Household Robot Market Synopsis

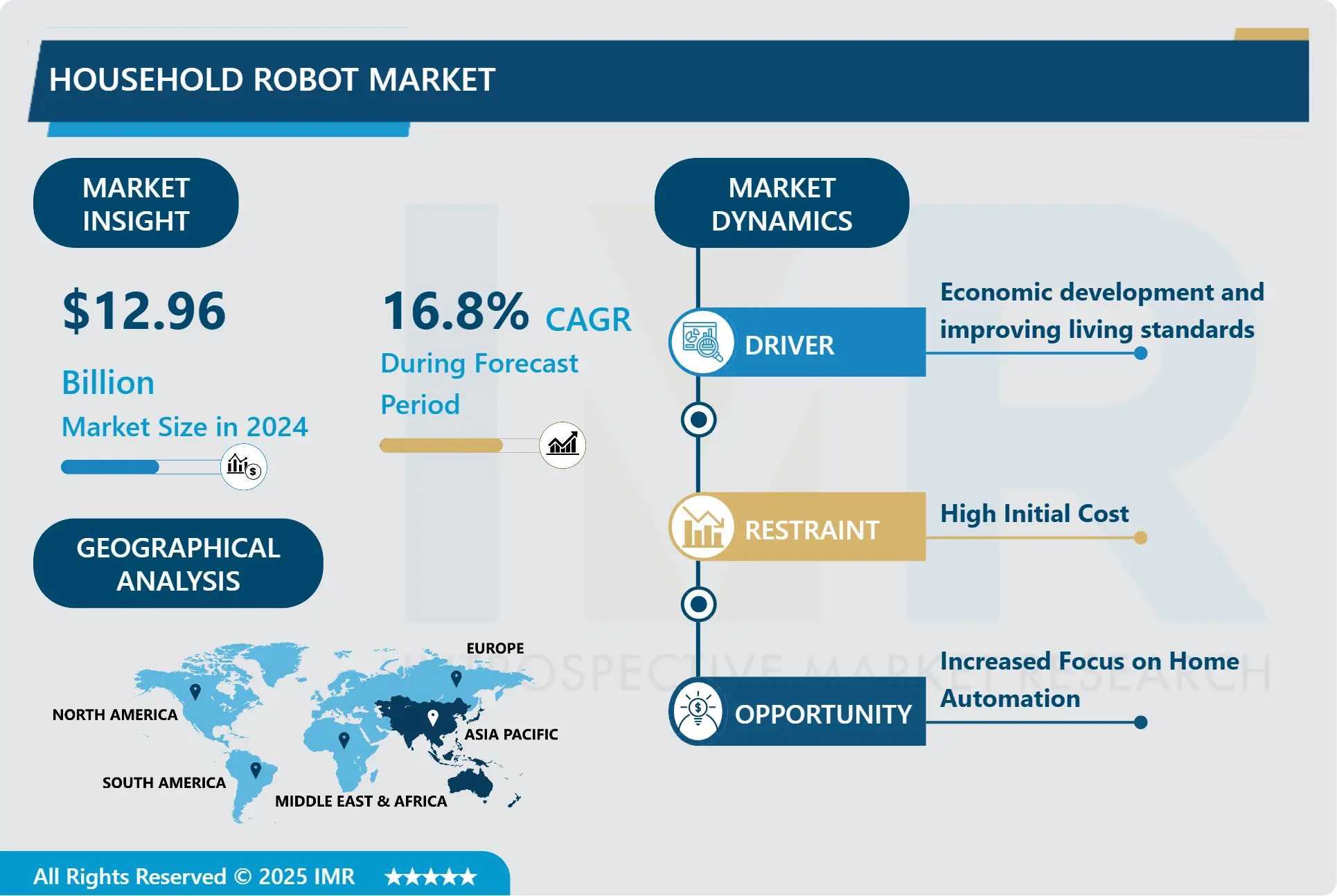

Household Robot Market Size Was Valued at USD 12.96 Billion in 2024, and is Projected to Reach USD 44.9 Billion by 2032, Growing at a CAGR of 16.8% From 2025-2032.

Household robots refers to home use robots which are devices that are indented to be used domestically. These robots are service-, fun-, and task-oriented and meant to improve the quality, productivity, and general well-being of the individual and his/her family. Household robots are endow with sophisticated technologies, sensors and artificial intelligence to perform assigned task in modified, fully autonomous or semi-automated manner.

Household robots are replacing human labor force in the aspect of consistence, other than being productive and faster in completing the task at hand. Moreover, repetitive work cause non-interested and boring with a situation lead them careless and not motivation to do the job which is avoided with robots as they are programmed for a specific task that enhance the market growth.

As the technologies are getting advanced, manufacturer pay much more attention to prepare robots with high endurance. Currently robots use nickel-metal hydride batteries as less toxic metal and high power generation help but it only let the robots to operate a few hours only. Many companies await the transition to the use of Li-ion batteries as they can be charged rapidly and power devices for a longer time.

The smart home concept has been increasing rapidly and because of this, Robotics is to be expected to have a significant impact in the entire smart home market. Probably the key factor that has fuelled the growth of the market is the cut back on home tasks due to utilization of robotic vacuum cleaners. Many households in the current society are computerized and this has made things easier and some of the work at home like washing being minimized. Despite the advancement of vacuum cleaners that have drastically reduced the challenges associated with house cleaning, they are noisy and cumbersome during common use.

In addition, the growth of the market is set by the growing investment by companies across the world in the production of household robots for different uses. For example, introduced in May 2022, Dyson – a British company – showcased the concept of home robots intended for performing home chores. The company also disclosed it intends to undertake the construction of the largest robot research and development center in UK.

Household Robot Market Trend Analysis

Household Robot Market Growth Driver- Increasing Smart Home Technology Demands Drive Domestic Robot Growth

- Helping elders with their personal cares and needs, responding to the growing population aging issue, and to enable them to live on their own have enhanced the overall perception of household robots. A demographic change is making Western and East Asian countries bigger markets for home robot manufacturers and suppliers through the projected years.

- Innovations in gesture detection and natural language processing software makes domestic robots to be easier to control and friendly. Nonetheless, to ensure that only safe and ethical robots are in the homes and other spaces, regulatory frameworks are now under development in several parts. With people having a desire for automatic and interconnected homes in recent years, there has been an influx of smart homes requirements.

Household Robot Market Opportunity- Technological advancements Drive the Market

- The potential of home robots can be realized through the enhancement of cognition, interaction and manipulation technology. Thus, it is technology and other component suppliers that have contributed to the development of the robotics ecosystem. Advancements in home appliances, high costs of labor and elevated risks of safety breaches are some of the factors that are making domestic robots more common. There is an increased appetite for household robots in the global market today. In accordance with the tendencies observed in connection with the so-called smart home concept, it is possible that the robot will occupy a significant place in the concept of smart home.

- Blended with the amazon’s Alexa virtual personal assistant technology and with AI face and speech recognition, the temi home robot constructs a mobile smart home hub which is expected to revolutionize human-machine interface. Another factor influencing the demand for Household Robot Market is increasing advantages by businesses worldwide for developing household robots system for different uses.

Household Robot Market Segment Analysis:

Household Robot Market Segmented based on Offering, Type, Distribution Channel, and Application.

By Offering, Product segment is expected to dominate the market during the forecast period

- The product segment will be the largest market during the forecast period owing to the increasing consumers’ shift towards the robotic technology that minimum steering by human. Futhermore, the increase in working women has enabled developed countries to embrace the use of autonomous and smart products.

- Additionally, the need to perform tasks from a distance is another feature that is continuously forming different lines of household robots. For instance, iRobot worked with google and incorporated Google’s AI helper to maintain the robots by voice and enhance functionality of daily operations.

- In addition, the use of software application bots with artificial intelligence and cognitive learning is being embraced actively by many companies to meet the need of the urban dwellers. For instance, current key players like Samsung and LG electronics have been investing significantly in possibly launching new household robotic products; such factors are presumed to foster segment growth.

By Type, Domestic robots segment held the largest share in 2024

- The most common type of a domestic robot is the smart vacuum and although, they are autonomous in that they move and operate on their own, they are still very much supervised robots. This sort of household robot is capable of moving circular within a room floor to clean the carpet and hard wood and all other sorts of floor. These robots are also implemented in home security systems.

- The demand for domestic robots likewise depends on the new trends in lifestyles apparent that includes both developed and developing nations. Besides, it is evident that domestic robots are useful in… Other tasks that are carried out effectively include mowing, washing floors and windows, among others.

- In addition, these robots also companion kids and the older persons and relaxes them and reminds them to take their respective medications, controlling their conduct and thus increasing the global consumption rates and hence the market growth.

Household Robot Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region shall be the most significant market and the fastest-growing one owing to the growing population, booming urbanization, and the deployment of smart solutions. They have strong manufacturing activity and increasing focus on technology products especially the increasing tech manufacturing capability making them highly involved in the creation and use of household robots. In addition, increase in the disposable income and change in trend of the lifestyles have been increasing the demand of the automated solutions in their homes that, in turn have positively impacted the growth of the Asia Pacific market.

- Currently, the Asia Pacific region holds the largest share of global household robots and is predicted to grow at a faster pace in the given time period due to the burgeoning demand for advanced technologies, and the increasing income of people. Further, segment growth is being supported by a continuous rise of cleaning robots in China and its regions. Cohesion and complex countries such as China and India transform their schooling systems and fund enhancement to back up human-added and Robot workforce.

- Recently, data obtained from the International Monetary Fund (IMF) suggest that China has become the largest consumer of these robots and can account for 50 percent of the entire Asia usage of these devices trailed by Korea and Japan. Also, the increasing need for household cleaning products, home security systems to monitor and control access to homes in China, Japan, South Korea, and India has become a key factor in the demand for the product.

Active Key Players in the Household Robot Market

- Samsung Electronics Co. Ltd (South Korea)

- iRobot (US)

- Neato (US)

- LG Electronics Inc (South Korea)

- Ecovacs (China)

- Dyson (UK)

- Alfred Kärcher (Germany)

- Lego (Denmark)

- John Deere (US)

- iLife Innovation (China)

- BSH Hausgeräte (Germany)

- Miele (Germany)

- Robomow (Israel)

- Blue Frog Robotics (France)

- Husqvarna (Sweden)

- Other Active Players

|

Global Household Robot Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 12.96 Bn. |

|

Forecast Period 2025-32 CAGR: |

16.8 % |

Market Size in 2032: |

USD 44.9 Bn. |

|

Segments Covered: |

By Offering |

|

|

|

By Type |

|

||

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Household Robot Market by Offering (2018-2032)

4.1 Household Robot Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Product

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Household Robot Market by Type (2018-2032)

5.1 Household Robot Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Domestic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Entertainment And Leisure

Chapter 6: Household Robot Market by Distribution Channel (2018-2032)

6.1 Household Robot Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online Channel

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline Channel

Chapter 7: Household Robot Market by Application (2018-2032)

7.1 Household Robot Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Vacuuming

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Lawn Mowing

7.5 Pool Cleaning

7.6 Companionship

7.7 Elderly Assistance and Handicap Assistance

7.8 Robot Toys and Hob

Chapter 8: Household Robot Market by Systems (2018-2032)

8.1 Household Robot Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Others

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Household Robot Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 SAMSUNG ELECTRONICS CO. LTD (SOUTH KOREA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 IROBOT (US)

9.4 NEATO (US)

9.5 LG ELECTRONICS INC (SOUTH KOREA)

9.6 ECOVACS (CHINA)

9.7 DYSON (UK)

9.8 ALFRED KÄRCHER (GERMANY)

9.9 LEGO (DENMARK)

9.10 JOHN DEERE (US)

9.11 ILIFE INNOVATION (CHINA)

9.12 BSH HAUSGERÄTE (GERMANY)

9.13 MIELE (GERMANY)

9.14 ROBOMOW (ISRAEL)

9.15 BLUE FROG ROBOTICS (FRANCE)

9.16 HUSQVARNA (SWEDEN)

9.17 OTHER KEY PLAYERS

Chapter 10: Global Household Robot Market By Region

10.1 Overview

10.2. North America Household Robot Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Offering

10.2.4.1 Product

10.2.4.2 Services

10.2.5 Historic and Forecasted Market Size by Type

10.2.5.1 Domestic

10.2.5.2 Entertainment And Leisure

10.2.6 Historic and Forecasted Market Size by Distribution Channel

10.2.6.1 Online Channel

10.2.6.2 Offline Channel

10.2.7 Historic and Forecasted Market Size by Application

10.2.7.1 Vacuuming

10.2.7.2 Lawn Mowing

10.2.7.3 Pool Cleaning

10.2.7.4 Companionship

10.2.7.5 Elderly Assistance and Handicap Assistance

10.2.7.6 Robot Toys and Hob

10.2.8 Historic and Forecasted Market Size by Systems

10.2.8.1 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Household Robot Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Offering

10.3.4.1 Product

10.3.4.2 Services

10.3.5 Historic and Forecasted Market Size by Type

10.3.5.1 Domestic

10.3.5.2 Entertainment And Leisure

10.3.6 Historic and Forecasted Market Size by Distribution Channel

10.3.6.1 Online Channel

10.3.6.2 Offline Channel

10.3.7 Historic and Forecasted Market Size by Application

10.3.7.1 Vacuuming

10.3.7.2 Lawn Mowing

10.3.7.3 Pool Cleaning

10.3.7.4 Companionship

10.3.7.5 Elderly Assistance and Handicap Assistance

10.3.7.6 Robot Toys and Hob

10.3.8 Historic and Forecasted Market Size by Systems

10.3.8.1 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Household Robot Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Offering

10.4.4.1 Product

10.4.4.2 Services

10.4.5 Historic and Forecasted Market Size by Type

10.4.5.1 Domestic

10.4.5.2 Entertainment And Leisure

10.4.6 Historic and Forecasted Market Size by Distribution Channel

10.4.6.1 Online Channel

10.4.6.2 Offline Channel

10.4.7 Historic and Forecasted Market Size by Application

10.4.7.1 Vacuuming

10.4.7.2 Lawn Mowing

10.4.7.3 Pool Cleaning

10.4.7.4 Companionship

10.4.7.5 Elderly Assistance and Handicap Assistance

10.4.7.6 Robot Toys and Hob

10.4.8 Historic and Forecasted Market Size by Systems

10.4.8.1 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Household Robot Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Offering

10.5.4.1 Product

10.5.4.2 Services

10.5.5 Historic and Forecasted Market Size by Type

10.5.5.1 Domestic

10.5.5.2 Entertainment And Leisure

10.5.6 Historic and Forecasted Market Size by Distribution Channel

10.5.6.1 Online Channel

10.5.6.2 Offline Channel

10.5.7 Historic and Forecasted Market Size by Application

10.5.7.1 Vacuuming

10.5.7.2 Lawn Mowing

10.5.7.3 Pool Cleaning

10.5.7.4 Companionship

10.5.7.5 Elderly Assistance and Handicap Assistance

10.5.7.6 Robot Toys and Hob

10.5.8 Historic and Forecasted Market Size by Systems

10.5.8.1 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Household Robot Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Offering

10.6.4.1 Product

10.6.4.2 Services

10.6.5 Historic and Forecasted Market Size by Type

10.6.5.1 Domestic

10.6.5.2 Entertainment And Leisure

10.6.6 Historic and Forecasted Market Size by Distribution Channel

10.6.6.1 Online Channel

10.6.6.2 Offline Channel

10.6.7 Historic and Forecasted Market Size by Application

10.6.7.1 Vacuuming

10.6.7.2 Lawn Mowing

10.6.7.3 Pool Cleaning

10.6.7.4 Companionship

10.6.7.5 Elderly Assistance and Handicap Assistance

10.6.7.6 Robot Toys and Hob

10.6.8 Historic and Forecasted Market Size by Systems

10.6.8.1 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Household Robot Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Offering

10.7.4.1 Product

10.7.4.2 Services

10.7.5 Historic and Forecasted Market Size by Type

10.7.5.1 Domestic

10.7.5.2 Entertainment And Leisure

10.7.6 Historic and Forecasted Market Size by Distribution Channel

10.7.6.1 Online Channel

10.7.6.2 Offline Channel

10.7.7 Historic and Forecasted Market Size by Application

10.7.7.1 Vacuuming

10.7.7.2 Lawn Mowing

10.7.7.3 Pool Cleaning

10.7.7.4 Companionship

10.7.7.5 Elderly Assistance and Handicap Assistance

10.7.7.6 Robot Toys and Hob

10.7.8 Historic and Forecasted Market Size by Systems

10.7.8.1 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Household Robot Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 12.96 Bn. |

|

Forecast Period 2025-32 CAGR: |

16.8 % |

Market Size in 2032: |

USD 44.9 Bn. |

|

Segments Covered: |

By Offering |

|

|

|

By Type |

|

||

|

By Distribution Channel |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||