Gluten Free Oats Market Synopsis

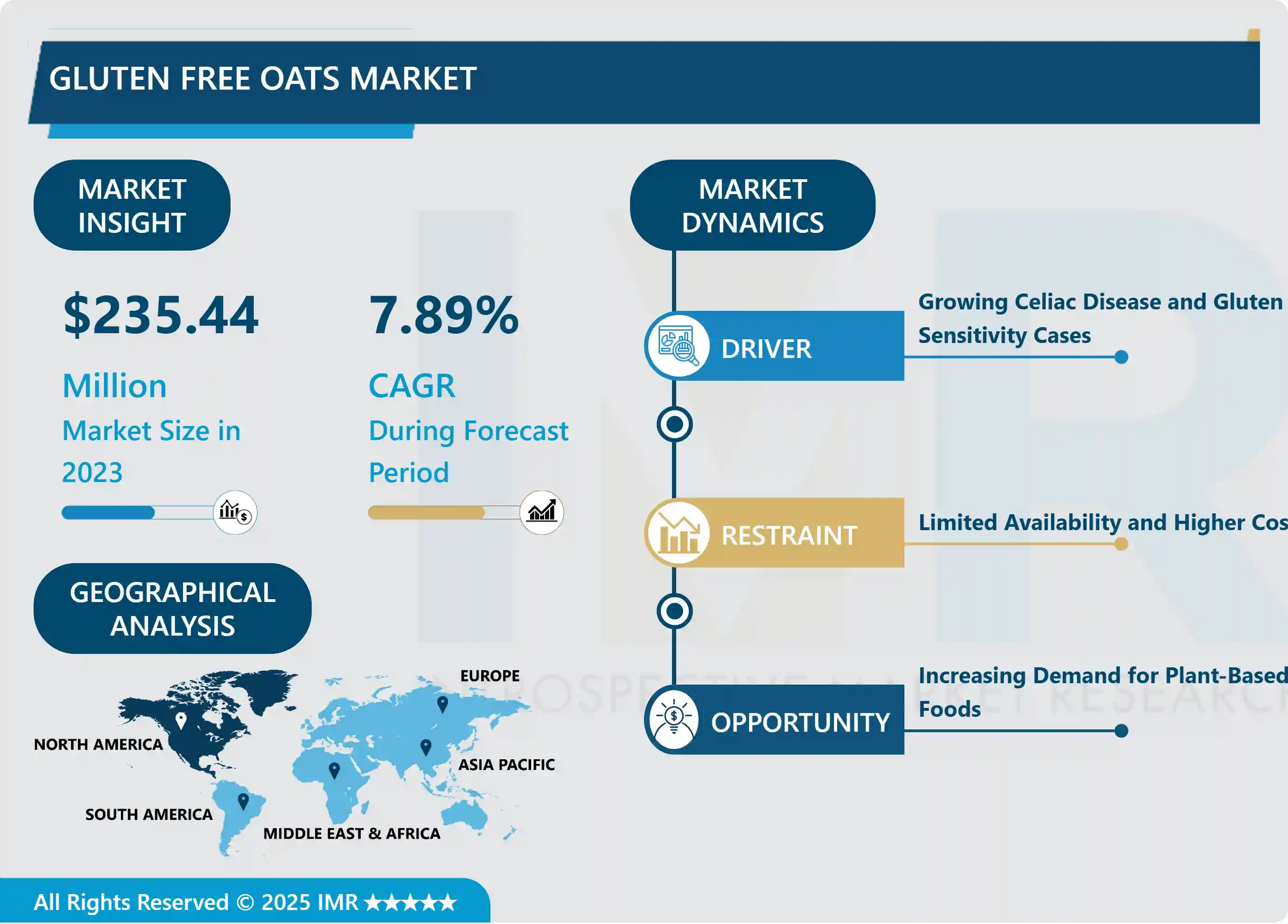

Gluten Free Oats Market Size is Valued at USD 235.44 Million in 2023 and is Projected to Reach USD 466.35 Million by 2032, Growing at a CAGR of 7.89% From 2024-2032.

The gluten-free oats market deals in oats that are manufactured, marketed, and consumed, with special measures put in place to ensure they don’t comprise wheat, barley or rye, which are gluten grains. These oats are for the celiac sufferers, people with gluten intolerance or those who require gluten free foods for other health issues. Here the opportunities for companies to launch a wide range of gluten-free oat based oats and oat products like oatmeal, granola, baked items and snack, available in supermarkets, health stores and online stores are identified. The need for the products is attributed to a growing concern for the health and the upsurge in cases of gluten-sensitivity disorders.

The market for gluten-free oats has been steadily growing over the recent past led by customer awareness of the gluten sensitivity and celiac disease. The subject has been gradually uncovering by the population’s increasing demand for gluten-free products to give way to wholesome oats. Oats themselves are not gluten–contaminated, but situations where they were contaminated got many people worried in the past. However, problems such as cross-contamination, which causes discomfort to its users, have limited its customer rights but with the introduction of certified gluten-free oats, consumer rights have been realized due to increased customer confidence. This trend is has been bolstered by the growing demand for health and wellness, conscious plant-based diet, and the increased utilization of oats both as ingredient and ready-to-consumer products such as oats-cereal, oats-snacks, oats-bakery and others.

Regionally, North America controls the largest share of the gluten-free oats market including the United States. Due to increased health awareness around the globe, coupled with favorable legal frameworks and increased availability of Gluten-free products, this particular region has been set for growth. It is also growing due to awareness of gluten free diets, and the emerging disease of celiac disease in the European market. As for the future market trends, Asia-Pacific region seems to be very prospective since healthy lifestyle tendency is actively developing and the consumers’ demand on gluten-free products is increasing. As a whole, the market for gluten-free oats remains promising, as innovations in the production of new products and increasing popularity of gluten-free products continue to appear.

Gluten Free Oats Market Trend Analysis

Rising Demand and Market Expansion for Gluten-Free Oats

- Shoppers are especially interested in oats as gluten-free products remain a fast-growing category as consumers become more focused on health and diets because of the prevalence of diseases such as celiac disease and gluten intolerance. Even those people without celiac disease or a sensitivity to gluten are turning to gluten-free foods because these products are perceived as being healthier and better for digestion. Thus, gluten-free oats are very relevant for many people, regardless of their age, gender or other peculiarities, including vegans or vegetarians, or those, who choose special kind of diet. This broad appeal has led to a growing number of gluten-free products being stock by retailers and supermarkets, which should help ensure that gluten-free oats are more visible and available worldwide. New, certified gluten-free oats on the shelves informing the customer that these products are indeed safe and of good quality has helped boost demand.

- This change has been noted by food manufacturers and thus in a bid to meet the changing market trend, producers have started using gluten free oats in a range of products. Nowadays, companies can buy gluten-free oats which are used in many breakfast foods including cereals and oatmeal and snacks like bars, cookies and crackers. Here, some product development features include the following: these tasty and healthful novelties enable consumers to make right and convenient choice in eating products without any detriment to their health condition. Also they are gradually launching gluten-free oats in flour format that can be used in gluten-free recipes, so consumers can prepare meals themselves. Thirdly, the health food market as a whole possesses huge versatility for gluten-free oats and also the adoption of new processing techniques and technologies applied by gluten-free oats manufacturers to enhance the taste and texture of the products have contributed to the growth of the consumption of gluten-free oats in the branded food preparations. Therefore, change in legislation to permit gluten-free oat-based products has enhanced manufacturers’ business position and improved the gluten-free food markets.

Growing Popularity of Plant-Based, Organic, and Sustainable Gluten-Free Oats

- The current trend of getting value-added food products through incorporating vegetarian and organic food products is anticipated to lead to the growth opportunity in the gluten-free oats market. Modern consumers who are living healthy lifestyles are opting for gluten-free oats not only because they can benefit consumers who have celiac disease, but also inasmuch as they can complement the vegan and plant-based diets of their consumers. Furthermore, gluten-free oats would be appreciated in the regions as North America and Europe where plant-based diets would be popular, nutritious and useful grains substitute. Organic certifications add to this appeal speaking to customers who consider certified-organic foods as better-tasting, nutritionally superior, and containing lower levels of chemical residues. It has therefore created a demand for gluten-free oats in the organic and plant-based product lines hence seeing manufacturers expanding their portfolio to embrace environmentally and ethically conscious consumer.

- In addition, modernization of oat processing technology has made improved the flavours, texture and nutrient quality of the gluten-free oats for those consumers whose earlier option had been hampered due to the overload of gritty or dense oats offered by earlier products. New innovative methods in milling and roasting have also been developed to improve the flavor and texture of the gluten-free oat for them to be used in various products like breakfast cereals and baked foods and even snack bars. Further, the gluten-free oats market has felt the pressure of sustainable and ethically procured products that have many brands selecting eco-friendly packaging and sourcing raw materials. This positioning of gluten-free oats with broader sustainability and health trends has not only appealed to sustainability-minded consumers, but has also placed gluten-free oats at the forefront of one of the most significant and innovative consumer markets of today, that of ethical foods.

Gluten Free Oats Market Segment Analysis:

Gluten Free Oats Market Segmented based on By Product Type, By Flavor and By Distribution Channel

By Product Type, Rolled Oats segment is expected to dominate the market during the forecast period

- Technology alternatives such as plant-derived, organic oats have shaped fresh growth trends in the gluten-free oats market due to shifting consumer trends towards natural and eco-friendly foods. People who maintain a healthy diet are choosing gluten-free oats not only in terms of gluten-free but also in terms of vegan and plant-based diets. For instance, in North America and in the European countries which embrace veganism most, the new gluten-free oats are seen as an advantageous substitute for traditional grains since they lack essential nutrients. Additional organic certifications accompany them since consumer values organic produce higher quality, better nutrients, and low chemical content. There is therefore pressure on producers of organic and plant-based many products lines including oats, gluten-free oats in particular to broaden its portfolio to meet the demand needs of the global environmentally and ethically conscious customer base.

- Furthermore, the technology advancement in processing oats has enhanced the flavour, texture and quality of gluten free oats that some consumer may have rejected in the past due to the presence of grit or density product. This means that new methods of milling and roasting has grown the appeal for gluten-free oats in food such as breakfast foods, pastries, and energy bars. Also, the changing demographics and consumer preference for conscious consumption have helped the gluten-free oats market grow, more brands are trying to be environmentally conscious by sourcing their raw materials sustainably and packing their products sustainably. This synchronization of gluten-free oats with general trends in sustainability has not only appealed to eco-conscious customers but also has placed it at the vanguard of a burgeoning industry of better-for-you, sustainable foods.

By Distribution Channel, Supermarkets and Hypermarkets segment held the largest share in 2023

- A highly appropriate channel of distribution for oats are supermarkets and hypermarkets because it provides consumers with a wide range of oat products all under one roof. This store format allows direct comparison of different brands, types, and flavors of oats and allows consumer to make an informed decision based on their choice of the type of oats they want to consume. Also, these stores are laid and arranged in a format that will increase the customer shopping convenience so that they are able to find the product they need. Sales promotions including, coupons, offer limited time special offers and free gifts are potent interventions affecting consumer behaviour by persuading them to switch between brands or products they normally wouldn’t.

- As the trend toward health and wellness continues to grow, supermarkets are providing more shelf space for organic and specialty oat items for the health/specialty oat segment. This change associates with demand criteria of cleaner eating or Whole/Minimally processed food consumption. This trend is informing consumption by providing a diverse selection of oats for retailers, gluten-free oats, flavored oats, and oats that are nutrient-fortified. Furthermore, many supermarkets cooperate with these brands to deliver related informational materials and sales promotion activities to promote the importance of including oats as ingredients in consumers’ daily meals. That, in addition, stimulate sales increases the customer’s perception of supermarkets as reliable sources of health-related products thus ensuring brand loyalty.

Gluten Free Oats Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The gluten-free oats market in North America is liberal and continuously growing due to the immense popularity of the products by celiac sufferers and gluten intolerance. These diseases being common with today’s generations the number of consumers who adopt gluten-free products as their daily foods is increasing. Further, even in those without celiac disease, gluten-free food and diets as products of healthy living diets are widely demanded today. The United States ranks high in the realisation of this growth, it boasts of a strong retail industry that has a rich line of gluten-free oat products. Walmart, Costco and Whole Foods Markets among other major supermarkets are not only adding increasing numbers of gluten-free products to their stores but also sourcing brands with certified gluten-free oats. Such retailers are instrumental in improving the glutens from reaching a wider market hence impacting the growth of the market.

- Canada is on the very similar pattern, is demand for certified gluten-free products being pulled by today’s health-conscious population. The Canadian market is not as large as the U.S. market however, it is also experiencing the rising awareness of the medical advantages of gluten free products. Another factor that encourages the expansion of this sector is governmental laws and approvals which recommend products’ suitability and guarantee their originality and quality. The market for gluten free products in both the U.S and Canada are fueled by several factors key among them being availability of efficient distribution networks, and overwhelming support from key players supplemented by reputable dedicated gluten free brands. These are utilizing the new and advanced techniques of marketing to serve different oriented consumers and are also diversifying their product range to bring changes as per the new market trends; these are mainly the reasons that North America occupies a good position in the Gluten-Free oats Market all over the world.

Active Key Players in the Gluten Free Oats Market

- Bob's Red Mill

- Nature's Path

- General Mills

- Quaker Oats

- Freedom Foods Group

- Glutenfreeda Foods

- Bakery On Main

- Purely Elizabeth

- Thrive Market

- Trader Joe's

- Other Key Players

Key Industry Developments in the Gluten Free Oats Market:

- In Sep 2024, Bay State Milling, one of the largest family-owned, privately held milling companies in the United States, announced the addition of Bay State Milling Montana to its portfolio. This acquisition strengthens the company's offerings of trusted, innovative food ingredients and is part of a strategic realignment that now includes 13 milling and processing facilities across the U.S. and Canada.

- In Aug 2024, As of August 15, 2024, new estimates reveal that at least 10% of UK consumers are now following a gluten-free diet due to adverse reactions to the protein. This growing trend reflects heightened awareness of gluten sensitivity and celiac disease, with more individuals choosing to avoid gluten in their daily diets. The shift has prompted an increased demand for gluten-free products across the UK.

- In March 2024, Natura launched a groundbreaking line of oat beverages that surpasses the standards of current offerings in the oat beverage market. The plant-based drinks are made from 100% Organic Canadian and gluten-free oats and come in three flavours: Original, Vanilla, and Chocolate. The new products are now available at retailers across Canada, including online platforms like Amazon. With this launch, Natura continues offering consumers a healthier, more sustainable, and more affordable alternative to dairy, and other plant-based beverages.

|

Gluten Free Oats Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 235.44 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.89% |

Market Size in 2032: |

USD 466.35 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Flavor |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Gluten Free Oats Market by Product Type (2018-2032)

4.1 Gluten Free Oats Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Rolled Oats

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Steel-Cut Oats

4.5 Instant Oats

Chapter 5: Gluten Free Oats Market by Flavor (2018-2032)

5.1 Gluten Free Oats Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Flavored

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Unflavored

Chapter 6: Gluten Free Oats Market by Distribution Channel (2018-2032)

6.1 Gluten Free Oats Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Supermarkets and Hypermarkets

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Convenience Stores

6.5 Online Retail

6.6 Others (Specialty Stores)

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Gluten Free Oats Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BOB'S RED MILL

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NATURE'S PATH

7.4 GENERAL MILLS

7.5 QUAKER OATS

7.6 FREEDOM FOODS GROUP

7.7 GLUTENFREEDA FOODS

7.8 BAKERY ON MAIN

7.9 PURELY ELIZABETH

7.10 THRIVE MARKET

7.11 TRADER JOE'S

7.12 OTHER KEY PLAYERS

Chapter 8: Global Gluten Free Oats Market By Region

8.1 Overview

8.2. North America Gluten Free Oats Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product Type

8.2.4.1 Rolled Oats

8.2.4.2 Steel-Cut Oats

8.2.4.3 Instant Oats

8.2.5 Historic and Forecasted Market Size by Flavor

8.2.5.1 Flavored

8.2.5.2 Unflavored

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Supermarkets and Hypermarkets

8.2.6.2 Convenience Stores

8.2.6.3 Online Retail

8.2.6.4 Others (Specialty Stores)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Gluten Free Oats Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product Type

8.3.4.1 Rolled Oats

8.3.4.2 Steel-Cut Oats

8.3.4.3 Instant Oats

8.3.5 Historic and Forecasted Market Size by Flavor

8.3.5.1 Flavored

8.3.5.2 Unflavored

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Supermarkets and Hypermarkets

8.3.6.2 Convenience Stores

8.3.6.3 Online Retail

8.3.6.4 Others (Specialty Stores)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Gluten Free Oats Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product Type

8.4.4.1 Rolled Oats

8.4.4.2 Steel-Cut Oats

8.4.4.3 Instant Oats

8.4.5 Historic and Forecasted Market Size by Flavor

8.4.5.1 Flavored

8.4.5.2 Unflavored

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Supermarkets and Hypermarkets

8.4.6.2 Convenience Stores

8.4.6.3 Online Retail

8.4.6.4 Others (Specialty Stores)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Gluten Free Oats Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product Type

8.5.4.1 Rolled Oats

8.5.4.2 Steel-Cut Oats

8.5.4.3 Instant Oats

8.5.5 Historic and Forecasted Market Size by Flavor

8.5.5.1 Flavored

8.5.5.2 Unflavored

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Supermarkets and Hypermarkets

8.5.6.2 Convenience Stores

8.5.6.3 Online Retail

8.5.6.4 Others (Specialty Stores)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Gluten Free Oats Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product Type

8.6.4.1 Rolled Oats

8.6.4.2 Steel-Cut Oats

8.6.4.3 Instant Oats

8.6.5 Historic and Forecasted Market Size by Flavor

8.6.5.1 Flavored

8.6.5.2 Unflavored

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Supermarkets and Hypermarkets

8.6.6.2 Convenience Stores

8.6.6.3 Online Retail

8.6.6.4 Others (Specialty Stores)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Gluten Free Oats Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product Type

8.7.4.1 Rolled Oats

8.7.4.2 Steel-Cut Oats

8.7.4.3 Instant Oats

8.7.5 Historic and Forecasted Market Size by Flavor

8.7.5.1 Flavored

8.7.5.2 Unflavored

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Supermarkets and Hypermarkets

8.7.6.2 Convenience Stores

8.7.6.3 Online Retail

8.7.6.4 Others (Specialty Stores)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Gluten Free Oats Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 235.44 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.89% |

Market Size in 2032: |

USD 466.35 Mn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Flavor |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||