Green Mining Market Synopsis

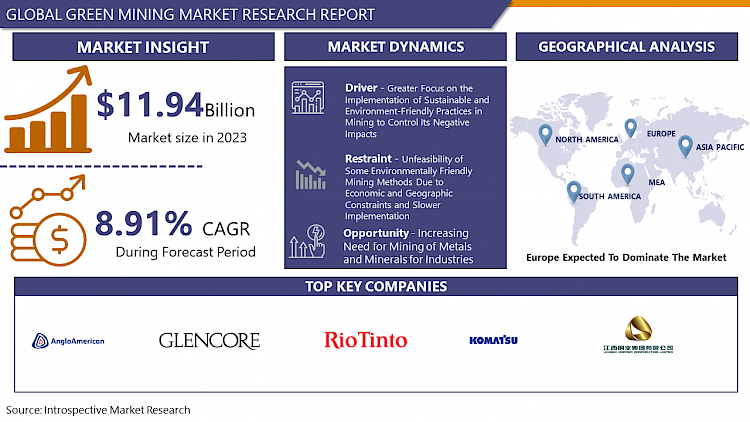

The Green Mining Market size is estimated at 11.94 billion USD in 2023 and is expected to reach 23.63 billion USD by 2032, growing at a CAGR of 8.91% during the forecast period (2024-2032).

Green mining is the implementation of technological advances and best practices in order to achieve the extraction of minerals and metals while mitigating the environmental impacts that occur during the mining process. Green Mining right from the beginning of the mining process till the end ensures sustainability through the adoption of green mining practices. Green mining reduces greenhouse gases and uses energy more efficiently while conserving minerals, it also involves the proper treatment of abandoned mine water and recycling it back into production and domestic water.

- Presently, mining is a very essential process for economies worldwide as it gives many benefits like employment and development at local national, and international levels. The mining industry is one of the largest and most money-oriented industries in the world. To be explained, the revenue of the top 40 global mining companies in the world, which represent a very large part when considered the whole industry, amounted to somewhere around USD 925 billion in 2021. Also, their operating cost was around USD 633 billion.

- However, many environmental impacts occur due to mining activities and hence the miners need to focus on various environmental issues to maintain their economic gain as well as social well-being. Some of the Impacts associated with mining are pollution of air, water, soil, noise, loss of biodiversity, land degradation, and desertification. Of all the most foreseen effects of mining is the depletion of natural resources and hazards. Also, over-exploitation of minerals causes pollution of surface and groundwater and affects sustainable development.

- Although, there are several key parts of the mining lifecycle in which green mining practices can be applied, such as power consumption, water usage, and mine decommissioning. These practices help in controlling the mentioned hazards caused by mining to some extent. It is a technology that holds the key to reducing the environmental impacts as we require greater quantities of material to supply global demand.

The Green Mining Market Trend Analysis

Greater Focus on the Implementation of Sustainable and Environment-Friendly Practices in Mining to Control Its Negative Impacts

- Green mining is a practical approach intended to make the mining industry more sustainable than before. Green mining is concentrated on the sustainability of resources, the environment, and socio-economic benefits while carrying out mining activities. the purpose of green mining is to develop and apply technologies and processes that will help in increasing environmental performance while maintaining competitiveness throughout the entire mining process right from exploration to post-closure.

- Presently, mining is one of the world’s most necessary functions as almost every industry and sector needs some kind of metal or element. Miners produced roughly 3 billion tonnes of iron ore in 2019, representing close to 94% of all mined metals. The primary use of all this iron is to make steel which is the most demanded metal across many industries. In fact, 98% of total iron ore goes into steelmaking. Hence, when such a mining industry when begins to demand greater environmental accountability, it leads to growth of the Green Mining Applications.

- Moreover, the implementation of recently discovered green mining technologies by almost every miner is another factor supporting the growth of the market. These technologies include mining from tailings, dust suppression techniques, liquid membrane emulsion technology, sulphuric acid leaching extraction, impermeable tailings storage, and improved energy efficiency by using better ventilation systems and diesel engines

Increasing Need for Mining of Metals and Minerals for Industries and Growing Adoption of Low-Energy, Sustainable, and Green Ways to Meet Such Demand

- Presently, mining activities are carried out at a rapid pace owing to advancements in tools, equipment, and machinery. Such elevated mining is attributed to the increased consumption of mine extracts from the end-user industries. For instance, according to Circle Economy, the world consumes 100.6 billion tonnes of materials annually. Of this total, 3.2 billion tonnes of metals produced in 2019 would account for just 3% of our overall material consumption.

- Also, Industrial and technology metals made up the other 6% of all mined metals in 2019. Despite the fact that many of the mines were closed in the last two decades there are still almost 12,567 active mines present across the world including all types.

- Hence, looking at such great requirements the importance of improving the implementation of green mining processes and practices cannot be overestimated. Also, with the help of continued investment in the Research and Development of these technologies, considerable progress can be made in reducing the negative impact of mining. Investments in the scientific infrastructure to support green mining technologies are going on, and such sustainable technologies and practices that can be efficiently integrated into existing mining operations are expected to see the fastest development during the forecast period by improving profitability for miners.

Segmentation Analysis Of The Green Mining Market

Green Mining market segments cover the Type and Technology. By Type, the Surface Mining segment is Anticipated to Dominate the Market Over the Forecast period.

- Surface Mining is an influential segment in the green mining market due to its greater employment as compared to underground or in-situ mining. Surface mining dominates the global production of minerals and metals. Currently, more than 95% of non-metallic minerals and more than 90% of metallic minerals, and a large fraction of coal i.e., more than 60% are mined by using surface mining methods.

- Over 30 billion tonnes of ore and waste materials are mined each year of which surface mining accounts for around 25 billion tonnes. The subsurface of the earth is the only source of fossil energy and mineral products, and hence surface mining is the only way to get at them. several operations of drilling, blasting, loading, and hauling are used in surface mining. Due to the greater execution of these activities, the demand for green technologies to be used in these activities is also increasing.

- Moreover, these activities are easy to be integrated with sustainable technologies and many of the miners have already started incorporating such changes to their surface mining methods which are expected to boost the segment growth of surface mining in the Green Mining Industry.

Regional Analysis of The Green Mining Market

Europe is Expected to Dominate the Global Market of Green Mining, and the Asia Pacific Is Also Expected to Show the Fastest Growth in The Market Over the Forecast Period.

- The European mining industry is greatly known in history, and even today it is among the world’s most modern and innovative industrial sectors. Europe has the most mining companies and most of them have already started adopting sustainable and eco-friendly mining methods. In 2019, there were 16,900 companies classified under mining and quarrying in Europe. The current mining industry in Europe has a major emphasis on research and development for discovering new deposits, mining, and ore dressing. Mining exploration, extraction, and closure in the region are now supported by high-level technologies which are leading to greater implementation of green mining methods among the regional miners.

- The European mining industry is fundamental for the economic well-being of the region and along with that the market has also seen the adoption of sustainable and environmentally friendly practices in countries like Germany, France, Russia, and the UK. Consumption of aggregates, industrial minerals, and metals in Europe has also grown rapidly over the past 8-10 years. The industry also promotes advancements in the areas of environmental, health, and safety protection all of which make the region have considerable growth in the market of green mining.

Top Key Players Covered in The Green Mining Market

- Anglo American PLC(UK)

- Glencore PLC (Switzerland)

- Rio Tinto Group (UK)

- Komatsu Limited (Japan)

- Jiangxi Copper Corporation Limited (China)

- Caterpillar Inc. (US)

- BHP Group Limited (Australia)

- Vale S.A. (Brazil)

- Liebherr (Switzerland)

- Tata Steel Limited (India)

- Cummins Inc (US)

- Dundee Precious Metals (Canada)

- Freeport-McMoRan (US)

- Shandong Gold Mining Co. (China)

- Zijin Mining Group Ltd (China) and Other Major Players

Key Industry Developments in the Green Mining Market

- March 2023: The World Bank announced a new $1 billion fund to support the development of green mining projects in developing countries. The fund will focus on projects that reduce greenhouse gas emissions, improve water management, and protect biodiversity.

- In November 2022, Caterpillar Inc., world's leading manufacturer of construction and mining equipment announced a successful demonstration of its first battery electric 793 large mining truck and a significant investment to transform its Arizona-based proving ground into a sustainable testing and validation hub of the future. The company has completed the development of its first battery electric 793 prototypes with the help of key mining companies participating in Caterpillar's Early Learner program, these participants with definitive electrification agreements include BHP, Freeport-McMoRan, Newmont Corporation, Rio Tinto and Teck Resources Limited.

- In April 2022, Australian mining giant BHP Billiton has signed a Power Purchase Agreement (PPA) with Enel Green Power an Italian multinational renewable energy corporation to meet the power needs of two of its Nickel West operations in Western Australia (WA). Under the agreement, BHP will purchase power from Enel’s proposed Flat Rocks Wind Farm located in WA to meet 100% of the current power requirements for BHP’s Kalgoorlie nickel smelter and concentrator from 2024.

- In September 2021, Liebherr Mining officially launched its Zero Emission Program to offer low carbon emission solutions for the full range of its trucks and excavators by 2022 and fossil fuel-free solutions by 2030. Liebherr aims for long-term sustainable solutions, by focusing on environmental sustainability, safety, cost, flexibility, and maintainability. This approach will provide solutions that will support customers on their path toward total decarbonisation.

|

Global Green Mining Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.94 Bn. |

|

Forecast Period 2024-2032 CAGR: |

8.91% |

Market Size in 2032: |

USD 23.63 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Technology

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Green Mining Market by Type

5.1 Green Mining Market Overview Snapshot and Growth Engine

5.2 Green Mining Market Overview

5.3 Surface Mining

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Surface Mining: Geographic Segmentation

5.4 Underground Mining

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Underground Mining: Geographic Segmentation

Chapter 6: Green Mining Market by Technology

6.1 Green Mining Market Overview Snapshot and Growth Engine

6.2 Green Mining Market Overview

6.3 Power Reduction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Power Reduction: Geographic Segmentation

6.4 Fuel And Maintenance Reduction

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Fuel And Maintenance Reduction: Geographic Segmentation

6.5 Emission Reduction

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Emission Reduction: Geographic Segmentation

6.6 Toxicity Reduction

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Toxicity Reduction: Geographic Segmentation

6.7 Water Reduction

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Water Reduction: Geographic Segmentation

6.8 Other

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2017-2032F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Other: Geographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Green Mining Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Green Mining Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Green Mining Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 ANGLO AMERICAN PLC (UK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 GLENCORE PLC (SWITZERLAND)

7.4 RIO TINTO GROUP (UK)

7.5 KOMATSU LIMITED (JAPAN)

7.6 JIANGXI COPPER CORPORATION LIMITED (CHINA)

7.7 CATERPILLAR INC. (US)

7.8 BHP GROUP LIMITED (AUSTRALIA)

7.9 VALE S.A. (BRAZIL)

7.10 LIEBHERR (SWITZERLAND)

7.11 TATA STEEL LIMITED (INDIA)

7.12 CUMMINS INC (US)

7.13 DUNDEE PRECIOUS METALS (CANADA)

7.14 FREEPORT-MCMORAN (US)

7.15 SHANDONG GOLD MINING CO. (CHINA)

7.16 ZIJIN MINING GROUP LTD (CHINA)

7.17 OTHER MAJOR PLAYERS

Chapter 8: Global Green Mining Market Analysis, Insights and Forecast, 2017-2032

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Type

8.2.1 Surface Mining

8.2.2 Underground Mining

8.3 Historic and Forecasted Market Size By Technology

8.3.1 Power Reduction

8.3.2 Fuel And Maintenance Reduction

8.3.3 Emission Reduction

8.3.4 Toxicity Reduction

8.3.5 Water Reduction

8.3.6 Other

Chapter 9: North America Green Mining Market Analysis, Insights and Forecast, 2017-2032

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Type

9.4.1 Surface Mining

9.4.2 Underground Mining

9.5 Historic and Forecasted Market Size By Technology

9.5.1 Power Reduction

9.5.2 Fuel And Maintenance Reduction

9.5.3 Emission Reduction

9.5.4 Toxicity Reduction

9.5.5 Water Reduction

9.5.6 Other

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Green Mining Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Surface Mining

10.4.2 Underground Mining

10.5 Historic and Forecasted Market Size By Technology

10.5.1 Power Reduction

10.5.2 Fuel And Maintenance Reduction

10.5.3 Emission Reduction

10.5.4 Toxicity Reduction

10.5.5 Water Reduction

10.5.6 Other

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Green Mining Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Surface Mining

11.4.2 Underground Mining

11.5 Historic and Forecasted Market Size By Technology

11.5.1 Power Reduction

11.5.2 Fuel And Maintenance Reduction

11.5.3 Emission Reduction

11.5.4 Toxicity Reduction

11.5.5 Water Reduction

11.5.6 Other

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Green Mining Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Surface Mining

12.4.2 Underground Mining

12.5 Historic and Forecasted Market Size By Technology

12.5.1 Power Reduction

12.5.2 Fuel And Maintenance Reduction

12.5.3 Emission Reduction

12.5.4 Toxicity Reduction

12.5.5 Water Reduction

12.5.6 Other

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Green Mining Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Surface Mining

13.4.2 Underground Mining

13.5 Historic and Forecasted Market Size By Technology

13.5.1 Power Reduction

13.5.2 Fuel And Maintenance Reduction

13.5.3 Emission Reduction

13.5.4 Toxicity Reduction

13.5.5 Water Reduction

13.5.6 Other

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Green Mining Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.94 Bn. |

|

Forecast Period 2024-2032 CAGR: |

8.91% |

Market Size in 2032: |

USD 23.63 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. GREEN MINING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. GREEN MINING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. GREEN MINING MARKET COMPETITIVE RIVALRY

TABLE 005. GREEN MINING MARKET THREAT OF NEW ENTRANTS

TABLE 006. GREEN MINING MARKET THREAT OF SUBSTITUTES

TABLE 007. GREEN MINING MARKET BY TYPE

TABLE 008. SURFACE MINING MARKET OVERVIEW (2016-2028)

TABLE 009. UNDERGROUND MINING MARKET OVERVIEW (2016-2028)

TABLE 010. GREEN MINING MARKET BY TECHNOLOGY

TABLE 011. POWER REDUCTION MARKET OVERVIEW (2016-2028)

TABLE 012. FUEL AND MAINTENANCE REDUCTION MARKET OVERVIEW (2016-2028)

TABLE 013. EMISSION REDUCTION MARKET OVERVIEW (2016-2028)

TABLE 014. TOXICITY REDUCTION MARKET OVERVIEW (2016-2028)

TABLE 015. WATER REDUCTION MARKET OVERVIEW (2016-2028)

TABLE 016. OTHER MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA GREEN MINING MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA GREEN MINING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 019. N GREEN MINING MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE GREEN MINING MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE GREEN MINING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 022. GREEN MINING MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC GREEN MINING MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC GREEN MINING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 025. GREEN MINING MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA GREEN MINING MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA GREEN MINING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 028. GREEN MINING MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA GREEN MINING MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA GREEN MINING MARKET, BY TECHNOLOGY (2016-2028)

TABLE 031. GREEN MINING MARKET, BY COUNTRY (2016-2028)

TABLE 032. ANGLO AMERICAN PLC (UK): SNAPSHOT

TABLE 033. ANGLO AMERICAN PLC (UK): BUSINESS PERFORMANCE

TABLE 034. ANGLO AMERICAN PLC (UK): PRODUCT PORTFOLIO

TABLE 035. ANGLO AMERICAN PLC (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. GLENCORE PLC (SWITZERLAND): SNAPSHOT

TABLE 036. GLENCORE PLC (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 037. GLENCORE PLC (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 038. GLENCORE PLC (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. RIO TINTO GROUP (UK): SNAPSHOT

TABLE 039. RIO TINTO GROUP (UK): BUSINESS PERFORMANCE

TABLE 040. RIO TINTO GROUP (UK): PRODUCT PORTFOLIO

TABLE 041. RIO TINTO GROUP (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. KOMATSU LIMITED (JAPAN): SNAPSHOT

TABLE 042. KOMATSU LIMITED (JAPAN): BUSINESS PERFORMANCE

TABLE 043. KOMATSU LIMITED (JAPAN): PRODUCT PORTFOLIO

TABLE 044. KOMATSU LIMITED (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. JIANGXI COPPER CORPORATION LIMITED (CHINA): SNAPSHOT

TABLE 045. JIANGXI COPPER CORPORATION LIMITED (CHINA): BUSINESS PERFORMANCE

TABLE 046. JIANGXI COPPER CORPORATION LIMITED (CHINA): PRODUCT PORTFOLIO

TABLE 047. JIANGXI COPPER CORPORATION LIMITED (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. CATERPILLAR INC. (US): SNAPSHOT

TABLE 048. CATERPILLAR INC. (US): BUSINESS PERFORMANCE

TABLE 049. CATERPILLAR INC. (US): PRODUCT PORTFOLIO

TABLE 050. CATERPILLAR INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. BHP GROUP LIMITED (AUSTRALIA): SNAPSHOT

TABLE 051. BHP GROUP LIMITED (AUSTRALIA): BUSINESS PERFORMANCE

TABLE 052. BHP GROUP LIMITED (AUSTRALIA): PRODUCT PORTFOLIO

TABLE 053. BHP GROUP LIMITED (AUSTRALIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. VALE S.A. (BRAZIL): SNAPSHOT

TABLE 054. VALE S.A. (BRAZIL): BUSINESS PERFORMANCE

TABLE 055. VALE S.A. (BRAZIL): PRODUCT PORTFOLIO

TABLE 056. VALE S.A. (BRAZIL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. LIEBHERR (SWITZERLAND): SNAPSHOT

TABLE 057. LIEBHERR (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 058. LIEBHERR (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 059. LIEBHERR (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. TATA STEEL LIMITED (INDIA): SNAPSHOT

TABLE 060. TATA STEEL LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 061. TATA STEEL LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 062. TATA STEEL LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. CUMMINS INC (US): SNAPSHOT

TABLE 063. CUMMINS INC (US): BUSINESS PERFORMANCE

TABLE 064. CUMMINS INC (US): PRODUCT PORTFOLIO

TABLE 065. CUMMINS INC (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. DUNDEE PRECIOUS METALS (CANADA): SNAPSHOT

TABLE 066. DUNDEE PRECIOUS METALS (CANADA): BUSINESS PERFORMANCE

TABLE 067. DUNDEE PRECIOUS METALS (CANADA): PRODUCT PORTFOLIO

TABLE 068. DUNDEE PRECIOUS METALS (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. FREEPORT-MCMORAN (US): SNAPSHOT

TABLE 069. FREEPORT-MCMORAN (US): BUSINESS PERFORMANCE

TABLE 070. FREEPORT-MCMORAN (US): PRODUCT PORTFOLIO

TABLE 071. FREEPORT-MCMORAN (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. SHANDONG GOLD MINING CO. (CHINA): SNAPSHOT

TABLE 072. SHANDONG GOLD MINING CO. (CHINA): BUSINESS PERFORMANCE

TABLE 073. SHANDONG GOLD MINING CO. (CHINA): PRODUCT PORTFOLIO

TABLE 074. SHANDONG GOLD MINING CO. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. ZIJIN MINING GROUP LTD (CHINA): SNAPSHOT

TABLE 075. ZIJIN MINING GROUP LTD (CHINA): BUSINESS PERFORMANCE

TABLE 076. ZIJIN MINING GROUP LTD (CHINA): PRODUCT PORTFOLIO

TABLE 077. ZIJIN MINING GROUP LTD (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 078. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 079. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 080. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. GREEN MINING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. GREEN MINING MARKET OVERVIEW BY TYPE

FIGURE 012. SURFACE MINING MARKET OVERVIEW (2016-2028)

FIGURE 013. UNDERGROUND MINING MARKET OVERVIEW (2016-2028)

FIGURE 014. GREEN MINING MARKET OVERVIEW BY TECHNOLOGY

FIGURE 015. POWER REDUCTION MARKET OVERVIEW (2016-2028)

FIGURE 016. FUEL AND MAINTENANCE REDUCTION MARKET OVERVIEW (2016-2028)

FIGURE 017. EMISSION REDUCTION MARKET OVERVIEW (2016-2028)

FIGURE 018. TOXICITY REDUCTION MARKET OVERVIEW (2016-2028)

FIGURE 019. WATER REDUCTION MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA GREEN MINING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE GREEN MINING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC GREEN MINING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA GREEN MINING MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA GREEN MINING MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Green Mining Market research report is 2024-2032.

Anglo American PLC (UK), Glencore PLC (Switzerland), Rio Tinto Group (UK), Komatsu Limited (Japan), Jiangxi Copper Corporation Limited (China), Caterpillar Inc. (US), BHP Group Limited (Australia), Vale S.A. (Brazil), Liebherr (Switzerland), Tata Steel Limited (India), Cummins Inc (US), Dundee Precious Metals (Canada), Freeport-McMoRan (US), Shandong Gold Mining Co. (China), Zijin Mining Group Ltd (China) and Other Major Players.

The Green Mining Market is segmented into Type, Technology, and region. By Type, the market is categorized into Surface Mining and Underground Mining. By Technology, the market is categorized into Power Reduction, Fuel And Maintenance Reduction, Emission Reduction, Toxicity Reduction, Water Reduction, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Green mining is the implementation of technological advances and best practices in order to achieve the extraction of minerals and metals while mitigating the environmental impacts that occur during the mining process. Green Mining right from the beginning of the mining process till the end ensures sustainability through the adoption of green mining practices. Green mining reduces greenhouse gases and uses energy more efficiently while conserving minerals.

The Green Mining Market size is estimated at 11.94 billion USD in 2023 and is expected to reach 23.63 billion USD by 2032, growing at a CAGR of 8.91% during the forecast period (2024-2032).