Global Guar Gum Market Overview

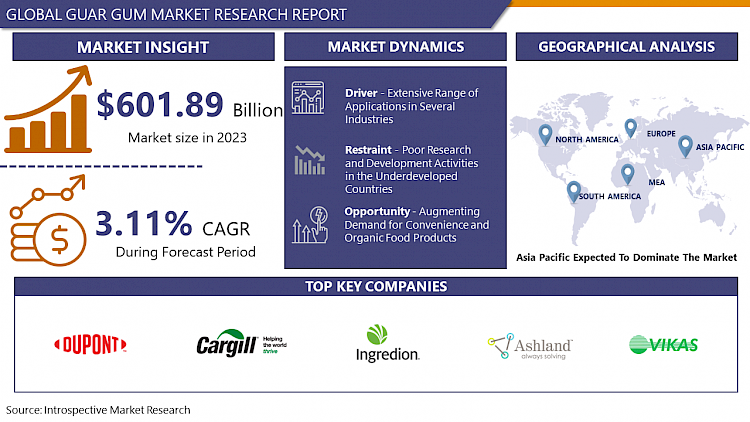

Guar Gum Market size is projected to reach USD 792.92 Million by 2032 from an estimated USD 601.89 Million in 2023, growing at a CAGR of 3.11% globally, during the forecast period (2024-2032).

Guar Gum also called Guaran, is a free-flowing powder made from the legumes known as guar beans. Guar Gum is a large chain of bonded carbohydrate molecules or a kind of galactomannan polysaccharide and is made up of two sugars such as galactose as well as mannose. Guar gum is used primarily in the food manufacturing industry, as they are thick and hold the ability to absorb water, forms a thickening gel, and helps in binding the food products. The Food and Drug Administration (FDA) addresses Guar Gum as a food product that is safe for consumption in required amounts. Owing to its various properties such as high fiber content, low-calorie content, and protein content of 5 to 6%, it is high in demand among consumers all across the world. It is also used widely among the population as it possesses the ability to reduce the amount of cholesterol and glucose in the stomach and large & small intestines. Furthermore, guar gum plays a major role in the gas and oil hydraulic fracturing procedure as a fracking fluid due to its gelling and thickening property, which fuels the market growth of guar gum worldwide. Additionally, due to rising lifestyle and chronic diseases, and the aging population, there has been observed an immense growth of guar gum in the pharmaceutical industry.

Market Dynamics And Factors For Guar Gum Market

Drivers:

Extensive Range of Applications in Several Industries

Guar Gum is a type of powder obtained from cluster beans. It is used widely in many industries such as pharmaceuticals, explosives, cosmetics, paper manufacturing, oil and gas well drilling, and as an additive in the food industry. It is used chiefly as a stabilizer and thickener in the food and beverage sector. Also, the capability of guar gum powder to form hydrogen bonding with water molecules, cushions the growth of guar gum in various industries. Moreover, the rising awareness among the consumers for the consumption of guar gum to treat irritable bowel syndromes, high blood pressure, constipation, high cholesterol levels, diarrhea, and many more is expected to drive the market growth of guar gum in the upcoming years. Guar gum is witnessing huge demand from health-conscious people as it is essential in reducing excessive body fat and easing the process of weight loss. The development of cationic and anionic guar gum derivatives and their wide utilization in oil and gas well stimulation has propelled the growth in recent years. In carpet and textile printing, guar gum is used as a thickening agent in the dye solutions which helps in obtaining sharply printed patterns of design. It is also used in explosives as an additive for water blocking. Furthermore, adding small amounts of guar gum to the pulp for paper production also drives the market growth of guar gum in the forthcoming years.

Restraints:

Poor Research and Development Activities in the Underdeveloped Countries

Although there has been observed an immense growth of guar gum in many countries, the unawareness and lack of poor R&D activities in many parts of the world are expected to hinder the guar gum market. The Asia Pacific holds the largest market share of guar gum, but in some parts of the region such as Pakistan and India, there is a lack of general research and development facilities. Additionally, these countries have not expanded their R&D associations which can focus on the development of industry-specific products, guar seed production, or manufacturing and processing technology, which is anticipated to impede the market growth of guar gum in the forecast period. The agricultural and research institutes in these regions lack in major resources required to develop new varieties and certified seeds, which further restrains the growth of the guar gum market.

Opportunities:

Augmenting Demand for Convenience and Organic Food Products

The rising awareness about lifestyle diseases has brought a drastic change in the eating habits and dietary patterns of consumers all across the world. Additionally, due to the health benefits offered by organic food products, the market for guar gum can witness rapid growth. This growth can be attributed to the substantial use of guar gum as a food additive in almond milk, yogurts, fiber supplements, bottled coconut, soups, and others, which creates a huge demand for convenience foods among the population. Also, the utilization of guar gum as a firming agent and emulsifier in foods such as breakfast cereals, jams, baking mixes, ice creams, jellies, cheese, and sauces to enhance the food quality and taste fabricates a profitable opportunity for market growth over the forecast period. An increase in consumer preference and interest for low-calorie, low-fat and processed convenience food is anticipated to augment the demand for the guar gum market. This rise in interest is also influenced more by the factors such as longer working hours, increasing income levels, and usage of household technologies that can grow rapidly in the forecasted years.

Challenges:

Introduction of New Substitutes for Guar Gum Products

Guar gum has a wide range of applications including in the oil & gas and food & beverage industries. However, major factors such as fluctuating guar prices and unavailability have led to the introduction of new substitutes to guar gum products at a cheaper rate, especially in the oil and shale gas sector. Locust bean gum, Cassia tora, carboxymethylcellulose, carboxymethyl-hydroxyethyl cellulose-based gum, xanthan gum, clear starch, and synthetic polymers are some of the newly introduced products that act as a substitute for guar gum which can create a huge challenge for the guar gum market in the forthcoming years. Additionally, the tamarind kernel powder has crucially replaced guar gum in the textile sector, and meanwhile Cassia Tora in the pet food industry.

Segmentation Analysis Of Guar Gum Market

By Function, the gelling agent segment is expected to dominate the market growth in the upcoming years. The wide application of gelling agent function in the oil and gas industry as a key ingredient for the hydraulic fracking procedure drives the market growth. It is also used extensively in the oil drilling industry to increase the production of oil and gas. The multifunctional properties such as water and fluid loss control, shale inhibitor, and cooling & lubrication of drill bits are estimated to boost the growth of gelling agent segment. Also, its application in various food products such as candies, desserts, and jellies propels the growth of the gelling function.

By Application, the oil and gas segment holds the largest market share and is anticipated to dominate the market over the forecast period. The segment witnessed huge growth owing to the shale gas boom in the North American region. Also, the rise in drilling and exploration activities for the removal of technically recoverable resources in India, China, Algeria, and Argentina is expected to boost the demand for this segment in the upcoming years. The Food & beverage industry is expected to witness a rise in demand owing to the rising trend of consuming convenience, processed and organic foods.

By Grade, the industrial-grade segment is skyrocketing due to its various applications such as oil well drilling, oil recovery, water drilling, well fracturing, oil well stimulation, and geological drilling. Industrial grade also acts as a surfactant, synthetic polymer, and deformer in the oil and gas sector further boosting the growth of this segment. Additionally, the huge growth in oil recovery and drilling activities in the Middle Eastern and North American regions drives the demand for guar gum products for industrial use.

Regional Analysis Of Guar Gum Market:

The Asia Pacific dominates the market growth of Guar gum products in recent years and is estimated to witness huge demand in the forecasted period. The rapid development of the food & beverages and pharmaceutical industry is the major factor that drives the growth of the guar gum market in the Asia Pacific region. India is the major country that produces guar seeds and it accounts for 80% of the total guar produced all across the world. The favorable climatic conditions, availability of soil, land, and fertilizers are the key factors that influence the production of guar seeds in this region. Additionally, the initiatives taken by Government bodies in the country to support the large-scale export of guar gum are anticipated to boost the growth of the guar gum market in the forecasted years. Also, the awareness among consumers regarding the health benefits and the weight loss properties drive the market growth in the Asia Pacific region.

North America is the second-most dominating region of the guar gum market and is expected to be the fastest-growing owing to the adoption of oil well drilling and hydraulic cracking in the oil and gas industry. Furthermore, the initiatives taken by the United States government to strengthen exploration activities are anticipated to influence the market of guar gum positively. The US is the largest importer of guar gum and its products which propels the market growth. Also, the availability of plenty of oil and gas resources in this region drives rapid growth. The demand for natural additives, convenience, and processed foods among the population is fuelling the food-grade guar gum market in the North American region. In addition to this, the presence of major key players such as TIC Gums Inc., Penford Corporation, Ingredion, and Cargill in the region also cushions the rapid growth of the guar gum market.

Covid-19 impact Analysis On Guar Gum Market

The COVID-19 pandemic had a strong impact on numerous industries. Due to the global pandemic, many regions have imposed complete shutdown, social distancing, and lockdown guidelines. This had a direct impact on the market growth of global guar gum. The global guar gum market was in a slump, and there were no investments in guar gum products. Due to this, major key players have implemented different ideas and tactics to propel the reduced demand for guar gum products. In the current scenario, the global guar gum market is estimated to boost market growth during the forecast period. Also, the consistent growth in lifestyle and chronic disorders and increasing demand for medicines will sustain the requirement of guar gum in the pharmaceutical industry, in addition to the consumption from other applications like paper manufacturing, mining, oil and gas, and textile sector.

Top Key Players Covered In Guar Gum Market:

- E. I. DuPont de Nemours and Company (US)

- Cargill (US)

- Shree Ram Industries (India)

- Ingredion Incorporated (US)

- Ashland Inc. (US)

- Vikas WSP Limited (India)

- Hindustan Gums and Chemical Limited (India)

- Dabur India Ltd. (India)

- India Glycols Ltd. (India)

- Neelkanth Polymers (India)

- Lucid Group (India)

- Global Gums and Chemicals Pvt. Limited (Pakistan)

- Guangrao Liuhe Chemical Co. Ltd. (China)

- Jai Bharat Gums and Chemicals Ltd (India)

- Altrafine Gums (India) and other major players.

Key Industry Development In The Guar Gum Market

- In January 2023, Nexira, a leader in natural and botanical ingredients, introduced its latest range of efficient texturizers under the brand ‘Naltive’. Naltive offers three major types of hydrocolloids, including tara gum, locust bean gum, and guar specialties, for plant-based and dairy applications.

- In December 2022, Solvay, a Belgian chemicals company, announced its latest partnership with Procter & Gamble (P&G), one of the biggest beauty companies, in its sustainable guar initiative farming program. With the help of this partnership, Solvay will be capable of increasing its impact by expanding its efforts to educate guar farmers, especially women farmers, regarding the knowledge and tools of good agricultural practices.

|

Global Guar Gum Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 601.89 Mn. |

|

Forecast Period 2024-32 CAGR: |

3.11% |

Market Size in 2032: |

USD 795.92 Mn. |

|

Segments Covered: |

By Function |

|

|

|

By Application |

|

||

|

By Grade |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Function

3.2 By Application

3.3 By Grade

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Guar Gum Market by Function

5.1 Guar Gum Market Overview Snapshot and Growth Engine

5.2 Guar Gum Market Overview

5.3 Gelling

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Gelling: Grographic Segmentation

5.4 Thickening

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Thickening: Grographic Segmentation

5.5 Binding

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Binding: Grographic Segmentation

5.6 Friction Reducing

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Friction Reducing: Grographic Segmentation

Chapter 6: Guar Gum Market by Application

6.1 Guar Gum Market Overview Snapshot and Growth Engine

6.2 Guar Gum Market Overview

6.3 Oil & Gas

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Oil & Gas: Grographic Segmentation

6.4 Food & Beverages

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Food & Beverages: Grographic Segmentation

6.5 Paper manufacturing

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Paper manufacturing: Grographic Segmentation

6.6 Mining & Explosives

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Mining & Explosives: Grographic Segmentation

6.7 Pharmaceuticals & Cosmetics

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Pharmaceuticals & Cosmetics: Grographic Segmentation

Chapter 7: Guar Gum Market by Grade

7.1 Guar Gum Market Overview Snapshot and Growth Engine

7.2 Guar Gum Market Overview

7.3 Food

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Food: Grographic Segmentation

7.4 Industrial

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Industrial: Grographic Segmentation

7.5 Pharmaceutical

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Pharmaceutical: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Guar Gum Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Guar Gum Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Guar Gum Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 E. I. DUPONT DE NEMOURS AND COMPANY (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 CARGILL (US)

8.4 SHREE RAM INDUSTRIES (INDIA)

8.5 INGREDION INCORPORATED (US)

8.6 ASHLAND INC. (US)

8.7 VIKAS WSP LIMITED (INDIA)

8.8 HINDUSTAN GUMS AND CHEMICAL LIMITED (INDIA)

8.9 DABUR INDIA LTD. (INDIA)

8.10 INDIA GLYCOLS LTD. (INDIA)

8.11 NEELKANTH POLYMERS (INDIA)

8.12 LUCID GROUP (INDIA)

8.13 GLOBAL GUMS AND CHEMICALS PVT. LIMITED (PAKISTAN)

8.14 GUANGRAO LIUHE CHEMICAL CO. LTD. (CHINA)

8.15 JAI BHARAT GUMS AND CHEMICALS LTD (INDIA)

8.16 ALTRAFINE GUMS (INDIA)

8.17 OTHER MAJOR PLAYERS

Chapter 9: Global Guar Gum Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Function

9.2.1 Gelling

9.2.2 Thickening

9.2.3 Binding

9.2.4 Friction Reducing

9.3 Historic and Forecasted Market Size By Application

9.3.1 Oil & Gas

9.3.2 Food & Beverages

9.3.3 Paper manufacturing

9.3.4 Mining & Explosives

9.3.5 Pharmaceuticals & Cosmetics

9.4 Historic and Forecasted Market Size By Grade

9.4.1 Food

9.4.2 Industrial

9.4.3 Pharmaceutical

Chapter 10: North America Guar Gum Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Function

10.4.1 Gelling

10.4.2 Thickening

10.4.3 Binding

10.4.4 Friction Reducing

10.5 Historic and Forecasted Market Size By Application

10.5.1 Oil & Gas

10.5.2 Food & Beverages

10.5.3 Paper manufacturing

10.5.4 Mining & Explosives

10.5.5 Pharmaceuticals & Cosmetics

10.6 Historic and Forecasted Market Size By Grade

10.6.1 Food

10.6.2 Industrial

10.6.3 Pharmaceutical

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Guar Gum Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Function

11.4.1 Gelling

11.4.2 Thickening

11.4.3 Binding

11.4.4 Friction Reducing

11.5 Historic and Forecasted Market Size By Application

11.5.1 Oil & Gas

11.5.2 Food & Beverages

11.5.3 Paper manufacturing

11.5.4 Mining & Explosives

11.5.5 Pharmaceuticals & Cosmetics

11.6 Historic and Forecasted Market Size By Grade

11.6.1 Food

11.6.2 Industrial

11.6.3 Pharmaceutical

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Guar Gum Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Function

12.4.1 Gelling

12.4.2 Thickening

12.4.3 Binding

12.4.4 Friction Reducing

12.5 Historic and Forecasted Market Size By Application

12.5.1 Oil & Gas

12.5.2 Food & Beverages

12.5.3 Paper manufacturing

12.5.4 Mining & Explosives

12.5.5 Pharmaceuticals & Cosmetics

12.6 Historic and Forecasted Market Size By Grade

12.6.1 Food

12.6.2 Industrial

12.6.3 Pharmaceutical

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Guar Gum Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Function

13.4.1 Gelling

13.4.2 Thickening

13.4.3 Binding

13.4.4 Friction Reducing

13.5 Historic and Forecasted Market Size By Application

13.5.1 Oil & Gas

13.5.2 Food & Beverages

13.5.3 Paper manufacturing

13.5.4 Mining & Explosives

13.5.5 Pharmaceuticals & Cosmetics

13.6 Historic and Forecasted Market Size By Grade

13.6.1 Food

13.6.2 Industrial

13.6.3 Pharmaceutical

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Guar Gum Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Function

14.4.1 Gelling

14.4.2 Thickening

14.4.3 Binding

14.4.4 Friction Reducing

14.5 Historic and Forecasted Market Size By Application

14.5.1 Oil & Gas

14.5.2 Food & Beverages

14.5.3 Paper manufacturing

14.5.4 Mining & Explosives

14.5.5 Pharmaceuticals & Cosmetics

14.6 Historic and Forecasted Market Size By Grade

14.6.1 Food

14.6.2 Industrial

14.6.3 Pharmaceutical

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Guar Gum Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 601.89 Mn. |

|

Forecast Period 2024-32 CAGR: |

3.11% |

Market Size in 2032: |

USD 795.92 Mn. |

|

Segments Covered: |

By Function |

|

|

|

By Application |

|

||

|

By Grade |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. GUAR GUM MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. GUAR GUM MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. GUAR GUM MARKET COMPETITIVE RIVALRY

TABLE 005. GUAR GUM MARKET THREAT OF NEW ENTRANTS

TABLE 006. GUAR GUM MARKET THREAT OF SUBSTITUTES

TABLE 007. GUAR GUM MARKET BY FUNCTION

TABLE 008. GELLING MARKET OVERVIEW (2016-2028)

TABLE 009. THICKENING MARKET OVERVIEW (2016-2028)

TABLE 010. BINDING MARKET OVERVIEW (2016-2028)

TABLE 011. FRICTION REDUCING MARKET OVERVIEW (2016-2028)

TABLE 012. GUAR GUM MARKET BY APPLICATION

TABLE 013. OIL & GAS MARKET OVERVIEW (2016-2028)

TABLE 014. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 015. PAPER MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 016. MINING & EXPLOSIVES MARKET OVERVIEW (2016-2028)

TABLE 017. PHARMACEUTICALS & COSMETICS MARKET OVERVIEW (2016-2028)

TABLE 018. GUAR GUM MARKET BY GRADE

TABLE 019. FOOD MARKET OVERVIEW (2016-2028)

TABLE 020. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 021. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA GUAR GUM MARKET, BY FUNCTION (2016-2028)

TABLE 023. NORTH AMERICA GUAR GUM MARKET, BY APPLICATION (2016-2028)

TABLE 024. NORTH AMERICA GUAR GUM MARKET, BY GRADE (2016-2028)

TABLE 025. N GUAR GUM MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE GUAR GUM MARKET, BY FUNCTION (2016-2028)

TABLE 027. EUROPE GUAR GUM MARKET, BY APPLICATION (2016-2028)

TABLE 028. EUROPE GUAR GUM MARKET, BY GRADE (2016-2028)

TABLE 029. GUAR GUM MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC GUAR GUM MARKET, BY FUNCTION (2016-2028)

TABLE 031. ASIA PACIFIC GUAR GUM MARKET, BY APPLICATION (2016-2028)

TABLE 032. ASIA PACIFIC GUAR GUM MARKET, BY GRADE (2016-2028)

TABLE 033. GUAR GUM MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA GUAR GUM MARKET, BY FUNCTION (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA GUAR GUM MARKET, BY APPLICATION (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA GUAR GUM MARKET, BY GRADE (2016-2028)

TABLE 037. GUAR GUM MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA GUAR GUM MARKET, BY FUNCTION (2016-2028)

TABLE 039. SOUTH AMERICA GUAR GUM MARKET, BY APPLICATION (2016-2028)

TABLE 040. SOUTH AMERICA GUAR GUM MARKET, BY GRADE (2016-2028)

TABLE 041. GUAR GUM MARKET, BY COUNTRY (2016-2028)

TABLE 042. E. I. DUPONT DE NEMOURS AND COMPANY (US): SNAPSHOT

TABLE 043. E. I. DUPONT DE NEMOURS AND COMPANY (US): BUSINESS PERFORMANCE

TABLE 044. E. I. DUPONT DE NEMOURS AND COMPANY (US): PRODUCT PORTFOLIO

TABLE 045. E. I. DUPONT DE NEMOURS AND COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. CARGILL (US): SNAPSHOT

TABLE 046. CARGILL (US): BUSINESS PERFORMANCE

TABLE 047. CARGILL (US): PRODUCT PORTFOLIO

TABLE 048. CARGILL (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. SHREE RAM INDUSTRIES (INDIA): SNAPSHOT

TABLE 049. SHREE RAM INDUSTRIES (INDIA): BUSINESS PERFORMANCE

TABLE 050. SHREE RAM INDUSTRIES (INDIA): PRODUCT PORTFOLIO

TABLE 051. SHREE RAM INDUSTRIES (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. INGREDION INCORPORATED (US): SNAPSHOT

TABLE 052. INGREDION INCORPORATED (US): BUSINESS PERFORMANCE

TABLE 053. INGREDION INCORPORATED (US): PRODUCT PORTFOLIO

TABLE 054. INGREDION INCORPORATED (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. ASHLAND INC. (US): SNAPSHOT

TABLE 055. ASHLAND INC. (US): BUSINESS PERFORMANCE

TABLE 056. ASHLAND INC. (US): PRODUCT PORTFOLIO

TABLE 057. ASHLAND INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. VIKAS WSP LIMITED (INDIA): SNAPSHOT

TABLE 058. VIKAS WSP LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 059. VIKAS WSP LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 060. VIKAS WSP LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. HINDUSTAN GUMS AND CHEMICAL LIMITED (INDIA): SNAPSHOT

TABLE 061. HINDUSTAN GUMS AND CHEMICAL LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 062. HINDUSTAN GUMS AND CHEMICAL LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 063. HINDUSTAN GUMS AND CHEMICAL LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. DABUR INDIA LTD. (INDIA): SNAPSHOT

TABLE 064. DABUR INDIA LTD. (INDIA): BUSINESS PERFORMANCE

TABLE 065. DABUR INDIA LTD. (INDIA): PRODUCT PORTFOLIO

TABLE 066. DABUR INDIA LTD. (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. INDIA GLYCOLS LTD. (INDIA): SNAPSHOT

TABLE 067. INDIA GLYCOLS LTD. (INDIA): BUSINESS PERFORMANCE

TABLE 068. INDIA GLYCOLS LTD. (INDIA): PRODUCT PORTFOLIO

TABLE 069. INDIA GLYCOLS LTD. (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. NEELKANTH POLYMERS (INDIA): SNAPSHOT

TABLE 070. NEELKANTH POLYMERS (INDIA): BUSINESS PERFORMANCE

TABLE 071. NEELKANTH POLYMERS (INDIA): PRODUCT PORTFOLIO

TABLE 072. NEELKANTH POLYMERS (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. LUCID GROUP (INDIA): SNAPSHOT

TABLE 073. LUCID GROUP (INDIA): BUSINESS PERFORMANCE

TABLE 074. LUCID GROUP (INDIA): PRODUCT PORTFOLIO

TABLE 075. LUCID GROUP (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. GLOBAL GUMS AND CHEMICALS PVT. LIMITED (PAKISTAN): SNAPSHOT

TABLE 076. GLOBAL GUMS AND CHEMICALS PVT. LIMITED (PAKISTAN): BUSINESS PERFORMANCE

TABLE 077. GLOBAL GUMS AND CHEMICALS PVT. LIMITED (PAKISTAN): PRODUCT PORTFOLIO

TABLE 078. GLOBAL GUMS AND CHEMICALS PVT. LIMITED (PAKISTAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. GUANGRAO LIUHE CHEMICAL CO. LTD. (CHINA): SNAPSHOT

TABLE 079. GUANGRAO LIUHE CHEMICAL CO. LTD. (CHINA): BUSINESS PERFORMANCE

TABLE 080. GUANGRAO LIUHE CHEMICAL CO. LTD. (CHINA): PRODUCT PORTFOLIO

TABLE 081. GUANGRAO LIUHE CHEMICAL CO. LTD. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. JAI BHARAT GUMS AND CHEMICALS LTD (INDIA): SNAPSHOT

TABLE 082. JAI BHARAT GUMS AND CHEMICALS LTD (INDIA): BUSINESS PERFORMANCE

TABLE 083. JAI BHARAT GUMS AND CHEMICALS LTD (INDIA): PRODUCT PORTFOLIO

TABLE 084. JAI BHARAT GUMS AND CHEMICALS LTD (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. ALTRAFINE GUMS (INDIA): SNAPSHOT

TABLE 085. ALTRAFINE GUMS (INDIA): BUSINESS PERFORMANCE

TABLE 086. ALTRAFINE GUMS (INDIA): PRODUCT PORTFOLIO

TABLE 087. ALTRAFINE GUMS (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 088. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 089. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 090. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. GUAR GUM MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. GUAR GUM MARKET OVERVIEW BY FUNCTION

FIGURE 012. GELLING MARKET OVERVIEW (2016-2028)

FIGURE 013. THICKENING MARKET OVERVIEW (2016-2028)

FIGURE 014. BINDING MARKET OVERVIEW (2016-2028)

FIGURE 015. FRICTION REDUCING MARKET OVERVIEW (2016-2028)

FIGURE 016. GUAR GUM MARKET OVERVIEW BY APPLICATION

FIGURE 017. OIL & GAS MARKET OVERVIEW (2016-2028)

FIGURE 018. FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 019. PAPER MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 020. MINING & EXPLOSIVES MARKET OVERVIEW (2016-2028)

FIGURE 021. PHARMACEUTICALS & COSMETICS MARKET OVERVIEW (2016-2028)

FIGURE 022. GUAR GUM MARKET OVERVIEW BY GRADE

FIGURE 023. FOOD MARKET OVERVIEW (2016-2028)

FIGURE 024. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 025. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA GUAR GUM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE GUAR GUM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC GUAR GUM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA GUAR GUM MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA GUAR GUM MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Guar Gum Market research report is 2024-2032.

E. I. DuPont de Nemours and Company (US), Cargill (US), Shree Ram Industries (India), Ingredion Incorporated (US), Ashland Inc. (US), and other major players.

The Guar Gum Market is segmented into Function, Application, Grade, and region. By Function, the market is categorized into Gelling, Thickening, Binding, and Friction Reducing. By Application, the market is categorized into Oil & Gas, Food & Beverages, Paper manufacturing, Mining & Explosives, and Pharmaceuticals & Cosmetics. By Grade, the market is categorized into Food grade, Industrial grade, and Pharmaceutical Grade. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Guar Gum is highly rich in Guar Gum also called Guaran, which is a free-flowing powder made from the legumes known as guar beans. Guar gum is used primarily in the food manufacturing industry, as they are thick and hold the ability to absorb water, forms a thickening gel, and helps in binding the food products.

Guar Gum Market size is projected to reach USD 792.92 Million by 2032 from an estimated USD 601.89 Million in 2023, growing at a CAGR of 3.11% globally, during the forecast period (2024-2032).