Global Flavors & Fragrances Market Overview

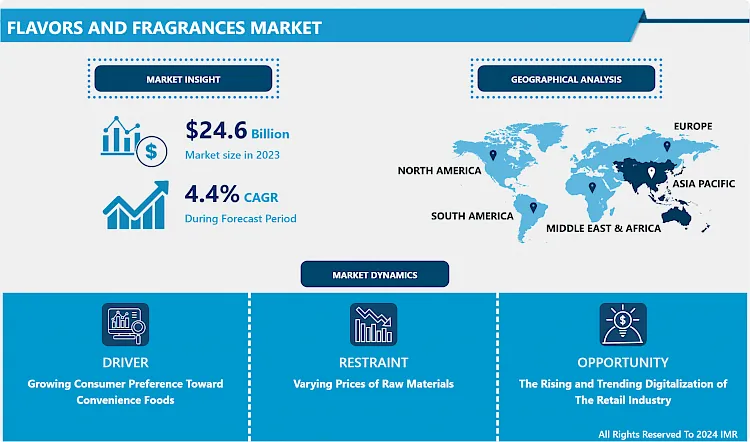

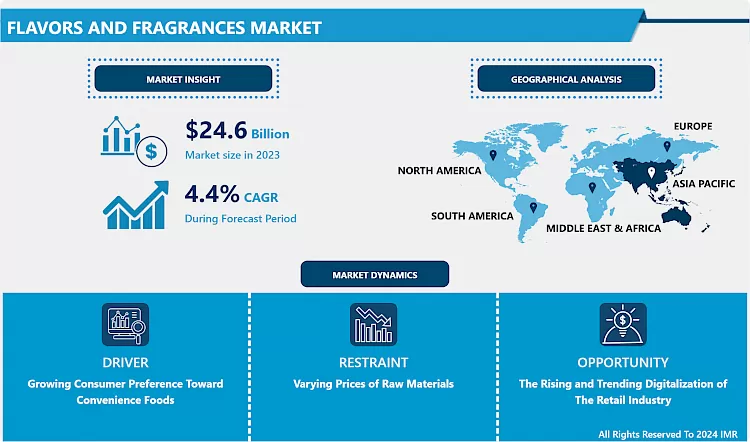

The Global Flavors and Fragrances Market size is expected to grow from USD 24.6 billion in 2023 to USD 36.24 billion by 2032, at a CAGR of 4.4% during the forecast period (2024-2032).

- Flavors and fragrances create scents and tastes for application in an extensive range of consumer products, incorporating prepared foods, personal care, and fine fragrances, household products, cosmetics, and beverages. Natural and synthetic flavor compositions are accountable for the fruity taste of cherry cola and the cool mint flavor of toothpaste. Fragrance compositions mix the fresh scent of pine to household cleaning products and exotic top notes to fine perfumes. Due to these characteristics, the fragrance and flavor are mostly used in perfumes and perfumed products and for the flavoring of food. Whether a product is known as a fragrance or a flavor substance depends on its application and end-users. Additionally, the fragrances and flavors are obtained from synthetic or natural sources. Despite wide applications of flavor and fragrances from synthetic sources, natural sources provide flavor and fragrance materials that are unique and effective.

- Global utilization of flavor and fragrance (F&F) products flavor and fragrance compositions as well as the natural extracts, essential oils, and aroma chemicals that serve as starting materials. The application of aroma chemicals has increased at the expense of beneficial oils and extracts of natural origin. Synthetic aroma chemicals generally provide security of supply and price stability, whereas essential oils and natural extracts can be subject to supply scarcity and price volatility. According to Statista, flavor and fragrance (F&F) are both components that can be found in an extensive variety of consumer goods. The value of the global flavor and fragrance market amounted to some 35 billion U.S. dollars in 2019 and gained almost 36 billion in 2020. As per the market value, the largest of the three divisions within the Flavors and Fragrances industry was the flavor division in 2020. The fragrance came in second, although aroma molecules and cosmetic ingredients manufactured the smallest division.

Market Dynamics For The Flavors And Fragrances Market

Drivers:

- Growing demand for ready-to-eat and convenience foods, health and wellness foods integrated with technological developments are anticipated to trigger the flavors and fragrances market growth. Rising consumer disposable income along with significant industrialization in emerging economies such as India and China are estimated to accelerate the food flavors market.

- Furthermore, convenience foods are commercially processed food products that required little or no further preparation before utilization. They include preserved foods, packaged foods, and ready-to-eat food products. To improve the taste of these products, individual flavor ingredients are added to these food products. Significant urbanization and growth in the working-class population in emerged and emerging economies have increased utilization of convenience foods. Additionally, the growing disposable income of the middle-class population and rising expenditure on convenience foods are anticipated to drive the demand for convenience foods, which in turn, will drive the demand for flavors. In most European and North American economies, a majority of the women population is working, which decreases their time available to cook at home. Owing to this, convenience food becomes an easy solution as it is tasty as well as healthy. Frozen food is also easy to utilize, consume, and store for a longer time, therefore making it more convenient for single households; these factors also add to the popularity of these products among the younger individuals.

Restraints:

- Varying prices of raw materials are anticipated to discourage the demand in this market. Stringent rules and regulations imposed by various governments over the economies on using flavors and fragrances such as US Food and Drug Administration (FDA), European Food Safety Authority, and International Fragrance Association (IFRA). These strict regulations can delay or prevent the introduction of new products, raise the prices of any latest product launched in the market, and may lead to product recalls. Hence, implementation of new regulations and modifications in addition to the existing regulations poorly affect the growth of the flavors and fragrances market over the forecast period.

Opportunities:

- Significant growth in industrialization over the world has led to the growth of huge production of scented or flavored products such as processed food and beverages, soaps, household cleaners, personal care products, detergents, and oral hygiene products. Furthermore, the growing demand for natural ingredients over a large number of consumers could turn the demand in the flavors and fragrances market.

- Moreover, the rising and trending digitalization of the retail industry may create a lucrative opportunity for the flavors and fragrances market. Consumers are induced toward online shopping owing to features of convenience and variety. Gartner has forecasted an increase of 3.6% globally in tech retail spending, which might amount to $218.5 billion by 2021 over the globe. Moreover, factors such as growing smartphone usage, dedicated apps, and developing payment methods accelerate the overall online grocery market, therefore subscribing to the growth of the flavors and fragrance market.

Market Segmentation

Segmentation Analysis of Flavors and Fragrances Market:

- Based on Ingredient Type, the synthetic segment is accounts for the maximum flavors and fragrance market share and is estimated to remain dominant over the forecast period. Synthetic flavors are prepared from a complex mixture of chemical compounds. Usage of synthetic flavors and fragrances has increased in food & beverages and cosmetics & personal care industries due to its low cost and more life span properties.

- Based on Application, the Bakery segment is anticipated to grow owing to an increase in demand for aspirational purchase of global drink brands and rising demand for dietary drinks due to the growing percentage of health-conscious individuals. The consumer products segment is projected to grow owing to augment of organized retail chains, switching lifestyles, and the growing demand for various consumer products such as home care and personal care products

Regional Analysis of Flavors and Fragrances Market:

- Asia Pacific region is expected to hold maximum flavors and fragrance market share during the forecast period. Augmenting economic development in developing economies such as India and is considered responsible for the dominance of Asia Pacific. Additionally, growing countries are rising at a significant rate, thus, the investors are investing heavily in these markets. This is probably to produce massive growth opportunities for the flavor and fragrances market. The demand for flavor and fragrances is anticipated to remain high in developed countries.

- The North American market for flavor and fragrance is developed and thoroughly stable. Therefore, there is a high potential for transformed growth, as the market regains from the economic deflation. The United States is the maximum market for flavors and fragrances in the region, followed by Canada, due to the high utilization of convenience and processed food. Due to the United States' fast-paced food and beverage industries, foreign companies are strengthening their footprints in the country to deliver the most innovative nutritional flavors to serve the rising demand of consumers.?

- European economies have had a strong base in the application of flavors and fragrances for the past few decades. Major industries such as beverages, bakery, dairy products, consumer products, and savory & snacks, use flavors and fragrance to add value to the product. Beverages and consumer products are the maximum end-use industries of flavors and fragrances market, respectively.

Players Covered in Flavors & Fragrances Market are:

- The Archer Daniels Midland Company (ADM) (US)

- Kerry Group (Ireland)

- Mane SA (France)

- Givaudan (Switzerland)

- Bell Flavors & Fragrances (US)

- Firmenich SA (Switzerland)

- International Flavors & Fragrances (IFF) (US)

- Sensient Technologies (US)

- Symrise AG (Germany)

- Takasago (Japan)

- Robertet (France)

- Frutarom (Israel)

- T. Hasegawa (Japan)

- Huabao (China)

- Ogawa & Co.Ltd. (Japan) and Other Major Players.

Key Industry Developments In Flavors And Fragrances Market

-

In Mar 2024, DSM-Firmenich recently inaugurated two new production plants in Castets, southwestern France. The first facility, a multipurpose unit, focuses on producing pine-based ingredients and ensuring a stable supply of finished products and intermediates for the perfume industry. These plants aim to enhance production capacity for renewable ingredients, reinforcing the company’s commitment to sustainability and innovation in perfumery.

-

In Mar 2023, IFF recently unveiled two advanced flavor labs at its Brabrand, Denmark facility. The new sweet and culinary flavor creation labs were the latest additions to the site, which has been operational since 1964. Spanning over 312,150 square feet, the facility houses a variety of resources, including pilot plant manufacturing and evaluation studios. This expansion further strengthens IFF’s commitment to innovation and enhancing its flavor offerings to meet evolving consumer demands in the region. The labs are set to play a key role in driving creativity and development for the company’s diverse product portfolio.

|

Flavors And Fragrances Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.4% |

Market Size in 2032: |

USD 36.24 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Flavors And Fragrances Market by Product Type (2018-2032)

4.1 Flavors And Fragrances Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Natural

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Synthetic

Chapter 5: Flavors And Fragrances Market by Application (2018-2032)

5.1 Flavors And Fragrances Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Confectionary & Bakery Products

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Dairy Products

5.5 Soap & Detergent

5.6 Beverages

5.7 Cosmetics & Toiletries

5.8 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Flavors And Fragrances Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 DOWDUPONTINCBASF SE

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 VCM POLYURETHANES PVT. LTDLANXESS AG

6.4 ACCELLA POLYURETHANE SYSTEMS

6.5 TOSOH CORPORATION

6.6 AXSON TECHNOLOGIES

6.7 CHEMLINE INCCOIM S.P.A (COIM GROUP)

6.8 COVESTRO AG

6.9 WANHUA CHEMICAL GROUP CO.LTD

6.10 HERIKON; HUNTSMAN CORPORATION

6.11 LUC GROUP

6.12 EVERCHEM SPECIALTY CHEMICALS

6.13 MAKRO CHEMICAL ENDUSTRIYEL KIMYASALLAR SAN. VE TIC. LTD. TI

6.14 MITSUI CHEMICALSINCTAIWAN PU CORPORATION

6.15 NOTEDOME LTDPERSTORP HOLDING AB

6.16 SYNTHESIA INTERNACIONAL SLU

6.17 POLYCOAT PRODUCTS LLCRECKLI GMBH

6.18 SAPICI S.P.AERA POLYMERS PTY.LTDAND OTHERS MAJOR KEY PLAYERS.

Chapter 7: Global Flavors And Fragrances Market By Region

7.1 Overview

7.2. North America Flavors And Fragrances Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Natural

7.2.4.2 Synthetic

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Confectionary & Bakery Products

7.2.5.2 Dairy Products

7.2.5.3 Soap & Detergent

7.2.5.4 Beverages

7.2.5.5 Cosmetics & Toiletries

7.2.5.6 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Flavors And Fragrances Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Natural

7.3.4.2 Synthetic

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Confectionary & Bakery Products

7.3.5.2 Dairy Products

7.3.5.3 Soap & Detergent

7.3.5.4 Beverages

7.3.5.5 Cosmetics & Toiletries

7.3.5.6 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Flavors And Fragrances Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Natural

7.4.4.2 Synthetic

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Confectionary & Bakery Products

7.4.5.2 Dairy Products

7.4.5.3 Soap & Detergent

7.4.5.4 Beverages

7.4.5.5 Cosmetics & Toiletries

7.4.5.6 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Flavors And Fragrances Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Natural

7.5.4.2 Synthetic

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Confectionary & Bakery Products

7.5.5.2 Dairy Products

7.5.5.3 Soap & Detergent

7.5.5.4 Beverages

7.5.5.5 Cosmetics & Toiletries

7.5.5.6 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Flavors And Fragrances Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Natural

7.6.4.2 Synthetic

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Confectionary & Bakery Products

7.6.5.2 Dairy Products

7.6.5.3 Soap & Detergent

7.6.5.4 Beverages

7.6.5.5 Cosmetics & Toiletries

7.6.5.6 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Flavors And Fragrances Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Natural

7.7.4.2 Synthetic

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Confectionary & Bakery Products

7.7.5.2 Dairy Products

7.7.5.3 Soap & Detergent

7.7.5.4 Beverages

7.7.5.5 Cosmetics & Toiletries

7.7.5.6 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Flavors And Fragrances Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 24.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.4% |

Market Size in 2032: |

USD 36.24 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Flavors and Fragrances Market research report is 2024-2032.

The Archer Daniels Midland Company (ADM) (US), Kerry Group (Ireland), Mane SA (France), Givaudan (Switzerland), Bell Flavors & Fragrances (US), Firmenich SA (Switzerland), International Flavors & Fragrances (IFF) (US), Sensient Technologies (US), Symrise AG (Germany), Takasago (Japan), Robertet (France), Frutarom (Israel), T. Hasegawa (Japan), Huabao (China), Ogawa & Co., Ltd. (Japan), and other major players.

The Flavors and Fragrances Market is segmented into Product Type, Application, and region. By Product Type, the market is categorized into Natural, Synthetic. By Application, the market is categorized into Confectionary & Bakery Products, Dairy Products, Soap & Detergent, Beverages, Cosmetics & Toiletries, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Flavors and fragrances create scents and tastes for application in an extensive range of consumer products, incorporating prepared foods, personal care, and fine fragrances, household products, cosmetics, and beverages. Natural and synthetic flavor compositions are accountable for the fruity taste of cherry cola and the cool mint flavor of toothpaste. Fragrance compositions mix the fresh scent of pine to household cleaning products and exotic top notes to fine perfumes.

Global Flavors and Fragrances Market size is expected to grow from USD 24.6 billion in 2023 to USD 36.24 billion by 2032, at a CAGR of 4.4% during the forecast period (2024-2032).