Digital Manufacturing Market Synopsis

Digital Manufacturing Market Size Was Valued at USD 307.87 Billion in 2023, and is Projected to Reach USD 1813.07 Billion by 2032, Growing at a CAGR of 19.40 % From 2024-2032.

Digital manufacturing refers to the use of digital technologies to improve and optimize manufacturing processes throughout the product lifecycle. It involves integrating digital tools such as simulation, modeling, automation, and data analytics to enhance efficiency, quality, and flexibility in manufacturing operations. However, digital manufacturing leverages technology to streamline and optimize every aspect of the manufacturing process, from design and planning to production and maintenance, ultimately leading to faster time-to-market, lower costs, and better products.

- Digital manufacturing is a technology that uses digital data and computer-based systems to optimize manufacturing processes. It allows engineers to create and simulate product designs using CAD software, reducing the time and costs associated with traditional prototyping. Additive manufacturing, also known as 3D printing, allows for the creation of complex geometries and customized parts directly from digital designs. Virtual manufacturing and process simulation enable manufacturers to optimize processes before physical production begins. Digital twins, virtual replicas of physical assets, enable real-time monitoring, analysis, and optimization.

- The Industrial Internet of Things (IoT) ecosystem enables predictive maintenance, remote monitoring, and real-time decision-making, leading to higher productivity and flexibility. Digital manufacturing technologies enable customization and mass personalization, enabling companies to offer unique products tailored to individual customer preferences. Furthermore, digital manufacturing techniques like generative design and topology optimization reduce material waste and energy consumption and enable the implementation of circular economy principles to minimize environmental impact.

- Digital manufacturing is gaining popularity due to its efficiency, cost savings, customization, faster time-to-market, supply chain resilience, innovation, sustainability, and integration with Industry 4.0 technologies. Technologies like CAD, CAM, and CNC machining enable precise production processes, leading to reduced material waste and labor costs. Customization is crucial in industries like automotive, aerospace, and consumer goods. Rapid prototyping and iterative design processes reduce the time to market, making it essential for industries with short product life cycles or changing consumer demands.

- Digital manufacturing also offers greater flexibility and resilience, allowing businesses to adapt quickly to disruptions and mitigate risks. It also facilitates innovation by providing tools for simulation, virtual testing, and collaborative design, driving continuous improvement and competitiveness. Digital manufacturing technologies can integrate and optimize supply chain operations, reducing costs, lead times, and customer service. Digital manufacturing contributes to sustainability goals by optimizing resource utilization, reducing energy consumption, and minimizing environmental impact.

Digital Manufacturing Market Trend Analysis

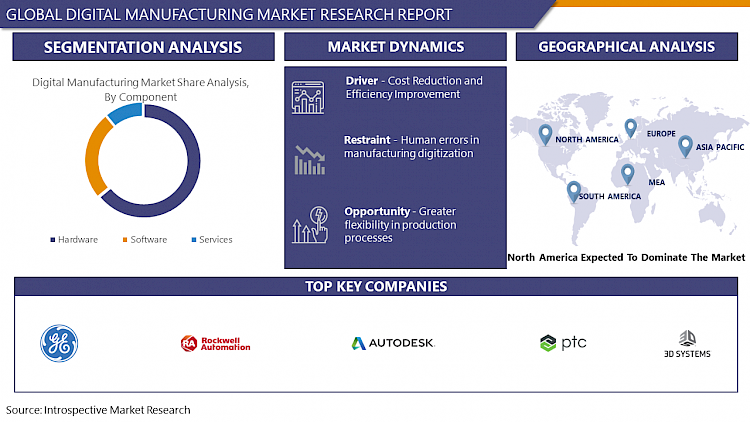

Cost Reduction and Efficiency Improvement

- Digital manufacturing is a strategy that uses digital technologies to optimize and streamline the manufacturing process. It enables companies to optimize their processes by leveraging data analytics, simulation, and modeling tools to identify inefficiencies, bottlenecks, and waste. Digital manufacturing also allows better utilization of resources, including raw materials, energy, and equipment.

- Technologies like IoT sensors and predictive maintenance allow manufacturers to monitor equipment performance in real-time, scheduling maintenance proactively and minimizing idle time. Advanced planning and scheduling software optimize production schedules, reducing costs.

- Quality improvement is also facilitated by real-time monitoring and control systems throughout the production process. This proactive approach reduces the likelihood of rework, scrap, and warranty claims, leading to cost savings and improved customer satisfaction.

- Supply chain optimization is achieved through cloud-based platforms, blockchain, and advanced analytics, optimizing inventory levels, minimizing lead times, and improving demand forecasting accuracy. This reduces supply chain costs, enhances operational efficiency, and improves customer responsiveness.

- Digital manufacturing also empowers companies to innovate faster and more cost-effectively. Technologies like computer-aided design (CAD), simulation, and rapid prototyping allow manufacturers to design, test, and iterate product designs in a virtual environment before physical production begins, reducing the time and cost associated with traditional trial-and-error methods.

Human Errors in Manufacturing Digitization

- Human errors pose a significant challenge in digital manufacturing, despite advancements in automation and digitization technologies. These errors can lead to data input errors, programming mistakes, misinterpretation of data, lack of training and skill development, cybersecurity risks, resistance to change, and communication breakdowns.

- Data input errors, such as typos or incorrect measurements, can lead to faulty product designs, production delays, or equipment damage. Programming mistakes can result in malfunctioning machinery, production line downtime, and costly rework. Misinterpretation of data can lead to suboptimal outcomes and missed opportunities for improvement.

- Lack of training and skill development can also lead to inefficiencies and errors in production. Cybersecurity risks can result from human errors, such as clicking on phishing emails or using weak passwords. Resistance to change and communication breakdowns can also hinder the successful adoption of digital manufacturing solutions.

Greater Flexibility in Production Processes

- Digital manufacturing offers significant opportunities for greater flexibility in production processes across various industries. It involves the use of advanced digital technologies to improve efficiency, productivity, and flexibility. Digital manufacturing enables agile manufacturing practices, allowing companies to quickly adapt to changing market demands and customer requirements.

- It also allows for customization and personalization, allowing companies to produce highly customized products at scale. On-demand manufacturing eliminates the need for large inventories and reduces waste, allowing companies to respond quickly to fluctuating demand. Digital technologies also enable remote and distributed manufacturing, allowing for decentralization and decentralization closer to end markets or raw material sources.

- Digital manufacturing facilitates the creation of dynamic supply chains responsive to real-time demand signals and market conditions. Continuous improvement through data-driven insights and predictive analytics allows manufacturers to identify opportunities for optimization and make proactive adjustments to improve quality, reduce downtime, and enhance overall flexibility.

Challenge

High Initial Cost of Implementing Digital Technologies

- Digital manufacturing faces several challenges, including high initial costs for hardware and software, infrastructure upgrades, training and skill development, customization and integration, risk of technology obsolescence, and return on investment (ROI). These costs can be prohibitive for smaller companies or those on tight budgets, as they require substantial investments in hardware and software systems.

- Upgrading infrastructure, such as networking and cybersecurity measures, can also incur significant costs. Training and skill development are also necessary for transitioning to digital manufacturing, adding to the overall implementation costs.

- Customization and integration can be complex and resource-intensive, requiring investment in software development and consulting services. The risk of technology obsolescence and uncertainty in return on investment can also hinder companies from committing to significant upfront investments.

Digital Manufacturing Market Segment Analysis:

Digital Manufacturing Market Segmented based on component, technology, and application.

By Component, Hardware segment is expected to dominate the market during the forecast period

- Hardware technologies such as 3D printers, CNC machines, industrial robots, and advanced sensors are continuously evolving, offering enhanced capabilities, precision, and efficiency in manufacturing processes. These advancements drive the adoption of hardware solutions in digital manufacturing. The concept of Industry 4.0, characterized by the integration of digital technologies into manufacturing processes, relies heavily on advanced hardware components. Smart factories leverage interconnected hardware devices, sensors, and robotics to automate production, monitor operations in real time, and optimize efficiency.

- Additive manufacturing, also known as 3D printing, is gaining traction across various industries due to its ability to produce complex geometries, reduce material waste, and enable rapid prototyping and customization. Hardware solutions enable automation, precision, and scalability, leading to cost savings, improved product quality, and faster time-to-market for manufacturers. Hardware components are utilized across a wide range of industrial sectors, including aerospace, automotive, healthcare, consumer goods, and electronics.

- Many companies, including technology providers, equipment manufacturers, and industrial firms, are investing in the development of digital manufacturing hardware. Partnerships and collaborations between technology companies and industrial manufacturers further drive innovation and adoption in the hardware segment.

By Technology, Robotics segment held the largest share of 37% in 2023

- Robotics technology is increasingly being used in manufacturing processes due to its ability to perform repetitive tasks with high precision and consistency. This technology improves efficiency and productivity by automating labor-intensive tasks, accelerating production cycles, and reducing cycle times. Modern robotics systems are flexible and adaptable, allowing manufacturers to quickly reconfigure production lines and respond to market demands.

- Technological advancements, such as sensors, artificial intelligence, machine learning, and collaborative robotics expanded the capabilities of robots in manufacturing. Despite initial investment costs, long-term benefits like increased productivity, quality improvement, and cost savings often outweigh these initial costs. As robotics becomes more accessible and affordable, SMEs are increasingly adopting robotics solutions to stay competitive.

Digital Manufacturing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America, particularly the United States, is a global hub for technological innovation, with numerous technology companies, research institutions, and startups advancing digital manufacturing technologies. The region's diverse manufacturing base, including automotive, aerospace, electronics, healthcare, and consumer goods, is increasingly adopting digital manufacturing to improve efficiency and flexibility.

- Governments in North America support advanced manufacturing and digital transformation initiatives, including funding for research and development, tax incentives, and workforce development. The region's robust supply chain infrastructure, including digital manufacturing technologies like digital twins and predictive analytics, optimizes supply chain operations.

- The adoption of Industry 4.0 principles, such as smart factories and data-driven decision-making, gained traction in North America. North American manufacturers face increasing pressure to innovate and adapt to evolving market demands, and digital manufacturing technologies offer solutions to enable agile, efficient, and responsive production processes.

Digital Manufacturing Market Top Key Players:

- General Electric Company (US)

- Autodesk, Inc. (US)

- 3D Systems Corporation (US)

- Cisco Systems, Inc. (US)

- Rockwell Automation, Inc. (US)

- PTC Inc. (US)

- IBM Corporation (US)

- Stratasys Ltd. (US)

- HP Inc. (US)

- Oracle Corporation (US)

- Intel Corporation (US)

- Siemens Digital Industries Software (US)

- Microsoft Corporation (US)

- Siemens PLM Software (US)

- ANSYS, Inc. (US)

- Zebra Technologies Corporation (US)

- Bosch Rexroth AG (Germany)

- SAP SE (Germany)

- Siemens AG (Germany)

- Dassault Systèmes SE (France)

- Schneider Electric SE (France)

- ABB Ltd. (Switzerland)

- Accenture plc (Ireland)

- Hexagon AB (Sweden)

- Fanuc Corporation (Japan), and other major players

Key Industry Developments in the Digital Manufacturing Market:

- In February 2022, Prodsmart announced that it had been acquired by Autodesk, Prodsmart delivered value to manufacturers by automating and digitizing manufacturing processes in real time, optimizing those businesses from the shop floor upwards. The company stated that teaming up with Autodesk will allow it to pursue its mission with renewed vigor. Autodesk is committed to enabling the full gamut of smart manufacturing, giving its customers the ability to work in entirely new and more productive ways.

- In February 2022, 3D Systems announced that it has agreed to acquire Kumovis, a Munich, Germany-based additive manufacturing solutions provider for personalized healthcare applications. Kumovis’ solutions are built upon their unique extrusion technology specifically developed for precision printing of medical-grade, high-performance polymers such as PEEK (polyether ether ketone).

|

Global Digital Manufacturing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

307.87 Bn |

|

Forecast Period 2023-30 CAGR: |

19.40% |

Market Size in 2032: |

1813.07 Bn |

|

Segments Covered: |

By Component |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DIGITAL MANUFACTURING MARKET BY COMPONENT (2017-2032)

- DIGITAL MANUFACTURING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HARDWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOFTWARE

- SERVICES

- DIGITAL MANUFACTURING MARKET BY TECHNOLOGY (2017-2032)

- DIGITAL MANUFACTURING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ROBOTICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- 3D PRINTING

- INTERNET OF THINGS (IOT)

- DIGITAL MANUFACTURING MARKET BY APPLICATION (2017-2032)

- DIGITAL MANUFACTURING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMATION & TRANSPORTATION

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AEROSPACE & DEFENSE

- CONSUMER ELECTRONICS

- INDUSTRIAL MACHINERY

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Digital Manufacturing Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- GENERAL ELECTRIC COMPANY (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AUTODESK, INC. (US)

- 3D SYSTEMS CORPORATION (US)

- CISCO SYSTEMS, INC. (US)

- ROCKWELL AUTOMATION, INC. (US)

- PTC INC. (US)

- IBM CORPORATION (US)

- STRATASYS LTD. (US)

- HP INC. (US)

- ORACLE CORPORATION (US)

- INTEL CORPORATION (US)

- SIEMENS DIGITAL INDUSTRIES SOFTWARE (US)

- MICROSOFT CORPORATION (US)

- SIEMENS PLM SOFTWARE (US)

- ANSYS, INC. (US)

- ZEBRA TECHNOLOGIES CORPORATION (US)

- BOSCH REXROTH AG (GERMANY)

- SAP SE (GERMANY)

- SIEMENS AG (GERMANY)

- DASSAULT SYSTÈMES SE (FRANCE)

- SCHNEIDER ELECTRIC SE (FRANCE)

- ABB LTD. (SWITZERLAND)

- ACCENTURE PLC (IRELAND)

- HEXAGON AB (SWEDEN)

- FANUC CORPORATION (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL DIGITAL MANUFACTURING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Digital Manufacturing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

307.87 Bn |

|

Forecast Period 2023-30 CAGR: |

19.40% |

Market Size in 2032: |

1813.07 Bn |

|

Segments Covered: |

By Component |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DIGITAL MANUFACTURING MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DIGITAL MANUFACTURING MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DIGITAL MANUFACTURING MARKET COMPETITIVE RIVALRY

TABLE 005. DIGITAL MANUFACTURING MARKET THREAT OF NEW ENTRANTS

TABLE 006. DIGITAL MANUFACTURING MARKET THREAT OF SUBSTITUTES

TABLE 007. DIGITAL MANUFACTURING MARKET BY COMPONENT

TABLE 008. HARDWARE MARKET OVERVIEW (2016-2030)

TABLE 009. SOFTWARE MARKET OVERVIEW (2016-2030)

TABLE 010. SERVICES MARKET OVERVIEW (2016-2030)

TABLE 011. DIGITAL MANUFACTURING MARKET BY TECHNOLOGY

TABLE 012. ROBOTICS MARKET OVERVIEW (2016-2030)

TABLE 013. 3D PRINTING MARKET OVERVIEW (2016-2030)

TABLE 014. INTERNET OF THINGS (IOT) MARKET OVERVIEW (2016-2030)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 016. DIGITAL MANUFACTURING MARKET BY APPLICATION

TABLE 017. AUTOMOTIVE & TRANSPORTATION MARKET OVERVIEW (2016-2030)

TABLE 018. AEROSPACE & DEFENSE MARKET OVERVIEW (2016-2030)

TABLE 019. CONSUMER ELECTRONICS MARKET OVERVIEW (2016-2030)

TABLE 020. INDUSTRIAL MACHINERY MARKET OVERVIEW (2016-2030)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 022. NORTH AMERICA DIGITAL MANUFACTURING MARKET, BY COMPONENT (2016-2030)

TABLE 023. NORTH AMERICA DIGITAL MANUFACTURING MARKET, BY TECHNOLOGY (2016-2030)

TABLE 024. NORTH AMERICA DIGITAL MANUFACTURING MARKET, BY APPLICATION (2016-2030)

TABLE 025. N DIGITAL MANUFACTURING MARKET, BY COUNTRY (2016-2030)

TABLE 026. EASTERN EUROPE DIGITAL MANUFACTURING MARKET, BY COMPONENT (2016-2030)

TABLE 027. EASTERN EUROPE DIGITAL MANUFACTURING MARKET, BY TECHNOLOGY (2016-2030)

TABLE 028. EASTERN EUROPE DIGITAL MANUFACTURING MARKET, BY APPLICATION (2016-2030)

TABLE 029. DIGITAL MANUFACTURING MARKET, BY COUNTRY (2016-2030)

TABLE 030. WESTERN EUROPE DIGITAL MANUFACTURING MARKET, BY COMPONENT (2016-2030)

TABLE 031. WESTERN EUROPE DIGITAL MANUFACTURING MARKET, BY TECHNOLOGY (2016-2030)

TABLE 032. WESTERN EUROPE DIGITAL MANUFACTURING MARKET, BY APPLICATION (2016-2030)

TABLE 033. DIGITAL MANUFACTURING MARKET, BY COUNTRY (2016-2030)

TABLE 034. ASIA PACIFIC DIGITAL MANUFACTURING MARKET, BY COMPONENT (2016-2030)

TABLE 035. ASIA PACIFIC DIGITAL MANUFACTURING MARKET, BY TECHNOLOGY (2016-2030)

TABLE 036. ASIA PACIFIC DIGITAL MANUFACTURING MARKET, BY APPLICATION (2016-2030)

TABLE 037. DIGITAL MANUFACTURING MARKET, BY COUNTRY (2016-2030)

TABLE 038. MIDDLE EAST & AFRICA DIGITAL MANUFACTURING MARKET, BY COMPONENT (2016-2030)

TABLE 039. MIDDLE EAST & AFRICA DIGITAL MANUFACTURING MARKET, BY TECHNOLOGY (2016-2030)

TABLE 040. MIDDLE EAST & AFRICA DIGITAL MANUFACTURING MARKET, BY APPLICATION (2016-2030)

TABLE 041. DIGITAL MANUFACTURING MARKET, BY COUNTRY (2016-2030)

TABLE 042. SOUTH AMERICA DIGITAL MANUFACTURING MARKET, BY COMPONENT (2016-2030)

TABLE 043. SOUTH AMERICA DIGITAL MANUFACTURING MARKET, BY TECHNOLOGY (2016-2030)

TABLE 044. SOUTH AMERICA DIGITAL MANUFACTURING MARKET, BY APPLICATION (2016-2030)

TABLE 045. DIGITAL MANUFACTURING MARKET, BY COUNTRY (2016-2030)

TABLE 046. DASSAULT SYSTEMS (FRANCE): SNAPSHOT

TABLE 047. DASSAULT SYSTEMS (FRANCE): BUSINESS PERFORMANCE

TABLE 048. DASSAULT SYSTEMS (FRANCE): PRODUCT PORTFOLIO

TABLE 049. DASSAULT SYSTEMS (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. TATA CONSULTANCY SERVICES (INDIA): SNAPSHOT

TABLE 050. TATA CONSULTANCY SERVICES (INDIA): BUSINESS PERFORMANCE

TABLE 051. TATA CONSULTANCY SERVICES (INDIA): PRODUCT PORTFOLIO

TABLE 052. TATA CONSULTANCY SERVICES (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. SIEMENS AG (GERMANY): SNAPSHOT

TABLE 053. SIEMENS AG (GERMANY): BUSINESS PERFORMANCE

TABLE 054. SIEMENS AG (GERMANY): PRODUCT PORTFOLIO

TABLE 055. SIEMENS AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. AUTODESK INC (UNITED STATES): SNAPSHOT

TABLE 056. AUTODESK INC (UNITED STATES): BUSINESS PERFORMANCE

TABLE 057. AUTODESK INC (UNITED STATES): PRODUCT PORTFOLIO

TABLE 058. AUTODESK INC (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. MENTOR GRAPHICS CORPORATION (UNITED STATES): SNAPSHOT

TABLE 059. MENTOR GRAPHICS CORPORATION (UNITED STATES): BUSINESS PERFORMANCE

TABLE 060. MENTOR GRAPHICS CORPORATION (UNITED STATES): PRODUCT PORTFOLIO

TABLE 061. MENTOR GRAPHICS CORPORATION (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. PARAMETRIC TECHNOLOGY CORPORATION INC (UNITED STATES): SNAPSHOT

TABLE 062. PARAMETRIC TECHNOLOGY CORPORATION INC (UNITED STATES): BUSINESS PERFORMANCE

TABLE 063. PARAMETRIC TECHNOLOGY CORPORATION INC (UNITED STATES): PRODUCT PORTFOLIO

TABLE 064. PARAMETRIC TECHNOLOGY CORPORATION INC (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. SAP SE (GERMANY): SNAPSHOT

TABLE 065. SAP SE (GERMANY): BUSINESS PERFORMANCE

TABLE 066. SAP SE (GERMANY): PRODUCT PORTFOLIO

TABLE 067. SAP SE (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. ARAS CORPORATION (UNITED STATES): SNAPSHOT

TABLE 068. ARAS CORPORATION (UNITED STATES): BUSINESS PERFORMANCE

TABLE 069. ARAS CORPORATION (UNITED STATES): PRODUCT PORTFOLIO

TABLE 070. ARAS CORPORATION (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. COGISCAN INC (CANADA): SNAPSHOT

TABLE 071. COGISCAN INC (CANADA): BUSINESS PERFORMANCE

TABLE 072. COGISCAN INC (CANADA): PRODUCT PORTFOLIO

TABLE 073. COGISCAN INC (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. AND BESTPLANT (ITALY): SNAPSHOT

TABLE 074. AND BESTPLANT (ITALY): BUSINESS PERFORMANCE

TABLE 075. AND BESTPLANT (ITALY): PRODUCT PORTFOLIO

TABLE 076. AND BESTPLANT (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 077. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 078. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 079. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DIGITAL MANUFACTURING MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DIGITAL MANUFACTURING MARKET OVERVIEW BY COMPONENT

FIGURE 012. HARDWARE MARKET OVERVIEW (2016-2030)

FIGURE 013. SOFTWARE MARKET OVERVIEW (2016-2030)

FIGURE 014. SERVICES MARKET OVERVIEW (2016-2030)

FIGURE 015. DIGITAL MANUFACTURING MARKET OVERVIEW BY TECHNOLOGY

FIGURE 016. ROBOTICS MARKET OVERVIEW (2016-2030)

FIGURE 017. 3D PRINTING MARKET OVERVIEW (2016-2030)

FIGURE 018. INTERNET OF THINGS (IOT) MARKET OVERVIEW (2016-2030)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 020. DIGITAL MANUFACTURING MARKET OVERVIEW BY APPLICATION

FIGURE 021. AUTOMOTIVE & TRANSPORTATION MARKET OVERVIEW (2016-2030)

FIGURE 022. AEROSPACE & DEFENSE MARKET OVERVIEW (2016-2030)

FIGURE 023. CONSUMER ELECTRONICS MARKET OVERVIEW (2016-2030)

FIGURE 024. INDUSTRIAL MACHINERY MARKET OVERVIEW (2016-2030)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 026. NORTH AMERICA DIGITAL MANUFACTURING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. EASTERN EUROPE DIGITAL MANUFACTURING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 028. WESTERN EUROPE DIGITAL MANUFACTURING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 029. ASIA PACIFIC DIGITAL MANUFACTURING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 030. MIDDLE EAST & AFRICA DIGITAL MANUFACTURING MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 031. SOUTH AMERICA DIGITAL MANUFACTURING MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Digital Manufacturing Market research report is 2024-2032.

General Electric Company (US), Autodesk, Inc. (US), 3D Systems Corporation (US), Cisco Systems, Inc. (US), Rockwell Automation, Inc. (US), PTC Inc. (US), IBM Corporation (US), Stratasys Ltd. (US), HP Inc. (US), Oracle Corporation (US), Intel Corporation (US), Siemens Digital Industries Software (US), Microsoft Corporation (US), Siemens PLM Software (US), ANSYS, Inc. (US), Zebra Technologies Corporation (US), Bosch Rexroth AG (Germany), SAP SE (Germany), Siemens AG (Germany), Dassault Systems SE (France), Schneider Electric SE (France), ABB Ltd. (Switzerland), Accenture plc (Ireland), Hexagon AB (Sweden), Fanuc Corporation (Japan), and Other Major Players.

The Digital Manufacturing Market is segmented into Component, Technology, Application, and region. By Component, the market is categorized into Hardware, Software, and Services. By Technology, the market is categorized into Robotics, 3D Printing, Internet of Things (IoT), and Others. By Application, the market is categorized into Automation & transportation, Aerospace & Defense, Consumer Electronics, Industrial Machinery, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Digital Manufacturing Market refers to the use of advanced digital technologies and processes to optimize and improve manufacturing operations. It encompasses a wide range of technologies, including 3D printing, robotics, artificial intelligence, the Internet of Things (IoT), big data analytics, and cloud computing. Digital manufacturing enables companies to digitize and automate various aspects of the manufacturing process, from design and prototyping to production and supply chain management. Its goal is to enhance efficiency, flexibility, quality, and innovation in manufacturing, ultimately driving competitive advantage for businesses.

Digital Manufacturing Market Size Was Valued at USD 307.87 Billion in 2023, and is Projected to Reach USD 1813.07 Billion by 2032, Growing at a CAGR of 19.40 % From 2024-2032.