Fiber Cement Market Synopsis

Fiber Cement Market Size Was Valued at USD 18.88 Billion in 2023 and is Projected to Reach USD 28.79 Billion by 2032, Growing at a CAGR of 4.8 % From 2024-2032.

Fibre cement is a composite material used mostly in roofing and facade products due to its strength and longevity in building and construction. Fiber cement siding for buildings is one frequent use. Fiber cement, a versatile building material made from cement, sand, cellulose fibers, and water, is suitable for various construction applications due to its durability, fire resistance, and low maintenance. Its eco-friendly composition makes it popular in residential and commercial projects.

- Fibre cement tile backer board is a suitable tiling base for wet areas like bathrooms, kitchens, and showers due to its resistance to permanent water damage and lack of need for treatment. It is an alternative to Plywood and Plasterboard tiling bases. Installation is easy and can be done directly onto a stud wall or wooden or timber floor.

- Fibre cement is also a durable and low-maintenance exterior cladding material, resisting termites, woodpeckers, and other pests. It is fire-resistant and non-combustible, making it non-combustible. It is easy to work with and install, with the appropriate tools allowing for one-person installation. Overall, fiber cement is a cost-effective and environmentally friendly alternative to traditional cladding materials.

- Fiber cement cladding is a composite material made from cement reinforced with cellulose fibers, used in residential and commercial buildings as a protective and attractive exterior coating. It is manufactured in boards or sheets that lock together to form a weather-tight layer.

- Fiber cement siding offers long-term durability with an average lifespan of 40 years. Its combination of cement and fiber provides versatility in style, fire and heat resistance, weather resistance, minimal maintenance, and environmental benefits. The material's special curing process absorbs less moisture, reducing the risk of cracking or breaking. Fiber cement is made from recycled materials and other sustainable products, making it a great choice for DIY installation. It expands and contracts less than wood, requiring minimal expansion gaps. It comes in multiple colors, making it an excellent choice for homeowners looking to change their home's exterior color. Fiber cement boards come in various textures, shares, and sizes, reflecting the homeowner's style.

Fiber Cement Market Trend Analysis

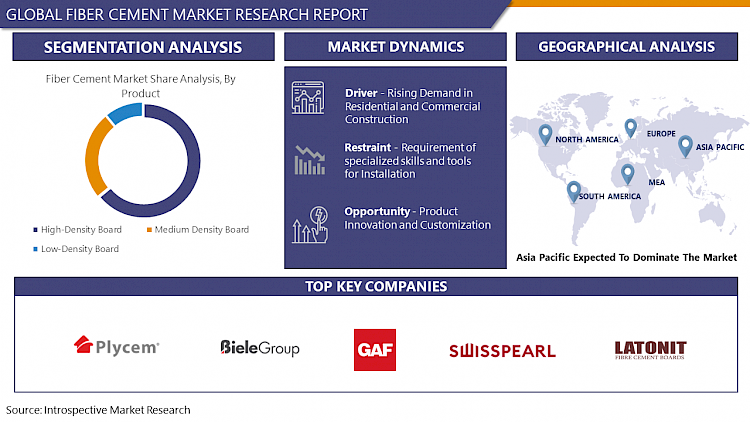

Rising Demand in Residential and Commercial Construction

- The fiber cement market is experiencing a surge in demand due to the increasing preference for durable, low-maintenance building materials in both residential and commercial sectors. Fiber cement products, such as siding, roofing, and trim, are popular due to their durability, resistance to moisture, pests, and fire, and their cost-saving properties. In the commercial construction sector, fiber cement is preferred for its durability, versatility, and aesthetic appeal, making it ideal for cladding, roofing, and architectural features in office buildings, retail spaces, and industrial facilities.

- The growing focus on sustainable construction practices in both sectors further drives the demand for fiber cement, as its composition, often including recycled materials, aligns well with sustainability goals. Overall, fiber cement is a popular choice for both residential and commercial construction. Fiber cement offers design versatility due to its diverse textures, colors, and profiles, allowing architects to achieve various aesthetic styles. Its low-maintenance nature makes it appealing in residential and commercial settings.

- Fiber cement's resistance to fire, moisture, pests, and impact makes it suitable for construction projects in diverse climates. With increasing availability and accessibility in global markets, fiber cement is increasingly used in construction projects of varying scales and complexities worldwide.

Product Innovation and Customization

- The fiber cement market is experiencing significant opportunities due to product innovation and customization. Manufacturers can differentiate their offerings, meet evolving customer needs, and gain a competitive edge in the construction industry. Innovations in formulations, manufacturing techniques, and fiber reinforcement can enhance the performance and properties of fiber cement products, improving durability, weather resistance, and installation ease. Customization allows manufacturers to tailor products to specific project requirements, design preferences, and regional considerations. This can include offering a wider range of colors, textures, sizes, and profiles to accommodate diverse architectural styles and aesthetic preferences.

- Customization can lead to specialized solutions for unique applications. This approach also addresses emerging trends, such as sustainable construction materials, by incorporating recycled content, eco-friendly additives, and energy-efficient features into fiber cement products. Product innovation and customization in the construction industry foster collaboration between manufacturers, architects, and builders, resulting in innovative solutions. Advanced design software, 3D printing technology, and collaborative processes allow stakeholders to incorporate fiber cement into architectural designs. This position positions manufacturers as valuable partners, driving customer satisfaction, brand loyalty, and long-term success in the industry.

Fiber Cement Market Segment Analysis:

Fiber Cement Market Segmented on the basis of Product, Material, Production Process, Application, and End-User.

By Product, High-Density Board segment is expected to dominate the market during the forecast period

- The High-Density Board segment is expected to dominate the fiber cement market due to its exceptional strength, durability, and dimensional stability. Compared with traditional building materials, these HD boards are not only lighter but also provide more strength with a reduced thickness. This High-Density cement board is pre-finished, easy to install, and durable, so it will shorten the time needed for construction.

- These boards are suitable for residential and commercial construction due to their resistance to impact, moisture, fire, and pests. They also offer superior thermal and acoustic insulation properties, enhancing energy efficiency and indoor comfort. They come in various thicknesses, sizes, and surface finishes, offering versatility in design and application. Architects and builders appreciate the flexibility in customization projects. Regulatory requirements and industry standards regarding fire safety, structural integrity, and environmental sustainability drive the demand for high-density fiber cement boards. This segment's dominance is expected to continue due to ongoing construction activities and increasing global demand for high-performance building materials.

By Application, Siding Segment Is Expected To Dominate The Market During The Forecast Period.

- The fiber cement siding segment is expected to dominate the market due to its durability, low maintenance, and aesthetic appeal. Its resistance to rot, pests, fire, and harsh weather conditions ensures long-term performance and reduces the need for frequent repairs, saving property owners money. Fiber cement siding comes in various textures, colors, and profiles, allowing architects to achieve various design styles and enhance building curb appeal. Stringent building codes and regulations drive demand for fiber cement siding, as it meets or exceeds these standards.

- Fiber cement's eco-friendly composition, containing recycled materials and being recyclable itself, strengthens its position in the market. These factors position the siding segment as a dominant force in the fiber cement market, with sustained growth expected due to ongoing construction activities and renovation projects worldwide. Fiber cement siding is a durable and low-maintenance material commonly used to cover the exterior of houses and, in some cases, commercial buildings. It's manufactured with cellulose fibers, cement, and sand, making it long-lasting and durable.

Fiber Cement Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to dominate the fiber cement market due to its growing population, urbanization, and increasing awareness of its benefits, such as durability, fire resistance, and low maintenance requirements. As consumers become more environmentally conscious, fiber cement becomes a preferred choice for various applications like siding, roofing, cladding, and trim.

- Government policies and initiatives promoting sustainable construction practices further drive the adoption of fiber cement in the region. Governments across the region are implementing regulations and standards focused on energy efficiency, fire safety, and environmental protection, incentivizing the use of eco-friendly building materials like fiber cement.

- Advancements in manufacturing technologies also improve the efficiency and quality of fiber cement production, enabling manufacturers to meet the growing demand while maintaining competitive pricing. With its expanding construction industry, increasing demand for sustainable building materials, supportive regulatory environment, and technological advancements, the Asia Pacific region is well-positioned to dominate the fiber cement market in the coming years.

Fiber Cement Market Top Key Players:

- Allura (U.S.)

- GAF Materials Corporation (U.S.)

- Fry Reglet Corporation (U.S.)

- American Fiber Cement Corporation (U.S.)

- Plycem Corporation (Mexico)

- Elementia, S.A.B. de C.V. (Mexico)

- LATONIT (Russia)

- Biele Group (Spain)

- SWISSPEARL (Switzerland)

- Saint-Gobain SA (France)

- Etex Group (Belgium)

- Etex Group (Belgium)

- Cembrit Holding A/S (Denmark)

- NICHIHA (Japan)

- Toray Industries Inc. (Japan)

- Copal Company Limited (Japan)

- Everest Industries Ltd (India)

- Visaka Industries Limited (India)

- Soben International (China)

- CSR Limited (Australia)

- James Hardie Europe GmbH (Australia)

- SHERA (Thailand)

- SCG (Thailand)

- Taisyou International Business Co., Ltd. (Taiwan)

- Hume Cemboard Industries Sdn Bhd (Malaysia), and Other Major Players.

Key Industry Developments in the Fiber Cement Market:

- In March 2022, James Hardie Industries advanced its expansion plans for fiber cement production by acquiring land in Melbourne, Victoria. The move aims to establish a new manufacturing facility in Victoria to meet the rising demand for premium building solutions in the Asia Pacific region.

- In January 2022, Swisspearl Group AG completed the acquisition of Cembrit, a prominent fiber cement manufacturer based in Denmark. This acquisition positioned Swisspearl Group as the second-largest player in the European fiber cement market, bolstering its presence across geographical regions and facilitating the exploration of new market opportunities.

|

Global Fiber Cement Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.88 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.8 % |

Market Size in 2032: |

USD 28.79 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Material |

|

||

|

By Production Process |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- FIBER CEMENT MARKET BY PRODUCT (2017-2032)

- FIBER CEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HIGH-DENSITY BOARD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDIUM DENSITY BOARD

- LOW-DENSITY BOARD

- FIBER CEMENT MARKET BY MATERIAL (2017-2032)

- FIBER CEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PORTLAND CEMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SILICA

- CELLULOSIC FIBERS

- FIBER CEMENT MARKET BY PRODUCTION PROCESS (2017-2032)

- FIBER CEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HATSCHEK PROCESS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- EXTRUSION PROCESS

- PERTILE PROCESS

- FIBER CEMENT MARKET BY APPLICATION (2017-2032)

- FIBER CEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SIDING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ROOFING

- CLADDING

- MOLDING AND TRIMMING

- FIBER CEMENT MARKET BY END-USER (2017-2032)

- FIBER CEMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL CONSTRUCTION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL CONSTRUCTION

- INDUSTRIAL CONSTRUCTION

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Fiber Cement Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ALLURA (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- GAF MATERIALS CORPORATION (U.S.)

- FRY REGLET CORPORATION (U.S.)

- AMERICAN FIBER CEMENT CORPORATION (U.S.)

- PLYCEM CORPORATION (MEXICO)

- ELEMENTIA, S.A.B. DE C.V. (MEXICO)

- LATONIT (RUSSIA)

- BIELE GROUP (SPAIN)

- SWISSPEARL (SWITZERLAND)

- SAINT-GOBAIN SA (FRANCE)

- ETEX GROUP (BELGIUM)

- ETEX GROUP (BELGIUM)

- CEMBRIT HOLDING A/S (DENMARK)

- NICHIHA (JAPAN)

- TORAY INDUSTRIES INC. (JAPAN)

- COPAL COMPANY LIMITED (JAPAN)

- EVEREST INDUSTRIES LTD (INDIA)

- VISAKA INDUSTRIES LIMITED (INDIA)

- SOBEN INTERNATIONAL (CHINA)

- CSR LIMITED (AUSTRALIA)

- JAMES HARDIE EUROPE GMBH (AUSTRALIA)

- SHERA (THAILAND)

- SCG (THAILAND)

- TAISYOU INTERNATIONAL BUSINESS CO., LTD. (TAIWAN)

- HUME CEMBOARD INDUSTRIES SDN BHD (MALAYSIA)

- COMPETITIVE LANDSCAPE

- GLOBAL FIBER CEMENT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Material

- Historic And Forecasted Market Size By Production Process

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

|

Global Fiber Cement Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.88 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.8 % |

Market Size in 2032: |

USD 28.79 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Material |

|

||

|

By Production Process |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Frequently Asked Questions :

The forecast period in the Fiber Cement Market research report is 2024-2032.

Allura (U.S.), GAF Materials Corporation (U.S.), Fry Reglet Corporation (U.S.), American Fiber Cement Corporation (U.S.), Plycem Corporation (Mexico), Elementia, S.A.B. de C.V. (Mexico), LATONIT (Russia), Biele Group (Spain), SWISSPEARL (Switzerland), Saint-Gobain SA (France), Etex Group (Belgium), Etex Group (Belgium), Cembrit Holding A/S (Denmark), NICHIHA (Japan), Toray Industries Inc. (Japan), Copal Company Limited (Japan), Everest Industries Ltd (India), Visaka Industries Limited (India), Soben International (China), CSR Limited (Australia), James Hardie Europe GmbH (Australia), SHERA (Thailand), SCG (Thailand), Taisyou International Business Co., Ltd. (Taiwan), Hume Cemboard Industries Sdn Bhd (Malaysia), and Other Major Players.

The Fiber Cement Market is segmented into Product, Material, Production Process, Application, End-User, and region. By Product, the market is categorized into High-Density Board, Medium Density Board, and Low-Density Board. By Material, the market is categorized into Portland Cement, Silica, and Cellulosic Fibers. By Production Process, the market is categorized into Hatschek Process, Extrusion Process, and Pertile Process. By Application, the market is categorized into Siding, Roofing, Cladding, Molding and Trimming. By End-User, the market is categorized into Residential Construction, Commercial Construction, and Industrial Construction. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Fibre cement is a composite material used mostly in roofing and facade products due to its strength and longevity in building and construction. Fiber cement siding for buildings is one frequent use. Fiber cement, a versatile building material made from cement, sand, cellulose fibers, and water, is suitable for various construction applications due to its durability, fire resistance, and low maintenance. Its eco-friendly composition makes it popular in residential and commercial projects.

Fiber Cement Market Size Was Valued at USD 18.88 Billion in 2023 and is Projected to Reach USD 28.79 Billion by 2032, Growing at a CAGR of 4.8 % From 2024-2032.