Green Data Center Market Synopsis

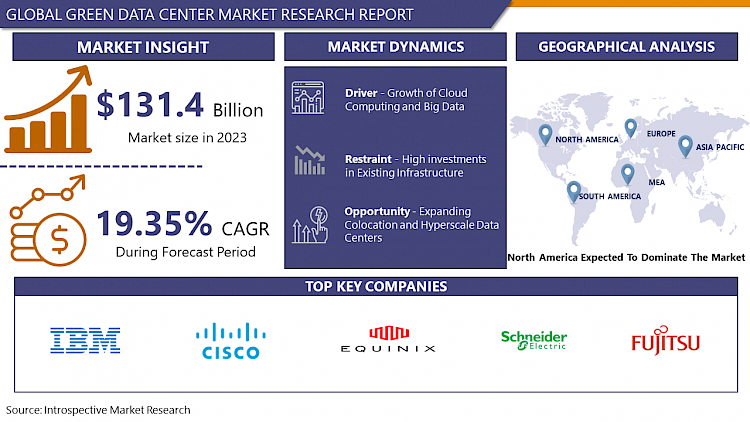

Green Data Center Market Size Was Valued at USD 131.4 Billion in 2023 and is Projected to Reach USD 645.65 Billion by 2032, Growing at a CAGR of 19.35 % From 2024-2032.

A Green Data Center is a repository for data management, storage, and distribution where the computer, lighting, mechanical, and electrical systems are built to minimize environmental impact and maximize energy efficiency. Modern techniques and technologies are used in the design and management of a green data center.

- The Internet's exponential growth and usage have led to a significant increase in data center power consumption. As a result of the ensuing effects on the environment, rising public awareness, rising energy costs, and legislative action, businesses are implementing green policies. These factors make the development of sustainable data centers important from both an environmental and a commercial standpoint.

- Green data centres are built with energy efficiency in mind, featuring advanced cooling systems, high-efficiency power distribution units, and optimised server layouts to reduce energy consumption. Many green data centres use renewable energy sources such as solar, wind, and hydroelectric power to reduce their reliance on fossil fuels and carbon emissions.

- Technology advancements, such as improved cooling systems, energy-efficient hardware, and virtualization techniques, are allowing data centres to operate more efficiently and sustainably. These innovations encourage the use of green data centre solutions. Many businesses are embracing corporate social responsibility and integrating sustainability into their operations.

Green Data Center Market Trend Analysis

Growth of Cloud Computing and Big Data

- Cloud computing has reshaped how businesses operate, transforming IT from a traditional cost center to a strategic growth driver. Data is the new fuel of the modern world, and to maintain and process the data, we need data centers that are more dependable and efficient. By using advanced technologies and procedures to minimize energy use and lower carbon emissions, green data centers provide sustainable solutions to meet these demands.

- Additionally, data centers need to consume more energy to meet their needs for server maintenance, which increases power consumption. To power their data centers, businesses are investing more and more in environmentally friendly technologies like wind turbines, solar panels, and sophisticated cooling systems. The market for green data centers is expanding as a result of the use of energy management software and intelligent monitoring tools, which further improve sustainability and efficiency.

- The market is anticipated to grow as a result of government programs supporting green technologies and energy-saving rules. The market is expected to keep growing in the upcoming years due to rising awareness of environmental issues and the advantages of green data center solutions.

Expanding Colocation and Hyperscale Data Centers

- Colocation data centers offer a different value proposition—the freedom to rent space, utilities, and other necessary resources, allowing for cost-effective expansion and management—while hyperscale data centers satisfy enterprise data needs by providing scalability and high-speed processing for large volumes of data. The scalability and flexibility offered by colocation and hyperscale data centers make them appealing options for organizations seeking to expand their IT.

- Increasing awareness of environmental sustainability, which has led to significant investments in green data center infrastructure by hyperscale businesses like Google and Amazon as well as colocation providers. Organizations are also being pushed to adopt eco-friendly data center solutions by government rules and policies that aim to reduce carbon emissions.

- These renewable energy sources are being used more often by colocation providers and hyperscale businesses to power their data centers, which helps them cut down on their dependency on fossil fuels and their carbon footprint. Technological developments like energy-efficient cooling systems and hardware are making the shift to greener data center infrastructure possible.

Green Data Center Market Segment Analysis:

Green Data Center Market Segmented on the basis of type, application, and end-users.

By Size, Large Data Centre segment is expected to dominate the market during the forecast period

- Large data centers are made up of high-density server racks and have an area of more than 25,000 square feet. They provide better installation of ceiling services and a smoother production floor workflow. High-energy-efficient Precision Air Handling Unit (PAHU) and Computer Room Air Handler (CRAH) equipment are used in large data centers. Improved liquid cooling is another feature that maximizes effectiveness and reduces losses.

- Large data centers can drastically reduce their power consumption and carbon emissions by putting energy-efficient technologies like server virtualization and sophisticated cooling systems into place. This is due to more sophisticated networking, servers, storage, and other equipment present in data centers, necessitating the use of effective green data center services and solutions.

- These establishments can cut operating expenses related to cooling and energy use by implementing sustainable practices. Tax breaks and incentives for using renewable energy and lowering greenhouse gas emissions are frequently available to green data centers. For large data center operators, switching to green data centers is a strategic choice considering the twofold benefit of cost savings and environmental responsibility.

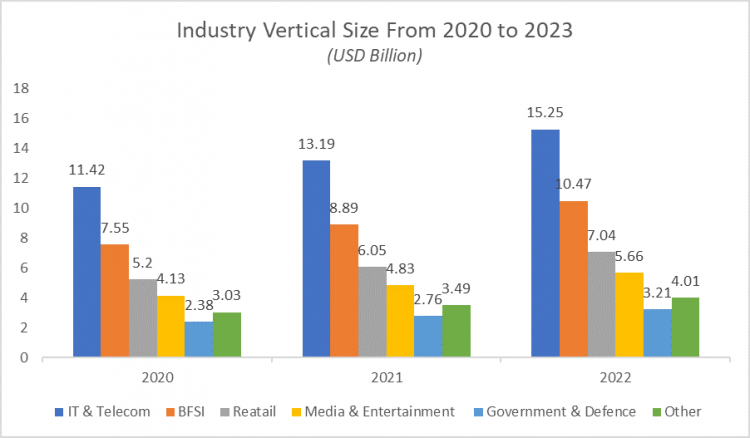

By Application, IT and Telecom segment is expected to dominate the market during the forecast period

- The demand for sustainable infrastructure to support the operations of digital services and telecommunications networks is increasing due to their exponential growth. Businesses are making investments in innovative cooling systems, streamlined server designs, and sustainable energy sources to reduce their environmental footprint and increase efficiency and dependability.

- IT and telecom companies are working with colocation providers and hyperscale companies to create environmentally friendly data centers that run on renewable energy. In addition to meeting the increasing need for cloud services, this collaboration will help achieve environmental objectives by lowering energy and carbon emissions from data management.

- According to the graph, the IT and telecommunications sector held the largest share of any industry sector in 2022, accounting for 15.25 billion US dollars of the global green data center market. The largest market revenue is being generated by the IT and telecommunications category due to its widespread use and dependability on data centers for system integration, networking, and management.

Green Data Center Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- The growth of the cloud computing, big data analytics, and mobile broadband markets is anticipated to coincide with the expansion of the green data center market in North America. Data center sustainability is a goal shared by colocation firms like Equinix, Digital Realty, Compass Datacenters, and DataBank, as well as hyperscale firms like Facebook (Meta), Google, AWS, and Microsoft.

- Major tech hubs such as California and Texas are leading the way in adopting green data center practices, owing to state-level regulations and incentives aimed at encouraging renewable energy and sustainability. Similarly, Canada has emerged as a key player in the green data center market, with provinces such as Quebec leveraging abundant hydroelectric power to attract data centre investments that prioritize sustainability.

- Tech Industry giants such as, such as Google, Amazon, and Microsoft, are leading the development of green data centers in North America. These companies are heavily investing in energy-efficient technologies and renewable energy projects to power their data centers, establishing industry standards for sustainability. Partnerships among data center providers, utilities, and governments are facilitating the expansion of green data center initiatives.

Green Data Center Market Top Key Players:

- IBM Corporation (US)

- Cisco Technology Inc. (US)

- Equinix (US)

- Vertiv (US)

- HP Inc. (US)

- Dell EMC Inc. (US)

- Digital Realty (US)

- CyrusOne (US)

- Iron Mountain (US)

- QTS Data Center (US)

- Rittal (Germany)

- Hetzner (Germany)

- Global Data Centers (UK)

- Schneider Electric (France)

- OVHcloud (France)

- Eaton Corporation (Ireland)

- Green Mountain Data Centers (Norway)

- Fujitsu Ltd (Japan)

- Hitachi Ltd (Japan)

- NTT Communications (Japan)

- GDS Holdings (China)

- China Telecom (China)

- ST Telemedia (Singapore)

- Delta Electronics (Taiwan), and other major players.

Key Industry Developments in the Green Data Center Market:

- In July 2023, IBM has partnered with Borealis Data Centre. In collaboration with IBM Denmark, Borealis Data Centre will provide companies with sustainable cloud services. Danish businesses can now select a sustainable cloud data center solution for storing and processing data in Iceland.

- In March 2023, Hewlett Packard Enterprise (NYSE: HPE) has acquired OpsRamp, extending its hybrid cloud leadership and expanding HPE GreenLake into IT Operations Management.an IT operations management (ITOM) firm that monitors, observes, automates, and manages IT infrastructure, cloud resources, workloads, and applications in hybrid and multi-cloud environments, including the top hyperscalers.

|

Global Green Data Center Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 131.40 Bn. |

|

Forecast Period 2024-32 CAGR: |

19.35 % |

Market Size in 2032: |

USD 645.65 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Data Center Size |

|

||

|

By User |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- GREEN DATA CENTER MARKET BY COMPONENT (2017-2032)

- GREEN DATA CENTER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOLUTIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICES

- GREEN DATA CENTER MARKET BY DATA CENTER SIZE (2017-2032)

- GREEN DATA CENTER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMALL & MID-SIZE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE

- GREEN DATA CENTER MARKET BY USER (2017-2032)

- GREEN DATA CENTER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COLOCATION PROVIDERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- CLOUD SERVICE PROVIDERS

- ENTERPRISES

- GREEN DATA CENTER MARKET BY INDUSTRY VERTICAL (2017-2032)

- GREEN DATA CENTER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- IT AND TELECOM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BFSI

- RETAIL

- MEDIA AND ENTERTAINMENT

- GOVERNMENT AND DEFENSE

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Green Data Center Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- IBM CORPORATION (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- CISCO TECHNOLOGY INC. (US)

- EQUINIX (US)

- VERTIV (US)

- HP INC. (US)

- DELL EMC INC. (US)

- DIGITAL REALTY (US)

- CYRUSONE (US)

- IRON MOUNTAIN (US)

- QTS DATA CENTER (US)

- RITTAL (GERMANY)

- HETZNER (GERMANY)

- GLOBAL DATA CENTERS (UK)

- SCHNEIDER ELECTRIC (FRANCE)

- OVHCLOUD (FRANCE)

- EATON CORPORATION (IRELAND)

- GREEN MOUNTAIN DATA CENTERS (NORWAY)

- FUJITSU LTD (JAPAN)

- HITACHI LTD (JAPAN)

- NTT COMMUNICATIONS (JAPAN)

- GDS HOLDINGS (CHINA)

- CHINA TELECOM (CHINA)

- ST TELEMEDIA (SINGAPORE)

- DELTA ELECTRONICS (TAIWAN)

- COMPETITIVE LANDSCAPE

- GLOBAL GREEN DATA CENTER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Data Center Size

- Historic And Forecasted Market Size By User

- Historic And Forecasted Market Size By Industry Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Green Data Center Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 131.40 Bn. |

|

Forecast Period 2024-32 CAGR: |

19.35 % |

Market Size in 2032: |

USD 645.65 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Data Center Size |

|

||

|

By User |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. GREEN DATA CENTER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. GREEN DATA CENTER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. GREEN DATA CENTER MARKET COMPETITIVE RIVALRY

TABLE 005. GREEN DATA CENTER MARKET THREAT OF NEW ENTRANTS

TABLE 006. GREEN DATA CENTER MARKET THREAT OF SUBSTITUTES

TABLE 007. GREEN DATA CENTER MARKET BY COMPONENT

TABLE 008. SOLUTION [COOLING MARKET OVERVIEW (2016-2028)

TABLE 009. NETWORKING MARKET OVERVIEW (2016-2028)

TABLE 010. POWER MARKET OVERVIEW (2016-2028)

TABLE 011. MANAGEMENT SOFTWARE] MARKET OVERVIEW (2016-2028)

TABLE 012. SERVICE [INSTALLATION & INTEGRATION MARKET OVERVIEW (2016-2028)

TABLE 013. CONSULTING MARKET OVERVIEW (2016-2028)

TABLE 014. MANAGED] MARKET OVERVIEW (2016-2028)

TABLE 015. GREEN DATA CENTER MARKET BY END USER

TABLE 016. BFSI MARKET OVERVIEW (2016-2028)

TABLE 017. IT AND TELECOMMUNICATIONS MARKET OVERVIEW (2016-2028)

TABLE 018. GOVERNMENT AND DEFENSE MARKET OVERVIEW (2016-2028)

TABLE 019. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA GREEN DATA CENTER MARKET, BY COMPONENT (2016-2028)

TABLE 021. NORTH AMERICA GREEN DATA CENTER MARKET, BY END USER (2016-2028)

TABLE 022. N GREEN DATA CENTER MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE GREEN DATA CENTER MARKET, BY COMPONENT (2016-2028)

TABLE 024. EUROPE GREEN DATA CENTER MARKET, BY END USER (2016-2028)

TABLE 025. GREEN DATA CENTER MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC GREEN DATA CENTER MARKET, BY COMPONENT (2016-2028)

TABLE 027. ASIA PACIFIC GREEN DATA CENTER MARKET, BY END USER (2016-2028)

TABLE 028. GREEN DATA CENTER MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA GREEN DATA CENTER MARKET, BY COMPONENT (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA GREEN DATA CENTER MARKET, BY END USER (2016-2028)

TABLE 031. GREEN DATA CENTER MARKET, BY COUNTRY (2016-2028)

TABLE 032. SOUTH AMERICA GREEN DATA CENTER MARKET, BY COMPONENT (2016-2028)

TABLE 033. SOUTH AMERICA GREEN DATA CENTER MARKET, BY END USER (2016-2028)

TABLE 034. GREEN DATA CENTER MARKET, BY COUNTRY (2016-2028)

TABLE 035. SCHNEIDER ELECTRIC: SNAPSHOT

TABLE 036. SCHNEIDER ELECTRIC: BUSINESS PERFORMANCE

TABLE 037. SCHNEIDER ELECTRIC: PRODUCT PORTFOLIO

TABLE 038. SCHNEIDER ELECTRIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. VERTIV: SNAPSHOT

TABLE 039. VERTIV: BUSINESS PERFORMANCE

TABLE 040. VERTIV: PRODUCT PORTFOLIO

TABLE 041. VERTIV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. HEWLETT PACKARD ENTERPRISE: SNAPSHOT

TABLE 042. HEWLETT PACKARD ENTERPRISE: BUSINESS PERFORMANCE

TABLE 043. HEWLETT PACKARD ENTERPRISE: PRODUCT PORTFOLIO

TABLE 044. HEWLETT PACKARD ENTERPRISE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. GREEN REVOLUTION COOLING: SNAPSHOT

TABLE 045. GREEN REVOLUTION COOLING: BUSINESS PERFORMANCE

TABLE 046. GREEN REVOLUTION COOLING: PRODUCT PORTFOLIO

TABLE 047. GREEN REVOLUTION COOLING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. MIDAS GREEN TECHNOLOGIES: SNAPSHOT

TABLE 048. MIDAS GREEN TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 049. MIDAS GREEN TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 050. MIDAS GREEN TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. DELTA ELECTRONICS: SNAPSHOT

TABLE 051. DELTA ELECTRONICS: BUSINESS PERFORMANCE

TABLE 052. DELTA ELECTRONICS: PRODUCT PORTFOLIO

TABLE 053. DELTA ELECTRONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. RITTAL: SNAPSHOT

TABLE 054. RITTAL: BUSINESS PERFORMANCE

TABLE 055. RITTAL: PRODUCT PORTFOLIO

TABLE 056. RITTAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. EATON: SNAPSHOT

TABLE 057. EATON: BUSINESS PERFORMANCE

TABLE 058. EATON: PRODUCT PORTFOLIO

TABLE 059. EATON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. CISCO: SNAPSHOT

TABLE 060. CISCO: BUSINESS PERFORMANCE

TABLE 061. CISCO: PRODUCT PORTFOLIO

TABLE 062. CISCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. NORTEK AIR SOLUTIONS: SNAPSHOT

TABLE 063. NORTEK AIR SOLUTIONS: BUSINESS PERFORMANCE

TABLE 064. NORTEK AIR SOLUTIONS: PRODUCT PORTFOLIO

TABLE 065. NORTEK AIR SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. DELL TECHNOLOGIES: SNAPSHOT

TABLE 066. DELL TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 067. DELL TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 068. DELL TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. ASETEK: SNAPSHOT

TABLE 069. ASETEK: BUSINESS PERFORMANCE

TABLE 070. ASETEK: PRODUCT PORTFOLIO

TABLE 071. ASETEK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. AIREDALE: SNAPSHOT

TABLE 072. AIREDALE: BUSINESS PERFORMANCE

TABLE 073. AIREDALE: PRODUCT PORTFOLIO

TABLE 074. AIREDALE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. LENOVO: SNAPSHOT

TABLE 075. LENOVO: BUSINESS PERFORMANCE

TABLE 076. LENOVO: PRODUCT PORTFOLIO

TABLE 077. LENOVO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. FUJITSU: SNAPSHOT

TABLE 078. FUJITSU: BUSINESS PERFORMANCE

TABLE 079. FUJITSU: PRODUCT PORTFOLIO

TABLE 080. FUJITSU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. CYBER POWER SYSTEMS: SNAPSHOT

TABLE 081. CYBER POWER SYSTEMS: BUSINESS PERFORMANCE

TABLE 082. CYBER POWER SYSTEMS: PRODUCT PORTFOLIO

TABLE 083. CYBER POWER SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. SUPER MICRO: SNAPSHOT

TABLE 084. SUPER MICRO: BUSINESS PERFORMANCE

TABLE 085. SUPER MICRO: PRODUCT PORTFOLIO

TABLE 086. SUPER MICRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. TRIPP LITE: SNAPSHOT

TABLE 087. TRIPP LITE: BUSINESS PERFORMANCE

TABLE 088. TRIPP LITE: PRODUCT PORTFOLIO

TABLE 089. TRIPP LITE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. INSPUR: SNAPSHOT

TABLE 090. INSPUR: BUSINESS PERFORMANCE

TABLE 091. INSPUR: PRODUCT PORTFOLIO

TABLE 092. INSPUR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. CDP ENERGY: SNAPSHOT

TABLE 093. CDP ENERGY: BUSINESS PERFORMANCE

TABLE 094. CDP ENERGY: PRODUCT PORTFOLIO

TABLE 095. CDP ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. BXTERRA POWER TECHNOLOGY: SNAPSHOT

TABLE 096. BXTERRA POWER TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 097. BXTERRA POWER TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 098. BXTERRA POWER TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. ZUTACORE: SNAPSHOT

TABLE 099. ZUTACORE: BUSINESS PERFORMANCE

TABLE 100. ZUTACORE: PRODUCT PORTFOLIO

TABLE 101. ZUTACORE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. SUBMER: SNAPSHOT

TABLE 102. SUBMER: BUSINESS PERFORMANCE

TABLE 103. SUBMER: PRODUCT PORTFOLIO

TABLE 104. SUBMER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. DCX THE LIQUID COOLING COMPANY: SNAPSHOT

TABLE 105. DCX THE LIQUID COOLING COMPANY: BUSINESS PERFORMANCE

TABLE 106. DCX THE LIQUID COOLING COMPANY: PRODUCT PORTFOLIO

TABLE 107. DCX THE LIQUID COOLING COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. LIQIT IO: SNAPSHOT

TABLE 108. LIQIT IO: BUSINESS PERFORMANCE

TABLE 109. LIQIT IO: PRODUCT PORTFOLIO

TABLE 110. LIQIT IO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 111. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 112. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 113. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. GREEN DATA CENTER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. GREEN DATA CENTER MARKET OVERVIEW BY COMPONENT

FIGURE 012. SOLUTION [COOLING MARKET OVERVIEW (2016-2028)

FIGURE 013. NETWORKING MARKET OVERVIEW (2016-2028)

FIGURE 014. POWER MARKET OVERVIEW (2016-2028)

FIGURE 015. MANAGEMENT SOFTWARE] MARKET OVERVIEW (2016-2028)

FIGURE 016. SERVICE [INSTALLATION & INTEGRATION MARKET OVERVIEW (2016-2028)

FIGURE 017. CONSULTING MARKET OVERVIEW (2016-2028)

FIGURE 018. MANAGED] MARKET OVERVIEW (2016-2028)

FIGURE 019. GREEN DATA CENTER MARKET OVERVIEW BY END USER

FIGURE 020. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 021. IT AND TELECOMMUNICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 022. GOVERNMENT AND DEFENSE MARKET OVERVIEW (2016-2028)

FIGURE 023. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA GREEN DATA CENTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE GREEN DATA CENTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC GREEN DATA CENTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA GREEN DATA CENTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA GREEN DATA CENTER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Green Data Center Market research report is 2024-2032.

IBM Corporation (US), Cisco Technology Inc. (US), Equinix (US), Vertiv (US), HP Inc. (US), Dell EMC Inc. (US), Digital Realty (US), CyrusOne (US), Iron Mountain (US), QTS Data Center (US), Rittal (Germany), Hetzner (Germany), Global Data Centers (UK), Schneider Electric (France), OVHcloud (France), Eaton Corporation (Ireland), Green Mountain Data Centers (Norway), Fujitsu Ltd (Japan), Hitachi Ltd (Japan), NTT Communications (Japan), GDS Holdings (China), China Telecom (China), ST Telemedia (Singapore), Delta Electronics (Taiwan) and Other Major Players.

The Green Data Center Market is segmented into Components, Data Center Size, User, Industry Vertical, and region. By Type, the market is categorized into Solutions and Services. By Data Center Size, the market is categorized into Small & Mid-Size and Large. By User, the market is categorized into Colocation Providers, Cloud service providers, and Enterprises. By Application, the market is categorized into IT and Telecom, BFSI, Retail, Media and Entertainment, Government and Defense, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A Green Data Center is a repository for data management, storage, and distribution where the computer, lighting, mechanical, and electrical systems are built to minimize environmental impact and maximize energy efficiency. Modern techniques and technologies are used in the design and management of a green data center

Green Data Center Market Size Was Valued at USD 131.4 Billion in 2023 and is Projected to Reach USD 645.65 Billion by 2032, Growing at a CAGR of 19.35 % From 2024-2032.