Electric Vehicle Testing Equipment Market Synopsis

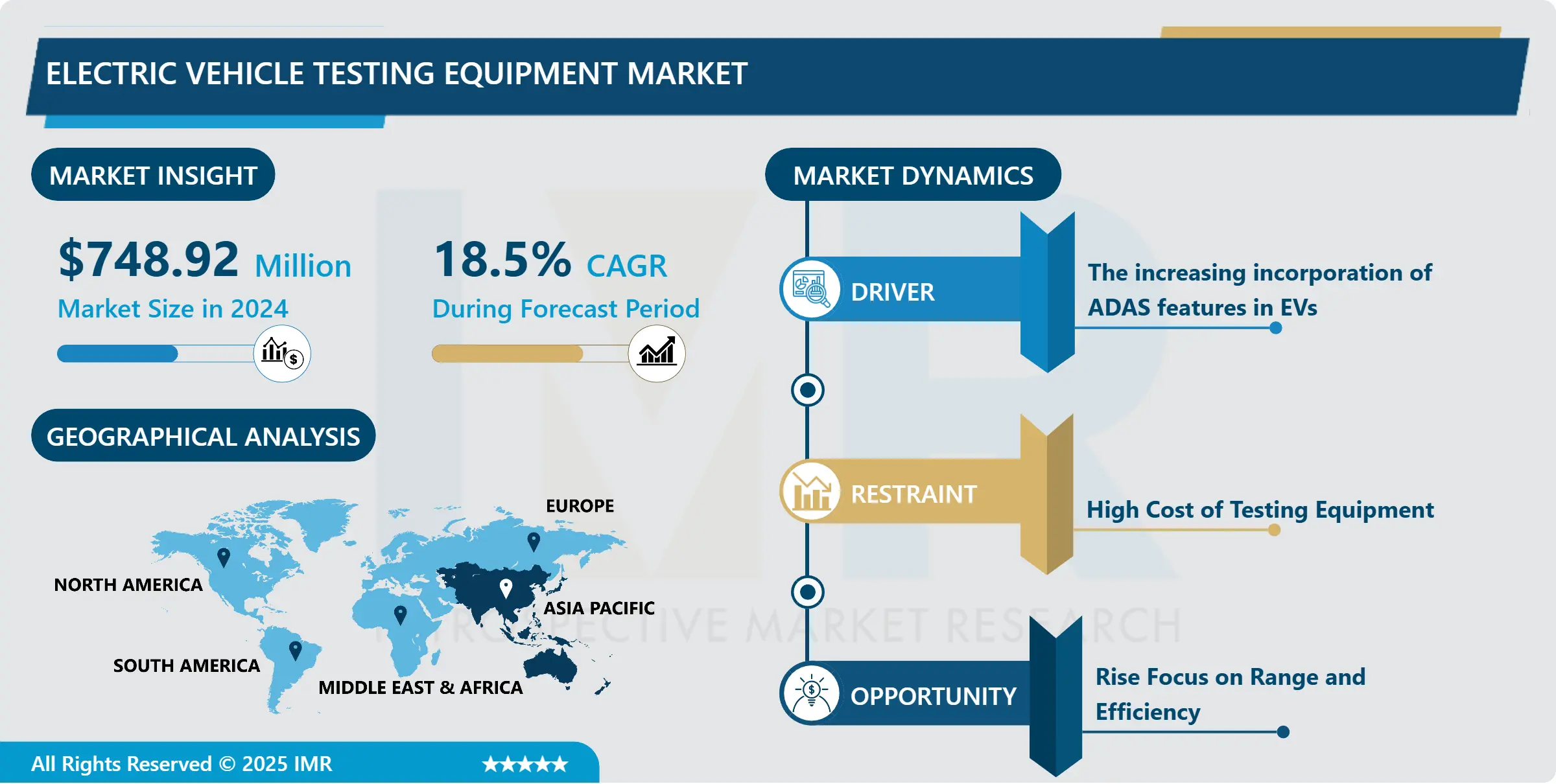

Electric Vehicle Testing Equipment Market Size Was Valued at USD 748.92 Million in 2024 and is Projected to Reach USD 2911.94 Million by 2032, Growing at a CAGR of 18.5% From 2025-2032.

EV testing comes beyond mere vehicle type and component certification. It is made up of charging stations, infrastructure, and the processes that make it possible for EVs to communicate with charging stations and back-office systems; this is known as interoperability or conformance testing. The EV test equipment industry is volatile due to the pandemic. Governments of different areas with temporary or total closing of industries have negatively impacted production and sales in the whole. Furthermore, flights were cancelled, there were travel restrictions and quarantine rules were in place which had a significant impact on global logistics as well as the supply chain activities.

Alterations of paramount proportions took place in the automotive and electronic sectors recently. Powertrain systems that are highly advanced, intense power conversion systems, and more power are essential to meet the expanding market need that requires sophisticated automotive applications and safety features including infotainment, electronic ignition, navigation and infotainment systems. Moreover, this pioneering innovation has also been the key factor for the development of modern electric vehicle testing facilities that include programmable power sources and electronic loads with higher output power and faster response times.

However, in the long term, the market is expected to grow on account of the conformance testing of all electrical components, including plugs, cables, connectors, wiring and switches, which is a key step in the testing of electric vehicles. When velocity increases, engineers are to overcome additional testing difficulties. 800/1000VDC is substituting the normal voltage and power levels of 300/400VDC, with the presence of transients up to 1200V. The higher voltages enable rapid charging, greater transmission capacity, and less vehicle weight. The combo of high-performance batteries, drivetrains, power converters, inverters, and faster recharge are propelling these components.

Customers want for expantable power capacities, integrated protection features, larger operating window, integrated measurements, and fast transient reaction times for the existing products, modular testing solution. As a result, the advent of modern testing methods developed to support the growth of the EV testing equipment industry is witnessed during the forecast period. They do so by decreasing expenses and energy consumption, organizing development and testing processes, and limiting time constraints. Mortorintelligence. com/industry-reports/electric-vehicle-test-equipment-market is the source.

Electric Vehicle Testing Equipment Market Trend Analysis

Electric Vehicle Testing Equipment Market Drivers-The increasing incorporation of ADAS features in EVs

- The main driving force behind the growth of the Electric Vehicle Testing Equipment Market is the growing demand for electric vehicles due to various factors. On the other hand, with the increasing popularity of the EVs (Electric Vehicles) on a global stage, there is a growing need for comprehensive analysis and testing of the varied components and systems that are used in these automobiles.

- Electric vehicles are such complex mechanical systems, which can be split into parts like charging systems, batteries, electric drivetrains, and power electronics that are all subject to strict testing protocols for their compliance with regulations, performance and safety standards. The electric vehicle testing equipment is an indispensable function at every stage of the vehicle development cycle, such as research and development, production, and aftermarket services where the effectiveness, dependability, and durability of all constituents are examined.

- Moreover, the large investments by automakers and suppliers for the next-generation electric vehicle makes the innovation and ongoing refinement in electric vehicle technology more and more focus. Thus, it advocates for advanced diagnostic tools that are precise in determining inefficiencies, doing performance evaluations, and replicating real-world scenarios.

- Additionally, the niche for EV-specific testing solutions that cater to EV trucks, buses, and commercial fleets is rising based on the progression of EV technology and the introduction of new vehicle models. Therefore, the increasing demand for electric vehicles propels the growth of the electric vehicle testing equipment market by encouraging innovation and providing opportunities for the creation of advanced testing solutions that help in the expansion of the EV ecosystem.

Electric Vehicle Testing Equipment Market Opportunities- Rise Focus on Range and Efficiency

- The possible benefits of standardizing testing procedures for the Electric Vehicle Testing Equipment Market include the shortening of testing processes, amendments to interoperability, and the development of cooperation within the industry.

- The standardization of testing procedures implies a uniform basis and a system of rules that assesses the conformity, safety, and performance of EVs and their components. Manufacturers, regulators, and stakeholders can provide testing results consistency and reliabilityacross different organizations and locations by developing common testing methodologies, standards, and protocols accepted worldwide.

- Furthermore, there is a high expectation that the implementation of standardized testing protocols will increase the productivity and economic viability of electric vehicle development and certification. Through the adherence to established standards, manufacturers may eliminate redundancies in the performance of tests, reduce the rate of errors or inconsistencies, and, what is more, accelerate the time needed to produce new generation electric vehicles and technologies.

- Furthermore, this advanced approach boosts the validity of the assessment results, a very crucial matter that gives confidence to investors, regulatory bodies and consumers.

- Also, we can use the establishment of a testing systems standard to create a growth outlook for the electric vehicle testing equipment market. The most recent trend is the increasing use of standards for testing that creates demand for advanced testing equipment to suit both standardized protocols and regulations.

- Such readiness compels a financial outlay on testing solutions development for specific purposes, including battery assessment, heat control, vehicle dynamics, as well as safety testings. Consequently, the market growth and the innovation in Electric Vehicle Testing Equipment are boosted, as the process of standardization of testing procedures is improved thus increasing the efficiency and reliability of testing process.

Electric Vehicle Testing Equipment Market Segment Analysis:

Electric Vehicle Testing Equipment Market is Segmented on the basis of Vehicle type, Equipment Type, and Application.

By Vehicle type, Battery electric vehicles (BEVs) segment is expected to dominate the market during the forecast period

- The battery electric vehicles (BEVs) segment of the electric vehicle testing equipment market has the biggest share by vehicle type. Such supremacy can be attributed to a lot of key components. Firstly, EVs are a new type of automobile with no internal combustion.

- Therefore, BEVs are distinguished by more sophisticated electric propulsion systems and large-capacity power packs than PHEVs and HEVs. The complexity of this question demands a detailed investigation on battery function, charging mechanisms, power electronics, and vehicle efficiency, and therefore program development for testing facilities that are aimed at the particular requirements of BEVs.

- The further development of BEVs has led to increased investment in research and development, manufacturing, and regulatory compliance. There is an increasing need for testing solutions that are more complex to guarantee the safety, performance and reliability of BEV as the technology advances. This includes battery tests, heat control, acceptable driving range, and complying with compliance requirements that include safety certifications and emission standards. Thus, the EV testing equipment market is concentrated on BEVs since their technological complexities, market presence and the need for specialized testing solutions allowing their implementation and improvement are some of the factors which contribute to this trend.

- Though it is undeniably true that with the growing market share of PHEVs and HEVs, there is a corresponding increase in demand for test devices customized to meet their specific requirements,

- As far as the case of PHEVs is concerned, it involves the analysis of both internal combustion and electric systems in addition to their mutual interaction while HEVs require the evaluation of hybrid propulsion and regenerative braking mechanisms. Therefore, while BEVs currently lead the Electric Vehicle Testing Equipment Market, this will change with growth and diversification of the electric vehicle market as a whole.

By Application, Passenger Cars segment held the largest share in 2024

- As in the area of electric vehicles' testing equipment, the dominating application segment is passenger cars. It is a multifaceted monopoly that has a wide array of influencing variables. Actually, majority market share is occupied by electric passenger cars, because many carmakers globally are focused on the further development and creation of electric passenger cars.

- So, it can be said that there is a pressing demand for a wide range of testing platforms that can be designed to assess the performance, reliability, and compliance with regulations of electronic passenger cars. These are tools to analyze the battery systems, the electric drivetrains, the charging infrastructure, and the control electronics.

- Additionally, the fact that there is a steady increase in the number of consumer and government agencies that are preferring electric passenger vehicles, and consequently a need for this kind of testing instruments. There is a growing need of an established mechanism for their (the consumers) regular testing and validation to ensure their reliability, output and security.

- On the other hand, these different safety, emissions and efficiency performance standards require agencies to have rigid criteria and certifications, which also increases the demand for testing facilities that are specially designed to run tests on electric cars.

- With the development of the electric vehicle industry, including electric buses and trucks, commercial vehicles bring an increasing number but a smaller market share and sales, so the total amount of testing equipment is still far greater in the passenger car sector. Moreover, the market for electric commercial vehicles is experiencing a widening trend toward niche testing technologies that are specifically designed for fleet utilization, robust truck drivetrains, and battery management.

Electric Vehicle Testing Equipment Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Complementary sales of BEV and PHEV in addition to decreasing power-train costs owing to material improvements and good packaging arrangement are pushing the market. On the top of that, because of the fabulous price of batteries, additions to the performance of the energy systems have been needed.

- In addition, governments all over have devised a broad array of policies and programs in order to make individuals choose electric vehicles as opposed to conventional ones. As an illustration of this approach, we can cite the ZEV initiative in California, which aims to have the 1. 5 million electric vehicles on the road in 2025. The program's purpose is to encourage more electric car owners. In addition to the Netherlands, India, China, the UK, and South Korea, which are followed by France, Germany, and Norway, there are a wide range of support measures.

- After the spread of COVID-19, there as been unexpected rise in the sales of electric vehicles. The imposition of the lockdown by the governments in various countries has had troublesome impacts on the economy lowering sales of EVs and charging infrastructure systems as well. Furthermore, other components' accessibility became limited, for example inverters and lithium-ion battery cells. It is incomplete without a power inverter for an electric vehicle. The car drives by the motor through which the energy stored in the battery is changed.

- Acquiring consumer demand is complicated and poses a formidable challenge for electric vehicle manufacturers. A lack of charging stations and the high cost of the electric vehicles whose prices are equivalent to that of premium vehicles have prevented many people from buying them, despite their numerous benefits. Consequential to covid-19 pandemic, the government of many countries such as India announced to delay the establishment of more than 50,000 charging stations and put in place the charging infrastructure.

- Specifically, some OEMS have opted to restructure their product divisions such that they now produce only electric cars. Moreover, as General Motors disclosed its plan to distribute USD 20 billion towards electric and autonomous vehicles by 2025, in 2021. The corporation seeks to introduce twenty new electric models in the market by 2023 and achieve the sales of more than one million electric vehicles per year in China and the United States.

- Volkswagen has specified the amount of investment of USD 36 billion in electric vehicles for its mass-market brands until the year 2024. The company stipulates that they will sell at least 25% of their global total vehicles electrically by the year 2025. Mortorintelligence. com/industry-reports/electric-vehicle-test-equipment-market is the source.

Active Key Players in the Electric Vehicle Testing Equipment Market

- Arbin instruments

- Atestep Gruh

- AVL (Austria)

- Blum- Novotet Gmbh

- Burke Portar Group

- Chroma ATE ( Taiwan)

- Comemso electronics Gmbh

- Dewesoft

- Durr Group (Germany)

- Dynomerk Controls

- FEV group GMBH

- Froude, Inc

- Horiba (Japan)

- KukaAG (Key Innovator)

- TUV Rheinland (Germany)

- Keysight Technologies (USA)

- National Instruments (NI) (USA)

- Siemens AG (Germany)

- Vector Informatik GmbH (Germany)

- Maccor, Inc. (USA)

- Other Active players

Key Industry Developments in the Electric Vehicle Testing Equipment Market:

- In June 2024, SAE International®, a leading authority in mobility standards development, partnered with Pearson VUE, the global leader in computer-based testing for certification and licensure exams, to launch its Electric Vehicle Supply Equipment (EVSE) Technician Certification in May 2024. This collaboration aimed to tackle the shortage of qualified EV technicians needed to support the expanding EV infrastructure in the US and globally. By leveraging Pearson VUE's expertise, SAE International sought to ensure that technicians were equipped with the necessary skills to meet the demands of the rapidly growing electric vehicle industry.

- In January 2023, Hitachi Energy, a global leader in advancing sustainable energy, announced that it had completed the acquisition of COET, a prominent designer and manufacturer of power equipment for electric mobility, rail, and industry, located in the greater Milan area of Italy. This acquisition bolstered Hitachi Energy's global standing and expanded its offerings in high-power electric vehicle charging infrastructure, power electronics, and grid-edge solutions. The strategic move enhanced the company's production capacity and technological capabilities, reinforcing its commitment to driving a sustainable energy future.

|

Global Electric Vehicle Testing Equipment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 748.92 Mn. |

|

Forecast Period 2024-32 CAGR: |

18.5% |

Market Size in 2032: |

USD 2911.94 Mn. |

|

Segments Covered: |

By Vehicle type

|

|

|

|

By Equipment Type

|

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle Testing Equipment Market by Vehicle type (2018-2032)

4.1 Electric Vehicle Testing Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 BEV

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 PHEV

4.5 HEV

Chapter 5: Electric Vehicle Testing Equipment Market by Equipment Type (2018-2032)

5.1 Electric Vehicle Testing Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Battery Test

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Powertrain

5.5 EV Component

5.6 EV Charging

5.7 Others

Chapter 6: Electric Vehicle Testing Equipment Market by Application (2018-2032)

6.1 Electric Vehicle Testing Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Passenger Cars

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Commercial Vehicles

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Electric Vehicle Testing Equipment Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DENSO CORPORATION

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ROBERT BOSCH GMBH

7.4 INFINEON TECHNOLOGIES AG

7.5 DELPHI TECHNOLOGIES

7.6 CONTINENTAL AG

7.7 HITACHI AUTOMOTIVE SYSTEMS LTDVALEO

7.8 MITSUBISHI ELECTRIC CORPORATION

7.9 HELLA

7.10 PANASONIC CORPORATION

7.11 TESLA INCTOYOTA INDUSTRIES CORPORATION

7.12 HANGZHOU TIECHENG INFORMATION TECHNOLOGY

7.13 APTIV

7.14 BOLAB SYSTEMS GMBH

7.15 EHFCV

7.16 ELECTRODRIVE POWERTRAIN SOLUTIONS

7.17 HYUNDAI KEFICO

7.18 MARELLI

7.19 PEKTRON GROUP

7.20 TE CONNECTIVITY

7.21 VITESCO TECHNOLOGIES

7.22 WACKER CHEMIE AG.

Chapter 8: Global Electric Vehicle Testing Equipment Market By Region

8.1 Overview

8.2. North America Electric Vehicle Testing Equipment Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Vehicle type

8.2.4.1 BEV

8.2.4.2 PHEV

8.2.4.3 HEV

8.2.5 Historic and Forecasted Market Size by Equipment Type

8.2.5.1 Battery Test

8.2.5.2 Powertrain

8.2.5.3 EV Component

8.2.5.4 EV Charging

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Passenger Cars

8.2.6.2 Commercial Vehicles

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Electric Vehicle Testing Equipment Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Vehicle type

8.3.4.1 BEV

8.3.4.2 PHEV

8.3.4.3 HEV

8.3.5 Historic and Forecasted Market Size by Equipment Type

8.3.5.1 Battery Test

8.3.5.2 Powertrain

8.3.5.3 EV Component

8.3.5.4 EV Charging

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Passenger Cars

8.3.6.2 Commercial Vehicles

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Electric Vehicle Testing Equipment Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Vehicle type

8.4.4.1 BEV

8.4.4.2 PHEV

8.4.4.3 HEV

8.4.5 Historic and Forecasted Market Size by Equipment Type

8.4.5.1 Battery Test

8.4.5.2 Powertrain

8.4.5.3 EV Component

8.4.5.4 EV Charging

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Passenger Cars

8.4.6.2 Commercial Vehicles

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Electric Vehicle Testing Equipment Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Vehicle type

8.5.4.1 BEV

8.5.4.2 PHEV

8.5.4.3 HEV

8.5.5 Historic and Forecasted Market Size by Equipment Type

8.5.5.1 Battery Test

8.5.5.2 Powertrain

8.5.5.3 EV Component

8.5.5.4 EV Charging

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Passenger Cars

8.5.6.2 Commercial Vehicles

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Electric Vehicle Testing Equipment Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Vehicle type

8.6.4.1 BEV

8.6.4.2 PHEV

8.6.4.3 HEV

8.6.5 Historic and Forecasted Market Size by Equipment Type

8.6.5.1 Battery Test

8.6.5.2 Powertrain

8.6.5.3 EV Component

8.6.5.4 EV Charging

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Passenger Cars

8.6.6.2 Commercial Vehicles

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Electric Vehicle Testing Equipment Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Vehicle type

8.7.4.1 BEV

8.7.4.2 PHEV

8.7.4.3 HEV

8.7.5 Historic and Forecasted Market Size by Equipment Type

8.7.5.1 Battery Test

8.7.5.2 Powertrain

8.7.5.3 EV Component

8.7.5.4 EV Charging

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Passenger Cars

8.7.6.2 Commercial Vehicles

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Electric Vehicle Testing Equipment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 748.92 Mn. |

|

Forecast Period 2024-32 CAGR: |

18.5% |

Market Size in 2032: |

USD 2911.94 Mn. |

|

Segments Covered: |

By Vehicle type

|

|

|

|

By Equipment Type

|

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||