Electric Vehicle Coolants Market Synopsis

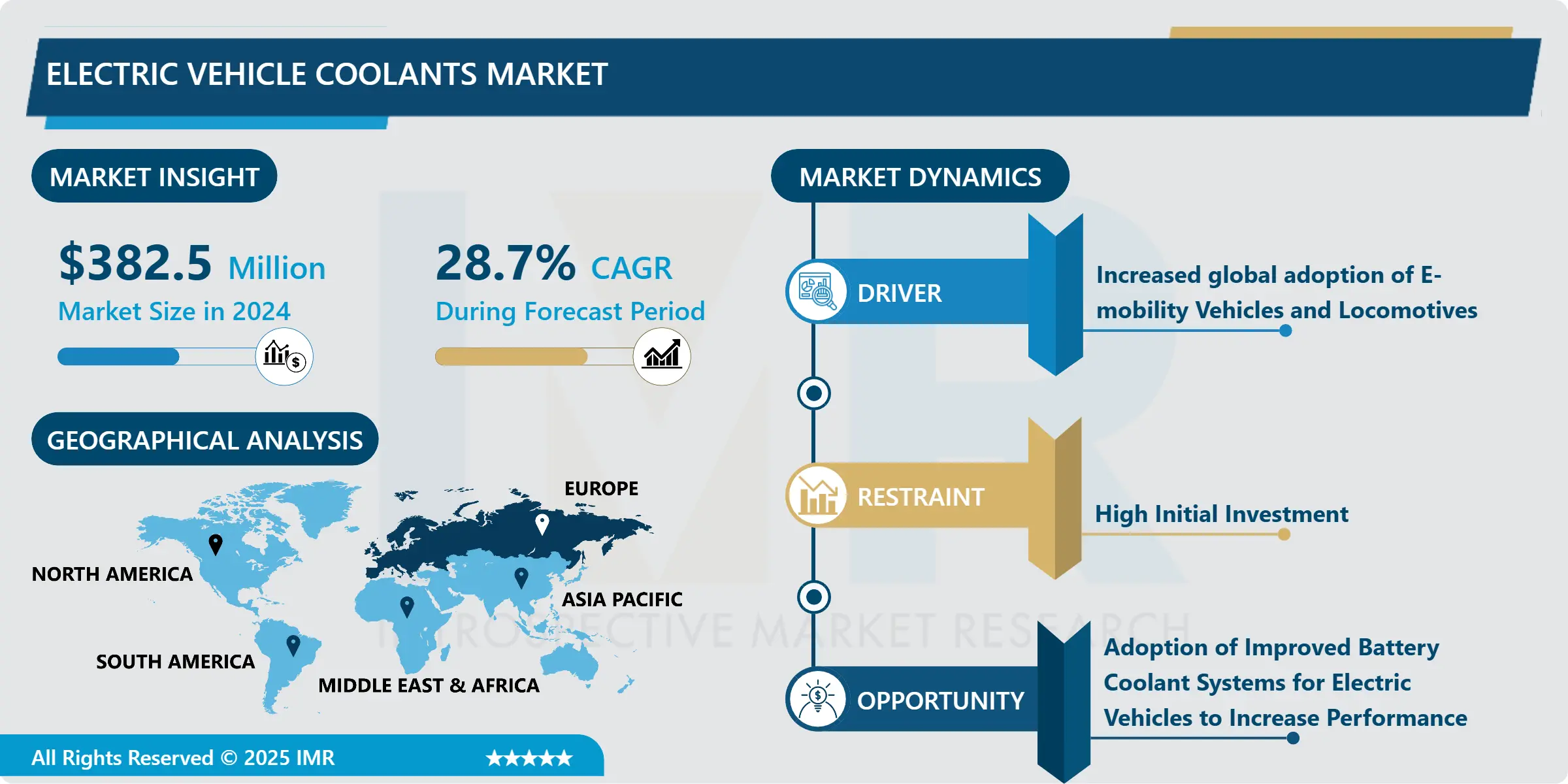

The Electric Vehicle Refrigerant market size is valued at USD 382.5 million by 2024 and is predicted to reach USD 2879.12 million by way of 2032, growing at a CAGR of 28.7% from 2025-2032.

Special fluids, referred to as electric-powered car (EV) refrigerants, are used to successfully manage the thermal electricity generated with the aid of the electric electronics, electric automobiles, and batteries in the thermal control systems of EVs. In comparison to internal combustion engines, which predominantly rely upon air and liquid coolants for heat dissipation, electric powered motors (EVs) necessitate efficient cooling mechanisms to sustain best temperatures-thereby ensuring the electric additives' safety, efficiency, and sturdiness.

Electric vehicle coolants are engineered with elevated specific heat capacity and thermal conductivity. This enables them to efficiently transfer and absorb heat, thereby preventing the overloading of electrical components while in operation.

The growth trajectory of the Electric Vehicle Coolants market through 2031 is additionally impacted by favorable government regulations and policies that encourage the utilization of advanced materials. These regulations promote the adoption of sustainable practices by companies and stimulate investments in Electric Vehicle Coolants technologies, thereby accelerating market expansion.

Moreover, government policies that are favorable towards sustainability and renewable resources are stimulating investments in environmentally benign alternatives for use in the market for electric vehicle coolants. Given the aforementioned dynamics at work, the market for electric vehicle coolants is positioned to experience continuous growth, in response to shifting consumer inclinations and worldwide market patterns.

The market is anticipated to undergo significant growth due to the growing focus of numerous governments on promoting the adoption of electric vehicles. Presently, two technologies, aqueous and dielectric, each with a unique set of applications, vie for market share in the EV coolants industry. Aqueous or water-glycol EV coolants generate net losses of less than $0.5 per liter, rendering them underperforming commodities in the eyes of market participants.

Electric Vehicle Coolants Market Trend Analysis

Electric Vehicle Coolants Market-Increased global adoption of E-mobility Vehicles and Locomotives

- The expansion of the worldwide electric vehicle coolants market is being propelled by the increasing demand for electric vehicles (EVs). ?The demand for electric powered vehicles (EVs) has expanded dramatically as a developing wide variety of governments and consumers recognize the value financial savings and environmental benefits presented with the aid of EVs. The growing use of electrical automobiles has an instantaneous effect on the market for fridges for such cars.

- The increasing demand for electric vehicles requires high-capacity batteries and other efficient cooling solutions, which in turn is expected to set the growth trajectory for this market through global expansion of electrification power vehicle recognition to drive the global electric vehicle cooling market.

- The substantial growth potential within the commercial vehicle industry is driving the worldwide electric vehicle coolants market's expansion. Unlike the initial emphasis on passenger vehicles in the electric vehicle market, commercial vehicles (including trucks, buses and vans) are now rapidly transitioning to electric propulsion on.

- The global proliferation of electric commercial vehicles is anticipated to generate significant demand expansion for coolants designed for electric vehicles over the next few years.

Electric Vehicle Coolants Market- Adoption of Improved Battery Coolant Systems for Electric Vehicles to Increase Performance

- The integration of cutting-edge technologies and the creation of intelligent cooling systems are substantial developments that are anticipated to increase the demand for coolants for electric vehicles (EVsWith electric car batteries that combine advanced electronics with high efficiency, efficient and effective thermal load management is of the utmost importance For an intelligent cooling system with sensors, AI algorithms , along with real-time data analytics are used, coolant flow and temperature can be adjusted in a dynamic manner in response to vehicle battery needs and operating conditions .

- In addition to improving performance and longevity is, this method ensures safety by preventing overheating and the risk of heat escape. These developments are increasing the reliability and desirability of electric vehicles (EVs), which in turn encourages their continued adoption and creates a market for EV coolers specifically designed to meet the needs of EVs it’s an amazing thermal management application.

Electric Vehicle Coolants Market Segment Analysis:

Electric Vehicle Coolants Market is Segmented based on Coolant Type, and Vehicle Type.

By Coolant Type, Ethylene glycol segment is expected to dominate the market during the forecast period

- In the coming years, the market for electric vehicle coolants is anticipated to be dominated by the ethylene glycol segment, primarily due to its cost-effectiveness and superior heat transfer capabilities. Electric vehicles' rigorous thermal demands are notably well-managed by ethylene glycol, a well-established coolant base in a variety of applications. Due to its remarkable adaptability to a wide temperature spectrum, this component is ideally suited for the varied operational conditions that electric vehicles encounter.

- In addition, the thermal stability and overheat prevention capabilities of ethylene glycol are crucial for preserving the efficacy and integrity of electronic components and battery packs for electric vehicles. In addition to its great appeal, its affordability provides manufacturers with a cost-effective and efficient solution. Furthermore, the availability of additive technology has enabled the development of ethylene glycol-based refrigerators, which have increased environmental friendliness and reduced waste These refrigerants are the ecosystem meets the certifications that the electric vehicle industry is actively pursuing.The convergence of ethylene glycol coolants with performance requirements and economic benefits positions them to spearhead market expansion in light of the ongoing worldwide surge in demand for electric vehicles.

By Vehicle Type, Passenger Car segment held the largest share in 2024

- In the coming years, the electric vehicle (EV) revolution will primarily propel the Passenger Car segment, which is anticipated to account for the largest share of the Electric Vehicle Coolants market. In light of the growing consumer demand for environmentally sustainable transportation alternatives, automotive manufacturers are augmenting their electric passenger vehicle lineups. ?This boom within the range of traditional gas-powered automobiles followed by using common purchasers isn't always simply a passing fad, but as an alternative a transition closer to more environmentally friendly alternatives.

- An escalating number of luxury and economy models of passenger automobiles are being outfitted with sophisticated battery systems, which require effective thermal management in order to maximize battery life and performance. Increasing sales and production of electric passenger vehicles thus have a direct impact on the demand for premium EV coolants. ?The usage of these coolants is critical to be able to keep the vehicles' safety and dependability even as sustaining perfect running temperatures. The call for for cooling solutions which are both effective and efficient increases as more and more customers adopt electric powered cars as their fundamental mode of transportation.This, in turn, drives the market expansion of EV coolants in this particular sector.

Electric Vehicle Coolants Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast period

- For a variety of motives, numerous European nations are presently engaged in the development and implementation of e-mobility. ?The European Union has mandated that municipalities and towns appoint inexperienced and sustainable guidelines, along with increasing the use of electric powered vehicles.

- Germany is the foremost European nation in terms of revenue generated from the sale of EV coolants in 2022, amounting to $25.76 million. ?It became determined that this accounted for approximately eleven.7% of the whole revenue, setting up it as the preeminent market globally. The EV coolants market in Germany is being bolstered with the aid of some of massive factors, which includes the developing interest of famous EV manufacturers in coming into the market.

- Conversely, it has been observed that the demand for electric vehicle (EV) coolants in the United Kingdom has increased significantly over the past few years. ?The market analysis document initiatives that the EV coolants marketplace in the United Kingdom will make bigger at a rate of 20.5% yearly via 2033.

Active Key Players in the Electric Vehicle Coolants Market

- BASF SE

- Dober Chemical Corporation

- Shell plc

- TotalEnergies SE

- Valeo SA

- Chevron Corp.

- Exxon Mobil Corp.

- Lukoil Petronas

- Ashland Corporation

- Sinclair Oil Corporation

- Blue Star Lubrication Technology

- PPG Industries Inc (USA)

- AkzoNobel N.V.(Netherland)

- Sherwin-Williams Company (USA)

- Bayer AG (Germany)

- DuPont (USA)

- Other Active Players

Key Industry Developments in the Electric Vehicle Coolants Market:

- In April 2024, Schaeffler Automotive Aftermarket Korea launched the 'Schaeffler TruPower Commercial Vehicle Coolant, optimized for engine thermal management. The coolant, available in a 4-liter specification, was introduced to the Korean market through 'Junwoo APS,' a specialized automotive aftermarket distributor. Schaeffler TruPower included additives designed to prevent corrosion of the engine and internal components, thereby extending the engine's lifespan.

- In April 2023, Arteco launched Freecor® EV Multi 10, a new electric vehicle (EV) coolant tailored for the cooling of e-Motors, power electronics, batteries, and all other components in both full electric and hybrid vehicles. In conventional commercial EVs, standard combustion engine coolants were originally used for thermal management, despite being optimized primarily for internal combustion engines (ICE). Freecor® EV Multi 10 revolutionized this approach by offering an all-encompassing EV coolant solution, engineered to provide lifelong protection and efficient cooling for electric motors and electronic components.

|

Global Electric Vehicle Coolants Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 382.5 Mn. |

|

Forecast Period 2024-32 CAGR: |

28.7% |

Market Size in 2032: |

USD 2,879.12 Mn. |

|

Segments Covered: |

By Coolant Type |

|

|

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Vehicle Coolants Market by Coolant Type (2018-2032)

4.1 Electric Vehicle Coolants Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Ethylene glycol

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Polypropylene glycol

4.5 Others

Chapter 5: Electric Vehicle Coolants Market by Vehicle Type (2018-2032)

5.1 Electric Vehicle Coolants Market Snapshot and Growth Engine

5.2 Market Overview

5.3 2 & 3-Wheeler

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Passenger Car

5.5 Light Commercial Vehicle

5.6 Heavy Commercial Vehicle

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Electric Vehicle Coolants Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BORGWARNER INC

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BVF HEATING SOLUTIONS

6.4 CALORIQUE

6.5 CARBONTEC

6.6 DAEWOO ENG

6.7 ENERPIA

6.8 FENIX GROUP

6.9 FRENZELIT

6.10 KARBONIK

6.11 KOREA HEATING

6.12 LIVINGHEAT

6.13 MODINE MANUFACTURING COMPANY

6.14 MYHEAT

6.15 REXVA CO.LTDTERMOFOL

6.16 VARME

6.17 ZHONGHUI FLOOR HEATING

6.18 OTHER KEY PLAYERS

6.19

Chapter 7: Global Electric Vehicle Coolants Market By Region

7.1 Overview

7.2. North America Electric Vehicle Coolants Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Coolant Type

7.2.4.1 Ethylene glycol

7.2.4.2 Polypropylene glycol

7.2.4.3 Others

7.2.5 Historic and Forecasted Market Size by Vehicle Type

7.2.5.1 2 & 3-Wheeler

7.2.5.2 Passenger Car

7.2.5.3 Light Commercial Vehicle

7.2.5.4 Heavy Commercial Vehicle

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Electric Vehicle Coolants Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Coolant Type

7.3.4.1 Ethylene glycol

7.3.4.2 Polypropylene glycol

7.3.4.3 Others

7.3.5 Historic and Forecasted Market Size by Vehicle Type

7.3.5.1 2 & 3-Wheeler

7.3.5.2 Passenger Car

7.3.5.3 Light Commercial Vehicle

7.3.5.4 Heavy Commercial Vehicle

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Electric Vehicle Coolants Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Coolant Type

7.4.4.1 Ethylene glycol

7.4.4.2 Polypropylene glycol

7.4.4.3 Others

7.4.5 Historic and Forecasted Market Size by Vehicle Type

7.4.5.1 2 & 3-Wheeler

7.4.5.2 Passenger Car

7.4.5.3 Light Commercial Vehicle

7.4.5.4 Heavy Commercial Vehicle

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Electric Vehicle Coolants Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Coolant Type

7.5.4.1 Ethylene glycol

7.5.4.2 Polypropylene glycol

7.5.4.3 Others

7.5.5 Historic and Forecasted Market Size by Vehicle Type

7.5.5.1 2 & 3-Wheeler

7.5.5.2 Passenger Car

7.5.5.3 Light Commercial Vehicle

7.5.5.4 Heavy Commercial Vehicle

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Electric Vehicle Coolants Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Coolant Type

7.6.4.1 Ethylene glycol

7.6.4.2 Polypropylene glycol

7.6.4.3 Others

7.6.5 Historic and Forecasted Market Size by Vehicle Type

7.6.5.1 2 & 3-Wheeler

7.6.5.2 Passenger Car

7.6.5.3 Light Commercial Vehicle

7.6.5.4 Heavy Commercial Vehicle

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Electric Vehicle Coolants Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Coolant Type

7.7.4.1 Ethylene glycol

7.7.4.2 Polypropylene glycol

7.7.4.3 Others

7.7.5 Historic and Forecasted Market Size by Vehicle Type

7.7.5.1 2 & 3-Wheeler

7.7.5.2 Passenger Car

7.7.5.3 Light Commercial Vehicle

7.7.5.4 Heavy Commercial Vehicle

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Electric Vehicle Coolants Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 382.5 Mn. |

|

Forecast Period 2024-32 CAGR: |

28.7% |

Market Size in 2032: |

USD 2,879.12 Mn. |

|

Segments Covered: |

By Coolant Type |

|

|

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||