High-Pressure Hydrogen Compressors Market Synopsis

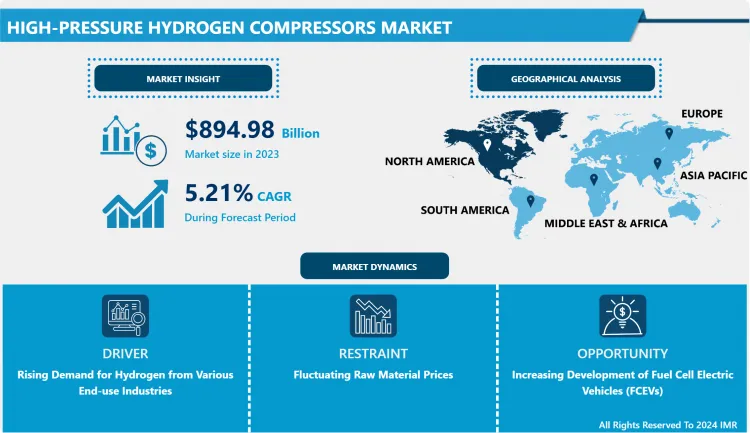

High-Pressure Hydrogen Compressors Market Size Was Valued at USD 566.63 Billion in 2023, and is Projected to Reach USD 894.98 Billion by 2032, Growing at a CAGR of 5.21% From 2024-2032.

A High-Pressure Hydrogen Compressor is a specialized apparatus designed to elevate the pressure of hydrogen, resulting in a decrease in its volume and transforming it into compressed gas, compressed hydrogen, or liquid hydrogen.

- Hydrogen compressors and pumps are closely interconnected, both recognized for their ability to increase the pressure of fluids or gases, facilitating their transfer through pipelines. While compressors reduce the volume of hydrogen gas during compression, pumps primarily elevate the pressure of liquid hydrogen to enable its transportation to other locations.

- In the near term, factors such as growing demand for hydrogen in industries like fertilizers and oil refineries, coupled with the global expansion of hydrogen pipeline infrastructure for transportation, are anticipated to propel the hydrogen compressor market in the forecast period. Conversely, a slowdown in industrial and economic activities, driven by a decline in manufacturing and global trade accompanied by trade policy uncertainties and higher tariffs, is expected to dampen the demand for capital goods in hydrogen-utilizing industries, restraining market growth.

- Nonetheless, technological advancements and the emergence of cleaner sources, such as solar and wind, in conjunction with electrolysis for hydrogen production, present promising opportunities for market expansion.

High-Pressure Hydrogen Compressors Market Trend Analysis

Rising Demand for Hydrogen from Various End-use Industries

- The global transition towards cleaner and more sustainable energy solutions fuels the rising demand for hydrogen from various end-use industries. Hydrogen is gaining traction as a versatile and clean energy carrier, particularly in industries aiming to reduce their carbon footprint. Transportation, manufacturing, and power generation sectors are increasingly turning to hydrogen as a viable alternative to traditional fossil fuels. As a consequence, the demand for High-Pressure Hydrogen Compressors has surged, as these compressors play a crucial role in facilitating the efficient storage and transportation of high-pressure hydrogen, ensuring its availability for a range of applications.

- Industries that heavily rely on hydrogen, such as refineries, chemical manufacturing, and electronics, are witnessing a surge in demand. This demand is often attributed to the benefits of hydrogen, including its capacity to serve as a clean feedstock and energy carrier. As a result, companies in these sectors are investing in infrastructure to produce, store, and transport hydrogen at high pressures. High-Pressure Hydrogen Compressors become integral components of this infrastructure, supporting the compression of hydrogen to the required levels for storage and transportation.

Increasing Development of Fuel Cell Electric Vehicles (FCEVs)

- The increasing development and adoption of Fuel Cell Electric Vehicles (FCEVs) present a significant opportunity for the High-Pressure Hydrogen Compressors market. First and foremost, FCEVs rely on hydrogen fuel cells for power generation, and high-pressure hydrogen compressors play a crucial role in the efficient refueling of these vehicles. The demand for FCEVs has been rising due to their environmental sustainability, longer driving ranges, and faster refueling times compared to traditional electric vehicles.

- Moreover, as governments and industries globally are actively investing in the development of a hydrogen economy, the demand for High-Pressure Hydrogen Compressors is likely to experience a substantial boost. The automotive sector's commitment to reducing carbon emissions and achieving a greener transportation landscape further underscores the importance of high-pressure hydrogen compressors in enabling the widespread use of FCEVs.

High-Pressure Hydrogen Compressors Market Segment Analysis:

High-Pressure Hydrogen Compressors Market Segmented on the basis of type, application, and end-users.

By Type, Single stage segment is expected to dominate the market during the forecast period

- Single-stage compressors are renowned for their simplicity and cost-effectiveness. In applications in high pressure is required but within a relatively narrow range, such as in hydrogen compression for fuel cell vehicles, single-stage compressors are often more economical to manufacture and maintain. This cost efficiency makes them a preferred choice for industries looking to establish hydrogen refueling infrastructure for applications like Fuel Cell Electric Vehicles (FCEVs).

- Single-stage compressors are known for their energy efficiency in certain pressure ranges. In applications where the compression ratio is not extremely high, a single-stage compressor can offer a more energy-efficient solution compared to multi-stage alternatives. As the demand for sustainable and energy-efficient technologies rises, particularly in the context of hydrogen production and distribution, the single-stage segment becomes increasingly attractive

By Application, Chemical segment held the largest share of 32.2% in 2022

- Hydrogen is a crucial feedstock in the production of numerous chemicals, including ammonia and methanol. These processes often require high-pressure conditions for efficient synthesis. High-Pressure Hydrogen Compressors are essential for compressing and supplying hydrogen to chemical reactors at the necessary pressures, ensuring optimal reaction rates and yields. As the demand for chemicals continues to rise globally, particularly in industries such as petrochemicals and specialty chemicals, the need for high-pressure hydrogen compressors in chemical applications becomes increasingly pronounced.

- The growing emphasis on sustainable and green practices within the chemical industry has led to an increased interest in hydrogen as a cleaner alternative to traditional feedstocks. Hydrogen can be produced through renewable methods and used in chemical processes to reduce carbon emissions. High-pressure hydrogen compressors play a critical role in facilitating the integration of hydrogen into these sustainable chemical production processes.

High-Pressure Hydrogen Compressors Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The High-Pressure Hydrogen Compressors market can be attributed to several key factors, solidifying its position as a leading player in the industry. Firstly, the region's early adoption of hydrogen technologies has played a pivotal role. North American countries, particularly the United States and Canada, have been at the forefront of research, development, and implementation of hydrogen-related technologies. The early recognition of the potential of hydrogen as a clean and sustainable energy carrier has led to significant investments in infrastructure, including high-pressure hydrogen compressors, to support various applications such as transportation and industrial processes.

- Government initiatives promoting clean energy have been instrumental in fostering the growth of the High-Pressure Hydrogen Compressors market in North America. Stringent environmental regulations and policies aimed at reducing carbon emissions have incentivized industries to explore hydrogen as an alternative and cleaner energy source.

High-Pressure Hydrogen Compressors Market Top Key Players:

- Ariel Corporation (USA)

- Baker Hughes Company (USA)

- Cameron, a GE company (USA)

- Gardner Denver Inc. (USA)

- Hypertronics Corporation (USA)

- Hydra-Force Inc. (USA)

- Sargent & Lundy LLC (USA)

- VOGT Power International, Inc. (USA)

- Worthington Industries, Inc. (USA)

- Sundyne (U.K.)

- Atlas Copco AB (Sweden)

- Burckhardt Compression AG (Switzerland)

- GEA Refrigeration Technologies GmbH (Germany)

- Howden Group plc (United Kingdom)

- Kaeser Kompressoren GmbH (Germany)

- MAN Energy Solutions SE (Germany)

- Sulzer Ltd. (Switzerland)

- Techno Anlagenbau GmbH (Germany)

- TGE Gas Engineering (Germany)

- Hyundai Heavy Industries Co., Ltd. (South Korea)

- IHI Corporation (Japan)

- Kobe Steel Ltd. (Japan)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Shanghai Sanjiang Mechanical Co., Ltd. (China)

- Yutong Heavy Industries Co., Ltd. (China)

- Cryostar SAS (France)

Key Industry Developments in the High-Pressure Hydrogen Compressors Market:

- In August 2023, Sundyne introduced an innovative line of four standard PPI diaphragm compressor packages, aiming to streamline the procurement, deployment, and maintenance processes for PPI hydrogen compressors. This new range of compressor packages spans a pressure spectrum, commencing from 20 bar (290 psi) suction and extending up to 550 bar (8,000 psi) discharge, accommodating flow rates ranging from 10 kg/hr (22 lbs/hr) to 60 kg/hr (132 lbs/hr). Notably, each package is customizable to meet either North American or European regulatory standards, enhancing flexibility and ensuring compliance across diverse markets. This strategic initiative by Sundyne is geared towards enhancing user convenience, expediting deployment timelines, and optimizing cost-effectiveness in the acquisition and maintenance of PPI hydrogen compressors.

- In May 2024, Baker Hughes, an energy technology company, announced on Thursday that it had expanded its Industrial & Energy Technology (IET) Damman Center in Dammam, Saudi Arabia. The completed expansion was expected to create 60 new jobs and add capacity for the current manufacturing and repairs of compression trains, seal gas, and control panels. Additionally, the expanded site added capabilities for the manufacturing and testing of vibration monitoring systems and for gears repairs.

|

High-Pressure Hydrogen Compressors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 566.63 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.21% |

Market Size in 2032: |

USD 894.98 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Type of Compressors |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HIGH-PRESSURE HYDROGEN COMPRESSORS MARKET BY TYPE (2017 – 2032)

- HIGH-PRESSURE HYDROGEN COMPRESSORS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SINGLE-STAGE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MULTI-STAGE

- HIGH-PRESSURE HYDROGEN COMPRESSORS MARKET BY TYPE OF COMPRESSORS (2017 – 2032)

- HIGH-PRESSURE HYDROGEN COMPRESSORS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POSITIVE DISPLACEMENT COMPRESSORS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DYNAMIC COMPRESSORS

- HIGH-PRESSURE HYDROGEN COMPRESSORS MARKET BY APPLICATION (2017 – 2032)

- HIGH-PRESSURE HYDROGEN COMPRESSORS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CHEMICAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OIL & GAS

- REFINING

- POWER GENERATION

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- HIGH-PRESSURE HYDROGEN COMPRESSORS Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ARIEL CORPORATION

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BAKER HUGHES COMPANY

- CAMERON

- GARDNER DENVER INC.

- HYPERTRONICS CORPORATION

- HYDRA-FORCE INC.

- SARGENT & LUNDY LLC

- VOGT POWER INTERNATIONAL INC.

- WORTHINGTON INDUSTRIES INC.

- SUNDYNE

- ATLAS COPCO AB

- BURCKHARDT COMPRESSION AG

- GEA REFRIGERATION TECHNOLOGIES GMBH

- HOWDEN GROUP PLC

- KAESER KOMPRESSOREN GMBH

- MAN ENERGY SOLUTIONS SE

- SULZER LTD.

- TECHNO ANLAGENBAU GMBH

- TGE GAS ENGINEERING

- HYUNDAI HEAVY INDUSTRIES CO. LTD.

- IHI CORPORATION

- KOBE STEEL LTD.

- MITSUBISHI HEAVY INDUSTRIES LTD.

- SHANGHAI SANJIANG MECHANICAL CO. LTD.

- YUTONG HEAVY INDUSTRIES CO. LTD.

- CRYOSTAR SAS.

- COMPETITIVE LANDSCAPE

- GLOBAL HIGH-PRESSURE HYDROGEN COMPRESSORS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By TYPE OF COMPRESSORS

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

High-Pressure Hydrogen Compressors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 566.63 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.21% |

Market Size in 2032: |

USD 894.98 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Type of Compressors |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the High-Pressure Hydrogen Compressors Market research report is 2024-2032.

Ariel Corporation, Baker Hughes Company, Cameron (a GE company), Gardner Denver Inc., Hypertronics Corporation, Hydra-Force Inc., Sargent & Lundy LLC, VOGT Power International Inc., Worthington Industries Inc., Sundyne, Atlas Copco AB, Burckhardt Compression AG, GEA Refrigeration Technologies GmbH, Howden Group plc, Kaeser Kompressoren GmbH, MAN Energy Solutions SE, Sulzer Ltd., Techno Anlagenbau GmbH, TGE Gas Engineering, Hyundai Heavy Industries Co. Ltd., IHI Corporation, Kobe Steel Ltd., Mitsubishi Heavy Industries Ltd., Shanghai Sanjiang Mechanical Co. Ltd., Yutong Heavy Industries Co. Ltd., Cryostar SAS. and Other Major Players.

The High-Pressure Hydrogen Compressors Market is segmented into Type, Type of Compressors, Application, and region. By Type, the market is categorized into Single-stage and multi-stage. By Type of Compressors, the market is categorized into (Positive Displacement Compressors, Dynamic Compressors. By Application, the market is categorized into Chemical, Oil & Gas, Refining, and Power Generation. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A high-pressure hydrogen compressor is equipment made to increase the pressure of hydrogen resulting in a reduction of the volume of the hydrogen that results in compressed gas or compressed hydrogen or liquid hydrogen.

High-Pressure Hydrogen Compressors Market Size Was Valued at USD 566.63 Billion in 2023, and is Projected to Reach USD 894.98 Billion by 2032, Growing at a CAGR of 5.21% From 2024-2032.