Health Drink Market Synopsis

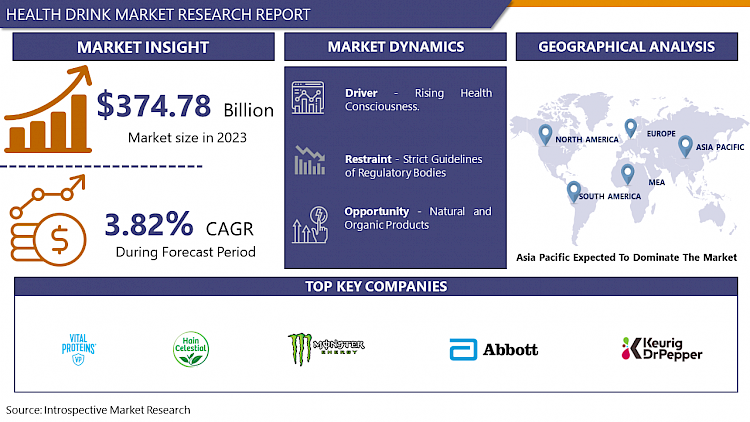

Health Drink Market Size Was Valued at USD 374.78 Billion in 2023 and is Projected to Reach USD 525.18 Billion by 2032, Growing at a CAGR of 3.82% From 2024-2032.

Health drinks refer to beverages that are specifically formulated to provide nutritional benefits and support overall well-being. These drinks typically contain a combination of vitamins, minerals, antioxidants, and other bioactive compounds that are believed to contribute to a person's health. Health drinks come in various forms, including shakes, smoothies, juices, and supplements, and they are often marketed as a convenient way to boost nutrient intake and address specific health concerns.

- Consumers often turn to health drinks as a convenient and accessible means of incorporating essential nutrients into their diets. These beverages are designed to cater to different health goals, such as immune system support, energy enhancement, weight management, or recovery after physical activity. While health drinks can be a convenient addition to a balanced diet, it's essential for individuals to approach them with a discerning eye, considering factors such as added sugars, artificial ingredients, and overall dietary needs.

- The health drinks market has witnessed significant growth in recent years, fueled by increasing consumer awareness of the importance of a healthy lifestyle and a growing focus on preventive healthcare. With rising concerns about obesity, diabetes, and other lifestyle-related diseases, consumers are increasingly seeking beverages that offer nutritional benefits and functional ingredients. The market has seen a surge in demand for products that promote hydration, provide vitamins and minerals, and cater to specific health needs, such as immune support, digestive health, and energy boosters.

- Additionally, innovative formulations, such as plant-based and organic ingredients, are gaining popularity, reflecting a shift towards clean and natural products in the health drinks sector. Manufacturers are continually striving to introduce new and unique offerings, leveraging trends such as personalized nutrition, sustainable packaging, and exotic flavors to stay competitive.

Health Drink Market Trend Analysis

Rising Health Consciousness

- The health drinks market has experienced a significant surge due to the escalating health consciousness among consumers. With an increasing awareness of the importance of a healthy lifestyle, individuals are actively seeking products that align with their wellness goals. This growing trend has propelled the demand for health drinks, as they are perceived as convenient and effective solutions to meet nutritional requirements.

- Consumers are now more inclined to make informed choices, opting for beverages that offer functional benefits such as vitamins, minerals, antioxidants, and other health-promoting ingredients. The rising prevalence of lifestyle-related diseases and the desire for preventive healthcare have further intensified the focus on health-enhancing beverages.

Natural and Organic Products create an Opportunity for Health Drink Market

- The health drinks market is witnessing a significant shift towards natural and organic products, presenting lucrative opportunities for growth. Consumers are becoming increasingly health-conscious, seeking beverages that align with their wellness goals. Natural and organic products are gaining traction as they are perceived as healthier alternatives, free from synthetic additives, preservatives, and artificial sweeteners.

- Consumers are more inclined towards ingredients sourced from nature, such as organic fruits, herbs, and botanicals, which offer nutritional benefits and are believed to support overall well-being. The demand for transparency in product labelling and a preference for clean labels further propel the popularity of natural and organic health drinks.

- This trend is driven by a growing awareness of the potential health risks associated with consuming synthetic ingredients. As consumers prioritize holistic health, the health drinks market is adapting to meet these preferences by offering a wide range of natural and organic options. Companies that position themselves as providers of clean, wholesome, and sustainable beverage choices are likely to capture a larger share of this expanding market, tapping into the increasing consumer interest in a healthier and more environmentally conscious lifestyle.

Health Drink Market Segment Analysis:

Health Drink Market Segmented on the basis of Type, and Distribution Channel.

By Type, Fresh Packaged Fruit Juices segment is expected to dominate the market during the forecast period

- The Fresh Packaged Fruit Juices segment is poised to assert its dominance in the health drinks market, exhibiting robust growth and capturing a substantial share of consumer preferences. This trend is driven by a global shift towards healthier lifestyles, with consumers increasingly prioritizing natural and nutrient-rich beverage options.

- Fresh Packaged Fruit Juices stand out as a preferred choice due to their inherent health benefits and refreshing taste. Packed with essential vitamins, antioxidants, and minerals, these juices cater to health-conscious consumers seeking beverages that not only quench their thirst but also contribute to overall well-being. The segment's prominence can be attributed to the rising awareness of the importance of a balanced diet and the role of natural fruit extracts in promoting health.

- Moreover, the convenience factor associated with ready-to-drink Fresh Packaged Fruit Juices further enhances their appeal. As busy lifestyles become the norm, consumers appreciate the ease of incorporating nutritious options into their daily routines. The versatility of flavors and combinations within this segment also contributes to its dominance, appealing to a diverse range of taste preferences.

By Distribution Channel, E-Commerce segment held the largest share in 2022

- The E-Commerce segment is poised to dominate the health drinks market, representing a significant shift in consumer behavior and purchasing patterns. The convenience and accessibility offered by online platforms have revolutionized the way consumers shop for health drinks. With the increasing penetration of internet services and the growing trend of digitalization, consumers prefer the ease of browsing and ordering health drinks online.

- E-Commerce platforms provide a wide array of health drink options, allowing consumers to compare products, read reviews, and make informed choices from the comfort of their homes. The convenience of doorstep delivery further adds to the appeal of online purchasing. Moreover, E-Commerce offers a platform for specialized health drink brands to reach a global audience, breaking down geographical barriers.

Health Drink Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to maintain its dominant position in the health drinks market, with a combination of evolving consumer preferences, heightened health awareness, and a thriving wellness culture. The region's health drinks market is anticipated to experience robust growth, fueled by a rising demand for functional beverages that offer not only refreshment but also health benefits.

- Consumers in North America are increasingly prioritizing products that contribute to their overall well-being, and health drinks have emerged as a popular choice. The market is characterized by a diverse range of offerings, including natural juices, herbal teas, and fortified water, catering to different health-conscious segments.

- North America's dominance in the health drinks sector include a well-established distribution network, innovative product launches, and a strong focus on marketing and brand positioning. Additionally, the region benefits from a proactive approach to health and wellness trends, with consumers embracing products that align with their fitness and nutritional goals.

- From the selected regions, the ranking by average volume per capita in the 'Energy & Sports Drinks' segment of the non-alcoholic drinks market is led by the United States with 28.4 litres and is followed by the United Kingdom (11.97 litres). In contrast, the ranking is trailed by Russia with 0.23 litres, recording a difference of 28.17 litres to the United States.

Health Drink Market Top Key Players:

- Vital Proteins (United States)

- Hain Celestial Group, Inc. (United States)

- Monster Beverage Corporation (United States)

- Abbott Laboratories (United States)

- Keurig Dr Pepper Inc. (United States)

- The Coca-Cola Company (United States)

- PepsiCo, Inc. (United States)

- Danone S.A. (France)

- Nestlé S.A. (Switzerland)

- Glanbia plc (Ireland)

- Yakult Honsha Co., Ltd. (Japan)

- Asahi Group Holdings, Ltd. (Japan)

- Red Bull GmbH (Austria)

Key Industry Developments in the Health Drink Market:

- In January 2024, Abbott launches a new protality brand to support adults on their weight loss journey. The Protality brand provides nutritional support for adults pursuing weight loss in the form of a high-protein nutrition shake featuring a blend of fast- and slow-digesting protein designed to feed muscles for up to seven hours

- In May 2023, Urban lifestyle brand Salud launched new products in the spirit-based ready-to-drink (RTD) category in 10 new Indian markets with an investment of $1.5 million. The brand aims to establish a strong presence in key regions across India, including Karnataka, Goa, Telangana, Maharashtra, Orissa, Pondicherry, Kerala, Punjab, Uttar Pradesh and Chandigarh.

- In May 2022, PerfectTed introduced a line of health drinks made of matcha green tea-based natural energy beverages to combat fatigue. The challenger brand's goal was to transform caffeine usage into something healthier by utilizing a matcha ingredient that has been used for over 800 years.

|

Global Health Drink Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 374.78 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.82% |

Market Size in 2032: |

USD 525.18 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- HEALTH DRINK MARKET BY TYPE (2017 - 2032)

- HEALTH DRINK MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FRESH PACKAGED FRUIT JUICES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 - 2032)

- Historic And Forecasted Market Size in Volume (2017 - 2032)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NUTRITIONAL DRINKS

- FUNCTIONAL DRINKS

- HEALTH DRINK MARKET BY DISTRIBUTION CHANNEL (2017 - 2032)

- HEALTH DRINK MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- E-COMMERCE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 - 2032)

- Historic And Forecasted Market Size in Volume (2017 - 2032)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SUPERMARKET & HYPERMARKET

- SPECIALTY STORE

- CONVENIENCE STORES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Health Drink Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- VITAL PROTEINS (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- HAIN CELESTIAL GROUP, INC. (UNITED STATES)

- MONSTER BEVERAGE CORPORATION (UNITED STATES)

- ABBOTT LABORATORIES (UNITED STATES)

- KEURIG DR PEPPER INC. (UNITED STATES)

- THE COCA-COLA COMPANY (UNITED STATES)

- PEPSICO, INC. (UNITED STATES)

- DANONE S.A. (FRANCE)

- NESTLÉ S.A. (SWITZERLAND)

- GLANBIA PLC (IRELAND)

- YAKULT HONSHA CO., LTD. (JAPAN)

- ASAHI GROUP HOLDINGS, LTD. (JAPAN)

- RED BULL GMBH (AUSTRIA)

- COMPETITIVE LANDSCAPE

- GLOBAL HEALTH DRINK MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Health Drink Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 374.78 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.82% |

Market Size in 2032: |

USD 525.18 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. HEALTH DRINK MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. HEALTH DRINK MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. HEALTH DRINK MARKET COMPETITIVE RIVALRY

TABLE 005. HEALTH DRINK MARKET THREAT OF NEW ENTRANTS

TABLE 006. HEALTH DRINK MARKET THREAT OF SUBSTITUTES

TABLE 007. HEALTH DRINK MARKET BY TYPE

TABLE 008. FRESH PACKAGED FRUIT JUICES MARKET OVERVIEW (2016-2030)

TABLE 009. NUTRITIONAL DRINKS MARKET OVERVIEW (2016-2030)

TABLE 010. FUNCTIONAL DRINKS MARKET OVERVIEW (2016-2030)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 012. HEALTH DRINK MARKET BY DISTRIBUTION CHANNEL

TABLE 013. ONLINE RETAIL MARKET OVERVIEW (2016-2030)

TABLE 014. SUPERMARKET & HYPERMARKET MARKET OVERVIEW (2016-2030)

TABLE 015. SPECIALTY STORE MARKET OVERVIEW (2016-2030)

TABLE 016. CONVENIENCE STORES MARKET OVERVIEW (2016-2030)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 018. NORTH AMERICA HEALTH DRINK MARKET, BY TYPE (2016-2030)

TABLE 019. NORTH AMERICA HEALTH DRINK MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 020. N HEALTH DRINK MARKET, BY COUNTRY (2016-2030)

TABLE 021. EASTERN EUROPE HEALTH DRINK MARKET, BY TYPE (2016-2030)

TABLE 022. EASTERN EUROPE HEALTH DRINK MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 023. HEALTH DRINK MARKET, BY COUNTRY (2016-2030)

TABLE 024. WESTERN EUROPE HEALTH DRINK MARKET, BY TYPE (2016-2030)

TABLE 025. WESTERN EUROPE HEALTH DRINK MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 026. HEALTH DRINK MARKET, BY COUNTRY (2016-2030)

TABLE 027. ASIA PACIFIC HEALTH DRINK MARKET, BY TYPE (2016-2030)

TABLE 028. ASIA PACIFIC HEALTH DRINK MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 029. HEALTH DRINK MARKET, BY COUNTRY (2016-2030)

TABLE 030. MIDDLE EAST & AFRICA HEALTH DRINK MARKET, BY TYPE (2016-2030)

TABLE 031. MIDDLE EAST & AFRICA HEALTH DRINK MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 032. HEALTH DRINK MARKET, BY COUNTRY (2016-2030)

TABLE 033. SOUTH AMERICA HEALTH DRINK MARKET, BY TYPE (2016-2030)

TABLE 034. SOUTH AMERICA HEALTH DRINK MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 035. HEALTH DRINK MARKET, BY COUNTRY (2016-2030)

TABLE 036. NESTLÉ S.A. (SWITZERLAND): SNAPSHOT

TABLE 037. NESTLÉ S.A. (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 038. NESTLÉ S.A. (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 039. NESTLÉ S.A. (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. THE COCA-COLA COMPANY (UNITED STATES): SNAPSHOT

TABLE 040. THE COCA-COLA COMPANY (UNITED STATES): BUSINESS PERFORMANCE

TABLE 041. THE COCA-COLA COMPANY (UNITED STATES): PRODUCT PORTFOLIO

TABLE 042. THE COCA-COLA COMPANY (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. PEPSICO INC. (UNITED STATES): SNAPSHOT

TABLE 043. PEPSICO INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 044. PEPSICO INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 045. PEPSICO INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. DANONE S.A. (FRANCE): SNAPSHOT

TABLE 046. DANONE S.A. (FRANCE): BUSINESS PERFORMANCE

TABLE 047. DANONE S.A. (FRANCE): PRODUCT PORTFOLIO

TABLE 048. DANONE S.A. (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. KEURIG DR PEPPER INC. (UNITED STATES): SNAPSHOT

TABLE 049. KEURIG DR PEPPER INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 050. KEURIG DR PEPPER INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 051. KEURIG DR PEPPER INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. RED BULL GMBH (AUSTRIA): SNAPSHOT

TABLE 052. RED BULL GMBH (AUSTRIA): BUSINESS PERFORMANCE

TABLE 053. RED BULL GMBH (AUSTRIA): PRODUCT PORTFOLIO

TABLE 054. RED BULL GMBH (AUSTRIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. MONSTER BEVERAGE CORPORATION (UNITED STATES): SNAPSHOT

TABLE 055. MONSTER BEVERAGE CORPORATION (UNITED STATES): BUSINESS PERFORMANCE

TABLE 056. MONSTER BEVERAGE CORPORATION (UNITED STATES): PRODUCT PORTFOLIO

TABLE 057. MONSTER BEVERAGE CORPORATION (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ABBOTT LABORATORIES (UNITED STATES): SNAPSHOT

TABLE 058. ABBOTT LABORATORIES (UNITED STATES): BUSINESS PERFORMANCE

TABLE 059. ABBOTT LABORATORIES (UNITED STATES): PRODUCT PORTFOLIO

TABLE 060. ABBOTT LABORATORIES (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. YAKULT HONSHA CO. LTD. (JAPAN): SNAPSHOT

TABLE 061. YAKULT HONSHA CO. LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 062. YAKULT HONSHA CO. LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 063. YAKULT HONSHA CO. LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. GLANBIA PLC (IRELAND): SNAPSHOT

TABLE 064. GLANBIA PLC (IRELAND): BUSINESS PERFORMANCE

TABLE 065. GLANBIA PLC (IRELAND): PRODUCT PORTFOLIO

TABLE 066. GLANBIA PLC (IRELAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. ASAHI GROUP HOLDINGS LTD. (JAPAN): SNAPSHOT

TABLE 067. ASAHI GROUP HOLDINGS LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 068. ASAHI GROUP HOLDINGS LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 069. ASAHI GROUP HOLDINGS LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. VITAL PROTEINS (UNITED STATES): SNAPSHOT

TABLE 070. VITAL PROTEINS (UNITED STATES): BUSINESS PERFORMANCE

TABLE 071. VITAL PROTEINS (UNITED STATES): PRODUCT PORTFOLIO

TABLE 072. VITAL PROTEINS (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. HAIN CELESTIAL GROUP INC. (UNITED STATES): SNAPSHOT

TABLE 073. HAIN CELESTIAL GROUP INC. (UNITED STATES): BUSINESS PERFORMANCE

TABLE 074. HAIN CELESTIAL GROUP INC. (UNITED STATES): PRODUCT PORTFOLIO

TABLE 075. HAIN CELESTIAL GROUP INC. (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 076. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 077. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 078. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. HEALTH DRINK MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. HEALTH DRINK MARKET OVERVIEW BY TYPE

FIGURE 012. FRESH PACKAGED FRUIT JUICES MARKET OVERVIEW (2016-2030)

FIGURE 013. NUTRITIONAL DRINKS MARKET OVERVIEW (2016-2030)

FIGURE 014. FUNCTIONAL DRINKS MARKET OVERVIEW (2016-2030)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 016. HEALTH DRINK MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 017. ONLINE RETAIL MARKET OVERVIEW (2016-2030)

FIGURE 018. SUPERMARKET & HYPERMARKET MARKET OVERVIEW (2016-2030)

FIGURE 019. SPECIALTY STORE MARKET OVERVIEW (2016-2030)

FIGURE 020. CONVENIENCE STORES MARKET OVERVIEW (2016-2030)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 022. NORTH AMERICA HEALTH DRINK MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 023. EASTERN EUROPE HEALTH DRINK MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. WESTERN EUROPE HEALTH DRINK MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. ASIA PACIFIC HEALTH DRINK MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. MIDDLE EAST & AFRICA HEALTH DRINK MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. SOUTH AMERICA HEALTH DRINK MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Health Drink Market research report is 2024-2032.

Nestlé S.A. (Switzerland), The Coca-Cola Company (United States), PepsiCo, Inc. (United States), Danone S.A. (France), Keurig Dr Pepper Inc. (United States), Red Bull GmbH (Austria), Monster Beverage Corporation (United States), Abbott Laboratories (United States), Yakult Honsha Co., Ltd. (Japan), Glanbia plc (Ireland), Asahi Group Holdings, Ltd. (Japan), Vital Proteins (United States), Hain Celestial Group, Inc. (United States) and Other Major Players and Other Major Players.

he Health Drink Market is segmented into Market Type, Distribution Channel, and Region. By Type, the market is categorized as Fresh Packaged Fruit Juices, Nutritional Drinks, Functional Drinks. By Distribution Channel, the market is categorized as E-Commerce, Supermarkets and Hypermarket, Specialty Stores, Convenience Stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Health drinks refer to beverages that are specifically formulated to provide nutritional benefits and support overall well-being. These drinks typically contain a combination of vitamins, minerals, antioxidants, and other bioactive compounds that are believed to contribute to a person's health. Health drinks come in various forms, including shakes, smoothies, juices, and supplements, and they are often marketed as a convenient way to boost nutrient intake and address specific health concerns.

Health Drink Market Size Was Valued at USD 374.78 Billion in 2023 and is Projected to Reach USD 525.18 Billion by 2032, Growing at a CAGR of 3.82% From 2024-2032.