Family Office Market Synopsis

Family Office Market Size Was Valued at USD 16.71 Billion in 2022, and is Projected to Reach USD 26.65 Billion by 2030, Growing at a CAGR of 6.01% From 2023-2030.

A family office is a privately held corporation that manages the investments and fortune of a wealthy family, often with over $100 million in investable assets, to effectively grow and transfer wealth across generations. The family's wealth serves as the company's financial capital.

- Management of household staff, travel arrangements, property management, day-to-day accounting and payroll activities, management of legal affairs, family management services, family governance, financial and investor education, coordination of philanthropy and private foundations, and succession planning are all examples of tasks that family offices may handle.

- Family Offices are becoming a very significant force within the global business landscape, now managing almost half of the $9 trillion controlled by the world’s billionaires. EY estimates that there are currently 10,000 family offices, a ten-fold increase since 2008. The demand for family office services is being driven by the expanding number of UHNWIs (private wealth advisory firms). Because they have a shaky faith in private banks, wealthy families are increasingly turning to family offices to handle their fortune.

- The industry is beset by a slew of legal, technological, and operational issues that are projected to stymie the market's expansion. In comparison to private equity, direct investments are stand-alone investments with good returns. Direct investments account for more than 65% of high-net-worth individuals' assets. It allows them to leverage their assets and helps the market become more varied around the world.

- The given graph shows that the Exclusion-based investments was the most common sustainable investment strategy among family offices in Middle East and Africa, Western Europe, and the United States as of 2022, while environmental, social and governance (ESG) integration was the most common strategy in Latin America and the Asia-Pacific region. The United States had the highest share of family offices without sustainable investments, at 61 percent.

Family Office Market Trend Analysis

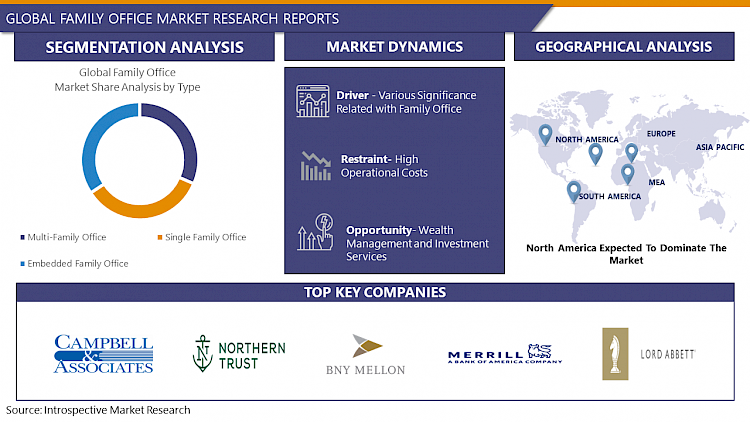

Various Significance Related with Family Office

- In the asset management of HNWIs, the family office plays an essential role. It also assists HNWIs with succession planning within their businesses as they grow into new regions throughout the world. With a growing interest in sustainability and impact investing, wealthy families are establishing family offices.

- The majority of family offices are formed as a result of succession planning and wealth transfer from one generation to the next. Furthermore, family offices give greater confidentiality and privacy, as well as higher returns, while also ensuring effective governance and better alignment of interests. It also solves a wide variety of financial services complexity requested by HNWIs. The worldwide family office market is expected to increase as a result of such reasons.

Wealth Management and Investment Services Create an Opportunity Family Office Market

- Wealth management and investment services present significant opportunities for the Family Office market in the current financial landscape. As high-net-worth individuals and families seek to optimize their financial portfolios, the demand for sophisticated wealth management solutions has grown. Family offices, with their tailored and comprehensive approach, are well-positioned to address these needs.

- In the realm of wealth management, Family Offices offer personalized investment strategies, risk management, and financial planning services, aligning with the unique goals and preferences of affluent clients. The integration of technology, data analytics, and innovative investment instruments further enhances the efficiency and effectiveness of these services.

- Moreover, the global investment landscape has become increasingly complex, with diverse asset classes and evolving market conditions. Family offices, equipped with expert advisors and extensive resources, can navigate this complexity to identify lucrative investment opportunities while managing risks. The emphasis on long-term wealth preservation and multi-generational planning makes family offices vital partners in securing and growing the financial legacies of affluent families.

Family Office Market Segment Analysis:

Family Office Market Segmented on the basis of type, Asset Classification.

By Type, single-family segment is expected to dominate the market during the forecast period

- the single-family office segment is expected to register the maximum family office market share during the forecast period. The single-family office market is primarily driven by the expanding need for wealth management, which is fueled by the growing number of billionaires. There is a considerable increase in the growth of single-family offices, which is driving the growth of the market, with numerous new organizations and enterprises being created every day.

- When establishing investments, single-family offices use either periodically adjusted term sheets or conventional protection standards. Family services such as accounting and tax management are provided by the majority of single-family offices, which are followed by succession planning.

By Asset Classification, alternative assets segment held the largest share of 45% in 2022

- Alternative assets classification segment is anticipated to register the maximum family office market share over the forecast period. Family offices are engaging specialized investment professionals to maintain and safeguard the family legacy, trust, and provide concierge services due to the evolution of asset classification, where family offices are changing from traditional asset management services to alternative asset classes. Almost a third of family offices participate in alternative assets, which will help the sector flourish.

Family Office Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is poised to dominate the family office market, reflecting a confluence of factors that position the region as a key player in wealth management. The robust economic landscape, technological advancements, and a concentration of high-net-worth individuals contribute to North America's prominence in this sector. The region's sophisticated financial infrastructure and a mature ecosystem of family offices further enhance its dominance.

- The United States, in particular, stands out as a hub for family offices, driven by a dynamic entrepreneurial culture and a history of successful wealth creation. The increasing complexity of financial instruments and the need for specialized services also play into the hands of family offices, making them indispensable for managing substantial fortunes. Regulatory stability and a well-established legal framework add to the attractiveness of North America for family office operations.

- As wealth continues to grow in the region, family offices are becoming integral to preserving and growing assets, providing a range of services from investment management to estate planning. North America's ascendancy in the family office market is indicative of its strategic position in global wealth management and its ability to cater to the diverse needs of affluent individuals and families.

Family Office Market Top Key Players:

- Campbell Family & Associates (USA)

- U.S. Trust - Bank of America Private Wealth Management (USA)

- Bespoke Wealth Management (USA)

- JPMorgan Chase Wealth Management (USA)

- Northern Trust Wealth Management (USA)

- Wells Fargo Private Bank(USA)

- Bessemer Trust (USA)

- Citi Private Bank (USA)

- BNY Mellon Wealth Management (USA)

- PNC Wealth Management (USA)

- Merrill Lynch Wealth Management (USA)

- Morgan Stanley Wealth Management (USA)

- Goldman Sachs Family Office (USA)

- Schroders Family Office (UK)

- Eaton Family Office (USA)

- Rockefeller Capital Management (USA)

- Prestige Family Office (USA)

- Tiedemann Trust (USA)

- GenSpring Family Offices (USA)

- Moss Adams LLP (, USA)

- Lord Abbett & Co. LLC (USA)

- Seix Investment Advisors (USA)

- Flexstone Partners (Switzerland)

- Credit Suisse Family Office (Switzerland)

- UBS Family Office (Switzerland)

Key Industry Developments in the Family Office Market:

In October 2023, U.S. Trust Bank (Bank of America Private Wealth Management): Partnered with AI-powered wealth management platform "Abbove" to offer holistic financial planning solutions to their family office clients.

In September 2023, Northern Trust: Launched "NT Invest", a digital wealth management platform for family offices and high-net-worth individuals, providing access to alternative investments and private market opportunities.

|

Global Family Office Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 16.71 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.01 % |

Market Size in 2030: |

USD 26.65 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Asset Classification |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- FAMILY OFFICE MARKET BY TYPE (2016-2030)

- FAMILY OFFICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MULTI-FAMILY OFFICE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SINGLE FAMILY OFFICE

- EMBEDDED FAMILY OFFICE

- FAMILY OFFICE MARKET BY ASSET CLASSIFICATION (2016-2030)

- FAMILY OFFICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ALTERNATIVE ASSET CLASSIFICATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TRADITIONAL ASSET CLASSIFICATION

- PRECIOUS METALS, ART & ARTIFACTS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- FAMILY OFFICE Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CAMPBELL FAMILY & ASSOCIATES (USA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- U.S. TRUST - BANK OF AMERICA PRIVATE WEALTH MANAGEMENT (USA)

- BESPOKE WEALTH MANAGEMENT (USA)

- JPMORGAN CHASE WEALTH MANAGEMENT (USA)

- NORTHERN TRUST WEALTH MANAGEMENT (USA)

- WELLS FARGO PRIVATE BANK (USA)

- BESSEMER TRUST (USA)

- CITI PRIVATE BANK (USA)

- BNY MELLON WEALTH MANAGEMENT (USA)

- PNC WEALTH MANAGEMENT (USA)

- MERRILL LYNCH WEALTH MANAGEMENT (USA)

- MORGAN STANLEY WEALTH MANAGEMENT (USA)

- GOLDMAN SACHS FAMILY OFFICE (USA)

- SCHRODERS FAMILY OFFICE (UK)

- EATON FAMILY OFFICE (USA)

- ROCKEFELLER CAPITAL MANAGEMENT (USA)

- PRESTIGE FAMILY OFFICE (USA)

- TIEDEMANN TRUST (USA)

- GENSPRING FAMILY OFFICES (USA)

- MOSS ADAMS LLP (, USA)

- COMPETITIVE LANDSCAPE

- GLOBAL FAMILY OFFICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Asset Classification

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Family Office Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 16.71 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.01 % |

Market Size in 2030: |

USD 26.65 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Asset Classification |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. FAMILY OFFICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. FAMILY OFFICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. FAMILY OFFICE MARKET COMPETITIVE RIVALRY

TABLE 005. FAMILY OFFICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. FAMILY OFFICE MARKET THREAT OF SUBSTITUTES

TABLE 007. FAMILY OFFICE MARKET BY TYPE

TABLE 008. MULTI-FAMILY OFFICE MARKET OVERVIEW (2016-2028)

TABLE 009. SINGLE FAMILY OFFICE MARKET OVERVIEW (2016-2028)

TABLE 010. EMBEDDED FAMILY OFFICE MARKET OVERVIEW (2016-2028)

TABLE 011. FAMILY OFFICE MARKET BY ASSET CLASSIFICATION

TABLE 012. ALTERNATIVE ASSET CLASSIFICATION MARKET OVERVIEW (2016-2028)

TABLE 013. TRADITIONAL ASSET CLASSIFICATION PRECIOUS METALS MARKET OVERVIEW (2016-2028)

TABLE 014. ART & ARTIFACTS MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA FAMILY OFFICE MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA FAMILY OFFICE MARKET, BY ASSET CLASSIFICATION (2016-2028)

TABLE 017. N FAMILY OFFICE MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE FAMILY OFFICE MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE FAMILY OFFICE MARKET, BY ASSET CLASSIFICATION (2016-2028)

TABLE 020. FAMILY OFFICE MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC FAMILY OFFICE MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC FAMILY OFFICE MARKET, BY ASSET CLASSIFICATION (2016-2028)

TABLE 023. FAMILY OFFICE MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA FAMILY OFFICE MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA FAMILY OFFICE MARKET, BY ASSET CLASSIFICATION (2016-2028)

TABLE 026. FAMILY OFFICE MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA FAMILY OFFICE MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA FAMILY OFFICE MARKET, BY ASSET CLASSIFICATION (2016-2028)

TABLE 029. FAMILY OFFICE MARKET, BY COUNTRY (2016-2028)

TABLE 030. BAYSHORE GLOBAL MANAGEMENT L.L.C: SNAPSHOT

TABLE 031. BAYSHORE GLOBAL MANAGEMENT L.L.C: BUSINESS PERFORMANCE

TABLE 032. BAYSHORE GLOBAL MANAGEMENT L.L.C: PRODUCT PORTFOLIO

TABLE 033. BAYSHORE GLOBAL MANAGEMENT L.L.C: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. EUCLIDEAN CAPITAL: SNAPSHOT

TABLE 034. EUCLIDEAN CAPITAL: BUSINESS PERFORMANCE

TABLE 035. EUCLIDEAN CAPITAL: PRODUCT PORTFOLIO

TABLE 036. EUCLIDEAN CAPITAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. BESSEMER TRUST: SNAPSHOT

TABLE 037. BESSEMER TRUST: BUSINESS PERFORMANCE

TABLE 038. BESSEMER TRUST: PRODUCT PORTFOLIO

TABLE 039. BESSEMER TRUST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. THE BANK OF NEW YORK MELLON CORPORATION: SNAPSHOT

TABLE 040. THE BANK OF NEW YORK MELLON CORPORATION: BUSINESS PERFORMANCE

TABLE 041. THE BANK OF NEW YORK MELLON CORPORATION: PRODUCT PORTFOLIO

TABLE 042. THE BANK OF NEW YORK MELLON CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. UBS AG: SNAPSHOT

TABLE 043. UBS AG: BUSINESS PERFORMANCE

TABLE 044. UBS AG: PRODUCT PORTFOLIO

TABLE 045. UBS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. BMO FINANCIAL GROUP: SNAPSHOT

TABLE 046. BMO FINANCIAL GROUP: BUSINESS PERFORMANCE

TABLE 047. BMO FINANCIAL GROUP: PRODUCT PORTFOLIO

TABLE 048. BMO FINANCIAL GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. PICTET GROUP: SNAPSHOT

TABLE 049. PICTET GROUP: BUSINESS PERFORMANCE

TABLE 050. PICTET GROUP: PRODUCT PORTFOLIO

TABLE 051. PICTET GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. WELLS FARGO BANK (ABBOT DOWNING): SNAPSHOT

TABLE 052. WELLS FARGO BANK (ABBOT DOWNING): BUSINESS PERFORMANCE

TABLE 053. WELLS FARGO BANK (ABBOT DOWNING): PRODUCT PORTFOLIO

TABLE 054. WELLS FARGO BANK (ABBOT DOWNING): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. WALTON ENTERPRISES INC.: SNAPSHOT

TABLE 055. WALTON ENTERPRISES INC.: BUSINESS PERFORMANCE

TABLE 056. WALTON ENTERPRISES INC.: PRODUCT PORTFOLIO

TABLE 057. WALTON ENTERPRISES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. BEZOS EXPEDITIONS: SNAPSHOT

TABLE 058. BEZOS EXPEDITIONS: BUSINESS PERFORMANCE

TABLE 059. BEZOS EXPEDITIONS: PRODUCT PORTFOLIO

TABLE 060. BEZOS EXPEDITIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. CASCADE INVESTMENT LLC: SNAPSHOT

TABLE 061. CASCADE INVESTMENT LLC: BUSINESS PERFORMANCE

TABLE 062. CASCADE INVESTMENT LLC: PRODUCT PORTFOLIO

TABLE 063. CASCADE INVESTMENT LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. MSD CAPITAL L.P.: SNAPSHOT

TABLE 064. MSD CAPITAL L.P.: BUSINESS PERFORMANCE

TABLE 065. MSD CAPITAL L.P.: PRODUCT PORTFOLIO

TABLE 066. MSD CAPITAL L.P.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. GLENMEDE TRUST: SNAPSHOT

TABLE 067. GLENMEDE TRUST: BUSINESS PERFORMANCE

TABLE 068. GLENMEDE TRUST: PRODUCT PORTFOLIO

TABLE 069. GLENMEDE TRUST: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. SILVERCREST ASSET MANAGEMENT GROUP INC.: SNAPSHOT

TABLE 070. SILVERCREST ASSET MANAGEMENT GROUP INC.: BUSINESS PERFORMANCE

TABLE 071. SILVERCREST ASSET MANAGEMENT GROUP INC.: PRODUCT PORTFOLIO

TABLE 072. SILVERCREST ASSET MANAGEMENT GROUP INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 073. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 074. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 075. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. FAMILY OFFICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. FAMILY OFFICE MARKET OVERVIEW BY TYPE

FIGURE 012. MULTI-FAMILY OFFICE MARKET OVERVIEW (2016-2028)

FIGURE 013. SINGLE FAMILY OFFICE MARKET OVERVIEW (2016-2028)

FIGURE 014. EMBEDDED FAMILY OFFICE MARKET OVERVIEW (2016-2028)

FIGURE 015. FAMILY OFFICE MARKET OVERVIEW BY ASSET CLASSIFICATION

FIGURE 016. ALTERNATIVE ASSET CLASSIFICATION MARKET OVERVIEW (2016-2028)

FIGURE 017. TRADITIONAL ASSET CLASSIFICATION PRECIOUS METALS MARKET OVERVIEW (2016-2028)

FIGURE 018. ART & ARTIFACTS MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA FAMILY OFFICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE FAMILY OFFICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC FAMILY OFFICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA FAMILY OFFICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA FAMILY OFFICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Family Office Market research report is 2023-2030.

Campbell Family & Associates (USA), U.S. Trust - Bank of America Private Wealth Management (USA), Bespoke Wealth Management (USA), JPMorgan Chase Wealth Management (USA), Northern Trust Wealth Management (USA), Wells Fargo Private Bank (USA), Bessemer Trust (USA), Citi Private Bank (USA), BNY Mellon Wealth Management (USA), PNC Wealth Management (USA), Merrill Lynch Wealth Management (USA), Morgan Stanley Wealth Management (USA), Goldman Sachs Family Office (USA), Schroders Family Office (UK),Eaton Family Office (USA), Rockefeller Capital Management (USA), Prestige Family Office (USA),Tiedemann Trust (USA), GenSpring Family Offices (USA), Moss Adams LLP (USA), Lord Abbett & Co. LLC (USA), Seix Investment Advisors (USA), Flexstone Partners (Switzerland), Credit Suisse Family Office (Switzerland), UBS Family Office (Switzerland) and Other Major Players.

Family Office Market is segmented into Type, Asset Classification, and region. By Type, the market is categorized into Multi-Family Office, Single Family Office, and Embedded Family Office. By Asset Classification, the market is categorized into Alternative Asset Classification, Traditional Asset Classification Precious Metals, and Art & Artifacts. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A family office is a privately held corporation that manages the investments and fortune of a wealthy family, often with over $100 million in investable assets, to effectively grow and transfer wealth across generations. The family's wealth serves as the company's financial capital.

Family Office Market Size Was Valued at USD 16.71 Billion in 2022, and is Projected to Reach USD 26.65 Billion by 2030, Growing at a CAGR of 6.01% From 2023-2030.