Digitalization of Beauty Market Synopsis

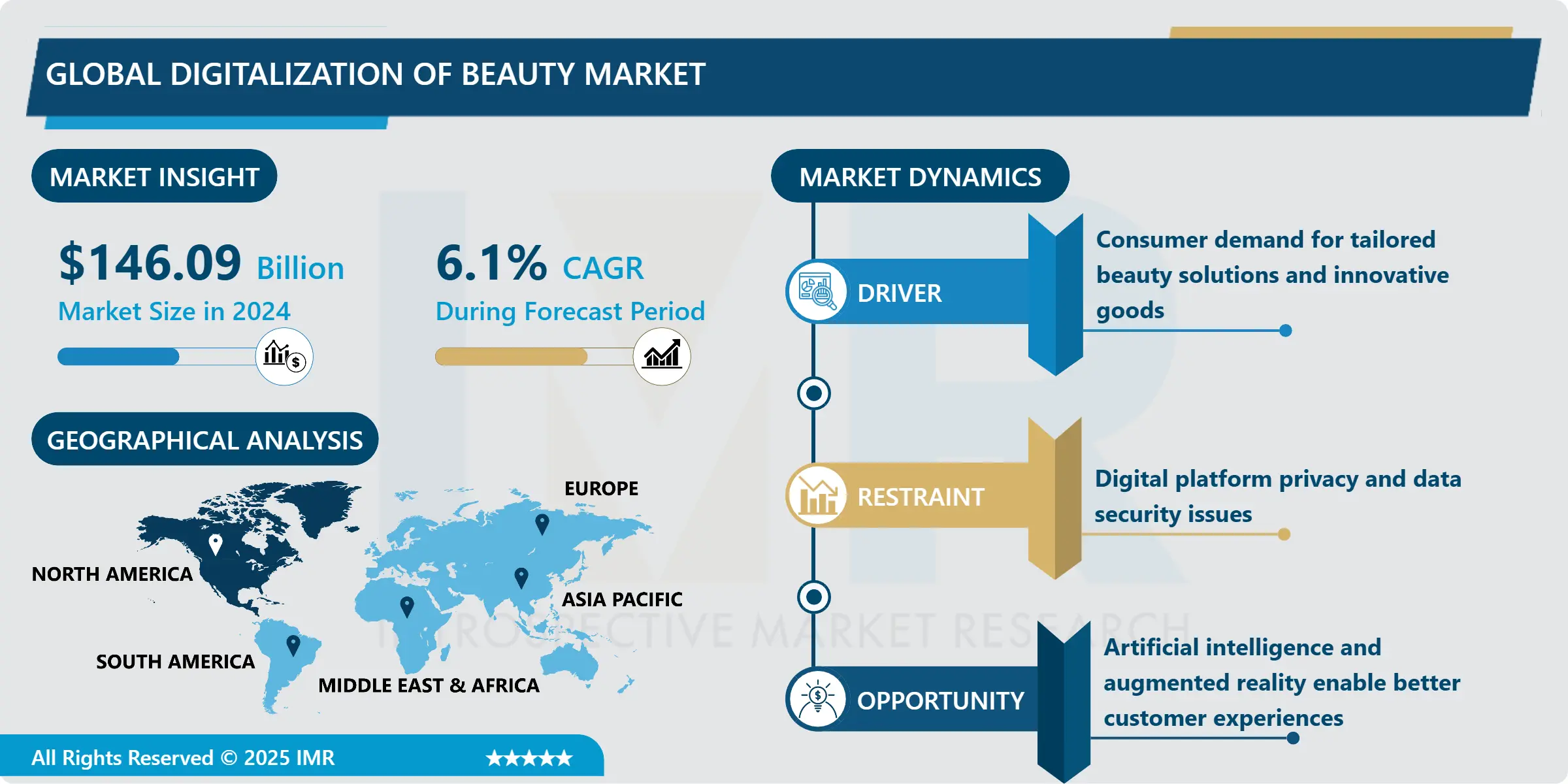

Digitalization of Beauty Market Size Was Valued at USD 146.09 Billion in 2024, and is Projected to Reach USD 234.61 Billion by 2032, Growing at a CAGR of 6.1% From 2025-2032.

Technology, data analytics, and online platforms fuel the transformative digitalization of the beauty market. This transition includes the implementation of e-commerce solutions that optimize purchasing processes and increase consumer engagement, as well as the development of virtual try-on tools and personalized hygiene recommendations based on AI. Beauty brands are leveraging digital technologies to improve customer service, expand their market reach, and provide personalized products and experiences, resulting in strong market growth. Digitalization is transforming consumer expectations and behavior, resulting in more personalized and interactive beauty solutions, thanks to the influence of social media and influencer marketing.

The beauty market is undergoing a transformation as a result of digitalization, which involves incorporating advanced technologies into a variety of aspects, including product development, marketing, and consumer engagement. E-commerce platforms, social media influence, and virtual try-on tools are revolutionizing the marketing and sales of cosmetic products.

Consumers are now able to make more informed purchasing decisions by utilizing augmented reality applications, AI-driven skin analysis, and online consultations to access personalized cosmetic solutions. In addition, this digital transformation is allowing brands to gain a more comprehensive understanding of consumer preferences and trends by utilizing data analytics, resulting in more effective and targeted marketing strategies.

The market overview indicates a substantial transition to digital innovations and online cosmetic retail. In order to optimize operations and improve consumer experiences, organizations are investing in digital transformation. Mobile commerce, influencer partnerships, and digital advertising are driving the expansion of the cosmetics market.

Furthermore, the integration of technologies such as blockchain and machine learning facilitates the enhancement of product traceability and authenticity for brands. We anticipate that as digitalization progresses, it will further disrupt conventional beauty industry practices and create new opportunities for innovation and development.

Digitalization of Beauty Market Trend Analysis

Personalization through AI and Data Analytics

- The beauty market is becoming more digital as the integration of AI and data analytics revolutionizes the personalization of beauty products and services. Brands can analyze a vast quantity of consumer data, including purchase history and social media interactions, using advanced algorithms and machine learning technologies.

- This enables the development of highly customized marketing strategies and product recommendations. This transition toward personalization not only improves customer satisfaction but also fosters engagement by providing customized experiences that align with the unique preferences and requirements of each individual.

- Additionally, the application of AI in the cosmetics industry is expanding beyond personalized recommendations to encompass predictive analytics, virtual try-ons, and skin analysis. In addition to offering consumers interactive and immersive experiences, these innovations also provide brands with a more comprehensive understanding of consumer behavior and trends.

- As digitalization continues to transform the beauty industry, the convergence of AI, data analytics, and personalized solutions stands poised to revolutionize market dynamics and cultivate new levels of consumer engagement.

Virtual Try-Ons and Augmented Reality

- The integration of augmented reality (AR) and virtual try-ons is revolutionizing the digitalization of the cosmetics market. These technologies enable consumers to test on cosmetics, skincare products, and hair colors in a virtual environment without the need for physical application.

- Using AR, beauty brands can improve consumer engagement and satisfaction by providing personalized experiences. The increasing demand for interactive and seamless purchasing experiences, which empower users to make informed decisions and eliminate the need for in-store trials, is driving this trend.

- Virtual try-ons and AR facilitate the digitalization of the cosmetics market, enabling brands to gather valuable data on consumer preferences and behaviors. This data-driven approach plays a crucial role in crafting product offerings and marketing strategies tailored to individual needs. As technology advances, we expect the integration of AR in beauty applications to further influence the future of the industry and the way consumers interact with beauty products.

Digitalization of Beauty Market Segment Analysis:

Digitalization of Beauty Market Segmented on the basis of By Product Type, and Application.

By Product Type, Software segment is expected to dominate the market during the forecast period

- Advancements in both software and services are propelling the cosmetics market into digitalization. Software solutions like augmented reality (AR) beauty apps, virtual try-on applications, and AI-driven skin analysis tools are transforming the way consumers interact with beauty products. These technologies facilitate more informed purchasing decisions, enhanced user experiences, and personalized recommendations. Companies are making significant investments in software innovations to offer consumers interactive and immersive cosmetic experiences, thereby strengthening the relationship between brands and their customers.

- Conversely, services have a significant influence on the digital transformation of the cosmetics industry. This encompasses customized skincare services, digital beauty tutorials, and online consultations that are accessible through digital platforms. These services utilize technology to provide consumers with convenience and accessibility, enabling them to receive expert advice and customized solutions from the comfort of their residences. Together, software and services are influencing the future of the cosmetics industry, transforming it into a more consumer-centric and dynamic entity.

By Application, Beauty Companies segment held the largest share in 2024

- The beauty market's digitalization has significantly altered the manner in which beauty companies interact with consumers on a variety of platforms. Beauty companies can maximize their marketing strategies, streamline product development, and enhance brand visibility by utilizing digital tools and technologies.

- The integration of sophisticated digital solutions, including augmented reality (AR) for virtual try-ons and data analytics for personalized recommendations, has significantly enhanced brand loyalty and revolutionized consumer experiences.

- Significant changes have also occurred in the retail and e-commerce sectors as a result of digitalization. In order to satisfy consumers' evolving expectations, retailers are progressively implementing omnichannel strategies that integrate online and offline touchpoints to deliver seamless shopping experiences. By providing personalized purchasing experiences, targeted promotions, and efficient order fulfillment processes, e-commerce platforms capitalize on digital advancements.

- In general, digitalization has enabled beauty companies to innovate and adapt, while retail and e-commerce channels leverage technological advancements to fuel growth and engagement in the beauty market.

Digitalization of Beauty Market Regional Insights:

North American beauty industry is a burgeoning Market

- The North American beauty industry is expanding rapidly, with a growing emphasis on self-care, wellness, and innovative beauty solutions. Consumer preference for advanced formulations and high-quality ingredients bolsters the high demand for premium and personalized beauty products in this emerging market. Major industry players are leveraging these trends by broadening their product lines and improving their offerings to meet the diverse requirements of consumers.

- The beauty market is undergoing a substantial transformation as a result of digitalization, which is providing new opportunities for sales and engagement. Digital technologies such as e-commerce platforms, virtual try-ons, and personalized beauty applications are transforming the way consumers interact with beauty brands.

- This digital transformation not only enables a more personalized purchasing experience but also enables brands to customize their products and marketing strategies by leveraging data-driven insights, thereby fostering further growth and innovation in the sector.

Active Key Players in the Digitalization of Beauty Market

- Unilever (United Kingdom)

- Procter & Gamble (United States)

- Adimo ( Kenya)

- Amorepacific Corporation (South Korea)

- CFEB Sisley SAS ( France)

- Elizabeth Arden Inc (United States)

- Johnson & Johnson (United States)

- Lancer Skincare (United States)

- L’Oréal S.A (France)

- Shiseido (Japan)

- Other Active Players

|

Global Digitalization of Beauty Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 146.09 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.1 % |

Market Size in 2032: |

USD 234.61 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Digitalization of Beauty Market by Product Type (2018-2032)

4.1 Digitalization of Beauty Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Services

Chapter 5: Digitalization of Beauty Market by Application (2018-2032)

5.1 Digitalization of Beauty Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Beauty Companies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Retail

5.5 E-commerce

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Digitalization of Beauty Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 DOODLY (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 EXPLAINDIO (U.S.)

6.4 TTS SKETCH MAKER (U.S.)

6.5 TOONLY (U.S.)

6.6 VYOND (U.S.)

6.7 CAMTASIA (U.S.)

6.8 EXPLAINDIO (U.S.)

6.9 ADOBE SPARK (U.S.)

6.10 MYSIMPLESHOW (GERMANY)

6.11 POWTOON (UK)

6.12 VIDEOMAKERFX (UK)

6.13 VIDEOSCRIBE (UK)

6.14 EASY SKETCH PRO (UK)

6.15 MOOVLY (BELGIUM)

6.16 RAWSHORTS (ISRAEL)

6.17 FIVERR (ISRAEL)

6.18 ANIMIZ (CHINA)

6.19 BITEABLE (AUSTRALIA)

6.20 ANIMAKER (INDIA)

6.21

Chapter 7: Global Digitalization of Beauty Market By Region

7.1 Overview

7.2. North America Digitalization of Beauty Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Software

7.2.4.2 Services

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Beauty Companies

7.2.5.2 Retail

7.2.5.3 E-commerce

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Digitalization of Beauty Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Software

7.3.4.2 Services

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Beauty Companies

7.3.5.2 Retail

7.3.5.3 E-commerce

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Digitalization of Beauty Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Software

7.4.4.2 Services

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Beauty Companies

7.4.5.2 Retail

7.4.5.3 E-commerce

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Digitalization of Beauty Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Software

7.5.4.2 Services

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Beauty Companies

7.5.5.2 Retail

7.5.5.3 E-commerce

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Digitalization of Beauty Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Software

7.6.4.2 Services

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Beauty Companies

7.6.5.2 Retail

7.6.5.3 E-commerce

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Digitalization of Beauty Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Software

7.7.4.2 Services

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Beauty Companies

7.7.5.2 Retail

7.7.5.3 E-commerce

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Digitalization of Beauty Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 146.09 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.1 % |

Market Size in 2032: |

USD 234.61 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||