Horse-Riding Apparel Market Synopsis

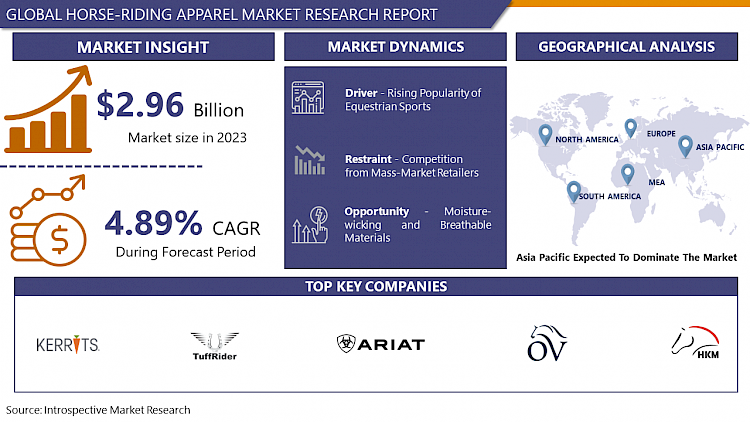

Horse-Riding Apparel Market Size Was Valued at USD 2.96 Billion in 2023 and is Projected to Reach USD 4.48 Billion by 2032, Growing at a CAGR of 4.7% From 2024-2032.

Horse-riding apparel is designed for equestrian activities, focusing on functionality, comfort, and safety. It includes riding breeches, jackets, shirts, boots, helmets, gloves, protective vests, and riding boots. These garments cater to various disciplines and environments, ensuring rider safety. Horse-riding apparel is essential for performance and style, catering to riders of all levels of experience and expertise, from casual riding to competitive events.

- Horse-riding apparel is a crucial component of the equestrian community, offering riders comfort, safety, and performance. Its features include moisture-wicking fabrics, stretch panels, and ergonomic designs, ensuring riders can move freely and maintain optimal comfort. Specialized riding apparel also incorporates protective elements like reinforced seams, padding, and impact-resistant materials to reduce the risk of injuries. The demand for horse-riding apparel is driven by the increasing popularity of equestrian sports and recreational activities worldwide. The equestrian lifestyle extends beyond competitive riding, with many enthusiasts seeking stylish and functional apparel for leisurely rides, barn chores, and equestrian-themed events.

- Market trends in horse-riding apparel reflect evolving fashion preferences, technological advancements, and sustainability considerations. Contemporary designs blend traditional equestrian aesthetics with modern styling elements, offering riders a wide range of options to express their style. Sustainable materials and production practices are also gaining traction, with brands prioritizing eco-friendly fabrics, ethical sourcing, and transparent manufacturing processes. Horse-riding apparel is used in a broad spectrum of activities, from competitive events to casual rides and stable chores.

- Horse-riding apparel reflects a rider's identity and sense of belonging within the equestrian community. Riders choose attire that reflects their personality, riding discipline, and affiliation with specific brands or teams. This form of self-expression fosters unity and shared passion. The versatility of riding attire extends beyond the arena, with many riders incorporating equestrian-inspired fashion into their everyday wardrobe, driving demand for stylish and functional horse-riding apparel in the market.

Horse-Riding Apparel Market Trend Analysis

Rising Popularity of Equestrian Sports

- The increasing popularity of equestrian sports is driving the horse-riding apparel market, resulting in a demand for specialized attire tailored to riders' needs. The accessibility and inclusivity of equestrian activities cater to a wide range of ages, abilities, and interests, making them accessible to individuals from diverse backgrounds. The global appeal of equestrian sports is amplified by their inclusion in major international competitions like the Olympic Games, World Equestrian Games, and prestigious horse shows and championships.

- The rise of social media and digital platforms has also played a significant role in promoting equestrian sports and connecting riders and enthusiasts worldwide. Online communities, forums, and social networking sites allow riders to share experiences, exchange knowledge, and showcase achievements, fostering camaraderie and support within the equestrian community.

- The health and wellness benefits of equestrian activities, such as physical strength, balance, coordination, and mental focus, have also contributed to their growing popularity. As awareness of these benefits increases, more individuals are drawn to equestrian sports as a means of staying active, improving fitness levels, and enhancing overall well-being.

Moisture-wicking and Breathable Materials

- Moisture-wicking and breathable materials offer a significant opportunity in the horse-riding apparel market, providing riders with enhanced comfort, performance, and safety during equestrian activities. These fabrics are designed to manage moisture and regulate body temperature, addressing common challenges faced by riders. Moisture-wicking materials quickly draw sweat away from the skin, allowing it to evaporate more readily, enhancing rider comfort and reducing the risk of chafing, irritation, and discomfort. Breathable materials facilitate better airflow and ventilation, promoting efficient heat dissipation and regulating body temperature. This is particularly beneficial during strenuous activities or warmer climates.

- Incorporating moisture-wicking and breathable materials into horse-riding apparel aligns with the increasing emphasis on performance-driven and technologically advanced riding gear. Riders prioritize apparel that enhances their performance, supports their physical well-being, and enables them to perform at their best. Manufacturers can differentiate their products and gain a competitive edge by integrating these innovative fabrics into their designs.

- The growing demand for moisture-wicking and breathable riding apparel reflects broader trends toward active lifestyles, athleisure fashion, and sustainability. Manufacturers that prioritize eco-friendly, sustainable materials in their riding apparel collections can capitalize on this opportunity to attract environmentally conscious consumers and strengthen their brand reputation in the market.

Horse-Riding Apparel Market Segment Analysis:

Horse-Riding Apparel Market Segmented on the basis of Type, Gender, and Distribution Channel.

By Gender, Clothing segment is expected to dominate the market during the forecast period

- The clothing segment is expected to dominate the horse-riding apparel market due to its significant role in the equestrian community and the broader fashion industry. Riding apparel provides comfort, protection, and style for both competitive and recreational riders, offering a wide range of options tailored to different disciplines, seasons, and riding environments. The clothing segment also allows riders to express their style, individuality, and affiliation with specific equestrian brands or teams. Equestrian fashion trends evolve, reflecting changes in riding disciplines, cultural influences, and societal preferences. Riders seek clothing that aligns with their aesthetic preferences and identity within the equestrian community.

- Continuous innovation and technological advancements in textile materials, design techniques, and manufacturing processes enhance the quality, comfort, and durability of riding apparel. Manufacturers and brands invest in developing high-performance fabrics, ergonomic designs, and sustainable production methods to enhance the quality, comfort, and durability of riding apparel. The widespread availability of riding apparel through various distribution channels, including specialty equestrian stores, online retailers, and mainstream fashion outlets, further reinforces the clothing segment's dominance.

By Gender, Women's Riding Apparel segment is expected to dominate the market during the forecast period

- The Women's Riding Apparel segment dominates the horse-riding apparel market due to various factors. The increasing participation of women in equestrian sports and recreational activities has led to a demand for specialized riding apparel tailored specifically for female riders. This demand is driven by the need for clothing that fits well, offers performance-enhancing features, and is stylishly designed for women's bodies and riding styles.

- The Women's Riding Apparel segment is expected to dominate due to the large female rider population, which represents a significant consumer base with diverse needs and purchasing power. Manufacturers and retailers have focused on developing and marketing riding apparel specifically for women, ranging from performance-oriented technical gear to fashionable equestrian lifestyle apparel.

- The rise of social media and digital marketing has also contributed to the growth of the Women's Riding Apparel segment, enabling brands to connect directly with female riders and engage with consumers on platforms like Instagram, Facebook, and equestrian blogs. This increased visibility and accessibility have further fueled the demand for women's riding apparel, driving sales both online and in traditional retail channels.

Horse-Riding Apparel Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region is poised to dominate the horse-riding apparel market due to its rapid economic growth, urbanization, and increasing standard of living. This has led to a growing market of affluent individuals who can afford high-quality horse-riding apparel. The region's diverse population, including equestrian enthusiasts and riders, is also a significant factor in the demand for specialized riding apparel. Countries like China, Japan, Australia, and South Korea have vibrant equestrian communities, which further fuel the demand for specialized riding apparel.

- The region is also witnessing a growing trend towards Westernization of fashion and lifestyle, leading to an increased demand for authentic and high-quality horse-riding apparel that meets international standards. The rise of e-commerce and digital retail platforms has transformed the way consumers shop for horse-riding apparel in the Asia-Pacific region, offering convenience, accessibility, and a wide range of product options. This shift towards online shopping is expected to further drive the growth of the horse-riding apparel market in the region.

Horse-Riding Apparel Market Top Key Players:

- Ariat International (US)

- Kerrits (US)

- TuffRider (US)

- Goode Rider (US)

- Cavalliera (US)

- RJ Classics (US)

- Ovation Riding (US)

- Eskadron (Germany)

- Schockemöhle Sports (Germany)

- HKM Sports Equipment (Germany)

- Pikeur (Germany)

- Harry Hall (UK)

- Shires Equestrian (UK)

- Charles Owen (UK)

- Horseware Ireland (Ireland)

- Tredstep Ireland (Ireland)

- Dublin Clothing (Ireland)

- Cavalleria Toscana (Italy)

- Animo (Italy)

- Equiline (Italy)

- Horze (Finland)

- Mountain Horse (Sweden)

- Kingsland Equestrian (Norway)

- GPA Helmets (France)

- B Vertigo (Finland), and Other Major Players.

Key Industry Developments in the Horse-Riding Apparel Market:

- In May 2023, Charles Owen, the Official Helmet Sponsor of British Showjumping, announced the launch of a new brand, EQX. EQX aimed to offer affordable riding helmets and equipment with next-level style and performance for its customers. Dave Derby, CEO of Charles Owen, commented, “The Charles Owen name has long been synonymous with the best in equestrian safety and innovation. We recognized a year ago that our customers were under growing pressure to keep up with the increasing cost of living while still keeping their horses.

- In March 2023, The California-based company announced that it had partnered with resale tech company Archive to launch a secondhand marketplace for its products. The site, called Ariat Reboot, is powered by Archive’s digital platform, though it resides on the Ariat.com website. Initially, the product offerings were limited to Ariat’s English and Western boots for men, women, and kids.

|

Global Horse-Riding Apparel Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.96 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.7 % |

Market Size in 2032: |

USD 4.48 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Gender |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HORSE-RIDING APPAREL MARKET BY TYPE (2017-2032)

- HORSE-RIDING APPAREL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOTHING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BOOTS

- HELMETS

- GLOVES

- HORSE-RIDING APPAREL MARKET BY GENDER (2017-2032)

- HORSE-RIDING APPAREL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEN’S RIDING APPAREL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WOMEN’S RIDING APPAREL

- HORSE-RIDING APPAREL MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- HORSE-RIDING APPAREL MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ONLINE RETAIL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPECIALTY STORES

- SPORTS RETAIL CHAINS

- SUPERMARKETS AND HYPERMARKETS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Horse-Riding Apparel Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ARIAT INTERNATIONAL (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- KERRITS (US)

- TUFFRIDER (US)

- GOODE RIDER (US)

- CAVALLIERA (US)

- RJ CLASSICS (US)

- OVATION RIDING (US)

- ESKADRON (GERMANY)

- SCHOCKEMÖHLE SPORTS (GERMANY)

- HKM SPORTS EQUIPMENT (GERMANY)

- PIKEUR (GERMANY)

- HARRY HALL (UK)

- SHIRES EQUESTRIAN (UK)

- CHARLES OWEN (UK)

- HORSEWARE IRELAND (IRELAND)

- TREDSTEP IRELAND (IRELAND)

- DUBLIN CLOTHING (IRELAND)

- CAVALLERIA TOSCANA (ITALY)

- ANIMO (ITALY)

- EQUILINE (ITALY)

- HORZE (FINLAND)

- MOUNTAIN HORSE (SWEDEN)

- KINGSLAND EQUESTRIAN (NORWAY)

- GPA HELMETS (FRANCE)

- B VERTIGO (FINLAND)

- COMPETITIVE LANDSCAPE

- GLOBAL HORSE-RIDING APPAREL MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Gender

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Horse-Riding Apparel Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.96 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.7 % |

Market Size in 2032: |

USD 4.48 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Gender |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HORSE-RIDING APPAREL MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HORSE-RIDING APPAREL MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HORSE-RIDING APPAREL MARKET COMPETITIVE RIVALRY

TABLE 005. HORSE-RIDING APPAREL MARKET THREAT OF NEW ENTRANTS

TABLE 006. HORSE-RIDING APPAREL MARKET THREAT OF SUBSTITUTES

TABLE 007. HORSE-RIDING APPAREL MARKET BY TYPE

TABLE 008. CLOTHS MARKET OVERVIEW (2016-2030)

TABLE 009. BOOTS MARKET OVERVIEW (2016-2030)

TABLE 010. HELMETS MARKET OVERVIEW (2016-2030)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 012. HORSE-RIDING APPAREL MARKET BY DISTRIBUTION CHANNEL

TABLE 013. SPECIALTY STORES MARKET OVERVIEW (2016-2030)

TABLE 014. SUPERMARKETS MARKET OVERVIEW (2016-2030)

TABLE 015. HYPERMARKETS MARKET OVERVIEW (2016-2030)

TABLE 016. ONLINE RETAILERS MARKET OVERVIEW (2016-2030)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 018. NORTH AMERICA HORSE-RIDING APPAREL MARKET, BY TYPE (2016-2030)

TABLE 019. NORTH AMERICA HORSE-RIDING APPAREL MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 020. N HORSE-RIDING APPAREL MARKET, BY COUNTRY (2016-2030)

TABLE 021. EASTERN EUROPE HORSE-RIDING APPAREL MARKET, BY TYPE (2016-2030)

TABLE 022. EASTERN EUROPE HORSE-RIDING APPAREL MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 023. HORSE-RIDING APPAREL MARKET, BY COUNTRY (2016-2030)

TABLE 024. WESTERN EUROPE HORSE-RIDING APPAREL MARKET, BY TYPE (2016-2030)

TABLE 025. WESTERN EUROPE HORSE-RIDING APPAREL MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 026. HORSE-RIDING APPAREL MARKET, BY COUNTRY (2016-2030)

TABLE 027. ASIA PACIFIC HORSE-RIDING APPAREL MARKET, BY TYPE (2016-2030)

TABLE 028. ASIA PACIFIC HORSE-RIDING APPAREL MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 029. HORSE-RIDING APPAREL MARKET, BY COUNTRY (2016-2030)

TABLE 030. MIDDLE EAST & AFRICA HORSE-RIDING APPAREL MARKET, BY TYPE (2016-2030)

TABLE 031. MIDDLE EAST & AFRICA HORSE-RIDING APPAREL MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 032. HORSE-RIDING APPAREL MARKET, BY COUNTRY (2016-2030)

TABLE 033. SOUTH AMERICA HORSE-RIDING APPAREL MARKET, BY TYPE (2016-2030)

TABLE 034. SOUTH AMERICA HORSE-RIDING APPAREL MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 035. HORSE-RIDING APPAREL MARKET, BY COUNTRY (2016-2030)

TABLE 036. COLUMBIA SPORTSWEAR (U.S.): SNAPSHOT

TABLE 037. COLUMBIA SPORTSWEAR (U.S.): BUSINESS PERFORMANCE

TABLE 038. COLUMBIA SPORTSWEAR (U.S.): PRODUCT PORTFOLIO

TABLE 039. COLUMBIA SPORTSWEAR (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. MOUNTAIN HORSE (U.S.): SNAPSHOT

TABLE 040. MOUNTAIN HORSE (U.S.): BUSINESS PERFORMANCE

TABLE 041. MOUNTAIN HORSE (U.S.): PRODUCT PORTFOLIO

TABLE 042. MOUNTAIN HORSE (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ARIAT (U.S.): SNAPSHOT

TABLE 043. ARIAT (U.S.): BUSINESS PERFORMANCE

TABLE 044. ARIAT (U.S.): PRODUCT PORTFOLIO

TABLE 045. ARIAT (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. EQUETECH (UK): SNAPSHOT

TABLE 046. EQUETECH (UK): BUSINESS PERFORMANCE

TABLE 047. EQUETECH (UK): PRODUCT PORTFOLIO

TABLE 048. EQUETECH (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. DECATHLON (FRANCE): SNAPSHOT

TABLE 049. DECATHLON (FRANCE): BUSINESS PERFORMANCE

TABLE 050. DECATHLON (FRANCE): PRODUCT PORTFOLIO

TABLE 051. DECATHLON (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. HORSEWARE (IRELAND): SNAPSHOT

TABLE 052. HORSEWARE (IRELAND): BUSINESS PERFORMANCE

TABLE 053. HORSEWARE (IRELAND): PRODUCT PORTFOLIO

TABLE 054. HORSEWARE (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. PIKEUR (GERMANY): SNAPSHOT

TABLE 055. PIKEUR (GERMANY): BUSINESS PERFORMANCE

TABLE 056. PIKEUR (GERMANY): PRODUCT PORTFOLIO

TABLE 057. PIKEUR (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. SHANGHAI GOLDTEX CLOTHING & BAGS CO. (CHINA): SNAPSHOT

TABLE 058. SHANGHAI GOLDTEX CLOTHING & BAGS CO. (CHINA): BUSINESS PERFORMANCE

TABLE 059. SHANGHAI GOLDTEX CLOTHING & BAGS CO. (CHINA): PRODUCT PORTFOLIO

TABLE 060. SHANGHAI GOLDTEX CLOTHING & BAGS CO. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. NOBLE OUTFITTERS (U.S.): SNAPSHOT

TABLE 061. NOBLE OUTFITTERS (U.S.): BUSINESS PERFORMANCE

TABLE 062. NOBLE OUTFITTERS (U.S.): PRODUCT PORTFOLIO

TABLE 063. NOBLE OUTFITTERS (U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. GPA (UK): SNAPSHOT

TABLE 064. GPA (UK): BUSINESS PERFORMANCE

TABLE 065. GPA (UK): PRODUCT PORTFOLIO

TABLE 066. GPA (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. KERRITS (THE U.S.): SNAPSHOT

TABLE 067. KERRITS (THE U.S.): BUSINESS PERFORMANCE

TABLE 068. KERRITS (THE U.S.): PRODUCT PORTFOLIO

TABLE 069. KERRITS (THE U.S.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. KEP ITALIA (ITALY): SNAPSHOT

TABLE 070. KEP ITALIA (ITALY): BUSINESS PERFORMANCE

TABLE 071. KEP ITALIA (ITALY): PRODUCT PORTFOLIO

TABLE 072. KEP ITALIA (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 073. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 074. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 075. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HORSE-RIDING APPAREL MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HORSE-RIDING APPAREL MARKET OVERVIEW BY TYPE

FIGURE 012. CLOTHS MARKET OVERVIEW (2016-2030)

FIGURE 013. BOOTS MARKET OVERVIEW (2016-2030)

FIGURE 014. HELMETS MARKET OVERVIEW (2016-2030)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 016. HORSE-RIDING APPAREL MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 017. SPECIALTY STORES MARKET OVERVIEW (2016-2030)

FIGURE 018. SUPERMARKETS MARKET OVERVIEW (2016-2030)

FIGURE 019. HYPERMARKETS MARKET OVERVIEW (2016-2030)

FIGURE 020. ONLINE RETAILERS MARKET OVERVIEW (2016-2030)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 022. NORTH AMERICA HORSE-RIDING APPAREL MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. EASTERN EUROPE HORSE-RIDING APPAREL MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. WESTERN EUROPE HORSE-RIDING APPAREL MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. ASIA PACIFIC HORSE-RIDING APPAREL MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. MIDDLE EAST & AFRICA HORSE-RIDING APPAREL MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. SOUTH AMERICA HORSE-RIDING APPAREL MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Horse-Riding Apparel Market research report is 2024-2032.

Ariat International (US), Kerrits (US), TuffRider (US), Goode Rider (US), Cavalliera (US), RJ Classics (US), Ovation Riding (US), Eskadron (Germany), Schockemöhle Sports (Germany), HKM Sports Equipment (Germany), Pikeur (Germany), Harry Hall (UK), Shires Equestrian (UK), Charles Owen (UK), Horseware Ireland (Ireland), Tredstep Ireland (Ireland), Dublin Clothing (Ireland), Cavalleria Toscana (Italy), Animo (Italy), Equiline (Italy), Horze (Finland), Mountain Horse (Sweden), Kingsland Equestrian (Norway), GPA Helmets (France), B Vertigo (Finland) and Other Major Players.

The Horse-Riding Apparel Market is segmented into Type, Gender, Distribution Channel, and region. By Type, the market is categorized into Clothing, Boots, Helmets, and Gloves. By Gender, the market is categorized into Men's Riding Apparel and women's Riding Apparel. By Distribution Channel, the market is categorized into Online Retail, Specialty Stores, Sports Retail Chains, Supermarkets, and Hypermarkets. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Horse-riding apparel is designed for equestrian activities, focusing on functionality, comfort, and safety. It includes riding breeches, jackets, shirts, boots, helmets, gloves, protective vests, and riding boots. These garments cater to various disciplines and environments, ensuring rider safety. Horse-riding apparel is essential for performance and style, catering to riders of all levels of experience and expertise, from casual riding to competitive events.

Horse-Riding Apparel Market Size Was Valued at USD 2.96 Billion in 2023 and is Projected to Reach USD 4.48 Billion by 2032, Growing at a CAGR of 4.7% From 2024-2032.