Electric Vehicle Onboard Charger (OBC) Market Synopsis

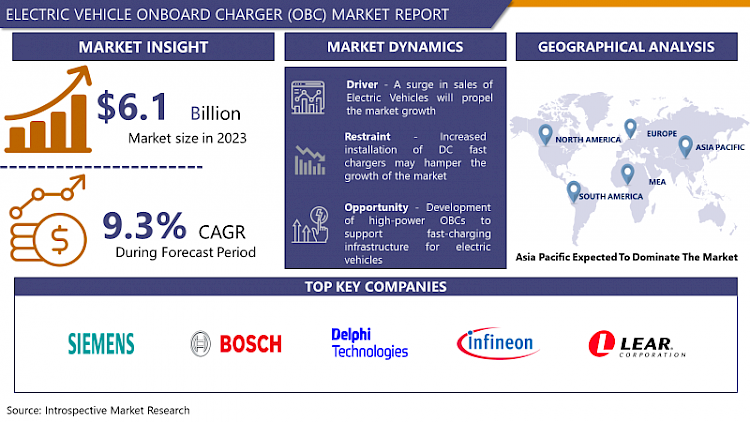

Electric Vehicle Onboard Charger (OBC) Market Size Was Valued at USD 6.1 Billion in 2023, and is Projected to Reach USD 13.6 Billion by 2032, Growing at a CAGR of 9.3% From 2024-2032.

- The EV OBC is an essential hardware component located within EVs that is used to transform AC from an external source (i.e., a charging station or outlet) into DC in order to charge the vehicle’s battery pack. Located between the power source and the battery, the OBC controls the voltage and current that charges the battery and also takes into consideration factors like temperature and state of charge of the battery. Its small size and sophisticated technology allow it to work with different input voltage and charging current that charges most of the present charging infrastructure. Moreover, nowadays, OBCs are commonly equipped with smart features, enabling their communication with external systems to manage the charging parameters and to display real-time information about the charging status, which can also contribute to the positive EV charging experience.

- The EV OBC, a fundamental part of EVs, performs the vital task of transforming AC from external points into DC for charging the batteries.

- It acts as the interface between the power source and the battery controlling the voltage and current supplied to the battery during charging.

- The OBC is supposed to accommodate different input voltages and charging rates in order to be compatible with different charging infrastructures.

- It oversees aspects like temperature and battery state of charge to enhance charging proficiency and battery wellness.

- Today’s OBC also contains intelligent modules for communication with external systems, which can be used to adjust charging parameters and receive information on the battery status in real time.

- Its compact size and high-tech electronics also help make EV charging systems more efficient and reliable.

- The OBC is generally mounted within the electric vehicle’s powertrain where it does not have any interference during charging.

- It has a significant role in controlling power delivery and ensuring that the battery pack is not over- or under-charged.

- OBCs are also equipped with intrinsic safety functions that help prevent electrical failures and ensure that users are not electrocuted during the charging process.

Electric Vehicle Onboard Charger (OBC) Market Trend Analysis

Increased Power Density

- The rise of power density in EV OBCs is a significant step in EV charging technology. With the rising need for faster charging and larger batteries, OBCs have the responsibility of supplying greater power levels in a more compact package. Power electronics and advanced thermal management are some of the ways through which manufacturers are meeting this challenge. With the help of the latest semiconductor technologies like SiC and GaN, the OBCs can be more efficient and support increased power conversion density, meaning that more power can be delivered in the same volume.

- In addition, progress in the field of thermal management is of critical importance in the improvement of high-power OBCs’ performance and reliability. It is also essential to effectively remove the heat produced during the charging process to avoid component damage and ensure the device functions safely. Some manufacturers are investing in complex cooling solutions, like liquid cooling or innovative air cooling architectures, to better control thermal energy and temperature buildup. Moreover, there have been attempts to incorporate smart thermal-control technologies into OBCs to regulate charging factors according to temperature, which will further enhance efficiency and safety. Through achieving higher power densities and enhancing thermal management in OBCs, the manufacturers are enhancing the charging rates and other efficient charging experiences for the EV owners in turn fueling the electric mobility.

Electric Vehicle Onboard Charger (OBC) Market Segment Analysis:

Electric Vehicle Onboard Charger Market Segmented based on Charger Power Rating, Charger Type, By Vehicle Type, Charging Level, Charging Connector, Propulsion Type and End-User

By Charger Power Rating, is expected to dominate the market during the forecast period

- The charger power rating defines the charging rate and capability of the charger. It is categorized into three main types: Low Power, Medium Power and High Power.

- Low Power chargers are generally designed to deliver up to 3. 6 kW, appropriate for slower charging requirements like domestic charging at night.

- Medium Power chargers vary from 3. 7 kW-22 kW to better meet the needs of charging at homes and some businesses.

- High Power chargers with a rating above 22 kW, provide fast charging options that are ideal for highly frequented sites such as public fast charging and commercial fleet charging applications.

By Propulsion Type: Battery Electric Vehicles (BEV) Plug-in Hybrid Electric Vehicles (PHEV) segment held the largest share in 2023

- The electric vehicles can be divided into Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs). BEVs rely solely on electric propulsion and use power from the battery while PHEVs have an internal combustion engine that can be used in case of long distance travel.

- This dominance can be attributed to various factors. Firstly, the overall climate change concerns and rising environmental awareness among consumers have accelerated the demand for more sustainable transportation options. BEVs run on electricity alone and thus produce no emissions, making them environmentally friendly vehicles that help consumers achieve their sustainability goals. Furthermore, the progress in the battery technology allowed for an increase in the driving range and the establishment of the charging infrastructure, which reduced the range anxiety and contributed to the acceptance of BEVs for everyday use.

- On the other hand, PHEVs were also still very prominently featured in the market in 2023, although on a slightly smaller scale than BEVs. This option gives the driver an extended range and allows him/her to operate the vehicle on conventional fuels without worrying about the availability or accessibility of charging stations. This versatility makes EVs attractive to consumers who may otherwise be hesitant to switch to fully electric vehicles because they are worried about range anxiety or the lack of charging stations in their area. In addition, the rise in the production of BEVs and PHEVs witnessed in 2023 can be attributed to government subsidies and policies that encourage the adoption of EVs. The environmental concern and supportive policies coupled with the technological innovations have catapulted both BEVs and PHEVs to the forefront of EV market and BEVs are at the forefront of EV market in 2023..

Electric Vehicle Onboard Charger (OBC) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific EV on-board charger market accounted for USD 1. 30 Billion in 2020. Urbanization in China and India leads to environmental pollution due to the auto and industrial gases that contribute to the green house effect. Thus the governments are responding to this by supporting the clean fuel-powered vehicles especially the EV through various positive government programs and initiatives for supporting the EV sector.

- In addition, the rise in urbanization and smart cities is likely to support EV growth for the development of this region’s electric vehicle on-board charger market. Stringent emission regulations, government policies & subsidies, rising EV and charging point penetration, and growing vehicle electrification are some of the factors that are driving EV adoption in Europe. Some of the countries in the European region like Norway, Sweden, Denmark, Germany, UK are driving the electric vehicle market. The availability of prominent EV manufacturers also presents desirable growth prospects for the EV on-board chargers in the region.

- Continuous innovation, especially in the area of EV’s batteries and the development of charging stations, are also making EVs more attractive to the consumer. Better battery mileage, quicker charging, and the development of charging networks lead to increased EV uptake.

- Due to the reduced price of EV components, including batteries and chargers, EVs will become more competitive in terms of pricing compared to ICE vehicles. This affordability makes consumers opt to purchase EVs hence increasing the demand for on-board chargers.

- Rising concerns about the environment, for instance, air pollution, and climate change compel consumers and governments to focus on cleaner means of transport, including EVs. Such awareness creates a positive ecosystem for the adoption of EVs and the establishment of necessary infrastructure.

Active Key Players in the Electric Vehicle Onboard Charger (OBC) Market

- Delphi Technologies

- Siemens AG

- Bosch

- Infineon Technologies AG

- Lear Corporation

- Panasonic Corporation

- Mitsubishi Electric Corporation

- Delta Electronics

- Signet Systems Inc.

- Schneider Electric

- BorgWarner Inc.

- alfanar Group

- Powell Industries

- Kirloskar Electric Company

- Bell Power Solution

- BRUSA Elektronik AG

- Current Ways Inc.

- Eaton Corporation

- Stercom Power Solutions GmbH

- STMicroelectronics

- innolectric AG

- AVID Technology Limited

- Ficosa International SA

- Toyota Industries Corporation

- Xepics Italia SRL

- Other Key Players

Key Industry Developments in the Electric Vehicle Onboard Charger (OBC) Market:

- In April 2022: Indian Brand Equity Foundation reported that India is likely to have an extensive range of EV chargers and EV infrastructure with the investment of USD 1. 84 billion in coming 3 to 4 years under the FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme which on the other hand will have a positive impact on the deployment of EV charging station.

- January 2021: Bel Power Solutions issued the BCL25-700-8 bi-directional on-board battery charger in which as much as 4 charging units can be combined parallel with effectiveness close to 94%. Bel Power says this charger can be connected to a charging station or even to the grid for EV battery charging.

|

Global Electric Vehicle Thermal Management Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 6.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.3 % |

Market Size in 2032: |

USD 13.6Bn. |

|

Segments Covered: |

Charger Power Rating |

|

|

|

Charger Type |

|

||

|

By Vehicle Type |

|

||

|

Charging Level |

|

||

|

Charging Connector |

|

||

|

Propulsion Type |

|

||

|

End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BY CHARGER POWER RATING (2017-2032)

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LOW POWER (UP TO 3.6 KW)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDIUM POWER (3.7 KW - 22 KW)

- HIGH POWER (ABOVE 22 KW)

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BY CHARGER TYPE (2017-2032)

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AC ON-BOARD CHARGER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DC ON-BOARD CHARGER

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BY VEHICLE TYPE (2017-2032)

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PASSENGER VEHICLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL VEHICLES

- TWO-WHEELER

- THREE WHEELERS

- OTHERS (ELECTRIC BOATS, OFF-ROAD ELECTRIC VEHICLES, ETC.)

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BY CHARGING LEVEL (2017-2032)

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LEVEL 1 CHARGER (120V AC)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LEVEL 2 CHARGER (240V AC)

- DC FAST CHARGER (LEVEL 3 CHARGER)

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BY CHARGING CONNECTOR (2017-2032)

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TYPE 1 (J1772)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TYPE 2 (MENNEKES)

- CCS (COMBINED CHARGING SYSTEM)

- CHADEMO

- TESLA SUPERCHARGER

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BY PROPULSION TYPE (2017-2032)

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BATTERY ELECTRIC VEHICLES (BEV)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PLUG-IN HYBRID ELECTRIC VEHICLES (PHEV)

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BY END-USER (2017-2032)

- ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL (FLEET OPERATORS, CHARGING STATIONS, ETC.)

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Electric Vehicle Onboard Charger (OBC) Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DELPHI TECHNOLOGIES

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SIEMENS AG

- BOSCH

- INFINEON TECHNOLOGIES AG

- LEAR CORPORATION

- PANASONIC CORPORATION

- MITSUBISHI ELECTRIC CORPORATION

- DELTA ELECTRONICS

- SIGNET SYSTEMS INC.

- SCHNEIDER ELECTRIC

- BORGWARNER INC.

- ALFANAR GROUP

- POWELL INDUSTRIES

- KIRLOSKAR ELECTRIC COMPANY

- BELL POWER SOLUTION

- BRUSA ELEKTRONIK AG

- CURRENT WAYS INC.

- EATON CORPORATION

- STERCOM POWER SOLUTIONS GMBH

- STMICROELECTRONICS

- INNOLECTRIC AG

- AVID TECHNOLOGY LIMITED

- FICOSA INTERNATIONAL SA

- TOYOTA INDUSTRIES CORPORATION

- XEPICS ITALIA SRL

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Power Rating

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Vehicle Type

- Historic And Forecasted Market Size By Charging Level

- Historic And Forecasted Market Size By Charging Connector

- Historic And Forecasted Market Size By Propulsion Type

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Vehicle Thermal Management Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 6.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.3 % |

Market Size in 2032: |

USD 13.6Bn. |

|

Segments Covered: |

Charger Power Rating |

|

|

|

Charger Type |

|

||

|

By Vehicle Type |

|

||

|

Charging Level |

|

||

|

Charging Connector |

|

||

|

Propulsion Type |

|

||

|

End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BY VEHICLE TYPE

TABLE 008. PASSENGER CARS MARKET OVERVIEW (2016-2028)

TABLE 009. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 010. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BY PROPULSION

TABLE 011. BATTERY ELECTRIC VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 012. PLUG-IN HYBRID ELECTRIC VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 013. HYBRID ELECTRIC VEHICLES MARKET OVERVIEW (2016-2028)

TABLE 014. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET BY RATED POWER

TABLE 015. LESS THAN 3.3 KW MARKET OVERVIEW (2016-2028)

TABLE 016. 3.3-11 KW MARKET OVERVIEW (2016-2028)

TABLE 017. MORE THAN 11 KW MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 019. NORTH AMERICA ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY PROPULSION (2016-2028)

TABLE 020. NORTH AMERICA ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY RATED POWER (2016-2028)

TABLE 021. N ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 023. EUROPE ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY PROPULSION (2016-2028)

TABLE 024. EUROPE ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY RATED POWER (2016-2028)

TABLE 025. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY COUNTRY (2016-2028)

TABLE 026. ASIA PACIFIC ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 027. ASIA PACIFIC ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY PROPULSION (2016-2028)

TABLE 028. ASIA PACIFIC ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY RATED POWER (2016-2028)

TABLE 029. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY COUNTRY (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY PROPULSION (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY RATED POWER (2016-2028)

TABLE 033. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY COUNTRY (2016-2028)

TABLE 034. SOUTH AMERICA ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 035. SOUTH AMERICA ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY PROPULSION (2016-2028)

TABLE 036. SOUTH AMERICA ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY RATED POWER (2016-2028)

TABLE 037. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET, BY COUNTRY (2016-2028)

TABLE 038. FICOSA CORPORATION: SNAPSHOT

TABLE 039. FICOSA CORPORATION: BUSINESS PERFORMANCE

TABLE 040. FICOSA CORPORATION: PRODUCT PORTFOLIO

TABLE 041. FICOSA CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. LG ELECTRONICS: SNAPSHOT

TABLE 042. LG ELECTRONICS: BUSINESS PERFORMANCE

TABLE 043. LG ELECTRONICS: PRODUCT PORTFOLIO

TABLE 044. LG ELECTRONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. HYUNDAI MOBIS CO. LTD: SNAPSHOT

TABLE 045. HYUNDAI MOBIS CO. LTD: BUSINESS PERFORMANCE

TABLE 046. HYUNDAI MOBIS CO. LTD: PRODUCT PORTFOLIO

TABLE 047. HYUNDAI MOBIS CO. LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. BORGWARNER INC.: SNAPSHOT

TABLE 048. BORGWARNER INC.: BUSINESS PERFORMANCE

TABLE 049. BORGWARNER INC.: PRODUCT PORTFOLIO

TABLE 050. BORGWARNER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. BEL POWER SOLUTIONS: SNAPSHOT

TABLE 051. BEL POWER SOLUTIONS: BUSINESS PERFORMANCE

TABLE 052. BEL POWER SOLUTIONS: PRODUCT PORTFOLIO

TABLE 053. BEL POWER SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. BRUSA ELEKTRONIK AG: SNAPSHOT

TABLE 054. BRUSA ELEKTRONIK AG: BUSINESS PERFORMANCE

TABLE 055. BRUSA ELEKTRONIK AG: PRODUCT PORTFOLIO

TABLE 056. BRUSA ELEKTRONIK AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. DELPHI TECHNOLOGIES: SNAPSHOT

TABLE 057. DELPHI TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 058. DELPHI TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 059. DELPHI TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. TOYOTA INDUSTRIES CORPORATION: SNAPSHOT

TABLE 060. TOYOTA INDUSTRIES CORPORATION: BUSINESS PERFORMANCE

TABLE 061. TOYOTA INDUSTRIES CORPORATION: PRODUCT PORTFOLIO

TABLE 062. TOYOTA INDUSTRIES CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. XEPICS ITALIA SRL: SNAPSHOT

TABLE 063. XEPICS ITALIA SRL: BUSINESS PERFORMANCE

TABLE 064. XEPICS ITALIA SRL: PRODUCT PORTFOLIO

TABLE 065. XEPICS ITALIA SRL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. INFINEON TECHNOLOGIES AG: SNAPSHOT

TABLE 066. INFINEON TECHNOLOGIES AG: BUSINESS PERFORMANCE

TABLE 067. INFINEON TECHNOLOGIES AG: PRODUCT PORTFOLIO

TABLE 068. INFINEON TECHNOLOGIES AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. STERCOM POWER SOLUTIONS GMBH: SNAPSHOT

TABLE 069. STERCOM POWER SOLUTIONS GMBH: BUSINESS PERFORMANCE

TABLE 070. STERCOM POWER SOLUTIONS GMBH: PRODUCT PORTFOLIO

TABLE 071. STERCOM POWER SOLUTIONS GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. EATON CORPORATION: SNAPSHOT

TABLE 072. EATON CORPORATION: BUSINESS PERFORMANCE

TABLE 073. EATON CORPORATION: PRODUCT PORTFOLIO

TABLE 074. EATON CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 075. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 076. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 077. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 012. PASSENGER CARS MARKET OVERVIEW (2016-2028)

FIGURE 013. COMMERCIAL VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 014. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET OVERVIEW BY PROPULSION

FIGURE 015. BATTERY ELECTRIC VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 016. PLUG-IN HYBRID ELECTRIC VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 017. HYBRID ELECTRIC VEHICLES MARKET OVERVIEW (2016-2028)

FIGURE 018. ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET OVERVIEW BY RATED POWER

FIGURE 019. LESS THAN 3.3 KW MARKET OVERVIEW (2016-2028)

FIGURE 020. 3.3-11 KW MARKET OVERVIEW (2016-2028)

FIGURE 021. MORE THAN 11 KW MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA ELECTRIC VEHICLE ONBOARD CHARGER (OBC) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Vehicle Onboard Charger (OBC) Market research report is 2024-2032.

Delphi Technologies, Siemens AG, Bosch, Infineon Technologies AG, Lear Corporation, Panasonic Corporation, Mitsubishi Electric Corporation, Delta Electronics,Signet Systems Inc.,Schneider Electric,BorgWarner Inc., alfanar Group, Powell Industries, Kirloskar Electric Company, Bell Power Solution, BRUSA Elektronik AG, Current Ways Inc., Eaton Corporation, Stercom Power Solutions GmbH, STMicroelectronics, innolectric AG, AVID Technology Limited, Ficosa International SA, Toyota Industries Corporation and Other Key Players

The Electric Vehicle Onboard Charger (OBC) Market is segmented into Charger Power Rating, Charger Type, By Vehicle Type, Charging Level, Charging Connector, Propulsion Type, End-User. Charger Power Rating the market is categorized into Low Power (Up to 3.6 kW), Medium Power (3.7 kW - 22 kW) and High Power (Above 22 kW). Charger Type, the market is categorized into AC On-Board Charger and DC On-Board Charger. By Vehicle Type, the market is categorized into Passenger Vehicles , Commercial Vehicles, Two-Wheeler, And Three Wheelers and Others (Electric boats, off-road electric vehicles, etc.)Others. Charging Level the market is categorized into Level 1 Charger (120V AC), Level 2 Charger (240V AC) and DC Fast Charger (Level 3 Charger). Charging Connector the market is categorized into Type 1 (J1772), Type 2 (Mennekes), CCS (Combined Charging System), CHAdeMO and Tesla Supercharger. Propulsion Type the market is categorized into Battery Electric Vehicles (BEV) and Plug-in Hybrid Electric Vehicles (PHEV) . End-User the market is categorized into Residential and Commercial (Fleet Operators, Charging Stations, etc.). By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Electric Vehicle Onboard Charger (OBC) is a crucial component integrated within electric vehicles (EVs) responsible for converting alternating current (AC) from an external power source, typically a charging station or outlet, into direct current (DC) to charge the vehicle's battery pack. Serving as the intermediary between the power source and the battery, the OBC regulates the voltage and current flow to ensure safe and efficient charging, while also managing factors such as temperature and battery state of charge. Its compact design and advanced electronics enable it to efficiently handle various input voltages and charging rates, catering to the diverse charging infrastructure available. Additionally, modern OBCs often incorporate smart functionalities, allowing for communication with external systems to optimize charging parameters and provide real-time data on charging status, further enhancing the overall EV charging experience.

Electric Vehicle Onboard Charger (OBC) Market Size Was Valued at USD 6.1 Billion in 2023, and is Projected to Reach USD 13.6 Billion by 2032, Growing at a CAGR of 9.3% From 2024-2032.