EV Transmission Market Synopsis

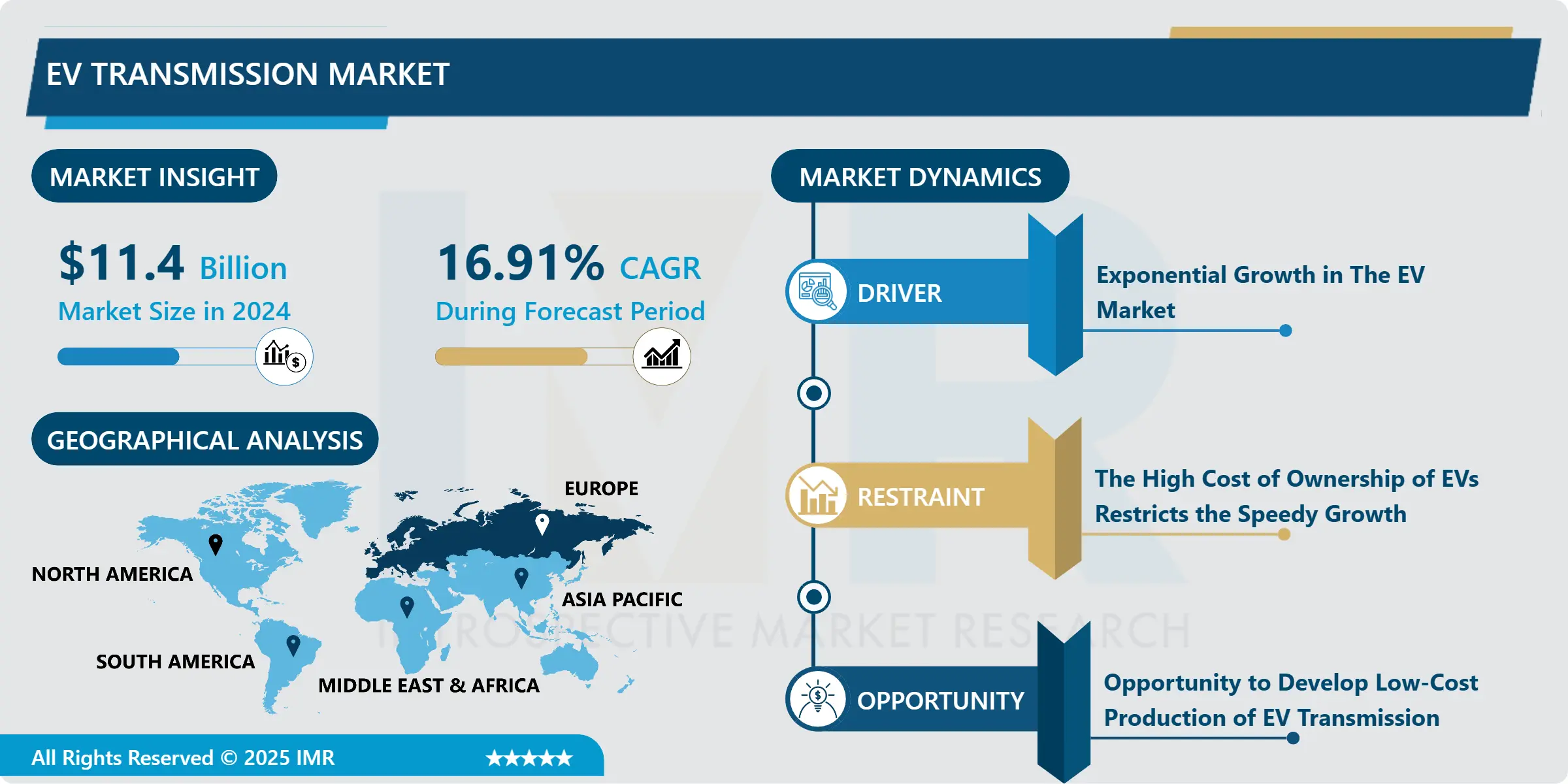

The Global EV Transmission Market size is expected to grow from USD 11.4 billion in 2024 to USD 39.78 billion by 2030, at a CAGR of 16.91% during the forecast period (2025-2032).

Transmission for electric vehicles is used to transmit mechanical power from the electric traction motor to the wheels of an electric vehicle. The majority of electric cars only have a single-speed transmission since, in today's world, it is sufficient for efficient operation. There are other vehicle types, though, for which using a multi-speed gearbox makes sense.

Since discrete power devices and obscure design methodologies predominated in the field of power electronics a few years ago, where they were often closely supervised by professional power engineers, the field has advanced significantly. Power electronics are now being integrated into systems by integrating with high-speed networking, microprocessors, converters for smart power designs, and cutting-edge thermal management techniques.

In terms of power density, compact size, weight, and power consumption, power electronics are also keeping up with technological advances (SWaP). Therefore, the development of contemporary power electronics will accelerate market growth in the years to come.

Power electronics play a significant part in several industries, including aircraft, consumer goods, heavy industry, and automobiles. Additionally, it aids in enhancing the usefulness, safety, and performance of automobiles.

EV Transmission Market Trend Analysis

EV Transmission Market Growth Driver- Exponential Growth in The EV Market

- Exponential growth serves as the dynamic force propelling the Electric Vehicle (EV) market into a transformative era. The intersection of technological advancements, environmental consciousness, and policy incentives has catalyzed a surge in EV adoption, creating a self-reinforcing cycle of expansion. The improving energy density of batteries, coupled with declining costs, has fueled the exponential rise of EVs, enhancing their viability and attractiveness to consumers.

- Governments worldwide are increasingly committing to sustainability goals, offering incentives, subsidies, and regulatory support that further amplify the growth trajectory of the EV market. This supportive environment encourages innovation and investment, fostering a robust ecosystem for electric mobility solutions.

- The network effect comes into play as a growing infrastructure of charging stations addresses range anxiety, reinforcing consumer confidence and facilitating mass adoption. As EVs become more prevalent, economies of scale drive down production costs, making electric vehicles increasingly cost-competitive with traditional internal combustion engine vehicles.

- This exponential growth is reshaping the automotive landscape, ushering in a cleaner and more sustainable future. The EV market's upward trajectory signifies a paradigm shift towards environmentally conscious transportation, with the potential to revolutionize the entire automotive industry.

EV Transmission Market Opportunities- Opportunity to Develop Low-Cost Production of EV Transmission

- The growing demand for electric vehicles (EVs) presents a significant opportunity for developing low-cost production of EV transmissions, contributing to the advancement of the EV market. As the automotive industry undergoes a transformative shift toward sustainable and clean transportation, the need for cost-effective solutions becomes paramount.

- By focusing on the development of affordable electric vehicle transmissions, manufacturers can address a critical component in the production process, potentially reducing the overall cost of EVs. This cost efficiency is vital for making EVs more accessible to a broader consumer base, fostering increased adoption and market penetration.

- A low-cost EV transmission system not only benefits consumers but also supports the broader goals of environmental sustainability. The reduction in production costs could translate into more competitive pricing for EVs, making them an attractive option compared to traditional internal combustion engine vehicles. This, in turn, can accelerate the transition to a greener automotive landscape, aligning with global efforts to combat climate change and reduce reliance on fossil fuels.

EV Transmission Market Segment Analysis:

EV Transmission Market Segmented on the basis of Transmission System, Transmission Type, and Vehicle Type,

By Transmission System, AMT Transmission segment is expected to dominate the market during the forecast period

- Automated Manual Transmission (AMT) is poised to dominate the Electric Vehicle (EV) market within the Transmission System segment. AMT offers a seamless blend of manual and automatic transmission characteristics, providing drivers with the convenience of automatic gear changes while retaining the option for manual control. This technology is gaining traction in the EV market due to its cost-effectiveness, fuel efficiency, and ease of integration into electric drivetrains.

- AMT transmissions contribute significantly to enhancing the overall driving experience in electric vehicles by optimizing power delivery and improving energy efficiency. The simplicity of design and reduced manufacturing complexity make AMT an attractive choice for EV manufacturers looking to streamline production processes and reduce costs, ultimately benefiting end consumers.

By Transmission Type, Multi-Speed segment held the largest share in 2024

- The Multi-Speed segment is poised to assert dominance in the Electric Vehicle (EV) market by Transmission Type. As technological advancements and consumer demands converge, the Multi-Speed transmission system offers a compelling solution to enhance overall EV performance and efficiency. Unlike traditional single-speed transmissions, Multi-Speed transmissions enable better optimization of power delivery across varying driving conditions.

- This dominance can be attributed to several key advantages. Multi-Speed transmissions facilitate improved acceleration and deceleration, addressing a common concern in the EV market. This enhancement in dynamic performance contributes to a more enjoyable driving experience, potentially attracting a broader consumer base.

EV Transmission Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- Europe is poised to emerge as a dominant force in the Electric Vehicle (EV) market, showcasing a robust and progressive stance toward sustainable transportation. The region's commitment to environmental goals, stringent emission regulations, and substantial investments in EV infrastructure contribute to its anticipated leadership.

- Government initiatives and incentives, such as tax breaks, subsidies, and charging station development, further propel the adoption of electric vehicles across European countries. Key players in the automotive industry are strategically aligning themselves with this trend, unveiling an array of electric models to meet the rising demand. Additionally, the European Union's ambitious targets for reducing carbon emissions and promoting green technologies underscore the continent's dedication to fostering a cleaner and greener automotive landscape.

- The collaborative efforts between governments, industry stakeholders, and consumers in embracing electric mobility contribute to Europe's projected dominance in the EV market.

EV Transmission Market Top Key Players:

- BorgWarner Inc. (USA)

- Allison Transmission Inc. (USA)

- TREMEC Holding Corporation (USA)

- Dana Incorporated (USA)

- Magna International Inc. (Canada)

- Valeo S.A. (France)

- Voith GmbH (Germany)

- ZF Friedrichshafen AG (Germany)

- Aisin Seiki Co., Ltd. (Japan)

- Bosch Rexroth AG (Germany)

- ThyssenKrupp AG (Germany)

- AVL Schrick GmbH (Germany)

- AVL Speed GmbH (Germany)

- Schaeffler AG (Germany)

- Eaton Corporation plc (Ireland)

- Marelli S.p.A. (Italy)

- GKN Automotive (UK)

- TE Connectivity Ltd. (Switzerland)

- AVL List GmbH (Austria)

- AVL DiTEST GmbH (Austria)

- AVL India Pvt Ltd (India)

- JATCO Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- HYUNDAI WIA Corporation (South Korea)

- Other Active Players

Key Industry Developments in the EV Transmission Market:

- In January 2023, Weber Drivetrain announced a strategic partnership with Wuxi Lingbo Electronic Technology (China) to manufacture controllers and BMS for electric two-wheelers in India. This represents a significant step towards localized production of EV components in India.

- In January 2023, ARENQ forged a three-year association with KAL for the distribution of e-vehicles in Kerala and Maharashtra. This expands reach and accessibility of EVs in these key Indian markets.

|

Global EV Transmission Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 11.4 Bn. |

|

Forecast Period 2023-30 CAGR: |

16.91% |

Market Size in 2032: |

USD 39.78 Bn. |

|

Segments Covered: |

By Transmission System |

|

|

|

By Transmission Type |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: EV Transmission Market by Transmission System (2018-2032)

4.1 EV Transmission Market Snapshot and Growth Engine

4.2 Market Overview

4.3 AMT Transmission

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 CVT Transmission

4.5 AT Transmission

Chapter 5: EV Transmission Market by Transmission Type (2018-2032)

5.1 EV Transmission Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Single Speed

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Multi-Speed

Chapter 6: EV Transmission Market by Vehicle Type (2018-2032)

6.1 EV Transmission Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Battery Electric Vehicle

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Plug-In Hybrid Electric Vehicle

6.5 Hybrid Electric Vehicle

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 EV Transmission Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 EATON CORPORATION(UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ON SEMICONDUCTOR (UNITED STATES)

7.4 VICOR CORPORATION (UNITED STATES)

7.5 VISHAY INTERTECHNOLOGY (UNITED STATES)

7.6 ABB (SWITZERLAND)

7.7 APTIV (IRELAND)

7.8 BOSCH (GERMANY)

7.9 CONTINENTAL AG (GERMANY)

7.10 INFINEON TECHNOLOGIES (GERMANY)

7.11 STMICROELECTRONICS (SWITZERLAND)

7.12 VALEO (FRANCE)

7.13 WEIDMÜLLER (GERMANY)

7.14 ZF FRIEDRICHSHAFEN AG (GERMANY)

7.15 DENSO (JAPAN)

7.16 FUJI ELECTRIC (JAPAN)

7.17 MITSUBISHI ELECTRIC (JAPAN)

7.18 NXP SEMICONDUCTORS (NETHERLANDS)

7.19 OMRON (JAPAN)

7.20 PANASONIC (JAPAN)

7.21 ROHM SEMICONDUCTOR (JAPAN)

7.22 TOSHIBA (JAPAN)

7.23 YAZAKI (JAPAN)

Chapter 8: Global EV Transmission Market By Region

8.1 Overview

8.2. North America EV Transmission Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Transmission System

8.2.4.1 AMT Transmission

8.2.4.2 CVT Transmission

8.2.4.3 AT Transmission

8.2.5 Historic and Forecasted Market Size by Transmission Type

8.2.5.1 Single Speed

8.2.5.2 Multi-Speed

8.2.6 Historic and Forecasted Market Size by Vehicle Type

8.2.6.1 Battery Electric Vehicle

8.2.6.2 Plug-In Hybrid Electric Vehicle

8.2.6.3 Hybrid Electric Vehicle

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe EV Transmission Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Transmission System

8.3.4.1 AMT Transmission

8.3.4.2 CVT Transmission

8.3.4.3 AT Transmission

8.3.5 Historic and Forecasted Market Size by Transmission Type

8.3.5.1 Single Speed

8.3.5.2 Multi-Speed

8.3.6 Historic and Forecasted Market Size by Vehicle Type

8.3.6.1 Battery Electric Vehicle

8.3.6.2 Plug-In Hybrid Electric Vehicle

8.3.6.3 Hybrid Electric Vehicle

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe EV Transmission Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Transmission System

8.4.4.1 AMT Transmission

8.4.4.2 CVT Transmission

8.4.4.3 AT Transmission

8.4.5 Historic and Forecasted Market Size by Transmission Type

8.4.5.1 Single Speed

8.4.5.2 Multi-Speed

8.4.6 Historic and Forecasted Market Size by Vehicle Type

8.4.6.1 Battery Electric Vehicle

8.4.6.2 Plug-In Hybrid Electric Vehicle

8.4.6.3 Hybrid Electric Vehicle

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific EV Transmission Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Transmission System

8.5.4.1 AMT Transmission

8.5.4.2 CVT Transmission

8.5.4.3 AT Transmission

8.5.5 Historic and Forecasted Market Size by Transmission Type

8.5.5.1 Single Speed

8.5.5.2 Multi-Speed

8.5.6 Historic and Forecasted Market Size by Vehicle Type

8.5.6.1 Battery Electric Vehicle

8.5.6.2 Plug-In Hybrid Electric Vehicle

8.5.6.3 Hybrid Electric Vehicle

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa EV Transmission Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Transmission System

8.6.4.1 AMT Transmission

8.6.4.2 CVT Transmission

8.6.4.3 AT Transmission

8.6.5 Historic and Forecasted Market Size by Transmission Type

8.6.5.1 Single Speed

8.6.5.2 Multi-Speed

8.6.6 Historic and Forecasted Market Size by Vehicle Type

8.6.6.1 Battery Electric Vehicle

8.6.6.2 Plug-In Hybrid Electric Vehicle

8.6.6.3 Hybrid Electric Vehicle

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America EV Transmission Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Transmission System

8.7.4.1 AMT Transmission

8.7.4.2 CVT Transmission

8.7.4.3 AT Transmission

8.7.5 Historic and Forecasted Market Size by Transmission Type

8.7.5.1 Single Speed

8.7.5.2 Multi-Speed

8.7.6 Historic and Forecasted Market Size by Vehicle Type

8.7.6.1 Battery Electric Vehicle

8.7.6.2 Plug-In Hybrid Electric Vehicle

8.7.6.3 Hybrid Electric Vehicle

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global EV Transmission Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 11.4 Bn. |

|

Forecast Period 2023-30 CAGR: |

16.91% |

Market Size in 2032: |

USD 39.78 Bn. |

|

Segments Covered: |

By Transmission System |

|

|

|

By Transmission Type |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||