Global Food Antioxidant Market Overview

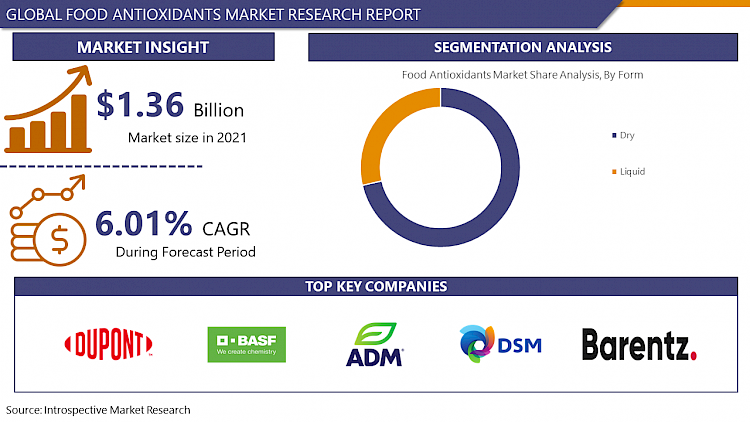

The Global Food Antioxidants market was estimated at USD 1.36 billion in 2021, and is anticipated to reach USD 2.05 billion by 2028, growing at a CAGR of 6.01%.

Antioxidants are natural compounds that minimize damage caused owing to oxygen. It is often referred to as a substance that obstructs oxidation it prevents chemical reaction obtained by free radicals that leads to chain reaction thereby damaging the cells of organisms. It aids to neutralize free radicals in our body. The popular antioxidants are vitamin C, vitamin E, and beta carotene which can prevent the damaging effects of oxidation. Owing to their high stability and low volatility, the antioxidants support to maintain the level of nutrients, the color, functionality, taste, freshness, aroma, texture, and appeal to consumers such as the older person, ceteris paribus. Furthermore, antioxidants are not only in food additives but are also to begin in food supplements and levels should be measured, as such, in body tissues and fluids. In addition, lesser-known sources of antioxidants to that cited in reference abound, for instance, black chokeberry (Aronia melanocarpa) found in jams, juices, purees, and along with, containing high levels of polyphenols and flavonoids, has the ability to interventive value for a range of chronic diseases such as diabetes and cardiovascular diseases which leads to the growth of the market over the forecast period. Fermented grain food supplements also hold antioxidants, e.g., Antioxidant Biofactor, lowering lipid oxidation by searching upon the peroxyl radical.

Market Dynamics and Factors for the Food Antioxidant Market:

Drivers:

The world economic decline had a low effect on the global antioxidants market and the market for antioxidants is anticipated to continue to witness growth over the forecast period. However, shifting eating patterns are influencing the market growth regionally, owing to switching diet patterns, urbanization and population, and economic growth. The global meat market, worldwide, was valued at US$ 838 Bn in 2020 and US$ 868 Bn in 2021.

The global population is anticipated to gain more than 7.99 Bn by 2025, from 6.9 Bn in 2011. Owing to rising life expectancy and strong growth of the agriculture sector, the demand for feed antioxidants in the global meat industry is anticipated to grow over the forecast period. India and Brazil are amongst the global rapidly emerging economies and are witnessing continuous growth in their per capita income. This may cause a standard shift in dietary preferences in these economies.

Antioxidants are applied to food products to preserve their nutrients, flavor, and freshness, thereby intercepting food wastage and extending their overall shelf life. In many situations, two or more antioxidants are used in a food product to boost their food quality protection standards. Preservatives are also used in commercial products to maintain their freshness for a longer time and protect them from bacteria. Antioxidant support prevents oxidation of food containing fat or oil and thereby, prevents it from going foul-smelling.

Apart from that, they prevent the browning of vegetables, cut fruit and fruit juices, and improve their shelf life. For instance, vitamin C, which is also called ascorbic acid, helps recycle vitamin E. Ascorbates, such as vitamin C, help to detach oxygen through the self-oxidation process. For instance, monosodium glutamate is used in processed foods, such as soups, sausages, and sauces. Due to these applications, the demand for antioxidants is anticipated to observe a surge globally, mainly from the packaged food industry.

Restraints:

Some antioxidants are somehow can be high in different food products. Consuming large amounts of antioxidants continuously can grow triglyceride levels, a type of fat in the bloodstream. It raises the risk of heart disease and it can also poorly affect dental health. These are some of the factors that are hampering the growth of the market.

Opportunity:

Rising demand in developing economies for food antioxidants. Though awareness regarding food antioxidants is low, developing economies such as China and India are facing high industrialization. As these developing economies grow and gain high disposable income, their demand for food antioxidants is also growing. The APAC region is displaying increased demand for prepared and functional foods & beverages, and thus, the region's food antioxidants market is anticipated to grow. The demand for food antioxidants is anticipated to grow at a quiet pace in early acquiring countries such as Japan, Germany, and a fractional rate in new & developing markets such as Thailand, Malaysia, and other Asian economies.

Furthermore, the rising world population is putting more pressure on manufacturers for the preparation, extraction, and maintenance of scarce resources. Growing energy prices and increasing raw material costs are affecting food prices, thus impacting low-income consumers. Pressure on food supplies is being compounded by water shortages, particularly over Africa and Northern Asia. Advances in science and technology are helping in improving the shelf life of foods to a greater extent. The requirement for marketing food preservatives to the smallest of food & beverage manufacturers will expand the market size.

Market Segmentation

Based on Type, the synthetic segment accounted for the maximum share in the food antioxidant market. Synthetic food antioxidants are manufactured from petroleum-based products. They are utilized primarily in the food industry to delay lipid oxidation for stabilizing and preserving refined fats & oils within a food system/product. The maximum acceptable limit for synthetic antioxidants varies greatly over countries and is dependent on the food it is being used in. Four types of synthetic antioxidants are mostly used in foods such as BHA, BHT, PG, and TBHQ.

Based on Application, the prepared meat & poultry segment accounted for the maximum market share as well as the highest growth rate in the food antioxidants market. The usage of antioxidants can improve the shelf life of meat & poultry products. Prepared meat & poultry products comprising of fat along with unsaturated fatty acids undergo oxidative degradation during storage. Antioxidants hinder lipid oxidation and minimize rancidity without any unacceptable impact on the nutritional or sensory properties, resulting in quality preservation and boost the shelf life of meat & poultry products.

Based on Form, the dry segment dominates the food antioxidant market over the forecast period. Numerous synthetic food antioxidants are in the dry form, which incorporates fine granular, fine powder, flakes, and tablets. The dry segment recorded a market share in the year 2018. It observes higher demand among food producers, as they are easy to mix with various food products such as prepared meat & poultry products, bakery & confectionery, prepared snacks, and are easy to store and handle. The producers process them to convert them into a form highly suitable for stakeholders.

Based on Source, the market is categorized into fruits and vegetables, oils, spices & herbs, botanical extracts, gallic acids, nuts & seeds, and petroleum. There are various natural sources from where antioxidants are obtained. Depending on the further application, the source is decided. Fruits and vegetables and nuts and seeds are utilized as they are. Oils are usually added to prepared foods to enhance their shelf life and inhibit oxidation.

Players Covered in Food Antioxidant market are :

- VDH Chem Tech Pvt Ltd (India)

- Yasho Industries (India)

- Nagase Group (Japan)

- Fooodchem International Corporation (US)

- Guangzhou ZIO Chemicals Co. Ltd (China)

- Koninklijke DSM N.V. (Netherlands)

- Kemin Industries Inc. (the US)

- DuPont (US)

- Eastman Chemical Company (US)

- Barentz Group (Netherlands)

- Camlin Fine Sciences (India)

- Kalsec Inc. (US)

- Frutarom Ltd (Israel)

- BTSA (Spain)

- Archer-Daniels-Midland Company (US)

- Vitablend Nederland BV (Netherlands)

- Sasol Limited (South Africa)

- Advanced Organic Materials (Germany)

- Crystal Quinone Pvt Ltd. (India)

- Oxiris Chemicals S.A (Spain)

- Pharmorgana GmBH (Germany)

- Naturex (France)

- BASF SE (Germany)

- 3A Antioxidants (US) and Other major players.

Regional Analysis for Food Antioxidant Market:

- In the Asia Pacific region, the food & beverages sector is greatly impacted by the consumer preference for healthy consumption, the trend towards natural and organic foods, and the rising need for convenience food products. With developing countries, increasing industrialization, rising urge for processed foods, and consumer preference for quality products, ingredient suppliers are becoming growingly optimistic about the growth of the food & beverage industry. These trends and preferences have generated a need for new additives in foods, despite the growing consciousness regarding the health hazards related to synthetic food additives.

- The European region is propelled by UK, France, and German food antioxidants market and is expected to gain maximum market share during the forecast period. The product helps to improve the shelf life of bakery products. Growing demand for bakery products due to their appealing taste and easy-to-digest nature is probably to turn regional market growth.

- In Latin America, Brazil's food antioxidants market size may witness remarkable gains in the projected period owing to growing meat and meat product demand. The product is used by meat suppliers to enhance the shelf life of meat products. Rising consciousness regarding nutritious diet and the need to impart genetic taste will act as a crucial role in accelerating the industry size.

COVID-19 Impact on the Food Antioxidant Market:

COVID-19 outbreak on the feed consumption has directed influenced the consumption of meat and livestock products and by-products, such as milk, eggs. This is primarily owing to feed supply shortages as a result of the shutdown of many units and completed lockdown in major economies. Furthermore, there is an increased suspicion among consumers towards the utilization of poultry products owing to the scare of the covid-19 outbreak getting spread to humans by the consumption. This has declined the demand for animal feed in the global market. Because of this pandemic, "panic-buying" became more widespread for grocery and food ingredients. The supermarkets observed a surge in demand for yeast products, both active and inactive. To accomplish the demand in the beginning phase of the pandemic, various sellers had cut up the bulk product packaging and sold in smaller sachets. Notwithstanding the challenges produced by the coronavirus, by the International Food Additives Council (IFAC), the safety and quality of the global food supply remain healthy, and that food additives/antioxidants continue to act as a crucial role in maintaining the quality of food products at home. The food additives/antioxidants make sure food products remain shelf-stable, improve the product shelf life, and allow consumers to stock up on food products without fear of sudden expiration. Throughout this pandemic challenging time, the consumers are often reducing their time in stores and supermarkets but are also stocking up on food and packaged foods containing food additives as an instable solution. According to IFAC, in addition to giving to taste, texture, freshness, and the overall appearance of food, food additives contribute to product stability and shelf life.

Key Industry Developments of the Food Antioxidant Market:

- In December 2019, BASF launched the second phase of its latest, world-scale antioxidants production plant at its Caojing site in Shanghai, China. The second phase incorporates a synthesis plant to manufacture the antioxidants Irgafos® 168 and Irganox® 1076. By the completion of the second phase, the plant would have an annual capacity of 42,000 tons, mainly catering to consumers in China.

- In October 2020, a Netherlands-based Barentz inaugurated the accretion of Maroon Group, one of the leading distributors of specialty chemicals (CASE and HI&I) and life science ingredients over North America. This accession would support the company build up its foothold further in North America and become a global leader in the life science and broader specialty chemical industries.

|

Global Food Antioxidant Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.36 Bn. |

|

Forecast Period 2022-28 CAGR: |

6.01% |

Market Size in 2028: |

USD 2.05 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Source |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Application

3.3 By Source

3.4 By Form

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

3.5.1 Drivers

3.5.2 Restraints

3.5.3 Opportunities

3.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 4: Food Antioxidant Market by Type

4.1 Food Antioxidant Market Overview Snapshot and Growth Engine

4.2 Food Antioxidant Market Overview

4.3 Natural

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size (2016-2028F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Natural: Grographic Segmentation

4.4 Synthetic

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size (2016-2028F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Synthetic: Grographic Segmentation

Chapter 5: Food Antioxidant Market by Application

5.1 Food Antioxidant Market Overview Snapshot and Growth Engine

5.2 Food Antioxidant Market Overview

5.3 Prepared Foods

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Prepared Foods: Grographic Segmentation

5.4 Prepared Meat & Poultry

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Prepared Meat & Poultry: Grographic Segmentation

5.5 Fats & Oils

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Fats & Oils: Grographic Segmentation

5.6 Beverages

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Beverages: Grographic Segmentation

5.7 Bakery 7 Confectionery

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Bakery 7 Confectionery: Grographic Segmentation

5.8 Seafood And

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size (2016-2028F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Seafood And: Grographic Segmentation

5.9 Others

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size (2016-2028F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Others: Grographic Segmentation

Chapter 6: Food Antioxidant Market by Source

6.1 Food Antioxidant Market Overview Snapshot and Growth Engine

6.2 Food Antioxidant Market Overview

6.3 Fruits And Vegetables

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Fruits And Vegetables: Grographic Segmentation

6.4 Oils

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Oils: Grographic Segmentation

6.5 Spices & Herbs

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Spices & Herbs: Grographic Segmentation

6.6 Botanical Extracts

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Botanical Extracts: Grographic Segmentation

6.7 Gallic Acids

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Gallic Acids: Grographic Segmentation

6.8 Nuts & Seeds

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2016-2028F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Nuts & Seeds: Grographic Segmentation

6.9 Petroleum

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size (2016-2028F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Petroleum: Grographic Segmentation

Chapter 7: Food Antioxidant Market by Form

7.1 Food Antioxidant Market Overview Snapshot and Growth Engine

7.2 Food Antioxidant Market Overview

7.3 Dry

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Dry: Grographic Segmentation

7.4 Liquid

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Liquid: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Food Antioxidant Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Food Antioxidant Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Food Antioxidant Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 VDH CHEM TECH PVT LTD (INDIA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 YASHO INDUSTRIES (INDIA)

8.4 NAGASE GROUP (JAPAN)

8.5 FOOODCHEM INTERNATIONAL CORPORATION (US)

8.6 GUANGZHOU ZIO CHEMICALS CO. LTD (CHINA)

8.7 KONINKLIJKE DSM N.V. (NETHERLANDS)

8.8 KEMIN INDUSTRIES INC. (THE US)

8.9 DUPONT (US)

8.10 EASTMAN CHEMICAL COMPANY (US)

8.11 BARENTZ GROUP (NETHERLANDS)

8.12 CAMLIN FINE SCIENCES (INDIA)

8.13 KALSEC INC. (US)

8.14 FRUTAROM LTD (ISRAEL)

8.15 BTSA (SPAIN)

8.16 ARCHER-DANIELS-MIDLAND COMPANY (US)

8.17 VITABLEND NEDERLAND BV (NETHERLANDS)

8.18 SASOL LIMITED (SOUTH AFRICA)

8.19 ADVANCED ORGANIC MATERIALS (GERMANY)

8.20 CRYSTAL QUINONE PVT LTD. (INDIA)

8.21 OXIRIS CHEMICALS S.A (SPAIN)

8.22 PHARMORGANA GMBH (GERMANY)

8.23 NATUREX (FRANCE)

8.24 BASF SE (GERMANY)

8.25 3A ANTIOXIDANTS (US)

8.26 OTHERS

Chapter 9: Global Food Antioxidant Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Natural

9.2.2 Synthetic

9.3 Historic and Forecasted Market Size By Application

9.3.1 Prepared Foods

9.3.2 Prepared Meat & Poultry

9.3.3 Fats & Oils

9.3.4 Beverages

9.3.5 Bakery 7 Confectionery

9.3.6 Seafood And

9.3.7 Others

9.4 Historic and Forecasted Market Size By Source

9.4.1 Fruits And Vegetables

9.4.2 Oils

9.4.3 Spices & Herbs

9.4.4 Botanical Extracts

9.4.5 Gallic Acids

9.4.6 Nuts & Seeds

9.4.7 Petroleum

9.5 Historic and Forecasted Market Size By Form

9.5.1 Dry

9.5.2 Liquid

Chapter 10: North America Food Antioxidant Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Natural

10.4.2 Synthetic

10.5 Historic and Forecasted Market Size By Application

10.5.1 Prepared Foods

10.5.2 Prepared Meat & Poultry

10.5.3 Fats & Oils

10.5.4 Beverages

10.5.5 Bakery 7 Confectionery

10.5.6 Seafood And

10.5.7 Others

10.6 Historic and Forecasted Market Size By Source

10.6.1 Fruits And Vegetables

10.6.2 Oils

10.6.3 Spices & Herbs

10.6.4 Botanical Extracts

10.6.5 Gallic Acids

10.6.6 Nuts & Seeds

10.6.7 Petroleum

10.7 Historic and Forecasted Market Size By Form

10.7.1 Dry

10.7.2 Liquid

10.8 Historic and Forecast Market Size by Country

10.8.1 U.S.

10.8.2 Canada

10.8.3 Mexico

Chapter 11: Europe Food Antioxidant Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Natural

11.4.2 Synthetic

11.5 Historic and Forecasted Market Size By Application

11.5.1 Prepared Foods

11.5.2 Prepared Meat & Poultry

11.5.3 Fats & Oils

11.5.4 Beverages

11.5.5 Bakery 7 Confectionery

11.5.6 Seafood And

11.5.7 Others

11.6 Historic and Forecasted Market Size By Source

11.6.1 Fruits And Vegetables

11.6.2 Oils

11.6.3 Spices & Herbs

11.6.4 Botanical Extracts

11.6.5 Gallic Acids

11.6.6 Nuts & Seeds

11.6.7 Petroleum

11.7 Historic and Forecasted Market Size By Form

11.7.1 Dry

11.7.2 Liquid

11.8 Historic and Forecast Market Size by Country

11.8.1 Germany

11.8.2 U.K.

11.8.3 France

11.8.4 Italy

11.8.5 Russia

11.8.6 Spain

Chapter 12: Asia-Pacific Food Antioxidant Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Natural

12.4.2 Synthetic

12.5 Historic and Forecasted Market Size By Application

12.5.1 Prepared Foods

12.5.2 Prepared Meat & Poultry

12.5.3 Fats & Oils

12.5.4 Beverages

12.5.5 Bakery 7 Confectionery

12.5.6 Seafood And

12.5.7 Others

12.6 Historic and Forecasted Market Size By Source

12.6.1 Fruits And Vegetables

12.6.2 Oils

12.6.3 Spices & Herbs

12.6.4 Botanical Extracts

12.6.5 Gallic Acids

12.6.6 Nuts & Seeds

12.6.7 Petroleum

12.7 Historic and Forecasted Market Size By Form

12.7.1 Dry

12.7.2 Liquid

12.8 Historic and Forecast Market Size by Country

12.8.1 China

12.8.2 India

12.8.3 Japan

12.8.4 Southeast Asia

Chapter 13: South America Food Antioxidant Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Natural

13.4.2 Synthetic

13.5 Historic and Forecasted Market Size By Application

13.5.1 Prepared Foods

13.5.2 Prepared Meat & Poultry

13.5.3 Fats & Oils

13.5.4 Beverages

13.5.5 Bakery 7 Confectionery

13.5.6 Seafood And

13.5.7 Others

13.6 Historic and Forecasted Market Size By Source

13.6.1 Fruits And Vegetables

13.6.2 Oils

13.6.3 Spices & Herbs

13.6.4 Botanical Extracts

13.6.5 Gallic Acids

13.6.6 Nuts & Seeds

13.6.7 Petroleum

13.7 Historic and Forecasted Market Size By Form

13.7.1 Dry

13.7.2 Liquid

13.8 Historic and Forecast Market Size by Country

13.8.1 Brazil

13.8.2 Argentina

Chapter 14: Middle East & Africa Food Antioxidant Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Natural

14.4.2 Synthetic

14.5 Historic and Forecasted Market Size By Application

14.5.1 Prepared Foods

14.5.2 Prepared Meat & Poultry

14.5.3 Fats & Oils

14.5.4 Beverages

14.5.5 Bakery 7 Confectionery

14.5.6 Seafood And

14.5.7 Others

14.6 Historic and Forecasted Market Size By Source

14.6.1 Fruits And Vegetables

14.6.2 Oils

14.6.3 Spices & Herbs

14.6.4 Botanical Extracts

14.6.5 Gallic Acids

14.6.6 Nuts & Seeds

14.6.7 Petroleum

14.7 Historic and Forecasted Market Size By Form

14.7.1 Dry

14.7.2 Liquid

14.8 Historic and Forecast Market Size by Country

14.8.1 Saudi Arabia

14.8.2 South Africa

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Food Antioxidant Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.36 Bn. |

|

Forecast Period 2022-28 CAGR: |

6.01% |

Market Size in 2028: |

USD 2.05 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Source |

|

||

|

By Form |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FOOD ANTIOXIDANT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FOOD ANTIOXIDANT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FOOD ANTIOXIDANT MARKET COMPETITIVE RIVALRY

TABLE 005. FOOD ANTIOXIDANT MARKET THREAT OF NEW ENTRANTS

TABLE 006. FOOD ANTIOXIDANT MARKET THREAT OF SUBSTITUTES

TABLE 007. FOOD ANTIOXIDANT MARKET BY TYPE

TABLE 008. NATURAL MARKET OVERVIEW (2016-2028)

TABLE 009. SYNTHETIC MARKET OVERVIEW (2016-2028)

TABLE 010. FOOD ANTIOXIDANT MARKET BY APPLICATION

TABLE 011. PREPARED FOODS MARKET OVERVIEW (2016-2028)

TABLE 012. PREPARED MEAT & POULTRY MARKET OVERVIEW (2016-2028)

TABLE 013. FATS & OILS MARKET OVERVIEW (2016-2028)

TABLE 014. BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 015. BAKERY 7 CONFECTIONERY MARKET OVERVIEW (2016-2028)

TABLE 016. SEAFOOD AND MARKET OVERVIEW (2016-2028)

TABLE 017. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. FOOD ANTIOXIDANT MARKET BY SOURCE

TABLE 019. FRUITS AND VEGETABLES MARKET OVERVIEW (2016-2028)

TABLE 020. OILS MARKET OVERVIEW (2016-2028)

TABLE 021. SPICES & HERBS MARKET OVERVIEW (2016-2028)

TABLE 022. BOTANICAL EXTRACTS MARKET OVERVIEW (2016-2028)

TABLE 023. GALLIC ACIDS MARKET OVERVIEW (2016-2028)

TABLE 024. NUTS & SEEDS MARKET OVERVIEW (2016-2028)

TABLE 025. PETROLEUM MARKET OVERVIEW (2016-2028)

TABLE 026. FOOD ANTIOXIDANT MARKET BY FORM

TABLE 027. DRY MARKET OVERVIEW (2016-2028)

TABLE 028. LIQUID MARKET OVERVIEW (2016-2028)

TABLE 029. NORTH AMERICA FOOD ANTIOXIDANT MARKET, BY TYPE (2016-2028)

TABLE 030. NORTH AMERICA FOOD ANTIOXIDANT MARKET, BY APPLICATION (2016-2028)

TABLE 031. NORTH AMERICA FOOD ANTIOXIDANT MARKET, BY SOURCE (2016-2028)

TABLE 032. NORTH AMERICA FOOD ANTIOXIDANT MARKET, BY FORM (2016-2028)

TABLE 033. N FOOD ANTIOXIDANT MARKET, BY COUNTRY (2016-2028)

TABLE 034. EUROPE FOOD ANTIOXIDANT MARKET, BY TYPE (2016-2028)

TABLE 035. EUROPE FOOD ANTIOXIDANT MARKET, BY APPLICATION (2016-2028)

TABLE 036. EUROPE FOOD ANTIOXIDANT MARKET, BY SOURCE (2016-2028)

TABLE 037. EUROPE FOOD ANTIOXIDANT MARKET, BY FORM (2016-2028)

TABLE 038. FOOD ANTIOXIDANT MARKET, BY COUNTRY (2016-2028)

TABLE 039. ASIA PACIFIC FOOD ANTIOXIDANT MARKET, BY TYPE (2016-2028)

TABLE 040. ASIA PACIFIC FOOD ANTIOXIDANT MARKET, BY APPLICATION (2016-2028)

TABLE 041. ASIA PACIFIC FOOD ANTIOXIDANT MARKET, BY SOURCE (2016-2028)

TABLE 042. ASIA PACIFIC FOOD ANTIOXIDANT MARKET, BY FORM (2016-2028)

TABLE 043. FOOD ANTIOXIDANT MARKET, BY COUNTRY (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA FOOD ANTIOXIDANT MARKET, BY TYPE (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA FOOD ANTIOXIDANT MARKET, BY APPLICATION (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA FOOD ANTIOXIDANT MARKET, BY SOURCE (2016-2028)

TABLE 047. MIDDLE EAST & AFRICA FOOD ANTIOXIDANT MARKET, BY FORM (2016-2028)

TABLE 048. FOOD ANTIOXIDANT MARKET, BY COUNTRY (2016-2028)

TABLE 049. SOUTH AMERICA FOOD ANTIOXIDANT MARKET, BY TYPE (2016-2028)

TABLE 050. SOUTH AMERICA FOOD ANTIOXIDANT MARKET, BY APPLICATION (2016-2028)

TABLE 051. SOUTH AMERICA FOOD ANTIOXIDANT MARKET, BY SOURCE (2016-2028)

TABLE 052. SOUTH AMERICA FOOD ANTIOXIDANT MARKET, BY FORM (2016-2028)

TABLE 053. FOOD ANTIOXIDANT MARKET, BY COUNTRY (2016-2028)

TABLE 054. VDH CHEM TECH PVT LTD (INDIA): SNAPSHOT

TABLE 055. VDH CHEM TECH PVT LTD (INDIA): BUSINESS PERFORMANCE

TABLE 056. VDH CHEM TECH PVT LTD (INDIA): PRODUCT PORTFOLIO

TABLE 057. VDH CHEM TECH PVT LTD (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. YASHO INDUSTRIES (INDIA): SNAPSHOT

TABLE 058. YASHO INDUSTRIES (INDIA): BUSINESS PERFORMANCE

TABLE 059. YASHO INDUSTRIES (INDIA): PRODUCT PORTFOLIO

TABLE 060. YASHO INDUSTRIES (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. NAGASE GROUP (JAPAN): SNAPSHOT

TABLE 061. NAGASE GROUP (JAPAN): BUSINESS PERFORMANCE

TABLE 062. NAGASE GROUP (JAPAN): PRODUCT PORTFOLIO

TABLE 063. NAGASE GROUP (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. FOOODCHEM INTERNATIONAL CORPORATION (US): SNAPSHOT

TABLE 064. FOOODCHEM INTERNATIONAL CORPORATION (US): BUSINESS PERFORMANCE

TABLE 065. FOOODCHEM INTERNATIONAL CORPORATION (US): PRODUCT PORTFOLIO

TABLE 066. FOOODCHEM INTERNATIONAL CORPORATION (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. GUANGZHOU ZIO CHEMICALS CO. LTD (CHINA): SNAPSHOT

TABLE 067. GUANGZHOU ZIO CHEMICALS CO. LTD (CHINA): BUSINESS PERFORMANCE

TABLE 068. GUANGZHOU ZIO CHEMICALS CO. LTD (CHINA): PRODUCT PORTFOLIO

TABLE 069. GUANGZHOU ZIO CHEMICALS CO. LTD (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. KONINKLIJKE DSM N.V. (NETHERLANDS): SNAPSHOT

TABLE 070. KONINKLIJKE DSM N.V. (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 071. KONINKLIJKE DSM N.V. (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 072. KONINKLIJKE DSM N.V. (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. KEMIN INDUSTRIES INC. (THE US): SNAPSHOT

TABLE 073. KEMIN INDUSTRIES INC. (THE US): BUSINESS PERFORMANCE

TABLE 074. KEMIN INDUSTRIES INC. (THE US): PRODUCT PORTFOLIO

TABLE 075. KEMIN INDUSTRIES INC. (THE US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. DUPONT (US): SNAPSHOT

TABLE 076. DUPONT (US): BUSINESS PERFORMANCE

TABLE 077. DUPONT (US): PRODUCT PORTFOLIO

TABLE 078. DUPONT (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. EASTMAN CHEMICAL COMPANY (US): SNAPSHOT

TABLE 079. EASTMAN CHEMICAL COMPANY (US): BUSINESS PERFORMANCE

TABLE 080. EASTMAN CHEMICAL COMPANY (US): PRODUCT PORTFOLIO

TABLE 081. EASTMAN CHEMICAL COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. BARENTZ GROUP (NETHERLANDS): SNAPSHOT

TABLE 082. BARENTZ GROUP (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 083. BARENTZ GROUP (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 084. BARENTZ GROUP (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. CAMLIN FINE SCIENCES (INDIA): SNAPSHOT

TABLE 085. CAMLIN FINE SCIENCES (INDIA): BUSINESS PERFORMANCE

TABLE 086. CAMLIN FINE SCIENCES (INDIA): PRODUCT PORTFOLIO

TABLE 087. CAMLIN FINE SCIENCES (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. KALSEC INC. (US): SNAPSHOT

TABLE 088. KALSEC INC. (US): BUSINESS PERFORMANCE

TABLE 089. KALSEC INC. (US): PRODUCT PORTFOLIO

TABLE 090. KALSEC INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. FRUTAROM LTD (ISRAEL): SNAPSHOT

TABLE 091. FRUTAROM LTD (ISRAEL): BUSINESS PERFORMANCE

TABLE 092. FRUTAROM LTD (ISRAEL): PRODUCT PORTFOLIO

TABLE 093. FRUTAROM LTD (ISRAEL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. BTSA (SPAIN): SNAPSHOT

TABLE 094. BTSA (SPAIN): BUSINESS PERFORMANCE

TABLE 095. BTSA (SPAIN): PRODUCT PORTFOLIO

TABLE 096. BTSA (SPAIN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. ARCHER-DANIELS-MIDLAND COMPANY (US): SNAPSHOT

TABLE 097. ARCHER-DANIELS-MIDLAND COMPANY (US): BUSINESS PERFORMANCE

TABLE 098. ARCHER-DANIELS-MIDLAND COMPANY (US): PRODUCT PORTFOLIO

TABLE 099. ARCHER-DANIELS-MIDLAND COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. VITABLEND NEDERLAND BV (NETHERLANDS): SNAPSHOT

TABLE 100. VITABLEND NEDERLAND BV (NETHERLANDS): BUSINESS PERFORMANCE

TABLE 101. VITABLEND NEDERLAND BV (NETHERLANDS): PRODUCT PORTFOLIO

TABLE 102. VITABLEND NEDERLAND BV (NETHERLANDS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. SASOL LIMITED (SOUTH AFRICA): SNAPSHOT

TABLE 103. SASOL LIMITED (SOUTH AFRICA): BUSINESS PERFORMANCE

TABLE 104. SASOL LIMITED (SOUTH AFRICA): PRODUCT PORTFOLIO

TABLE 105. SASOL LIMITED (SOUTH AFRICA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. ADVANCED ORGANIC MATERIALS (GERMANY): SNAPSHOT

TABLE 106. ADVANCED ORGANIC MATERIALS (GERMANY): BUSINESS PERFORMANCE

TABLE 107. ADVANCED ORGANIC MATERIALS (GERMANY): PRODUCT PORTFOLIO

TABLE 108. ADVANCED ORGANIC MATERIALS (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 108. CRYSTAL QUINONE PVT LTD. (INDIA): SNAPSHOT

TABLE 109. CRYSTAL QUINONE PVT LTD. (INDIA): BUSINESS PERFORMANCE

TABLE 110. CRYSTAL QUINONE PVT LTD. (INDIA): PRODUCT PORTFOLIO

TABLE 111. CRYSTAL QUINONE PVT LTD. (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 111. OXIRIS CHEMICALS S.A (SPAIN): SNAPSHOT

TABLE 112. OXIRIS CHEMICALS S.A (SPAIN): BUSINESS PERFORMANCE

TABLE 113. OXIRIS CHEMICALS S.A (SPAIN): PRODUCT PORTFOLIO

TABLE 114. OXIRIS CHEMICALS S.A (SPAIN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 114. PHARMORGANA GMBH (GERMANY): SNAPSHOT

TABLE 115. PHARMORGANA GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 116. PHARMORGANA GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 117. PHARMORGANA GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 117. NATUREX (FRANCE): SNAPSHOT

TABLE 118. NATUREX (FRANCE): BUSINESS PERFORMANCE

TABLE 119. NATUREX (FRANCE): PRODUCT PORTFOLIO

TABLE 120. NATUREX (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 120. BASF SE (GERMANY): SNAPSHOT

TABLE 121. BASF SE (GERMANY): BUSINESS PERFORMANCE

TABLE 122. BASF SE (GERMANY): PRODUCT PORTFOLIO

TABLE 123. BASF SE (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 123. 3A ANTIOXIDANTS (US): SNAPSHOT

TABLE 124. 3A ANTIOXIDANTS (US): BUSINESS PERFORMANCE

TABLE 125. 3A ANTIOXIDANTS (US): PRODUCT PORTFOLIO

TABLE 126. 3A ANTIOXIDANTS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 126. OTHERS: SNAPSHOT

TABLE 127. OTHERS: BUSINESS PERFORMANCE

TABLE 128. OTHERS: PRODUCT PORTFOLIO

TABLE 129. OTHERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FOOD ANTIOXIDANT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FOOD ANTIOXIDANT MARKET OVERVIEW BY TYPE

FIGURE 012. NATURAL MARKET OVERVIEW (2016-2028)

FIGURE 013. SYNTHETIC MARKET OVERVIEW (2016-2028)

FIGURE 014. FOOD ANTIOXIDANT MARKET OVERVIEW BY APPLICATION

FIGURE 015. PREPARED FOODS MARKET OVERVIEW (2016-2028)

FIGURE 016. PREPARED MEAT & POULTRY MARKET OVERVIEW (2016-2028)

FIGURE 017. FATS & OILS MARKET OVERVIEW (2016-2028)

FIGURE 018. BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 019. BAKERY 7 CONFECTIONERY MARKET OVERVIEW (2016-2028)

FIGURE 020. SEAFOOD AND MARKET OVERVIEW (2016-2028)

FIGURE 021. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. FOOD ANTIOXIDANT MARKET OVERVIEW BY SOURCE

FIGURE 023. FRUITS AND VEGETABLES MARKET OVERVIEW (2016-2028)

FIGURE 024. OILS MARKET OVERVIEW (2016-2028)

FIGURE 025. SPICES & HERBS MARKET OVERVIEW (2016-2028)

FIGURE 026. BOTANICAL EXTRACTS MARKET OVERVIEW (2016-2028)

FIGURE 027. GALLIC ACIDS MARKET OVERVIEW (2016-2028)

FIGURE 028. NUTS & SEEDS MARKET OVERVIEW (2016-2028)

FIGURE 029. PETROLEUM MARKET OVERVIEW (2016-2028)

FIGURE 030. FOOD ANTIOXIDANT MARKET OVERVIEW BY FORM

FIGURE 031. DRY MARKET OVERVIEW (2016-2028)

FIGURE 032. LIQUID MARKET OVERVIEW (2016-2028)

FIGURE 033. NORTH AMERICA FOOD ANTIOXIDANT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. EUROPE FOOD ANTIOXIDANT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. ASIA PACIFIC FOOD ANTIOXIDANT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. MIDDLE EAST & AFRICA FOOD ANTIOXIDANT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 037. SOUTH AMERICA FOOD ANTIOXIDANT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Food Antioxidants Market research report is 2022-2028.

Nagase Group, Koninklijke DSM N.V., Barentz Group, Archer-Daniels-Midland Company, BASF SE, DuPont, Naturex, and Other Major Players.

The Food Antioxidants Market is segmented into Type, Application, Source, Form and Region. By Type, the market is categorized into Natural, and Synthetic. By Application, the market is categorized into Prepared Foods, Prepared Meat & Poultry, and Fats & Oils. By Source the market is categorized into Fruits & Vegetables, Oils, Spices & Herbs, Botanical Extracts, Gallic Acids, Nuts & Seeds, Petroleum. By Form, the market is categorized into Dry, and Liquid. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Antioxidants are applied to food products to preserve their nutrients, flavor, and freshness, thereby intercepting food wastage and extending their overall shelf life. In many situations, two or more antioxidants are used in a food product to boost their food quality protection standards. Preservatives are also used in commercial products to maintain their freshness for a longer time and protect them from bacteria. Antioxidant support prevents oxidation of food containing fat or oil and thereby, prevents it from going foul-smelling.

The Global Food Antioxidants market was estimated at USD 1.36 billion in 2021, and is anticipated to reach USD 2.05 billion by 2028, growing at a CAGR of 6.01%.