Gluten Free Food Market Synopsis

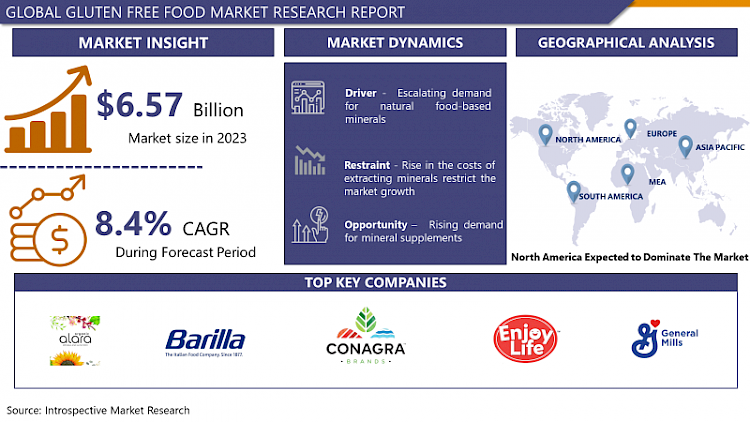

Gluten Free Food Market Size Was Valued at USD 6.57 Billion in 2023, and is Projected to Reach USD 13.58 Billion by 2032, Growing at a CAGR of 8.4% From 2024-2032.

Gluten-free foods therefore encompasses various products and food which contain no gluten; a protein that is mostly found in wheat, barley, rye and triticale. Cooked and fermented gluten can evoke reactions among the affected individuals especially those that suffer from celiac disease, gluten intolerance, and wheat allergy.

- Consumption of foods containing gluten by these individuals may result in diarrhea, bloated stomach, inflammation of the gut and other ailments. As a result, gluten-free products witnessed a growth of remarkable rate due to increased need of a gluten-free diet for celiac diseases, and other purposes of people desiring a change in their eating habits.

- Gluten free foods can actually refer to any food product that is derived from bread, pasta, baked goods snacks and even some drinks, all of which are products made without the inclusion of any gluten containing elements. Popular grains incorporated in GF substitutes include rice, corn, quinoa, oats, and other types of flour including almond, coconut, and chickpea flour, among others.

- Moreover, there are several common natural and unprocessed food items including fruits, vegetables, meats, fish, dairy products, and legumes that are naturally free from gluten and act as key components of GF diet. With increased enlightenment today regarding celiac disease and other gluten sensitivities, more eating options and choices exist for those required to maintain a gluten-free diet and as such, they too can enjoy the choices and variety available to them in the culinary world today.

Gluten Free Food Market Trend Analysis

Rising demand for gluten-free convenience foods

- The trend towards convenience consumer foods is noticeable in the gluten-free food market due to the continuously-rising demand for gluten-free food. Convenience foods which are foods that once bought can be prepared very quickly and can be eaten on the go are copiously consumed due to direct reasons such as the busy lives that people have and diverse ways of eating among other causes.

- This is especially the case in the gluten-free category, where the market for gluten-free offerings expands beyond individuals who suffer from celiac disease to people who do not have any gluten intolerance issues but choose gluten-free products for various reasons such as health or as part of a healthy lifestyle trend. Hence, manufacturers have come up with many gluten-free processed foods in the convenience foods category, from frozen foods and snacks, processed baked cereals and mixes.

- New commercial gluten-free products also show other trends on the market, such as the need for new tasty, gluten-free convenient foods that do not harm the buyers’ diets or preferences. These products provide those diagnosed with gluten intolerance or celiac disease some ease in consuming food they crave and getting nutrients they need, without sabotaging their diets.

- Also, the convenience cooking foods and snacks industry has justified and extended awareness and entry of gluten-free products in conventional grocery store and restaurants thus making it a routine to offer gluten-free requires more to those suffering from Gluten-intolerance.

Development of new gluten-free ingredients

- The rise of new gluten free solutions indeed holds exciting prospects for the future of gluten-free food, in both innovation and growth. And due to consumer awareness of Celiac disease and gluten sensitiveness as well as increase attention towards gluten-free products in the market there is need for a variety of non-gluten containing ingredients that can match gluten containing flours in terms of taste, texture and functionality. This helps to develop further R & D in food industry towards exploring liberal, and inventing new gluten-free foods from other grains, legumes, seeds and any other resource.

- Furthermore, the continued introduction of new gluten free ingredients present future innovation opportunities for product diversification whereby manufacturers can proceed to develop new products with new forms and specialty customizations suited to the requirements of different individuals.

- Three, adoption of new ingredients in the food manufacturing process including grains such as teff, sorghum among others that are yet to gain a broad market or ingredients like cassava flour and tiger nut flour would help introduce new foods which would would benefit a section of a population beyond those people with gluten intolerance. As a result, future innovations in ingredients will produce better tasting, textured gluten-free products making these attractive options appropriate for a wide audience.

- Therefore, continued investment in the enhancement of new substitute ingredients for gluten is not only a response to the demand for the gluten-free foods but also a creative path to reaching customers and being unique in the expanding gluten-free food market.

Gluten Free Food Market Segment Analysis:

Gluten Free Food Market is segmented based on Type, Distribution Channel.

By Type, Bakery products is expected to dominate the market during the forecast period

- The demand for gluten-free products is relativly high, especially in the category of bakery products. Bakery products are some of the popular food items and they comprise of breads, cookies, cakes and pastries among others and all of them include gluten in their recipes. However, as the market has shifted to demand more gluten-free products, this segment has grown rapidly for innovative brands. Research has shown that today it is possible to find gluten-free bakery products in the local supermarkets as well as in health food stores and Bio shops for people with celiac disease, for those who are sensitive to gluten, or for those who decided to change their diet for some reason.

- Gluten free bakery products Indeed, there are several reasons causing high popularity of gluten-free bakery products, such as better ingredient technology, the progress in the taste and texture of the products, and the popularity of gluten-related disorders. Similarly, the use of gluten-free flours and other ingredients enables preparation of a broad meal map of bakery goods that resemble the gluten containing ones in terms of palatability and quality as per the consumer preferences and satisfaction.

- Another category that has been on the right trajectory and gaining improved market acceptability in the gluten-free foods is the snacks and Ready to Eat (RTE) foods. Based on the trend of increasing working and studying people with busy schedules and heavy snacking, there has been an interest in portable gluten free snacks.

- This section consists of crisps, biscuits, snack bars, luxury popcorns and many more that are specially equipped to be free from any gluten products. Retailers have addressed this need, by using value chain mechanisms to obtain innovative gluten-free snacks, that are not only convenient for consumers with allergies, but also possess a luxurious appeal and packaging that is appealing to the eye.

- The snacks and RTE products segment is positively influenced by the convenience factor, especially when a consumer is answerable for gluten free snacks or products at some juncture in the middle of the day or night when they have a craving or are hungry. In the same vein, increased awareness of outlets with gluten-free produce and the growth in demand for gluten-free snacks within specialty outlets and online shopping enables this segment to grow to a wider market.

By Applications, the supermarkets and hypermarkets segment held the largest share

- In the gluten-free food market, one noted that the main distribution channel would be supermarkets and hypermarkets. It is a form of large supermarkets that have an assortment of products where among dozens of products which are gluten-containing there are some that are gluten-free for people with celiac disease. Compared to the conventional grocery stores, supermarkets and hypermarkets have a plus factor, especially in offering one stop shopping solutions where one can sight gluten free products amongst other foodstuff on the same shelves.

- A wide popularity of their stores and broad ranges of products make them convenient grocery store for customers with gluten intolerance as well as for people who strive to improve their health and adopt a gluten-free diet. Furthermore, ways such as highlights sections or use of signs showing products that are gluten-free to help the consumers make their choice could be common in supermarkets.

- Another important certified sector in the distribution of gluten-free foods is online retail. Since the modern world has seen the emergence of numerous online stores, the choosings for consumers with their gluten-free delicacies are enhanced. The fact that they can do it conveniently from the comfort of their homes, cross check the prices and even read some of the comments that the previous customers have made makes it mouth watering especially to anyone who is gluten intolerant. In addition, most online retailers offer a more expansive selection of specialty and more specific gluten-free items than those found in physical stores, which I think play a crucial role given the heterogeneity of GPL.

- Another source is that the direct-to-consumer brands and the subscription services at the online retail segment create an added advantage where consumers can order what they need through various online platforms and easily switch between brands depending on the kind of gluten-free diet they are following.

Gluten Free Food Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is seen to lead in the overall global gluten-free food market due to several factors. First of all, it is for the sales of cakes produced from gluten-free products, as there is a high incidence of gluten related disorders including celiac disease and gluten sensitivity in North America. The authors note that there is a marked availability of health resources in the region and a raised awareness about these diseases, so a larger portion of the populace is moving toward a gluten-free lifestyle to maintain their wellbeing.

- Further, North America has a good craze for diet trends and healthy lifestyle still going strong and with the increasing awareness amongst the population about health and nutrition it fuels the demand for gluten-free.

- In addition, the food industry structure coupled with the critical innovation ecosystem in North America must support the gluten-free food market. The whole area has a vast number of food companies that have a vast experience in producing and marketing gluten free products. These companies tend to incorporate higher ingredient technology and research and development to produce better gluten-free products that are appealing to the taste buds and have desirable dough characteristics.

- Moreover, the gluten-free trend is specific to North America with its diversified food and consumer preferences signaled through different food segments such as bakery products, snacks, and ready-to eat meals and condiments. Therefore, North America continues to be an authoritative market for gluten-free foods; it still inculcates new consumer demands for such products and promotes their consumption in both the domestic and the global settings.

Active Key Players in the Gluten Free Food Market

- Alara Wholefoods Ltd. (London, U.K.)

- Barilla G.E.R Fratelli S.P.A (Parma, Italy)

- Conagra Brands, Inc. (Illinois, U.S.)

- Enjoy Life Foods (Mondelez International) (Illinois, U.S.)

- General Mills Inc. (Minnesota, U.S.)

- Kellogg’s Company (Michigan, U.S.)

- Noumi Limited (Australia)

- Prima Foods Ltd. (South Wales, U.K.)

- The Hain Celestial Group Inc. (New York, U.S.)

- The Kraft Heinz Company (Illinois, U.S.)

- Other Key Players

Key Industry Developments in the Gluten Free Food Market:

- In February 2024, GOODLES, a food manufacturing firm based in the U. S forayed into the newly emerging gluten-free category and released gluten free Cheddy Mac and gluten free Vegan Be Heroes pasta. Similarly, other pastas, this Italian gluten-free pasta is enriched with prebiotics, fiber, and 21 notт lesser plant-based nutrients.

- In May 2023, Crosta & Mollica, a food and beverages firm based in London wanted their brand to to adapt and this saw them launch a new product in their production line-a gluten free margherita pizza. The crust of this pizza is prepared using just pure wheat flour and can be an advisable choice for consumers on the coeliac diet.

|

Global Gluten Free Food Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.57 Bn. |

|

Forecast Period 2023-34 CAGR: |

8.4% |

Market Size in 2032: |

USD 13.58 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- GLUTEN FREE MARKET BY TYPE (2017-2032)

- GLUTEN FREE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BABY FOOD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PASTAS & PIZZAS

- SNACKS & RTE PRODUCTS

- BAKERY PRODUCTS

- CONDIMENTS & DRESSINGS

- GLUTEN FREE MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- GLUTEN FREE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKETS/HYPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONVENIENCE STORES

- SPECIALTY STORES

- DRUGSTORES & PHARMACIES

- ONLINE RETAILS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- GLUTEN FREE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ALARA WHOLEFOODS LTD. (LONDON, U.K.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BARILLA G.E.R FRATELLI S.P.A (PARMA, ITALY)

- CONAGRA BRANDS, INC. (ILLINOIS, U.S.)

- ENJOY LIFE FOODS (MONDELEZ INTERNATIONAL) (ILLINOIS, U.S.)

- GENERAL MILLS INC. (MINNESOTA, U.S.)

- KELLOGG’S COMPANY (MICHIGAN, U.S.)

- NOUMI LIMITED (AUSTRALIA)

- PRIMA FOODS LTD. (SOUTH WALES, U.K.)

- THE HAIN CELESTIAL GROUP INC. (NEW YORK, U.S.)

- THE KRAFT HEINZ COMPANY (ILLINOIS, U.S.)

- COMPETITIVE LANDSCAPE

- GLOBAL GLUTEN-FREE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Gluten Free Food Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.57 Bn. |

|

Forecast Period 2023-34 CAGR: |

8.4% |

Market Size in 2032: |

USD 13.58 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. GLUTEN FREE FOOD MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. GLUTEN FREE FOOD MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. GLUTEN FREE FOOD MARKET COMPETITIVE RIVALRY

TABLE 005. GLUTEN FREE FOOD MARKET THREAT OF NEW ENTRANTS

TABLE 006. GLUTEN FREE FOOD MARKET THREAT OF SUBSTITUTES

TABLE 007. GLUTEN FREE FOOD MARKET BY TYPE

TABLE 008. BAKERY PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 009. GLUTEN FREE READY TO EAT PRODUCTS AND SNACKS MARKET OVERVIEW (2016-2028)

TABLE 010. CONDIMENTS AND DRESSINGS MARKET OVERVIEW (2016-2028)

TABLE 011. PIZZAS AND PASTAS MARKET OVERVIEW (2016-2028)

TABLE 012. AND OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. GLUTEN FREE FOOD MARKET BY APPLICATION

TABLE 014. FOR HUMAN CONSUMTION MARKET OVERVIEW (2016-2028)

TABLE 015. GLUTEN FREE FOOD MARKET BY DISTRIBUTION CHANNELS

TABLE 016. HYPERMARKETS/SUPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 017. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 018. CONVENIENCE STORE MARKET OVERVIEW (2016-2028)

TABLE 019. DRUG STORE AND PHARMACIES MARKET OVERVIEW (2016-2028)

TABLE 020. NORTH AMERICA GLUTEN FREE FOOD MARKET, BY TYPE (2016-2028)

TABLE 021. NORTH AMERICA GLUTEN FREE FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 022. NORTH AMERICA GLUTEN FREE FOOD MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 023. N GLUTEN FREE FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 024. EUROPE GLUTEN FREE FOOD MARKET, BY TYPE (2016-2028)

TABLE 025. EUROPE GLUTEN FREE FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 026. EUROPE GLUTEN FREE FOOD MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 027. GLUTEN FREE FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 028. ASIA PACIFIC GLUTEN FREE FOOD MARKET, BY TYPE (2016-2028)

TABLE 029. ASIA PACIFIC GLUTEN FREE FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 030. ASIA PACIFIC GLUTEN FREE FOOD MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 031. GLUTEN FREE FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA GLUTEN FREE FOOD MARKET, BY TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA GLUTEN FREE FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA GLUTEN FREE FOOD MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 035. GLUTEN FREE FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 036. SOUTH AMERICA GLUTEN FREE FOOD MARKET, BY TYPE (2016-2028)

TABLE 037. SOUTH AMERICA GLUTEN FREE FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 038. SOUTH AMERICA GLUTEN FREE FOOD MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 039. GLUTEN FREE FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 040. SILLY YAKS: SNAPSHOT

TABLE 041. SILLY YAKS: BUSINESS PERFORMANCE

TABLE 042. SILLY YAKS: PRODUCT PORTFOLIO

TABLE 043. SILLY YAKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. BOB’S RED MILL: SNAPSHOT

TABLE 044. BOB’S RED MILL: BUSINESS PERFORMANCE

TABLE 045. BOB’S RED MILL: PRODUCT PORTFOLIO

TABLE 046. BOB’S RED MILL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. THE KRAFT HEINZ COMPANY: SNAPSHOT

TABLE 047. THE KRAFT HEINZ COMPANY: BUSINESS PERFORMANCE

TABLE 048. THE KRAFT HEINZ COMPANY: PRODUCT PORTFOLIO

TABLE 049. THE KRAFT HEINZ COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. QUINOA CORPORATION: SNAPSHOT

TABLE 050. QUINOA CORPORATION: BUSINESS PERFORMANCE

TABLE 051. QUINOA CORPORATION: PRODUCT PORTFOLIO

TABLE 052. QUINOA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. CONAGRA BRANDS INC.: SNAPSHOT

TABLE 053. CONAGRA BRANDS INC.: BUSINESS PERFORMANCE

TABLE 054. CONAGRA BRANDS INC.: PRODUCT PORTFOLIO

TABLE 055. CONAGRA BRANDS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. HERO AG: SNAPSHOT

TABLE 056. HERO AG: BUSINESS PERFORMANCE

TABLE 057. HERO AG: PRODUCT PORTFOLIO

TABLE 058. HERO AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. WARBURTONS: SNAPSHOT

TABLE 059. WARBURTONS: BUSINESS PERFORMANCE

TABLE 060. WARBURTONS: PRODUCT PORTFOLIO

TABLE 061. WARBURTONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. FARMO S.P.A.: SNAPSHOT

TABLE 062. FARMO S.P.A.: BUSINESS PERFORMANCE

TABLE 063. FARMO S.P.A.: PRODUCT PORTFOLIO

TABLE 064. FARMO S.P.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. KEKIN LTD.: SNAPSHOT

TABLE 065. KEKIN LTD.: BUSINESS PERFORMANCE

TABLE 066. KEKIN LTD.: PRODUCT PORTFOLIO

TABLE 067. KEKIN LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. THE HAIN CELESTIAL GROUP INC.: SNAPSHOT

TABLE 068. THE HAIN CELESTIAL GROUP INC.: BUSINESS PERFORMANCE

TABLE 069. THE HAIN CELESTIAL GROUP INC.: PRODUCT PORTFOLIO

TABLE 070. THE HAIN CELESTIAL GROUP INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. AMY’S FOOD.: SNAPSHOT

TABLE 071. AMY’S FOOD.: BUSINESS PERFORMANCE

TABLE 072. AMY’S FOOD.: PRODUCT PORTFOLIO

TABLE 073. AMY’S FOOD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. GENERAL MILLS: SNAPSHOT

TABLE 074. GENERAL MILLS: BUSINESS PERFORMANCE

TABLE 075. GENERAL MILLS: PRODUCT PORTFOLIO

TABLE 076. GENERAL MILLS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. RAISIOPLC.: SNAPSHOT

TABLE 077. RAISIOPLC.: BUSINESS PERFORMANCE

TABLE 078. RAISIOPLC.: PRODUCT PORTFOLIO

TABLE 079. RAISIOPLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. KELLOGG’S COMPANY: SNAPSHOT

TABLE 080. KELLOGG’S COMPANY: BUSINESS PERFORMANCE

TABLE 081. KELLOGG’S COMPANY: PRODUCT PORTFOLIO

TABLE 082. KELLOGG’S COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. GOLDEN WEST SPECIALTY FOODS.: SNAPSHOT

TABLE 083. GOLDEN WEST SPECIALTY FOODS.: BUSINESS PERFORMANCE

TABLE 084. GOLDEN WEST SPECIALTY FOODS.: PRODUCT PORTFOLIO

TABLE 085. GOLDEN WEST SPECIALTY FOODS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. ENJOY LIFE FOODS.: SNAPSHOT

TABLE 086. ENJOY LIFE FOODS.: BUSINESS PERFORMANCE

TABLE 087. ENJOY LIFE FOODS.: PRODUCT PORTFOLIO

TABLE 088. ENJOY LIFE FOODS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. NORTHSIDE FOODS LTD.: SNAPSHOT

TABLE 089. NORTHSIDE FOODS LTD.: BUSINESS PERFORMANCE

TABLE 090. NORTHSIDE FOODS LTD.: PRODUCT PORTFOLIO

TABLE 091. NORTHSIDE FOODS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. BIG OZ: SNAPSHOT

TABLE 092. BIG OZ: BUSINESS PERFORMANCE

TABLE 093. BIG OZ: PRODUCT PORTFOLIO

TABLE 094. BIG OZ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. AND OTHERS: SNAPSHOT

TABLE 095. AND OTHERS: BUSINESS PERFORMANCE

TABLE 096. AND OTHERS: PRODUCT PORTFOLIO

TABLE 097. AND OTHERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. GLUTEN FREE FOOD MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. GLUTEN FREE FOOD MARKET OVERVIEW BY TYPE

FIGURE 012. BAKERY PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 013. GLUTEN FREE READY TO EAT PRODUCTS AND SNACKS MARKET OVERVIEW (2016-2028)

FIGURE 014. CONDIMENTS AND DRESSINGS MARKET OVERVIEW (2016-2028)

FIGURE 015. PIZZAS AND PASTAS MARKET OVERVIEW (2016-2028)

FIGURE 016. AND OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. GLUTEN FREE FOOD MARKET OVERVIEW BY APPLICATION

FIGURE 018. FOR HUMAN CONSUMTION MARKET OVERVIEW (2016-2028)

FIGURE 019. GLUTEN FREE FOOD MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 020. HYPERMARKETS/SUPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 021. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 022. CONVENIENCE STORE MARKET OVERVIEW (2016-2028)

FIGURE 023. DRUG STORE AND PHARMACIES MARKET OVERVIEW (2016-2028)

FIGURE 024. NORTH AMERICA GLUTEN FREE FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. EUROPE GLUTEN FREE FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. ASIA PACIFIC GLUTEN FREE FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. MIDDLE EAST & AFRICA GLUTEN FREE FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. SOUTH AMERICA GLUTEN FREE FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Gluten Free Food Market research report is 2024-2032.

Alara Wholefoods Ltd. (London, U.K.), Barilla G.E.R Fratelli S.P.A (Parma, Italy), Conagra Brands, Inc. (Illinois, U.S.), Enjoy Life Foods (Mondelez International) (Illinois, U.S.), General Mills Inc. (Minnesota, U.S.), Kellogg’s Company (Michigan, U.S.), Noumi Limited (Australia), Prima Foods Ltd. (South Wales, U.K.) , The Hain Celestial Group Inc. (New York, U.S.), The Kraft Heinz Company (Illinois, U.S.) and Other Major Players.

The Gluten Free Food Market is segmented into Type, Distribution channel, and region. By Type, the market is categorized into Baby Foodm, Pastas & Pizzas, Snacks & RTE Products, Bakery Products, Condiments & Dressings. By Applications, the market is categorized into Supermarkets/Hypermarkets Convenience Stores Specialty Stores Drugstores & Pharmacies Online retails. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Gluten free food is both the food products and meals which do not contain gluten, a protein composite found in some grains including wheat, barley, rye, and triticale. These foods are crucial for those who suffer from digestive disorder conditions such as celiac disease, gluten intolerance, and wheat allergy since their consumption is problematic for them. Gluten replacements are usually made from grains like rice, corn, quinoa, other grains normally replaced through gluten-free flours probably from almonds or coconuts.

Gluten Free Food Market Size Was Valued at USD 6.57 Billion in 2023, and is Projected to Reach USD 13.58 Billion by 2032, Growing at a CAGR of 8.4% From 2024-2032.