Field-Programmable Gate Array (FPGA) Market Synopsis

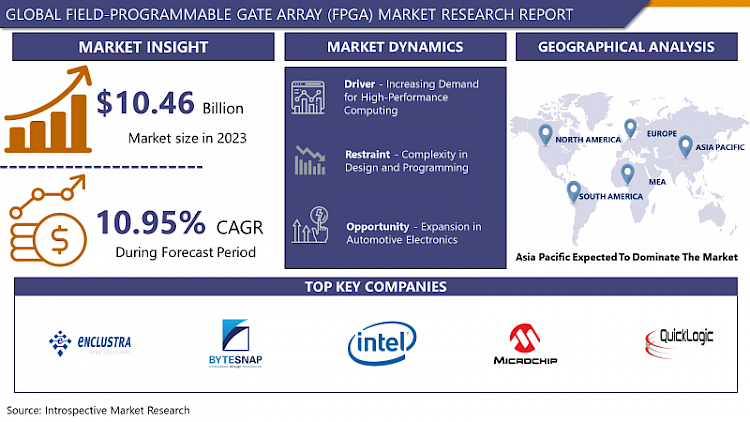

Field-Programmable Gate Array (FPGA) Market Size Was Valued at USD 10.46 Billion in 2023 and is Projected to Reach USD 26.65 Billion by 2032, Growing at a CAGR of 10.95% From 2024-2032.

A Field-Programmable Gate Array (FPGA) is a reconfigurable integrated circuit designed to be customized after manufacturing. It contains an array of programmable logic blocks and interconnects, allowing users to define their digital circuits. FPGAs are utilized in various applications such as prototyping, emulation, and acceleration of algorithms in fields like telecommunications, automotive, and aerospace due to their flexibility, parallelism, and performance.

FPGAs are integrated circuits that can be reprogrammed after manufacturing, allowing for flexible hardware configurations tailored to specific applications. This adaptability has made FPGAs increasingly popular across various industries, including telecommunications, automotive, aerospace, and data centers. FPGAs offer a unique balance of processing power, flexibility, and energy efficiency, making them ideal for tasks such as real-time data processing, artificial intelligence, and machine learning inference.

- Moreover, the proliferation of 5G networks and the Internet of Things (IoT) has created new opportunities for FPGA deployment in wireless communication infrastructure and edge computing devices. FPGAs enable the implementation of custom algorithms and protocols, enhancing system performance and reducing latency.

- Additionally, advancements in FPGA technology, such as increased logic capacity, faster data rates, and improved power efficiency, have expanded their applicability and competitiveness compared to traditional application-specific integrated circuits (ASICs) and general-purpose processors (GPUs).

- The FPGA market is characterized by intense competition among key players such as Xilinx, Intel (formerly Altera), and Lattice Semiconductor, driving innovation and product development. Furthermore, the emergence of cloud-based FPGA services and development tools has democratized access to FPGA technology, enabling smaller companies and startups to leverage its benefits.

- The FPGA market is poised for continued growth as industries increasingly recognize the value of customizable hardware solutions to meet their evolving computational needs.

Field-Programmable Gate Array (FPGA) Market Trend Analysis

Increasing Demand for High-Performance Computing

- FPGAs offer unique advantages in accelerating computational tasks by providing customizable hardware acceleration, parallel processing capabilities, and low latency. As industries and applications require faster processing speeds, higher efficiency, and lower power consumption, FPGAs have emerged as a versatile solution to meeting these demands.

- In fields like artificial intelligence, data analytics, genomics, finance, and more, where massive amounts of data need to be processed rapidly, FPGAs provide a competitive edge by enabling real-time processing and analysis. Their ability to be reconfigured and optimized for specific tasks makes them attractive for diverse applications, driving their adoption across various sectors. Moreover, as FPGA technology advances, becoming more cost-effective and accessible, it further fuels market growth, attracting both established players and new entrants keen on harnessing the power of FPGA-based solutions to meet the demands of high-performance computing environments.

Expansion in Automotive Electronics

- There is a growing demand for advanced electronic systems to support features such as autonomous driving, infotainment, connectivity, and advanced driver assistance systems (ADAS). FPGAs offer flexibility and programmability, making them ideal for implementing complex algorithms and processing tasks required in automotive applications.

- FPGAs enable rapid prototyping and iteration, crucial in the fast-paced automotive industry where innovation is constant. Moreover, FPGAs can be reprogrammed and updated over-the-air (OTA), allowing for easier integration of new functionalities and enhancements throughout a vehicle's lifecycle.

- With the proliferation of electric vehicles (EVs) and the integration of IoT devices within automobiles, the demand for FPGAs is expected to surge further. These devices play a vital role in managing power distribution, optimizing energy efficiency, and facilitating communication between various vehicle components and external networks.

- The expansion in automotive electronics presents a fertile ground for the FPGA market, offering opportunities for innovation, flexibility, and adaptability to meet the evolving needs of the automotive industry.

Field-Programmable Gate Array (FPGA) Market Segment Analysis:

Field-Programmable Gate Array (FPGA) Market Segmented based on type, and application,

Application, Military & Aerospace segment is expected to dominate the Field-Programmable Gate Array (FPGA) Market

- FPGA technology offers unparalleled flexibility and adaptability, crucial for the dynamic requirements of military and aerospace applications. These sectors demand rapid prototyping, reconfiguration, and customization, all of which FPGAs excel at. Secondly, the stringent reliability and performance standards in military and aerospace applications necessitate cutting-edge, high-performance computing solutions, wherein FPGAs play a pivotal role. Additionally, the growing complexity of defense systems, including radar, communication, and electronic warfare systems, requires advanced processing capabilities provided by FPGAs. Moreover, the increasing investments in defense modernization and space exploration initiatives globally further drive the demand for FPGAs in these sectors. Overall, the critical nature of mission-critical operations, coupled with the unique advantages offered by FPGA technology, positions the Military & Aerospace segment as the dominant force in the FPGA market.

By Technology, Antifuse segment is expected to dominate the market during the forecast period

- Antifuse technology offers significant advantages over its counterparts, such as lower power consumption, higher speed, and greater reliability. By leveraging the inherent properties of Antifuse-based FPGAs, businesses can achieve enhanced performance and efficiency in diverse applications ranging from aerospace and defense to telecommunications and automotive sectors.

- Moreover, Antifuse FPGAs exhibit robust resistance to radiation and harsh environmental conditions, making them ideal for mission-critical operations. This segment's dominance underscores the industry's relentless pursuit of innovation and underscores Antifuse technology's pivotal role in shaping the future of FPGA solutions. As demand for customizable and high-performance computing continues to surge across various industries, Antifuse-based FPGAs are poised to maintain their stronghold, driving further growth and innovation in the market.

Field-Programmable Gate Array (FPGA) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- FPGA technology, known for its flexibility and reconfigurability, has found extensive applications across various industries, including telecommunications, automotive, aerospace, and consumer electronics.

- Several factors contribute to the region's dominance in this market. Firstly, Asia Pacific boasts a robust ecosystem of semiconductor manufacturers, facilitating the production of high-quality FPGAs at competitive prices. Additionally, the region benefits from a large pool of skilled engineers and researchers, driving advancements in FPGA design and implementation.

- Moreover, favorable government policies and investment initiatives aimed at fostering technological innovation further bolster the Asia Pacific FPGA market. Countries like China, Japan, South Korea, and Taiwan are at the forefront of this technological revolution, with companies continuously pushing the boundaries of FPGA capabilities.

- Furthermore, the growing demand for FPGA-based solutions in emerging economies of the Asia Pacific, coupled with the rapid digitalization across industries, propels the market's growth trajectory.

- The Asia Pacific region's strong manufacturing capabilities, technological expertise, and market demand position it as a dominant player in the global FPGA market, poised for sustained growth and innovation in the coming years.

Field-Programmable Gate Array (FPGA) Market Top Key Players:

- Intel Corporation (US)

- Microchip Technology Inc. (US)

- Lattice Semiconductor Corporation (US)

- Achronix Semiconductor Corporation (US)

- QuickLogic Corporation (US)

- Efinix Inc. (US)

- LeafLabs LLC (US)

- Aldec Inc. (US)

- Gidel (US)

- Nuvation Engineering (US)

- FlexLogix (US)

- Shenzhen Ziguang Tongchuang Electronics Co. Ltd. (China)

- Renesas Electronics Corporation (Japan)

- ByteSnap Design (UK)

- Enclustra (Switzerland)

- EnSilica (UK)

- EmuPro Consulting Private Limited (India), and other major players.

Key Industry Developments in the Field-Programmable Gate Array (FPGA) Market:

- In March 2024, Intel unveiled its new standalone FPGA venture, Altera, poised to tap into the burgeoning AI landscape. With a focus on cloud, network, and edge sectors, Altera aims to seize a substantial share of the estimated $55 billion market. Offering solutions like FPGA AI Suite and OpenVINO, Altera leverages standard AI frameworks like TensorFlow and PyTorch to deliver optimized intellectual property.

- In April 2024, Microchip Technology Inc. finalized its acquisition of VSI Co. Ltd., headquartered in Seoul, Korea. VSI is renowned for its expertise in high-speed, asymmetric connectivity technologies for automotive applications, based on the Automotive SerDes Alliance (ASA) open standard for In-Vehicle Networking (IVN).

|

Global Field-Programmable Gate Array (FPGA) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 10.46 Bn. |

|

Forecast Period 2023-30 CAGR: |

10.95 % |

Market Size in 2030: |

USD 26.65 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET BY TYPE (2017-2030)

- FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LOW-END

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HIGH-END

- FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET BY TECHNOLOGY (2017-2030)

- FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SRAM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ANTIFUSE

- FLASH

- FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET BY APPLICATION (2017-2030)

- FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MILITARY & AEROSPACE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TELECOM

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Field-Programmable Gate Array (FPGA) Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- INTEL CORPORATION (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MICROCHIP TECHNOLOGY INC. (US)

- LATTICE SEMICONDUCTOR CORPORATION (US)

- ACHRONIX SEMICONDUCTOR CORPORATION (US)

- QUICKLOGIC CORPORATION (US)

- EFINIX INC. (US)

- LEAFLABS LLC (US)

- ALDEC INC. (US)

- GIDEL (US)

- NUVATION ENGINEERING (US)

- FLEXLOGIX (US)

- SHENZHEN ZIGUANG TONGCHUANG ELECTRONICS CO. LTD. (CHINA)

- RENESAS ELECTRONICS CORPORATION (JAPAN)

- BYTESNAP DESIGN (UK)

- ENCLUSTRA (SWITZERLAND)

- ENSILICA (UK)

- EMUPRO CONSULTING PRIVATE LIMITED (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Field-Programmable Gate Array (FPGA) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 10.46 Bn. |

|

Forecast Period 2023-30 CAGR: |

10.95 % |

Market Size in 2030: |

USD 26.65 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET COMPETITIVE RIVALRY

TABLE 005. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET THREAT OF NEW ENTRANTS

TABLE 006. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET THREAT OF SUBSTITUTES

TABLE 007. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET BY TYPE

TABLE 008. SRAM PROGRAMMED FPGA MARKET OVERVIEW (2016-2028)

TABLE 009. ANTIFUSE PROGRAMMED FPGA MARKET OVERVIEW (2016-2028)

TABLE 010. EEPROM PROGRAMMED FPGA MARKET OVERVIEW (2016-2028)

TABLE 011. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET BY APPLICATION

TABLE 012. TELECOM MARKET OVERVIEW (2016-2028)

TABLE 013. INDUSTRIAL MARKET OVERVIEW (2016-2028)

TABLE 014. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

TABLE 015. CONSUMER ELECTRONICS MARKET OVERVIEW (2016-2028)

TABLE 016. DATA CENTER MARKET OVERVIEW (2016-2028)

TABLE 017. MILITARY AND AEROSPACE MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY TYPE (2016-2028)

TABLE 019. NORTH AMERICA FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY APPLICATION (2016-2028)

TABLE 020. N FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY TYPE (2016-2028)

TABLE 022. EUROPE FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY APPLICATION (2016-2028)

TABLE 023. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY COUNTRY (2016-2028)

TABLE 024. ASIA PACIFIC FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY TYPE (2016-2028)

TABLE 025. ASIA PACIFIC FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY APPLICATION (2016-2028)

TABLE 026. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY COUNTRY (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY TYPE (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY APPLICATION (2016-2028)

TABLE 029. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY COUNTRY (2016-2028)

TABLE 030. SOUTH AMERICA FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY TYPE (2016-2028)

TABLE 031. SOUTH AMERICA FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY APPLICATION (2016-2028)

TABLE 032. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET, BY COUNTRY (2016-2028)

TABLE 033. ALTERA: SNAPSHOT

TABLE 034. ALTERA: BUSINESS PERFORMANCE

TABLE 035. ALTERA: PRODUCT PORTFOLIO

TABLE 036. ALTERA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. XILINX: SNAPSHOT

TABLE 037. XILINX: BUSINESS PERFORMANCE

TABLE 038. XILINX: PRODUCT PORTFOLIO

TABLE 039. XILINX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. MICROSEMI: SNAPSHOT

TABLE 040. MICROSEMI: BUSINESS PERFORMANCE

TABLE 041. MICROSEMI: PRODUCT PORTFOLIO

TABLE 042. MICROSEMI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. ATMEL: SNAPSHOT

TABLE 043. ATMEL: BUSINESS PERFORMANCE

TABLE 044. ATMEL: PRODUCT PORTFOLIO

TABLE 045. ATMEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. ACHRONIX: SNAPSHOT

TABLE 046. ACHRONIX: BUSINESS PERFORMANCE

TABLE 047. ACHRONIX: PRODUCT PORTFOLIO

TABLE 048. ACHRONIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. CYPRESS SEMICONDUCTOR: SNAPSHOT

TABLE 049. CYPRESS SEMICONDUCTOR: BUSINESS PERFORMANCE

TABLE 050. CYPRESS SEMICONDUCTOR: PRODUCT PORTFOLIO

TABLE 051. CYPRESS SEMICONDUCTOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. INTEL CORPORATION: SNAPSHOT

TABLE 052. INTEL CORPORATION: BUSINESS PERFORMANCE

TABLE 053. INTEL CORPORATION: PRODUCT PORTFOLIO

TABLE 054. INTEL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. TEXAS INSTRUMENTS: SNAPSHOT

TABLE 055. TEXAS INSTRUMENTS: BUSINESS PERFORMANCE

TABLE 056. TEXAS INSTRUMENTS: PRODUCT PORTFOLIO

TABLE 057. TEXAS INSTRUMENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. LATTICE: SNAPSHOT

TABLE 058. LATTICE: BUSINESS PERFORMANCE

TABLE 059. LATTICE: PRODUCT PORTFOLIO

TABLE 060. LATTICE: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET OVERVIEW BY TYPE

FIGURE 012. SRAM PROGRAMMED FPGA MARKET OVERVIEW (2016-2028)

FIGURE 013. ANTIFUSE PROGRAMMED FPGA MARKET OVERVIEW (2016-2028)

FIGURE 014. EEPROM PROGRAMMED FPGA MARKET OVERVIEW (2016-2028)

FIGURE 015. FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET OVERVIEW BY APPLICATION

FIGURE 016. TELECOM MARKET OVERVIEW (2016-2028)

FIGURE 017. INDUSTRIAL MARKET OVERVIEW (2016-2028)

FIGURE 018. AUTOMOTIVE MARKET OVERVIEW (2016-2028)

FIGURE 019. CONSUMER ELECTRONICS MARKET OVERVIEW (2016-2028)

FIGURE 020. DATA CENTER MARKET OVERVIEW (2016-2028)

FIGURE 021. MILITARY AND AEROSPACE MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA FIELD-PROGRAMMABLE GATE ARRAY (FPGA) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Field-Programmable Gate Array (FPGA) Market research report is 2024-2032.

Intel Corporation (US), Microchip Technology Inc. (US), Lattice Semiconductor Corporation (US), Achronix Semiconductor Corporation (US), QuickLogic Corporation (US), Efinix Inc. (US), LeafLabs LLC (US), Aldec Inc. (US), Gidel (US), Nuvation Engineering (US), FlexLogix (US), Shenzhen Ziguang Tongchuang Electronics Co. Ltd. (China), Renesas Electronics Corporation (Japan), ByteSnap Design (UK), Enclustra (Switzerland), EnSilica (UK), EmuPro Consulting Private Limited (India)and Other Major Players.

The Field-Programmable Gate Array (FPGA) Market is segmented into Type, Technology, Application, and region. By Type, the market is categorized into Low-End and High-End. By Technology, the market is categorized into SRAM, Antifuse, and Flash. By Application, the market is categorized into Military & Aerospace, and Telecom. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A Field-Programmable Gate Array (FPGA) is a reconfigurable integrated circuit designed to be customized after manufacturing. It contains an array of programmable logic blocks and interconnects, allowing users to define their digital circuits. FPGAs are utilized in various applications such as prototyping, emulation, and acceleration of algorithms in fields like telecommunications, automotive, and aerospace due to their flexibility, parallelism, and performance.

Field-Programmable Gate Array (FPGA) Market Size Was Valued at USD 10.46 Billion in 2023 and is Projected to Reach USD 26.65 Billion by 2032, Growing at a CAGR of 10.95% From 2024-2032.