Dot Matrix Printer Market Synopsis

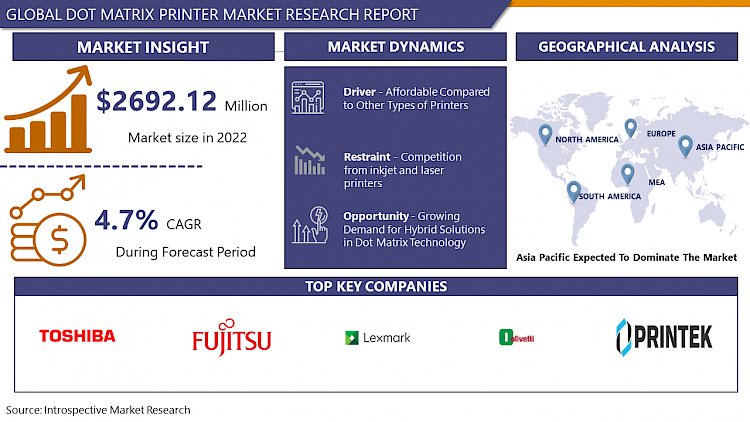

Dot Matrix Printer Market Size Was Valued at USD 2692.12 Million in 2022, and is Projected to Reach USD 3741.42 Million by 2030, Growing at a CAGR of 4.2% From 2023-2030.

A dot matrix printer is a type of impact printer that produces characters and images by striking pins against an ink ribbon to form dots on paper. It operates by creating patterns of dots, typically in a matrix formation, to generate text and graphics. Although less common, dot matrix printers are still used for tasks like printing multipart forms and receipts due to their durability and ability to produce carbon copies.

- The Dot Matrix printers utilize a matrix of small pins to produce characters and images by striking an ink-soaked ribbon against the paper, making them suitable for tasks requiring carbon copies or multipart forms.

- The Dot Matrix Printer market has faced challenges from the rise of more advanced printing technologies such as inkjet and laser printing. However, it continues to find a foothold in specific industries where durability, reliability, and low operational costs. These include manufacturing, logistics, banking, and certain governmental sectors.

- The market demand has declined, but there remains a steady need for Dot Matrix Printers due to their ability to handle continuous stationery and multipart forms with ease. Moreover, their longevity and ability to operate in harsh environments make them indispensable in certain applications where other printers may struggle.

- The manufacturers have focused on improving print speed, enhancing print quality, and integrating modern connectivity options to align with the evolving needs of businesses. The environmental considerations have led to the development of energy-efficient models and the promotion of recycling programs for printer components, contributing to sustainability efforts within the industry.

Dot Matrix Printer Market Trend Analysis

Affordable Compared to Other Types of Printers

- The Dot Matrix Printer Market is driven by affordability, offering lower initial costs compared to inkjet or laser printers. This is particularly beneficial for small businesses, startups, and individuals with limited budgets. Dot matrix printers are known for their durability and longevity, reducing the need for frequent replacements, additional enhancing their cost-effectiveness over time.

- The operational costs of dot matrix printers are considerably lower. They utilize ribbon cartridges, which are more economical than the toner or ink cartridges required by inkjet and laser printers. Additionally, dot matrix printers are adept at handling multi-part forms, making them indispensable in industries requiring continuous printing of invoices, receipts, or other multipart documents.

- Furthermore, in environments where ruggedness and reliability are paramount, such as industrial or manufacturing settings, dot matrix printers excel. Their robust construction allows them to withstand harsh conditions and perform consistently, thus offering excellent value for money over their lifespan.

- The affordability of dot matrix printers in terms of both initial investment and operational expenses positions them as a compelling choice for various sectors, thereby driving their market growth and adoption.

Growing Demand for Hybrid Solutions in Dot Matrix Technology

- Hybrid solutions offer a blend of traditional dot matrix printing technology with modern advancements, catering to diverse needs across various industries. This integration of conventional reliability with contemporary features addresses the demand for versatile printing solutions.

- The increased interest in hybrid solutions is their ability to bridge the gap between legacy systems and modern workflows. Many businesses still rely on dot matrix printers for specific tasks due to their durability and low operational costs. However, these organizations also require compatibility with newer technologies and software applications. Hybrid dot matrix printers provide the necessary connectivity options and compatibility features to meet these requirements, allowing businesses to integrate them seamlessly into their existing setups.

- Moreover, hybrid dot matrix printers often come equipped with enhanced functionalities such as wireless connectivity, cloud printing capabilities, and compatibility with mobile devices. These features enable greater flexibility and efficiency in printing operations, contributing to improved productivity and workflow management.

- The demand for hybrid solutions is also driven by the need for sustainable printing practices. Many businesses are increasingly adopting eco-friendly initiatives, and hybrid dot matrix printers offer energy-efficient options, reducing both operational costs and environmental impact.

Dot Matrix Printer Market Segment Analysis:

Dot Matrix Printer Market Segmented based on type, and end-users.

By Type, Low-Resolution Printer segment is expected to dominate the market during the forecast period

- The dot matrix printers are often more affordable compared to other types of printers, making them accessible to a wider range of consumers, especially those with budget constraints. Secondly, for certain applications such as basic text printing or simple graphics, low-resolution printers like dot matrix printers suffice, eliminating the need for higher resolution and more expensive alternatives. Additionally, dot matrix printers are known for their durability and reliability, especially in industrial environments where they are frequently used for tasks like printing invoices, receipts, or labels. Their ability to handle multipart forms and carbon copies also contributes to their popularity in specific niche markets. The combination of affordability, suitability for specific tasks, and durability makes low-resolution printers, particularly dot matrix printers, the dominant choice in their market segment.

Dot Matrix Printer Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The region's large population creates a significant demand for affordable printing solutions, especially in sectors such as retail, logistics, and banking, where dot matrix printers are still widely used for tasks like invoice printing and barcode labeling. Asia Pacific is the world's largest electronics manufacturing hub, such as China, Japan, South Korea, and Taiwan. These countries have well-established infrastructures and skilled labor forces, allowing for efficient production and distribution of dot matrix printers.

- The Asia Pacific economy is experiencing rapid industrialization and urbanization, leading to increased demand for office automation equipment like dot matrix printers in businesses of all sizes. Furthermore, favorable government policies and incentives aimed at promoting the manufacturing sector have encouraged investment in the production of dot matrix printers within the region. The convergence of manufacturing expertise, market demand, and supportive policies has propelled the Asia Pacific to dominate the dot matrix printer market, making it a key player in the global printing industry.

Dot Matrix Printer Market Top Key Players:

- Lexmark (United States)

- Printek (United States)

- Olivetti (Italy)

- Winpos (Finland)

- Jolimark (China)

- ZONERICH (China)

- New Beiyang (China)

- GAINSCHA (China)

- ICOD (China)

- SPRT (China)

- EPSON (Japan)

- Fujitsu (Japan)

- OKI (Japan)

- Toshiba (Japan)

- Star (Japan)

- Bixlon (Korea),and other major players.

|

Global Dot Matrix Printer Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2692.12 Mn. |

|

Forecast Period 2023-30 CAGR: |

4.2 % |

Market Size in 2030: |

USD 3741.42 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DOT MATRIX PRINTER MARKET BY TYPE (2017-2030)

- DOT MATRIX PRINTER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LOW-RESOLUTION PRINTER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MIDDLE-RESOLUTION PRINTER

- HIGH-RESOLUTION PRINTER

- DOT MATRIX PRINTER MARKET BY END USER (2017-2030)

- DOT MATRIX PRINTER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FINANCE & INSURANCE GOVERNMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MANUFACTURING

- LOGISTICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Dot Matrix Printer Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- LEXMARK (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- PRINTEK (UNITED STATES)

- OLIVETTI (ITALY)

- WINPOS (FINLAND)

- JOLIMARK (CHINA)

- ZONERICH (CHINA)

- NEW BEIYANG (CHINA)

- GAINSCHA (CHINA)

- ICOD (CHINA)

- SPRT (CHINA)

- EPSON (JAPAN)

- FUJITSU (JAPAN)

- OKI (JAPAN)

- TOSHIBA (JAPAN)

- STAR (JAPAN)

- BIXLON (KOREA)

- COMPETITIVE LANDSCAPE

- GLOBAL DOT MATRIX PRINTER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Dot Matrix Printer Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 2692.12 Mn. |

|

Forecast Period 2023-30 CAGR: |

4.2 % |

Market Size in 2030: |

USD 3741.42 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DOT MATRIX PRINTER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DOT MATRIX PRINTER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DOT MATRIX PRINTER MARKET COMPETITIVE RIVALRY

TABLE 005. DOT MATRIX PRINTER MARKET THREAT OF NEW ENTRANTS

TABLE 006. DOT MATRIX PRINTER MARKET THREAT OF SUBSTITUTES

TABLE 007. DOT MATRIX PRINTER MARKET BY TYPE

TABLE 008. HOUSEHOLD USE MARKET OVERVIEW (2016-2028)

TABLE 009. COMMERCIAL USE MARKET OVERVIEW (2016-2028)

TABLE 010. DOT MATRIX PRINTER MARKET BY APPLICATION

TABLE 011. BALLISTIC PRINTER MARKET OVERVIEW (2016-2028)

TABLE 012. ENERGY STORAGE PRINTER MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA DOT MATRIX PRINTER MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA DOT MATRIX PRINTER MARKET, BY APPLICATION (2016-2028)

TABLE 015. N DOT MATRIX PRINTER MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE DOT MATRIX PRINTER MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE DOT MATRIX PRINTER MARKET, BY APPLICATION (2016-2028)

TABLE 018. DOT MATRIX PRINTER MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC DOT MATRIX PRINTER MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC DOT MATRIX PRINTER MARKET, BY APPLICATION (2016-2028)

TABLE 021. DOT MATRIX PRINTER MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA DOT MATRIX PRINTER MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA DOT MATRIX PRINTER MARKET, BY APPLICATION (2016-2028)

TABLE 024. DOT MATRIX PRINTER MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA DOT MATRIX PRINTER MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA DOT MATRIX PRINTER MARKET, BY APPLICATION (2016-2028)

TABLE 027. DOT MATRIX PRINTER MARKET, BY COUNTRY (2016-2028)

TABLE 028. PANASONIC: SNAPSHOT

TABLE 029. PANASONIC: BUSINESS PERFORMANCE

TABLE 030. PANASONIC: PRODUCT PORTFOLIO

TABLE 031. PANASONIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. EPSON: SNAPSHOT

TABLE 032. EPSON: BUSINESS PERFORMANCE

TABLE 033. EPSON: PRODUCT PORTFOLIO

TABLE 034. EPSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. LENOVO: SNAPSHOT

TABLE 035. LENOVO: BUSINESS PERFORMANCE

TABLE 036. LENOVO: PRODUCT PORTFOLIO

TABLE 037. LENOVO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. TOSHIBA: SNAPSHOT

TABLE 038. TOSHIBA: BUSINESS PERFORMANCE

TABLE 039. TOSHIBA: PRODUCT PORTFOLIO

TABLE 040. TOSHIBA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. SPRT: SNAPSHOT

TABLE 041. SPRT: BUSINESS PERFORMANCE

TABLE 042. SPRT: PRODUCT PORTFOLIO

TABLE 043. SPRT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. START: SNAPSHOT

TABLE 044. START: BUSINESS PERFORMANCE

TABLE 045. START: PRODUCT PORTFOLIO

TABLE 046. START: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. BENQ: SNAPSHOT

TABLE 047. BENQ: BUSINESS PERFORMANCE

TABLE 048. BENQ: PRODUCT PORTFOLIO

TABLE 049. BENQ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. OKI: SNAPSHOT

TABLE 050. OKI: BUSINESS PERFORMANCE

TABLE 051. OKI: PRODUCT PORTFOLIO

TABLE 052. OKI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. FUJITSU: SNAPSHOT

TABLE 053. FUJITSU: BUSINESS PERFORMANCE

TABLE 054. FUJITSU: PRODUCT PORTFOLIO

TABLE 055. FUJITSU: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. DASCOM: SNAPSHOT

TABLE 056. DASCOM: BUSINESS PERFORMANCE

TABLE 057. DASCOM: PRODUCT PORTFOLIO

TABLE 058. DASCOM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. COMET: SNAPSHOT

TABLE 059. COMET: BUSINESS PERFORMANCE

TABLE 060. COMET: PRODUCT PORTFOLIO

TABLE 061. COMET: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. JOLIMARK: SNAPSHOT

TABLE 062. JOLIMARK: BUSINESS PERFORMANCE

TABLE 063. JOLIMARK: PRODUCT PORTFOLIO

TABLE 064. JOLIMARK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. COYOB: SNAPSHOT

TABLE 065. COYOB: BUSINESS PERFORMANCE

TABLE 066. COYOB: PRODUCT PORTFOLIO

TABLE 067. COYOB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. DELI: SNAPSHOT

TABLE 068. DELI: BUSINESS PERFORMANCE

TABLE 069. DELI: PRODUCT PORTFOLIO

TABLE 070. DELI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. FLYER: SNAPSHOT

TABLE 071. FLYER: BUSINESS PERFORMANCE

TABLE 072. FLYER: PRODUCT PORTFOLIO

TABLE 073. FLYER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. REGO: SNAPSHOT

TABLE 074. REGO: BUSINESS PERFORMANCE

TABLE 075. REGO: PRODUCT PORTFOLIO

TABLE 076. REGO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. GAINSCHA: SNAPSHOT

TABLE 077. GAINSCHA: BUSINESS PERFORMANCE

TABLE 078. GAINSCHA: PRODUCT PORTFOLIO

TABLE 079. GAINSCHA: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DOT MATRIX PRINTER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DOT MATRIX PRINTER MARKET OVERVIEW BY TYPE

FIGURE 012. HOUSEHOLD USE MARKET OVERVIEW (2016-2028)

FIGURE 013. COMMERCIAL USE MARKET OVERVIEW (2016-2028)

FIGURE 014. DOT MATRIX PRINTER MARKET OVERVIEW BY APPLICATION

FIGURE 015. BALLISTIC PRINTER MARKET OVERVIEW (2016-2028)

FIGURE 016. ENERGY STORAGE PRINTER MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA DOT MATRIX PRINTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE DOT MATRIX PRINTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC DOT MATRIX PRINTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA DOT MATRIX PRINTER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA DOT MATRIX PRINTER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Dot Matrix Printer Market research report is 2023-2030.

Lexmark (United States), Printek (United States), Olivetti (Italy), Winpos (Finland), Jolimark (China), ZONERICH (China), New Beiyang (China), GAINSCHA (China), ICOD (China), SPRT (China), EPSON (Japan), Fujitsu (Japan), OKI (Japan), Toshiba (Japan), Star (Japan), Bixlon (Korea), and Other Major Players.

The Dot Matrix Printer Market is segmented into Type, End-User, and region. By Type, the market is categorized into Low-Resolution Printer, Middle-Resolution Printer, and High-Resolution Printer. By End User, the market is categorized into Finance & Insurance Government, Retail, Manufacturing, and Logistics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A dot matrix printer is a type of impact printer that produces characters and images by striking pins against an ink ribbon to form dots on paper. It operates by creating patterns of dots, typically in a matrix formation, to generate text and graphics. Although less common, dot matrix printers are still used for tasks like printing multipart forms and receipts due to their durability and ability to produce carbon copies.

Dot Matrix Printer Market Size Was Valued at USD 2692.12 Million in 2022, and is Projected to Reach USD 3741.42 Million by 2030, Growing at a CAGR of 4.2% From 2023-2030.