Electric Axle Drive and Wheel Drive Market Synopsis

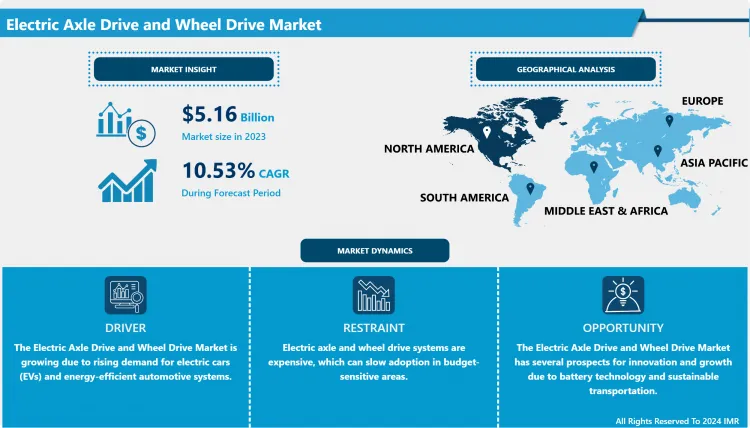

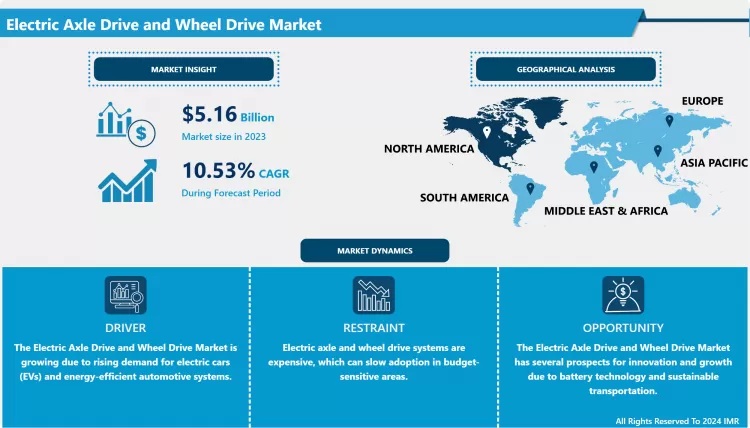

Electric Axle Drive and Wheel Drive Market Size is Valued at USD 5.16 Billion in 2023, and is Projected to Reach USD 11.5 Billion by 2032, Growing at a CAGR of 10.53% From 2024-2032.

The factors leading to rapid growth of the Electric Axle Drive and Wheel Drive Market are stringent government policies pertaining to CO2 emissions, raising awareness of the need for sustainable mobility, and the growing global interest in electric vehicles (EVs). Electric axle drives and wheel drives play important roles in EVs for power management as well as for improving the performance of vehicles. Reducing the weight of these systems provides benefits such as, improved efficiency, lighter vehicles, better traction control requirements important for new age electric and hybrid cars. The increasing use of electric vehicles due to incentives offered by governments and increasing stringency of emission norms are expected to drive the demand for electric axle and wheel drives.

- Technological developments are also placing pressures on competition within the electric axle drive and wheel drive market. Industries are putting their efforts into implementing better performing and highly efficient systems and technologies. Compatibility with other new technologies including regenerative braking and integrated control of electric motors improves the performance of electric powertrains. Additionally, advancements in vehicles in terms of automation and connectivity is a factor that is encouraging the creation of more advanced and integrated electric drive systems thus extending the growth of the market.

- Regionally the demand for the market is being observed to be increasing in areas like North America, Europe and Asia-Pacific. Noteworthy trends like the rising number of EV charging stations, a higher level of consumers’ concern for the environment, and governmental support for adoption of digital technologies are also driving the electric axle and wheel drive systems growth in those locations. With car manufacturers concentrating on producing efficient and environment friendly vehicles, the predicted growth of electric axle drive and wheel drive market is expected to have substantial growth in the coming years to fulfil the automotive market.

Electric Axle Drive and Wheel Drive Market Trend Analysis

Increasing Adoption of Electric Vehicles (EVs)

- The availably of affordable electric vehicle or EV has proved to be one of the most revolutionary trends in the Electric Axle Drive and Wheel Drive Market. Due to the evolving preferences of the populace bearing in mind that consumers are becoming more environmentally sensitive than before, thus they seek new cleaner sources of energy than traditional fossil fuel energy source, powering automobiles there lies a continuous demand for EVs.

- Governments across the globe are setting high emission standards besides offering stimulus to spur EV market. Electric axle and wheel drives are considered important parts for improving the performance, fuel economy and driving ranges of these vehicles making them crucial components for manufacturers. It is also contributing a growing market segment that is forcing the manufacturers to seek best electric drive solutions in order to increase competitiveness.

Advancements in Technology and Integration

- Innovation is becoming a strong driver of the Electric Axle Drive and Wheel Drive market, as key vendors increase spending on research and development to improve the performance of electric drivetrain solutions. New ideas like complex operative motor systems, regenerative brake systems and clever drive options are making their way to the marketplace. These innovations enhance vehicle efficiency and weight reduction in addition to energy effectiveness, which is significant to increase the operational durability of battery-powered cars.

- Furthermore, the convergence of the electric drive systems with connected vehicles is providing growth opportunities for manufacturers to deliver nuanced and self-sustaining driving systems. The electric axle and wheel drive will also experience the same development movement as these technologies move forward, and the market is expected to have growth and development.

Electric Axle Drive and Wheel Drive Market Segment Analysis:

Electric Axle Drive and Wheel Drive Market Segmented on the basis of By Motor Type, Drive Type ,Vehicle Type, Component Type, End-Use Industry

By Motor Type, Permanent Magnet AC Motor segment is expected to dominate the market during the forecast period

- The Electric Axle Drive and Wheel Drive Market mainly include Permanent Magnet Acquisition Cost (PMAC), Brush Electric Axle Drive and Wheel Drive Motor Price Brushless DC (BLDC), and other types. PMAC motors are preferred in electric vehicle applications because of the advantages such as high efficiency, small size and high power to mass ratio. These motors are characterized by better torque profile that ensures their applicability in traction power in electric axles. The increasing interest toward the improvement of comprehensive efficiency of e-vehicle is promoting the introduction of PMAC motors as one of the best options in the ELAD market.

- Another emerging market for brushless DC motors is the electric axle drive and wheel drive application space due to its high reliability low maintenance, and higher thermal performance. Offer high efficiency and can develop torque at different speeds, so they find wide uses in electric bicycles, scooters, and passenger cars. Based on the rising demand for electric cars and the efforts being made by car makers to improve the efficiency of electric drivetrain, the market for PMAC and BLDC motors is expected to grow at a very fast pace. Further, developments in motor technology such as improved integrated motor controllers, along with advancements in cooling systems, are adding support to the use of these motor types in electric drive applications.

By End-Use Industry, Passenger Vehicles segment held the largest share in 2024

- The electric axle drive and wheel drive markets have various application areas that are generally segmented based on the passenger cars, commercial vehicle other vehicles segment. The passenger vehicles segment remains apparent since the demand for electric vehicles keeps rising. Consumers are becoming aware of environment problems and benefits of electric vehicles hence automobile manufacturers are incorporating electric axle and wheel drive systems to improve vehicle performance, efficiency and eco-friendliness. This is also in line with increased development of electric vehicles supported by government policies such as tax relief and support for charging station establishment. Thus, the category of passenger vehicles was again identified as one of the most significant market drivers in the next few years.

- Besides PCVs, NCVs are gradually shifting their dependence on electric axle and wheel drives as well. This is a trend that has been developing over the past few years, especially as logistic companies and fleet operators try to cut down their operations cost and meet the emission regulation standards in the commercial fleet. Electric drive systems are advantageous because they offer better fuel economy, save on cost for hosting and far less noisy than traditional modes of transportation such as buses, delivery vehicles and the like. Consequently, the consistent increase in electric commercial vehicles will act as significant drivers for electric axle and wheel drive technologies that in turn will help the Electric Axle Drive and Wheel Drive Market gain momentum.

Electric Axle Drive and Wheel Drive Market Regional Insights:

North America is expected to dominate the market

- Several factors have lined up North America to be the market leader in Electric Axle Drive and Wheel Drive Market owing to the factors such as well-established automotive industry and rising government supports towards EVs. The United States and Canada have a well developed set of systems relating to the production and use of EVs and many car makers investing heavily into electric drive systems. Furthermore, the cutting of the emissions of the greenhouse gas in the region together with the push to achieve a shift towards more sustainable transport is also in harmony with the emerging trend of electrification within the automotive industry. This favourable environment fosters advancements in electric axle and wheel drive systems hence shaping North America market.

- In addition to that, growing market demand for electric and hybrid vehicles has made manufactures incorporate electric axle and wheel drive system for better performance and efficiency of vehicles. , all major automotive manufacturers such as Tesla, Ford, and General Motors are also investing heavily in production of new EV models, therefore, electric drive system market is expected to grow rapidly. Rise in consciousness regarding the environment and the demand for superior and pollution free transportation solutions also drive the market in North America. Consequently, the geographical area will continue dominant its rivals in the Electric Axle Drive and Wheel Drive Market over the next few years.

Active Key Players in the Electric Axle Drive and Wheel Drive Market

- ZF Friedrichshafen AG (Germany)

- ZIEHL-ABEGG SE (Germany)

- Robert Bosch GmbH (Germany)

- Magna International Inc. (Canada)

- GKN Automotive Limited (U.K.)

- Continental AG (Germany)

- Dana Limited (U.S.)

- American Axle & Manufacturing, Inc. (U.S.)

- Schaeffler AG (Germany)

- BorgWarner Inc. (U.S.)

- Bonfiglioli Transmissions Private Limited (India), Other Active Players

|

Global Electric Axle Drive and Wheel Drive Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.16 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.42% |

Market Size in 2032: |

USD 11.5 Bn. |

|

Segments Covered: |

By Motor Type |

|

|

|

By Drive Type |

|

||

|

By Vehicle Type |

|

||

|

By Component Type |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Electric Axle Drive and Wheel Drive Market by Motor Type (2018-2032)

4.1 Electric Axle Drive and Wheel Drive Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Permanent Magnet AC Motor

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Brushless DC Motor

4.5 Others

Chapter 5: Electric Axle Drive and Wheel Drive Market by Drive Type (2018-2032)

5.1 Electric Axle Drive and Wheel Drive Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fully Electric

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Hybrid

5.5 Others

Chapter 6: Electric Axle Drive and Wheel Drive Market by Vehicle Type (2018-2032)

6.1 Electric Axle Drive and Wheel Drive Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Pure Electric Vehicle

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hybrid Electric Vehicle

6.5 Plug-In Hybrid Electric Vehicle

Chapter 7: Electric Axle Drive and Wheel Drive Market by Component Type (2018-2032)

7.1 Electric Axle Drive and Wheel Drive Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Combination motor

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Power Electronics

7.5 Transmission

7.6 Others

Chapter 8: Electric Axle Drive and Wheel Drive Market by End-Use Industry (2018-2032)

8.1 Electric Axle Drive and Wheel Drive Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Passenger Vehicles

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Commercial Vehicles

8.5 Other Vehicles

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Electric Axle Drive and Wheel Drive Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ZF FRIEDRICHSHAFEN AG (GERMANY)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 ZIEHL-ABEGG SE (GERMANY)

9.4 ROBERT BOSCH GMBH (GERMANY)

9.5 MAGNA INTERNATIONAL INC. (CANADA)

9.6 GKN AUTOMOTIVE LIMITED (U.K.)

9.7 CONTINENTAL AG (GERMANY)

9.8 DANA LIMITED (U.S.)

9.9 AMERICAN AXLE & MANUFACTURING INC. (U.S.)

9.10 SCHAEFFLER AG (GERMANY)

9.11 BORGWARNER INC. (U.S.)

9.12 BONFIGLIOLI TRANSMISSIONS PRIVATE LIMITED (INDIA)

9.13

Chapter 10: Global Electric Axle Drive and Wheel Drive Market By Region

10.1 Overview

10.2. North America Electric Axle Drive and Wheel Drive Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Motor Type

10.2.4.1 Permanent Magnet AC Motor

10.2.4.2 Brushless DC Motor

10.2.4.3 Others

10.2.5 Historic and Forecasted Market Size by Drive Type

10.2.5.1 Fully Electric

10.2.5.2 Hybrid

10.2.5.3 Others

10.2.6 Historic and Forecasted Market Size by Vehicle Type

10.2.6.1 Pure Electric Vehicle

10.2.6.2 Hybrid Electric Vehicle

10.2.6.3 Plug-In Hybrid Electric Vehicle

10.2.7 Historic and Forecasted Market Size by Component Type

10.2.7.1 Combination motor

10.2.7.2 Power Electronics

10.2.7.3 Transmission

10.2.7.4 Others

10.2.8 Historic and Forecasted Market Size by End-Use Industry

10.2.8.1 Passenger Vehicles

10.2.8.2 Commercial Vehicles

10.2.8.3 Other Vehicles

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Electric Axle Drive and Wheel Drive Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Motor Type

10.3.4.1 Permanent Magnet AC Motor

10.3.4.2 Brushless DC Motor

10.3.4.3 Others

10.3.5 Historic and Forecasted Market Size by Drive Type

10.3.5.1 Fully Electric

10.3.5.2 Hybrid

10.3.5.3 Others

10.3.6 Historic and Forecasted Market Size by Vehicle Type

10.3.6.1 Pure Electric Vehicle

10.3.6.2 Hybrid Electric Vehicle

10.3.6.3 Plug-In Hybrid Electric Vehicle

10.3.7 Historic and Forecasted Market Size by Component Type

10.3.7.1 Combination motor

10.3.7.2 Power Electronics

10.3.7.3 Transmission

10.3.7.4 Others

10.3.8 Historic and Forecasted Market Size by End-Use Industry

10.3.8.1 Passenger Vehicles

10.3.8.2 Commercial Vehicles

10.3.8.3 Other Vehicles

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Electric Axle Drive and Wheel Drive Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Motor Type

10.4.4.1 Permanent Magnet AC Motor

10.4.4.2 Brushless DC Motor

10.4.4.3 Others

10.4.5 Historic and Forecasted Market Size by Drive Type

10.4.5.1 Fully Electric

10.4.5.2 Hybrid

10.4.5.3 Others

10.4.6 Historic and Forecasted Market Size by Vehicle Type

10.4.6.1 Pure Electric Vehicle

10.4.6.2 Hybrid Electric Vehicle

10.4.6.3 Plug-In Hybrid Electric Vehicle

10.4.7 Historic and Forecasted Market Size by Component Type

10.4.7.1 Combination motor

10.4.7.2 Power Electronics

10.4.7.3 Transmission

10.4.7.4 Others

10.4.8 Historic and Forecasted Market Size by End-Use Industry

10.4.8.1 Passenger Vehicles

10.4.8.2 Commercial Vehicles

10.4.8.3 Other Vehicles

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Electric Axle Drive and Wheel Drive Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Motor Type

10.5.4.1 Permanent Magnet AC Motor

10.5.4.2 Brushless DC Motor

10.5.4.3 Others

10.5.5 Historic and Forecasted Market Size by Drive Type

10.5.5.1 Fully Electric

10.5.5.2 Hybrid

10.5.5.3 Others

10.5.6 Historic and Forecasted Market Size by Vehicle Type

10.5.6.1 Pure Electric Vehicle

10.5.6.2 Hybrid Electric Vehicle

10.5.6.3 Plug-In Hybrid Electric Vehicle

10.5.7 Historic and Forecasted Market Size by Component Type

10.5.7.1 Combination motor

10.5.7.2 Power Electronics

10.5.7.3 Transmission

10.5.7.4 Others

10.5.8 Historic and Forecasted Market Size by End-Use Industry

10.5.8.1 Passenger Vehicles

10.5.8.2 Commercial Vehicles

10.5.8.3 Other Vehicles

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Electric Axle Drive and Wheel Drive Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Motor Type

10.6.4.1 Permanent Magnet AC Motor

10.6.4.2 Brushless DC Motor

10.6.4.3 Others

10.6.5 Historic and Forecasted Market Size by Drive Type

10.6.5.1 Fully Electric

10.6.5.2 Hybrid

10.6.5.3 Others

10.6.6 Historic and Forecasted Market Size by Vehicle Type

10.6.6.1 Pure Electric Vehicle

10.6.6.2 Hybrid Electric Vehicle

10.6.6.3 Plug-In Hybrid Electric Vehicle

10.6.7 Historic and Forecasted Market Size by Component Type

10.6.7.1 Combination motor

10.6.7.2 Power Electronics

10.6.7.3 Transmission

10.6.7.4 Others

10.6.8 Historic and Forecasted Market Size by End-Use Industry

10.6.8.1 Passenger Vehicles

10.6.8.2 Commercial Vehicles

10.6.8.3 Other Vehicles

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Electric Axle Drive and Wheel Drive Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Motor Type

10.7.4.1 Permanent Magnet AC Motor

10.7.4.2 Brushless DC Motor

10.7.4.3 Others

10.7.5 Historic and Forecasted Market Size by Drive Type

10.7.5.1 Fully Electric

10.7.5.2 Hybrid

10.7.5.3 Others

10.7.6 Historic and Forecasted Market Size by Vehicle Type

10.7.6.1 Pure Electric Vehicle

10.7.6.2 Hybrid Electric Vehicle

10.7.6.3 Plug-In Hybrid Electric Vehicle

10.7.7 Historic and Forecasted Market Size by Component Type

10.7.7.1 Combination motor

10.7.7.2 Power Electronics

10.7.7.3 Transmission

10.7.7.4 Others

10.7.8 Historic and Forecasted Market Size by End-Use Industry

10.7.8.1 Passenger Vehicles

10.7.8.2 Commercial Vehicles

10.7.8.3 Other Vehicles

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Electric Axle Drive and Wheel Drive Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.16 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.42% |

Market Size in 2032: |

USD 11.5 Bn. |

|

Segments Covered: |

By Motor Type |

|

|

|

By Drive Type |

|

||

|

By Vehicle Type |

|

||

|

By Component Type |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Electric Axle Drive and Wheel Drive Market research report is 2024-2032.

ZF Friedrichshafen AG (Germany), ZIEHL-ABEGG SE (Germany), Robert Bosch GmbH (Germany), Magna International Inc. (Canada), GKN Automotive Limited (U.K.), Continental AG (Germany), Dana Limited (U.S.), American Axle & Manufacturing, Inc. (U.S.), Schaeffler AG (Germany), BorgWarner Inc. (U.S.), Bonfiglioli Transmissions Private Limited (India), others.

The Electric Axle Drive and Wheel Drive Market is segmented into By Motor Type (Permanent Magnet AC Motor, Brushless DC Motor, and Others), Drive Type (Fully Electric, Hybrid, and Others), Vehicle Type (Pure Electric Vehicle, Hybrid Electric Vehicle, and Plug-In Hybrid Electric Vehicle), Component Type (Combination motor, Power electronics, Transmission, and Others), End User (Passenger Vehicles, Commercial Vehicles, and Other Vehicles).By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Wheel drive and axle drive are modern hybrid and electric vehicle powertrains that transmit power to wheels via wheels motors. These systems incorporate electric motors into the axle or wheel assembly reducing or completely eliminating common mechanical transmission parts like driveshafts. This design also enhances vehicle efficiency, space management and usage, weight control and distribution and lastly control. Electrified axle and wheel drives are crucial for the development of present-day EVs and play a significant role in improving acceleration, emissions, and energy efficacies, now especially in urban and business transport.

Electric Axle Drive and Wheel Drive Market Size is Valued at USD 5.16 Billion in 2023, and is Projected to Reach USD 11.5 Billion by 2032, Growing at a CAGR of 10.53% From 2024-2032.