Electric Vehicle Market Synopsis

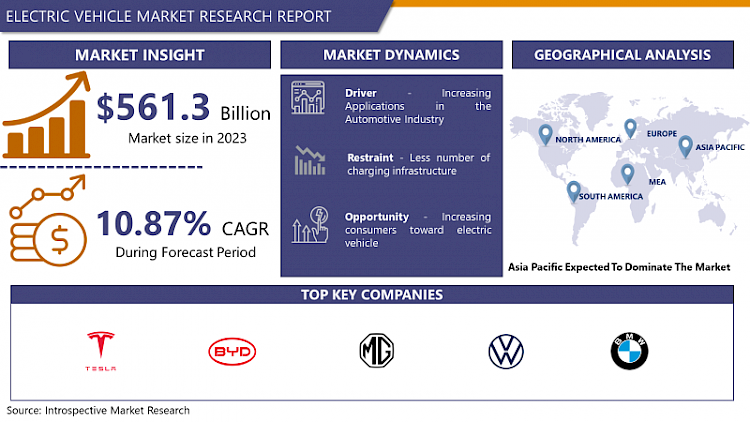

Electric Vehicle Market size was valued at USD 561.3 Billion in 2023 and is projected to reach USD 1420.76 Billion by 2032, growing at a CAGR of 10.87%from 2024 to 2032.

- Electric Vehicle (EV) is a class of automobile driven by one or multiple electric motors, making energy from stored electricity in sources such as batteries, fuel cells, or other energy reservoirs. In variation to conventional vehicles powered by internal combustion engines that rely on fossil fuels, electric vehicles employ electricity to generate motion, leading to reduced emissions and a lessened environmental footprint, the electricity originates from renewable sources. Electric vehicles are mainly used in sustainable transportation solutions, utilizing electric motors and rechargeable battery packs for propulsion. including lower operational costs, reduced environmental impact through zero emissions, decreased noise pollution, and smoother rides.

- The rapid growth of the electric vehicle industry is driven by its positive impact on the environment, including zero emissions and reduced greenhouse gases. This trend is supported by economic benefits like cost-effective operation, quiet performance, smooth acceleration, and government backing. The increasing adoption of EVs is not only advancing the automotive sector but also creating opportunities in various fields like battery supply, transportation, utilities, online shopping, delivery, and EV manufacturing. This situation is creating a favorable environment for expansion and innovation. Types of Electric Vehicles Battery Electric Vehicles (BEVs) operate solely on batteries for power, Plug-in Hybrid Electric Vehicles (PHEVs) combine electric and gasoline engines, and Fuel Cell Electric Vehicles (FCEVs) utilize hydrogen fuel cells. These varying types provide consumers with options that balance factors like range, charging times, and environmental impact.

- One of the major hurdles to EV adoption has been the cost of batteries. However, advancements in battery technology and economies of scale have led to a steady decline in battery costs, making EVs more affordable. Growing awareness of environmental issues and the benefits of EVs, along with a shift in consumer preferences towards sustainable options, has also driven demand for EVs.Partnerships between automakers, energy companies, and technology firms can accelerate the development of EVs, charging solutions, and associated technologies. This will help to make EVs more affordable and accessible to a wider range of consumers.

Electric Vehicle Market Key Player

Tesla(US), BYD(China), Mahindra & Mahindra (INDIA), MG Motor (India), ATUL(India), Bajaj Auto (India), Electrotherm (India), Tata Motors (India), Geely (China), SAIC Motor (China), Volkswagen (Germany), BMW(Germany), Daimler (Germany), Nissan (Japan), Toyota (Japan), Hyundai (South Korea), General Motors (US), Ford (US), Lucid Motors (US), Rivian (US), NIO(CHINA), TVS Motor (INDIA), VE Commercial Vehicles (INDIA), Olectra Greentech (INDIA), JBM Group (INDIA) and Other Major Player.

The Electric Vehicle Market Trend Analysis

Increasing Applications in the Automotive Industry

- The electric vehicle market is currently dominated by the passenger car segment, and this is expected to continue in the upcoming period. The rolling demand for eco-friendly and fuel-efficient vehicles is driving this phenomenon. Commercial vehicles are gradually embracing electric propulsion as enterprises aim to curtail operational expenses. Electric-powered buses and trucks are gaining traction as governmental bodies and urban centers prioritize enhancing air quality. Even two-wheelers and off-road vehicles are experiencing a roll in electric adoption due to their increasing affordability and availability.

- Battery technology has greatly improved, solving past issues like short electric vehicle range and expensive batteries. These improvements include better energy storage, faster charging, and longer-lasting batteries. electric vehicles now have longer ranges and are more reasonably priced. As technology gets better and more batteries are made, their production costs are going down. This makes electric cars cheaper for consumers to buy electric vehicles.

- Governments in different countries are giving rewards and discounts to encourage people to buy electric cars. These rewards can be in the form of tax breaks, money back, cheaper fees for registering the car, and even the ability to drive in special high-occupancy vehicle lanes. These rewards make electric cars more appealing to buyers and are helping the electric car market to grow.

- Technology is getting better and more electric car batteries are being made, the cost of making these batteries is going down. This is making electric cars cheaper for consumers to buy an electric vehicle.

Increasing consumers toward electric vehicle

- Consumers are concerned about the environmental impact of gasoline-powered vehicles and are looking for more sustainable transportation options. Electric vehicles produce zero emissions and help to reduce air pollution and climate change.

- Growing awareness and concern about environmental issues, particularly related to climate change and air pollution. consumers become more conscious of their carbon footprint and the negative impacts of traditional internal combustion engine (ICE) vehicles on the environment and are considering alternatives that are more sustainable and eco-friendlier. EVs offer a clear advantage as they produce zero tailpipe emissions, leading to reduced greenhouse gas emissions and improved air quality.

- Consumers have been drawn to the cutting-edge features, seamless driving experience, and the potential for reduced maintenance costs, EVs have a small number of moving parts compared to traditional gasoline-powered vehicles.

- The electric car market has been much better recently. Electric vehicles now have longer ranges and faster charging times, making them easy for regular driving. EVs have a small number of moving parts and require less maintenance, which translates to reduced servicing costs over the vehicle's lifetime. This economic advantage aligns with the consumer’s desire to save money while making a sustainable choice for the consumer.

Electric Vehicle Market Segmentation Analysis:

Electric Vehicle Market covers the Type, Application, and, vehicle type. By Type, the Battery Electric Vehicle segment is Anticipated to Dominate the Market Over the Forecast period.

- Battery Electric vehicles produce no tailpipe emissions, making them environmentally friendly and contributing to improved air quality in urban areas. Battery Electric vehicles provide instant torque, resulting in quick acceleration and responsive performance. They are design allows for a lower center of gravity, contributing to better handling.

- Battery Electric vehicles are equipped with advanced lithium-ion or similar battery technologies that store and provide energy to an electric motor, enabling the vehicle to move without using gasoline or diesel fuel.

- Electric cars largely depend on creating a robust charging network, which includes home and workplace charging stations as well as public ones. With the rise of fast-charging stations, the time it takes to recharge has significantly decreased.

- Plug-in Hybrid Electric Vehicle vehicles have both an electric battery and an internal combustion engine. They can run on electric power for a certain distance before the internal combustion engine kicks in the vehicle.

Electric Vehicle Market Regional Analysis:

Asia Pacific is Expected to Dominate Electric Vehicle Market Over the Forecast Period.

- The Asia Pacific region is dominating the electric vehicle market in the world. This is due to the region's large population and growing middle class, government policies and incentives, the rapidly developing EV industry, and growing environmental concerns.

- A growing middle class in developing countries in Asia, China, and India, is leading to increased demand for personal transportation. These countries have large populations and are seeing rapid urbanization, which is increasing the need for more efficient and environmentally friendly modes of transportation.

- Governments in the region are implementing policies to promote electric vehicles, such as subsidies and tax breaks. These policies are making electric vehicles more affordable for consumers and encouraging their adoption. The cost of electric vehicles is declining, making them more affordable for consumers. The cost of batteries, which are a major component of electric vehicles, has been declining, making electric vehicles more competitive with gasoline-powered vehicles.

- The availability of charging infrastructure is improving in the region. more charging stations available in the Asia Pacific region, making it easier for electric vehicle owners to charge their vehicles. The Asia Pacific electric vehicle market is expected to continue to grow in the coming years. The International Energy Agency (IEA) projects that the region will grow its market global electric vehicle sales by 2030.

Key Industry Developments in the Electric Vehicle Market

- In February 2023, BYD added two new dealer corporations to its network in the Europe region. Motor Distributors Ltd (MDL) is active in Ireland and will offer BYD models at select locations including Dublin and Cork. RSA is a dealer with whom BYD already works in Norway, and it will offer EVs of Chinese-make in Finland and Iceland. BYD initially launched three EV models in select European countries at the end of 2022. Two more series could follow in 2023.

- In May 2023 Ford Motor and Tesla joined forces to revolutionize electric vehicle charging for present and future models. Notably, current Ford EV owners will gain convenient access to over 12,000 Tesla Superchargers spanning the U.S. and Canada. This landmark agreement, announced by Ford CEO Jim Farley and Tesla CEO Elon Musk, will also witness the integration of Tesla's charging plug-in in Ford's upcoming EV line-up. This innovative move will enable Ford vehicle owners to seamlessly utilize Tesla Superchargers without the need for an adapter.

- In July 2023: Mahindra & Mahindra Ltd., a leader in automotive, farm, and services businesses in India, signed an MoU with NXP® Semiconductors, a world leader in secure connectivity solutions for embedded applications. With the association, M&M and NXP will jointly explore the electric and connected vehicle landscape, covering a wide range of vehicles including utility vehicles, light commercial vehicles, farm equipment, and tractors.

|

Electric Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 561.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.87 % |

Market Size in 2032: |

USD 1420.76 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE MARKET BY TYPES (2017-2032)

- ELECTRIC VEHICLE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BATTERY ELECTRIC VEHICLE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HYBRID ELECTRIC VEHICLE

- PLUG-IN HYBRID ELECTRIC VEHICLE

- FUEL CELL ELECTRIC VEHICLE

- ELECTRIC VEHICLE MARKET BY APPLICATION (2017-2032)

- ELECTRIC VEHICLE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BATTERY ELECTRIC VEHICLE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PLUG-IN HYBRID ELECTRIC VEHICLE

- ELECTRIC VEHICLE MARKET BY VEHICLE TYPE (2017-2032)

- ELECTRIC VEHICLE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TWO-WHEELERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PASSENGER CARS

- COMMERCIAL VEHICLES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- ELECTRIC VEHICLE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- TESLA

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BYD

- MAHINDRA & MAHINDRA

- MG MOTOR

- ATUL

- BAJAJ AUTO

- ELECTROTHERM

- TATA MOTORS

- GEELY

- SAIC MOTOR

- VOLKSWAGEN

- BMW

- DAIMLER

- NISSAN

- TOYOTA

- HYUNDAI

- GENERAL MOTORS

- FORD

- LUCID MOTORS

- RIVIAN

- NIO

- TVS MOTOR

- VE COMMERCIAL VEHICLES

- OLECTRA GREENTECH

- JBM GROUP

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC VEHICLE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segment1

- Historic And Forecasted Market Size By Segment2

- Historic And Forecasted Market Size By Segment3

- Historic And Forecasted Market Size By Segment4

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Electric Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 561.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.87 % |

Market Size in 2032: |

USD 1420.76 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC VEHICLE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC VEHICLE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC VEHICLE MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC VEHICLE MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC VEHICLE MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC VEHICLE MARKET BY TYPES

TABLE 008. BATTERY ELECTRIC VEHICLE MARKET OVERVIEW (2016-2030)

TABLE 009. HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2030)

TABLE 010. PLUG-IN HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2030)

TABLE 011. FUEL CELL ELECTRIC VEHICLE MARKET OVERVIEW (2016-2030)

TABLE 012. ELECTRIC VEHICLE MARKET BY APPLICATION

TABLE 013. BATTERY ELECTRIC VEHICLE MARKET OVERVIEW (2016-2030)

TABLE 014. PLUG-IN HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2030)

TABLE 015. ELECTRIC VEHICLE MARKET BY VEHICLE TYPE

TABLE 016. TWO-WHEELERS MARKET OVERVIEW (2016-2030)

TABLE 017. PASSENGER CARS MARKET OVERVIEW (2016-2030)

TABLE 018. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2030)

TABLE 019. NORTH AMERICA ELECTRIC VEHICLE MARKET, BY TYPES (2016-2030)

TABLE 020. NORTH AMERICA ELECTRIC VEHICLE MARKET, BY APPLICATION (2016-2030)

TABLE 021. NORTH AMERICA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE (2016-2030)

TABLE 022. N ELECTRIC VEHICLE MARKET, BY COUNTRY (2016-2030)

TABLE 023. EASTERN EUROPE ELECTRIC VEHICLE MARKET, BY TYPES (2016-2030)

TABLE 024. EASTERN EUROPE ELECTRIC VEHICLE MARKET, BY APPLICATION (2016-2030)

TABLE 025. EASTERN EUROPE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE (2016-2030)

TABLE 026. ELECTRIC VEHICLE MARKET, BY COUNTRY (2016-2030)

TABLE 027. WESTERN EUROPE ELECTRIC VEHICLE MARKET, BY TYPES (2016-2030)

TABLE 028. WESTERN EUROPE ELECTRIC VEHICLE MARKET, BY APPLICATION (2016-2030)

TABLE 029. WESTERN EUROPE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE (2016-2030)

TABLE 030. ELECTRIC VEHICLE MARKET, BY COUNTRY (2016-2030)

TABLE 031. ASIA PACIFIC ELECTRIC VEHICLE MARKET, BY TYPES (2016-2030)

TABLE 032. ASIA PACIFIC ELECTRIC VEHICLE MARKET, BY APPLICATION (2016-2030)

TABLE 033. ASIA PACIFIC ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE (2016-2030)

TABLE 034. ELECTRIC VEHICLE MARKET, BY COUNTRY (2016-2030)

TABLE 035. MIDDLE EAST & AFRICA ELECTRIC VEHICLE MARKET, BY TYPES (2016-2030)

TABLE 036. MIDDLE EAST & AFRICA ELECTRIC VEHICLE MARKET, BY APPLICATION (2016-2030)

TABLE 037. MIDDLE EAST & AFRICA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE (2016-2030)

TABLE 038. ELECTRIC VEHICLE MARKET, BY COUNTRY (2016-2030)

TABLE 039. SOUTH AMERICA ELECTRIC VEHICLE MARKET, BY TYPES (2016-2030)

TABLE 040. SOUTH AMERICA ELECTRIC VEHICLE MARKET, BY APPLICATION (2016-2030)

TABLE 041. SOUTH AMERICA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE (2016-2030)

TABLE 042. ELECTRIC VEHICLE MARKET, BY COUNTRY (2016-2030)

TABLE 043. TESLA (US): SNAPSHOT

TABLE 044. TESLA (US): BUSINESS PERFORMANCE

TABLE 045. TESLA (US): PRODUCT PORTFOLIO

TABLE 046. TESLA (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. BYD (CHINA): SNAPSHOT

TABLE 047. BYD (CHINA): BUSINESS PERFORMANCE

TABLE 048. BYD (CHINA): PRODUCT PORTFOLIO

TABLE 049. BYD (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. MAHINDRA & MAHINDRA (INDIA): SNAPSHOT

TABLE 050. MAHINDRA & MAHINDRA (INDIA): BUSINESS PERFORMANCE

TABLE 051. MAHINDRA & MAHINDRA (INDIA): PRODUCT PORTFOLIO

TABLE 052. MAHINDRA & MAHINDRA (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. MG MOTOR (INDIA): SNAPSHOT

TABLE 053. MG MOTOR (INDIA): BUSINESS PERFORMANCE

TABLE 054. MG MOTOR (INDIA): PRODUCT PORTFOLIO

TABLE 055. MG MOTOR (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ATUL(INDIA): SNAPSHOT

TABLE 056. ATUL(INDIA): BUSINESS PERFORMANCE

TABLE 057. ATUL(INDIA): PRODUCT PORTFOLIO

TABLE 058. ATUL(INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. BAJAJ AUTO (INDIA): SNAPSHOT

TABLE 059. BAJAJ AUTO (INDIA): BUSINESS PERFORMANCE

TABLE 060. BAJAJ AUTO (INDIA): PRODUCT PORTFOLIO

TABLE 061. BAJAJ AUTO (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. ELECTROTHERM (INDIA): SNAPSHOT

TABLE 062. ELECTROTHERM (INDIA): BUSINESS PERFORMANCE

TABLE 063. ELECTROTHERM (INDIA): PRODUCT PORTFOLIO

TABLE 064. ELECTROTHERM (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. TATA MOTORS (INDIA): SNAPSHOT

TABLE 065. TATA MOTORS (INDIA): BUSINESS PERFORMANCE

TABLE 066. TATA MOTORS (INDIA): PRODUCT PORTFOLIO

TABLE 067. TATA MOTORS (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. GEELY (CHINA): SNAPSHOT

TABLE 068. GEELY (CHINA): BUSINESS PERFORMANCE

TABLE 069. GEELY (CHINA): PRODUCT PORTFOLIO

TABLE 070. GEELY (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. SAIC MOTOR (CHINA): SNAPSHOT

TABLE 071. SAIC MOTOR (CHINA): BUSINESS PERFORMANCE

TABLE 072. SAIC MOTOR (CHINA): PRODUCT PORTFOLIO

TABLE 073. SAIC MOTOR (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. VOLKSWAGEN (GERMANY): SNAPSHOT

TABLE 074. VOLKSWAGEN (GERMANY): BUSINESS PERFORMANCE

TABLE 075. VOLKSWAGEN (GERMANY): PRODUCT PORTFOLIO

TABLE 076. VOLKSWAGEN (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. BMW(GERMANY): SNAPSHOT

TABLE 077. BMW(GERMANY): BUSINESS PERFORMANCE

TABLE 078. BMW(GERMANY): PRODUCT PORTFOLIO

TABLE 079. BMW(GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. DAIMLER (GERMANY): SNAPSHOT

TABLE 080. DAIMLER (GERMANY): BUSINESS PERFORMANCE

TABLE 081. DAIMLER (GERMANY): PRODUCT PORTFOLIO

TABLE 082. DAIMLER (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. NISSAN (JAPAN): SNAPSHOT

TABLE 083. NISSAN (JAPAN): BUSINESS PERFORMANCE

TABLE 084. NISSAN (JAPAN): PRODUCT PORTFOLIO

TABLE 085. NISSAN (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. TOYOTA (JAPAN): SNAPSHOT

TABLE 086. TOYOTA (JAPAN): BUSINESS PERFORMANCE

TABLE 087. TOYOTA (JAPAN): PRODUCT PORTFOLIO

TABLE 088. TOYOTA (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. HYUNDAI (SOUTH KOREA): SNAPSHOT

TABLE 089. HYUNDAI (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 090. HYUNDAI (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 091. HYUNDAI (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. GENERAL MOTORS (US): SNAPSHOT

TABLE 092. GENERAL MOTORS (US): BUSINESS PERFORMANCE

TABLE 093. GENERAL MOTORS (US): PRODUCT PORTFOLIO

TABLE 094. GENERAL MOTORS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. FORD (US): SNAPSHOT

TABLE 095. FORD (US): BUSINESS PERFORMANCE

TABLE 096. FORD (US): PRODUCT PORTFOLIO

TABLE 097. FORD (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. LUCID MOTORS (US): SNAPSHOT

TABLE 098. LUCID MOTORS (US): BUSINESS PERFORMANCE

TABLE 099. LUCID MOTORS (US): PRODUCT PORTFOLIO

TABLE 100. LUCID MOTORS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. RIVIAN (US): SNAPSHOT

TABLE 101. RIVIAN (US): BUSINESS PERFORMANCE

TABLE 102. RIVIAN (US): PRODUCT PORTFOLIO

TABLE 103. RIVIAN (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. NIO(CHINA): SNAPSHOT

TABLE 104. NIO(CHINA): BUSINESS PERFORMANCE

TABLE 105. NIO(CHINA): PRODUCT PORTFOLIO

TABLE 106. NIO(CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. TVS MOTOR (INDIA): SNAPSHOT

TABLE 107. TVS MOTOR (INDIA): BUSINESS PERFORMANCE

TABLE 108. TVS MOTOR (INDIA): PRODUCT PORTFOLIO

TABLE 109. TVS MOTOR (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. VE COMMERCIAL VEHICLES (INDIA): SNAPSHOT

TABLE 110. VE COMMERCIAL VEHICLES (INDIA): BUSINESS PERFORMANCE

TABLE 111. VE COMMERCIAL VEHICLES (INDIA): PRODUCT PORTFOLIO

TABLE 112. VE COMMERCIAL VEHICLES (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. OLECTRA GREENTECH (INDIA): SNAPSHOT

TABLE 113. OLECTRA GREENTECH (INDIA): BUSINESS PERFORMANCE

TABLE 114. OLECTRA GREENTECH (INDIA): PRODUCT PORTFOLIO

TABLE 115. OLECTRA GREENTECH (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. JBM GROUP (INDIA): SNAPSHOT

TABLE 116. JBM GROUP (INDIA): BUSINESS PERFORMANCE

TABLE 117. JBM GROUP (INDIA): PRODUCT PORTFOLIO

TABLE 118. JBM GROUP (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 119. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 120. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 121. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC VEHICLE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC VEHICLE MARKET OVERVIEW BY TYPES

FIGURE 012. BATTERY ELECTRIC VEHICLE MARKET OVERVIEW (2016-2030)

FIGURE 013. HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2030)

FIGURE 014. PLUG-IN HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2030)

FIGURE 015. FUEL CELL ELECTRIC VEHICLE MARKET OVERVIEW (2016-2030)

FIGURE 016. ELECTRIC VEHICLE MARKET OVERVIEW BY APPLICATION

FIGURE 017. BATTERY ELECTRIC VEHICLE MARKET OVERVIEW (2016-2030)

FIGURE 018. PLUG-IN HYBRID ELECTRIC VEHICLE MARKET OVERVIEW (2016-2030)

FIGURE 019. ELECTRIC VEHICLE MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 020. TWO-WHEELERS MARKET OVERVIEW (2016-2030)

FIGURE 021. PASSENGER CARS MARKET OVERVIEW (2016-2030)

FIGURE 022. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2030)

FIGURE 023. NORTH AMERICA ELECTRIC VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. EASTERN EUROPE ELECTRIC VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. WESTERN EUROPE ELECTRIC VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. ASIA PACIFIC ELECTRIC VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. MIDDLE EAST & AFRICA ELECTRIC VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 028. SOUTH AMERICA ELECTRIC VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Electric Vehicle Market research report is 2024-2032.

Tesla (US), BYD (China), Mahindra & Mahindra (INDIA), MG Motor (India), ATUL(India), Bajaj Auto (India), Electrotherm (India), Tata Motors (India), Geely (China), SAIC Motor (China), Volkswagen (Germany), BMW(Germany), Daimler (Germany), Nissan (Japan), Toyota (Japan), Hyundai (South Korea), General Motors (US), Ford (US), Lucid Motors (US), Rivian (US), NIO(CHINA), TVS Motor (INDIA), VE Commercial Vehicles (INDIA), Olectra Greentech (INDIA), JBM Group (INDIA) and other major player.

The Electric Vehicle Market is segmented into Type, Application, Vehicle Type, and region. By Type, the market is categorized into Battery Electric Vehicle, Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles, and Fuel Cell Electric Vehicle. By Application, the market is categorized into Battery Electric Vehicle and Plug-In Hybrid Electric Vehicle. By Vehicle Type, the market is categorized into Two-Wheelers, Passenger Cars, and Commercial Vehicles. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Electric Vehicle (EV) is a class of automobile driven by one or multiple electric motors, making energy from stored electricity in sources such as batteries, fuel cells, or other energy reservoirs. In variation to conventional vehicles powered by internal combustion engines that rely on fossil fuels, electric vehicles employ electricity to generate motion, leading to reduce emissions and a lessened environmental footprint, the electricity originates from renewable sources.

Electric Vehicle Market size was valued at USD 561.3 Billion in 2023 and is projected to reach USD 1420.76 Billion by 2032, growing at a CAGR of 10.87%from 2024 to 2032.