Electric Screwdriver Market Synopsis

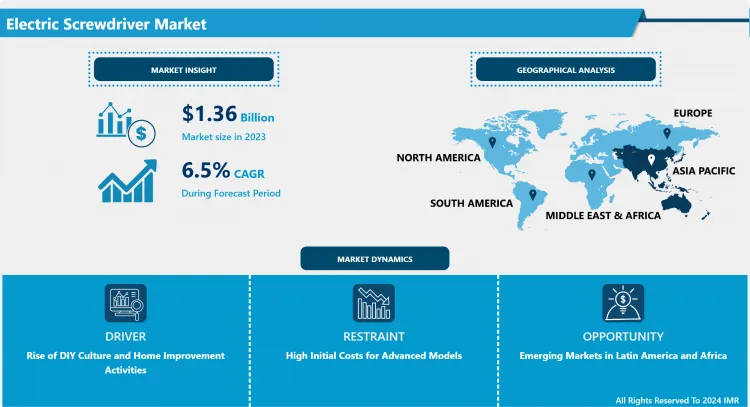

Electric Screwdriver Market Size is Valued at USD 1.36 Billion in 2023, and is Projected to Reach USD 2.25 Billion by 2032, Growing at a CAGR of 6.50% From 2024-2032.

The Electric Screwdriver market segment is one of the power tools used to drive screws through an electric motor which has control in terms of precision compared to manual effort. They are utilized across different industries like electronics, automotive, construction, manufacturing industries among others to meet both the needs of the professional and the home user when it comes to fastening requirements. The increased use of automated equipment over the last couple of years and improvements in power technology for cordless type are the key factors for the growth of this market internationally.

- The main stimulus for the development of the electric screwdriver market is the growth of the electronics and automotive industry. Since these sectors involve call for accurately and efficiently organized assembly line, thereby, making electric screwdrivers crucial in fastening operations with high efficiency rate. Furthermore, the increased automation of productions in the global market has also subsisted the demand for an electric screwdriver. The expansion of the market is also attributable to the increasing use of electric vehicles (EVs) as manufacturers look for effective assembly equipment to address production demand.

- The other remarkable driver that has contributed to the development of the market is due to the increasing home enhancement projects across various countries through DIY. Thanks to increased DIY projects including repair and renovation of houses, furniture assembly among many other related activities, electric screwdrivers are a must have. Cordless models are more and more common because of their mobility, light weight and comparatively long battery charging time, and are best suitable for any professional or amateur usage.

Electric Screwdriver Market Trend Analysis

Shift toward cordless screwdrivers

- Another interesting trend within electric screwdriver market is the market share of cordless screwdrivers. Modern battery technologies likeyanumi.jpg lithium ion batteries have helped in manufacturing more powerful and longer life cycle cordless tools. This consideration is also likely to persist as cordless device manufacturers strive to design portable devices that are convenient to use, yet powerful like their wired counterparts in as far as embracing the need of modern and contemporary industries and homes.

- Another trend is the Smart Integration of technologies in an electrical screwdriver. Additional facilities such as torque control, auto shut-off and digital readouts are getting added to the products to provide higher level of accuracy and manageability. These will enable the user to set the tool requirements of the devices to suitable performances for certain tasks hence increase the flexibility in handling complexities. It is relatively interesting to firms that need accurate equipment to support production, such as aerospace or electronics.

The growing construction sector presents significant opportunities

- Rising construction industry is expected to offer great opportunities for electric screwdriver market in the developing countries. Customers are always need Construction tools and this generated due to increment of urbanization electric screwdrivers are part of it. And all of these demands have been most evident especially in the Asia Pacific region as the construction infrastructure development and residential projects are rapidly flourishing which ultimately establishes a significant market for electric power tools. Secondly, the increasingly popular methods of segmented and modular constructions are also likely to fuel the demand.

- It is also important that emerging markets in Latin America and the Africa remain untapped by manufacturers of electric screwdrivers. With rapid improvement of industrialization in these areas, more and more people require better and cheaper equipment to increase output. These areas are best suited to investment by market players, especially through new cheap cordless solutions matching market needs.

Electric Screwdriver Market Segment Analysis:

Electric Screwdriver Market Segmented on the basis of type, Product Type, Torque Range, and end-users.

By Type, Corded Electric Screwdrivers segment is expected to dominate the market during the forecast period

- The electric screwdriver market is divided into two main types: corded and cordless electric screwdrivers. Corded electric screwdrivers are powered directly through an electrical outlet, offering a consistent and reliable source of power, making them ideal for extended use in industrial or professional settings where continuous operation is required. On the other hand, cordless electric screwdrivers operate on rechargeable batteries, providing greater mobility and flexibility. These cordless models have become increasingly popular due to advancements in battery technology, offering comparable power and torque to corded versions while being portable and convenient for use in areas without easy access to power outlets. Both types cater to different user needs, depending on the nature of the task and the environment in which they are used.

By Product Type, Pistol Grip Electric Screwdrivers segment held the largest share in 2024

- Electric screwdrivers, based on the type of product, available in three models which include pistol grip, straight, and right-Angle screwdrivers. Pistol grip electric screwdrivers are shaped like a gun where the handle is perpendicular to the tool most suitable in for high torque or precision jobs that in automotive or constructions. Straight electric screwdrivers on the other hand have a more conventional shape that looks more like the conventional manual screwdrivers, they are more suitable in general light duty work where there is relatively less concern about space and much more concern about accuracy. Right angle electric screwdrivers are unique screws with the head rotated to a 90 degrees position which allows workers to twist as they make adjustments making it ideal for use in areas where access is limited such as in connection of circuits in electronic devices or carrying out assembly work. One type of product is more ideal for particular usage due to the nature of the project that needs to be accomplished.

Electric Screwdriver Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific leads electric screwdriver market growth, and the region’s industrialization and manufacturing industries’ development significantly increased demand for electric screwdrivers in countries such as China, Japan, and South Korea. An increased use of electric devices in the electronics automotive, and construction industries has boosted the demand for an electric screwdriver in both professional and industrial sectors. The Asia-Pacific is the leading market for automotive electronics due, in part, to China, a formidable manufacturer of electronics and automobiles.

- Also, the use of electric vehicles is expected to rise in other locations such as Japan and South Korea; boosting demand for electric screwdrivers. The change in attitudes towards environmental conservation in the manufacturing practices as well as the growth of complex industries in these nations also translates to high demand of better electric screw drivers. Further, the increase in DIY activity over recent years, particularly in urban parts of the globe is also driving the demand for easy to operate cordless models.

Active Key Players in the Electric Screwdriver Market

- Bosch Power Tools (Germany)

- Stanley Black & Decker, Inc. (United States)

- Makita Corporation (Japan)

- Hilti Corporation (Liechtenstein)

- Panasonic Corporation (Japan)

- Ingersoll Rand (United States)

- FEIN Power Tools Inc. (Germany)

- Hitachi Koki Co., Ltd. (Japan)

- Metabo HPT (Germany)

- Snap-on Incorporated (United States), Other Active Players

|

Global Electric Screwdriver Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.50% |

Market Size in 2032: |

USD 2.25 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product Type |

|

||

|

By Torque Range |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Screwdriver Market by Type (2018-2032)

4.1 Electric Screwdriver Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Corded Electric Screwdrivers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Cordless Electric Screwdrivers

Chapter 5: Electric Screwdriver Market by Product Type (2018-2032)

5.1 Electric Screwdriver Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pistol Grip Electric Screwdrivers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Straight Electric Screwdrivers

5.5 Right Angle Electric Screwdrivers

Chapter 6: Electric Screwdriver Market by Torque Range (2018-2032)

6.1 Electric Screwdriver Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Low Torque (Up to 5 Nm)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Medium Torque (5–10 Nm)

6.5 High Torque (Above 10 Nm)

Chapter 7: Electric Screwdriver Market by End User (2018-2032)

7.1 Electric Screwdriver Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Electronics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Automotive

7.5 Construction

7.6 Aerospace & Defense

7.7 Furniture

7.8 Manufacturing & Assembly

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Electric Screwdriver Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BOSCH POWER TOOLS (GERMANY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 STANLEY BLACK & DECKER INC. (UNITED STATES)

8.4 MAKITA CORPORATION (JAPAN)

8.5 HILTI CORPORATION (LIECHTENSTEIN)

8.6 PANASONIC CORPORATION (JAPAN)

8.7 INGERSOLL RAND (UNITED STATES)

8.8 FEIN POWER TOOLS INC. (GERMANY)

8.9 HITACHI KOKI COLTD. (JAPAN)

8.10 METABO HPT (GERMANY)

8.11 SNAP-ON INCORPORATED (UNITED STATES)

8.12

Chapter 9: Global Electric Screwdriver Market By Region

9.1 Overview

9.2. North America Electric Screwdriver Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Corded Electric Screwdrivers

9.2.4.2 Cordless Electric Screwdrivers

9.2.5 Historic and Forecasted Market Size by Product Type

9.2.5.1 Pistol Grip Electric Screwdrivers

9.2.5.2 Straight Electric Screwdrivers

9.2.5.3 Right Angle Electric Screwdrivers

9.2.6 Historic and Forecasted Market Size by Torque Range

9.2.6.1 Low Torque (Up to 5 Nm)

9.2.6.2 Medium Torque (5–10 Nm)

9.2.6.3 High Torque (Above 10 Nm)

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Electronics

9.2.7.2 Automotive

9.2.7.3 Construction

9.2.7.4 Aerospace & Defense

9.2.7.5 Furniture

9.2.7.6 Manufacturing & Assembly

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Electric Screwdriver Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Corded Electric Screwdrivers

9.3.4.2 Cordless Electric Screwdrivers

9.3.5 Historic and Forecasted Market Size by Product Type

9.3.5.1 Pistol Grip Electric Screwdrivers

9.3.5.2 Straight Electric Screwdrivers

9.3.5.3 Right Angle Electric Screwdrivers

9.3.6 Historic and Forecasted Market Size by Torque Range

9.3.6.1 Low Torque (Up to 5 Nm)

9.3.6.2 Medium Torque (5–10 Nm)

9.3.6.3 High Torque (Above 10 Nm)

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Electronics

9.3.7.2 Automotive

9.3.7.3 Construction

9.3.7.4 Aerospace & Defense

9.3.7.5 Furniture

9.3.7.6 Manufacturing & Assembly

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Electric Screwdriver Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Corded Electric Screwdrivers

9.4.4.2 Cordless Electric Screwdrivers

9.4.5 Historic and Forecasted Market Size by Product Type

9.4.5.1 Pistol Grip Electric Screwdrivers

9.4.5.2 Straight Electric Screwdrivers

9.4.5.3 Right Angle Electric Screwdrivers

9.4.6 Historic and Forecasted Market Size by Torque Range

9.4.6.1 Low Torque (Up to 5 Nm)

9.4.6.2 Medium Torque (5–10 Nm)

9.4.6.3 High Torque (Above 10 Nm)

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Electronics

9.4.7.2 Automotive

9.4.7.3 Construction

9.4.7.4 Aerospace & Defense

9.4.7.5 Furniture

9.4.7.6 Manufacturing & Assembly

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Electric Screwdriver Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Corded Electric Screwdrivers

9.5.4.2 Cordless Electric Screwdrivers

9.5.5 Historic and Forecasted Market Size by Product Type

9.5.5.1 Pistol Grip Electric Screwdrivers

9.5.5.2 Straight Electric Screwdrivers

9.5.5.3 Right Angle Electric Screwdrivers

9.5.6 Historic and Forecasted Market Size by Torque Range

9.5.6.1 Low Torque (Up to 5 Nm)

9.5.6.2 Medium Torque (5–10 Nm)

9.5.6.3 High Torque (Above 10 Nm)

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Electronics

9.5.7.2 Automotive

9.5.7.3 Construction

9.5.7.4 Aerospace & Defense

9.5.7.5 Furniture

9.5.7.6 Manufacturing & Assembly

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Electric Screwdriver Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Corded Electric Screwdrivers

9.6.4.2 Cordless Electric Screwdrivers

9.6.5 Historic and Forecasted Market Size by Product Type

9.6.5.1 Pistol Grip Electric Screwdrivers

9.6.5.2 Straight Electric Screwdrivers

9.6.5.3 Right Angle Electric Screwdrivers

9.6.6 Historic and Forecasted Market Size by Torque Range

9.6.6.1 Low Torque (Up to 5 Nm)

9.6.6.2 Medium Torque (5–10 Nm)

9.6.6.3 High Torque (Above 10 Nm)

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Electronics

9.6.7.2 Automotive

9.6.7.3 Construction

9.6.7.4 Aerospace & Defense

9.6.7.5 Furniture

9.6.7.6 Manufacturing & Assembly

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Electric Screwdriver Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Corded Electric Screwdrivers

9.7.4.2 Cordless Electric Screwdrivers

9.7.5 Historic and Forecasted Market Size by Product Type

9.7.5.1 Pistol Grip Electric Screwdrivers

9.7.5.2 Straight Electric Screwdrivers

9.7.5.3 Right Angle Electric Screwdrivers

9.7.6 Historic and Forecasted Market Size by Torque Range

9.7.6.1 Low Torque (Up to 5 Nm)

9.7.6.2 Medium Torque (5–10 Nm)

9.7.6.3 High Torque (Above 10 Nm)

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Electronics

9.7.7.2 Automotive

9.7.7.3 Construction

9.7.7.4 Aerospace & Defense

9.7.7.5 Furniture

9.7.7.6 Manufacturing & Assembly

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Electric Screwdriver Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.50% |

Market Size in 2032: |

USD 2.25 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Product Type |

|

||

|

By Torque Range |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Electric Screwdriver Market research report is 2024-2032.

Bosch Power Tools (Germany), Stanley Black & Decker, Inc. (United States), Makita Corporation (Japan), Hilti Corporation (Liechtenstein), Panasonic Corporation (Japan), Ingersoll Rand (United States), FEIN Power Tools Inc. (Germany), Hitachi Koki Co., Ltd. (Japan), Metabo HPT (Germany), Snap-on Incorporated (United States). and Other Major Players.

The Electric Screwdriver Market is segmented into by Type (Corded Electric Screwdrivers, Cordless Electric Screwdrivers), Product Type (Pistol Grip Electric Screwdrivers, Straight Electric Screwdrivers, Right Angle Electric Screwdrivers), Torque Range (Low Torque (Up to 5 Nm), Medium Torque (5–10 Nm), High Torque (Above 10 Nm)), End-User (Electronics, Automotive, Construction, Aerospace & Defense, Furniture, Manufacturing & Assembly). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Electric Screwdriver market segment is one of the power tools used to drive screws through an electric motor which has control in terms of precision compared to manual effort. They are utilized across different industries like electronics, automotive, construction, and manufacturing to meet both the needs of the professional and the home user when it comes to fastening requirements. The increased use of automated equipment over the last couple of years and improvements in power technology for cordless type are the key factors for the growth of this market internationally.

Electric Screwdriver Market Size is Valued at USD 1.36 Billion in 2023, and is Projected to Reach USD 2.25 Billion by 2032, Growing at a CAGR of 6.50% From 2024-2032.