Electric Vehicle Adhesives Market Synopsis

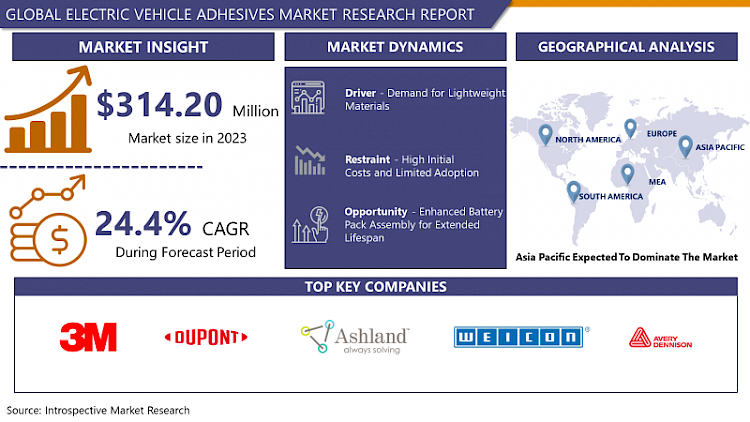

The size of the electric vehicle adhesive market was valued at USD 314.20 Million in 2023 and is Projected to Reach USD 2,241.74 Million by 2032, Growing at a CAGR of 24.4% From 2024 to 2032.

- EV Adhesives are an innovative kind of adhesives made to meet the specific needs of electric vehicles (EVs). Adhesives of this category are used in the assembly of various components of EVs, including the batteries, motors, and body panels. They provide high strength, durability, and the ability to withstand heat and chemicals, thus making EV structures maintain its integrity even under extreme conditions. Electric vehicle adhesives are part of lightweighting approaches, structural strength improvement, and efficient manufacturing procedures in the rapidly growing EV era.

- Strong growth in the EV market has been powered by the increase of EV sales worldwide. Such adhesives are used in bonding of battery packs, sealing of components, and the joining of lightweight materials to enhance the EVs performance, durability, and safety.

- The increasing adoption of electric vehicles will eventually be accompanied by a greater focus on environmental friendliness, causing manufacturers to strive for sustainable adhesives. Also, the technological evolution of adhesive formulation with excellent thermal conductivity and flame-retardant properties is a vital factor that drives market growth. The electric vehicle adhesives market is set to expand further as a result of concerted efforts to expand EV usage and strict rules demanding cleaner transportation.

- The market for electrical vehicle adhesives is also based on changing structure of the automotive industry. Automakers are now spending more on R&D to develop lighter cars that are more energy-efficient, which is making the use of adhesives that can bond dissimilar materials such as composites, aluminium and high-strength steel a must.

- The increasing popularity of autonomous and connected vehicles is certainly propelling adhesives that have exceptional qualities in terms of vibrations, shocks, and temperatures, so they remain in optimum condition for a long time.

- Together with adhesive producers, automotive OEM are facilitating innovation process and creating specific solutions to different areas of electric vehicles. Hence, electric vehicle adhesives market is a promising area for the manufacturers to explore new avenues beyond the transition towards electric mobility and sustainable transportation.

Electric Vehicle Adhesives Market Trend Analysis

Sustainable Materials Drive Innovation in Electric Vehicle Adhesives

- Sustainable materials are leading to the invention of EV (electric vehicle) glues that are changing the way the car industry puts vehicles together. In line with the soaring interest in EVs as a result of environmental and regulatory concerns, manufacturers emphasize sustainability throughout the production cycle. Adhesives are one of the most essential parts in EV assembly because they provide structural strength, reduce weight, and improve general performance. The use of conventional adhesives that include VOCs and other dangerous chemicals presents environmental and health risks.

- The entry of bio-based polymers, plant-derived resins, and recycled content provides a more sustainable alternative. These eco-friendly alternatives do not only reduce the carbon footprint but also ensure the same or even superior performance compared to conventional adhesives.

- Besides, they are aligned with circular economy principles that focus on reducing dependency on limited resources and conserving resources. Through incorporating sustainable materials in the adhesive technology in EVs, automakers are not only satisfying the need for green transportation but also leading innovation towards the growth of an environmentally responsible automotive industry.

Upgraded Battery Pack Assembly Designed for Longer Life Span

- The enlarged battery pack structure for the extended service life of EVs has boosted the demand for adhesives. With evolving customer awareness about sustainability and efficiency, automobile manufacturers are looking for durable and reliable adhesive solutions that will enhance the current advanced battery systems' performance and service life. Adhesives have a vital function in reinforcing components of battery structure, safeguarding against temperature shifts as well as powerful vibrations. While the development of electric vehicle technology continues, a great need for adhesives which can endure the rigor of long service life and have high safety and efficiency levels arises.

- The adhesives industry is flooded with cutting-edge formulations aimed to withstand the stringent conditions of extended-lifetime electric vehicles battery pack assembly. These particular adhesives have improved bonding strength, thermal conductivity, and degradation resistance and, consequently, contribute to enhanced reliability and performance of electric cars. With the increasing demand for electric vehicles, the market for adhesives is set to experience tremendous growth, owing to the continued advancement in the area of developing novel solutions that contribute to the rise of eco-friendly transport technologies.

Electric Vehicle Adhesives Market Segment Analysis:

The Vehicle vehicle Market is Segmented based on Type and application.

By Type, the Electric Vehicle (BEV) segment is expected to dominate the market during the forecast period

- Plug-in Hybrid Electric Vehicle (PHEV): PHEVs are usually a combination of internal combustion engine with electric motor and battery. The adhesives used in PHEVs must be able to provide bonding for both conventional vehicle parts (metal, glass, and plastic) and electric components (battery housing, electric motor mounts, and wiring harnesses). The hybrid electric vehicle market is driven by factors such as government regulations, consumer demand for higher fuel efficiency and the progress in battery technology. Adhesive manufacturers may aim at making adhesives that have high bonding strength, thermal conductivity and resistance to environmental factors so as to meet the specific needs of manufacturers of plug-in hybrid electric vehicles.

- Battery Electric Vehicle (BEV): BEVs are powered only by electricity, so the adhesives are mainly involved in the bonding of lightweight materials used in battery packs, chassis components, and interior elements. This adhesive should be high-strength, durable, heat, and vibration-resistant to protect the electric vehicle's structural integrity. The fast-growing BEV market is a result of climate change concerns, governmental support, and high-tech developments. Adhesive producers can develop advanced products like heat-conducting structural adhesives for better battery thermal management or tape for securing lightweight panels that contribute to light weight and performance of the BEVs.

The Applications Battery Cell Encapsulation segment held the largest share in 2023

- Pack & Module Bonding: This involves gluing different elements to the battery pack/module assembly. Attachment materials are of the utmost importance in fastening battery cells, heat management components, and structural elements together.

- Thermal Interface Bonding: The batteries in electric vehicles require superior thermal management in order to achieve maximum performance and longevity. Adhesives are used to attach heat sinks, thermal pads and other thermal interface materials in order to enhance heat dissipation and maintain the operation temperature as appropriate.

- Battery Cell Encapsulation: It is vital that encapsulation be used to secure the battery cells from environmental factors like dampness, dirt and vibrations. Adhesives are used for sealing and bonding of the batteries inside their enclosures to provide mechanical support and make safety better.

Electric Vehicle Adhesives Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The forecast period will be dominated by Asia-Pacific in the EV adhesives market. This predominance can be explained by a number of primary reasons. Primarily, Asia-Pacific is home to the world's largest production centers for automobiles in China, Japan, and South Korea, which are all progressing toward electric mobility. As EV manufacturing rises in these countries, it is anticipated that the demand for specialized adhesives used in electric vehicle assembly, e.g. for battery bonding and sealing, will also significantly increase. Furthermore, local governments are pushing electric vehicles utilization via various inducement and strict emissions standards, which in turn triggers boost in the EV market and ultimately adhesive demand.

- The presence of many major manufacturers of adhesives in the Asia-Pacific region and its robust supply chain structure increase the availability and lower prices of these products, therefore leading to market dominance. Under favorable market conditions, supportive policies, and thriving electric vehicle industry in Asia-Pacific, this region will assume a central role in the global market of adhesives for electric vehicles.

Active Key Players in the Electric Vehicle Adhesives Market

- 3M Company (US)

- Dupont (Dow Chemical) (US)

- Ashland (US)

- Weicon GmbH & Co. KG (GGermany)

- Avery Dennison (US)

- Bostik S.A (France)

- Dymax Corporation (US)

- Evonik Industries AG ( Germany)

- H.B. Fuller(US)

- Henkel ( Germany)

- Illinois Tool Works Corporation (US)

- Lord Corporation(US)

- Metlok Private Limited (India)

- Permabond LLC. (SShanghai)

- Wacker Chemie AG ( Germany)

- PPG Industries (US)

- Sika AG (SSwitzerland)

- Other Key Players

Key Industry Developments in the Electric Vehicle Adhesives Market

- Bostik, a worldwide market-leading adhesive specialist, displayed its Thermal Conductive Adhesives in an exhibition held in Mumbai, India, in October 2023. It is the India Battery Show from October 4 till October 6, 2023. The range of thermal conductive adhesives was a result of a partnership of Polytec and Bostik, which were dedicated to thermal management in the latest cell-to-pack configuration for e-mobility solutions.

- Henkel, an iconic functional coatings, sealants, and adhesives company, created a unique Battery Engineering Center in one of its special Inspiration Centers in Dusseldorf in February 2023. The acquisition firmly establishes the company as a trusted partner and the leading provider of automotive OEMs and battery producers globally.

- In September 2023, East China saw the official announcement of the new adhesive manufacturing facilities of DuPont in Zhangjiagang, Shanghai. The current facility will produce adhesives for service consumers in the transportation industry, growing electrification of automobiles, and mostly lightweight applications.

|

Global Electric Vehicle Adhesives Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 314.20 Mn. |

|

Forecast Period 2024-32 CAGR: |

24.4% |

Market Size in 2032: |

USD 2,241.74 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ELECTRIC VEHICLE ADHESIVES MARKET BY ELECTRIC TYPE (2017-2032)

- ELECTRIC VEHICLE ADHESIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BATTERY ELECTRIC VEHICLE (BEV)

- ELECTRIC VEHICLE ADHESIVES MARKET BY APPLICATION (2017-2032)

- ELECTRIC VEHICLE ADHESIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PACK & MODULE BONDING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- THERMAL INTERFACE BONDING

- BATTERY CELL ENCAPSULATION

- OTHER

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Electric Vehicle Adhesives Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- 3M COMPANY (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- DUPONT (DOW CHEMICAL) (US)

- ASHLAND (US)

- WEICON GMBH & CO. KG( GERMANY)

- AVERY DENNISON (US)

- BOSTIK S.A (FRANCE)

- DYMAX CORPORATION (US)

- EVONIK INDUSTRIES AG ( GERMANY)

- H.B. FULLER(US)

- HENKEL ( GERMANY)

- ILLINOIS TOOL WORKS CORPORATION (US)

- LORD CORPORATION(US)

- METLOK PRIVATE LIMITED.(INDIA)

- PERMABOND LLC.( SHANGHAI)

- WACKER CHEMIE AG ( GERMANY)

- PPG INDUSTRIES (US)

- SIKA AG( SWITZERLAND)

- COMPETITIVE LANDSCAPE

- GLOBAL ELECTRIC VEHICLE ADHESIVES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Electric Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Electric Vehicle Adhesives Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 314.20 Mn. |

|

Forecast Period 2024-32 CAGR: |

24.4% |

Market Size in 2032: |

USD 2,241.74 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC VEHICLE ADHESIVES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC VEHICLE ADHESIVES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC VEHICLE ADHESIVES MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC VEHICLE ADHESIVES MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC VEHICLE ADHESIVES MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC VEHICLE ADHESIVES MARKET BY TYPE

TABLE 008. PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) MARKET OVERVIEW (2016-2028)

TABLE 009. BATTERY ELECTRIC VEHICLE (BEV) MARKET OVERVIEW (2016-2028)

TABLE 010. ELECTRIC VEHICLE ADHESIVES MARKET BY APPLICATION

TABLE 011. PACK & MODULE BONDING MARKET OVERVIEW (2016-2028)

TABLE 012. THERMAL INTERFACE BONDING MARKET OVERVIEW (2016-2028)

TABLE 013. BATTERY CELL ENCAPSULATION MARKET OVERVIEW (2016-2028)

TABLE 014. OTHER MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA ELECTRIC VEHICLE ADHESIVES MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA ELECTRIC VEHICLE ADHESIVES MARKET, BY APPLICATION (2016-2028)

TABLE 017. N ELECTRIC VEHICLE ADHESIVES MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE ELECTRIC VEHICLE ADHESIVES MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE ELECTRIC VEHICLE ADHESIVES MARKET, BY APPLICATION (2016-2028)

TABLE 020. ELECTRIC VEHICLE ADHESIVES MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC ELECTRIC VEHICLE ADHESIVES MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC ELECTRIC VEHICLE ADHESIVES MARKET, BY APPLICATION (2016-2028)

TABLE 023. ELECTRIC VEHICLE ADHESIVES MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA ELECTRIC VEHICLE ADHESIVES MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA ELECTRIC VEHICLE ADHESIVES MARKET, BY APPLICATION (2016-2028)

TABLE 026. ELECTRIC VEHICLE ADHESIVES MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA ELECTRIC VEHICLE ADHESIVES MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA ELECTRIC VEHICLE ADHESIVES MARKET, BY APPLICATION (2016-2028)

TABLE 029. ELECTRIC VEHICLE ADHESIVES MARKET, BY COUNTRY (2016-2028)

TABLE 030. 3M COMPANY: SNAPSHOT

TABLE 031. 3M COMPANY: BUSINESS PERFORMANCE

TABLE 032. 3M COMPANY: PRODUCT PORTFOLIO

TABLE 033. 3M COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. DUPONT (DOW CHEMICAL): SNAPSHOT

TABLE 034. DUPONT (DOW CHEMICAL): BUSINESS PERFORMANCE

TABLE 035. DUPONT (DOW CHEMICAL): PRODUCT PORTFOLIO

TABLE 036. DUPONT (DOW CHEMICAL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. ASHLAND: SNAPSHOT

TABLE 037. ASHLAND: BUSINESS PERFORMANCE

TABLE 038. ASHLAND: PRODUCT PORTFOLIO

TABLE 039. ASHLAND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. WEICON GMBH & CO. KG: SNAPSHOT

TABLE 040. WEICON GMBH & CO. KG: BUSINESS PERFORMANCE

TABLE 041. WEICON GMBH & CO. KG: PRODUCT PORTFOLIO

TABLE 042. WEICON GMBH & CO. KG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. AVERY DENNISON: SNAPSHOT

TABLE 043. AVERY DENNISON: BUSINESS PERFORMANCE

TABLE 044. AVERY DENNISON: PRODUCT PORTFOLIO

TABLE 045. AVERY DENNISON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. BOSTIK S.A. (AN ARKEMA COMPANY): SNAPSHOT

TABLE 046. BOSTIK S.A. (AN ARKEMA COMPANY): BUSINESS PERFORMANCE

TABLE 047. BOSTIK S.A. (AN ARKEMA COMPANY): PRODUCT PORTFOLIO

TABLE 048. BOSTIK S.A. (AN ARKEMA COMPANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. DYMAX CORPORATION: SNAPSHOT

TABLE 049. DYMAX CORPORATION: BUSINESS PERFORMANCE

TABLE 050. DYMAX CORPORATION: PRODUCT PORTFOLIO

TABLE 051. DYMAX CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. EVONIK INDUSTRIES AG: SNAPSHOT

TABLE 052. EVONIK INDUSTRIES AG: BUSINESS PERFORMANCE

TABLE 053. EVONIK INDUSTRIES AG: PRODUCT PORTFOLIO

TABLE 054. EVONIK INDUSTRIES AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. H.B. FULLER: SNAPSHOT

TABLE 055. H.B. FULLER: BUSINESS PERFORMANCE

TABLE 056. H.B. FULLER: PRODUCT PORTFOLIO

TABLE 057. H.B. FULLER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. HENKEL: SNAPSHOT

TABLE 058. HENKEL: BUSINESS PERFORMANCE

TABLE 059. HENKEL: PRODUCT PORTFOLIO

TABLE 060. HENKEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ILLINOIS TOOL WORKS CORPORATION: SNAPSHOT

TABLE 061. ILLINOIS TOOL WORKS CORPORATION: BUSINESS PERFORMANCE

TABLE 062. ILLINOIS TOOL WORKS CORPORATION: PRODUCT PORTFOLIO

TABLE 063. ILLINOIS TOOL WORKS CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. JOWAT SE: SNAPSHOT

TABLE 064. JOWAT SE: BUSINESS PERFORMANCE

TABLE 065. JOWAT SE: PRODUCT PORTFOLIO

TABLE 066. JOWAT SE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. L&L PRODUCTS: SNAPSHOT

TABLE 067. L&L PRODUCTS: BUSINESS PERFORMANCE

TABLE 068. L&L PRODUCTS: PRODUCT PORTFOLIO

TABLE 069. L&L PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. LORD CORPORATION: SNAPSHOT

TABLE 070. LORD CORPORATION: BUSINESS PERFORMANCE

TABLE 071. LORD CORPORATION: PRODUCT PORTFOLIO

TABLE 072. LORD CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. DELO INDUSTRIES KLEBSTOFFE GMBH & CO. KGAA: SNAPSHOT

TABLE 073. DELO INDUSTRIES KLEBSTOFFE GMBH & CO. KGAA: BUSINESS PERFORMANCE

TABLE 074. DELO INDUSTRIES KLEBSTOFFE GMBH & CO. KGAA: PRODUCT PORTFOLIO

TABLE 075. DELO INDUSTRIES KLEBSTOFFE GMBH & CO. KGAA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. METLOK PRIVATE LIMITED.: SNAPSHOT

TABLE 076. METLOK PRIVATE LIMITED.: BUSINESS PERFORMANCE

TABLE 077. METLOK PRIVATE LIMITED.: PRODUCT PORTFOLIO

TABLE 078. METLOK PRIVATE LIMITED.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. PERMABOND LLC.: SNAPSHOT

TABLE 079. PERMABOND LLC.: BUSINESS PERFORMANCE

TABLE 080. PERMABOND LLC.: PRODUCT PORTFOLIO

TABLE 081. PERMABOND LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. WACKER CHEMIE AG: SNAPSHOT

TABLE 082. WACKER CHEMIE AG: BUSINESS PERFORMANCE

TABLE 083. WACKER CHEMIE AG: PRODUCT PORTFOLIO

TABLE 084. WACKER CHEMIE AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. PPG INDUSTRIES: SNAPSHOT

TABLE 085. PPG INDUSTRIES: BUSINESS PERFORMANCE

TABLE 086. PPG INDUSTRIES: PRODUCT PORTFOLIO

TABLE 087. PPG INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. RIËD B.V.: SNAPSHOT

TABLE 088. RIËD B.V.: BUSINESS PERFORMANCE

TABLE 089. RIËD B.V.: PRODUCT PORTFOLIO

TABLE 090. RIËD B.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. SIKA AG: SNAPSHOT

TABLE 091. SIKA AG: BUSINESS PERFORMANCE

TABLE 092. SIKA AG: PRODUCT PORTFOLIO

TABLE 093. SIKA AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. THREEBOND CO.LTD.: SNAPSHOT

TABLE 094. THREEBOND CO.LTD.: BUSINESS PERFORMANCE

TABLE 095. THREEBOND CO.LTD.: PRODUCT PORTFOLIO

TABLE 096. THREEBOND CO.LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 096. UNISEAL INC.: SNAPSHOT

TABLE 097. UNISEAL INC.: BUSINESS PERFORMANCE

TABLE 098. UNISEAL INC.: PRODUCT PORTFOLIO

TABLE 099. UNISEAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 099. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 100. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 101. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 102. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC VEHICLE ADHESIVES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC VEHICLE ADHESIVES MARKET OVERVIEW BY TYPE

FIGURE 012. PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) MARKET OVERVIEW (2016-2028)

FIGURE 013. BATTERY ELECTRIC VEHICLE (BEV) MARKET OVERVIEW (2016-2028)

FIGURE 014. ELECTRIC VEHICLE ADHESIVES MARKET OVERVIEW BY APPLICATION

FIGURE 015. PACK & MODULE BONDING MARKET OVERVIEW (2016-2028)

FIGURE 016. THERMAL INTERFACE BONDING MARKET OVERVIEW (2016-2028)

FIGURE 017. BATTERY CELL ENCAPSULATION MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA ELECTRIC VEHICLE ADHESIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE ELECTRIC VEHICLE ADHESIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC ELECTRIC VEHICLE ADHESIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA ELECTRIC VEHICLE ADHESIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA ELECTRIC VEHICLE ADHESIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Vehicle Adhesives Market research report is 2024-2032.

3M Company (US), Dupont (Dow Chemical) (US), Ashland (US), Weicon GmbH & Co. KG( Germany), Avery Dennison (US), Bostik S.A (France), Dymax Corporation (US), Evonik Industries AG ( Germany),and Other Major Players.

The Electric Vehicle Adhesives Market is segmented into Type, Application and Region. By Type, the market is categorized into Plug-in Hybrid Electric Vehicle (PHEV),Battery Electric Vehicle (BEV). By Application , the market is categorized into Pack & Module Bonding,Thermal Interface Bonding, Battery Cell Encapsulation,Other. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Electric Vehicle Adhesives are specialized bonding agents designed for the unique demands of electric vehicles (EVs). These adhesives play a crucial role in assembling various components of EVs, including batteries, motors, and body panels. They offer high strength, durability, and resistance to heat and chemicals, ensuring the integrity of EV structures under demanding conditions. Electric Vehicle Adhesives contribute to lightweighting strategies, enhance structural integrity, and support efficient manufacturing processes in the rapidly evolving EV industry.

Electric Vehicle Adhesives Market Size Was Valued at USD 314.20 Billion in 2023 and is Projected to Reach USD 2,241.74 Billion by 2032, Growing at a CAGR of 24.4% From 2024-2032.