existing HR processes to enhance HR functions, improve productivity, drive faster business value, facilitate HR strategies, and strengthen candidate and employee experience.

|

Global Hr Tech Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 37.66 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.28% |

Market Size in 2032: |

USD 83.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By Enterprise Type

|

|

||

|

By Industry

|

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Hr Tech Market by Type (2018-2032)

4.1 Hr Tech Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Talent Management

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Workforce Management

4.5 Recruitment

4.6 Payroll Management

4.7 Performance Management

4.8 Others (Employee Collaboration & Engagement)

Chapter 5: Hr Tech Market by Deployment (2018-2032)

5.1 Hr Tech Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cloud

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 On-premise

Chapter 6: Hr Tech Market by Enterprise Type (2018-2032)

6.1 Hr Tech Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small and Medium Sized Enterprises (SMEs)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprise

Chapter 7: Hr Tech Market by Industry (2018-2032)

7.1 Hr Tech Market Snapshot and Growth Engine

7.2 Market Overview

7.3 BFSI

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 IT and Telecommunication

7.5 Government

7.6 Manufacturing

7.7 Retail

7.8 Healthcare

7.9 Others (Education)

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Hr Tech Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SAP SE (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ORACLE CORPORATION (U.S.)

8.4 AUTOMATIC DATA PROCESSING (ADP) INC. (U.S.)

8.5 CORNERSTONE ONDEMAND INC. (U.S.)

8.6 CERIDIAN HCM HOLDING INC. (U.S.)

8.7 WORKDAY INC. (U.S.)

8.8 INFOR INC. (U.S.)

8.9 CEGID GROUP (FRANCE)

8.10 HI BOB INC. (U.K.)

8.11 THE ACCESS GROUP (U.K.)

8.12 OTHER KEY PLAYERS.

Chapter 9: Global Hr Tech Market By Region

9.1 Overview

9.2. North America Hr Tech Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Talent Management

9.2.4.2 Workforce Management

9.2.4.3 Recruitment

9.2.4.4 Payroll Management

9.2.4.5 Performance Management

9.2.4.6 Others (Employee Collaboration & Engagement)

9.2.5 Historic and Forecasted Market Size by Deployment

9.2.5.1 Cloud

9.2.5.2 On-premise

9.2.6 Historic and Forecasted Market Size by Enterprise Type

9.2.6.1 Small and Medium Sized Enterprises (SMEs)

9.2.6.2 Large Enterprise

9.2.7 Historic and Forecasted Market Size by Industry

9.2.7.1 BFSI

9.2.7.2 IT and Telecommunication

9.2.7.3 Government

9.2.7.4 Manufacturing

9.2.7.5 Retail

9.2.7.6 Healthcare

9.2.7.7 Others (Education)

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Hr Tech Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Talent Management

9.3.4.2 Workforce Management

9.3.4.3 Recruitment

9.3.4.4 Payroll Management

9.3.4.5 Performance Management

9.3.4.6 Others (Employee Collaboration & Engagement)

9.3.5 Historic and Forecasted Market Size by Deployment

9.3.5.1 Cloud

9.3.5.2 On-premise

9.3.6 Historic and Forecasted Market Size by Enterprise Type

9.3.6.1 Small and Medium Sized Enterprises (SMEs)

9.3.6.2 Large Enterprise

9.3.7 Historic and Forecasted Market Size by Industry

9.3.7.1 BFSI

9.3.7.2 IT and Telecommunication

9.3.7.3 Government

9.3.7.4 Manufacturing

9.3.7.5 Retail

9.3.7.6 Healthcare

9.3.7.7 Others (Education)

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Hr Tech Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Talent Management

9.4.4.2 Workforce Management

9.4.4.3 Recruitment

9.4.4.4 Payroll Management

9.4.4.5 Performance Management

9.4.4.6 Others (Employee Collaboration & Engagement)

9.4.5 Historic and Forecasted Market Size by Deployment

9.4.5.1 Cloud

9.4.5.2 On-premise

9.4.6 Historic and Forecasted Market Size by Enterprise Type

9.4.6.1 Small and Medium Sized Enterprises (SMEs)

9.4.6.2 Large Enterprise

9.4.7 Historic and Forecasted Market Size by Industry

9.4.7.1 BFSI

9.4.7.2 IT and Telecommunication

9.4.7.3 Government

9.4.7.4 Manufacturing

9.4.7.5 Retail

9.4.7.6 Healthcare

9.4.7.7 Others (Education)

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Hr Tech Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Talent Management

9.5.4.2 Workforce Management

9.5.4.3 Recruitment

9.5.4.4 Payroll Management

9.5.4.5 Performance Management

9.5.4.6 Others (Employee Collaboration & Engagement)

9.5.5 Historic and Forecasted Market Size by Deployment

9.5.5.1 Cloud

9.5.5.2 On-premise

9.5.6 Historic and Forecasted Market Size by Enterprise Type

9.5.6.1 Small and Medium Sized Enterprises (SMEs)

9.5.6.2 Large Enterprise

9.5.7 Historic and Forecasted Market Size by Industry

9.5.7.1 BFSI

9.5.7.2 IT and Telecommunication

9.5.7.3 Government

9.5.7.4 Manufacturing

9.5.7.5 Retail

9.5.7.6 Healthcare

9.5.7.7 Others (Education)

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Hr Tech Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Talent Management

9.6.4.2 Workforce Management

9.6.4.3 Recruitment

9.6.4.4 Payroll Management

9.6.4.5 Performance Management

9.6.4.6 Others (Employee Collaboration & Engagement)

9.6.5 Historic and Forecasted Market Size by Deployment

9.6.5.1 Cloud

9.6.5.2 On-premise

9.6.6 Historic and Forecasted Market Size by Enterprise Type

9.6.6.1 Small and Medium Sized Enterprises (SMEs)

9.6.6.2 Large Enterprise

9.6.7 Historic and Forecasted Market Size by Industry

9.6.7.1 BFSI

9.6.7.2 IT and Telecommunication

9.6.7.3 Government

9.6.7.4 Manufacturing

9.6.7.5 Retail

9.6.7.6 Healthcare

9.6.7.7 Others (Education)

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Hr Tech Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Talent Management

9.7.4.2 Workforce Management

9.7.4.3 Recruitment

9.7.4.4 Payroll Management

9.7.4.5 Performance Management

9.7.4.6 Others (Employee Collaboration & Engagement)

9.7.5 Historic and Forecasted Market Size by Deployment

9.7.5.1 Cloud

9.7.5.2 On-premise

9.7.6 Historic and Forecasted Market Size by Enterprise Type

9.7.6.1 Small and Medium Sized Enterprises (SMEs)

9.7.6.2 Large Enterprise

9.7.7 Historic and Forecasted Market Size by Industry

9.7.7.1 BFSI

9.7.7.2 IT and Telecommunication

9.7.7.3 Government

9.7.7.4 Manufacturing

9.7.7.5 Retail

9.7.7.6 Healthcare

9.7.7.7 Others (Education)

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Hr Tech Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 37.66 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.28% |

Market Size in 2032: |

USD 83.7 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By Enterprise Type

|

|

||

|

By Industry

|

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Hr Tech Market research report is 2024-2032.

SAP SE (Germany), Oracle Corporation (U.S.), Automatic Data Processing (ADP), Inc. (U.S.), Cornerstone OnDemand, Inc. (U.S.), Ceridian HCM Holding Inc. (U.S.), Workday, Inc. (U.S.), Infor, Inc. (U.S.), Cegid Group (France), Hi Bob Inc. (U.K.), The Access Group (U.K.) and Other Major Players.

The Hr Tech Market is segmented into By Type, By Deployment, By Enterprise Type, By Industry and region. By Type, the market is categorized into Talent Management, Workforce Management, Recruitment, Payroll Management, Performance Management and Others (Employee Collaboration & Engagement). By Deployment, the market is categorized into Cloud and On-premise. By Enterprise Type, the market is categorized into Small and Medium Sized Enterprises (SMEs) and Large Enterprise. By Industry, the market is categorized into BFSI, IT and Telecommunication, Government, Manufacturing, Retail, Healthcare and Others (Education). By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The HR Tech market encompasses the technology solutions and software applications designed to streamline and enhance human resources functions and processes. This includes tools for recruitment, employee management, performance evaluation, payroll processing, and talent development. HR Tech aims to improve efficiency, reduce administrative burdens, and leverage data-driven insights to optimize human capital management, ultimately contributing to better organizational outcomes and employee experiences.

Hr Tech Market Size Was Valued at USD 37.66 Billion in 2023 and is Projected to Reach USD 83.7 Million by 2032, Growing at a CAGR of 9.28 % From 2024-2032.