Global Home Testing Kits Market Overview

The Global Market for Home Testing Kits Estimated at USD 3.83 Billion In the Year 2023, Is Projected to Reach A Revised Size of USD 6.69 Billion By 2032, Growing at A CAGR of 6.4% Over the Forecast Period 2024-2032

At-home testing kits are testing instruments that allow people to perform tests at home and receive results within a minute. Health testing instruments include health monitoring equipment for regular checking and controlling the health of various diseased patients like diabetes, HIV, and other infectious diseases. It is more convenient and comfortable to perform the test at home by using home test kits. These kits are self-testing kits and are advanced versions of the fast, point-of-care test kits that were created for healthcare professionals. Manufacturers are designing the kits for the strategy of wellness and prevention, and management of acute as well as chronic disorders. The variety of home test kits available in the market such as HIV tests, pregnancy tests, diabetes, ovulation test, and infectious diseases such as malaria, COVID-19, and others. In recent years there is rising the use of self-help and do-it-yourself (DIY) test kits because of the convenience to use and rapid results which significantly drives the market of the home test kit.

Market Dynamics And Factors For Home Testing Kits Market

Drivers:

Rising Adoption of The Home Testing Kits

Growing awareness among the people about several new products, so adoption of the home testing kits is increased is the key factor that helps the growth of the market. In the last few decades increasing the prevalence of chronic diseases like heart disease, and diabetes. For instance, Statista stated that in 2021 there were 537 million people suffering from diabetes worldwide. Moreover, according to WHO in 2021, there were 1.5 million people who acquired HIV worldwide. Thus, among the people growing awareness about the prevention of diseases. It is not possible for every patient to visit the hospital every day for a check-up. Hence, they prefer home test kits for regular check-ups. The pandemic period brings a huge change in the demand for home test kits. Owing to several restrictions in place, peoples like to buy home test kits. Apart from this, home testing kits are easily available at every pharmacy including online as well as offline pharmacies. Thus, its adoption is increasing that supporting the growth of the market of home testing kits over the forecast periods.

Restraints:

Inaccuracy in Results Associated with Home Testing Kits

Home testing kits have various benefits but most peoples are always doubtful about the accuracy of the result is the key factor that restricts the market growth of home testing kits.

Home testing kits are easy to use and come at affordable prices and are used for monitoring various infectious diseases. But some of the kits show variations in the result, so peoples are confused and have not trust the result of the home testing kits. Thus. they like to prefer to visit hospitals or laboratories for tests instead of home tests which is hampering the growth of the home testing kit market.

Opportunity:

Opportunity in the Advanced Technologies

The latest technologies used in the making of medical products provide a lucrative opportunity for the home testing kit market. Artificial Intelligence, Machine learning has the most important role in the healthcare sector and have the ability to improve the safety of patients and administrative processes through their quicker and automated performance. Owing growing prevalence of various infectious diseases manufacturers and the government also increasing their investment in new products. For instance, DAM Health a medical diagnostic company launched a new home test kit in March 2022 to meet the demand of the pandemic. AI technology is used in these kits for rapid and accurate results. Thus, novel advanced technology offers a huge opportunity for the home testing kits market during the forecast periods.

Segmentation Analysis Of Home Testing Kits Market

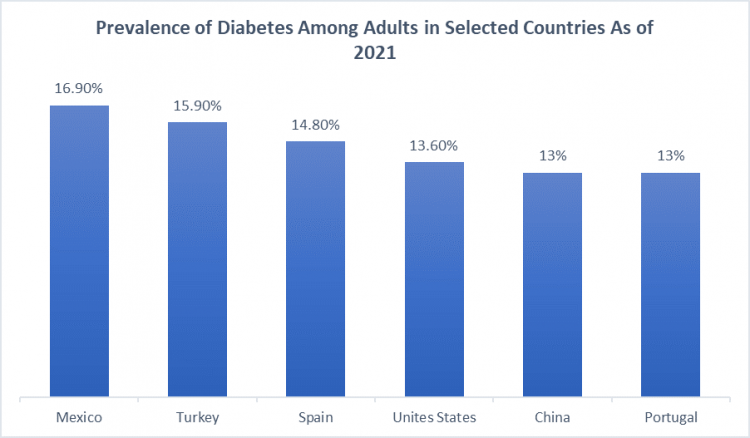

By Test Type, the glucose test is expected to have the maximum share in the home testing kit market during the forecast periods. Owing to the growing prevalence of diabetes patients around the world. The following figure shows the prevalence of diabetes in the world in the selected countries as of 2021.

Thus, this is the growing prevalence of coronavirus infections, rising the demand for cassettes for testing. Moreover, cassettes are also used for pregnancy tests, and an increase in the number of women using home pregnancy test kits. Thus, the growing demand for cassettes for various tests supports the growth of the market over the forecast periods.

By Distribution Channels, online pharmacies are dominated the market share of home test kits. Owing to the growing prevalence of various infectious diseases, rising the trend of purchasing medicines online. Apart from this increasing number of internet users in the world prefer online pharmacies for purchasing any medical products. For instance, according to Statista, in 2021 there were 4.9 billion people using the internet in the world. The products in online pharmacies are cost-effective as compared to the products in retail pharmacies and drug stores. Thus, increasing the number of peoples that uses online pharmacies for the purchase of home test kits support the growth of the market.

Regional Analysis Of Home Testing Kits Market

North America is expected to dominate the home testing kit market owing to high healthcare expenditure and rising awareness about the home testing kits benefits. Additionally, in the North American region growing prevalence of the diseases such as diabetes, heart disease, and other infectious diseases. For instance, according to the center for disease control and prevention, in 2021 there was 37.3 million Americans had diabetes and 96 million Americans had prediabetes. Moreover, the covid-19 cases in North America are also increased and people in this region use rapid antigen test kits. There are various home testing kits are available in the market for the detection of pregnancy. According to Statista, in Unites State in 2020, there were 7.92 million women who used home pregnancy tests. Thus, the growing awareness about home testing kit use and the rising number of infectious disease patients in this region that expected to increase the market of home testing kits in the North American region over the forecast period.

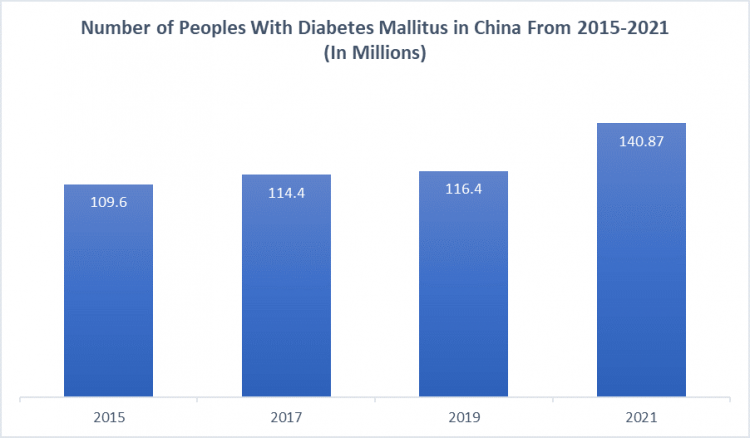

The Asia Pacific is the second dominant region in the home test kit market. This is due to the highest population base with the large prevalence of various infectious diseases. In the APAC region high number of people that suffering from diabetes. For instance, according to Statista, China is the country with which the highest number of diabetes population. The flowing diagram shows the growing number of diabetes patients from 2015 to 2021 in China

Apart from this, in Pakistan, there were 31% of the diabetes population in the same year. In this region covid-19 incidence cases also increased and peoples are more aware of the new healthcare products for diagnosis including home test kits. Thus, the demand for home testing kits is increased from the APAC region which increases the market of this region.

Europe has rapid growth in the home testing kit market owing to the high adoption of the new technology. European peoples are well-educated and are more open to accepting new technology. In recent years, the prevalence of chronic diseases in Europe is increased. For instance, Statista stated that there were 2.6 million people have diabetes in 2021 Italy. The incidence of coronavirus patients is also increasing in this region. In Europe, there were 246 million confirmed cases of the covid-19 from January 2020 to August 2022. Peoples in this region are more aware of the diagnosis of diseases and they use home care tests for regular check-ups that propel the growth of the market of this region.

Top Key Players Covered In Home Testing Kits Market

- Abbott(US)

- ACON Laboratories Inc. (US)

- Rapikit (US)

- BTNX INC. (Canada)

- bioLytical Laboratories Inc. (Canada)

- OraSure Technologies Inc. (USA)

- BD (US)

- Cardinal Health (USA)

- B. Braun Melsungen AG (Germany)

- Piramal Enterprises Ltd. (India)

- PRIMA Lab SA (Switzerland)

- Siemens Healthcare GmbH (Germany)

- Quidel Corporation (California)

- Bionime Corporation (California)

- SA Scientific (US)

- ARKRAY USA Inc. (USA)

- Everlywell Inc. (US)

- Nova Biomedical (Waltham, MA)

- Eurofins Viracor Inc. (US)

- SelfDiagnostics OU (Estonia)

- AdvaCare Pharma (Shanghai)

- AccuBio Tech Co. Ltd (China)

- BioSure (UK)

- Atlas Medical (UK)

- TaiDoc Technology Corporation (Taiwan)

- LifeScan IP Holdings LLC (Switzerland)

- Chembio Diagnostics Inc. (US)

- Drägerwerk AG & Co. KGaA (Germany)

- F. Hoffmann-La Roche Ltd. (Switzerland), and other major players.

Key Industry Development in The Home Testing Kits Market

- In May 2024, The Ministry of Health in Uganda recently launched the Community CheckNow HIV self-testing kit at a ceremony attended by Vice President Jessica Alupo and Health Minister Jane Ruth Aceng at Kololo Ceremonial Grounds, urging for increased awareness and behavior change to combat HIV/AIDS.

- In August 2023, Viome Life Sciences launched a Gut Intelligence Test at 200 CVS locations for evaluating gut health and providing personalized dietary recommendations. Viome uses advanced technology to analyze individual uniqueness and the microbiome, translating data into actionable insights for better healthspan and lifespan.

|

Global Home Testing Kits Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024 -2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2023: |

USD 3.83 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.31 % |

Market Size in 2032: |

USD 6.69 Bn. |

|

Segments Covered: |

By Test Type |

|

|

|

By Product Type |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HOME TESTING KITS MARKET BY TEST TYPE (2017-2032)

- HOME TESTING KITS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PREGNANCY TEST

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- HIV TEST KIT

- INFECTIOUS DISEASES

- GLUCOSE TEST

- OTHERS

- HOME TESTING KITS MARKET BY PRODUCT TYPE (2017-2032)

- HOME TESTING KITS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CASSETTE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- STRIP

- MIDSTREAM

- TEST PANEL

- OTHERS

- HOME TESTING KITS MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- HOME TESTING KITS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RETAIL PHARMACIES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DRUG STORE

- SUPERMARKET/ HYPERMARKET

- ONLINE PHARMACIES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- HOME TESTING KITS Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABBOTT (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ACON LABORATORIES INC. (US)

- RAPIKIT (US)

- BTNX INC. (CANADA)

- BIOLYTICAL LABORATORIES INC. (CANADA)

- ORASURE TECHNOLOGIES INC. (USA)

- BD (US)

- CARDINAL HEALTH (USA)

- B. BRAUN MELSUNGEN AG (GERMANY)

- PIRAMAL ENTERPRISES LTD. (INDIA)

- PRIMA LAB SA (SWITZERLAND)

- SIEMENS HEALTHCARE GMBH (GERMANY)

- QUIDEL CORPORATION (CALIFORNIA)

- BIONIME CORPORATION (CALIFORNIA)

- SA SCIENTIFIC (US)

- ARKRAY USA INC. (USA)

- EVERLYWELL INC. (US)

- NOVA BIOMEDICAL (WALTHAM, MA)

- EUROFINS VIRACOR INC. (US)

- SELFDIAGNOSTICS OU (ESTONIA)

- ADVACARE PHARMA (SHANGHAI)

- ACCUBIO TECH CO. LTD (CHINA)

- BIOSURE (UK)

- ATLAS MEDICAL (UK)

- TAIDOC TECHNOLOGY CORPORATION (TAIWAN)

- LIFESCAN IP HOLDINGS LLC (SWITZERLAND)

- CHEMBIO DIAGNOSTICS INC. (US)

- DRÄGERWERK AG & CO. KGAA (GERMANY)

- F. HOFFMANN-LA ROCHE LTD. (SWITZERLAND)

- COMPETITIVE LANDSCAPE

- GLOBAL HOME TESTING KITS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Test Type

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

Potential Market Strategies

|

Global Home Testing Kits Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024 -2032 |

|

Historical Data : |

2017 to 2023 |

Market Size in 2023: |

USD 3.83 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.31 % |

Market Size in 2032: |

USD 6.69 Bn. |

|

Segments Covered: |

By Test Type |

|

|

|

By Product Type |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HOME TESTING KITS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HOME TESTING KITS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HOME TESTING KITS MARKET COMPETITIVE RIVALRY

TABLE 005. HOME TESTING KITS MARKET THREAT OF NEW ENTRANTS

TABLE 006. HOME TESTING KITS MARKET THREAT OF SUBSTITUTES

TABLE 007. HOME TESTING KITS MARKET BY TYPE

TABLE 008. COMPREHENSIVE COVERAGE MARKET OVERVIEW (2016-2028)

TABLE 009. DWELLING COVERAGE MARKET OVERVIEW (2016-2028)

TABLE 010. CONTENT COVERAGE MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. HOME TESTING KITS MARKET BY APPLICATION

TABLE 013. PERSONAL MARKET OVERVIEW (2016-2028)

TABLE 014. ENTERPRISE MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA HOME TESTING KITS MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA HOME TESTING KITS MARKET, BY APPLICATION (2016-2028)

TABLE 017. N HOME TESTING KITS MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE HOME TESTING KITS MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE HOME TESTING KITS MARKET, BY APPLICATION (2016-2028)

TABLE 020. HOME TESTING KITS MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC HOME TESTING KITS MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC HOME TESTING KITS MARKET, BY APPLICATION (2016-2028)

TABLE 023. HOME TESTING KITS MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA HOME TESTING KITS MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA HOME TESTING KITS MARKET, BY APPLICATION (2016-2028)

TABLE 026. HOME TESTING KITS MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA HOME TESTING KITS MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA HOME TESTING KITS MARKET, BY APPLICATION (2016-2028)

TABLE 029. HOME TESTING KITS MARKET, BY COUNTRY (2016-2028)

TABLE 030. ABBOTT: SNAPSHOT

TABLE 031. ABBOTT: BUSINESS PERFORMANCE

TABLE 032. ABBOTT: PRODUCT PORTFOLIO

TABLE 033. ABBOTT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. ACON LABORATORIES INC.: SNAPSHOT

TABLE 034. ACON LABORATORIES INC.: BUSINESS PERFORMANCE

TABLE 035. ACON LABORATORIES INC.: PRODUCT PORTFOLIO

TABLE 036. ACON LABORATORIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. RAPIKIT: SNAPSHOT

TABLE 037. RAPIKIT: BUSINESS PERFORMANCE

TABLE 038. RAPIKIT: PRODUCT PORTFOLIO

TABLE 039. RAPIKIT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. BTNX INC.: SNAPSHOT

TABLE 040. BTNX INC.: BUSINESS PERFORMANCE

TABLE 041. BTNX INC.: PRODUCT PORTFOLIO

TABLE 042. BTNX INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. BIOLYTICAL LABORATORIES INC.: SNAPSHOT

TABLE 043. BIOLYTICAL LABORATORIES INC.: BUSINESS PERFORMANCE

TABLE 044. BIOLYTICAL LABORATORIES INC.: PRODUCT PORTFOLIO

TABLE 045. BIOLYTICAL LABORATORIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. ORASURE TECHNOLOGIES INC.: SNAPSHOT

TABLE 046. ORASURE TECHNOLOGIES INC.: BUSINESS PERFORMANCE

TABLE 047. ORASURE TECHNOLOGIES INC.: PRODUCT PORTFOLIO

TABLE 048. ORASURE TECHNOLOGIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. BD: SNAPSHOT

TABLE 049. BD: BUSINESS PERFORMANCE

TABLE 050. BD: PRODUCT PORTFOLIO

TABLE 051. BD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. CARDINAL HEALTH: SNAPSHOT

TABLE 052. CARDINAL HEALTH: BUSINESS PERFORMANCE

TABLE 053. CARDINAL HEALTH: PRODUCT PORTFOLIO

TABLE 054. CARDINAL HEALTH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. B. BRAUN MELSUNGEN AG: SNAPSHOT

TABLE 055. B. BRAUN MELSUNGEN AG: BUSINESS PERFORMANCE

TABLE 056. B. BRAUN MELSUNGEN AG: PRODUCT PORTFOLIO

TABLE 057. B. BRAUN MELSUNGEN AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. PIRAMAL ENTERPRISES LTD.: SNAPSHOT

TABLE 058. PIRAMAL ENTERPRISES LTD.: BUSINESS PERFORMANCE

TABLE 059. PIRAMAL ENTERPRISES LTD.: PRODUCT PORTFOLIO

TABLE 060. PIRAMAL ENTERPRISES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. PRIMA LAB SA: SNAPSHOT

TABLE 061. PRIMA LAB SA: BUSINESS PERFORMANCE

TABLE 062. PRIMA LAB SA: PRODUCT PORTFOLIO

TABLE 063. PRIMA LAB SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. SIEMENS HEALTHCARE GMBH: SNAPSHOT

TABLE 064. SIEMENS HEALTHCARE GMBH: BUSINESS PERFORMANCE

TABLE 065. SIEMENS HEALTHCARE GMBH: PRODUCT PORTFOLIO

TABLE 066. SIEMENS HEALTHCARE GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. QUIDEL CORPORATION: SNAPSHOT

TABLE 067. QUIDEL CORPORATION: BUSINESS PERFORMANCE

TABLE 068. QUIDEL CORPORATION: PRODUCT PORTFOLIO

TABLE 069. QUIDEL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. BIONIME CORPORATION: SNAPSHOT

TABLE 070. BIONIME CORPORATION: BUSINESS PERFORMANCE

TABLE 071. BIONIME CORPORATION: PRODUCT PORTFOLIO

TABLE 072. BIONIME CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. SA SCIENTIFIC: SNAPSHOT

TABLE 073. SA SCIENTIFIC: BUSINESS PERFORMANCE

TABLE 074. SA SCIENTIFIC: PRODUCT PORTFOLIO

TABLE 075. SA SCIENTIFIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. ARKRAY USA INC.: SNAPSHOT

TABLE 076. ARKRAY USA INC.: BUSINESS PERFORMANCE

TABLE 077. ARKRAY USA INC.: PRODUCT PORTFOLIO

TABLE 078. ARKRAY USA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. EVERLYWELL INC.: SNAPSHOT

TABLE 079. EVERLYWELL INC.: BUSINESS PERFORMANCE

TABLE 080. EVERLYWELL INC.: PRODUCT PORTFOLIO

TABLE 081. EVERLYWELL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. NOVA BIOMEDICAL: SNAPSHOT

TABLE 082. NOVA BIOMEDICAL: BUSINESS PERFORMANCE

TABLE 083. NOVA BIOMEDICAL: PRODUCT PORTFOLIO

TABLE 084. NOVA BIOMEDICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. EUROFINS VIRACOR INC.: SNAPSHOT

TABLE 085. EUROFINS VIRACOR INC.: BUSINESS PERFORMANCE

TABLE 086. EUROFINS VIRACOR INC.: PRODUCT PORTFOLIO

TABLE 087. EUROFINS VIRACOR INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. SELFDIAGNOSTICS OU: SNAPSHOT

TABLE 088. SELFDIAGNOSTICS OU: BUSINESS PERFORMANCE

TABLE 089. SELFDIAGNOSTICS OU: PRODUCT PORTFOLIO

TABLE 090. SELFDIAGNOSTICS OU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. ADVACARE PHARMA: SNAPSHOT

TABLE 091. ADVACARE PHARMA: BUSINESS PERFORMANCE

TABLE 092. ADVACARE PHARMA: PRODUCT PORTFOLIO

TABLE 093. ADVACARE PHARMA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. ACCUBIO TECH CO. LTD: SNAPSHOT

TABLE 094. ACCUBIO TECH CO. LTD: BUSINESS PERFORMANCE

TABLE 095. ACCUBIO TECH CO. LTD: PRODUCT PORTFOLIO

TABLE 096. ACCUBIO TECH CO. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. BIOSURE: SNAPSHOT

TABLE 097. BIOSURE: BUSINESS PERFORMANCE

TABLE 098. BIOSURE: PRODUCT PORTFOLIO

TABLE 099. BIOSURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. ATLAS MEDICAL: SNAPSHOT

TABLE 100. ATLAS MEDICAL: BUSINESS PERFORMANCE

TABLE 101. ATLAS MEDICAL: PRODUCT PORTFOLIO

TABLE 102. ATLAS MEDICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. TAIDOC TECHNOLOGY CORPORATION: SNAPSHOT

TABLE 103. TAIDOC TECHNOLOGY CORPORATION: BUSINESS PERFORMANCE

TABLE 104. TAIDOC TECHNOLOGY CORPORATION: PRODUCT PORTFOLIO

TABLE 105. TAIDOC TECHNOLOGY CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. LIFESCAN IP HOLDINGS LLC: SNAPSHOT

TABLE 106. LIFESCAN IP HOLDINGS LLC: BUSINESS PERFORMANCE

TABLE 107. LIFESCAN IP HOLDINGS LLC: PRODUCT PORTFOLIO

TABLE 108. LIFESCAN IP HOLDINGS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. CHEMBIO DIAGNOSTICS INC.: SNAPSHOT

TABLE 109. CHEMBIO DIAGNOSTICS INC.: BUSINESS PERFORMANCE

TABLE 110. CHEMBIO DIAGNOSTICS INC.: PRODUCT PORTFOLIO

TABLE 111. CHEMBIO DIAGNOSTICS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 111. DRÄGERWERK AG & CO. KGAA: SNAPSHOT

TABLE 112. DRÄGERWERK AG & CO. KGAA: BUSINESS PERFORMANCE

TABLE 113. DRÄGERWERK AG & CO. KGAA: PRODUCT PORTFOLIO

TABLE 114. DRÄGERWERK AG & CO. KGAA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 114. F. HOFFMANN-LA ROCHE LTD.: SNAPSHOT

TABLE 115. F. HOFFMANN-LA ROCHE LTD.: BUSINESS PERFORMANCE

TABLE 116. F. HOFFMANN-LA ROCHE LTD.: PRODUCT PORTFOLIO

TABLE 117. F. HOFFMANN-LA ROCHE LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 117. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 118. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 119. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 120. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HOME TESTING KITS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HOME TESTING KITS MARKET OVERVIEW BY TYPE

FIGURE 012. COMPREHENSIVE COVERAGE MARKET OVERVIEW (2016-2028)

FIGURE 013. DWELLING COVERAGE MARKET OVERVIEW (2016-2028)

FIGURE 014. CONTENT COVERAGE MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. HOME TESTING KITS MARKET OVERVIEW BY APPLICATION

FIGURE 017. PERSONAL MARKET OVERVIEW (2016-2028)

FIGURE 018. ENTERPRISE MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA HOME TESTING KITS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE HOME TESTING KITS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC HOME TESTING KITS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA HOME TESTING KITS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA HOME TESTING KITS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Home Testing Kits Market research report is 2024-2032.

Abbott (US), ACON Laboratories Inc. (US), Rapikit (US), BTNX INC. (Canada), bioLytical Laboratories Inc. (Canada), OraSure Technologies Inc. (USA), BD (US), Cardinal Health (USA), B. Braun Melsungen AG (Germany), Piramal Enterprises Ltd. (India), PRIMA Lab SA (Switzerland), Siemens Healthcare GmbH (Germany), Quidel Corporation (California), Bionime Corporation (California), SA Scientific (US), ARKRAY USA Inc. (USA), Everlywell Inc. (US), Nova Biomedical (Waltham, MA), Eurofins Viracor Inc. (US), SelfDiagnostics OU (Estonia), AdvaCare Pharma (Shanghai), AccuBio Tech Co. Ltd (China), BioSure (UK), Atlas Medical (UK), TaiDoc Technology Corporation (Taiwan), LifeScan IP Holdings LLC (Switzerland), Chembio Diagnostics Inc. (US), Drägerwerk AG & Co. KGaA (Germany), F. Hoffmann-La Roche Ltd.( Switzerland), and other major players.

The Home Testing Kits Market is segmented into Test Type, Product Type, Distribution Channels, and region. By Test type, the market is categorized into Pregnancy Tests, HIV Test kits, Infectious Diseases, Glucose Tests, and Others. By Product Type, the market is categorized into Cassette, Strip, Midstream, Test Panel, and Others. By Distribution Channels, the market is categorized into Retail Pharmacies, Drug Stores, Supermarkets/hypermarkets, and Online Pharmacies. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain etc.), Asia-Pacific (China; India; Japan; Southeast Asia etc.), South America (Brazil; Argentina etc.), Middle East & Africa (Saudi Arabia; South Africa etc.).

At-home testing kits are testing instruments that allow people to perform tests at home and receive results within a minute. Health testing instruments include health monitoring equipment for regular checking and controlling the health of various diseased patients like diabetes, HIV, and other infectious diseases.

The Global Market for Home Testing Kits Estimated at USD 3.83 Billion In the Year 2023, Is Projected to Reach A Revised Size of USD 6.69 Billion By 2032, Growing at A CAGR of 6.4% Over the Forecast Period 2024-2032