Foodservice Market Synopsis

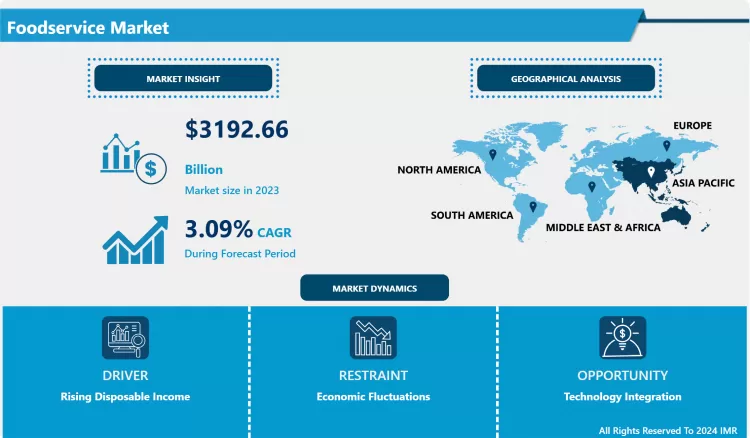

Foodservice Market Size is Valued at USD 3192.66 Billion in 2023, and is Projected to Reach USD 4198.57 Billion by 2032, Growing at a CAGR of 3.09% From 2024-2032.

The foodservice market encompasses the segment of the food industry dedicated to providing food and beverage services outside the home, including restaurants, cafeterias, catering services, and institutional food providers like schools and hospitals. This market includes both commercial entities, such as quick-service and full-service restaurants, as well as non-commercial operations, such as those found in educational and healthcare institutions. It is characterized by a wide range of service models, menu offerings, and dining experiences, aiming to meet diverse consumer needs and preferences in various settings.

- The foodservice market encompasses a diverse array of establishments that prepare and serve meals outside the home, including restaurants, cafeterias, and catering services. This industry is a major component of the global economy, influenced by shifting consumer preferences, technological advancements, and economic factors. Recent trends show a growing demand for convenience and health-conscious options, with consumers increasingly favoring quick-service and fast-casual dining.

- Technology is also reshaping the market, with innovations in online ordering, delivery services, and automation enhancing operational efficiency and customer experience. Sustainability and ethical sourcing are becoming critical considerations, as both consumers and businesses prioritize environmentally friendly practices. Despite challenges such as fluctuating economic conditions and supply chain disruptions, the foodservice market continues to evolve, driven by a focus on innovation, adaptability, and meeting the changing needs of consumers.

Foodservice Market Trend Analysis

Growing Demand for Healthier and More Sustainable Food Options

- The growing demand for healthier and more sustainable food options reflects a broader societal shift towards wellness and environmental consciousness. As consumers become more informed about the impact of their dietary choices on both personal health and the planet, there is an increasing preference for food that aligns with these values. This trend has led to a surge in popularity for organic produce, which is grown without synthetic pesticides or fertilizers, and for locally sourced ingredients, which reduce the carbon footprint associated with transportation. Additionally, plant-based diets are gaining traction due to their lower environmental impact and potential health benefits, such as reduced risks of chronic diseases. Restaurants and foodservice providers are responding to these preferences by revamping their menus to include more organic, local, and plant-based options, often highlighting these features to attract eco-conscious and health-minded customers.

- Incorporating these healthier and more sustainable options not only meets consumer demand but also enhances a foodservice provider's brand reputation. Establishments that prioritize sustainability and health are often seen as more socially responsible and innovative, which can differentiate them in a competitive market. This adaptation can involve significant changes in sourcing practices, menu design, and marketing strategies. For example, restaurants may partner with local farmers to ensure a fresh supply of seasonal produce or implement waste reduction practices to minimize their environmental footprint. As the demand for these options continues to grow, foodservice providers who successfully integrate them into their operations are likely to build stronger customer loyalty and capture a larger share of the market focused on health and sustainability.

Integration of Technology in Foodservice Operations

- The integration of technology into foodservice operations is revolutionizing the industry by streamlining processes and enhancing customer experiences. Online ordering and delivery platforms have become indispensable, allowing customers to conveniently place orders from their smartphones or computers, and track their deliveries in real-time. These platforms also provide valuable data insights that help restaurants understand consumer preferences and optimize their menus accordingly. Additionally, advanced kitchen automation technologies, such as robotic cooking assistants and smart ovens, are increasing efficiency and consistency in food preparation. Digital payment systems are further simplifying transactions, reducing wait times, and minimizing errors associated with traditional payment methods.

- The rise of ghost kitchens and virtual restaurants exemplifies how technology is reshaping the foodservice landscape. These establishments operate without a traditional dine-in space, relying entirely on delivery apps to reach customers. By focusing solely on delivery, ghost kitchens can significantly reduce overhead costs associated with maintaining a physical location and can experiment with different cuisines or concepts with lower financial risk. Virtual restaurants, often leveraging existing kitchen facilities, can also offer specialized menus or serve multiple brands from a single location, maximizing kitchen utilization and catering to niche markets. This model highlights how technology is not only enhancing operational efficiency but also enabling innovative business models that adapt to changing consumer behaviors and preferences.

Foodservice Market Segment Analysis:

Foodservice Market Segmented based on By Service Type and By System Type

By Service Type, Commercialsegment is expected to dominate the market during the forecast period

- Commercial food service operations represent a substantial portion of the food service industry, reflecting their dominant market presence. This category encompasses a wide array of businesses, including restaurants, hotels, and catering services, all of which operate with the primary goal of generating profit. The sector benefits from a diverse range of dining experiences, from casual eateries to fine dining establishments, each catering to different customer preferences and spending capacities. Restaurants, as the largest component of this segment, provide a wide range of cuisines and dining experiences, which helps to attract a broad customer base. Hotels contribute by offering dining services that complement their accommodations, while catering services cater to events and special occasions, further expanding the market reach.

- Within the commercial food service sector, quick-service restaurants (QSRs) hold a particularly significant share due to their widespread appeal and operational efficiency. These establishments, characterized by their fast service and standardized menu offerings, cater to a broad demographic seeking convenience and affordability. Fast-casual dining, which combines elements of quick service with a higher quality of food and a more relaxed dining environment, also captures a large market share. The success of these commercial operations is driven by their ability to deliver consistent, high-quality experiences while adapting to evolving consumer tastes and preferences. The convenience, variety, and affordability offered by these businesses play a crucial role in their substantial market presence.

By System Type, Conventionalsegment held the largest share in 2023

- In the conventional food service system, the largest share is generally dominated by large-scale institutions such as hospitals, schools, and other large organizational kitchens. These institutions benefit significantly from on-site food preparation due to the necessity of catering to a diverse range of dietary requirements and ensuring food safety standards. Hospitals, for instance, need to accommodate patients with specific nutritional needs and medical conditions, which makes on-site preparation essential for delivering tailored, nutritious meals. Similarly, schools must provide balanced meals to students of various ages, often adhering to strict nutritional guidelines and accommodating dietary restrictions.

- The conventional system's focus on immediate food preparation and service enables these institutions to maintain high standards of quality control and food safety. By preparing meals on-site, these organizations can closely monitor the ingredients used, handle food with care, and adjust recipes as needed to meet specific dietary guidelines. This method also allows for greater flexibility in responding to unforeseen changes, such as last-minute dietary adjustments or special requests. Consequently, the conventional system is particularly well-suited for environments where direct control over food preparation is crucial for meeting complex dietary needs and maintaining overall food safety.

Foodservice Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region stands out as one of the most dynamic and rapidly expanding foodservice markets globally. This growth is largely fueled by rapid urbanization and an expanding middle class in major economies like China and India. In these countries, the burgeoning urban population is driving demand for both quick-service and fine dining establishments, as people seek diverse and convenient dining options that fit their busy lifestyles. The region's foodservice sector is seeing a rise in innovative dining concepts, including fast-casual restaurants and gourmet fast-food chains, as well as traditional establishments adapting to modern tastes. As disposable incomes increase, consumers are becoming more adventurous, exploring a wide range of culinary experiences from global fast-food brands to high-end international cuisine.

- Additionally, the influence of traditional food practices remains strong across Asia-Pacific, but there's a notable shift towards fusion cuisines that blend local flavors with international influences. This trend is particularly evident in metropolitan areas where global culinary trends converge with regional tastes. Technology also plays a crucial role in shaping the foodservice landscape in the region. The widespread adoption of mobile ordering and delivery apps reflects a growing consumer preference for convenience and instant access to a variety of food options. Restaurants and foodservice providers are leveraging these technologies to streamline operations and enhance customer experiences, making the foodservice market in Asia-Pacific not only diverse but also increasingly tech-savvy and innovative.

Active Key Players in the Foodservice Market

- Amoy Food Limited

- Aramark Corporation

- Compass Group PLC

- Darden Concepts, Inc.

- Domino’s IP Holder LLC

- Mitchells & Butlers

- McDonald’s

- Starbucks Coffee Company

- Wendy’s Company (Quality Is Our Recipe, LLC), Other Active Players

|

Global Foodservice Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3192.66 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.09% |

Market Size in 2032: |

USD 4198.57 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By System Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Foodservice Market by Service Type (2018-2032)

4.1 Foodservice Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Commercial

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-commercial

Chapter 5: Foodservice Market by System Type (2018-2032)

5.1 Foodservice Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Conventional

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Ready Prepared

5.5 Centralized

5.6 Assembly Serve

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Foodservice Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AMOY FOOD LIMITED

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ARAMARK CORPORATION

6.4 COMPASS GROUP PLC

6.5 DARDEN CONCEPTS INCDOMINO’S IP HOLDER LLC

6.6 MITCHELLS & BUTLERS

6.7 MCDONALD’S

6.8 STARBUCKS COFFEE COMPANY

6.9 WENDY’S COMPANY (QUALITY IS OUR RECIPE

6.10 LLC)

6.11

Chapter 7: Global Foodservice Market By Region

7.1 Overview

7.2. North America Foodservice Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Service Type

7.2.4.1 Commercial

7.2.4.2 Non-commercial

7.2.5 Historic and Forecasted Market Size by System Type

7.2.5.1 Conventional

7.2.5.2 Ready Prepared

7.2.5.3 Centralized

7.2.5.4 Assembly Serve

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Foodservice Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Service Type

7.3.4.1 Commercial

7.3.4.2 Non-commercial

7.3.5 Historic and Forecasted Market Size by System Type

7.3.5.1 Conventional

7.3.5.2 Ready Prepared

7.3.5.3 Centralized

7.3.5.4 Assembly Serve

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Foodservice Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Service Type

7.4.4.1 Commercial

7.4.4.2 Non-commercial

7.4.5 Historic and Forecasted Market Size by System Type

7.4.5.1 Conventional

7.4.5.2 Ready Prepared

7.4.5.3 Centralized

7.4.5.4 Assembly Serve

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Foodservice Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Service Type

7.5.4.1 Commercial

7.5.4.2 Non-commercial

7.5.5 Historic and Forecasted Market Size by System Type

7.5.5.1 Conventional

7.5.5.2 Ready Prepared

7.5.5.3 Centralized

7.5.5.4 Assembly Serve

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Foodservice Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Service Type

7.6.4.1 Commercial

7.6.4.2 Non-commercial

7.6.5 Historic and Forecasted Market Size by System Type

7.6.5.1 Conventional

7.6.5.2 Ready Prepared

7.6.5.3 Centralized

7.6.5.4 Assembly Serve

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Foodservice Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Service Type

7.7.4.1 Commercial

7.7.4.2 Non-commercial

7.7.5 Historic and Forecasted Market Size by System Type

7.7.5.1 Conventional

7.7.5.2 Ready Prepared

7.7.5.3 Centralized

7.7.5.4 Assembly Serve

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Foodservice Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3192.66 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.09% |

Market Size in 2032: |

USD 4198.57 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By System Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Foodservice Market research report is 2024-2032.

Amoy Food Limited, Aramark Corporation, Compass Group PLC, Darden Concepts, Inc., Domino’s IP Holder LL, Mitchells & Butlers, McDonald’s, Starbucks Coffee Company, Wendy’s Company (Quality Is Our Recipe, LLC)and Other Major Players.

The Foodservice Market is segmented into By Service Type, By System Type and region. By Service Type, the market is categorized into Commercial and Non-commercial. By System Type, the market is categorized into Conventional, Ready Prepared, Centralized and Assembly Serve. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The foodservice market encompasses the segment of the food industry dedicated to providing food and beverage services outside the home, including restaurants, cafeterias, catering services, and institutional food providers like schools and hospitals. This market includes both commercial entities, such as quick-service and full-service restaurants, as well as non-commercial operations, such as those found in educational and healthcare institutions. It is characterized by a wide range of service models, menu offerings, and dining experiences, aiming to meet diverse consumer needs and preferences in various settings.

Foodservice Market Size is Valued at USD 3192.66 Billion in 2023, and is Projected to Reach USD 4198.57 Billion by 2032, Growing at a CAGR of 3.09% From 2024-2032.