Green Packaging Market Synopsis

Green Packaging Market Size Was Valued at USD 306.73 Billion in 2022 and is Projected to Reach USD 507.63 Billion by 2030, Growing at a CAGR of 6.5% From 2023-2030.

Green packaging refers to the usage of packaging materials and the implementation of manufacturing methods that have a low impact on energy consumption and the environment.

- Green packaging involves the usage of recyclable and biodegradable materials and thus is referred to as energy-efficient or sustainable packaging.

- Furthermore, bio-degradable plastics, bio-based plastics, Solid Bleach Sulfate, and recycled papers are some of the essential ingredients utilized for the development of green packaging items. Factors such as widespread read knowledge among consumers regarding the environmental safety and benefits of green packaging are the primary factors fueling gr the of the global green packaging industry.

- Moreover, initiatives of regulatory bodies in recommending the adoption of eco-friendly alternatives by the manufacturers, will further boost the growth of the global green packaging market during the forecast period.

Green Packaging Market Trend Analysis

Growing Prevalence of Sustainable Food Packaging

- The increasing popularity of environmentally friendly food packaging is anticipated to stimulate the expansion of the green packaging industry. When referring to the creation of packaging items, the term "green packaging" refers to the utilization of environmentally friendly materials and procedures. Food packaging that is sustainable is a subcategory of environmentally friendly packaging that is intended to lessen the negative effects of food packaging on the surrounding environment.

- The rising use of environmentally friendly food packaging can be attributed to a number of different factors. To begin, customers are developing a greater awareness of the environment and are placing an increased demand for items that are manufactured in a manner that is environmentally responsible. Because of this, there has been a rise in demand for environmentally friendly food packaging. Second, regulations and policies are being enacted in order to lessen the amount of non-biodegradable and non-recyclable materials that are used in the production of packaging. Because of this, manufacturers have been urged to produce environmentally friendly food packaging.

- Overall, the growing prevalence of sustainable food packaging is a positive trend that is likely to have a significant impact on the market growth of green packaging. As more consumers and manufacturers adopt sustainable packaging practices, the environmental impact of packaging products is expected to be reduced, which is good news for the planet.

Strict Government Regulations and Increased Awareness

- Strict government requirements, as well as growing consumer awareness, present considerable prospects for the green packaging market. Governments all across the world are enacting laws to limit the use of non-biodegradable and non-recyclable packaging materials, such as single-use plastics. To comply with the new laws, manufacturers are being forced to adopt sustainable packaging strategies.

- For example, the European Union has set a target of making all plastic packaging recyclable or reusable by 2030. In the United States, several states and cities have banned single-use plastic bags, and there are calls for similar measures at the federal level.

- Increased awareness among consumers is also driving the demand for green packaging. Consumers are becoming more environmentally conscious and are demanding products that are produced sustainably. They are willing to pay more for products that are packaged in eco-friendly materials, and they are increasingly choosing products based on their environmental impact.

- This increased demand for green packaging is creating new opportunities for manufacturers and suppliers in the market. Companies that adopt sustainable packaging practices can differentiate themselves from their competitors and appeal to environmentally conscious consumers. They can also reduce their environmental impact and comply with government regulations.

Green Packaging Market Segment Analysis:

Green Packaging Market Segmented on the basis of Packaging Type and Application.

By Packaging Type, Recycled segment is expected to dominate the market during the forecast period

- Recycled content packaging dominates the market over the forecast period. Increased collecting and processing capability, combined with increased usage of recycled content packaging by businesses seeking to demonstrate environmental friendliness and differentiate their products, would boost gains in recycled content packaging. Initiatives by industry bodies, brand owners, packaging businesses, and others to promote sustainability programs aimed at increasing recycling rates of various types of packaging materials will benefit the segment's growth.

- In general, recycled plastic packaging includes pallets, bins, reservoirs, intermediate bulk containers (IBCs), reusable plastic containers (RPCs), and other handheld containers and totes, trays, and dunnage containers that transfer goods across supply chains easily and securely.

- Reusable transport packaging items are primarily intended for business-to-business uses, but the rise in applications for e-commerce and home delivery opens up possibilities for the efficient use of reusable packaging for the domestic transport of goods.

By Application, the Food & Beverage segment held the largest share of 35.70% in 2022

- The food & and beverages segment held the largest share of the global green packaging market. Convenience food is majorly driving the demand for food & and beverage packaging due to easy portability, long shelf life, and easy manufacturing. Convenience food items consist of frozen foods, snacks, finger foods, beverages, and others. The food products usually require less preparation time and are served in hot ready-to-go containers.

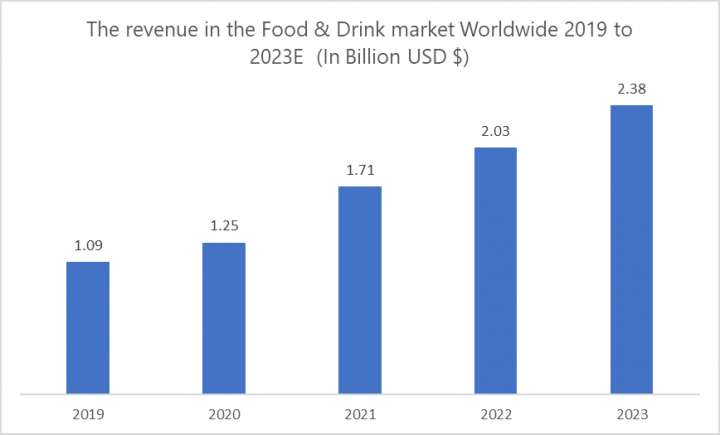

- The global food and beverage market experienced a surge in revenue attributed to the dominance of the food and drink segment in the green packaging market. This growth is indicative of the industry's increasing commitment to sustainable practices, with eco-friendly packaging solutions playing a pivotal role in shaping consumer choices.

- The rising demand due to the hectic lifestyle of consumers along with the geriatric population has resulted in the high use of convenience food. The major attributes consumers look for in convenience food are nutritional value, ease of packaging, product appeal, and safety of the products. Innovative packaging and advanced technology have widened various food options that are readily available in the market, such as packaged food, frozen, chilled food, etc. Most of the packaging manufacturers are focusing on product safety and sustainability.

Green Packaging Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is expected to remain at the forefront and hold the highest position in the global green packaging market. There are several factors contributing to this trend.

- Asia Pacific is home to some of the world's largest and fastest-growing economies, such as China and India, which have large populations with increasing purchasing power. This has led to a growing demand for eco-friendly products, including green packaging, as consumers become more environmentally conscious.

- Furthermore, governments in the region are under increasing pressure to decrease pollution and promote sustainable development. Many Asian Pacific countries have put in place legislation to encourage green activities, such as the use of eco-friendly packaging materials. Furthermore, Asia Pacific is a major manufacturing base for a variety of industries such as food and beverage, consumer goods, and electronics. These industries necessitate a considerable number of packaging materials, and there is a growing demand for environmentally friendly packaging solutions that can assist in reducing waste and environmental effects.

- Overall, these factors are likely to support the expansion of the Asia Pacific green packaging market, with the region remaining at the forefront of the industry. As more customers and governments embrace sustainability, the need for green packaging is likely to rise, fueling industry innovation and advancement.

Green Packaging Market Top Key Players:

- Sealed Air Corporation (USA)

- Ball Corporation (USA)

- Berry Global, Inc. (USA)

- WestRock Company (USA)

- Sonoco Products Company (USA)

- Evergreen Packaging Inc. (USA)

- Crown Holdings, Inc. (USA)

- Printpack Inc. (USA)

- DuPont (USA)

- Winpak Ltd. (Canada)

- Tetra Pak International S.A. (Switzerland)

- Mondi plc (Austria)

- Smurfit Kappa Group (Ireland)

- DS Smith Plc (UK)

- Huhtamäki Oyj (Finland)

- Ardagh Group S.A. (Luxembourg)

- Ecolean AB (Sweden)

- Elopak AS (Norway)

- Coveris Holdings S.A. (Luxembourg)

- Uflex Ltd. (India)

- Amcor Limited (Australia),

- Reynolds Group Holdings (New Zealand), And Other Major Players.

Key Industry Developments in the Green Packaging Market:

In May 2023, DuPont announced to acquired Spectrum Plastics Group from global private equity firm AEA Investors for $1.75 billion. For DuPont, the acquisition complements its existing offerings for biopharma and pharma processing, medical devices, and packaging, including the Liveo silicone line and Tyvek medical packaging. DuPont added that the purchase strengthens its position in the fast-growing healthcare markets that are less exposed to up-and-down business cycles than other sectors.

In February 2023, Amcor, a global leader in developing and producing responsible packaging solutions, announced a $250,000 investment into smart reusable food packaging start-up circulation, the third winner of Amcor’s Lift-Off initiative. Launched in April 2022, Amcor Lift-Off targets breakthrough, state-of-the-art technologies that will further advance Amcor’s goal to make the future of packaging more sustainable.

In January 2023, Amcor, a global leader in developing and producing responsible packaging solutions, announced that it had agreed to acquire Shanghai-based MDK, a leading provider of medical device packaging.

|

Global Green Packaging Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 306.73 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.5 % |

Market Size in 2030: |

USD 507.63 Bn. |

|

Segments Covered: |

By Packaging Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

TABLE OF CONTENTS

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat of New Entrants

- Threat of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- GREEN PACKAGING MARKET BY PACKAGING TYPE (2016-2030)

- GREEN PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RECYCLED

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- REUSABLE

- DEGRADABLE

- GREEN PACKAGING MARKET BY APPLICATION (2016-2030)

- GREEN PACKAGING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FOOD & BEVERAGE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HEALTH CARE

- PERSONAL CARE

- OTHER

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- GREEN PACKAGING Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- AMCOR LIMITED (AUSTRALIA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- TETRA PAK INTERNATIONAL S.A. (SWITZERLAND)

- SEALED AIR CORPORATION (USA)

- BALL CORPORATION USA

- MONDI PLC (AUSTRIA)

- SMURFIT KAPPA GROUP (IRELAND)

- DS SMITH PLC (UK)

- HUHTAMÄKI OYJ (FINLAND)

- BERRY GLOBAL, INC. (USA)

- UFLEX LTD. (INDIA)

- ARDAGH GROUP S.A. (LUXEMBOURG)

- WESTROCK COMPANY (USA)

- ECOLEAN AB (SWEDEN)

- ELOPAK AS (NORWAY)

- GERRESHEIMER AG (GERMANY)

- REYNOLDS GROUP HOLDINGS (NEW ZEALAND)

- KLÖCKNER PENTAPLAST GROUP (GERMANY)

- WINPAK LTD. (CANADA)

- SONOCO PRODUCTS COMPANY (USA)

- EVERGREEN PACKAGING INC. (USA)

- COVERIS HOLDINGS S.A. (LUXEMBOURG)

- CROWN HOLDINGS, INC. (USA)

- SIG COMBIBLOC GROUP AG (SWITZERLAND)

- PRINTPACK INC. (USA)

- APTARGROUP, INC. (USA)

- COMPETITIVE LANDSCAPE

- GLOBAL GREEN PACKAGING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segment1

- Historic And Forecasted Market Size By Segment2

- Historic And Forecasted Market Size By Segment3

- Historic And Forecasted Market Size By Segment4

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Green Packaging Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 306.73 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.5 % |

Market Size in 2030: |

USD 507.63 Bn. |

|

Segments Covered: |

By Packaging Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Green Packaging Market research report is 2023-2030.

Amcor Limited (Australia), Tetra Pak International S.A. (Switzerland), Sealed Air Corporation (USA), Ball Corporation USA, Mondi plc (Austria), Smurfit Kappa Group (Ireland), DS Smith Plc (UK), Huhtamäki Oyj (Finland), Berry Global, Inc. (USA), Uflex Ltd. (India), Ardagh Group S.A. (Luxembourg), WestRock Company (USA). Ecolean AB (Sweden), Elopak AS (Norway), Gerresheimer AG (Germany), Reynolds Group Holdings (New Zealand), Klöckner Pentaplast Group (Germany), Winpak Ltd. (Canada), Sonoco Products Company (USA), Evergreen Packaging Inc. (USA), Coveris Holdings S.A. (Luxembourg), Crown Holdings, Inc. (USA), SIG Combibloc Group AG (Switzerland), Printpack Inc. (USA), AptarGroup, Inc. (USA), And Other Major Players.

The Green Packaging Market is segmented into Packaging Type, Application, and region. By Packaging Type, the market is categorized into Recycled, Reusable, and Degradable. By Application, the market is categorized into Food and beverage, Health Care, Personal Care, Other. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Green packaging involves the usage of recyclable and biodegradable materials and thus is referred to as energy-efficient or sustainable packaging. Furthermore, bio-degradable plastics, bio-based plastics, Solid Bleach Sulfate, and recycled papers are some of the key materials used for the manufacture of green packaging products. Factors such as widespread read awareness among consumers regarding the environmental safety and benefits of green packaging are the key factors propelling growth of the of the global green packaging market.

Green Packaging Market Size Was Valued at USD 306.73 Billion in 2022 and is Projected to Reach USD 507.63 Billion by 2030, Growing at a CAGR of 6.5% From 2023-2030.