Food Service Packaging Market Synopsis

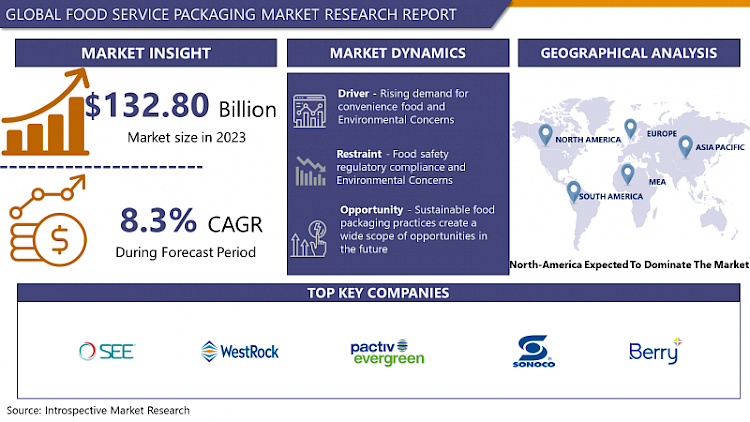

Food Service Packaging Market Size Was Valued at USD 132.80 Billion in 2023 and is Projected to Reach 272.18 Billion by 2032, Growing at a CAGR of 8.3% From 2024-2032.

Packaging provides quality and quantity assurance besides creating a hygienic environment for food products. It offers security through tamper-proof designs and contributes to the product image through structural and graphical design. Food safety is of permanent importance as packaged products against biological, chemical, and distribution damages. The primary objective of packaging is to protect the contents during storage, transportation, and distribution against deterioration. It may be physical, chemical, or biological. According to Robertson (1992), the packaging is the enclosure of the products, items, or packages in a wrapped pouch, bag, box, cup, tray, can, tube, bottle, or other containers to perform various functions, i.e. containment, protection, information, promotion, etc. Packaging of food serves many purposes such as providing effective protection to package foods against external contamination from the environment and preserving the quality of food. It is one of the most important parameters that sell the product and also a communication device to provide detailed information about the product like, contents, ingredients, notional values, cooking instructions, packaging and expiry dates, etc. Generally, packaging materials are lighter in weight, easier to open, reseal and store, ensure safe transport and distribution, and protect the product from adverse effects such as heat, cold, moisture, etc.

Food Service Packaging Market Trend Analysis

Active Packaging in the recent emerging trend

- Various terms for new packaging methods can be found in the literature, such as active, smart, interactive, clever, or intelligent packaging. Active packaging changes the condition of the packed food to extend shelf life or to improve safety or sensory properties while maintaining the quality of the packaged food. Intelligent packaging systems monitor the condition of packaged foods to give information about the quality of the packaged food during transport and storage. Active packaging refers to the incorporation of certain additives into packaging film or within packaging containers to maintain and extend product shelf life. Packaging may be termed active when it performs some desired role in food preservation other than providing an inert barrier to external conditions.

- Active packaging includes additives or ‗freshness enhancers that are capable of scavenging oxygen, adsorbing carbon dioxide, moisture, ethylene, and/or flavor/odor taints, releasing ethanol, sorbates, antioxidants and/or other preservatives and/or maintaining temperature control. Active packaging techniques for preservation and improving the quality and safety of foods can be divided into three categories; absorbers (i.e. scavengers, releasing systems, and other systems. Absorbing (scavenging) systems remove undesired compounds such as oxygen, carbon dioxide, ethylene, excessive water, taints, and other specific compounds. Releasing systems actively add or emit compounds to the packaged food or into the headspace of the package such as carbon dioxide, antioxidants, and preservatives. Other systems may have miscellaneous tasks, such as self-heating, self-cooling, and preservation.

Opportunity

Sustainable food packaging practices create a wide scope of opportunities in the future.

- In Europe and the US demand growth for more eco-friendly packaging materials and for packaging which is (partially) based on post-consumer recycled content. Both new legislation and the need to hit certain carbon emission reduction targets act as a catalyst for corporations. Besides, there is a clear reputational risk because packaging pollution, notably from plastic, is a major concern for consumers and NGOs.

- Packaging is one of the more carbon-intensive parts in the lifecycle of food and beverage products due to the fossil fuel required to produce packaging materials, the fossil inputs needed to make plastics and the end-of-life treatment (recycling, incineration or landfilling) of used packaging. Calls from investors to disclose more information on the impact of plastics are getting louder. According to the analysis of 20 major food & beverage companies and found that some already report the carbon footprint of their packaging in detail. In relative terms, the share of packaging within their total footprint is largest for beer brewers and soft drinks producers. For those brewers, this mainly stems from the energy required to produce glass bottles and aluminum cans. Soft drinks producers generally have a large footprint from aluminum cans and use a large volume of plastic packaging, of which the majority doesn’t get adequately recycled.

Food Service Packaging Market Segment Analysis:

The Food Service Packaging Market is Segmented based on Type, Application, biofuel type, and region.

By Material, Plastic Segment Is Expected To Dominate The Market During The Forecast Period

- Plastics are used in the packaging of food because they offer a wide range of appearance and performance properties which are derived from the inherent features of the individual plastic material and how it is processed and used. Plastics are resistant to many types of compounds – they are not very reactive with inorganic chemicals, including acids, alkalis, and organic solvents, thus making them suitable, i.e. inert, for food packaging. Plastics do not support the growth of microorganisms. Some plastics may absorb some food constituents, such as oils and fats, and hence it is important that thorough testing is conducted to check all food applications for absorption and migration. Gases such as oxygen, carbon dioxide, and nitrogen together with water vapor and organic solvents permeate through plastics.

- Plastics are used as containers, container components, and flexible packaging. In usage, by weight, they are the second most widely used type of packaging and first in terms of value. Applications of plastic are rigid plastic containers such as bottles, jars, pots, tubs, and trays, flexible plastic films in the form of bags, sachets, pouches, and heat-sealable flexible lidding materials. Plastics combined with paperboard in liquid packaging cartons. Expanded or foamed plastic for uses where some form of insulation, rigidity and the ability to withstand compression is required. Plastic lids and caps and the wadding used in such closures

By Nature, Flexible Segment Held The Largest Share In 2023

- The food service packaging market has been classified on the basis nature of packaging, which includes flexible packaging, rigid packaging, paper and pouches, bags, and others. Among these segments, flexible packaging is the dominant player in the market. This type of packaging uses flexible materials as its primary component, offering several advantages about functionality and versatility.

- Flexible packaging exhibits functions such as tear-resistance, stretchability, and shrinkability, allowing it to adapt to various shapes and sizes effectively. It is commonly manufactured using lightweight and thin materials, which contribute to its flexibility and ease of molding. Stand-up pouches (SU PP), films and laminates, pouches, and bags are some examples of a wide range of flexible packaging options. The popularity of flexible packaging is due to several factors. Its lightweight nature reduces transportation costs and makes it an economical choice for businesses. Also, its flexible and moldable properties provide excellent protection to the contents which ensures efficient preservation and prolonged shelf life. The tear-resistant nature of flexible packaging with the added advantage of durability, reduces the risk of damage during handling and transportation.

- Flexible packaging offers a visually appealing presentation, which allows for creative designs and branding opportunities. It also provides convenience to consumers, with features like resealable closures and easy-to-open mechanisms. The use of flexible packaging is environmentally friendly because it generates less waste compared to rigid alternatives. Flexible packaging has emerged as the dominant segment in the food service packaging market due to reasons like versatility, cost-effectiveness, durability, and environmental sustainability. Its ability to adapt to various shapes, lightweight construction, and functional advantages make it a preferred choice for businesses and consumers alike.

Food Service Packaging Market Regional Insights:

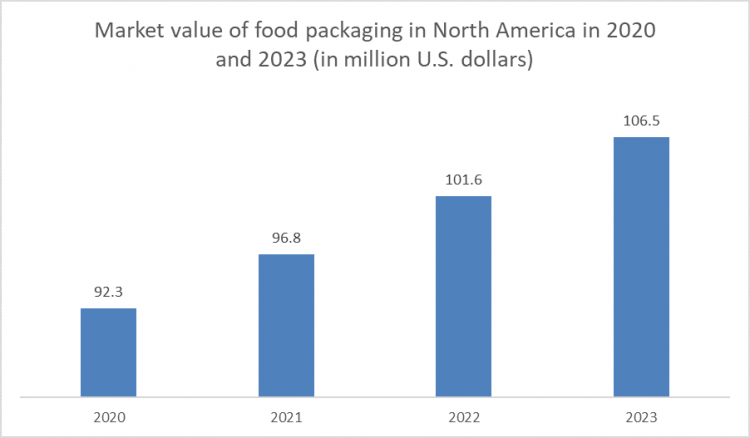

North America is Expected to Dominate the Market Over the Forecast Period in 2023

- The study on the food service packaging market includes several regions, including North America, Europe, Asia-Pacific, and the Rest of the World. From these regions, North America dominates the market due to several contributing factors including market expansion which results in the significant reliance of consumers on packaged food products and the strong presence of food processing businesses in the region. The increasing digitalization of operations by food service suppliers, the growing vegan population, and the shift in consumer preferences towards meat alternatives present new opportunities for the food packaging industry.

- The United States stands as a major consumer of packaged foods because the rising awareness regarding a healthy lifestyle has influenced consumers to demand higher-quality packaged food products, driving market growth. Other reasons like the strength of the dollar, the possibility of tightening monetary policies, and a potential weakening of the world economy pose risks to the market despite of this growth continues to encourage capital investments. The recent decline in interest rates has further stimulated an increase in capital investment as businesses seek to secure funding at reduced rates also American and Canadian companies are considering relocating their manufacturing operations to Mexico to benefit from duty-free goods and lower labor costs. North America stands as the dominant region in the food service packaging market, due to factors like consumer reliance on packaged food, digitalization in the industry, and shifting consumer preferences, though risks associated with global economic conditions and currency fluctuations exist. Nonetheless, overall market growth and strategic investment opportunities remain.

In 2020, the market value of food packaging in North America reached a total of over 92 billion U.S. dollars. The market is valued at about 106.5 billion U.S. dollars by 2023.

Food Service Packaging Market Top Key Players:

- Sealed Air Corporation (U.S.)

- Sonoco Products Company (U.S.)

- Berry Global Inc. (U.S.)

- WestRock Company (U.S.)

- Genpak LLC (U.S.)

- Pactiv LLC (U.S.)

- The Dow Chemical Company (U.S.)

- Bemis Company, Inc. (U.S.)

- International Paper Company (U.S.)

- Ball Corporation (U.S.)

- Dart Container Corporation (U.S.)

- Anchor Packaging Inc. (U.S.)

- Sabert Corporation (U.S.)

- Union Packaging (U.S.)

- Fabri-Kal (U.S.)

- Excellent Packaging & Supply (U.S.)

- RockTenn Company (now part of WestRock Company) (U.S.)

- Letica Corporation (U.S.)

- Greif Incorporated (U.S.)

- Ampac Packaging LLC (U.S.)

- Amcor plc (Switzerland)

- Tetra Pak International S.A. (Switzerland)

- Amcor Limited (Australia)

- Chantler Packages (Canada)

- Winpak Limited (Canada)

- BSI Biodegradable Solution (Canada)

- Mondi Group (Austria)

- Constantia Flexibles (Austria)

- Reynolds Group Holdings Limited (New Zealand)

- DS Smith Plc (U.K.)

- Vegware (U.K.)

- Huhtamaki Oyj (Finland)

- Stora Enso (Finland) and Others are Major Players.

Key Industry Developments in Femtocell Market:

- May 2022: The Biodegradable Products Institute (BPI) certification and ASTM D6868 compliance of the new wax paper sandwich wrap from Novolex Packaging. The wrap can be utilized as a pick-up sheet, a scale, a food wrap, or a basket liner.

- February 2022: The funds administered by Apollo's affiliates (Apollo Fund) and Novolex announced they had achieved a final deal for the Apollo Fund to purchase most of the company from the Carlyle Fund. Carlyle will continue to own a small portion of the business. Financial details have not been made public.

- January 2022: Huhtamaki said that Smith Anderson Group Ltd SA had sold all its shares in Huhtamaki Smith Anderson Sp. z o.o., its joint venture company in Poland. At Huhtamaki's location in Czeladz, Poland, the company makes and sells food service paper bags across Eastern Europe.

|

Food Service Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

132.80 Billion |

|

Forecast Period 2024-32 CAGR: |

8.3% |

Market Size in 2032: |

272.18 Billion |

|

Segments Covered: |

By Material |

|

|

|

|

By Nature |

|

|

|

|

By Type |

|

|

|

|

By Application |

|

|

|

|

By End-users |

|

|

|

|

By Region |

|

|

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Sealed Air Corporation (U.S.), Sonoco Products Company (U.S.), Berry Global Inc. (U.S.), WestRock Company (U.S.), Genpak LLC (U.S.), Pactiv LLC (U.S.), The Dow Chemical Company (U.S.), Bemis Company, Inc. (U.S.), International Paper Company (U.S.) and other major players. |

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- FOOD SERVICE PACKAGING MARKET SEGMENT BY TYPE (2017-2032)

- FOOD SERVICE PACKAGING SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEGMENT BAGS & POUCHES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEGMENT FILMS& WRAPS

- SEGMENT STICK PACKS & SACHETS

- SEGMENT BOTTLES & JARS

- SEGMENT BOXES & CARTONS

- SEGMENT CANS

- SEGMENT TRAYS

- SEGMENT CLAMSHELLS

- FOOD SERVICE PACKAGING MARKET SEGMENT BY APPLICATION (2017-2032)

- FOOD SERVICE PACKAGING SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEGMENT ALCOHOLIC BEVERAGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEGMENT NON-ALCOHOLIC BEVERAGES

- SEGMENT FRUITS&VEGETABLES

- SEGMENT DAIRY PRODUCTS

- SEGMENT BAKERY & CONFECTIONERY

- SEGMENT MEAT & POULTRY

- FOOD SERVICE PACKAGING MARKET SEGMENT BY MATERIAL (2017-2032)

- FOOD SERVICE PACKAGING SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEGMENT GLASS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEGMENT METAL

- SEGMENT PAPER & PAPERBOARD

- SEGMENT PLASTIC

- SEGMENT WOOD

- FOOD SERVICE PACKAGING MARKET SEGMENT BY NATURE (2017-2032)

- FOOD SERVICE PACKAGING SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEGMENT RIGID

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEGMENT SEMI-RIGID

- SEGMENT FLEXIBLE

- FOOD SERVICE PACKAGING MARKET SEGMENT BY END-USERS (2017-2032)

- FOOD SERVICE PACKAGING SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SEGMENT HOTELS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SEGMENT RESTAURANTS & CAFE

- SEGMENT CATERING & EVENTS

- SEGMENT INSTITUTIONAL FOOD SERVICE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Benchmarking

- Food Service Packaging Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- COMPANY SEALED AIR CORPORATION

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- COMPETITIVE LANDSCAPE

- SONOCO PRODUCTS COMPANY (U.S.)

- BERRY GLOBAL INC. (U.S.)

- WESTROCK COMPANY (U.S.)

- GENPAK LLC (U.S.)

- PACTIV LLC (U.S.)

- THE DOW CHEMICAL COMPANY (U.S.)

- BEMIS COMPANY, INC. (U.S.)

- INTERNATIONAL PAPER COMPANY (U.S.)

- BALL CORPORATION (U.S.)

- DART CONTAINER CORPORATION (U.S.)

- ANCHOR PACKAGING INC. (U.S.)

- SABERT CORPORATION (U.S.)

- UNION PACKAGING (U.S.)

- FABRI-KAL (U.S.)

- EXCELLENT PACKAGING & SUPPLY (U.S.)

- ROCKTENN COMPANY (NOW PART OF WESTROCK COMPANY) (U.S.)

- LETICA CORPORATION (U.S.)

- GREIF INCORPORATED (U.S.)

- AMPAC PACKAGING LLC (U.S.)

- AMCOR PLC (SWITZERLAND)

- TETRA PAK INTERNATIONAL S.A. (SWITZERLAND)

- AMCOR LIMITED (AUSTRALIA)

- CHANTLER PACKAGES (CANADA)

- WINPAK LIMITED (CANADA)

- BSI BIODEGRADABLE SOLUTION (CANADA)

- MONDI GROUP (AUSTRIA)

- CONSTANTIA FLEXIBLES (AUSTRIA)

- REYNOLDS GROUP HOLDINGS LIMITED (NEW ZEALAND)

- DS SMITH PLC (U.K.)

- VEGWARE (U.K.)

- HUHTAMAKI OYJ (FINLAND)

- STORA ENSO (FINLAND) AND OTHERS ARE MAJOR PLAYERS.

- GLOBAL FOOD SERVICE PACKAGING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Material

- Historic And Forecasted Market Size By Nature

- Historic And Forecasted Market Size By End-user

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Food Service Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

132.80 Billion |

|

Forecast Period 2024-32 CAGR: |

8.3% |

Market Size in 2032: |

272.18 Billion |

|

Segments Covered: |

By Material |

|

|

|

|

By Nature |

|

|

|

|

By Type |

|

|

|

|

By Application |

|

|

|

|

By End-users |

|

|

|

|

By Region |

|

|

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Sealed Air Corporation (U.S.), Sonoco Products Company (U.S.), Berry Global Inc. (U.S.), WestRock Company (U.S.), Genpak LLC (U.S.), Pactiv LLC (U.S.), The Dow Chemical Company (U.S.), Bemis Company, Inc. (U.S.), International Paper Company (U.S.) and other major players. |

||

Frequently Asked Questions :

The forecast period in the Food Service Packaging Market research report is 2024-2032.

Sealed Air Corporation (U.S.), Sonoco Products Company (U.S.), Berry Global Inc. (U.S.), WestRock Company (U.S.), Genpak LLC (U.S.), Pactiv LLC (U.S.), The Dow Chemical Company (U.S.), Bemis Company, Inc. (U.S.), International Paper Company (U.S.), Ball Corporation (U.S.), Dart Container Corporation (U.S.), Anchor Packaging Inc. (U.S.), Sabert Corporation (U.S.), Union Packaging (U.S.), Fabri-Kal (U.S.), Excellent Packaging & Supply (U.S.), RockTenn Company (now part of WestRock Company) (U.S.), Letica Corporation (U.S.), Greif Incorporated (U.S.), Ampac Packaging LLC (U.S.), Amcor plc (Switzerland), Tetra Pak International S.A. (Switzerland), Amcor Limited (Australia), Chantler Packages (Canada), Winpak Limited (Canada), BSI Biodegradable Solution (Canada), Mondi Group (Austria), Constantia Flexibles (Austria), Reynolds Group Holdings Limited (New Zealand), DS Smith Plc (U.K.), Vegware (U.K.), Huhtamaki Oyj (Finland), Stora Enso (Finland) and Others are Major Players.

The Food Service Packaging Market is segmented into Material, Nature, Type, Application, End-user, and region. By Material, the market is categorized into Glass, Metal, Paper & Paperboard, Plastic, and Wood. By Nature, the market is categorized into Rigid, Semi-rigid, and Flexible. By Type, the market is categorized as Bags & Pouches, Films & Wraps, Stick Packs & Sachets, Bottles & Jars, Boxes & Cartons, Cans, Trays, and Clamshells. By Application, the market is categorized as Alcoholic beverages, Non-alcoholic beverages, Fruits and vegetables, Dairy products, Bakery & Confectionery, Meat & Poultry. By End-users, the market is categorized as Hotels, Restaurants & Café, Catering and Events, Institutional Foodservice. By regions, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Food Service Packaging Market refers to the industry segment that manufactures and sells packaging products specifically designed for use in the food service sector. This includes packaging solutions for restaurants, fast food outlets, cafes, catering services, and other food delivery and takeaway businesses. The market encompasses a wide range of packaging materials and products aimed at ensuring the safe, hygienic, and convenient transportation and consumption of food and beverages.

Food Service Packaging Market Size Was Valued at USD 132.80 Billion in 2023 and is Projected to Reach 272.18 Billion by 2032, Growing at a CAGR of 8.3% From 2024-2032.