Wall Beds Market Synopsis

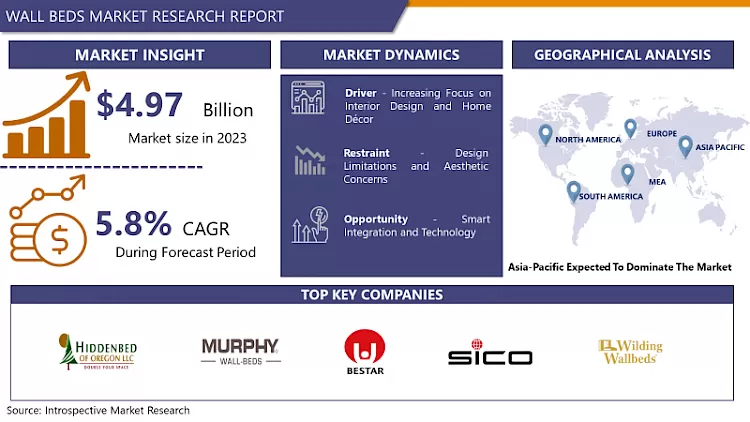

Wall Beds Market Size Was Valued at USD 4.97 Billion in 2023 and is Projected to Reach USD 8.26 Billion by 2032, Growing at a CAGR of 5.8% From 2024-2032.

Folding beds, or more commonly known as Murphy beds, are innovative furniture designs that are stored on a vertical manner by folding against the walls whenever they are not in use especially in areas where space is most certainly a concern. These beds were developed and patented in the 20th century by William Lawrence Murphy; they are generally attached at one end to the wall or an armoire and can be tilted conveniently for sleeping or raised effortlessly for storage, looking like furniture within the space. Owing to their functionality and capacity for being utilized both for sleeping and as a piece of furniture, wall beds have become a norm for apartments, small homes, and other residences where square footage is of the essence.

- Wall bed market has also expanded significantly over the past few years for various reasons, namely increased urbanization, housing space limitations, and consumer trend shifts. Despite their name, modern loft beds are very similar to those seen in Murphy beds, giving the resident the ability to have a comfortable, stylish, sleeping solution that still makes good use of limited space of studios or other small dwellings.

- Factors such as urbanization are the central contributing factors to the increased desire to own wall beds in modern societies. This is because a number of individuals continue shifting their living and working places in towns, and Crelan thus needs to make optimum utilization of the limited space it has. Wall beds are rather effective in solving this problem because during the day the bed is easily tucked away and in the evening it all becomes a comfortable size of a full-sized bed. An example being the conversion of a bedroom to a living room and home office, something that is quite common to owner-occupants of urban property, particularly in cities where the size of the living space is limited.

- In addition, the growing population of individuals who are keen on transforming their life styles and preferences towards the usage of wall beds has boosted the market. This is due to new trends in owning fewer items, which translates to more space-saving solutions to fit the few owned items and give a new meaning to efficient living. Wall beds do not only serve as solutions to space optimization but also provide a minimalist elegant design that can be integrated in the modern kind of interior design. Finally, the utility and adaptability of wall beds are also beneficial to residents, owners of apartments, houses, offices, and commercial spaces – all these factors create a high demand for this product, thus promoting market expansion.

- Also, some aspects like the design and technology of this furniture has very had a positive impact in the expansion of this wall bed to different people. There are many different features and options that advance manufacturers offer to their consumers to enhance the products and make it affordable and fitting for everyone’s specific requirements. When it comes to the technical aspects of a wall bed, technical advancements have allowed solutions to provide better integrated storage solutions, lights in the fold, flexible finishes, and materials. This innovation has continued and assisted to grow consumer’s awareness rate thus increasing the demand for wall beds.

- It is projected that the market will have even more promising future given that demand for the wall beds is likely going to increase in future due to advancements in the construction industry. The continual growth in the population coupled with the growth of the middle class and improved standards of living, particularly in the emerging countries, can be seen as potential drivers for fundamental market growth in the next couple of years. Furthermore, it is possible to note that, as acceptance of benefits derived from wall beds increases and its penetration progresses, the market will reveal more further potential for intensification in its internal and foreign segments. In general, it can be inferred that the wall beds market occupies a significant and promising niche within the furniture market, due to the constant demand for further development of sleeping-space-saving solutions for contemporary living spaces.

Wall Beds Market Trend Analysis

Space Optimization Solutions

- It is noted that the global market of Space Optimization Solutions Wall Beds Market has been constantly growing within the past few years thanks to the necessity of the peoples in the usage of the space effective sleeping places and other little used items. These wall beds sometimes referred to as Murphy beds, are more convenient and space friendly designs meant for tight living conditions especially in urban settings and limited housing accommodation spaces. As a result of the cut-down dimensions in living space this has led to an influx of compact households and micro living, there is always a demand for non-traditional full-service furniture that can bend and morph in various functions responding to the evolving needs of the consumers through time. This has in turn been met by the availability of so many stylish and fashionable wall beds in the market that it can easily fit modern home dècor trends and yet offer a comfortable sleeping area without having to take up much of the floor space.

- Innovations and improvements in technology and materials have fettered to the stronger and reliable, easier to operate, and attractive designs of the wall bed and hence, has propelling the market growth. Seeing increased amounts of urbanization and more people living in small spaces, the Space Optimization Solutions Wall Beds Market holds a strong and promising niche in the contemporary furniture demand.

Smart Integration and Technology

- The market for Smart Integration and Technology Wall Beds is currently in the growth stage and is expected to grow significantly as more people seek solutions leading to the space constraints in urban areas. Here are some of the promising features of state-of-art wall beds that can be included in the design: The operations can be performed with the help of automatic mechanisms; Additional besides the control of the process, the application of a remote control or the possibility of integration into smart home systems may be incorporated in the wall bed design. Due to the increase in the number of people living and working in limited space especially in urban areas, many need solutions that offer comfort and space-saving Universal Wall Bed Solutions are one of the advanced solutions that have been embraced due to the ability to offer convenience and versatility.

- Furthermore, product innovation in terms of the materials used as well as the design have led to better overall appearance and long-lasting nature of the related products thus boosting the market growth. Since consumers today are more conscious of their spaces and need to make the most of the room that they have without the compromise of the comfort of their beds, the global Smart Integration and Technology Wall Beds market will continue to grow with manufacturers looking for new ways to tap into the ever shifting consumer needs.

Wall Beds Market Segment Analysis:

Wall Beds Market Segmented based on By Type , By Size, By Functioning , By Application and ,By Sales Channel

By Type, Desk Wall Beds segment is expected to dominate the market during the forecast period

- The Wall Beds market offering a broad assortment of products listed majorly on the basis of type in order to fulfill the specific requirement of the end user. Plain Bed with Drawers – a practical combination of a wardrobe and a bed, Cabinet Beds are definitely worth consideration for those who need a functional bed but love stylized interiors. Desk Wall Beds are fold out beds in combination with a desk that allow people to incorporate two important items of furniture into a single piece in small flats. Library Wall Beds, combining a beauty of bookcase and functionality of the fold out bed, are perfect for style-conscious and space-challenged individuals.

- Also, the market also includes a segment of ‘Others’ which may include unique sty/,’ Dontion, style or other considerations that may appeal to consumers’’ desired space, or reach that can be attained with the piece. This segmentation highlights the dynamic use and flexibility of the Wall Beds because it encompasses pragmatic buyers who live in congested areas as well as style conscious first time homeowners which makes Wall Beds market very diverse.

By Size, King segment held the largest share in 2023

- The wall beds market can be segmented by size into four main categories: Building on the King and Queen categories, the Full subclass is analyzed in detail, followed by a discussion of other subclasses that have not been previously explored. All size categories serve various consumer purposes and expectations that are capable of flexibility for achieving maximum usage of the space as well as comfort. There are large wall beds available that are suitable for larger bedrooms so that people that are heading for sleep can have a lot of space if they are two people or just like to have more space on their beds. Queen size is the best size as it is providing ample of space and has an optimum size which can easily accommodate a couple and is suitable for most rooms in a house- the bedroom.

- The standard wall bed designs are most appropriate for the minor rooms or the guest rooms as it doesn’t claim a lot of space yet offer a perfect little space for a bed. The “Other” classification includes units with various dimensions and subtypes to fit particular conditions, including twin or customized WallBeds for different purposes. In conclusion, the stated segmentation is helpful to manufacturers and retailers in order to target the appropriate wall beds consumer groups and offer appropriate products for different living environments and customer orientations in the targeted market.

Wall Beds Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- Emerging nations of the Asia Pacific region are likely to challenge the supremacy of wall beds market throughout the forecast period. This projection is based on some assumptions such as: population growth rate, urbanization rate, changes in the socio-economic form of life etc. Due to high population density in populated towns and cities globally particularly in Asia’s countries like China, India and Japan the issue of space ad becomes very limited hence the need for space saving furniture like the wall bed. In addition, increased consumer spending and a focus on the appearance of the interior amenities are several other factors helping to boost the demand for the wall beds in the region.

- Despite this though, the growing real estate market especially in developing countries is viewed as having a positive impact on the market since developers and homeowners are looking to derive optimum use from limited space. Therefore, Asia-Pacific remains promising and is likely to dominate a global market in Wall beds and showers; the region’s growth rate is expected to be higher than any other regions in the near future.

Active Key Players in the Wall Beds Market

- Hiddenbed of Oregon LLC (US)

- Murphy Wall Beds Hardware Inc. (US)

- Bestar Inc. (Canada)

- SICO Inc. (US)

- The WallBed Company (Australia)

- Wilding Wallbeds (US)

- InovaBed (US)

- Oldham Wood (US)

- SMARTBett GmbH (Germany)

- The Bedder Way Company (US)

- Foshan Youpai Home Technology Co. Ltd. (China)

- B.O.F.F. Wall Bed (Canada)

- Bonbon Trading Limited (UK)

- FlyingBeds International (US)

- ClickBed Pl (Poland)

- Guangdong Nova Furniture Co. Limited (China)

- Foshan COOC Furniture Co. Ltd. (China)

- Other Key Players

Key Industry Developments in the Wall Beds Market:

- In May 2023, Resource Furniture, a US brand known for its space-maximizing designs the motorized Tonale sofa wall bed and the LGM 2.0 revolving wall bed as part of their latest collection. These wall beds were created to transform and maximize space efficiently, allowing homeowners to convert rooms into bedrooms quickly and effortlessly. The Tonale and LGM 2.0 form part of Resource Furniture's lineup of multifunctional furniture, reflecting a commitment to innovative design. The LGM 2.0 is an updated version of the brand's best-selling LGM revolving wall bed, which was originally developed in the 1970s.

|

Global Wall Beds Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.97 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 8.26 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Size |

|

||

|

By Functioning |

|

||

|

By Application |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Wall Beds Market by Type (2018-2032)

4.1 Wall Beds Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cabinet Beds

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Desk Wall Beds

4.5 Library Wall Beds

4.6 Others

Chapter 5: Wall Beds Market by Size (2018-2032)

5.1 Wall Beds Market Snapshot and Growth Engine

5.2 Market Overview

5.3 King

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Queen

5.5 Full

5.6 Others

Chapter 6: Wall Beds Market by Functioning (2018-2032)

6.1 Wall Beds Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Manual

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Automatic

Chapter 7: Wall Beds Market by Application (2018-2032)

7.1 Wall Beds Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

Chapter 8: Wall Beds Market by Sales Channel (2018-2032)

8.1 Wall Beds Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Online Stores

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Furniture Retail

8.5 Specialty Stores

8.6 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Wall Beds Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 BERRY GLOBAL GROUP INC. (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 WESTROCK COMPANY (US)

9.4 SILGAN HOLDINGS INC. (US)

9.5 APTARGROUP INC. (US)

9.6 CROWN HOLDINGS INC. (US)

9.7 CONSOLIDATED CONTAINER COMPANY (US)

9.8 SONOCO PRODUCTS COMPANY (US)

9.9 SEALED AIR CORPORATION (US)

9.10 GRAPHIC PACKAGING INTERNATIONAL

9.11 LLC (US)

9.12 WINPAK LTD. (CANADA)

9.13 CCL INDUSTRIES INC. (CANADA)

9.14 GERRESHEIMER AG (GERMANY)

9.15 RPC GROUP PLC (UK)

9.16 MONDI PLC (UK)

9.17 REXAM PLC (UK)

9.18 DS SMITH PLC (UK)

9.19 ALBEA S.A. (FRANCE)

9.20 TETRA LAVAL INTERNATIONAL S.A. (SWITZERLAND)

9.21 HUHTAMAKI OYJ (FINLAND)

9.22 ESSEL PROPACK LIMITED (INDIA)

9.23 AMCOR PLC (AUSTRALIA)

9.24 AND OTHER MAJOR PLAYER

Chapter 10: Global Wall Beds Market By Region

10.1 Overview

10.2. North America Wall Beds Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Cabinet Beds

10.2.4.2 Desk Wall Beds

10.2.4.3 Library Wall Beds

10.2.4.4 Others

10.2.5 Historic and Forecasted Market Size by Size

10.2.5.1 King

10.2.5.2 Queen

10.2.5.3 Full

10.2.5.4 Others

10.2.6 Historic and Forecasted Market Size by Functioning

10.2.6.1 Manual

10.2.6.2 Automatic

10.2.7 Historic and Forecasted Market Size by Application

10.2.7.1 Residential

10.2.7.2 Commercial

10.2.8 Historic and Forecasted Market Size by Sales Channel

10.2.8.1 Online Stores

10.2.8.2 Furniture Retail

10.2.8.3 Specialty Stores

10.2.8.4 Others

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Wall Beds Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Cabinet Beds

10.3.4.2 Desk Wall Beds

10.3.4.3 Library Wall Beds

10.3.4.4 Others

10.3.5 Historic and Forecasted Market Size by Size

10.3.5.1 King

10.3.5.2 Queen

10.3.5.3 Full

10.3.5.4 Others

10.3.6 Historic and Forecasted Market Size by Functioning

10.3.6.1 Manual

10.3.6.2 Automatic

10.3.7 Historic and Forecasted Market Size by Application

10.3.7.1 Residential

10.3.7.2 Commercial

10.3.8 Historic and Forecasted Market Size by Sales Channel

10.3.8.1 Online Stores

10.3.8.2 Furniture Retail

10.3.8.3 Specialty Stores

10.3.8.4 Others

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Wall Beds Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Cabinet Beds

10.4.4.2 Desk Wall Beds

10.4.4.3 Library Wall Beds

10.4.4.4 Others

10.4.5 Historic and Forecasted Market Size by Size

10.4.5.1 King

10.4.5.2 Queen

10.4.5.3 Full

10.4.5.4 Others

10.4.6 Historic and Forecasted Market Size by Functioning

10.4.6.1 Manual

10.4.6.2 Automatic

10.4.7 Historic and Forecasted Market Size by Application

10.4.7.1 Residential

10.4.7.2 Commercial

10.4.8 Historic and Forecasted Market Size by Sales Channel

10.4.8.1 Online Stores

10.4.8.2 Furniture Retail

10.4.8.3 Specialty Stores

10.4.8.4 Others

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Wall Beds Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Cabinet Beds

10.5.4.2 Desk Wall Beds

10.5.4.3 Library Wall Beds

10.5.4.4 Others

10.5.5 Historic and Forecasted Market Size by Size

10.5.5.1 King

10.5.5.2 Queen

10.5.5.3 Full

10.5.5.4 Others

10.5.6 Historic and Forecasted Market Size by Functioning

10.5.6.1 Manual

10.5.6.2 Automatic

10.5.7 Historic and Forecasted Market Size by Application

10.5.7.1 Residential

10.5.7.2 Commercial

10.5.8 Historic and Forecasted Market Size by Sales Channel

10.5.8.1 Online Stores

10.5.8.2 Furniture Retail

10.5.8.3 Specialty Stores

10.5.8.4 Others

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Wall Beds Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Cabinet Beds

10.6.4.2 Desk Wall Beds

10.6.4.3 Library Wall Beds

10.6.4.4 Others

10.6.5 Historic and Forecasted Market Size by Size

10.6.5.1 King

10.6.5.2 Queen

10.6.5.3 Full

10.6.5.4 Others

10.6.6 Historic and Forecasted Market Size by Functioning

10.6.6.1 Manual

10.6.6.2 Automatic

10.6.7 Historic and Forecasted Market Size by Application

10.6.7.1 Residential

10.6.7.2 Commercial

10.6.8 Historic and Forecasted Market Size by Sales Channel

10.6.8.1 Online Stores

10.6.8.2 Furniture Retail

10.6.8.3 Specialty Stores

10.6.8.4 Others

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Wall Beds Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Cabinet Beds

10.7.4.2 Desk Wall Beds

10.7.4.3 Library Wall Beds

10.7.4.4 Others

10.7.5 Historic and Forecasted Market Size by Size

10.7.5.1 King

10.7.5.2 Queen

10.7.5.3 Full

10.7.5.4 Others

10.7.6 Historic and Forecasted Market Size by Functioning

10.7.6.1 Manual

10.7.6.2 Automatic

10.7.7 Historic and Forecasted Market Size by Application

10.7.7.1 Residential

10.7.7.2 Commercial

10.7.8 Historic and Forecasted Market Size by Sales Channel

10.7.8.1 Online Stores

10.7.8.2 Furniture Retail

10.7.8.3 Specialty Stores

10.7.8.4 Others

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Wall Beds Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.97 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 8.26 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Size |

|

||

|

By Functioning |

|

||

|

By Application |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Wall Beds Market research report is 2024-2032.

Hiddenbed of Oregon LLC (US),Murphy Wall Beds Hardware Inc. (US),Bestar Inc. (Canada),SICO Inc. (US),The WallBed Company (Australia),Wilding Wallbeds (US),InovaBed (US),Oldham Wood (US),SMARTBett GmbH (Germany),The Bedder Way Company (US),Foshan Youpai Home Technology Co. Ltd. (China),B.O.F.F. Wall Bed (Canada),Bonbon Trading Limited (UK),FlyingBeds International (US),ClickBed Pl (Poland),Guangdong Nova Furniture Co. Limited (China),Foshan COOC Furniture Co. Ltd. (China),Other Key Players

The Wall Beds Market is segmented into Type , Size, Functioning , Application ,By Sales Channel, and Region. By Type , the market is categorized into Cabinet Beds, Desk Wall Beds, Library Wall Beds, Others. By Size , the market is categorized into King, Queen, Full, Others. By Functioning , the market is categorized into Manual, Automatic. By Application , the market is categorized into Residential, Commercial. By Sales Channel , the market is categorized into Online Stores, Furniture Retail, Specialty Stores, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Folding beds, or more commonly known as Murphy beds, are innovative furniture designs that are stored on a vertical manner by folding against the walls whenever they are not in use especially in areas where space is most certainly a concern. These beds were developed and patented in the 20th century by William Lawrence Murphy; they are generally attached at one end to the wall or an armoire and can be tilted conveniently for sleeping or raised effortlessly for storage, looking like furniture within the space. Owing to their functionality and capacity for being utilized both for sleeping and as a piece of furniture, wall beds have become a norm for apartments, small homes, and other residences where square footage is of the essence.

Wall Beds Market Size Was Valued at USD 4.97 Billion in 2023, and is Projected to Reach USD 8.26 Billion by 2032, Growing at a CAGR of 5.8% From 2024-2032.