Electric Vehicle Charging Gun Market Synopsis

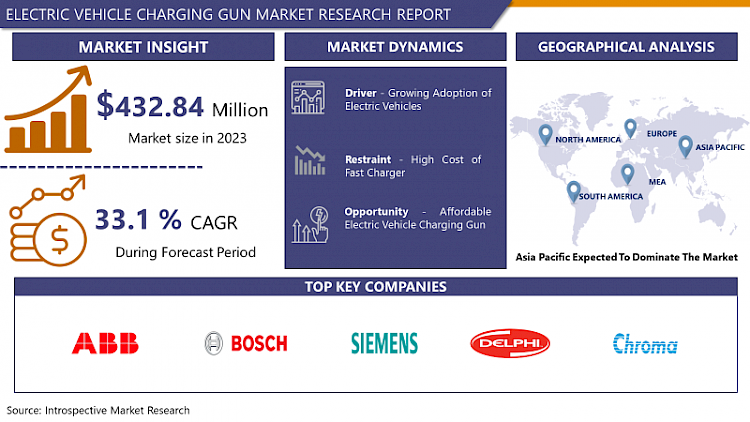

Electric Vehicle Charging Gun Market Size Was Valued at USD 432.84 Million in 2023, and is Projected to Reach USD 5,674.0 Million by 2032, Growing at a CAGR of 33.1 % From 2024-2032.

- Due to the boost in the EV usage all over the world, the EV market is growing tremendously. EVs (electric vehicles) are operated by means of charging guns (also known as charging connectors or plugs), which enable them to connect to a charging station and to receive electrical energy for recharging their battery. Along with the increase in investment in infrastructure and the sale of electric vehicles, also does the need for charging weapons come up. To improve charging efficiency, durability, and compatibility with diverse EV models, producers are working on the creation of new technologies. Also, the advancements in a constantly changing technology that assures the need of the customer for a better and faster charging experience are shaping this market. The supportive government regulation and incentives for electric vehicle adoption drives the fuel industry growth. Due to the major focus on sustainability development and the automotive transition toward electricity, it is obvious that the electric vehicle chargers demand will witness continuous development and growth.

- The EV charging gun market forms a key part of the growing electric vehicle infrastructure network. The answer to the worldwide automobile industry's move to replacing the traditional vehicles with the electric vehicles towards reducing environmental pollution and the greenhouse gases is the increasing demand for EV charging solutions.

- To replenish electric vehicle (EV) batteries, charge ports, sometimes called connectors, or charger cables, are used to transfer electrical energy from charging stations to the EVs.

- A number of stimuli are driving this large-scale growth of the market. Governmental policies on greenhouse gas (GHG) mitigation have become significant drivers of investment in EV (electric vehicles) infrastructure in the form of charging stations. In addition to this, the rapid development of battery technology has boosted the range of electric vehicles, therefore increasing the appearance of these cars to the consumer and therefore the demand for charging solutions.

- Moreover, charging technology advancements such as implementing fast charging and wireless charging is also growing the market. The charger manufacturers are always aiming to increase efficacy, dependability and compatibility of these devices due to the changing needs and focusing on the convenience of electric vehicle users.

- This growth will likely be dominated by the demand for electric vehicle charging guns, due to the rising global electric mobility trend. This development will give rise to many profitable players in the electric vehicle sector.

Electric Vehicle Charging Gun Market Trend Analysis

Government incentives and subsidies

- The development of smart charging solutions as an analytics data capabilities and connectivity feature is another significant development as well. Such developments allow for the remote control, scheduling, and improvement of charging procedures which in turn improve the quality of service to the customers and the capacity of the grid to manage aggregated energy.

- Furthermore, currently, there is a market trend toward interoperability and using a standard charging protocol, which allows users of various EVs to comfortably use a shared charging infrastructure. This benefits not only EV owners because it makes them travel more efficient but also supports the growth of electric car charging infrastructure.

- Government subsidies and incentives are absolutely vital to the enhancement of the electric vehicle use and charging network. Many countries give subsidies, tax credits, and financial subsidies to stimulate the growth of private ownership of EVs and installing residential charging stations.

- Moreover, government institutions provide funds and erect public charging structure; and as a result, electric vehicle charging station expand and lessen consumer range anxiety. The stated incentives significantly contribute to promoting the rise of the electric vehicle charging gun as an industry, hence influencing the influx of investment and demand.

Advancements in charging infrastructure

- One of the recent developments in the EV charging landscape is the penetration of new charging infrastructure, which is playing a critical role in the transformation of the EV charging gun market. A momentous development is the spread of high-power charging stations projecting ultra-high speed charging capabilities. These stations leverage technologies like liquid-cooled cables and higher voltage levels to reduce charging times dramatically, addressing one of the key barriers to EV adoption: range anxiety.

- Finally, the incorporation of renewables into charging systems also is embraced more widely. Besides its role in lowering the environmental impact of EV charging, this trend also helps develop a sustainable transportation environment.

- Moreover, constant development in software and connectivity will continuously improve the intelligence and efficiency of charging networks. Smart charging strategies are applied to dynamic load management as well as to demand response capabilities. Such solutions allow the smooth integration of charging processes and they contribute to grid stability improvement.

- Apart from that, the development of high-speed changing technology and the use of smart charging features by the charging gun manufacturing companies is the faster and more intelligent manner in which the EV owners can experience the charging. With time charging infrastructure will continue to keep on growing and the electric vehicle charging market will have more chances for further growth and innovation which will play a critical role in supporting widespread adoption of mobility.

Electric Vehicle Charging Gun Segment Analysis:

Electric Vehicle Charging Gun Market Segmented based on Charging Type, Vehicle and End Users

By Charging Type, Active segment is expected to dominate the market during the forecast period

- Besides the new EV charging infrastructure which is proven to be the game changer in this evolving EV charging gun market, The most outstanding development is the distribution of the high-power charging stations with the advanced ultra-high speed charging features. These stations leverage technologies like liquid-cooled cables and higher voltage levels to reduce charging times dramatically, addressing one of the key barriers to EV adoption: range anxiety.

- Lastly, the possibility of random accessing of renewables for charging systems is also accepted more widely. In addition to this, it also fosters greener nature of EV charging in the transport sector.

- Further, progress to make the software as well as the connectivity more and more intelligent and effective will continuously happen. Smart charging strategies help to balance loads through their use in dynamic load management as well as demand response. Such solutions are aimed at the seamless Integration of charging processes and these solutions also contribute to grid stability enhancement.

- On the other hand, the addition of high-speed changing technology to the charging gun manufacturing companies and the use of smart charging features by the EV owners is becoming the fastest and smartest way that the EV owners can experience the charging. Consequentially for the electric vehicle charging market, the growth of charging infrastructure will provide an opportunity for further development and innovation which in turn will create solutions for mass market adoption of mobility.

By Vehicle, Plug-in Hybrid Vehicle (PHEV) segment held the largest share in 2023

- Powered by both electricity and internal combustion engines, consequently, PHEVs are perfect option for consumers looking for versatility and more range on homogeneity. Battery-operated vehicles (EVs) are gaining popularity given rise to emissionless and improve battery packs. A combination of internal combustion engines powered by electricity generates power for HEVs resulting in great efficiency in fuel and reducing carbon emissions.

- Besides, the electric vehicle charging guns market is now a field of fast growth. The charge gun technologies are changing according to their power levels and other demands based on electric vehicles.

- This transition is made possible by the increase of contribution of fast-charging infrastructure and wireless charging technology to the market. The market is on the verge of an evolution.

- Governments’ regulations and incentives encourages electric vehicles usage which in turn spurs the market growth. Besides, car makers' devoting more attention to electric cars (EVs) and the improvement in battery technology also increases consumer confidence in EVs.

- Though in general the mix of developments in charging infrastructure and electric vehicles is shaping an interesting and positive trend for the sector of the electric vehicles.

Electric Vehicle Charging Gun Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period.

- The dynamics of the Asia-Pacific EV charging guns market during the forecast time are driven by several key factors which include: Reducing environmental issues, speeding up urbanization, and the growth of the population are the reasons of increasing demand for EVs and their charging infrastructure in the region.

- Electric vehicles (EV) have already been embraced by emerging economies like China, Japan or South Korea, thanks to their countries’ government policies, which provide such incentives as subsidies, tax breaks, and tougher emissions regulations. China, in general, is where the EV market is the biggest in the world. It is China who has high ambitions for EVs and charging infrastructure projects.

- The multinationals dominating the electric vehicle (EV) marketplace and the technology sphere in the Asia-Pacific also foster competition and innovation in the fast charging guns industry. Companies explore the potential of R&D to increase the speed, effectiveness, and a better fit of charge systems with different types of electric vehicles.

- Nevertheless, the situation is also advanced in the region which leads to the necessity of eco-friendly and easily accessible charging solutions. Moreover, it augments the demand in the market. Furthermore, EV integration and investment in intelligent charging infrastructure are also the main factors which show us the path towards the future of EV charging in the APAC region.

- On the whole, given the fact that Asia Pacific serves as an important region for sustainable transport and electric vehicle market, the experts forecast the future of the electric vehicle charging gun will be in the grasp of Asia Pacific.

Active Key Players in the Electric Vehicle Charging Gun Market

- ABB Ltd.

- Robert Bosch GmbH

- Siemens AG

- Delphi Automotive

- Chroma ATE

- Aerovironment Inc.

- Silicon Laboratories

- Chargemaster PLC

- Schaffner Holdings AG

- POD Point

- EVBox

- Blink Charging Co.

- Webasto Group

- ClipperCreek

- ChargePoint, Inc.

- Tesla, Inc.

- AeroVironment, Inc.

- Delta Electronics, Inc.

- Efacec

- IES Synergy

- Other Key Players.

Key Industry Developments in the Electric Vehicle Charging Gun Market

- In April 2024, Tata Passenger Electric Mobility Ltd. (TPEM) collaborated with Shell India Markets Private Limited (SIMPL) to establish public charging stations across India. The partnership aimed to leverage Shell's extensive fuel station network and Tata's charging behavior data collected from its EVs on the road to strategically deploy chargers at locations frequented by Tata EV owners, enhancing the accessibility and convenience of EV charging.

- In April 2024, ABB's E-mobility business embarked on an acquisition spree to achieve its ambitious sales targets following its flotation later that year, the business's CEO informed Reuters on Thursday. The division, known for producing rapid electric chargers for cars, buses, and trucks, had outlined plans to invest $750 million in expanding its footprint, as revealed during its capital markets day.

|

Global Electric Vehicle Thermal Management Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 576.1 Mn |

|

Forecast Period 2024-32 CAGR: |

33.1% |

Market Size in 2032: |

USD 5,674.0 Mn |

|

Segments Covered: |

By Charging Type |

|

|

|

By Vehicle Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers |

|

||

|

Key Market Restraints |

|

||

|

Key Opportunities |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE CHARGING GUN MARKET BY CHARGING TYPE (2017-2032)

- ELECTRIC VEHICLE CHARGING GUN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-BOARD CHARGER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OFF-BOARD CHARGER

- ELECTRIC VEHICLE CHARGING GUN MARKET BY VEHICLE TYPE (2017-2032)

- ELECTRIC VEHICLE CHARGING GUN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLUG-IN HYBRID VEHICLE (PHEV)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BATTERY ELECTRIC VEHICLE (BEV)

- HYBRID ELECTRIC VEHICLE (HEV)

- ELECTRIC VEHICLE CHARGING GUN MARKET BY END USERS (2017-2032)

- ELECTRIC VEHICLE CHARGING GUN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Electric Vehicle Charging Gun Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABB LTD.

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ROBERT BOSCH GMBH

- SIEMENS AG

- DELPHI AUTOMOTIVE

- CHROMA ATE

- AEROVIRONMENT INC.

- SILICON LABORATORIES

- CHARGEMASTER PLC

- SCHAFFNER HOLDINGS AG

- POD POINT

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC VEHICLE CHARGING GUN MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Charging Type

- Historic And Forecasted Market Size By Vehicle Type

- Historic And Forecasted Market Size By End Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Vehicle Thermal Management Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 576.1 Mn |

|

Forecast Period 2024-32 CAGR: |

33.1% |

Market Size in 2032: |

USD 5,674.0 Mn |

|

Segments Covered: |

By Charging Type |

|

|

|

By Vehicle Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers |

|

||

|

Key Market Restraints |

|

||

|

Key Opportunities |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC VEHICLE CHARGING GUN MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC VEHICLE CHARGING GUN MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC VEHICLE CHARGING GUN MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC VEHICLE CHARGING GUN MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC VEHICLE CHARGING GUN MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC VEHICLE CHARGING GUN MARKET BY CHARGING TYPE

TABLE 008. ON-BOARD CHARGER MARKET OVERVIEW (2016-2028)

TABLE 009. OFF-BOARD CHARGER MARKET OVERVIEW (2016-2028)

TABLE 010. ELECTRIC VEHICLE CHARGING GUN MARKET BY VEHICLE TYPE

TABLE 011. PLUG-IN HYBRID VEHICLE (PHEV) MARKET OVERVIEW (2016-2028)

TABLE 012. BATTERY ELECTRIC VEHICLE (BEV) MARKET OVERVIEW (2016-2028)

TABLE 013. HYBRID ELECTRIC VEHICLE (HEV) MARKET OVERVIEW (2016-2028)

TABLE 014. ELECTRIC VEHICLE CHARGING GUN MARKET BY END USERS

TABLE 015. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 016. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA ELECTRIC VEHICLE CHARGING GUN MARKET, BY CHARGING TYPE (2016-2028)

TABLE 018. NORTH AMERICA ELECTRIC VEHICLE CHARGING GUN MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 019. NORTH AMERICA ELECTRIC VEHICLE CHARGING GUN MARKET, BY END USERS (2016-2028)

TABLE 020. N ELECTRIC VEHICLE CHARGING GUN MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE ELECTRIC VEHICLE CHARGING GUN MARKET, BY CHARGING TYPE (2016-2028)

TABLE 022. EUROPE ELECTRIC VEHICLE CHARGING GUN MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 023. EUROPE ELECTRIC VEHICLE CHARGING GUN MARKET, BY END USERS (2016-2028)

TABLE 024. ELECTRIC VEHICLE CHARGING GUN MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC ELECTRIC VEHICLE CHARGING GUN MARKET, BY CHARGING TYPE (2016-2028)

TABLE 026. ASIA PACIFIC ELECTRIC VEHICLE CHARGING GUN MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 027. ASIA PACIFIC ELECTRIC VEHICLE CHARGING GUN MARKET, BY END USERS (2016-2028)

TABLE 028. ELECTRIC VEHICLE CHARGING GUN MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA ELECTRIC VEHICLE CHARGING GUN MARKET, BY CHARGING TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA ELECTRIC VEHICLE CHARGING GUN MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA ELECTRIC VEHICLE CHARGING GUN MARKET, BY END USERS (2016-2028)

TABLE 032. ELECTRIC VEHICLE CHARGING GUN MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA ELECTRIC VEHICLE CHARGING GUN MARKET, BY CHARGING TYPE (2016-2028)

TABLE 034. SOUTH AMERICA ELECTRIC VEHICLE CHARGING GUN MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 035. SOUTH AMERICA ELECTRIC VEHICLE CHARGING GUN MARKET, BY END USERS (2016-2028)

TABLE 036. ELECTRIC VEHICLE CHARGING GUN MARKET, BY COUNTRY (2016-2028)

TABLE 037. ABB LTD: SNAPSHOT

TABLE 038. ABB LTD: BUSINESS PERFORMANCE

TABLE 039. ABB LTD: PRODUCT PORTFOLIO

TABLE 040. ABB LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. ROBERT BOSCH GMBH: SNAPSHOT

TABLE 041. ROBERT BOSCH GMBH: BUSINESS PERFORMANCE

TABLE 042. ROBERT BOSCH GMBH: PRODUCT PORTFOLIO

TABLE 043. ROBERT BOSCH GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. SIEMENS AG: SNAPSHOT

TABLE 044. SIEMENS AG: BUSINESS PERFORMANCE

TABLE 045. SIEMENS AG: PRODUCT PORTFOLIO

TABLE 046. SIEMENS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. DELPHI AUTOMOTIVE: SNAPSHOT

TABLE 047. DELPHI AUTOMOTIVE: BUSINESS PERFORMANCE

TABLE 048. DELPHI AUTOMOTIVE: PRODUCT PORTFOLIO

TABLE 049. DELPHI AUTOMOTIVE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. CHROMA ATE: SNAPSHOT

TABLE 050. CHROMA ATE: BUSINESS PERFORMANCE

TABLE 051. CHROMA ATE: PRODUCT PORTFOLIO

TABLE 052. CHROMA ATE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. AEROVIRONMENT INC: SNAPSHOT

TABLE 053. AEROVIRONMENT INC: BUSINESS PERFORMANCE

TABLE 054. AEROVIRONMENT INC: PRODUCT PORTFOLIO

TABLE 055. AEROVIRONMENT INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. SILICON LABORATORIES: SNAPSHOT

TABLE 056. SILICON LABORATORIES: BUSINESS PERFORMANCE

TABLE 057. SILICON LABORATORIES: PRODUCT PORTFOLIO

TABLE 058. SILICON LABORATORIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. CHARGEMASTER PLC: SNAPSHOT

TABLE 059. CHARGEMASTER PLC: BUSINESS PERFORMANCE

TABLE 060. CHARGEMASTER PLC: PRODUCT PORTFOLIO

TABLE 061. CHARGEMASTER PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. SCHAFFNER HOLDINGS AG: SNAPSHOT

TABLE 062. SCHAFFNER HOLDINGS AG: BUSINESS PERFORMANCE

TABLE 063. SCHAFFNER HOLDINGS AG: PRODUCT PORTFOLIO

TABLE 064. SCHAFFNER HOLDINGS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. POD POINT: SNAPSHOT

TABLE 065. POD POINT: BUSINESS PERFORMANCE

TABLE 066. POD POINT: PRODUCT PORTFOLIO

TABLE 067. POD POINT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 068. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 069. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 070. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY CHARGING TYPE

FIGURE 012. ON-BOARD CHARGER MARKET OVERVIEW (2016-2028)

FIGURE 013. OFF-BOARD CHARGER MARKET OVERVIEW (2016-2028)

FIGURE 014. ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 015. PLUG-IN HYBRID VEHICLE (PHEV) MARKET OVERVIEW (2016-2028)

FIGURE 016. BATTERY ELECTRIC VEHICLE (BEV) MARKET OVERVIEW (2016-2028)

FIGURE 017. HYBRID ELECTRIC VEHICLE (HEV) MARKET OVERVIEW (2016-2028)

FIGURE 018. ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY END USERS

FIGURE 019. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 020. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The Electric Vehicle Charging Gun Market Research Report projects a period of development from 2024 to 2032.

• ABB Ltd.,• Robert Bosch GmbH,• Siemens AG,• Delphi Automotive,• Chroma ATE,• Aerovironment Inc.,• Silicon Laboratories,• Chargemaster PLC,• Schaffner Holdings AG,• POD Point,• EVBox,• Blink Charging Co.,• Webasto Group,• ClipperCreek,• ChargePoint, Inc.,• Tesla, Inc.,• AeroVironment, Inc.,• Delta Electronics, Inc.,• Efacec,• IES Synergy,• Other Key Players.

The Electric Vehicle Charging Gun Market is segmented into Charging Type, Vehicle Type, and region. By Charging Type, the market is categorized into On-board Charger, Off-board Charger. By End Users, the market is categorized into End Users. By Vehicle Type, the market is categorized into Plug-in Hybrid Vehicle (PHEV), Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV). By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Charging weapons link the rechargeable batteries of the vehicles to the charging devices. Although the control box contains the fundamental technology, the charging gun is responsible for maintaining compatibility between the device and adapters and safeguarding the circuitry as a whole.

The global market for Electric Vehicle Charging Gun estimated at USD 432.84 Million in the year 2023, is projected to reach a revised size of USD 5,674.0 Million by 2032, growing at a CAGR of 33.1% over the analysis period 2024-2032.