Force Sensor Market Synopsis

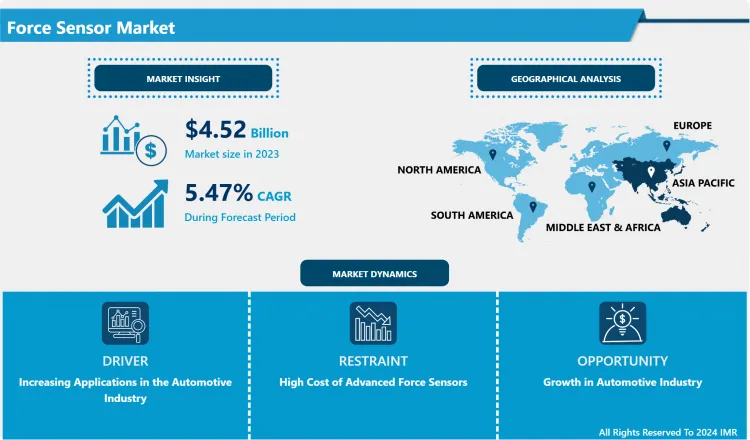

Force Sensor Market Size Was Valued at USD 4.52 Billion in 2023 and is Projected to Reach USD 7.3 Billion by 2032, Growing at a CAGR of 5.47% From 2024-2032.

Force sensors generally consist of electrodes and a sensing material. They measure the force applied to an object by detecting variations in the resistance values of force-sensing resistors. Most force sensors are designed using these force-sensing resistors.

- The increasing use of industrial automation in industries such as manufacturing, automotive, and aerospace has created a demand for accurate force measurement for quality assurance and safety purposes. Utilizing robots in various sectors also necessitates sophisticated force sensors for precise functioning. Improvements in technology, including enhanced sensor technologies like strain gauges and piezoelectric sensors, are increasing performance and dependability. Incorporating force sensors into IoT systems enables the collection and analysis of real-time data for improved decision-making. The growing utilization of smart gadgets is fueling the need for compact, high-accuracy force sensors in consumer electronics to improve user interactions and develop engaging experiences.

- The growing requirement for force sensors in medical devices and wearable health technologies is fuelled by the increasing demand in healthcare, which helps enhance diagnostics, monitoring, and safety in surgical applications. Furthermore, industries such as automotive and manufacturing are placing a greater emphasis on safety and quality, with force sensors playing a vital role in safety testing and quality control procedures. The growth of aerospace and defense industries also depends on force sensors for testing and monitoring aircraft parts and systems, as well as for various defense applications like testing weapon systems and equipment.

- Growing economies such as China and India are seeing an increase in demand for force sensors because of their quick industrialization and development of infrastructure. Continued research and development in sensor technologies are leading to the development of more sophisticated and specialized force sensors, with increased customization for specific uses opening up new possibilities in the market. The increasing need for improved data precision across different sectors is propelling the use of sophisticated force sensors for accurate measurement.

Force Sensor Market Trend Analysis

Increasing Applications in the Automotive Industry

- Integrating processors into smart sensors allows for instant data analysis, improving precision and efficiency in measuring forces. Sophisticated algorithms in these sensors offer accurate and dependable measurements, exceeding typical force sensors. Created to work with IoT devices, intelligent sensors can easily join forces with other gadgets, enabling them to be incorporated into larger networks and smart technology systems. They also allow for remote monitoring and control in difficult or dangerous areas, making it easier to share data and communicate across different systems.

- Sophisticated sensors come with capabilities like self-checks and automatic adjustment, resulting in better efficiency and extended sensor longevity. They additionally provide data fusion and analytics features to better comprehend the environment or system. With the rise of automation and Industry 4.0 projects, there is a growing need for intelligent sensors that can communicate and integrate with other systems. They play a vital role in intelligent systems such as robotics and predictive maintenance, allowing for advanced features. Thanks to their modular design and customizable features, smart sensors can be adapted for a wide range of uses, from industrial to consumer electronics, increasing their practicality and market value.

- Easy-to-use interfaces and dashboards make data visualization with smart sensors simpler, helping users make informed decisions. Integrating mobile devices allows easy access to sensor data and control functions using applications. Intelligent sensors use artificial intelligence and machine learning to improve performance and predictive abilities. Edge computing capabilities enable local data processing, decreasing latency and enhancing efficiency.

Growth in Automotive Industry

- The automotive sector is rapidly incorporating Advanced Driver-Assistance Systems (ADAS) to enhance safety and driving convenience. Force sensors are essential in tasks such as collision detection, adaptive cruise control, and lane-keeping assistance. Likewise, the progress of Self-Driving Cars depends on advanced sensors, such as force sensors for automated braking, load sensing, and vehicle stability control, to fulfill the increasing market need for precise and efficient technology.

- The rise of electric and hybrid vehicles has caused a growing need for force sensors for different uses. Force sensors are utilized in battery management systems to supervise the amount of load and pressure on battery packs, guaranteeing safe functioning. Safety measures in current cars depend on force sensors for tasks such as deploying airbags based on the forces of impact. The use of force sensors in monitoring systems for parameters such as wheel load and tire pressure improves vehicle performance and enhances driving experiences, driven by manufacturers' emphasis on safety and performance improvements.

- Force sensors play a vital role in quality control within the automotive industry, ensuring that components conform to strict standards in an increasingly precise and automated production process. Incorporating IoT in vehicles enables force sensors to offer immediate data for diagnostics and fleet management, increasing their usefulness. Innovation and customization within the sector inspire the creation of unique force sensors designed for specific uses, addressing the changing demands of the automotive industry.

Force Sensor Market Segment Analysis:

- Force Sensor Market Segmented on the basis of Type, Technology, Application, End-user, And Region.

By Type, AAA Segment Is Expected to Dominate the Market During the Forecast Period

- Smart sensors with built-in processors allow for immediate data analysis, improving the precision and speed of force measurements. Modern algorithms in intelligent sensors offer measurements that are more trustworthy compared to conventional sensors. These sensors are compatible with IoT, enabling easy connection with other devices for sharing information. Wireless data transmission enables remote monitoring and control, particularly in difficult or dangerous locations. In general, intelligent sensors enhance data processing, accuracy, connectivity, and integration abilities for improved decision-making and system functionality.

- Enhanced sensors provide self-assessment and adjustment, enhancing efficiency and durability. Data fusion abilities integrate data from various sensors to provide a complete perspective and improved analysis for a more profound understanding. In the context of Industry 4.0, automation requires sensors capable of connecting with other systems. Smart sensors enable smart manufacturing through data collection and control capabilities. They play a vital role in intelligent systems such as robotics, predictive maintenance, and quality control, allowing for enhanced features and performance in these areas.

- Intelligent sensors with adaptable and versatile modular designs have applications across different settings, ranging from industrial to consumer environments. Tailored choices meet individual requirements, increasing opportunities within the market. User-friendly interfaces and integration with mobile devices make it easier for users to interpret data and make decisions, leading to improved user experiences. Utilizing new technologies such as machine learning and AI enhances performance and predictive abilities. Edge computing enables the processing of data locally, which decreases latency and improves the efficiency of data management.

By Application, Industrial Segment Held the Largest Share In 2023

- The growing focus on automation and Industry 4.0 in manufacturing has underscored the significance of force sensors in industrial processes. The sensors play a vital role in overseeing and managing machinery, guaranteeing seamless functioning and effectiveness. Incorporating force sensors with IoT, AI, and robotics is improving automation capabilities and allowing for real-time data analysis and predictive maintenance. In addition, force sensors are crucial for upholding high-quality levels, identifying mistakes in production methods, guaranteeing operational safety, and confirming adherence to regulations.

- Force sensors are essential in product development as they verify that new products meet design specifications and performance standards. They offer important information to improve product designs as industries continue to innovate and advance in new technologies. Force sensors allow for predictive maintenance by monitoring equipment performance and wear, thereby preventing sudden breakdowns and prolonging the lifespans of machines in terms of maintenance and reliability. Furthermore, force sensors provide personalized features for particular industrial uses, like load cells for scales or torque sensors for rotational assessments, enhancing their utility for a range of industrial tasks.

- The increasing need for force sensors to oversee industrial processes and enhance energy efficiency is propelling the growth of manufacturing and production. As manufacturing techniques get more intricate, precise force measurement is crucial for controlling and enhancing operations. Progress in sensor technology, including improved sensitivity and integration with digital systems, is resulting in the creation of new smart sensors that improve their usefulness in industrial settings. By keeping track of force and load, industrial operations can be adjusted to lower energy wastage and enhance overall performance.

Force Sensor Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Countries in the Asia-Pacific region such as China and India are experiencing fast growth in industrial and urban areas, leading to an increased need for advanced technologies such as force sensors in sectors like manufacturing, automotive, aerospace, and electronics. The area is a center for tech advancements, requiring advanced sensors for accurate measurements and enhanced product quality.

- The automotive and aerospace sectors in nations such as Japan, South Korea, and China are quickly growing, leading to an increased need for force sensors in areas like load monitoring, safety mechanisms, and quality assurance. Moreover, the Asia-Pacific area plays a significant role in manufacturing consumer electronics, resulting in a higher need for force sensors in smartphones, wearable tech, and household appliances. The growth in research and development funding in the area is driving the progress and acceptance of advanced force-sensing technologies in various sectors.

- Governments in the Asia-Pacific region offer assistance through measures such as subsidies and tax breaks to promote the development of technology and expansion of industries. The growing focus on Industry 4.0 and smart manufacturing in the area is driving the need for advanced sensors, specifically force sensors in automation, robotics, and smart factories.

Force Sensor Market Active Players

- Honeywell International Inc. (USA)

- TE Connectivity Ltd. (Switzerland)

- Omega Engineering Inc. (USA)

- Vishay Precision Group, Inc. (USA)

- FUTEK Advanced Sensor Technology, Inc. (USA)

- MTS Systems Corporation (USA)

- Kistler Instrumente AG (Switzerland)

- Instron (part of ITW) (USA)

- SCAIME (France)

- Norgren (United Kingdom)

- National Instruments Corporation (USA)

- HBM Test and Measurement (Germany)

- Burster Präzision (Germany)

- Applied Measurements Ltd (United Kingdom)

- Zemic Europe B.V. (Netherlands)

- Tekscan, Inc. (USA)

- Celera Motion (USA)

- Jiangsu Lixing Instrument Co., Ltd. (China)

- HBM (Germany)

- Tecsis GmbH (Germany)

- Measurement Specialties, Inc. (USA)

- Siemens AG (Germany)

- Datasyst Engineering (France)

- Omega Engineering (USA)

- Aerospace Components (USA), and Other Active Players.

Key Industry Developments in the Force Sensor Market:

- In Jan 2024, ABB announced that it has agreed to acquire Canadian company Real Tech, a leading supplier of innovative optical sensor technology that enables real-time water monitoring and testing. Through the acquisition, ABB will expand its strong presence in the water segment and complement its product portfolio with optical technology critical for smart water management. Financial terms of the transaction that is expected to close in Q1 2024 were not disclosed.

- In July 2023, HBK launched smart mini forces sensors with IO-Link. HBK’s newly developed digital, ready-to-go force sensors, the U9C and C9C, are ideal for measuring fast processes – and provide a standardized interface to any PLC with IO-Link. They’re typically applied, for example, in the joining or pressing processes during assembly or in the manufacture of automotive parts and sub-systems.

|

Global Force Sensor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.47% |

Market Size in 2032: |

USD 7.3 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- FORCE SENSOR MARKET BY TYPE (2017-2032)

- FORCE SENSOR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PIEZO ELECTRIC FORCE SENSOR

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- PIEZO RESISTIVE FORCE SENSOR

- CAPACITIVE FORCE SENSOR

- OPTICAL FORCE SENSOR

- MAGNETIC FORCE SENSOR

- FORCE SENSOR MARKET BY TECHNOLOGY (2017-2032)

- FORCE SENSOR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ANALOG FORCE SENSORS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DIGITAL FORCE SENSORS

- FORCE SENSOR MARKET BY APPLICATION (2017-2032)

- FORCE SENSOR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PROCESS MONITORING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONTROL MONITORING

- FORCE SENSOR MARKET BY END-USER (2017-2032)

- FORCE SENSOR MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MANUFACTURING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HEALTHCARE

- CONSUMER GOODS

- OIL & GAS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Force Sensor Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- HONEYWELL INTERNATIONAL INC. (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- TE CONNECTIVITY LTD. (SWITZERLAND)

- OMEGA ENGINEERING INC. (USA)

- VISHAY PRECISION GROUP, INC. (USA)

- FUTEK ADVANCED SENSOR TECHNOLOGY, INC. (USA)

- MTS SYSTEMS CORPORATION (USA)

- KISTLER INSTRUMENTE AG (SWITZERLAND)

- INSTRON (PART OF ITW) (USA)

- SCAIME (FRANCE)

- NORGREN (UNITED KINGDOM)

- NATIONAL INSTRUMENTS CORPORATION (USA)

- HBM TEST AND MEASUREMENT (GERMANY)

- BURSTER PRÄZISION (GERMANY)

- APPLIED MEASUREMENTS LTD (UNITED KINGDOM)

- ZEMIC EUROPE B.V. (NETHERLANDS)

- TEKSCAN, INC. (USA)

- CELERA MOTION (USA)

- JIANGSU LIXING INSTRUMENT CO., LTD. (CHINA)

- HBM (GERMANY)

- TECSIS GMBH (GERMANY)

- MEASUREMENT SPECIALTIES, INC. (USA)

- SIEMENS AG (GERMANY)

- DATASYST ENGINEERING (FRANCE)

- OMEGA ENGINEERING (USA)

- AEROSPACE COMPONENTS (USA)

- COMPETITIVE LANDSCAPE

- GLOBAL FORCE SENSOR MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-user

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

-

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

-

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Force Sensor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.52 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.47% |

Market Size in 2032: |

USD 7.3 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Force Sensor Market research report is 2024-2032.

Honeywell International Inc. (USA), TE Connectivity Ltd. (Switzerland), Omega Engineering Inc. (USA), Vishay Precision Group, Inc. (USA), FUTEK Advanced Sensor Technology, Inc. (USA), MTS Systems Corporation (USA), Kistler Instrumente AG (Switzerland), Instron (part of ITW) (USA), SCAIME (France), Norgren (United Kingdom), National Instruments Corporation (USA), HBM Test and Measurement (Germany), Burster Präzision (Germany), Applied Measurements Ltd (United Kingdom), Zemic Europe B.V. (Netherlands), Tekscan, Inc. (USA), Celera Motion (USA), Jiangsu Lixing Instrument Co., Ltd. (China), HBM (Germany), Tecsis GmbH (Germany), Measurement Specialties, Inc. (USA), Siemens AG (Germany), Datasyst Engineering (France), Omega Engineering (USA), Aerospace Components (USA) and Other Active Players.

The Force Sensor Market is segmented into Type, Technology, Application, End-user, and region. By Type, the market is categorized into Piezo Electric Force Sensors, Piezo Resistive Force Sensor, Capacitive Force Sensor, Optical Force Sensor, and Magnetic Force Sensor. By Technology, the market is categorized into Analog Force Sensors and digital Force Sensors. By Application, the market is categorized into Process Monitoring and Control Monitoring. By End-user, the market is categorized into Manufacturing, Healthcare, Consumer Goods, and Oil & Gas. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Force sensors generally consist of electrodes and a sensing material. They measure the force applied to an object by detecting variations in the resistance values of force-sensing resistors. Most force sensors are designed using these force-sensing resistors.

Force Sensor Market Size Was Valued at USD 4.52 Billion in 2023 and is Projected to Reach USD 7.3 Billion by 2032, Growing at a CAGR of 5.47% From 2024-2032.