Global Healthcare Interoperability Solutions Market Overview

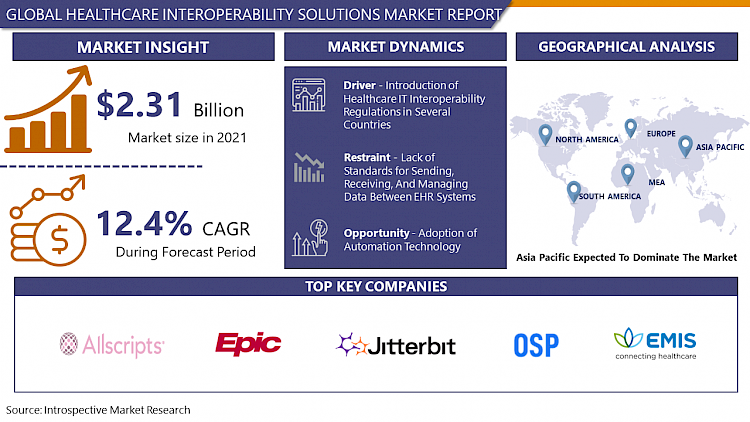

Global Healthcare Interoperability Solutions Market was valued at USD 2.31 billion in 2021 and is expected to reach USD 5.24 billion by the year 2028, at a CAGR of 12.4%.

Health information has always been difficult to access and share securely. The nature of health data creates a paradox as it's tough to share since it's sensitive and demands a high level of privacy and security. Failure to access it when it's needed the most could have serious consequences. Inadequate awareness of an individual's or population's health needs can result in lower outcomes and higher expenditures due to a lack of interoperability. As the world's population ages and individuals live longer, interoperability and data exchange will become increasingly important for delivering good healthcare services. According to the Agency for Healthcare Research and Quality, two out of every three older Americans in the United States have at least two chronic behavioral or physical disorders. Treatment for patients with multiple chronic illnesses is projected to account for 66 percent of all healthcare costs in the United States. Similarly, the rate of chronic disorders is also expected to increase in other countries. Integration of healthcare systems is anticipated to help develop a better understanding of an individual patient record. Additionally, this will help governments to analyze population data to see trends and meet their citizens' needs thus, promoting the growth of the healthcare interoperability solutions market over the forecast period.

Market Dynamics and Key Factors in Healthcare Interoperability Solutions:

Drivers:

Interoperability in the healthcare industry has increased considerably in recent years. The introduction of healthcare IT interoperability regulations in several countries has spurred market growth. The ongoing trend toward value-based patient care, as well as the advent of innovative healthcare delivery models, are estimated to boost the adoption of healthcare interoperability solutions. Healthcare interoperability solutions are projected to benefit from the pressing need to curb increasing healthcare costs. The demand for healthcare services is being driven by rising healthcare expenditures across the globe. The key variables that contribute to rising healthcare expenses are the aging population, the growing prevalence of chronic diseases, rising drug prices, higher healthcare service costs, and increased expenditure on healthcare administration.

Healthcare spending is also influenced by prices; the cost of healthcare services has risen faster than the cost of other products and services in the economy. Despite increasing healthcare spending, the United States falls behind other nations in terms of health outcomes. In this scenario, value-based care can lower healthcare costs by preventing unnecessary emergency visits, standardizing processes for cost-effectiveness, reducing readmissions or unnecessary medical tests, eliminating administrative procedures or tests, and improving medical team coordination and access to services. Moreover, the need to ensure connectivity of medical equipment and systems throughout the care continuum is also driving demand for these solutions. Increased adoption of app integration, application programming interface integration, data integration, data cleansing, data interoperability, and data analytics solutions are propelling the growth of the healthcare interoperability solutions market over the forecast period. The efficient and secure transmission of data across the healthcare ecosystem will help digital health reach its optimal potential thereby, supporting the development of the market.

Restraints:

One of the major constraints to the adoption of interoperability solutions is the lack of standards for sending, receiving, and managing data between EHR systems. Data must be altered and filtered before it can be imported into another system due to mismatched types, unusual data fields, and proprietary formats. Delays and inaccuracies are caused by the lack of a uniform standard for capturing, transmitting, receiving, storing, and managing patient data. Understanding and correctly interpreting medical terms is even more difficult. A fully interoperable system requires many layers of integration (inter and intra-organizational) and is difficult to achieve thus, hampering the expansion of the healthcare interoperability solutions market over the forecast period.

Opportunities:

Many organizations are working actively to make the shift to value-based care models. Healthcare Interoperability solutions are set to thrive from the shift to value-based care. Due to a lack of information flow, redundancy of lab tests and diagnosis creates a significant increase in healthcare expenses. Interoperability ensures that data is available across diverse systems to eliminate redundancy. According to studies, the interoperability of healthcare systems has the potential to save billions of dollars. The key strategy to reduce healthcare expenses and improve health value is to invest in new digital services that support the patient process. These new digital services require seamless interaction among all healthcare stakeholders, creating demand for interoperability solutions thus, creating a lucrative opportunity for the market players.

Government agencies in countries such as the United States have made interoperability rules essential for healthcare organizations. Data integration and analytics solutions are in high demand due to factors such as policy requirements and government regulations. These factors are driving the adoption of healthcare IT applications, that will benefit healthcare interoperability system providers. Moreover, in developing regions governments are spending more to develop the healthcare infrastructure. In these regions, the growing number of patients is expected to create a larger volume of data. The rise in the adoption of automation technology, growing IT infrastructure, and increasing government fundings are some major factors favoring the adoption of healthcare interoperability solutions. This creates a profitable growth opportunity for market players.

Market Segmentation

By type, the software segment is set to grow at the highest CAGR over the analysis period. Software solutions are the core of healthcare interoperability solutions. With the changing healthcare delivery models, service providers are developing innovative software solutions. The growth of this segment is attributed to the rising need for seamless access to individual patient data coupled with the usage of healthcare IT technologies to improve patient satisfaction and quality of care. The growth of this segment is expected to have 11% CAGR over the analysis period and currently, this segment accounts for a 45.1% share of the global healthcare interoperability solutions market.

By deployment, the cloud-based segment is forecasted to have the highest share of the healthcare interoperability solutions market. Cloud services offer healthcare professionals the to access data of patients at any given time and location. Cloud-based solution providers ensure that access to data is given to an authorized user. Furthermore, healthcare providers are prioritizing cloud-based electronic health record (EHR) systems to facilitate better communication between applications. Hospitals, affiliated practices, and anyone involved in patient care can access cloud-based solutions through a single platform thus, driving the growth of the segment in the forecast period.

By interoperability level, the structural segment is expected to have the lion's share of the healthcare interoperability solutions market. In Structural interoperability or structured transport, all of the data is standardized to a specific format so that it can be read by multiple systems and devices. This data is organized in a particular manner that enables the receiving system to recognize specific data fields automatically. Structural interoperability is provided by data standards such as Fast Healthcare Interoperability Resources (FHIR0 and Health Level Seven (HL7), which allow records to be uniform, centralized, and easy to move between systems. E-prescribing allows prescribers and pharmacists to access the same data thus, stimulating the adoption of structural interoperability in healthcare.

By end-user, the hospital segment is expected to dominate the healthcare interoperability solutions market over the projected timeframe. The data generated by hospitals is more than other end-users. Moreover, the safe and secure exchange of data between hospitals or medical professionals has created a huge demand for interoperability solutions. The growing medical tourism, rising prevalence of chronic disorders, and the COVID-19 pandemic have made the transfer of data essential. Hospitals are also investing heavily to protect the data generated, as the volume of generated data is large cloud-based storage solutions are getting popular amid the COVID-19 pandemic. In addition, individuals prefer hospitals for any major surgery due to flexible reimbursement policies thus, strengthening the development of the healthcare interoperability solutions market.

Players Covered in Healthcare Interoperability Solutions market are :

- Allscripts Healthcare LLC (US)

- NXGN Management LLC (US)

- EMIS Health (UK)

- Epic Systems Corporation (US)

- Infor Inc. (US)

- ViSolve Inc. (US)

- Cerner Corporation (US)

- InterSystems Corporation (US)

- Orion Health Group Limited (New Zealand)

- Jitterbit Inc. (US)

- Koninklijke Philips N.V. (Netherlands)

- iNTERFACEWARE Inc (Canada)

- OSP Labs (US)

Regional Analysis of Healthcare Interoperability Solutions Market:

The healthcare interoperability solutions market in the Asia-Pacific region is anticipated to develop at the highest CAGR attributed to the growing government initiatives for eHealth, medical tourism, and the rising prevalence of chronic disorders. China, India, Japan, Indonesia, and Australia are the major economies driving the growth of the healthcare interoperability solutions market in this region. There has been a rise in government spending on the development of healthcare infrastructure. For instance, in India, the healthcare market is expected to reach USD 372 billion by the end of 2022. This estimates a growing number of patients, thereby a large generation of data. To reduce the overall cost associated with delayed diagnosis and treatment, governments are adopting healthcare interoperability solutions thus, supporting the growth of the market in this region.

The North American region is expected to dominate the healthcare interoperability solutions market in the forecast period attributed to the implementation of various healthcare reforms by the major economies in this region. For instance, the Patient Protection and Affordable Care Enhancement Act (HR 1425), was presented in the United States House of Representatives on June 22, 2020. The bill aimed to strengthen and expand the Affordable Care Act (ACA) in order to reduce healthcare costs. Healthcare companies and clinicians must utilize healthcare interoperability solutions and services to make their operations easier, improve clinical outcomes, and lower healthcare costs, according to this act.

The healthcare interoperability solutions market in the European region is anticipated to develop at a significant growth rate attributed to the growing demand for the integration and implementation of medical devices and HCIT solutions to provide patients with cost-effective and high-quality treatment. The demand for electronic health record (EHR) systems and the need for flexible access to eHealth systems have increased in this region. The EU launched the ISA2 program in 2016 to encourage the development of digital solutions for interoperable cross-border and cross-sector public services. With this initiative the EU prioritizes the development of a single digital platform to help the healthcare professionals, researchers, and companies to make most of the generated data thus, supporting the growth in this region.

Recent Industry Developments in Healthcare Interoperability Solutions Market:

- In November 2021, NextGen Healthcare Inc. announced the launch of the NextGen® Community Health Collaborative (NCHC). This initiative, the first of its kind, will provide data benchmarking, comparative analytics, and reporting services, as well as a platform for members to network and exchange best practices to promote the objective of community health.

- In November 2021, InterSystems released the HealthShare 2021.2, the most recent version of the InterSystems HealthShare® suite of connected health solutions. HealthShare 2021.2 fosters collaboration across the patient care team while improving usability and security with expanded data and functionality throughout the suite.

COVID-19 Impact on Healthcare Interoperability Solutions Market:

The pandemic has had a positive impact on the market for healthcare interoperability solutions, and this trend is projected to continue in the coming years. Pre-COVID, healthcare organizations faced issues with interoperability and inadequate data management, which were exacerbated during the pandemic. Clinicians missed key COVID-19 information due to interoperability issues, which resulted in patient treatment delays and clinicians' inability to accurately document patients' status. Due to the fast changes each day of the pandemic, data interchange was not only inadequate but also difficult to arrange. With novel coronavirus strains causing fresh COVID-19 outbreaks around the world, data exchange through interoperability becomes even more critical. Frontline providers and researchers require access to the most comprehensive data sets available to track the disease, determine which protocols are most effective, and stay ahead of the virus, from understanding a single patient's entire medical journey to analyzing aggregated data at the community level. To summarize, the COVID-19 pandemic has spurred the demand for interoperability solutions in the healthcare sector.

|

Global Healthcare Interoperability Solutions Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 2.31 Bn. |

|

Forecast Period 2022-28 CAGR: |

12.4% |

Market Size in 2028: |

USD 5.24 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By Interoperability Levels |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Deployment

3.3 By Interoperability Levels

3.4 By End-User

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Healthcare Interoperability Solutions Market by Type

5.1 Healthcare Interoperability Solutions Market Overview Snapshot and Growth Engine

5.2 Healthcare Interoperability Solutions Market Overview

5.3 Software

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Software: Grographic Segmentation

5.4 Services

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Services: Grographic Segmentation

Chapter 6: Healthcare Interoperability Solutions Market by Deployment

6.1 Healthcare Interoperability Solutions Market Overview Snapshot and Growth Engine

6.2 Healthcare Interoperability Solutions Market Overview

6.3 Cloud-Based

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Cloud-Based: Grographic Segmentation

6.4 On-Premise

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 On-Premise: Grographic Segmentation

Chapter 7: Healthcare Interoperability Solutions Market by Interoperability Levels

7.1 Healthcare Interoperability Solutions Market Overview Snapshot and Growth Engine

7.2 Healthcare Interoperability Solutions Market Overview

7.3 Foundational

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Foundational: Grographic Segmentation

7.4 Structural

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Structural: Grographic Segmentation

7.5 Semantic

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Semantic: Grographic Segmentation

7.6 Organizational

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Organizational: Grographic Segmentation

Chapter 8: Healthcare Interoperability Solutions Market by End-User

8.1 Healthcare Interoperability Solutions Market Overview Snapshot and Growth Engine

8.2 Healthcare Interoperability Solutions Market Overview

8.3 Hospitals

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Hospitals: Grographic Segmentation

8.4 Pharmacies

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Pharmacies: Grographic Segmentation

8.5 Clinics

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Clinics: Grographic Segmentation

8.6 Payers

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Payers: Grographic Segmentation

8.7 Ambulatory Surgical Centres

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size (2016-2028F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Ambulatory Surgical Centres: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Healthcare Interoperability Solutions Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Healthcare Interoperability Solutions Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Healthcare Interoperability Solutions Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 ALLSCRIPTS HEALTHCARE LLC

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 NXGN MANAGEMENT LLC

9.4 EMIS HEALTH

9.5 EPIC SYSTEMS CORPORATION

9.6 INFOR INC.

9.7 VISOLVE INC.

9.8 CERNER CORPORATION

9.9 INTERSYSTEMS CORPORATION

9.10 ORION HEALTH GROUP LIMITED

9.11 JITTERBIT INC.

9.12 KONINKLIJKE PHILIPS N.V.

9.13 INTERFACEWARE INC.

9.14 OSP LABS

9.15 OTHER MAJOR PLAYERS

Chapter 10: Global Healthcare Interoperability Solutions Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Type

10.2.1 Software

10.2.2 Services

10.3 Historic and Forecasted Market Size By Deployment

10.3.1 Cloud-Based

10.3.2 On-Premise

10.4 Historic and Forecasted Market Size By Interoperability Levels

10.4.1 Foundational

10.4.2 Structural

10.4.3 Semantic

10.4.4 Organizational

10.5 Historic and Forecasted Market Size By End-User

10.5.1 Hospitals

10.5.2 Pharmacies

10.5.3 Clinics

10.5.4 Payers

10.5.5 Ambulatory Surgical Centres

Chapter 11: North America Healthcare Interoperability Solutions Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Software

11.4.2 Services

11.5 Historic and Forecasted Market Size By Deployment

11.5.1 Cloud-Based

11.5.2 On-Premise

11.6 Historic and Forecasted Market Size By Interoperability Levels

11.6.1 Foundational

11.6.2 Structural

11.6.3 Semantic

11.6.4 Organizational

11.7 Historic and Forecasted Market Size By End-User

11.7.1 Hospitals

11.7.2 Pharmacies

11.7.3 Clinics

11.7.4 Payers

11.7.5 Ambulatory Surgical Centres

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Healthcare Interoperability Solutions Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Software

12.4.2 Services

12.5 Historic and Forecasted Market Size By Deployment

12.5.1 Cloud-Based

12.5.2 On-Premise

12.6 Historic and Forecasted Market Size By Interoperability Levels

12.6.1 Foundational

12.6.2 Structural

12.6.3 Semantic

12.6.4 Organizational

12.7 Historic and Forecasted Market Size By End-User

12.7.1 Hospitals

12.7.2 Pharmacies

12.7.3 Clinics

12.7.4 Payers

12.7.5 Ambulatory Surgical Centres

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Healthcare Interoperability Solutions Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Software

13.4.2 Services

13.5 Historic and Forecasted Market Size By Deployment

13.5.1 Cloud-Based

13.5.2 On-Premise

13.6 Historic and Forecasted Market Size By Interoperability Levels

13.6.1 Foundational

13.6.2 Structural

13.6.3 Semantic

13.6.4 Organizational

13.7 Historic and Forecasted Market Size By End-User

13.7.1 Hospitals

13.7.2 Pharmacies

13.7.3 Clinics

13.7.4 Payers

13.7.5 Ambulatory Surgical Centres

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Healthcare Interoperability Solutions Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Software

14.4.2 Services

14.5 Historic and Forecasted Market Size By Deployment

14.5.1 Cloud-Based

14.5.2 On-Premise

14.6 Historic and Forecasted Market Size By Interoperability Levels

14.6.1 Foundational

14.6.2 Structural

14.6.3 Semantic

14.6.4 Organizational

14.7 Historic and Forecasted Market Size By End-User

14.7.1 Hospitals

14.7.2 Pharmacies

14.7.3 Clinics

14.7.4 Payers

14.7.5 Ambulatory Surgical Centres

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Healthcare Interoperability Solutions Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Software

15.4.2 Services

15.5 Historic and Forecasted Market Size By Deployment

15.5.1 Cloud-Based

15.5.2 On-Premise

15.6 Historic and Forecasted Market Size By Interoperability Levels

15.6.1 Foundational

15.6.2 Structural

15.6.3 Semantic

15.6.4 Organizational

15.7 Historic and Forecasted Market Size By End-User

15.7.1 Hospitals

15.7.2 Pharmacies

15.7.3 Clinics

15.7.4 Payers

15.7.5 Ambulatory Surgical Centres

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Healthcare Interoperability Solutions Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 2.31 Bn. |

|

Forecast Period 2022-28 CAGR: |

12.4% |

Market Size in 2028: |

USD 5.24 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment |

|

||

|

By Interoperability Levels |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET COMPETITIVE RIVALRY

TABLE 005. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET THREAT OF NEW ENTRANTS

TABLE 006. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET THREAT OF SUBSTITUTES

TABLE 007. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET BY TYPE

TABLE 008. SOFTWARE MARKET OVERVIEW (2016-2028)

TABLE 009. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 010. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET BY DEPLOYMENT

TABLE 011. CLOUD-BASED MARKET OVERVIEW (2016-2028)

TABLE 012. ON-PREMISE MARKET OVERVIEW (2016-2028)

TABLE 013. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET BY INTEROPERABILITY LEVELS

TABLE 014. FOUNDATIONAL MARKET OVERVIEW (2016-2028)

TABLE 015. STRUCTURAL MARKET OVERVIEW (2016-2028)

TABLE 016. SEMANTIC MARKET OVERVIEW (2016-2028)

TABLE 017. ORGANIZATIONAL MARKET OVERVIEW (2016-2028)

TABLE 018. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET BY END-USER

TABLE 019. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 020. PHARMACIES MARKET OVERVIEW (2016-2028)

TABLE 021. CLINICS MARKET OVERVIEW (2016-2028)

TABLE 022. PAYERS MARKET OVERVIEW (2016-2028)

TABLE 023. AMBULATORY SURGICAL CENTRES MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 025. NORTH AMERICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 026. NORTH AMERICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY INTEROPERABILITY LEVELS (2016-2028)

TABLE 027. NORTH AMERICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY END-USER (2016-2028)

TABLE 028. N HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 030. EUROPE HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 031. EUROPE HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY INTEROPERABILITY LEVELS (2016-2028)

TABLE 032. EUROPE HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY END-USER (2016-2028)

TABLE 033. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 035. ASIA PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 036. ASIA PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY INTEROPERABILITY LEVELS (2016-2028)

TABLE 037. ASIA PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY END-USER (2016-2028)

TABLE 038. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY INTEROPERABILITY LEVELS (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY END-USER (2016-2028)

TABLE 043. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 044. SOUTH AMERICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 045. SOUTH AMERICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY DEPLOYMENT (2016-2028)

TABLE 046. SOUTH AMERICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY INTEROPERABILITY LEVELS (2016-2028)

TABLE 047. SOUTH AMERICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY END-USER (2016-2028)

TABLE 048. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 049. ALLSCRIPTS HEALTHCARE LLC: SNAPSHOT

TABLE 050. ALLSCRIPTS HEALTHCARE LLC: BUSINESS PERFORMANCE

TABLE 051. ALLSCRIPTS HEALTHCARE LLC: PRODUCT PORTFOLIO

TABLE 052. ALLSCRIPTS HEALTHCARE LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. NXGN MANAGEMENT LLC: SNAPSHOT

TABLE 053. NXGN MANAGEMENT LLC: BUSINESS PERFORMANCE

TABLE 054. NXGN MANAGEMENT LLC: PRODUCT PORTFOLIO

TABLE 055. NXGN MANAGEMENT LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. EMIS HEALTH: SNAPSHOT

TABLE 056. EMIS HEALTH: BUSINESS PERFORMANCE

TABLE 057. EMIS HEALTH: PRODUCT PORTFOLIO

TABLE 058. EMIS HEALTH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. EPIC SYSTEMS CORPORATION: SNAPSHOT

TABLE 059. EPIC SYSTEMS CORPORATION: BUSINESS PERFORMANCE

TABLE 060. EPIC SYSTEMS CORPORATION: PRODUCT PORTFOLIO

TABLE 061. EPIC SYSTEMS CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. INFOR INC.: SNAPSHOT

TABLE 062. INFOR INC.: BUSINESS PERFORMANCE

TABLE 063. INFOR INC.: PRODUCT PORTFOLIO

TABLE 064. INFOR INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. VISOLVE INC.: SNAPSHOT

TABLE 065. VISOLVE INC.: BUSINESS PERFORMANCE

TABLE 066. VISOLVE INC.: PRODUCT PORTFOLIO

TABLE 067. VISOLVE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. CERNER CORPORATION: SNAPSHOT

TABLE 068. CERNER CORPORATION: BUSINESS PERFORMANCE

TABLE 069. CERNER CORPORATION: PRODUCT PORTFOLIO

TABLE 070. CERNER CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. INTERSYSTEMS CORPORATION: SNAPSHOT

TABLE 071. INTERSYSTEMS CORPORATION: BUSINESS PERFORMANCE

TABLE 072. INTERSYSTEMS CORPORATION: PRODUCT PORTFOLIO

TABLE 073. INTERSYSTEMS CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. ORION HEALTH GROUP LIMITED: SNAPSHOT

TABLE 074. ORION HEALTH GROUP LIMITED: BUSINESS PERFORMANCE

TABLE 075. ORION HEALTH GROUP LIMITED: PRODUCT PORTFOLIO

TABLE 076. ORION HEALTH GROUP LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. JITTERBIT INC.: SNAPSHOT

TABLE 077. JITTERBIT INC.: BUSINESS PERFORMANCE

TABLE 078. JITTERBIT INC.: PRODUCT PORTFOLIO

TABLE 079. JITTERBIT INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. KONINKLIJKE PHILIPS N.V.: SNAPSHOT

TABLE 080. KONINKLIJKE PHILIPS N.V.: BUSINESS PERFORMANCE

TABLE 081. KONINKLIJKE PHILIPS N.V.: PRODUCT PORTFOLIO

TABLE 082. KONINKLIJKE PHILIPS N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. INTERFACEWARE INC.: SNAPSHOT

TABLE 083. INTERFACEWARE INC.: BUSINESS PERFORMANCE

TABLE 084. INTERFACEWARE INC.: PRODUCT PORTFOLIO

TABLE 085. INTERFACEWARE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. OSP LABS: SNAPSHOT

TABLE 086. OSP LABS: BUSINESS PERFORMANCE

TABLE 087. OSP LABS: PRODUCT PORTFOLIO

TABLE 088. OSP LABS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 089. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 090. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 091. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET OVERVIEW BY TYPE

FIGURE 012. SOFTWARE MARKET OVERVIEW (2016-2028)

FIGURE 013. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 014. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET OVERVIEW BY DEPLOYMENT

FIGURE 015. CLOUD-BASED MARKET OVERVIEW (2016-2028)

FIGURE 016. ON-PREMISE MARKET OVERVIEW (2016-2028)

FIGURE 017. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET OVERVIEW BY INTEROPERABILITY LEVELS

FIGURE 018. FOUNDATIONAL MARKET OVERVIEW (2016-2028)

FIGURE 019. STRUCTURAL MARKET OVERVIEW (2016-2028)

FIGURE 020. SEMANTIC MARKET OVERVIEW (2016-2028)

FIGURE 021. ORGANIZATIONAL MARKET OVERVIEW (2016-2028)

FIGURE 022. HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET OVERVIEW BY END-USER

FIGURE 023. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 024. PHARMACIES MARKET OVERVIEW (2016-2028)

FIGURE 025. CLINICS MARKET OVERVIEW (2016-2028)

FIGURE 026. PAYERS MARKET OVERVIEW (2016-2028)

FIGURE 027. AMBULATORY SURGICAL CENTRES MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Healthcare Interoperability Solutions Market research report is 2022-2028.

Allscripts Healthcare LLC (US), NXGN Management LLC (US), EMIS Health (UK), Epic Systems Corporation (US), Infor Inc. (US), ViSolve Inc. (US), Cerner Corporation (US), InterSystems Corporation (US), Orion Health Group Limited (New Zealand), Jitterbit Inc. (US), Koninklijke Philips N.V. (Netherlands), iNTERFACEWARE Inc (Canada), OSP Labs (US), and other major players.

The Healthcare Interoperability Solutions Market is segmented into Type, Deployment, Interoperability Levels, End-User, and region. By Type, the market is categorized into Software, Services. By Deployment, the market is categorized into Cloud-Based, On-Premise. By Interoperability Levels, the market is categorized into Foundational, Structural, Semantic, and Organizational. By End-Users, the market is categorized into Hospitals, Pharmacies, Clinics, Payers, and Ambulatory Surgical Centres. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Health information has always been difficult to access and share securely. The nature of health data creates a paradox as it's tough to share since it's sensitive and demands a high level of privacy and security. Failure to access it when it's needed the most could have serious consequences. Inadequate awareness of an individual's or population's health needs can result in lower outcomes and higher expenditures due to a lack of interoperability.

Global Healthcare Interoperability Solutions Market was valued at USD 2.31 billion in 2021 and is expected to reach USD 5.24 billion by the year 2028, at a CAGR of 12.4%.