Geographic Information System (GIS) Software Market Synopsis

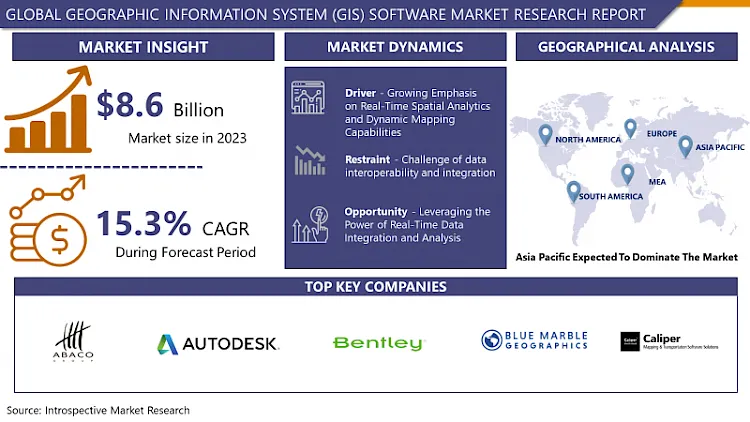

Geographic Information System (GIS) Software Market Size Was Valued at USD 8.6 Billion in 2023, and is Projected to Reach USD 31.1 Billion by 2032, Growing at a CAGR of 15.3% From 2024-2032.

A Geographic Information System (GIS) software is a tool used for capturing, storing, managing, analyzing, and presenting spatial or geographical data. It integrates various types of data, such as maps, satellite images, aerial photographs, and survey data, into a single database where relationships between different elements can be visualized and analyzed. GIS software enables users to perform complex spatial analysis and modeling, helping them to understand patterns, trends, and relationships in the data. This technology is widely used in fields such as urban planning, environmental management, natural resource management, transportation planning, and public health, among others, to make informed decisions based on geographic information.

The Geographic Information System (GIS) software market has witnessed substantial growth in recent years, fueled by the increasing demand for spatial data analysis and visualization across various industries. GIS software enables users to capture, store, manipulate, analyze, and present geographic data, providing valuable insights for decision-making processes. With the proliferation of location-based services, urban planning, environmental management, and infrastructure development, the demand for GIS software continues to rise globally.

Major players in the market, such as Esri, Hexagon AB, Autodesk, and Bentley Systems, are continuously innovating to offer advanced functionalities and cater to the evolving needs of users across diverse sectors, including government, utilities, healthcare, agriculture, and transportation. Additionally, the integration of GIS software with emerging technologies like artificial intelligence, IoT, and cloud computing is expected to further drive market growth, unlocking new opportunities for spatial analysis and predictive modeling.

However, despite the promising growth prospects, the GIS software market faces challenges such as data interoperability issues, high initial investment costs, and the complexity of integrating GIS with existing enterprise systems. Moreover, concerns regarding data privacy, security, and regulatory compliance pose significant hurdles for market expansion, particularly in sensitive sectors like defense and healthcare.

Nevertheless, the increasing adoption of open-source GIS software and the democratization of geospatial data through platforms like Google Maps and OpenStreetMap are fostering greater accessibility and affordability, thereby expanding the user base and stimulating market growth. As organizations increasingly recognize the importance of location intelligence in gaining a competitive edge and addressing complex spatial challenges, the GIS software market is poised for continued expansion in the foreseeable future.

.webp)

Geographic Information System (GIS) Software Market Trend Analysis

Geographic Information System (GIS) Software Market Trend Analysis

Growing Emphasis on Real-Time Spatial Analytics and Dynamic Mapping Capabilities

- Traditional GIS software primarily focused on static data analysis and mapping, but there's a shifting trend towards the integration of real-time data streams from various sources such as sensors, IoT devices, social media, and mobile applications. This trend is driven by the increasing need for timely and accurate insights to support decision-making processes in areas such as emergency response, urban planning, logistics optimization, and asset management.

- Advancements in technology, particularly in cloud computing, big data analytics, and edge computing, are enabling GIS software vendors to develop solutions that can handle large volumes of real-time spatial data and perform complex analyses on the fly. Additionally, the integration of machine learning and artificial intelligence algorithms into GIS software allows for predictive modeling, anomaly detection, and pattern recognition based on real-time spatial data inputs.

- Organizations across various industries are recognizing the value of real-time spatial analytics in gaining actionable insights, improving operational efficiency, and enhancing situational awareness. Consequently, there's a growing demand for GIS software solutions that can seamlessly integrate with real-time data sources and provide dynamic mapping visualizations that reflect the current state of the environment or assets being monitored. This trend is expected to continue driving innovation in the GIS software market, with vendors investing in research and development to deliver more robust, scalable, and user-friendly solutions for real-time spatial analysis and decision support.

Leveraging the Power of Real-Time Data Integration and Analysis

- As the world becomes more connected through IoT devices, sensors, and mobile technologies, there is a wealth of real-time spatial data available for analysis. GIS software providers can capitalize on this opportunity by developing solutions that seamlessly integrate with IoT platforms and sensor networks to gather, process, and analyze real-time location-based data. This could enable organizations to make more informed decisions, improve operational efficiency, and respond swiftly to dynamic environmental changes or emergencies.

- Furthermore, the increasing adoption of cloud computing presents another promising opportunity for GIS software providers. Cloud-based GIS solutions offer scalability, flexibility, and cost-effectiveness, making them accessible to a wider range of organizations, including small and medium-sized enterprises (SMEs) that may have limited IT infrastructure. By offering GIS software as a service (SaaS) or through subscription-based models on cloud platforms, providers can lower the barriers to entry for customers, accelerate deployment times, and facilitate collaboration and data sharing among geographically dispersed teams.

- Moreover, the integration of GIS software with emerging technologies such as artificial intelligence (AI) and machine learning (ML) presents a fertile ground for innovation. By harnessing AI and ML algorithms, GIS software can automate repetitive tasks, extract insights from large datasets, and perform predictive analytics, thereby empowering users to uncover hidden patterns, trends, and correlations in spatial data. This could find applications in diverse fields such as urban planning, disaster management, precision agriculture, logistics, and asset management, driving demand for advanced GIS software solutions.

Geographic Information System (GIS) Software Market Segment Analysis:

Geographic Information System (GIS) Software Market is Segmented on the basis of type, component, function and industry verticals.

By Type, Desktop GIS segment is expected to dominate the market during the forecast period

- The Desktop GIS segment is poised to maintain its dominance in the Geographic Information System (GIS) software market throughout the forecast period. Desktop GIS software offers a comprehensive suite of tools and functionalities for capturing, analyzing, and visualizing spatial data directly on personal computers or workstations. This segment's continued prominence can be attributed to several factors, including the robust capabilities of desktop GIS applications, which cater to the diverse needs of users across various industries such as urban planning, natural resource management, environmental monitoring, and geospatial analysis.

- Additionally, desktop GIS solutions provide users with greater control over data management, customization, and offline access, making them indispensable for professionals who require advanced spatial analysis capabilities and complex geoprocessing workflows.

- Moreover, the ongoing advancements in desktop GIS software, such as improved user interfaces, enhanced performance, and seamless integration with other software platforms, further bolster the segment's growth prospects. As organizations increasingly recognize the value of location intelligence in gaining insights and driving informed decision-making processes, the Desktop GIS segment is expected to remain a cornerstone of the GIS software market, empowering users with powerful spatial analytics tools and facilitating innovation across diverse sectors.

By Component, Software segment held the largest share in 2023

- Within the Geographic Information System (GIS) software market, the software segment stands out as the dominant contributor, holding the largest share. This segment encompasses a diverse array of GIS software offerings designed to cater to the varied needs of users across different industries and sectors. GIS software solutions provide the core functionalities necessary for capturing, storing, analyzing, and visualizing spatial data, empowering organizations to derive valuable insights and make informed decisions.

- From industry-leading platforms offered by established players like Esri's ArcGIS to open-source alternatives such as QGIS and GeoServer, the software segment offers a wide range of options to suit the requirements and budgets of diverse user groups. Moreover, with the continuous evolution of GIS technology and the integration of advanced features such as 3D visualization, real-time analytics, and cloud-based deployment, the software segment is poised for sustained growth and innovation.

- As organizations increasingly recognize the importance of location intelligence in gaining a competitive edge and addressing complex spatial challenges, the demand for GIS software solutions is expected to remain robust, further consolidating the dominance of the software segment in the GIS market landscape.

Geographic Information System (GIS) Software Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Geographic Information System (GIS) software market in the Asia Pacific region is poised for significant dominance over the forecast period, driven by several key factors. With rapid urbanization, population growth, and infrastructure development across countries like China, India, Japan, and South Korea, there is a burgeoning demand for spatial data analysis and management solutions. Government initiatives aimed at smart city development, environmental conservation, disaster management, and infrastructure planning further fuel the adoption of GIS software in the region.

- Moreover, the Asia Pacific region is witnessing robust investments in digital transformation, technology infrastructure, and Industry 4.0 initiatives, driving the adoption of GIS software across diverse sectors such as utilities, transportation, agriculture, healthcare, and e-commerce. Additionally, the proliferation of mobile devices, internet connectivity, and location-based services in the region has created vast opportunities for GIS software providers to cater to the needs of a tech-savvy and increasingly connected population.

- Furthermore, the presence of leading GIS software vendors and a burgeoning ecosystem of startups and technology innovators in countries like India, China, and Australia contribute to the region's dominance in the market. These factors, combined with favorable government policies, increasing awareness about the benefits of spatial data analytics, and the rising demand for precision agriculture and location-based marketing solutions, position the Asia Pacific as a key growth engine for the GIS software market in the coming years.

Active Key Players in the Geographic Information System (GIS) Software Market

- ABACO Group (Italy)

- Autodesk, Inc. (US)

- Bentley Systems, Incorporated (US)

- Blue Marble Geographics (US)

- Caliper Corporation (US)

- Computer Aided Development Corporation Limited (Cadcorp) (UK)

- General Electric Co. (US)

- Hexagon AB(Sweden)

- Maxar Technologies Inc. (US)

- Pitney Bowes Inc. (US)

- Trimble Inc. (US)

- Other key Players

Key Industry Developments in the Geographic Information System (GIS) Software Market:

- On November 2022, the new Geodata Portal and broadband maps for the state will become available to the public on November 18, 2022, the Connecticut Office of Policy and Management (OPM) announced in a statement. This declaration was released on GIS Day 2022, an occasion that promotes the study of geography and the pragmatic applications of GIS in order to effect positive societal change.

- On November 2022, Jammu and Kashmir, an Indian state, witnessed the implementation of a GIS-based system by its lieutenant governor. It emphasizes the importance of GIS technology in investigating new opportunities and addressing new challenges, as well as in its practical applications that accelerate the expansion of business, government, and society.

|

Geographic Information System (GIS) Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.3 % |

Market Size in 2032: |

USD 31.1 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By Function |

|

||

|

By Industry Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Geographic Information System (GIS) Software Market by Type (2018-2032)

4.1 Geographic Information System (GIS) Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Desktop GIS

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Server GIS

4.5 Developer GIS

4.6 Mobile GIS

4.7 Others

Chapter 5: Geographic Information System (GIS) Software Market by Component (2018-2032)

5.1 Geographic Information System (GIS) Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Software

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Services

Chapter 6: Geographic Information System (GIS) Software Market by Function (2018-2032)

6.1 Geographic Information System (GIS) Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Mapping

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Surveying

6.5 Location-Based Services

6.6 Navigation and Telematics

6.7 Others

Chapter 7: Geographic Information System (GIS) Software Market by Industry Verticals (2018-2032)

7.1 Geographic Information System (GIS) Software Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Automotive

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Energy and Utilities

7.5 Government

7.6 Defense and Intelligence

7.7 Smart Cities

7.8 Insurance

7.9 Natural Resources

7.10 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Geographic Information System (GIS) Software Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ALPHA FINTECH (IRELAND)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AMAZON (UNITED STATES)

8.4 AURUS INC. (UNITED STATES)

8.5 BITPAY (UNITED STATES)

8.6 BLUESNAP INC. (UNITED STATES)

8.7 BRAINTREE (UNITED STATES)

8.8 EPAY (DENMARK)

8.9 GOOGLE (UNITED STATES)

8.10 INGENICO (FRANCE)

8.11 PAYSAFE GROUP LTD. (UK)

8.12 PAYU (NETHERLANDS)

8.13 PINEAPPLE PAYMENTS (UNITED STATES)

8.14 SKRILL (UK)

8.15 STRIPE (UNITED STATES)

8.16 TOTAL SYSTEM SERVICES (TSYS) (UNITED STATES)

8.17 VERIFONE (UNITED STATES)

8.18 ZOHO CHECKOUT (INDIA)

8.19 OTHER KEY PLAYERS

Chapter 9: Global Geographic Information System (GIS) Software Market By Region

9.1 Overview

9.2. North America Geographic Information System (GIS) Software Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Desktop GIS

9.2.4.2 Server GIS

9.2.4.3 Developer GIS

9.2.4.4 Mobile GIS

9.2.4.5 Others

9.2.5 Historic and Forecasted Market Size by Component

9.2.5.1 Software

9.2.5.2 Services

9.2.6 Historic and Forecasted Market Size by Function

9.2.6.1 Mapping

9.2.6.2 Surveying

9.2.6.3 Location-Based Services

9.2.6.4 Navigation and Telematics

9.2.6.5 Others

9.2.7 Historic and Forecasted Market Size by Industry Verticals

9.2.7.1 Automotive

9.2.7.2 Energy and Utilities

9.2.7.3 Government

9.2.7.4 Defense and Intelligence

9.2.7.5 Smart Cities

9.2.7.6 Insurance

9.2.7.7 Natural Resources

9.2.7.8 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Geographic Information System (GIS) Software Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Desktop GIS

9.3.4.2 Server GIS

9.3.4.3 Developer GIS

9.3.4.4 Mobile GIS

9.3.4.5 Others

9.3.5 Historic and Forecasted Market Size by Component

9.3.5.1 Software

9.3.5.2 Services

9.3.6 Historic and Forecasted Market Size by Function

9.3.6.1 Mapping

9.3.6.2 Surveying

9.3.6.3 Location-Based Services

9.3.6.4 Navigation and Telematics

9.3.6.5 Others

9.3.7 Historic and Forecasted Market Size by Industry Verticals

9.3.7.1 Automotive

9.3.7.2 Energy and Utilities

9.3.7.3 Government

9.3.7.4 Defense and Intelligence

9.3.7.5 Smart Cities

9.3.7.6 Insurance

9.3.7.7 Natural Resources

9.3.7.8 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Geographic Information System (GIS) Software Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Desktop GIS

9.4.4.2 Server GIS

9.4.4.3 Developer GIS

9.4.4.4 Mobile GIS

9.4.4.5 Others

9.4.5 Historic and Forecasted Market Size by Component

9.4.5.1 Software

9.4.5.2 Services

9.4.6 Historic and Forecasted Market Size by Function

9.4.6.1 Mapping

9.4.6.2 Surveying

9.4.6.3 Location-Based Services

9.4.6.4 Navigation and Telematics

9.4.6.5 Others

9.4.7 Historic and Forecasted Market Size by Industry Verticals

9.4.7.1 Automotive

9.4.7.2 Energy and Utilities

9.4.7.3 Government

9.4.7.4 Defense and Intelligence

9.4.7.5 Smart Cities

9.4.7.6 Insurance

9.4.7.7 Natural Resources

9.4.7.8 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Geographic Information System (GIS) Software Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Desktop GIS

9.5.4.2 Server GIS

9.5.4.3 Developer GIS

9.5.4.4 Mobile GIS

9.5.4.5 Others

9.5.5 Historic and Forecasted Market Size by Component

9.5.5.1 Software

9.5.5.2 Services

9.5.6 Historic and Forecasted Market Size by Function

9.5.6.1 Mapping

9.5.6.2 Surveying

9.5.6.3 Location-Based Services

9.5.6.4 Navigation and Telematics

9.5.6.5 Others

9.5.7 Historic and Forecasted Market Size by Industry Verticals

9.5.7.1 Automotive

9.5.7.2 Energy and Utilities

9.5.7.3 Government

9.5.7.4 Defense and Intelligence

9.5.7.5 Smart Cities

9.5.7.6 Insurance

9.5.7.7 Natural Resources

9.5.7.8 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Geographic Information System (GIS) Software Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Desktop GIS

9.6.4.2 Server GIS

9.6.4.3 Developer GIS

9.6.4.4 Mobile GIS

9.6.4.5 Others

9.6.5 Historic and Forecasted Market Size by Component

9.6.5.1 Software

9.6.5.2 Services

9.6.6 Historic and Forecasted Market Size by Function

9.6.6.1 Mapping

9.6.6.2 Surveying

9.6.6.3 Location-Based Services

9.6.6.4 Navigation and Telematics

9.6.6.5 Others

9.6.7 Historic and Forecasted Market Size by Industry Verticals

9.6.7.1 Automotive

9.6.7.2 Energy and Utilities

9.6.7.3 Government

9.6.7.4 Defense and Intelligence

9.6.7.5 Smart Cities

9.6.7.6 Insurance

9.6.7.7 Natural Resources

9.6.7.8 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Geographic Information System (GIS) Software Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Desktop GIS

9.7.4.2 Server GIS

9.7.4.3 Developer GIS

9.7.4.4 Mobile GIS

9.7.4.5 Others

9.7.5 Historic and Forecasted Market Size by Component

9.7.5.1 Software

9.7.5.2 Services

9.7.6 Historic and Forecasted Market Size by Function

9.7.6.1 Mapping

9.7.6.2 Surveying

9.7.6.3 Location-Based Services

9.7.6.4 Navigation and Telematics

9.7.6.5 Others

9.7.7 Historic and Forecasted Market Size by Industry Verticals

9.7.7.1 Automotive

9.7.7.2 Energy and Utilities

9.7.7.3 Government

9.7.7.4 Defense and Intelligence

9.7.7.5 Smart Cities

9.7.7.6 Insurance

9.7.7.7 Natural Resources

9.7.7.8 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Geographic Information System (GIS) Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

15.3 % |

Market Size in 2032: |

USD 31.1 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Component |

|

||

|

By Function |

|

||

|

By Industry Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||