DNS DHCP and IP Address Management (DDI) Market Synopsis

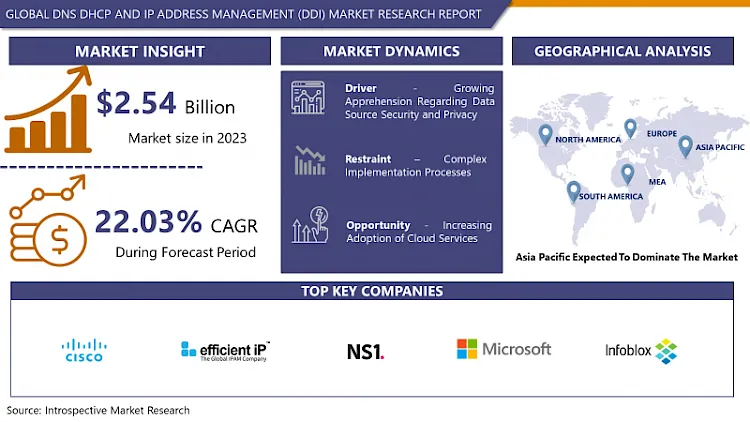

DNS DHCP and IP address management (DDI) Market Size Was Valued at USD 3.1 Billion in 2024 and is Projected to Reach USD 15.24 Billion by 2032, Growing at a CAGR of 22.03% From 2025-2032.

DNS, DHCP, and IP Address Management (DDI) constitute a set of network services. DNS (Domain Name System) converts user-friendly domain names to IP addresses. DHCP (Dynamic Host Configuration Protocol) automates the allocation of IP addresses to network devices. IP Address Management encompasses the organization, monitoring, and oversight of IP addresses for streamlined network functionality.

IP Address Management (DDI) is essential to in the effective management and optimization of network resources. DNS serves the purpose of translating domain names into IP addresses, making web addressing more user-friendly. DHCP automates the dynamic allocation of IP addresses to devices on a network, simplifying configuration and minimizing the risk of address conflicts. IP Address Management encompasses the planning, tracking, and administration of IP addresses to ensure efficient resource utilization.

The utilization of DNS, DHCP, and DDI is fundamental for achieving seamless network operations. In large-scale networks, DNS enables users to access resources using easily memorable domain names rather than complex IP addresses. DHCP streamlines the assignment of IP addresses, especially in environments with frequent device connections and disconnections, such as enterprise networks or public Wi-Fi settings. DDI systems provide a comprehensive solution for planning and managing IP address spaces, optimizing resource allocation, and preventing address conflicts. This is essential for maintaining network stability, reliability, and security.

The advantages of DNS, DHCP, and DDI are diverse. They enhance network efficiency by automating crucial processes, decrease administrative overhead through centralized control, and enhance scalability, particularly in dynamic and large-scale environments. Furthermore, these technologies contribute to improved network security by preventing IP address conflicts and unauthorized access.

DNS DHCP and IP Address Management (DDI) Market Trend Analysis:

Growing Apprehension Regarding Data Source Security and Privacy

- Increasing concerns regarding the security and privacy of data sources are fueling the demand for robust DNS, DHCP, and IP Address Management (DDI) solutions. With organizations relying more on interconnected systems and cloud-based services, the threat of cyberattacks and unauthorized access to sensitive data has risen. DDI systems has a vital role in strengthening network security by efficiently managing IP addresses, preventing unauthorized access, and reducing the risk of malicious activities. These solutions act as a defensive layer against cyber threats, addressing concerns about data source security.

- In response to stringent data protection regulations and privacy acts, businesses are compelled to enhance their cybersecurity measures. DNS, DHCP, and IP Address Management solutions contribute to compliance efforts by offering centralized control over IP address allocation, facilitating efficient tracking, and minimizing the potential for data breaches. As organizations prioritize compliance with data privacy and security regulations, the adoption of DDI solutions becomes integral to establishing a resilient and secure network infrastructure.

- Moreover, the evolving landscape of cyber threats requires real-time adaptability and proactive measures to safeguard data sources. DDI solutions enhance network resilience by providing automation, monitoring, and swift response capabilities, aligning with the growing concerns about data security. The increasing recognition of DDI as a critical component in fortifying network defenses underscores its importance in addressing the rising anxieties related to data source security and privacy.

Increasing Adoption of Cloud Services

- The increasing embrace of cloud services stands as a pivotal opportunity for the expansion of the DNS, DHCP, and IP Address Management (DDI) market. With businesses shifting towards cloud-centric infrastructures, the demand for DDI solutions that seamlessly integrate with diverse cloud environments is on the rise. Cloud adoption offers dynamic scaling, flexibility, and accessibility, necessitating DDI systems that adeptly manage IP addresses and DNS services in hybrid and multi-cloud setups.

- Cloud-native DDI solutions empower organizations to navigate the intricacies of distributed and virtualized networks efficiently. These solutions deliver crucial services for streamlined IP address allocation, domain name resolution, and DHCP configuration within the cloud. This transition towards cloud services aligns with the broader trend of digital transformation, motivating DDI providers to innovate and provide solutions tailored to the specific challenges and opportunities introduced by cloud adoption. The capability of DDI solutions to adapt to the dynamic nature of cloud-based infrastructures reinforces their significance in contemporary IT ecosystems.

- Moreover, the scalability and agility inherent in cloud services present an avenue for DDI providers to furnish flexible and scalable solutions, aligning with the evolving requirements of businesses. Integrating DDI functionalities with cloud platforms enhances the overall effectiveness of network management, ensuring a seamless transition for organizations embracing the cloud and cementing the role of DDI solutions as fundamental components in modern IT architectures.

DNS DHCP and IP Address Management (DDI) Market Segment Analysis:

DNS DHCP and IP Address Management (DDI) Market Segmented on the basis of Deployment Mode, Component, Version, Organization Size, Application, Vertical and Region.

By Deployment Mode, On-Premises segment is expected to dominate the market during the forecast period

- This is attributed to factors such as security considerations, the necessity for data control, and the demand for tailored network management. Many enterprises prioritize on-premises solutions to retain direct control over their infrastructure, sensitive data, and networking protocols. This approach offers a heightened level of security, allowing organizations to implement customized security measures and access controls.

- Moreover, industries subject to strict regulatory compliance often favor on-premises DDI solutions to ensure adherence to specific data governance requirements. The dominance of the on-premises segment underscores the persistent demand for robust, customizable, and secure DDI solutions that cater to the distinct operational needs and regulatory landscapes of diverse enterprises.

By Component, Software segment held the largest share in 2024

- The market for DNS, DHCP, and IP Address Management (DDI) solutions is predominantly led by the software segment, marking a shift in the industry towards software-centric and virtualized network infrastructures. Software-based DDI solutions offer enhanced flexibility, scalability, and ease of integration when compared to traditional hardware appliances. As organizations increasingly embrace virtualized environments and cloud-based architectures, there is a growing demand for software solutions that can be seamlessly deployed and managed across diverse IT ecosystems.

- The dominance of the software segment is also attributed to its adaptability to evolving technological trends, allowing for swift updates and feature enhancements. Software-based DDI solutions empower enterprises to effectively manage their network resources, ensuring agility in response to changing business needs. Amidst the ongoing digital transformation, the software segment is poised to uphold its leadership position by delivering scalable, cost-effective, and innovative solutions that align with the dynamic requirements of modern network infrastructures.

DNS DHCP and IP Address Management (DDI) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The DNS, DHCP, and IP Address Management (DDI) market are poised to witness significant growth and technological advancements, with Asia Pacific anticipated to emerge as the dominant force. This regional dominance is driven by the escalating digitization across various industries, substantial development in IT infrastructure, and a growing emphasis on network security. As businesses in Asia Pacific undergo digital transformation, there is an increased demand for efficient DDI solutions to effectively manage and secure the expanding network ecosystems.

- Furthermore, the region's large and diverse population, coupled with the rapid adoption of mobile devices and internet services, amplifies the requirement for scalable and reliable DDI solutions. Government initiatives promoting smart city projects and the continual expansion of the e-commerce sector further contribute to the heightened adoption of DDI solutions. Positioned as a key player in the global technology landscape, Asia Pacific is expected to sustain its dominance in the DNS, DHCP, and IP Address Management market, presenting substantial growth opportunities for industry players.

DNS DHCP and IP Address Management (DDI) Market Top Key Players:

- Cisco Systems (U.S.)

- Efficientip (U.S.)

- Bt Diamond Ip (U.S.)

- Pc Network (U.S.)

- Tcpwave Inc. (U.S.)

- Solarwinds Network (U.S.)

- Ns1 (U.S.)

- Microsoft Corporation (U.S.)

- Infoblox (U.S.)

- Bluecat Networks (Canada)

- Empowered Networks (Canada)

- Men & Mice (Iceland)

- Fusionlayer (Finland)

- Apteriks (Netherlands)

- Appliansys (Uk)

- Ncc Group (Uk)

- Alcatel-Lucent (France)

- Nokia Corporation (France)

- Datacomm (Indonesia)

- Invetico (Australia)

- Other Active Players

Key Industry Developments in the DNS DHCP and IP Address Management (DDI) Market:

- In March 2024, BlueCat Networks, a leading provider of core services for network infrastructure management, automation, and security, announced the availability of new capabilities across its expanded portfolio. CEO Stephen Devito emphasizes the importance of network modernization, highlighting the impact of recent acquisitions and investments. Integrity, BlueCat's integrated DDI platform, introduces support for new DNS record types and dynamic DHCP reservation deployment, enhancing service delivery and automation. Additionally, advanced API capabilities facilitate seamless integration with third-party applications like ServiceNow and Terraform, empowering organizations to manage, build, and secure their networks effectively.

- In January 2023, EfficientIP, a DDI security and automation specialist (DNS, DHCP, IPAM), has declared the launch of its new DNS-based Data Exfiltration Application. The application is primarily designed as a hands-on web tool to allow organizations to securely conduct their own "ethical hack" on their DNS system and related security defenses to identify various crucial potential vulnerabilities in their network that could lead to a data breach.

|

Global DNS DHCP and IP Address Management (DDI) Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.1 Bn. |

|

Forecast Period 2025-32 CAGR: |

22.03 % |

Market Size in 2032: |

USD 15.24 Bn. |

|

Segments Covered: |

By Deployment Mode |

|

|

|

By Component |

|

||

|

By Version |

|

||

|

By Organization Size |

|

||

|

By Application |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: DNS DHCP and IP address management (DDI) Market by Deployment Mode (2018-2032)

4.1 DNS DHCP and IP address management (DDI) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cloud

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 On-Premises

Chapter 5: DNS DHCP and IP address management (DDI) Market by Component (2018-2032)

5.1 DNS DHCP and IP address management (DDI) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hardware

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Software

Chapter 6: DNS DHCP and IP address management (DDI) Market by Version (2018-2032)

6.1 DNS DHCP and IP address management (DDI) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 IPv4

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 IPv6

Chapter 7: DNS DHCP and IP address management (DDI) Market by Organization Size (2018-2032)

7.1 DNS DHCP and IP address management (DDI) Market Snapshot and Growth Engine

7.2 Market Overview

7.3 SMEs

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Large Enterprises

Chapter 8: DNS DHCP and IP address management (DDI) Market by Application (2018-2032)

8.1 DNS DHCP and IP address management (DDI) Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Network Automation

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Virtualization and Cloud

8.5 Data Center Transformation

8.6 Network Security

8.7 Transition to IPv6

Chapter 9: DNS DHCP and IP address management (DDI) Market by Vertical (2018-2032)

9.1 DNS DHCP and IP address management (DDI) Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Telecom and IT

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 BFSI

9.5 Government and Defense

9.6 Healthcare and Life Sciences

9.7 Education

9.8 Others

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 DNS DHCP and IP address management (DDI) Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 DOWDUPONT (U.S.)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 PACIFIC BIOSCIENCES (U.S.)

10.4 CORTEVA (U.S.)

10.5 BASF SE (U.S.)

10.6 YIELD10 BIOSCIENCE INC (U.S.)

10.7 EUROFINS SCIENTIFIC (LUXEMBOURG)

10.8 BAYER AG (GERMANY)

10.9 BENSON HILL BIOSYSTEMS INC. (GERMANY)

10.10 KWS (GERMANY)

10.11 LIMAGRAIN (FRANCE)

10.12 GROUPE LIMAGRAIN (FRANCE)

10.13 SYNGENTA (SWITZERLAND)

10.14 ADVANTA SEEDS (INDIA)

10.15 SAKATA SEED CORPORATION (JAPAN)

10.16 EVOGENE LTD. (ISRAEL)

10.17

Chapter 11: Global DNS DHCP and IP address management (DDI) Market By Region

11.1 Overview

11.2. North America DNS DHCP and IP address management (DDI) Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Deployment Mode

11.2.4.1 Cloud

11.2.4.2 On-Premises

11.2.5 Historic and Forecasted Market Size by Component

11.2.5.1 Hardware

11.2.5.2 Software

11.2.6 Historic and Forecasted Market Size by Version

11.2.6.1 IPv4

11.2.6.2 IPv6

11.2.7 Historic and Forecasted Market Size by Organization Size

11.2.7.1 SMEs

11.2.7.2 Large Enterprises

11.2.8 Historic and Forecasted Market Size by Application

11.2.8.1 Network Automation

11.2.8.2 Virtualization and Cloud

11.2.8.3 Data Center Transformation

11.2.8.4 Network Security

11.2.8.5 Transition to IPv6

11.2.9 Historic and Forecasted Market Size by Vertical

11.2.9.1 Telecom and IT

11.2.9.2 BFSI

11.2.9.3 Government and Defense

11.2.9.4 Healthcare and Life Sciences

11.2.9.5 Education

11.2.9.6 Others

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe DNS DHCP and IP address management (DDI) Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Deployment Mode

11.3.4.1 Cloud

11.3.4.2 On-Premises

11.3.5 Historic and Forecasted Market Size by Component

11.3.5.1 Hardware

11.3.5.2 Software

11.3.6 Historic and Forecasted Market Size by Version

11.3.6.1 IPv4

11.3.6.2 IPv6

11.3.7 Historic and Forecasted Market Size by Organization Size

11.3.7.1 SMEs

11.3.7.2 Large Enterprises

11.3.8 Historic and Forecasted Market Size by Application

11.3.8.1 Network Automation

11.3.8.2 Virtualization and Cloud

11.3.8.3 Data Center Transformation

11.3.8.4 Network Security

11.3.8.5 Transition to IPv6

11.3.9 Historic and Forecasted Market Size by Vertical

11.3.9.1 Telecom and IT

11.3.9.2 BFSI

11.3.9.3 Government and Defense

11.3.9.4 Healthcare and Life Sciences

11.3.9.5 Education

11.3.9.6 Others

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe DNS DHCP and IP address management (DDI) Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Deployment Mode

11.4.4.1 Cloud

11.4.4.2 On-Premises

11.4.5 Historic and Forecasted Market Size by Component

11.4.5.1 Hardware

11.4.5.2 Software

11.4.6 Historic and Forecasted Market Size by Version

11.4.6.1 IPv4

11.4.6.2 IPv6

11.4.7 Historic and Forecasted Market Size by Organization Size

11.4.7.1 SMEs

11.4.7.2 Large Enterprises

11.4.8 Historic and Forecasted Market Size by Application

11.4.8.1 Network Automation

11.4.8.2 Virtualization and Cloud

11.4.8.3 Data Center Transformation

11.4.8.4 Network Security

11.4.8.5 Transition to IPv6

11.4.9 Historic and Forecasted Market Size by Vertical

11.4.9.1 Telecom and IT

11.4.9.2 BFSI

11.4.9.3 Government and Defense

11.4.9.4 Healthcare and Life Sciences

11.4.9.5 Education

11.4.9.6 Others

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific DNS DHCP and IP address management (DDI) Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Deployment Mode

11.5.4.1 Cloud

11.5.4.2 On-Premises

11.5.5 Historic and Forecasted Market Size by Component

11.5.5.1 Hardware

11.5.5.2 Software

11.5.6 Historic and Forecasted Market Size by Version

11.5.6.1 IPv4

11.5.6.2 IPv6

11.5.7 Historic and Forecasted Market Size by Organization Size

11.5.7.1 SMEs

11.5.7.2 Large Enterprises

11.5.8 Historic and Forecasted Market Size by Application

11.5.8.1 Network Automation

11.5.8.2 Virtualization and Cloud

11.5.8.3 Data Center Transformation

11.5.8.4 Network Security

11.5.8.5 Transition to IPv6

11.5.9 Historic and Forecasted Market Size by Vertical

11.5.9.1 Telecom and IT

11.5.9.2 BFSI

11.5.9.3 Government and Defense

11.5.9.4 Healthcare and Life Sciences

11.5.9.5 Education

11.5.9.6 Others

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa DNS DHCP and IP address management (DDI) Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Deployment Mode

11.6.4.1 Cloud

11.6.4.2 On-Premises

11.6.5 Historic and Forecasted Market Size by Component

11.6.5.1 Hardware

11.6.5.2 Software

11.6.6 Historic and Forecasted Market Size by Version

11.6.6.1 IPv4

11.6.6.2 IPv6

11.6.7 Historic and Forecasted Market Size by Organization Size

11.6.7.1 SMEs

11.6.7.2 Large Enterprises

11.6.8 Historic and Forecasted Market Size by Application

11.6.8.1 Network Automation

11.6.8.2 Virtualization and Cloud

11.6.8.3 Data Center Transformation

11.6.8.4 Network Security

11.6.8.5 Transition to IPv6

11.6.9 Historic and Forecasted Market Size by Vertical

11.6.9.1 Telecom and IT

11.6.9.2 BFSI

11.6.9.3 Government and Defense

11.6.9.4 Healthcare and Life Sciences

11.6.9.5 Education

11.6.9.6 Others

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America DNS DHCP and IP address management (DDI) Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Deployment Mode

11.7.4.1 Cloud

11.7.4.2 On-Premises

11.7.5 Historic and Forecasted Market Size by Component

11.7.5.1 Hardware

11.7.5.2 Software

11.7.6 Historic and Forecasted Market Size by Version

11.7.6.1 IPv4

11.7.6.2 IPv6

11.7.7 Historic and Forecasted Market Size by Organization Size

11.7.7.1 SMEs

11.7.7.2 Large Enterprises

11.7.8 Historic and Forecasted Market Size by Application

11.7.8.1 Network Automation

11.7.8.2 Virtualization and Cloud

11.7.8.3 Data Center Transformation

11.7.8.4 Network Security

11.7.8.5 Transition to IPv6

11.7.9 Historic and Forecasted Market Size by Vertical

11.7.9.1 Telecom and IT

11.7.9.2 BFSI

11.7.9.3 Government and Defense

11.7.9.4 Healthcare and Life Sciences

11.7.9.5 Education

11.7.9.6 Others

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global DNS DHCP and IP Address Management (DDI) Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3.1 Bn. |

|

Forecast Period 2025-32 CAGR: |

22.03 % |

Market Size in 2032: |

USD 15.24 Bn. |

|

Segments Covered: |

By Deployment Mode |

|

|

|

By Component |

|

||

|

By Version |

|

||

|

By Organization Size |

|

||

|

By Application |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

_MARKET_(1).webp)