Higher Education Tools Market Synopsis

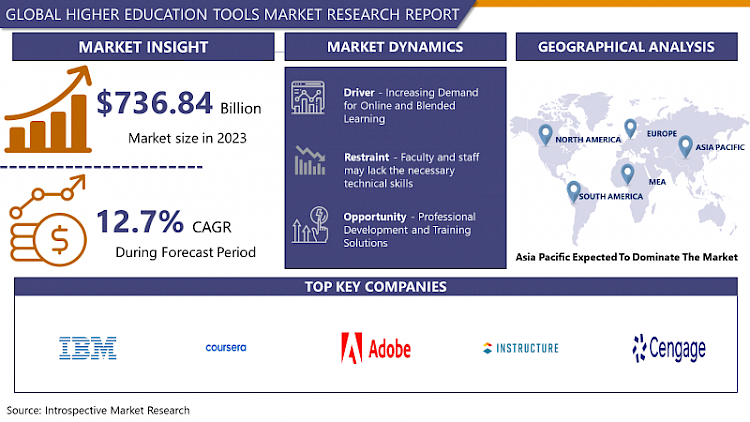

Higher Education Tools Market Size Was Valued at USD 736.84 Billion in 2023, and is Projected to Reach USD 1701.53 Billion by 2032, Growing at a CAGR of 12.7% From 2024-2032.

Higher education tools refer to various resources, platforms, technologies, and methodologies used to support teaching, learning, research, and administrative functions in colleges, universities, and other tertiary institutions. These tools encompass a wide range of digital and physical resources, including learning management systems (LMS), educational software, online libraries, academic databases, multimedia content, laboratory equipment, classroom technology, and administrative software. Higher education tools aim to enhance the quality, accessibility, and effectiveness of education delivery, facilitate collaboration and knowledge sharing, streamline administrative processes, and support academic and institutional objectives.

- Higher education tools are essential for various aspects of teaching, learning, administration, and research in colleges, universities, and other institutions. They enable course delivery and management, online learning and distance education, student engagement and interaction, assessment and feedback processes, personalized learning and adaptive education, research and scholarly activities, administrative and institutional management, and professional development and continuing education programs. Learning Management Systems (LMS) facilitate course creation, organization, student enrollment, assignment distribution, grading, and communication.

- Online learning and distance education tools provide virtual classrooms, multimedia resources, interactive course materials, discussion forums, and collaboration tools. Student engagement and interaction tools promote active learning, collaboration, peer-to-peer interaction, and community building. Assessment and feedback processes are supported by online testing platforms, assessment authoring tools, grading rubrics, plagiarism detection software, and peer review systems. Personalized learning and adaptive education tools use data analytics and algorithms to support student success and academic achievement. Administrative and institutional management tools support the operational functions of higher education institutions, improving efficiency and institutional effectiveness.

- Higher education tools are in high demand due to digital transformation, remote learning, hybrid education, flexible learning environments, personalized learning experiences, enhanced collaboration and communication, data-driven decision-making, competitive advantage, and continuous professional development. The digital transformation is driven by technological advancements and changing student expectations, while remote learning and hybrid education models are accelerated by the COVID-19 pandemic. Tools like online platforms, digital content, collaboration tools, and assessment technologies help institutions deliver quality education and maintain continuity during disruptions.

- Flexible learning environments cater to diverse student needs, preferences, and learning styles, while personalized learning experiences are provided by adaptive learning technologies and AI algorithms. Collaboration and communication tools facilitate seamless interaction among students, faculty, and staff, regardless of geographical location or time zone. Data-driven decision-making informs evidence-based decision-making, curriculum design, resource allocation, and student support services. Investment in innovative tools offers a competitive advantage by offering cutting-edge educational experiences, attracting top talent, and enhancing reputation.

Higher Education Tools Market Trend Analysis

Increasing Demand for Online and Blended Learning

- The rise of online education has led to a surge in demand for remote learning tools and technologies. These tools cater to students who prefer flexibility and convenience, offering a wide range of courses, degree programs, and certifications. Online learning offers flexible alternatives to traditional classroom-based education, allowing students to balance academic pursuits with work, family responsibilities, and other commitments.

- Online Learning also makes education more accessible to individuals with diverse needs and schedules, making it more accessible to those living in remote areas, individuals with disabilities, or non-traditional students. Online learning models are cost-effective, as students save on commuting, housing, and other expenses associated with campus-based programs, while institutions reduce overhead costs related to physical infrastructure and facilities.

- Online Learning also enables institutions to scale their online offerings and reach a global audience, providing personalized learning experiences tailored to individual needs. Online learning is increasingly used for professional development and lifelong learning. The COVID-19 pandemic has highlighted the importance of online and blended learning in ensuring continuity of teaching and learning during crises or emergencies.

Restraints

Faculty and Staff May Lack the Necessary Technical Skills

- The Higher Education Tools Market faces challenges due to the increasing reliance on technological tools for teaching, learning, administration, and research. These tools can be complex, requiring a certain level of technical proficiency. Faculty and staff members, particularly those from non-technical backgrounds or traditional teaching methods, may lack the necessary technical skills to effectively utilize these tools. Training programs and professional development initiatives may not always address the diverse needs and skill levels of faculty and staff, and participation may be limited due to time constraints or institutional priorities.

- Some faculty and staff members may exhibit resistance to change due to fear of the unknown, job security concerns, or perceived challenges in integrating technology with established teaching methodologies. This can impede the effectiveness and efficiency of various academic processes, hinder innovation, and put institutions at a competitive disadvantage compared to their peers.

Opportunity

Professional Development and Training Solutions

- Professional Development and Training Solutions are a growing market in higher education, focusing on enhancing the skills, knowledge, and competencies of faculty, staff, administrators, and students. These solutions include faculty development programs, staff training, leadership development initiatives, technology training, student success and career readiness programs, continuing education, and customized training solutions.

- Faculty development programs aim to improve teaching effectiveness, instructional design skills, technology integration, and pedagogical approaches. Staff training programs focus on job-specific competencies, customer service skills, leadership capabilities, and technical proficiencies. Leadership development programs focus on change management, conflict resolution, team building, decision-making, and performance evaluation. Technology training and digital literacy are also growing, focusing on learning management systems, multimedia authoring tools, online collaboration platforms, data analytics software, and cybersecurity awareness.

- Student success and career readiness programs aim to enhance academic skills, study habits, time management, career readiness, and employability. Continuing education programs provide opportunities for lifelong learners to acquire new skills, pursue personal interests, or advance their careers. Customized training solutions are designed in collaboration with institutional leaders to address unique challenges, strategic objectives, and performance improvement goals, ensuring relevance and effectiveness.

Challenges

Rapid technological advancements

- Modern vehicles have advanced electrical and electronic systems, requiring a complex network of cables to transmit power, data, and signals. As vehicle technologies evolve, there is a growing demand for cables with higher performance capabilities, such as increased power handling capacity, reliability, durability, and resistance to environmental factors. Technological advancements in materials science and manufacturing processes have led to the development of innovative materials and technologies for Higher Education Tools, such as high-strength conductors, advanced insulation materials, and improved shielding techniques.

- Integrating these new materials into cable designs while ensuring compatibility with existing systems and manufacturing processes can be challenging. Additionally, Higher Education Tools must comply with emerging standards and protocols, such as Ethernet, CAN FD, FlexRay, and LIN, to facilitate connectivity and interoperability between vehicle components and external systems. Balancing cost considerations with innovation and performance improvement is a significant challenge for cable manufacturers in highly competitive markets.

Higher Education Tools Market Segment Analysis:

Higher Education Tools Market Segmented based on product, and end user.

By Product, LMS segment is expected to dominate the market during the forecast period

- LMS serves as a centralized platform for managing various aspects of the learning process, including course materials, assignments, communication, and assessments. Its comprehensive nature makes it indispensable for institutions seeking to streamline their educational delivery methods. LMS platforms offer versatility and flexibility in delivering education. They can support a wide range of learning modalities, including traditional face-to-face instruction, fully online courses, and blended learning environments. This adaptability makes them attractive to institutions catering to diverse student needs and preferences.

- LMS solutions are scalable, meaning they can accommodate the needs of both small institutions and large universities with thousands of students. They offer features like user management, course enrollment, and content delivery that can scale up or down based on institutional requirements. LMS platforms often integrate with other educational technologies and systems, such as content repositories, video conferencing tools, and student information systems. This integration capability enhances their utility and allows institutions to create cohesive learning ecosystems.

- LMS platforms provide valuable insights into student engagement, performance, and learning outcomes through built-in analytics and reporting functionalities. Institutions can use this data to assess student progress, identify areas for improvement, and make data-driven decisions to enhance teaching and learning. The commitment to innovation ensures that LMS solutions remain relevant and competitive in an evolving educational landscape. LMS vendors typically offer robust customer support services and resources to assist institutions in implementing and maintaining their platforms.

By End User, Administrators segment held the largest share in 2022

- Administrators, including academic and administrative leaders, have significant decision-making authority in the selection and implementation of educational tools. They prioritize investments based on institutional priorities, student needs, and strategic objectives, influencing the adoption of tools across the institution.

- Administrators oversee the institutional-wide integration of educational tools, requiring coordination from various administrative departments. They are accountable for the performance and outcomes of educational initiatives, using educational tools for data collection, analysis, and reporting. They demonstrate accountability to stakeholders like faculty, students, and governing bodies.

- Administrators engage in strategic planning to address long-term institutional priorities and challenges, such as enhancing teaching and learning experiences, improving student success rates, and staying competitive in the higher education landscape. They leverage educational tools as strategic assets to achieve these objectives.

Higher Education Tools Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America, particularly the US, is a major player in the higher education tools sector due to its large number of institutions. The region's advanced technological infrastructure and widespread internet access enable the adoption of digital tools and platforms in higher education, such as learning management systems and online courseware. The region is also a global hub for innovation, with leading technology companies, research institutions, and startups based in major cities like Silicon Valley, Seattle, and Boston.

- Investments in education technology from venture capital firms, private equity investors, and government agencies support the development of new tools and platforms for higher education institutions. The strong demand for higher education in North America, driven by workforce demands, career advancement opportunities, and a culture that values education, creates a conducive environment for the growth of the higher education tools market.

- The complex regulatory environment in North America encourages innovation and entrepreneurship in the education sector, with policies supporting digital learning initiatives, research funding, and technology adoption. This global influence extends to the adoption of educational tools and technologies developed in the region.

Higher Education Tools Market Top Key Players:

- Blackboard Inc. (US)

- Instructure, Inc. (US)

- McGraw-Hill Education (US)

- Wiley (John Wiley & Sons, Inc.) (US)

- Cengage Learning (US)

- Adobe Inc. (US)

- Coursera Inc. (US)

- Pluralsight LLC (US)

- Chegg, Inc. (US)

- IBM Corporation (US)

- Microsoft Corporation (US)

- Oracle Corporation (US)

- Turnitin LLC (US)

- Knewton, Inc. (US)

- Schoology, Inc. (US)

- Echo360, Inc. (US)

- Panopto (US)

- ExamSoft Worldwide, Inc. (US)

- VitalSource Technologies LLC (US)

- Desire2Learn (D2L) Inc. (Canada)

- SAP SE (Germany)

- Pearson plc (UK)

- Elsevier (Netherlands), and other major players

Key Industry Developments in the Higher Education Tools Market:

- In October 2023, Instructure, the leading learning platform and maker of Canvas LMS, released the results from its annual global 2023 State of Student Success and Engagement, in partnership with Hanover Research. The study encapsulates current trends and movements within higher education and critical drivers of student success and engagement. Key findings include a preference for more certificate and apprenticeship programs, the ongoing need for mental health support for students and educators, and a continued concern over education accessibility.

- In February 2024, McGraw Hill announced the launch of a new English Language Teaching (ELT) course designed to help young learners around the world take their first steps towards learning English. The innovative six-level course called All Sorts, designed to the high standards that schools expect from McGraw Hill, is available to schools in Mexico, Colombia, Asia, and the Middle East.

|

Global Higher Education Tools Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

736.84 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.7% |

Market Size in 2032: |

1701.53 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Component

3.2 By Deployment

3.3 By Learning Mode

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Higher Education Tools Market by Component

5.1 Higher Education Tools Market Overview Snapshot and Growth Engine

5.2 Higher Education Tools Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hardware: Grographic Segmentation

5.4 Solutions

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Solutions: Grographic Segmentation

5.5 Services

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Services: Grographic Segmentation

Chapter 6: Higher Education Tools Market by Deployment

6.1 Higher Education Tools Market Overview Snapshot and Growth Engine

6.2 Higher Education Tools Market Overview

6.3 On Cloud

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 On Cloud: Grographic Segmentation

6.4 On Premises

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 On Premises: Grographic Segmentation

Chapter 7: Higher Education Tools Market by Learning Mode

7.1 Higher Education Tools Market Overview Snapshot and Growth Engine

7.2 Higher Education Tools Market Overview

7.3 Offline

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Offline: Grographic Segmentation

7.4 Online

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Online: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Higher Education Tools Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Higher Education Tools Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Higher Education Tools Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 ORACLE

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 UNIT4

8.4 HYLAND SOFTWARE

8.5 SAP

8.6 ELLUCIAN

8.7 BLACKBAUD

8.8 UNIFYED

8.9 PHOENIXS

8.10 TOP HAT

8.11 ACADEMYONE

8.12 CHERWELL

8.13 CAMPUS MANAGEMENT

8.14 JENZABAR

8.15 INSTRUCTURE

8.16 CIVITAS LEARNING

8.17 VERIZON

8.18 CISCO

8.19 REMIND

8.20 CENTURYLINK

8.21 HARMAN INTERNATIONAL

8.22 HURIX

8.23 CRAYON

8.24 VMWARE

8.25 XEROX

8.26 OTHER MAJOR PLAYERS

Chapter 9: Global Higher Education Tools Market Analysis, Insights and Forecast, 2017-2032

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Component

9.2.1 Hardware

9.2.2 Solutions

9.2.3 Services

9.3 Historic and Forecasted Market Size By Deployment

9.3.1 On Cloud

9.3.2 On Premises

9.4 Historic and Forecasted Market Size By Learning Mode

9.4.1 Offline

9.4.2 Online

Chapter 10: North America Higher Education Tools Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Component

10.4.1 Hardware

10.4.2 Solutions

10.4.3 Services

10.5 Historic and Forecasted Market Size By Deployment

10.5.1 On Cloud

10.5.2 On Premises

10.6 Historic and Forecasted Market Size By Learning Mode

10.6.1 Offline

10.6.2 Online

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Higher Education Tools Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Component

11.4.1 Hardware

11.4.2 Solutions

11.4.3 Services

11.5 Historic and Forecasted Market Size By Deployment

11.5.1 On Cloud

11.5.2 On Premises

11.6 Historic and Forecasted Market Size By Learning Mode

11.6.1 Offline

11.6.2 Online

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Higher Education Tools Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Component

12.4.1 Hardware

12.4.2 Solutions

12.4.3 Services

12.5 Historic and Forecasted Market Size By Deployment

12.5.1 On Cloud

12.5.2 On Premises

12.6 Historic and Forecasted Market Size By Learning Mode

12.6.1 Offline

12.6.2 Online

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Higher Education Tools Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Component

13.4.1 Hardware

13.4.2 Solutions

13.4.3 Services

13.5 Historic and Forecasted Market Size By Deployment

13.5.1 On Cloud

13.5.2 On Premises

13.6 Historic and Forecasted Market Size By Learning Mode

13.6.1 Offline

13.6.2 Online

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Higher Education Tools Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Component

14.4.1 Hardware

14.4.2 Solutions

14.4.3 Services

14.5 Historic and Forecasted Market Size By Deployment

14.5.1 On Cloud

14.5.2 On Premises

14.6 Historic and Forecasted Market Size By Learning Mode

14.6.1 Offline

14.6.2 Online

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Higher Education Tools Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

736.84 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.7% |

Market Size in 2032: |

1701.53 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HIGHER EDUCATION TOOLS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HIGHER EDUCATION TOOLS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HIGHER EDUCATION TOOLS MARKET COMPETITIVE RIVALRY

TABLE 005. HIGHER EDUCATION TOOLS MARKET THREAT OF NEW ENTRANTS

TABLE 006. HIGHER EDUCATION TOOLS MARKET THREAT OF SUBSTITUTES

TABLE 007. HIGHER EDUCATION TOOLS MARKET BY COMPONENT

TABLE 008. HARDWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SOLUTIONS MARKET OVERVIEW (2016-2028)

TABLE 010. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 011. HIGHER EDUCATION TOOLS MARKET BY DEPLOYMENT

TABLE 012. ON CLOUD MARKET OVERVIEW (2016-2028)

TABLE 013. ON PREMISES MARKET OVERVIEW (2016-2028)

TABLE 014. HIGHER EDUCATION TOOLS MARKET BY LEARNING MODE

TABLE 015. OFFLINE MARKET OVERVIEW (2016-2028)

TABLE 016. ONLINE MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA HIGHER EDUCATION TOOLS MARKET, BY COMPONENT (2016-2028)

TABLE 018. NORTH AMERICA HIGHER EDUCATION TOOLS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 019. NORTH AMERICA HIGHER EDUCATION TOOLS MARKET, BY LEARNING MODE (2016-2028)

TABLE 020. N HIGHER EDUCATION TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE HIGHER EDUCATION TOOLS MARKET, BY COMPONENT (2016-2028)

TABLE 022. EUROPE HIGHER EDUCATION TOOLS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 023. EUROPE HIGHER EDUCATION TOOLS MARKET, BY LEARNING MODE (2016-2028)

TABLE 024. HIGHER EDUCATION TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC HIGHER EDUCATION TOOLS MARKET, BY COMPONENT (2016-2028)

TABLE 026. ASIA PACIFIC HIGHER EDUCATION TOOLS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 027. ASIA PACIFIC HIGHER EDUCATION TOOLS MARKET, BY LEARNING MODE (2016-2028)

TABLE 028. HIGHER EDUCATION TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA HIGHER EDUCATION TOOLS MARKET, BY COMPONENT (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA HIGHER EDUCATION TOOLS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA HIGHER EDUCATION TOOLS MARKET, BY LEARNING MODE (2016-2028)

TABLE 032. HIGHER EDUCATION TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA HIGHER EDUCATION TOOLS MARKET, BY COMPONENT (2016-2028)

TABLE 034. SOUTH AMERICA HIGHER EDUCATION TOOLS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 035. SOUTH AMERICA HIGHER EDUCATION TOOLS MARKET, BY LEARNING MODE (2016-2028)

TABLE 036. HIGHER EDUCATION TOOLS MARKET, BY COUNTRY (2016-2028)

TABLE 037. ORACLE: SNAPSHOT

TABLE 038. ORACLE: BUSINESS PERFORMANCE

TABLE 039. ORACLE: PRODUCT PORTFOLIO

TABLE 040. ORACLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. UNIT4: SNAPSHOT

TABLE 041. UNIT4: BUSINESS PERFORMANCE

TABLE 042. UNIT4: PRODUCT PORTFOLIO

TABLE 043. UNIT4: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. HYLAND SOFTWARE: SNAPSHOT

TABLE 044. HYLAND SOFTWARE: BUSINESS PERFORMANCE

TABLE 045. HYLAND SOFTWARE: PRODUCT PORTFOLIO

TABLE 046. HYLAND SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. SAP: SNAPSHOT

TABLE 047. SAP: BUSINESS PERFORMANCE

TABLE 048. SAP: PRODUCT PORTFOLIO

TABLE 049. SAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. ELLUCIAN: SNAPSHOT

TABLE 050. ELLUCIAN: BUSINESS PERFORMANCE

TABLE 051. ELLUCIAN: PRODUCT PORTFOLIO

TABLE 052. ELLUCIAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. BLACKBAUD: SNAPSHOT

TABLE 053. BLACKBAUD: BUSINESS PERFORMANCE

TABLE 054. BLACKBAUD: PRODUCT PORTFOLIO

TABLE 055. BLACKBAUD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. UNIFYED: SNAPSHOT

TABLE 056. UNIFYED: BUSINESS PERFORMANCE

TABLE 057. UNIFYED: PRODUCT PORTFOLIO

TABLE 058. UNIFYED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. PHOENIXS: SNAPSHOT

TABLE 059. PHOENIXS: BUSINESS PERFORMANCE

TABLE 060. PHOENIXS: PRODUCT PORTFOLIO

TABLE 061. PHOENIXS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. TOP HAT: SNAPSHOT

TABLE 062. TOP HAT: BUSINESS PERFORMANCE

TABLE 063. TOP HAT: PRODUCT PORTFOLIO

TABLE 064. TOP HAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. ACADEMYONE: SNAPSHOT

TABLE 065. ACADEMYONE: BUSINESS PERFORMANCE

TABLE 066. ACADEMYONE: PRODUCT PORTFOLIO

TABLE 067. ACADEMYONE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CHERWELL: SNAPSHOT

TABLE 068. CHERWELL: BUSINESS PERFORMANCE

TABLE 069. CHERWELL: PRODUCT PORTFOLIO

TABLE 070. CHERWELL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. CAMPUS MANAGEMENT: SNAPSHOT

TABLE 071. CAMPUS MANAGEMENT: BUSINESS PERFORMANCE

TABLE 072. CAMPUS MANAGEMENT: PRODUCT PORTFOLIO

TABLE 073. CAMPUS MANAGEMENT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. JENZABAR: SNAPSHOT

TABLE 074. JENZABAR: BUSINESS PERFORMANCE

TABLE 075. JENZABAR: PRODUCT PORTFOLIO

TABLE 076. JENZABAR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. INSTRUCTURE: SNAPSHOT

TABLE 077. INSTRUCTURE: BUSINESS PERFORMANCE

TABLE 078. INSTRUCTURE: PRODUCT PORTFOLIO

TABLE 079. INSTRUCTURE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. CIVITAS LEARNING: SNAPSHOT

TABLE 080. CIVITAS LEARNING: BUSINESS PERFORMANCE

TABLE 081. CIVITAS LEARNING: PRODUCT PORTFOLIO

TABLE 082. CIVITAS LEARNING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. VERIZON: SNAPSHOT

TABLE 083. VERIZON: BUSINESS PERFORMANCE

TABLE 084. VERIZON: PRODUCT PORTFOLIO

TABLE 085. VERIZON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. CISCO: SNAPSHOT

TABLE 086. CISCO: BUSINESS PERFORMANCE

TABLE 087. CISCO: PRODUCT PORTFOLIO

TABLE 088. CISCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. REMIND: SNAPSHOT

TABLE 089. REMIND: BUSINESS PERFORMANCE

TABLE 090. REMIND: PRODUCT PORTFOLIO

TABLE 091. REMIND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. CENTURYLINK: SNAPSHOT

TABLE 092. CENTURYLINK: BUSINESS PERFORMANCE

TABLE 093. CENTURYLINK: PRODUCT PORTFOLIO

TABLE 094. CENTURYLINK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. HARMAN INTERNATIONAL: SNAPSHOT

TABLE 095. HARMAN INTERNATIONAL: BUSINESS PERFORMANCE

TABLE 096. HARMAN INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 097. HARMAN INTERNATIONAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. HURIX: SNAPSHOT

TABLE 098. HURIX: BUSINESS PERFORMANCE

TABLE 099. HURIX: PRODUCT PORTFOLIO

TABLE 100. HURIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. CRAYON: SNAPSHOT

TABLE 101. CRAYON: BUSINESS PERFORMANCE

TABLE 102. CRAYON: PRODUCT PORTFOLIO

TABLE 103. CRAYON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. VMWARE: SNAPSHOT

TABLE 104. VMWARE: BUSINESS PERFORMANCE

TABLE 105. VMWARE: PRODUCT PORTFOLIO

TABLE 106. VMWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. XEROX: SNAPSHOT

TABLE 107. XEROX: BUSINESS PERFORMANCE

TABLE 108. XEROX: PRODUCT PORTFOLIO

TABLE 109. XEROX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 110. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 111. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 112. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HIGHER EDUCATION TOOLS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HIGHER EDUCATION TOOLS MARKET OVERVIEW BY COMPONENT

FIGURE 012. HARDWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SOLUTIONS MARKET OVERVIEW (2016-2028)

FIGURE 014. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 015. HIGHER EDUCATION TOOLS MARKET OVERVIEW BY DEPLOYMENT

FIGURE 016. ON CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 017. ON PREMISES MARKET OVERVIEW (2016-2028)

FIGURE 018. HIGHER EDUCATION TOOLS MARKET OVERVIEW BY LEARNING MODE

FIGURE 019. OFFLINE MARKET OVERVIEW (2016-2028)

FIGURE 020. ONLINE MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA HIGHER EDUCATION TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE HIGHER EDUCATION TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC HIGHER EDUCATION TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA HIGHER EDUCATION TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA HIGHER EDUCATION TOOLS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Higher Education Tools Market research report is 2024-2032.

Blackboard Inc. (US), Instructure, Inc. (US), McGraw-Hill Education (US), Wiley (John Wiley & Sons, Inc.) (US), Cengage Learning (US), Adobe Inc. (US), Coursera Inc. (US), Pluralsight LLC (US), Chegg, Inc. (US), IBM Corporation (US), Microsoft Corporation (US), Oracle Corporation (US), Turnitin LLC (US), Knewton, Inc. (US), Schoology, Inc. (US), Echo360, Inc. (US), Panopto (US), ExamSoft Worldwide, Inc. (US), VitalSource Technologies LLC (US), Desire2Learn (D2L) Inc. (Canada), SAP SE (Germany), Pearson plc (UK), Elsevier (Netherlands), and Other Major Players.

The Higher Education Tools Market is segmented into Product, End User, and region. By Product, the market is categorized into LMS, Educational Content and Courseware, Assessment and Evaluation Tools, Research and Academic Tools, Adaptive Learning and Personalized Education, and Emerging Technologies. By End User, the market is categorized into Administrators, Students, Faculty, Librarians, Educational Technology Specialists, and Institutional Leaders. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Higher Education Tools Market refers to the sector focused on providing various technological solutions, software, platforms, and resources tailored to the needs of colleges, universities, and other institutions of higher learning. These tools aim to enhance teaching, learning, administration, research, and other academic activities within the higher education ecosystem.

Higher Education Tools Market Size Was Valued at USD 736.84 Billion in 2023, and is Projected to Reach USD 1701.53 Billion by 2032, Growing at a CAGR of 12.7% From 2024-2032.